John Atkinson Grimshaw Liverpool from Wapping 1875

Mel Gibson

SHOCKING: Mel Gibson (Sound of Freedom) is the REAL DEAL

warned about the evils of HOLLYWOOD in 1998

Predicted how they‘d turn on him

Alludes to actors being actual demons

He knows something very dark & wants to EXPOSE it. The seriousness in his voice is chilling pic.twitter.com/6l8Mu6LVxV

— E (@ElijahSchaffer) July 9, 2023

Ballard 2014, 2023

In 2014 CBS did a segment applauding Sound of Freedom ’s Tim Ballard’s work against child trafficking.

Almost 10 years later the same media is calling the film inspired by his work, “paranoid” “Qanon conspiracy Why? pic.twitter.com/I8Onud4sQ3

— Melissa Tate (@TheRightMelissa) July 9, 2023

JUST IN: Tim Ballard drops bombshell accusations — children are being trafficked from war torn Ukraine through Mexico, to be trafficked into the United States.. pic.twitter.com/Rct4PMFKR1

— Chuck Callesto (@ChuckCallesto) July 9, 2023

RFK full

Posting my full conversation with @RobertKennedyJr here, in case it gets taken down on other platforms. I have high hopes for Twitter increasingly being a great place to host long-form podcast conversations. pic.twitter.com/xYXfSJvWXt

— Lex Fridman (@lexfridman) July 7, 2023

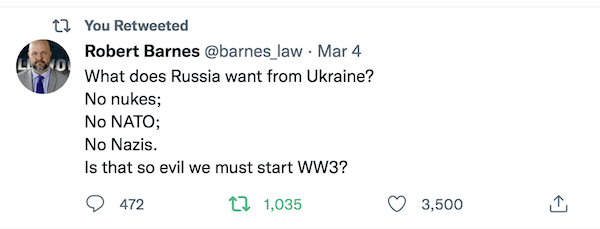

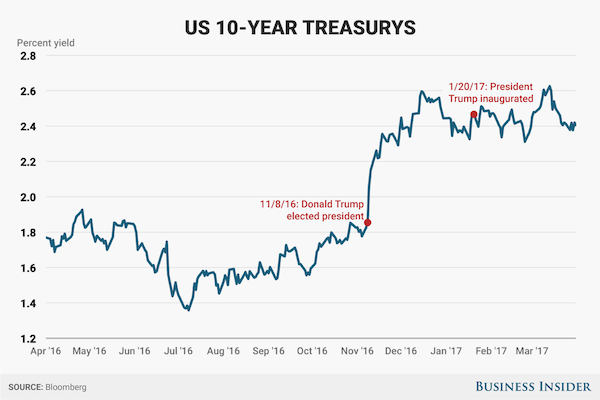

Dollar and oil

Putin has achieved what Gaddafi and Hussein failed at, to decouple the dollar from the oil. pic.twitter.com/TYRmS9EdDP

— Lord Bebo (@MyLordBebo) July 9, 2023

RFK seizures

This is the story that got RFK Jr to look into whether vaccines cause autism. It's just 3 minutes long. EVERYONE should watch it. pic.twitter.com/cXOoCybFL9

— Steve Kirsch (@stkirsch) July 9, 2023

Luft

.@SenRonJohnson discusses the DOJ arresting and silencing Dr. Gal Luft in November 2022, after their refusal to investigate Luft's March 2019 evidence suggesting the Bidens used an FBI mole named "One Eye" to exchange classified information for bribe money from CEFC China Energy.… pic.twitter.com/gj3ZHHq425

— KanekoaTheGreat (@KanekoaTheGreat) July 9, 2023

Levin

https://twitter.com/i/status/1678251441012502528

“..isn’t Hunter simply keeping up with the trends? If anything, all this makes the Bidens more relatable for their ultra-liberal fan base.”

• Hunter Biden’s Decadent Lifestyle Is A Metaphor For US Society (Robert Bridge)

On July 2, just as the nation was preparing to celebrate Independence Day, the Biden White House got far more fireworks than they had bargained for as news spread rapidly that a bag of cocaine had been discovered inside the White House. Two days later, Hunter Biden, currently America’s most infamous drug abuser, appeared on the White House balcony, looking sweaty and nervous, instantly reminding many viewers of the Hunter Biden we know from the folksy home-made videos and photos found on his “laptop from hell” – a story that the consolidated efforts of social media censorship and mainstream media memory-holing had failed to suppress. Hunter has been caught on camera (or even made the pictures himself) doing all kinds of seedy things, from apparently breaking the ground-speed record while smoking from a crack pipe to having sex with prostitutes. So naturally, it should come as no surprise that many people, primarily of the Fox News variety, took the cocaine evacuation scare to mean that Hunter was wreaking havoc once again, this time right at the heart of the nation.

Say what you will about former President Donald Trump – and much has been said – it is hard to imagine his own privileged children caught behaving in such an unhinged way, either in public or in private. And while America’s most controversial leader of all time may have had sticky fingers when it comes to classified and unclassified documents, at least we can say he was trying to keep abreast of international and domestic issues, while the entire establishment and deep state was working 24/7 to destroy him, as they are stilling doing now. Hunter Biden’s drug problems are well documented, including by the man himself. He talks about it in his memoir (which some sycophantic reviewers describe as a “story of redemption”) and in one of the most cringe interviews of all time.

“I spent more time on my hands and knees picking through rugs, smoking anything that remotely resembled crack cocaine,” Hunter freely admitted to CBS interviewer Tracy Smith. “I probably smoked more Parmesan cheese than anyone you know, Tracy.” Tracy Smith was so visibly stunned by the remark that she never bothered to ask the obvious question as to why there would be so much cheese on anybody’s carpet. But that’s neither here nor there. Given the above admission, one would be excused for picturing a mental image of Hunter hoovering up traces of cocaine-laced dust from Oval Office carpets with his nose. In fact, plenty of memes to the tune have been posted online since the White House drug scare, taken with various degrees of seriousness.

Yet the fact that one of the most powerful (but certainly not the most popular, as the Democratic Kennedy clan was, for example) American political dynasties could not keep in check Hunter’s deep-seated drug problems speaks volumes about the Biden administration and the fate of the nation at large. In due fairness to the Biden family, they did succeed in raising a successful and morally upstanding man, Hunter’s older brother, Beau, a politician, lawyer, and officer who had a very promising political career ahead of him, until he succumbed to brain cancer at the age of 46.

By comparison, to a large part of the conservative American public, Hunter has become a sinful, sweaty, hyperventilating metaphor for everything wrong with America today: crime, overindulgence, and degradation of the norms of morality in the same vein that sees young children exposed to sexualized drag shows as some sort of “inclusivity.” One would think that a wayward son such as Hunter and a bag of drugs discovered at the very seat of power (whether the two are linked in reality, or just in the public eye) should prove fatal to the president’s reputation. But in the current decadent-empire state of the US, with drug use less and less frowned upon and the boundaries of sexual depravity being pushed ever farther away, isn’t Hunter simply keeping up with the trends? If anything, all this makes the Bidens more relatable for their ultra-liberal fan base.

“MAGA Democrat.” To beat the Hillary-Obama-Biden machine, this could be the only ticket.

• Unlikely Trump-RFK Ticket Remains a Hot Topic (ET)

On July 6, Mr. Kennedy told NewsMax he wouldn’t consider being a running mate for either Trump or [Joe] Biden, but the prospect of a Kennedy/Trump ticket remains a hot topic on social media and also among high-profile politicians and could reveal how America will vote next November. Former Trump adviser Steve Bannon suggested a Trump/Kennedy ticket back in April. Early in July, on the Christian Broadcasting Network (CBN), former Arizona gubernatorial candidate Kari Lake, who considered herself a vice-presidential prospect for Trump, was asked about what she thought of the idea. While she didn’t directly answer the question, Mrs. Lake called Mr. Kennedy a good man who has done amazing and criticized people who have been referring to Mr. Kennedy as a “MAGA Democrat.”

“They just don’t want outsiders in the political machine, they don’t want outsiders coming into the swamp draining the swamp,” said Mrs. Lake, “They just want just the pre-approved, controllably, easily blackmailed and easily bribed people like Biden and the whole swamp system down there.” Mr. Bannon said Mrs. Lake is his favored choice for Trump’s vice president, but said on his War Room show that if she wasn’t available “Kennedy would be an excellent choice.” Others like Connecticut resident Libby DePiero, who has attended 41 Trump rallies since his first run for president in 2016, told The Epoch Times it would be a “dream come true” if Kennedy and Trump ran together. “Between Kennedy’s fight for medical freedom against the COVID tyrannists [sic], and Trump’s proven record to make Americans first in their own country, it would be an even better presidency than Trump’s first time in office,” she said.

Several who like the idea have run polls on social media posing the question. According to a Twitter poll of 1,629 users, 73.8 percent said they would support a Trump/Kennedy Ticket. The poll was based on 1,629 voters. Participants like New York Times bestselling author and founder of ACT for America Brigitte Gabriel said a “Trump-Kennedy 2024 unity ticket would end Biden’s chances of re-election!” Ms. Gericke said that while Kennedy does come from a political dynasty, she sees him as an outsider like Trump who knows that this world is such dire straits that the presidency is beyond party loyalty.

Mrs. Psenick Hope said while she and her husband were vacationing in Colorado, they broached the idea of a Kennedy/Trump ticket with locals in the left-leaning state. “They said they would support Trump if Kennedy was on the ticket with him, she said, “just like Republicans say they would support Kennedy if he was on the ticket with Trump.” Mrs. Lake told CBN anchor Gary Lane that the swell of support for a Kennedy/Trump ticket shows “we are almost beyond Democrat versus Republican. We are now Communism and Globalism versus Americanism,” she said. She said while like herself, Trump has political differences with Kennedy, she suspects “he also respects” RFK Jr.

“There is no other way than a total win and to get rid of Putin…We have to take all risks for that. No compromise is possible, no compromise.”

• How To Avoid The Worst Battlefield Defeat The US Has Suffered (Helmer)

There’s no American anti-war movement in the Vietnam War, Syrian War or Afghan War sense of the term. That’s because there is a genuine US strategic interest at stake in fighting Russia to the last Ukrainian, and further. No comparable strategic stake existed in the earlier wars. The stake in the war against Russia is the preservation of the US occupation of Germany and the empire in Europe and the UK, together with the credibility of US weapons which must be sold worldwide at prices to match their reputations in combat. Losing the war on the Ukrainian battlefield and in the sanctions war against Russia means a worldwide defeat for the US, its military power, its commercial and financial dominance, along with its command-and-control systems, subsidiaries, and retainers.

The substitute for an anti-war movement in Washington is faction-fighting over what means, what terms can be devised to get the US out of the Ukraine before the Ukrainian army capitulates, Vladimir Zelensky flees for his life and fortune, and with them the collapse of the US alliance called NATO. The apprehension of the allies in Europe was revealed a few days ago when Jacques Attali answered a telephone call he thought was from former Ukrainian president Petro Poroshenko, but which came instead from the Russian pranksters Vovan and Lexus. Attali, French presidential adviser, US retainer, and ex-head of the European Bank for Reconstruction and Development, said he knew French President Emmanuel Macron well and that Macron was afraid the US would abandon the Ukrainians to save itself.

There was the same fear among the Germans and British, Attali added. “The weak point is what happens in Washington.” “[This is] a nightmare scenario. That would be the US saying, well, enough is enough. We are not going to help Ukraine more. You have to go to negotiations, to the negotiating table. And that’s it. … Neither France, Germany or the UK can do that. But the US could arm-twist your [Poroshenko’s] government and your country [Ukraine] to say we want a ceasefire whatever it costs and stop [the war]. The most important thing is to avoid that.” “There is no other way than a total win and to get rid of Putin…We have to take all risks for that. No compromise is possible, no compromise.” This is the European allies’ last stand, their backs to the wall at the Dnieper River. It is the rationale for desperate measures on the battlefield, and at the NATO summit on July 11.

“They’re handing them equipment that they then have to learn to use, which usually takes six months to a year to actually effectively learn how to use. And they’re doing this in a training session compressed into just a few weeks..”

• Ukrainian Counteroffensive Headed for ‘Disaster’ – Ex-US Marine (Sp.)

The White House rushed into preemptive damage control mode on Friday amid backlash over President Joe Biden’s controversial decision to send cluster munitions to Ukraine. “The Ukrainians are running out of ammunition,” Biden said in a media interview. “This is a war related to munitions, and they’re running out of that ammunition and we’re low on it,” he added. Under Secretary of Defense Colin Kahl confirmed to reporters that the US would try to get the cluster munitions to Ukraine “in a timeframe that is relevant for the counteroffensive.”

But the latest news from the front suggests otherwise, with Ukrainian frontline commanders and grunts telling Western media that they’re running low on everything from vehicles and ammunition to man portable air defense missiles, while the much-advertised NATO main battle tanks once expected to turn the tide have actually been pulled back from the front after taking losses. Still, over a month into the offensive, Ukrainian and NATO officials and most media continue to assure that the battles have been “probing attacks,” and that, in Kahl’s words, the “majority of [Kiev’s] combat power for this fight has not yet been brought to bear.” “You don’t do probing actions with your best tanks, your best infantry fighting vehicles,” Brian Berletic told Sputnik’s New Rules podcast.

“You do that with forces that are in a certain way ‘expendable.’ And then you follow that up with your best forces to exploit any gains that they might make. They have not been making gains. They’ve been mired in these minefields. And I think what we’re actually watching is a failure to plan for and properly breach these minefields. And it’s being passed off as merely probing actions ahead of the main offensive,” the former Marine said. According to Russian Defense Ministry figures, between the beginning of June and July 9, Ukraine has lost close to 1,250 armored vehicles (including tanks), nearly 950 other military vehicles, 29 rocket artillery launchers, 425 pieces of artillery and mortars, two air defense systems, over 500 drones, 22 airplanes, and six helicopters.

It was “extremely unrealistic” from the start on Kiev’s part to imagine that going into the counteroffensive with NATO-trained troops and NATO equipment would somehow transform their forces into an invincible army, Berletic said. “We have to remember that even though NATO trained Ukrainian troops ahead of this offensive, they did so in a very abbreviated manner. They’re handing them equipment that they then have to learn to use, which usually takes six months to a year to actually effectively learn how to use. And they’re doing this in a training session compressed into just a few weeks. You cannot accelerate something like this. If you rush training, it’s going to play out disastrously on the battlefield,” the former Marine explained.

“We had to evacuate the evacuation team..”

• Ukraine Reportedly Pulls Leopard 2s From Front, Low on Armor, Ammo (Sp.)

The US announced Friday that it would be rushing controversial cluster munitions to Ukraine to help shore up Kiev’s flagging counteroffensive, which began a month ago but has run up against stiff resistance from Russian forces backed by heavy artillery and air support. The Ukrainian military doesn’t have enough tanks, armored vehicles or ammo to overrun heavily entrenched Russian positions, has pulled its vaunted Leopard 2s from the frontline, and is looking to ramp up domestic tank production – a process that will take up to 6 months, US business media have reported, citing senior Ukrainian officials and frontline commanders.

“It’s impossible to completely destroy such a well-prepared position before advancing,” a unit commander from Ukraine’s 108th Brigade said of Russian entrenchments, telling US media that Ukrainian forces are suffering a shortage of armored vehicles, with infantry forced to advance on foot, which makes them vulnerable to flanking maneuvers. “If we had more vehicles, we could have brought more infantry to the flanks,” the commander said, admitting that a month after the counteroffensive began, he had yet to take part in an operation that successfully captured and held a defended Russian position. Instead, Ukrainian forces have so far only be able to capture a “handful” of villages in Zaporozhye and Donetsk regions, at the cost of thousands killed and hundreds of tanks and armored vehicles destroyed.

Last week, the Russian military reported that in a month of battle, Ukraine had lost 920 armored vehicles, including 16 Leopard tanks, and 18 aircraft. Another major problem is the lack of artillery and air superiority, with Kiev’s small arsenal of Soviet-era fighters and helicopters facing up against a superior force of Russian Sukhoi fighter jets and Ka-52 Alligator gunships. Kiev has been loath to use its NATO-provided Leopard 2 tanks, with the 68 ton behemoths apparently getting stuck in minefields in the first phase of the offensive in early June, and Leopard 2s not “seen on the battlefield” since then. Western military analysts suggest Kiev may be saving them for use in a breakthrough amid probing for weak spots in Russian positions, but the task is said to be complicated significantly by the region’s mostly flat, open fields, which offer scant protection or places to hide.

Grunts offered candid appraisals of Ukrainian forces’ horrific losses, with soldiers from the southern front, presumably in Zaporozhye, saying they could lose “dozens of men” in a single assault. “We had to evacuate the evacuation team,” a 19-year-old combat medic said, recalling an instance where a mortar hit his vehicle during an evacuation of wounded.

What is pessimistic about not starting WWIII?

• Ukraine Pessimistic About Outcome Of NATO Summit In Vilnius (TASS)

Ukrainian authorities are not optimistic on the eve of the July 11-12 NATO summit in Vilnius, according to The Guardian newspaper. According to it, “Ukraine is increasingly pessimistic about taking a significant step forward in joining Nato as leaders of the western military alliance are set to assemble on Tuesday in the Lithuanian capital, Vilnius.” The newspaper says that the Kiev regime “is expected to be offered a package of last-minute ‘enabling security guarantees’ at the two day summit – an assurance from countries such as the US, UK, France and Germany that military aid and training will continue in the long term,” while Kiev believes that “Nato membership, carrying with it the defensive prospect of the western nuclear umbrella, is the only realistic long-term guarantee of its security.”

The Financial Times reported on Sunday, citing its sources, that the US and Germany were not going to guarantee Ukraine automatic NATO membership without profound reforms. At the April 2008 Bucharest summit, the alliance approved a political statement that Ukraine and Georgia would become NATO members with time, but refused to present the Membership Action Plan (MAP) to either country, given that this is a first step in the legal procedure on joining the organization. In February 2019, Ukraine’s Verkhovna Rada approved constitutional amendments enshrining Kiev’s aspiration to join NATO. Ukrainian President Vladimir Zelensky repeatedly stated that Kiev needed a specific timeframe of joining the military bloc.

There will be some convoluted wording.

• NATO Powers Race To Finish Security Pledges For Ukraine (RT)

A small group of Western allies are engaged in “advanced” and “frantic, last-minute” negotiations to finalize a security assurance declaration for Ukraine ahead of this week’s NATO summit in Lithuania, according to four officials familiar with the talks, Report informs, citing POLITICO. For weeks, the United States, the United Kingdom, France, and Germany have been discussing the issue with Kyiv, and have also reached out to other allies in NATO, the EU, and the G7. The idea is to create an “umbrella” for all countries willing to provide Ukraine with ongoing military aid, even if the details vary from country to country. A senior NATO diplomat said it would be up to each interested country to bilaterally determine with Ukraine “what your commitment will be. And it could be anything, from air defense to tanks to whatever.”

The initiative may ultimately amount to promises to continue much of the aid allies are already providing: arms, equipment, training, financing, and intelligence. But the intent is to offer a more-permanent signal of unity for Ukraine, especially as Kyiv is unlikely to get the firm pledge on NATO membership it wants at this week’s summit. “It is basically a guarantee towards Ukraine that we will, for a very long time to come, we will equip their armed forces, we will finance them, we will advise them, we will train them in order for them to have a deterrent force against any future aggression,” the senior NATO diplomat said.

“NATO was confined to the North Atlantic by the treaty that defines it..”

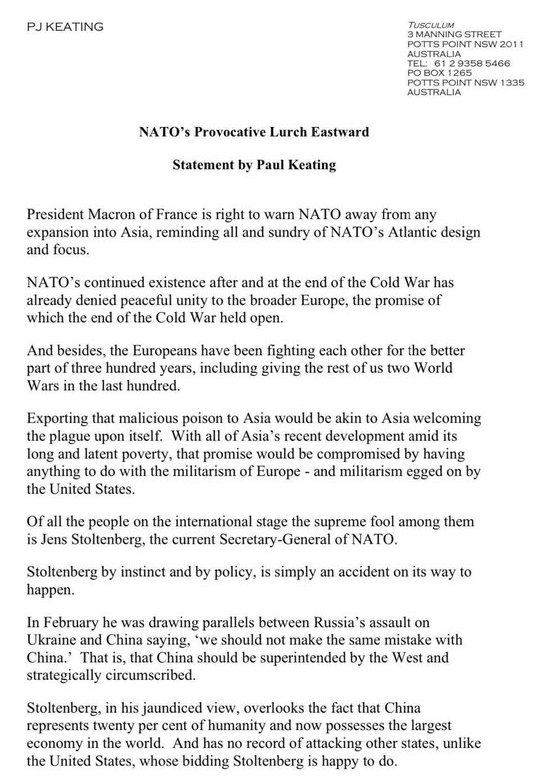

• Paul Keating: NATO Chief A ‘Supreme Fool’, ‘Accident On Its Way To Happen’ (G.)

Australia’s former prime minister Paul Keating has labelled the head of Nato a “supreme fool” for his push to increase the alliance’s ties with Asia in an attempt to contain China. Keating made the comments about secretary general Jens Stoltenberg in a statement released as Australia’s prime minister, Anthony Albanese, travels to Germany and the Nato leaders’ summit in Lithuania to discuss greater support for Ukraine. Keating is a strident critic of the acquisition of nuclear submarines through the Aukus alliance to guard against possible aggression from China, which Labor supported in opposition and has continued in government. In a statement, Keating praised French president Emmanuel Macron for warning Nato “away from any expansion into Asia, reminding all and sundry of Nato’s Atlantic design and focus”.

Paris has opposed Nato plans to open a liaison office in Japan, which would be the alliance’s first outpost in the region. The Vilnius summit was also reportedly to see the announcement of a new partnership between Nato and Japan which could see more joint military drills and interoperability. Keating said that Asia’s “promise” after its recent development “would be compromised by having anything to do with the militarism of Europe – and militarism egged on by the United States”. “Of all the people on the international stage the supreme fool among them is Jens Stoltenberg, the current secretary-general of Nato. “Stoltenberg by instinct and by policy, is simply an accident on its way to happen.”

Keating cited parallels Stoltenberg drew in February between Russia’s invasion of Ukraine and China in remarks that “we should not make the same mistake with China”. He said Stoltenberg’s position was “that China should be superintended by the West and strategically circumscribed”. “Stoltenberg, in his jaundiced view, overlooks the fact that China represents twenty per cent of humanity and now possesses the largest economy in the world … and has no record of attacking other states, unlike the United States, whose bidding Stoltenberg is happy to do,” Keating said. A Macron official told reporters last Friday the French were not in favour of an expansion into Asia “as a matter of principle”, saying NATO was confined to the North Atlantic by the treaty that defines it. Macron has previously resisted a Nato focus on China saying the country “has little to do with the North Atlantic”.

“If there is any logic behind the Administration’s decision to transfer cluster munitions, it boils down to ‘it won’t get any worse.’”

• White House Admits To Committing War Crimes In Ukraine – Russian Embassy (TASS)

The US administration has essentially admitted to committing war crimes in Ukraine, the Russian Embassy in Washington said reacting to a statement by US White House National Security Council spokesman John Kirby with regard to supplying the Kiev regime with cluster munitions. “We have taken note of the Director for Strategic Communications of the NSC John Kirby’s statements about the provision of cluster munitions to Ukraine. The official de facto confessed to the United States committing war crimes during the Ukrainian conflict. He overtly stated that civilians would fall victim to [the US’] cluster-type weapons. According to the perverted view of the White House representative, this does less harm than the actions of Russia,” the Russian diplomatic mission noted. “If there is any logic behind the Administration’s decision to transfer cluster munitions, it boils down to ‘it won’t get any worse.’

The United States is ready to destroy life far from its own borders with the hands of Ukrainians,” the embassy added. According to the Russian diplomats, the US administration is involved in this “only for the sake of an unattainable dream of the strategic defeat of the Russian Federation, which defends its people and its land. We fight Kiev criminals who embrace the Azov (a nationalist battalion outlawed in Russia – TASS) terrorists, while the United States is helping Ukrainian Nazis commit inhuman acts.” In an interview, broadcast on Sunday, Kirby insisted that Washington was supplying cluster ordnance to the Kiev regime in order to replenish the conventional artillery shells the Ukrainian armed forces are running out of quickly. “We are trying to ramp up our production of the kind of artillery shells that they’re using most. But that production is still not where we wanted it to be,” the White House official said. “So, we’re going to see these additional artillery shells that have cluster bomblets in them to help bridge the gap as we ramp up production of normal 155 artillery shells,” he added.

Farhan Haq, deputy spokesman for UN Secretary General Antonio Guterres, earlier said that the UN chief supported the Convention on Cluster Munitions and opposed the use of this type of weapons on the battlefield. When detonated in the air, cluster munitions scatter dozens of small bomblets over an area of dozens of square meters. If unexploded immediately, these bomblets pose a threat to civilians long after the end of any conflict. The Convention on Cluster Munitions was signed in 2008. By now, 111 countries have joined it, while another 12 nations have signed the document, but have yet to ratify it. According to Human Rights Watch, the dud rate of cluster munitions is usually much higher than the declared level, which leads to civilian casualties.

But their president would rather keep wasting their lives.

• US Can End Ukraine Conflict In 5 Minutes By Ceding Territory – Zelensky (TASS)

Ukrainian President Vladimir Zelensky has said that his US counterpart Joe Biden could end the Ukrainian conflict in five minutes by giving up Ukrainian territory but Kiev disagrees. “If we are talking about ending the war at the cost of Ukraine, in other words, to make us give up our territories, well, I think, in this way, Biden could have brought it to an end even in five minutes. But we would not agree,” he said in an interview with ABC News. He also commented on remarks by ex-US President Donald Trump who vowed to stop combat within 24 hours. Zelensky reiterated that Trump had already had that chance while he was in office.

“The sole desire to bring the war to an end is beautiful. But this desire should be based on some real-life experience. Well, it looks as if Donald Trump had already these 24 hours once in his time. We were at war, not a full-scale war, but we were at war and as I assume he had that time at his disposal, but he must have had some other priorities,” the Ukrainian leader insisted. That said, he mentioned some “dangerous signals” with regard to reducing aid to Ukraine “coming from particular politicians” in the US.

“..that common ground no longer exists between the U.S. and Russia, and there is no interest in diplomacy at all..”

Well, in Russia, there is.

• The Era of Nukes and No Diplomacy: ‘Crossing a Rubicon to Armageddon’ (SP)

The Doomsday Clock continues to tick toward nuclear war, but at its fastest pace ever. Professor Jackson Lears, a former naval officer serving on a U.S cruiser carrying tactical nuclear weapons, considers the current moment more frightening than at any time during the Cold War. Then, there was intense alarm for the fate of the earth and the survival of the human race. Today, rather than diplomacy or negotiation, talk revolves around new weapons shipments, disappointment in Ukraine’s counteroffensive failures, and even drone strikes in Moscow. But far less attention has been paid to the prospect of nuclear war between Russia and the U.S that threatens to end all life on this planet as we know it. That is the alarm sounded by cultural historian and author Jackson Lears who joins host Robert Scheer to discuss Lears’s essay for Harper’s Magazine, “Behind the Veil of Indifference.”

Lears’s piece warns that despite the public indifference, a “winnable nuclear war” has entered the minds of American strategists and politicians once again, undermining years of work towards nuclear disarmament. Lears tells Scheer that it is similar to the attitudes from the Cold War, yet this time, there is an eerie disinterest from the American side about even talking to someone like Vladimir Putin. “[T]his is, in a sense, a return to the worst kind of confrontations of the early 1960s but there’s a big difference because even Kennedy and even Reagan, cold warriors that they were, were eager to create common ground ultimately between the U.S. and the Soviet Union. And that common ground no longer exists between the U.S. and Russia, and there is no interest in diplomacy at all,” Lears said.

Scheer and Lears highlight a critical factor in shaping public perception: the Russiagate controversy and the media’s role in complying with government demands for secrecy, beginning in the late 1970s, while also promoting narratives that fostered consent for war with Russia. Scheer said, “if you even dare suggest there’s some complexity to this issue, or that the other side might have a point of view, or there’s something even worth negotiating about, you’re now considered unpatriotic.” Lears agreed: “We have former directors of the CIA who have perjured themselves before Congress, now posing as professional wise men and professional truth tellers on MSNBC and CNN.”

Biden’s too old to see the changes.

• Biden Believes China Wants to ‘Replace US as Leading Power’ (Sp.)

US President Joe Biden expressed belief on Sunday that the United States and China could establish working relationship that would benefit both sides. “I think there is a way to resolve, to establish a working relationship with China that benefits them and us,” Biden said. At the same time, he expressed the opinion that Chinese leader Xi Jinping wanted China to replace the United States as the leading power. “I’m confident he wants to have the largest economy in the world and have the largest military capacity in the world,” Biden said. He added that Xi also wanted to rewrite certain rules of the international order, but “not all of them.”

“I think so. Not all of them. But he pointed out to me and said we weren’t there when those rules were written … But I don’t think he wants, he’s looking for a war conflict, expansion of territory,” Biden said. The US President made these statements as he was leaving for Great Britain on Sunday to meet with King Charles III before continuing to Lithuania for a NATO summit on July 11-12 and then have a final stop in Finland. Biden’s comments on China came amid increased economic and financial contradictions between the two nations. US-China relations are strained by the growing restrictions on exports of US goods and services, the persistence of import duties on Chinese goods, Washington’s threats against Beijing over the latter’s cooperation with Moscow, the growth of world trade in yuan and the decreased influence of the US dollar across the globe.

The US President also touched upon the matter of cooperation with Saudi Arabia, saying that the the United States was a “long way from” providing Riyadh with defense treaty and civilian nuclear capacity. “We’re a long way from there,” Biden said, when asked whether the US was ready to provide Saudi Arabia with a defense treaty and civilian nuclear capacity to gain recognition of Israel on the part of Riyadh. In June, The New York Times reported that the Biden administration was making active attempts to normalize Israeli-Saudi relations. Riyadh, for its part, demands that Washington provide it with civilian nuclear capacity, sign a defense agreement on security guarantees with the country and remove some restrictions on the supply of US weapons to Saudi Arabia, the report said.

Guillain-Barre WAS rare.

• Peru Declares Health Emergency Due To Spike In Guillain-Barre Cases (Az.)

The Peruvian government declared a 90-day national health emergency Saturday due to an “unusual increase” of cases of Guillain-Barre syndrome, which total 165 with four deaths, Report informs via Xinhua. The decree, published in the official gazette El Peruano, details an action plan which has been drawn up with a budget of 12.12 million soles ($3.3 million) with an aim to improve patient care in health facilities, reinforce case control and prepare informative material for the population and health personnel. Among the measures were the acquisition of intravenous immunoglobulin and human albumin, as well as specialized diagnosis of the biological agents associated with the syndrome and assisted air transport for patients in emergency or critical condition.

Guillain-Barre syndrome is a rare disorder where the body’s immune system attacks part of the peripheral nervous system. So far this year, at least 18 of the country’s 24 departments have reported at least one case of the syndrome. The unusual spike in cases of a rare disease in a short period of time “negatively affects the continuity of health services, as there are not enough strategic resources to respond to the volume and complexity of the cases in health facilities,” warned the decree.

“They were struggling for a financial model to survive. They hadn’t really adapted to the age of the internet. You had Julian coming in with a completely new model of journalism.”

• Journalists Abandoned Julian Assange and Slit Their Own Throats (Chris Hedges)

When Julian and WikiLeaks released the secret diplomatic cables and Iraq War logs, which exposed numerous U.S. war crimes, including torture and the murder of civilians, corruption, diplomatic scandals, lies and spying by the U.S. government, the commercial media had no choice but to report the information. Julian and WikiLeaks shamed them into doing their job. But, even as they worked with Julian, organizations such as The New York Times and The Guardian were determined to destroy him. He threatened their journalistic model and exposed their accommodation with the centers of power.

“They hated him,” Matt said of the mainstream media reporters and editors. “They went to war with him immediately after those releases. I was working for The Financial Times in Washington in late 2010 when those releases happened. The reaction of the office at The Financial Times was one of the major reasons I got disillusioned with the mainstream media.” Julian went from being a journalistic colleague to a pariah as soon as the information he provided to these news organizations was published. He endured, in the words of Nils Melzer, at the time the U.N. Special Rapporteur on Torture, “a relentless and unrestrained campaign of public mobbing, intimidation and defamation.” These attacks included “collective ridicule, insults and humiliation, to open instigation of violence and even repeated calls for his assassination.”

Julian was branded a hacker, although all the information he published was leaked to him by others. He was smeared as a sexual predator and a Russian spy, called a narcissist and accused of being unhygienic and slovenly. The ceaseless character assassination, amplified by a hostile media, saw him abandoned by many who had regarded him a hero. “Once he had been dehumanized through isolation, ridicule and shame, just like the witches we used to burn at the stake, it was easy to deprive him of his most fundamental rights without provoking public outrage worldwide,” Melzer concluded. The New York Times, The Guardian, Le Monde, El Pais and Der Spiegel, all of which published WikiLeaks documents provided by Julian, published a joint open letter on Nov. 28, 2022 calling on the U.S. government “to end its prosecution of Julian Assange for publishing secrets.”

But the demonization of Julian, which these publications helped to foster, had already been accomplished. “It was pretty much an immediate shift,” Stella recalled. “While the media partners knew that Julian still had explosive material that still had to be released, they were partners. As soon as they had what they thought they wanted from him, they turned around and attacked him. You have to put yourself in the moment where the press was in 2010 when these stories broke. They were struggling for a financial model to survive. They hadn’t really adapted to the age of the internet. You had Julian coming in with a completely new model of journalism.”

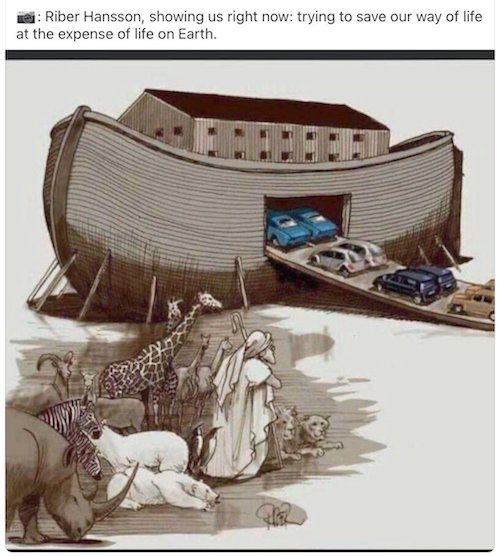

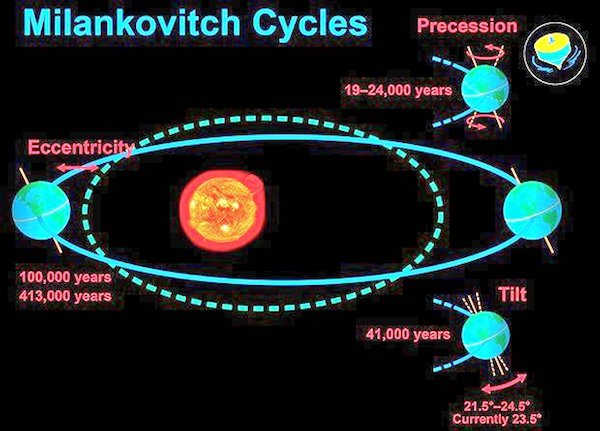

Primitive man believed the weather was determined by his good or bad actions. Today this belief takes the form of believing climate is determined by man, rather than by the Sun’s irregular orbit & activity: Milankovitch Cycles, Solar Inertial Motion, Solar Flares.

Vet

Vet walks the streets to help homeless people's dogs ❤️ @DrKwane pic.twitter.com/Tuaqr7zn5I

— The Dodo (@dodo) July 8, 2023

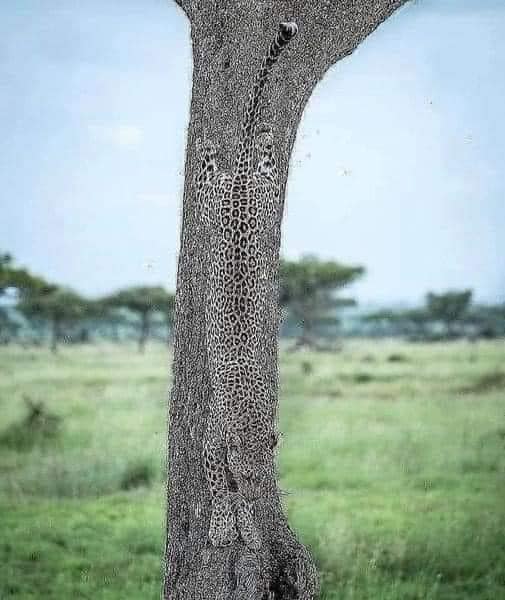

The photographer Leonardo Sens, waited 3 long years to take this fantastic shot in Rio de Janeiro, Brazil.

Chicken

chicken escape pic.twitter.com/anT2AdNNI1

— Shibetoshi Nakamoto (@BillyM2k) July 9, 2023

A baby blue marlin in the larvae stage. The eye to body ratio is quite high. This marlin might weigh up to 800 kg or 1800 pounds at maturity

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.