Giorgione The Tempest1508

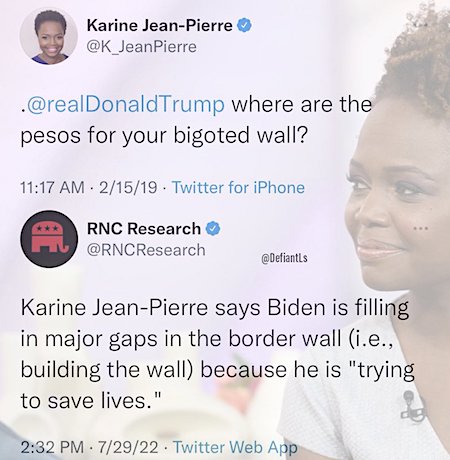

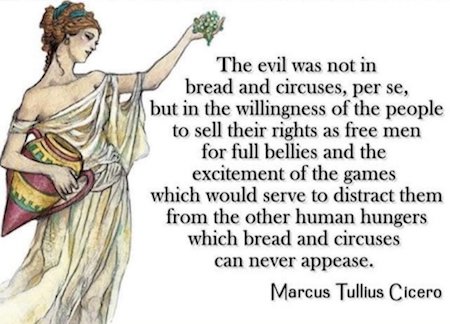

KJP

KJP: “President Biden does more in one hour than most people do in a day.”

Also KJP: He has nothing on his schedule tomorrow, Wednesday and Thursday

— Benny Johnson (@bennyjohnson) February 12, 2024

Campaign ad wars

https://twitter.com/i/status/1756754032108900694

Musk

"My mind is a storm, I don't think most people would want to be me. They may think they would want to be me, but they don't. They don't know, they don't understand."

— Elon Musk pic.twitter.com/rmvbLYmIMo

— DogeDesigner (@cb_doge) February 12, 2024

BREAKING: Speaking at the World Governments Summit in Dubai, United Arab Emirates, Tucker Carlson, who traveled from Russia, says Moscow is much cleaner and safer than any major city in the US. WATCH.pic.twitter.com/OQSZEyvW5m

— Simon Ateba (@simonateba) February 12, 2024

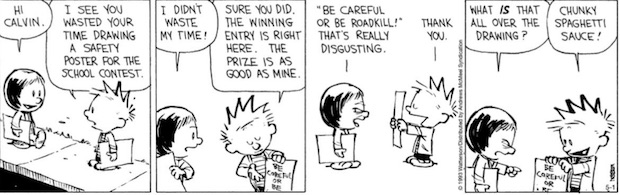

Ritter Larry

Bring it on!

• I Am Ready To Lead America – Kamala Harris (RT)

Vice President Kamala Harris is ready to replace President Joe Biden if necessary, she told the Wall Street Journal, amid growing concerns about his advanced age and apparent memory problems. The remarks by Harris were first reported by the WSJ on Monday, a week after the VP had made them to the daily during a flight on Air Force Two. Harris was asked whether concerns over Biden’s memory meant she must convince the public she was ready to serve. “I am ready to serve. There’s no question about that,” Harris stated boldly, brushing off the suggestion she actually needs to convince voters of anything. Anyone who sees her doing her job, “walks away fully aware of my capacity to lead,” she claimed.

Despite showing confidence about her leadership skills, Harris might still need to convince some voters, given her plummeting approval ratings. According to a fresh poll by NBC, the VP’s rating reached a new low, with a combined 53% of registered voters viewing her negatively. A vast majority of those holding such an opinion of her – some 42% of all the respondents interviewed during the poll – said they were actually “very negative” about the VP. At the same time, only a combined 28% of them held a positive view of Harris.

The remarks by Harris, despite being publicized only now, came ahead of a bombshell report compiled by US special counsel Robert Hur on Biden’s handling of classified documents, which only reinforced concerns over the president’s health. The Hur report described Biden as an “elderly man with a poor memory” and noted that the president had exhibited “diminished faculties” in public. The assessment prompted strong denial from the US administration, with Biden staging an extraordinary press conference to assure the public his memory was just fine and to angrily deny any suggestions to the contrary. During the event, however, the president managed to erroneously call his Egyptian counterpart Abdel Fattah el-Sisi the leader of Mexico while discussing the situation in Gaza.

“..As Kamala is not a viable candidate, she in turn would have to be moved aside. Her resignation would follow her choice of Hillary Clinton as her vice president..”

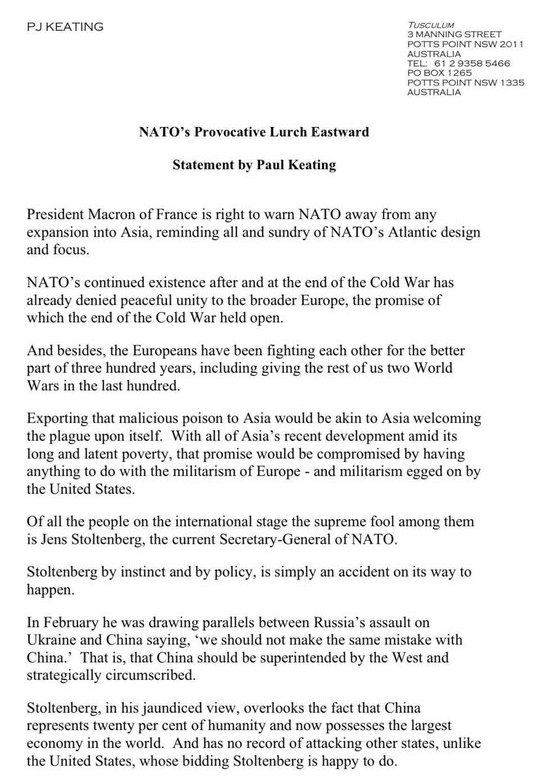

• What is the Democrats’ Playbook? (Paul Craig Roberts)

I raised this question in a column or an interview as polls revealed declining public confidence even among Democrats that Biden was fit to serve a second term. I suggested that one possibility would be that a deal would be worked whereby Biden would be moved aside, Kamala would become President, choose Hillary as her Vice President and then resign, having been promised a cabinet or judicial appointment. This would place in the White House a candidate that Democrats and the presstitutes claim won the 2016 election before Putin allegedly stole the election for Trump by hacking Hillary’s email. Evidence that something of this sort might be in the works emerges from the way Biden’s Justice (sic) Department cleared Biden of charges of possession of classified documents more serious than those for which President Trump is being prosecuted.

Biden was vice president with no power to declassify documents. Moreover, unlike Trump’s documents, which were stored in a secured room in a house in which US Secret Agents were present, Biden’s were scattered about in various insecure locations, including in the trunk of his Corvette in a garage. Special Counsel Robert Hur cleared Biden from prosecution by finding that Biden was not mentally competent to stand trial. So how is Biden mentally competent to be President of the United States and to have the nuclear briefcase in his hands? This is the Democrats’ dilemma. If Biden is judged capable of continuing as President, Robert Hur’s report comes across as more double standards in which a Democrat president is cleared of charges while a Republican is prosecuted for the same offense. The Democrats might bank on the presstitutes obfuscating the matter, but even insouciant Americans are likely to notice.

The rest of the world will conclude that Putin was correct when he said he doubted the president was the one really in charge. As Kamala is not a viable candidate, she in turn would have to be moved aside. Her resignation would follow her choice of Hillary Clinton as her vice president. Under the 25th Amendment, when a vice president ascends to the presidency, the vacant office of vice president is filled by the president nominating a candidate, who is then confirmed by the House and Senate. As the Senate is under Democrat control, and as the House Republicans are filled with Rinos who would confirm Hillary, it is an easily done deal. Trump himself might prefer the rematch in order to demonstrate a second victory over Hillary, one that the Democrats and media whores can’t again assign to Putin. Anyhow, this is my take for now. I will stick with it unless counter-evidence emerges.

“In a nutshell: It’s about who you are, not whether you broke the law..”

• Too Old For The Court, But Not For The White House (Tony Cox)

A US prosecutor’s report rationalizing why President Joe Biden won’t face justice for his mishandling of classified documents contained an excuse that ought to trigger some major soul-searching about the state of America’s leadership and how it got there. It won’t. Instead, in a nation where gaslighting and thick-faced contempt take the place of serious political discussion, Americans are expected to accept that Biden shouldn’t be prosecuted partly because he’s a “well-meaning, elderly man with a poor memory.” If that explanation – proffered in a report released on Thursday by US Department of Justice (DOJ) special counsel Robert Hur – isn’t absurd enough, citizens are also told to accept that the same guy who’s too addled for a jury to convict him is perfectly competent to serve as president and commander-in-chief.

The whole episode says a lot about how unjust, corrupted and broken Washington has become. For starters it comes at the same time Biden’s DOJ is prosecuting his chief political rival, ex-President Donald Trump, for mishandling classified documents. For another, as in the case of former presidential candidate Hillary Clinton, a prominent Democrat is being let off the hook for exposing state secrets despite investigators admitting that they found evidence of criminal conduct. This isn’t a minor violation of protocol, either. Hur found evidence that Biden “willfully retained and disclosed” classified materials from his two terms as vice president. As pictures included in Hur’s 345-page report showed, the documents were stashed in multiple locations, including cardboard boxes stacked in the garage of one of Biden’s homes. The special counsel also found that Biden’s conduct “presented serious risks to national security, given the vulnerability of sensitive information to loss or compromise to America’s adversaries.”

The mishandled documents contained information “implicating sensitive intelligence sources and methods,” including White House deliberations on the US occupation of Afghanistan. Biden’s defenders argue that his case wasn’t as bad as Trump’s because unlike Bad Orange Man, the president cooperated with investigators and surrendered his documents when they were discovered. That’s both unmitigating and untrue. Being cooperative after committing a criminal offense doesn’t make one less guilty of the crime. Moreover, Hur found a recorded conversation with the ghostwriter of Biden’s memoirs in which the former VP said he had “just found all this classified stuff downstairs.” That was in 2017, five years before one of Biden’s lawyers reported the discovery of classified materials at his think-tank office in Washington.

Incidentally, Biden’s ghostwriter deleted some of his recordings after learning of the special counsel’s investigation, but unlike the resort employees who allegedly helped hide Trump’s documents, he won’t be prosecuted. Another key difference in the cases was that Trump retained documents from his time as president and therefore had the authority to declassify such materials. Biden had no such power as vice president at the time his state secrets were retained. On the other hand, some of Trump’s charges concern alleged obstruction of justice, which could apply even if he were exonerated for keeping sensitive documents. The more preposterous wrinkle in the case is Hur’s commentary about Biden’s mental state, as well as the White House’s reaction. During interviews with investigators, the president couldn’t even remember such details as when he served as VP and roughly when his son Beau died, the special counsel said. The recorded 2017 conversations with the ghostwriter were “painfully slow, with Mr. Biden struggling to remember events and straining at times to read and relay his own notebook entries.” Biden displayed “diminished faculties and faulty memory.”

At 81, Biden is already the oldest president in US history. “Based on our direct interactions with and observations of him, he is someone for whom many jurors will want to identify reasonable doubt,” Hur said. “It would be difficult to convince a jury that they should convict him – by then a former president well into his 80s – of a serious felony that requires a mental state of willfulness.” In a nutshell: It’s about who you are, not whether you broke the law. Never mind that crimes were probably committed, and that national security was jeopardized, Biden’s DOJ concluded. The president is so scatterbrained and demonstrably old that jurors wouldn’t feel comfortable sending him to prison. But like the FBI’s then-director, James Comey, said in sparing Clinton prosecution in 2016, a criminal indictment wouldn’t be the “appropriate” remedy for this particular wrongdoing. Biden, who has been getting away with serious misconduct since he plagiarized his work as a college student nearly 60 years ago, will face no consequences.

“..considered by 86% of Americans too old to serve another presidential term..”

• Over 80% of US Citizens Deem Biden Too Old for Another Presidential Term (Sp.)

The incumbent 81-year-old US President, Joe Biden, is considered by 86% of Americans too old to serve another presidential term, a fresh ABC News/Ipsos poll showed. That includes 59% of the people polled who said that both Biden, 81, and the 77-year-old former US president, Donald Trump, are too old to be the head of state and 27% who said that it was exclusively Biden who is too old for the second term in the White House. As for Trump, 62% think that he is too old for the job. That includes 3% who think that only the Republican front-runner is too old. Only 11% of the respondents said neither of the presidents, Biden and Trump, was too old to go for another term. The poll was conducted from February 9-10 among 528 adult US citizens with a margin of sampling error of 4.5%. Biden is the oldest sitting US president. If he wins the election in 2024, he will be 82 when he takes office, and 86 when he completes his second term.

“..the idea of calling on Kamala Harris to take over makes a great deal of sense because her poll ratings are abysmal..”

• ‘Ground is Shifting Under Biden’s Feet’ After Hur Report (Sp.)

Last week, special counsel Robert Hur released a bombshell report, declining to press charges against US President Joe Biden partially because his report said, the president would appear to the jury as an “elderly man with a poor memory” and therefore would have trouble convincing the jury of his intent. The report also noted that he forgot when his term as Vice President ended and started, and couldn’t remember what year his son died. Biden attempted to quell concerns about his age by calling a press conference addressing the report but proceeded to confuse Mexico and Egypt while speaking to reporters. While Democratic leaders and administration officials were quick to defend the President, the cracks have started to show. Independent journalist and author Dan Lazare told Sputnik’s The Final Countdown on Monday that the “Biden administration is in real trouble,” and that “the ground is shifting beneath Biden’s feet.”

On Monday, Vice President Kamala Harris told a US media outlet she is “ready to serve” while slamming the report as “wrong” and “politically motivated.” Earlier in the week, former First Lady and 2016 democratic nominee Hillary Clinton admitted that Biden’s age is an issue. Finally, the New York Times editorial board released its opinion that Biden “needs to do more to show the public that he is capable of holding office until age 86” when his potential second term would end. It called on him to “hold regular news conferences” and said it looks like he is hiding “or worse, being hidden.” Lazare argued that is impossible for the Biden campaign. “Biden cannot go on that kind of tour,” he said. “He can’t sit down with Hannity or go on Fox News or do anything like that because he’ll only make things worse.[…] It’ll become completely clear that he doesn’t know what’s going on around him.”

Co-host Ted Rall asked how Republicans should tread the line between criticizing the president and being sensitive to people who have experienced dementia in their own families. “They can say, ‘look, that guy’s too old, he’s senile.’ and jump up and down […] [Or] is the best tactic to basically express sympathy and say, ‘look this can happen to any of us. We have sympathy for the president and his family […] but the needs of the country come first,’ and maybe they should call for Harris to take over knowing full well [that] politically she is unpopular.” That doesn’t sound like something former US President and presumptive Republican nominee Donald Trump would do, Lazare said, “But I think the idea of calling on Kamala Harris to take over makes a great deal of sense because her poll ratings are abysmal.” However, co-host Angie Wong, a Republican, argued that she “would love Biden to remain on the ticket in November. That’ll be fantastic for Donald Trump and [in down-ballot races].”

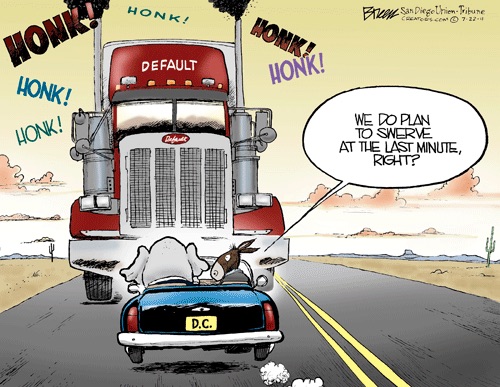

No immunity, no US president as we’ve known them. It becomes a whole new job description.

• Trump Asks Supreme Court To Intervene In Immunity Appeal (ZH)

Former President Donald Trump asked the Supreme Court on Monday to step in and weigh in on his claim of presidential immunity after the DC Circuit Court of Appeals sided with special counsel Jack Smith – ruling that Trump is not immune from prosecution. The lower court held off on issuing the mandate until Monday in order to allow Trump’s legal team time to approach the Supreme Court. Trump is specifically asking the Supreme Court to pause the lower court’s ruling until he can formally appeal, which will further delay his trial in front of District Court Judge Tanya Chutkan. The trial was originally scheduled for March 4, however Chutkan vacated the date in early February amid Trump’s immunity defense, and noted that the court would “set a new schedule if and when the mandate is returned.” Chutkan’s decision also denied Trump’s bid to toss the case in December based on the immunity claim.

“Smith sought to keep the trial on schedule in December by asking the Supreme Court to take up the question before the appeals court had a chance to consider it, but the justices rejected his request. “President Trump’s claim that Presidents have absolute immunity from criminal prosecution for their official acts presents a novel, complex, and momentous question that warrants careful consideration on appeal,” the application states. “The panel opinion below, like the district court, concludes that Presidential immunity from prosecution for official acts does not exist at all. This is a stunning breach of precedent and historical norms.” -Daily Caller

In January, Trump’s legal team presented oral arguments to the DC Circuit Court of Appeals, which Trump attended. The Judge, Biden appointee Florence Pan, questioned whether presidential immunity extended to such examples as a president ordering SEAL Team Six to assassinate a political rival without facing criminal charges. “For the purpose of this criminal case, former President Trump has become citizen Trump, with all of the defenses of any other criminal defendant. But any executive immunity that may have protected him while he served as President no longer protects him against this prosecution,” the panel wrote in its Feb. 6 ruling. “Former President Trump lacked any lawful discretionary authority to defy federal criminal law and he is answerable in court for his conduct.” In short, to be continued…

Booby-trapping the law.

• Ukraine Aid Bill Is A Trump Impeachment ‘Time Bomb’ – US Senator (RT)

Republican Senator JD Vance has argued that a new bill proposing additional military aid for Kiev could spell another impeachment case against Donald Trump should he win reelection in November, calling the measure a “time bomb.” In a memo circulated on Monday, Vance noted that the latest Ukraine bill calls for funding which would expire “nearly a year into the possible second term of President Trump,” suggesting that Democrats could ultimately impeach him if he chose not to renew the aid. “If President Trump were to withdraw from or pause financial support for the war in Ukraine in order to bring the conflict to a peaceful conclusion… it would amount to the same fake violation of budget law from the first impeachment,” Vance wrote, adding that “Partisan Democrats would seize on the opportunity to impeach him once again.”

He went on to say that the aid bill “represents an attempt by the foreign policy blob/deep state to stop President Trump from pursuing his desired policy,” as the former president has repeatedly questioned American largesse to Ukraine throughout the conflict with Russia. Democrats voted to impeach Trump in late 2019, accusing him of abuse of power and obstruction of Congress after he threatened to withhold US aid to Ukraine during a call with his counterpart Vladimir Zelensky. Part of a larger funding package worth more than $95 billion, the bill would devote $60 billion for Kiev, as well as additional aid for Israel and US allies in Asia. It has been subject to political deadlock for months. Trump himself has slammed the legislation, recently telling an audience in South Carolina that such foreign aid should be repaid to the US government.

“They want to give, like, almost $100 billion to a few countries, $100 billion. I said, ‘Why do we do this? If you do, you give them, not $100 billion, you give it to ‘em as a loan,’” he said. Following lengthy negotiations over the new military package in Washington, a final vote to pass the Senate’s version of the bill could come as soon as this week, according to multiple reports. Trump has said on multiple occasions that he would somehow resolve the two-year-old conflict “in one day” if he were to return to the White House. His eldest son, Donald Trump Jr., suggested that “the only way” to persuade Zelensky to engage in talks with Russia was to “cut off the money” that’s being provided to Kiev by Washington.

Ep. 74 The Ukrainian government canceled elections and killed an American journalist. Congress is about send them another $60 billion. J.D. Vance is trying to stop it. pic.twitter.com/x6mQFfuZFL

— Tucker Carlson (@TuckerCarlson) February 12, 2024

“Moscow’s representatives are not certain what caused this, but have simplified their messaging in response..”

• Western Diplomacy ‘Primitive’ – Moscow (RT)

Russian diplomats perceive their Western counterparts’ approach to international affairs to be “quite primitive,” Moscow’s deputy permanent representative to the UN, Dmitry Polyansky, has said. Moscow’s representatives are not certain what caused this, but have simplified their messaging in response, he added. Polyansky made remarks about the quality of the Western diplomatic corps in an interview with RIA Novosti published on Monday, based on his personal experience at the UN. He expressed concern about Anglophone speakers at the forum selectively ignoring the context of particular situations for their own benefit. ”They pick an arbitrary point in time and claim nothing happened before it. They try to blame a nation for its actions regardless of prior events or the general context,” he explained.

The diplomat cited the Ukraine conflict as an example. The US and its allies have been describing Moscow’s military action against Kiev as “unprovoked” and supposedly motivated by “imperial ambitions,” and have pressured other nations to frame it in the same way. As they learn more about the conflict, however, those parties realize how much the general context and Western actions since Ukraine gained its independence matter, he added. ”This trick does not always work, but it is a trend. I don’t know if it’s some deeper trend or just something typical for some people coming from [Western] schools of diplomacy,” Polyansky said. “Having a dialogue with them is challenging because they show certain superficiality, tunnel vision, and unwillingness to seek the core causes of conflicts. No solutions can be found without [such analysis].”

The office of the Russian envoy to the UN has been simplifying its addresses due to uncertainty over how their words are understood, he said. Russian diplomats used to quote foreign and Russian classics in speeches, but are no longer using this rhetorical device as much, Polyansky said. ”Times dictate things. Our partners may now be less well-read individuals, so occasionally we want to speak in plainer terms to make sure our signal comes through,” he explained.

“..Hillary Clinton calling him a “useful idiot” for Russia, Carlson laughed it off. “She’s a child, I don’t listen to her,” he said. “How’s Libya doing?”

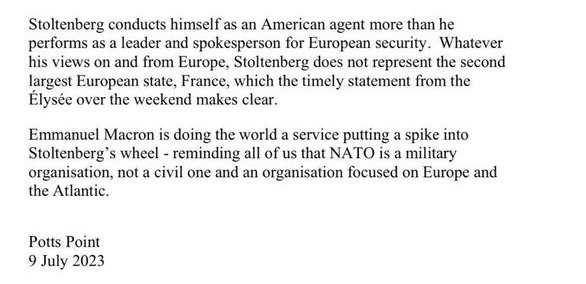

• Tucker Carlson Reviews Putin Interview And Reveals What ‘Radicalized’ Him (RT)

Following his two-hour interview with Russian President Vladimir Putin in Moscow, US journalist Tucker Carlson opened up about his experience at the World Government Summit in Dubai. In an hour-long interview with TV presenter Emad Eldin Adeeb, Carlson addressed why the conversation with Putin did not touch on certain topics, how the US political establishment had reacted to it, and why Washington has failed to understand Moscow, among other things. According to Carlson, he had an off-the-record conversation with Putin after their recorded interview was over. He would not reveal what was discussed, however. Carlson did say that Putin seemed willing to negotiate with the West about both the end of the Ukraine conflict and a new balance of power in the world. Diplomacy is the art of compromise, and almost everyone “other than maybe the United States during the unipolar period” understands this, Carlson said.

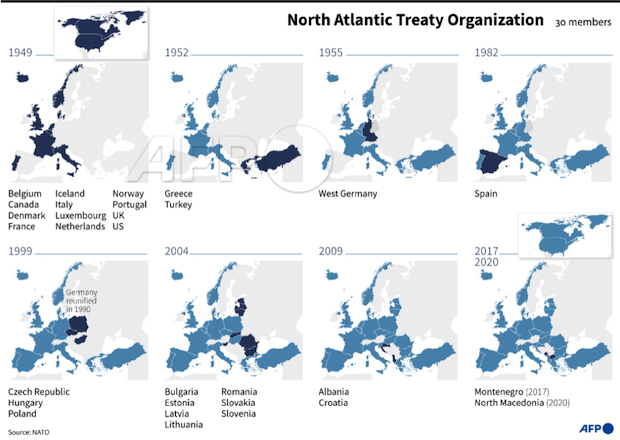

But while Putin wants the conflict to end, his position will only harden the longer it goes on, he added. One of the major revelations in the interview for Carlson was that Russia had asked to join NATO – and while then-US President Bill Clinton seemed receptive, his aides pushed against the idea and it ultimately failed. Since the entire point of NATO was to keep the Soviet Union out of Western Europe, Carlson said in Dubai, “if the Russians ask to join the alliance, that would suggest you have solved the problem and you can move on to do something constructive with your life. But we refused.” “Go sit in the sauna for an hour and think about what that means,” he added. Politicians in the West aren’t setting themselves “achievable” goals, Carlson has argued. “I have heard personally US government officials say well we just have to return Crimea to Ukraine,” he said. “That’s not going to happen, short of a nuclear war. That’s insane, actually.”

Even bringing up this kind of idea “shows you are a child, you don’t understand the area at all, and you have no real sense of what’s possible,” the journalist concluded. According to Carlson, one of the biggest issues in the US and the West in general is the tendency to reduce everything to the 1938 Munich conference, at which Britain and France sought to “appease” Nazi Germany by giving it a portion of Czechoslovakia. “The American policymaker historical template is tiny – in fact there’s only one – and it’s a 2-year period in the late 1930s, and everything is based on that understanding of history and human nature. That’s insane,” Carlson said. Carlson pointed out that he’s 54 and grew up in an America that had nice, safe and beautiful cities, “and we no longer have them.”

It was “radicalizing” to see Moscow “cleaner, safer and prettier” than American cities, he said, or be reminded of that in Dubai and Abu Dhabi – while in the US, one can’t ride the subway in New York City because it’s dirty and unsafe. “That’s a voluntary choice,” he said. “You don’t have to have crime, actually.” Asked why he hadn’t raised certain topics with Putin, Carlson said he wanted to do the interview because he was interested in how the Russian leader saw the world – and not to inject himself into the discussion. Most journalists who interview leaders the US dislikes tend to make it about themselves, Carlson added, and since he only cared about the approval of his wife and their children, he didn’t need to virtue-signal. Asked to comment on former US presidential candidate Hillary Clinton calling him a “useful idiot” for Russia, Carlson laughed it off. “She’s a child, I don’t listen to her,” he said. “How’s Libya doing?”

Tucker Moscow

Tucker Carlson on being radicalized in Moscow.

"If you can't use your subway…. isn't that the ultimate measure of leadership?" pic.twitter.com/jgb3nRGL3r

— DD Geopolitics (@DD_Geopolitics) February 12, 2024

“Leaders of any country on the planet, other than maybe the United States during the unipolar period, are forced by the nature of their jobs to compromise. That’s what diplomacy is..”

• Putin Wants To End Ukraine Conflict – Tucker Carlson (RT)

Russian President Vladimir Putin is willing to engage in diplomacy to end the fighting in Ukraine, but the longer it continues the less likely he will be to compromise, US journalist Tucker Carlson warned on Monday. Carlson spoke at the World Government Summit in Dubai, where he flew after interviewing Putin in Moscow last week. The video of the discussion has been viewed hundreds of millions of times. “Putin wants to get out of this war. He’s not going to become more open to negotiation the longer this goes on,” Carlson said in response to a moderator’s question. The West needs to keep in mind that “Russia’s industrial capacity is a lot more profound than we thought it was,” and that Moscow is having a far easier time manufacturing weapons and ammunition than NATO countries that have been supplying Ukraine, the journalist continued.

There are competent people in US President Joe Biden’s administration, Carlson noted, but they lack perspective and see international relations through a very narrow lens in which every foreign leader is Adolf Hitler and every day is Munich 1938. As a result, Western governments have no real sense of what is possible or achievable, he claimed. “Leaders of any country on the planet, other than maybe the United States during the unipolar period, are forced by the nature of their jobs to compromise. That’s what diplomacy is,” Carlson told the crowd in Dubai. Putin practices diplomacy just like everyone else, but “his position is hardening,” he added.

Following Carlson’s two-hour interview with Putin, the Kremlin said that Russia has communicated its stance to the US quite clearly, but that Washington did not appear interested in talks. “The US authorities know our position very well, they are perfectly aware of all of Putin’s main points,” Kremlin spokesman Dmitry Peskov told TASS news agency on Saturday. However, the American leadership apparently lacks the “political will” for negotiations. “This is not an issue of knowledge, but an issue of desire. The desire to do something to get on to the track of negotiations. We have not yet seen such a desire or the political will for this [in the US],” Peskov noted.

Tucker Russia

Russian President Vladimir Putin is open to a peace deal on Ukraine, American journalist Tucker Carlson said during a speech at the World Government Summit in Dubai.

However, Carlson noted that the longer the conflict drags on, the less incentive Putin will have to accept… pic.twitter.com/P5qZIluHiZ

— DD Geopolitics (@DD_Geopolitics) February 12, 2024

“..a world leader for a quarter century with the lack of gravitas — to put it politely of Joe Biden, Kamala Harris and many others in both parties who are surface-level, donor-captured, soundbite specialists..”

• Putin and Trump Seen as ‘Threat’ by Davos Globalists (Sp.)

Tucker Carlson’s interview with Vladimir Putin has attracted over 190 million views on X (formerly Twitter) as of February 11. “I think it was fortunate that the interview occurred well before the heart of the primary season so that voters got a fair chance to see the interaction for themselves in a long format forum that was, fortunately, not interrupted by pesky commercials,” Charles Ortel, a Wall Street analyst and investigative journalist, told Sputnik. “My guess is that getting on Putin’s calendar for such a long interview was a challenge, so I imagine it suited both parties to have this video out well in advance of the nominating convention for Democrats and of the general election. It would be great to have one or even more follow-ups in coming months,” he added.

“I also think the contrast between Putin’s measured and thoughtful perspectives, having been a world leader for a quarter century with the lack of gravitas — to put it politely of Joe Biden, Kamala Harris and many others in both parties who are surface-level, donor-captured, soundbite specialists was stunning. This contrast was remarkable considering Biden’s post-interview meltdown before what remains of the ‘press’,” Ortel continued. The Wall Street analyst noted that judging from viewership statistics, the corporate — and political donor-controlled — media is destroying itself. He stressed that “no political interview has garnered nearly as much coverage as Putin’s recent sit down with Tucker,” adding that he expects “it will, in the end, change the thinking of most open minds.” Prior to the historic interview, US corporate media pundits and Democratic political figures urged Americans to ignore Carlson’s show.

Former secretary of state Hillary Clinton called Tucker a “useful idiot”, claiming that the US journalist “parrots Vladimir Putin’s pack of lies about Ukraine.. Clinton’s remarks before the interview echoed those of Soviet-era apparatchiks who said of Nobel Prize-winning novel Doctor Zhivago by Boris Pasternak: “I haven’t read Pasternak, but I condemn him.” “Hillary Clinton’s star set long ago while Tucker Carlson is, today, one of the most followed and fair-minded voices on earth,” Ortel said, commenting on Clinton’s rant. “Certainly, the Clinton family has much to fear as 5 November 2024 looms.” The Wall Street analyst, who has carried out a private investigation into allegations of fraud by the Clinton Foundation over several years, noted that “there are serious unanswered questions over how much foreign government and oligarch money may have funded Hillary’s political campaigns in 2005-6, 2007-8, and 2015-16, including donations from Ukraine’s [oligarch] Victor Pinchuk and his wife.”

He added that there are also “reasonable concerns as in the case of the Bidens, that the Clinton family exploited their offices to enrich themselves for decades, illegally.” “Hillary Clinton will not be remembered well in history,” Ortel said. “She coasted into national politics, at first, in sympathy over the Lewinsky affair as she had no actual ties to my home state of New York. As Senator, she promoted foreign adventurism in Afghanistan and Iraq that clearly failed. Meanwhile her husband advanced a boldly crooked set of scam charities we have previously covered that bilked governments and other donors of billions of dollars, for which there has never been honest accounting.”

“Musk echoed Johnson’s sentiment, saying “As you said, there’s no way Putin is going to lose. If he backs off, he will be assassinated..”

Really?

• “Vladimir Putin Will Not Lose This War” (ZH)

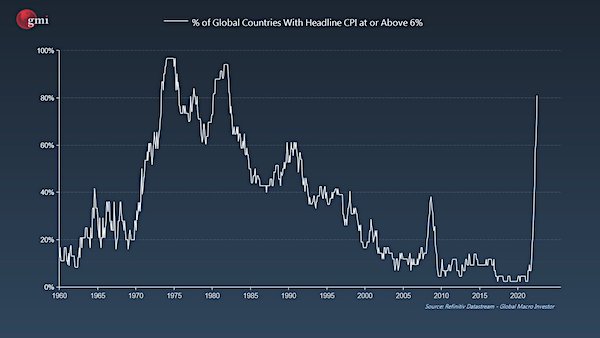

During today’s Twitter Spaces, Elon Musk and Sen. Ron Johnson (R-WI) discussed their opposition to the ongoing war in Ukraine. “We all have to understand that Vladimir Putin will not lose this war… Losing to Vladimir Putin is existential to Vladimir Putin. Russia has four times the population and a much larger industrial base,” said Johnson, adding “Russia can produce 4.5 million artillery shells per year. We’re not even up to 1 million per year. The average age of a Ukrainian soldier right now is 43 years old.” “If you’re worried about the people of Ukraine, you have to understand that probably 100,000 of their soldiers have been killed,” Johnson continued, adding “The only way this war ends is in a settlement, and every day that the war goes on, more Ukrainians and more Russian conscripts die, more civilians die, and more of Ukraine gets destroyed. Again, sending $60 billion as added fuel to the flames of a bloody stalemate makes no sense.”

Musk echoed Johnson’s sentiment, saying “As you said, there’s no way Putin is going to lose. If he backs off, he will be assassinated. And for those who want regime change in Russia, they should think about who is the person that could take out Putin?” He also defended his record – saying “My companies have probably done more to undermine Russia than anyone. Space X has taken away two-thirds of the Russian launch business. Starlink has overwhelmingly helped Ukraine.”

“I think it’s clear that disqualification can occur if evidence is produced presenting a conflict or the appearance of one..”

• Fani Willis Could Be Disqualified, Judge Says (ET)

Fulton County Superior Judge Scott McAfee confirmed on Feb. 12 that the hearing about misconduct claims against Fulton County District Attorney Fani Willis and special prosecutor Nathan Wade “must occur” on Feb. 15 and could lead to disqualification. Ms. Willis is presiding over the high-profile racketeering case that names former President Donald Trump and 14 others. “I think it’s clear that disqualification can occur if evidence is produced presenting a conflict or the appearance of one, and the filings submitted on this issue so far have presented a conflict of interest that can’t be resolved as a matter of law,” Judge McAfee said. Ms. Willis will be called as the first witness, the judge said after hearing some of the prosecutors’ arguments. “I don’t see how quash can be imposed here,” he said, referring to the district attorney’s effort to dismiss the subpoenas.

On Feb. 12, the judge held a hearing regarding the district attorney’s motions to quash the nine subpoenas issued on Ms. Willis herself and her staffers ahead of this week’s anticipated hearing in which the district attorney will have to respond to allegations of an “improper” relationship. On Jan. 8, defendant Michael Roman filed a lengthy motion that alleged that Ms. Willis was in a personal relationship with Mr. Wade, an attorney with a private law firm whom she had contracted to take a lead position in the racketeering case. He alleged that Mr. Wade took Ms. Willis on “lavish” vacations, including a cruise, and that she financially benefited from the situation. He also made several other allegations, including that Mr. Wade wasn’t qualified for the position and that Ms. Willis used funds improperly, which the judge indicated would not be the focus of the Feb. 15 evidentiary hearing. After the huge claims were made, several co-defendants filed their own motions to disqualify Ms. Willis based on “prejudicial” actions.

“Specifically looking at defendant Roman’s motion, it alleged a personal relationship that resulted in a financial benefit to the district attorney that is no longer a matter of speculation,” the judge said. “The state has admitted a relationship existed, and so what remains to be proven is the existence and extent of any financial benefit, again if there even was one.” Judge McAfee said the claims of prejudice were based on public statements—a speech Ms. Willis gave at an Atlanta church where she invoked God and said her critics were playing the “race card”—and did not warrant a hearing meant to produce evidence for the record. Other issues such as Mr. Wade’s resume also did not warrant an evidentiary hearing, according to the judge. The district attorney had filed a motion arguing that no evidentiary hearing was necessary because no conflict of interest had occurred, but the judge rejected the argument.

“Because I think it’s possible that the facts alleged by the defendant could result in disqualification, I think an evidentiary hearing must occur to establish a record on those core allegations,” Judge McAfee said. He said that the hearing will focus on “whether a relationship existed, whether that relationship was romantic or not in nature, when it formed, and whether it continues.” “I think that’s only relevant because it’s in relation to the question of the extent of any personal benefit conveyed as a result of the relationship,” Judge McAfee said. Mr. Roman’s attorney, Ashleigh Merchant, alleged that the relationship began as early as 2019 and that the couple cohabited at one point and claimed in a court filing that she could produce witnesses to testify to these allegations.

NEW: Judge in the Georgia criminal case against President Trump says "I think it's possible that the facts alleged could result in disqualification [for Fani Willis]. I think an evidentiary hearing must occur to establish the record on those core allegations" pic.twitter.com/TkP2nDQAxX

— Greg Price (@greg_price11) February 12, 2024

https://twitter.com/i/status/1757133934633386223

“What is unclear is why Putin, Xi, and Iran think they can reach an agreement with immoral governments. How many times will Putin purchase a Minsk Agreement?”

• Israel’s Ever-widening War (Paul Craig Roberts)

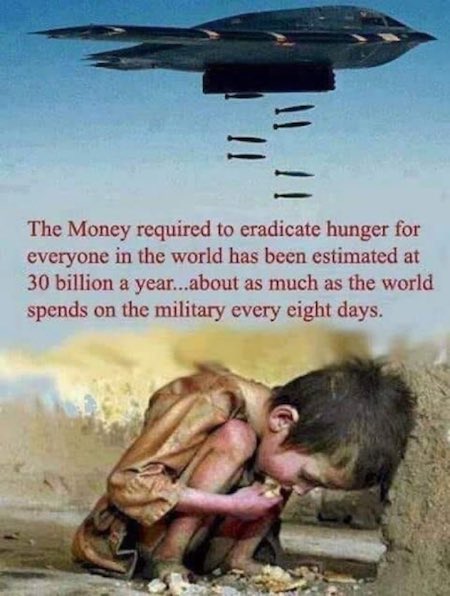

Rafah is the town that borders Egypt and the Sinai desert, where one million Palestinian refugees have fled to escape the merciless Israeli attacks against them. More than 100,000 Palestinian civilians, including 70,000 Palestinian women and children, have already been killed and wounded. Most of these poor refugees are literally starving to death because of the 3-month long Israeli blockade of water, food, electricity, and medicine to Gaza. If Israel launches this attack on Rafah, with the aim of driving one million Palestinians into the desert — and killing all those who refuse to leave Gaza– Egypt warns that a regional war will likely result, one which could conceivably become a World War. Biden could prevent this with a single phone call. If the US cut off all military and financial aid to Israel, the Israelis could not continue to prosecute its genocidal ethnic cleansing of the Palestinians from Gaza. However, just the opposite seems to be happening, with the full support and complicity of the United States.

Putin, Xi, and the Iranians are extraordinarily mistaken thinking that they can sit aside from the conflict as the conflict is directed against them. The Israeli offensive has left 85% of Gaza’s population internally displaced amid acute shortages of food, clean water, and medicine, while 60% of the enclave’s infrastructure was damaged or destroyed, according to the UN. And the Great Moral Western Democracies continue to support the Israeli Genocide of the Palestinians even as Egypt warns of a widening war. What is clear is that the West can no longer in any way be considered to be moral. What is unclear is why Putin, Xi, and Iran think they can reach an agreement with immoral governments. How many times will Putin purchase a Minsk Agreement?

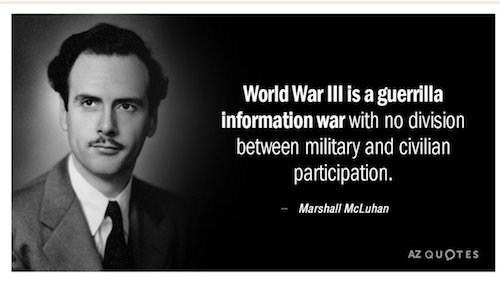

“..where we are cajoled to accept a “great reset” and a “new world order” controlled by unseen elites..

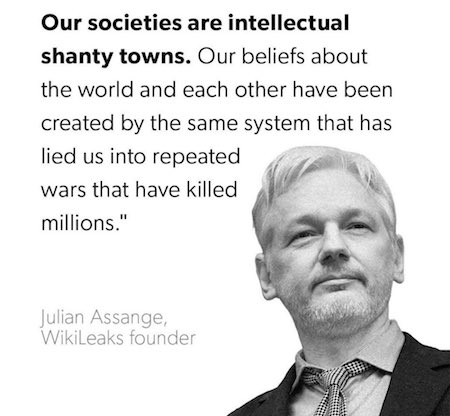

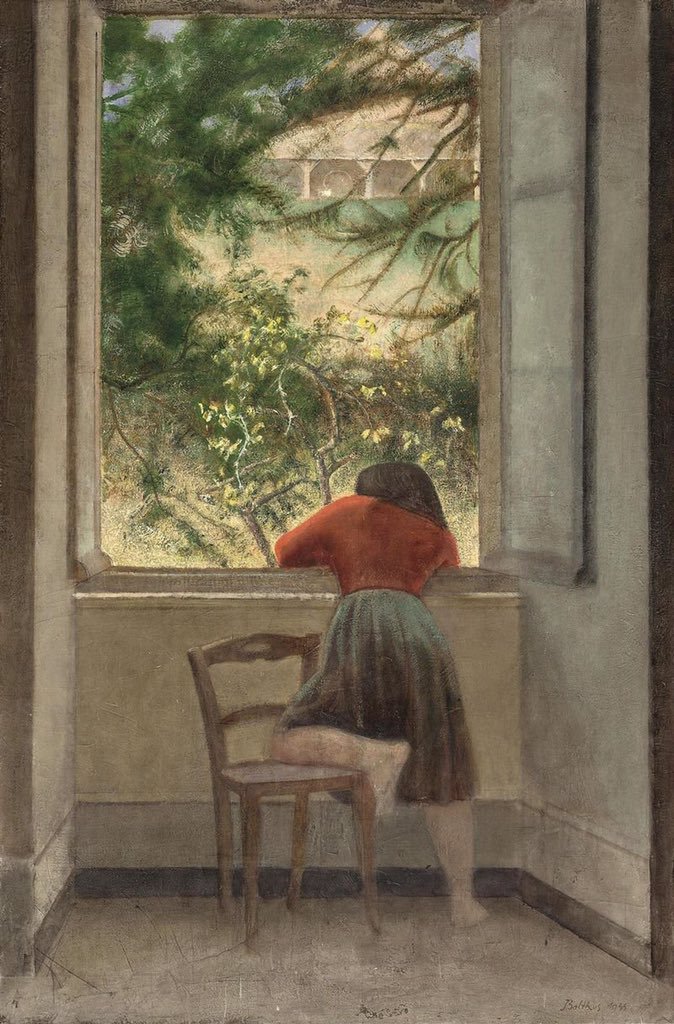

• Descent into Madness: Dostoevsky and the End of the West (Boyd)

Our society is coming to resemble a dystopian “peoples’ paradise” in its darkly disturbing features. Think back to iconic works of literature like Arthur Koestler’s Darkness At Noon and George Orwell’s Nineteen-Eighty-Four. Are we not living in a society which is little more than a cross between the nightmare visions of Koestler and Orwell? Do we not live in a society where dissidents are branded as “domestic terrorists,” “insurrectionists,” or “racists,” and face imprisonment for heretofore unimaginable thought crimes, all in the name of “defending our democracy”? –where our children have become wards of the state and are indoctrinated daily by mountains of fetid radical ideology? –where television and the Internet are employed to fashion a particular jaundiced view of life?—where science is now used to tell us the world will end in, what, ten years, if we don’t take immediate action to curb “the climate crisis”?—where we are cajoled to accept a “great reset” and a “new world order” controlled by unseen elites?

Far too many citizens do not fathom what has occurred and is happening in our society. And those who do understand, whether here in the US or in Europe, are swatted down by the long arm of “Big Brother,” turned into “non-persons,” their reputations destroyed, awakened by armed-to-the-teeth FBI agents before dawn and imprisoned for months or years without trial or the benefit of counsel—“enemies of the regime.” Is this not reminiscent of what occurred in Eastern Europe immediately after the conclusion of World War II, when the Soviets progressively installed socialist dictatorships by successfully eliminating and suppressing any real opposition, all happening why the benevolent USA looked on?

But in some ways our situation is worse than that of those Soviet-occupied countries in the aftermath of the world war. For while the post-war Communists essentially maintained certain inherited standards of behavior, for instance, supporting large families and traditional marriage, our elites continue to push the boundaries of what was once thought normative and acceptable in every area of human endeavor, even under Communism. And the disruption or rejection of the laws of nature and those well-established and valid millennia-old norms of behavior and belief leads to gross and grotesque imbalances and vicious infections in society which distort and eventually destroy it—what I have called in an earlier essay, “the zombification of our culture.”

It’s as if significant portions of American (and European) culture have been possessed by frenetic Evil incarnate…in academia and education, in our media and communications, in politics, and in our entertainment and sports industries. We are now supposed to be like Pavlov’s dog, trained to bark when prompted, to sit when told, in short, to be obedient and receptive subjects of the latest ukase or dogmatic proclamation of government or revelation of its satraps and lapdogs at some formerly-prestigious university or from fashionable glitterati.

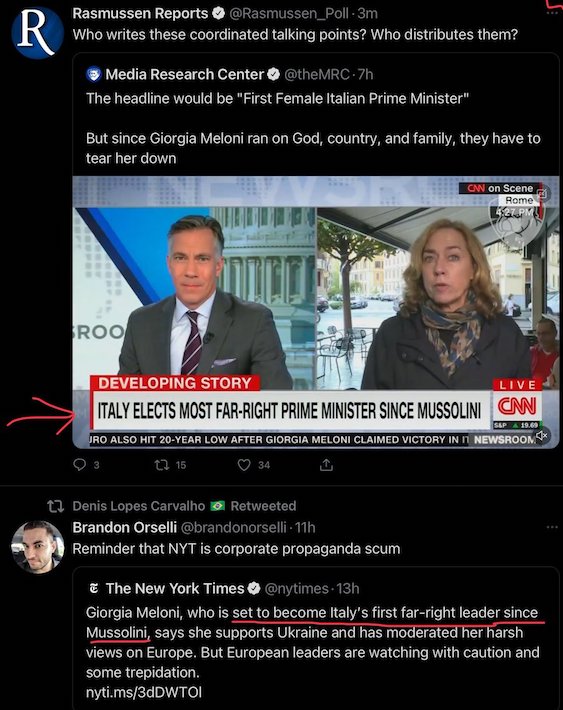

” We now have a usefully intricate anatomy of an undeservedly influential newspaper as it abjectly surrenders to power the sovereignty it is its duty to claim and assert in every day’s editions..”

• The Crisis at The New York Times (Patrick Lawrence)

It has been evident to many of us since the genocide in Gaza began Oct. 7 that Israel risked asking too much of those inclined to take its side. The Zionist state would ask what many people cannot give: It would ask them to surrender their consciences, their idea of moral order, altogether their native decency as it murders, starves and disperses a population of 2.3 million while making their land uninhabitable. The Israelis took this risk and they have lost. We are now able to watch videos of Israeli soldiers celebrating as they murder Palestinian mothers and children, as they dance and sing while detonating entire neighborhoods, as they mock Palestinians in a carnival of racist depravity one would have thought beyond what is worst in humanity—and certainly beyond what any Jew would do to another human being. The Israeli newspaper Haaretz reports, as American media do not, that the Israel Defense Forces covertly sponsor a social media channel disseminating this degenerate material in the cause of maintaining maximum hatred.

It is a psychologically diseased nation that boasts as it inflicts this suffering on The Other that obsesses it. The world is invited—the ultimate in perversity, this—to partake of Israel’s sickness and said, in a Hague courtroom two weeks ago, “No.” Post–Gaza, apartheid Israel is unlikely ever to recover what place it enjoyed, merited or otherwise, in the community of nations. It stands among the pariahs now. The Biden regime took this risk, too, and it has also lost. Its support for the Israelis’ daily brutalities comes at great political cost, at home and abroad, and is tearing America apart—its universities, its courts, its legislatures, its communities—and I would say what pride it still manages to take in itself. When the history of America’s decline as a hegemonic power is written, the Gaza crisis is certain to figure in it as a significant marker in the nation’s descent into a morass of immorality that has already contributed to a collapse of its credibility.

We come to U.S. media — mainstream media, corporate media, legacy media. However you wish to name them, they have gambled and lost, too. Their coverage of the Gaza crisis has been so egregiously and incautiously unbalanced in Israel’s behalf that we might count their derelictions as unprecedented. When the surveys are conducted and the returns are in, their unscrupulous distortions, their countless omissions, and—the worst offense, in my view—their dehumanization of the Palestinians of Gaza will have further damaged their already collapsing credibility. We come, finally, to The New York Times. No medium in America has had further to fall in consequence of its reporting on Israel and Gaza since last October. And the once-but-no-longer newspaper of record, fairly suffocating amid its well-known hubris, falls as we speak. It has erupted, by numerous accounts including implicitly its own, in an internal uproar over reportage from Israel and Gaza so shabby—so transparently negligent—that it, like Israel, may never fully restore its reputation.

Max Blumenthal, editor-in-chief of The Grayzone, described the crisis on Eighth Avenue better than anyone in the Jan. 30 segment of The Hill’s daily webcast, Rising. “We’re looking at one of the biggest media scandals of our time,” he told Briahna Joy Gray and Robby Soave. Indeed. This well captures the gravity of The Times’s willful corruptions in its profligate use of Israeli propaganda, and Blumenthal deserves the microphone to say so. Since late last year The Grayzone has exhaustively investigated The Times’s “investigations” of Hamas’s supposed savagery and Israel’s supposed innocence. This is more than “inside baseball,” as the saying goes. We now have a usefully intricate anatomy of an undeservedly influential newspaper as it abjectly surrenders to power the sovereignty it is its duty to claim and assert in every day’s editions. It would be hard to overstate the implications, for all of us, of what The Grayzone has just brought to light. This is independent journalism at its best reporting on corporate journalism at its worst.

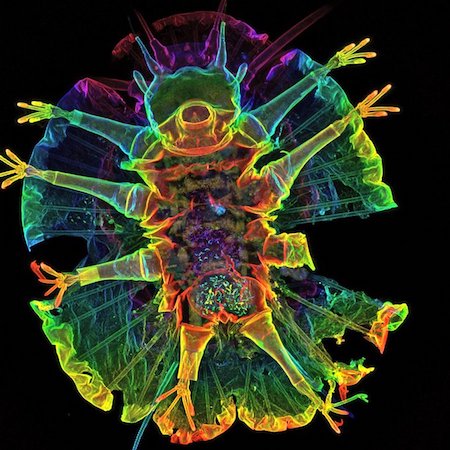

Assange

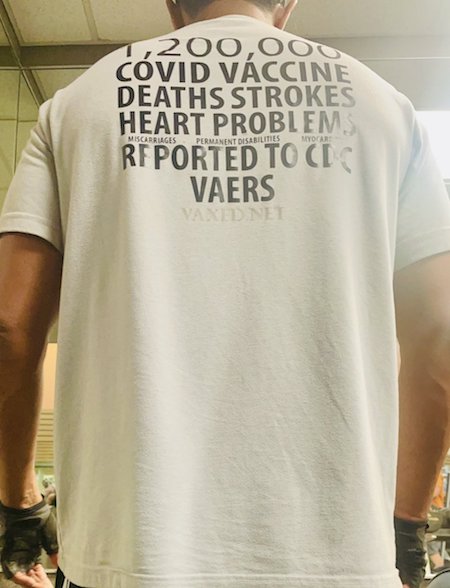

Elbalmer

John O’Looney (Funeral Director) raises concerns about the marked increase in abnormal pathological clots being found in deceased & an increase in excess deaths. pic.twitter.com/kgue34QM81

— Sai (@TheOriginalSai) February 11, 2024

Sunak vax

https://twitter.com/i/status/1757186168507052239

Silverback

It's not unusual for Silverbacks to be affectionate father figures. Shabani just takes that up to 11 pic.twitter.com/ZNNhDbNTwO

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 12, 2024

Tree planting

https://twitter.com/i/status/1757059356535804164

Longest truck

https://twitter.com/i/status/1756952347735921042

Milky Way

https://twitter.com/i/status/1756949552953778634

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.