DPC Madison Street east from Fifth Avenue, Chicago Sep 1 1900

Poverty is a problem the US flatly denies and ignores.

• Both US Parties Need to Worry About Poverty (BBG)

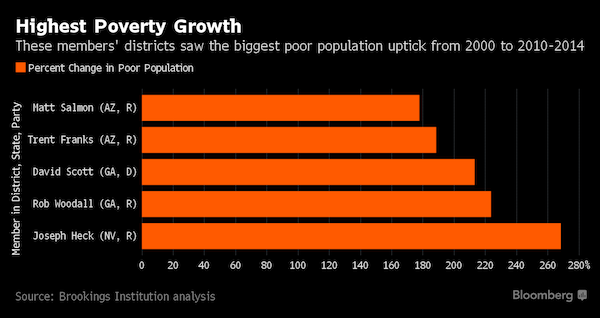

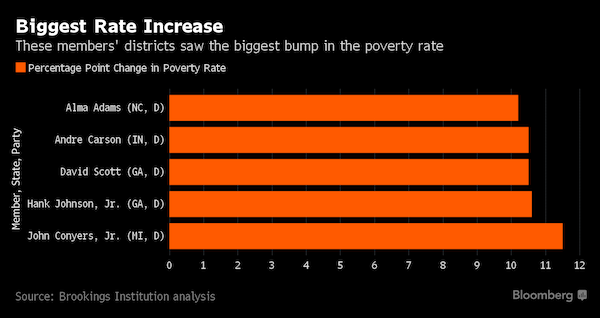

There’s a reason presidential nominee Donald Trump’s message of a declining America is inspiring support in Republican strongholds: poverty is worsening in his party’s congressional districts, a new analysis by the Brookings Institution shows. The poverty rate increased in nearly all – 96% – of the Republican-controlled districts between 2000 and the 2010-2014 period, according to a study by Elizabeth Kneebone, a fellow with the institute. She analyzed Census data and figures from the American Community Survey. The population living in poverty in all Republican districts climbed by 49%, compared with a 33% increase in Democratic areas. A big theme of this presidential election campaign that will be decided on Nov. 8 has been the battle to win low-income voters who feel left behind from the economic expansion.

Trump’s rallies have been often packed with middle-class supporters who are receiving his message to “make America great again.” Both him and Democratic candidate Hillary Clinton have promised to raise the minimum wage and deal with the affordability of college and childcare. Neighborhoods in Democrat-leaning districts also have a high proportion of poor people. Combined, the poverty rate in districts represented by Democrats was higher at 17.1% in 2010-14 than the 14.4% in Republican areas. However, the overall number of poor residents was larger in Red districts at 25.1 million compared with 22.7 million in Blue districts, the study found. “Poverty and opportunity should be more than a top-of-the-ticket conversation,” Kneebone said. “Challenges of poverty cut across the political divide and touch all 436 congressional districts.”

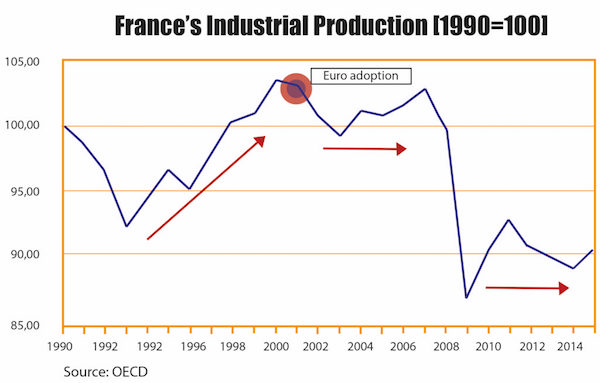

France suffers from the same disease as all Southern European contries. As long as it stays in the Eurozone, this can only get worse.

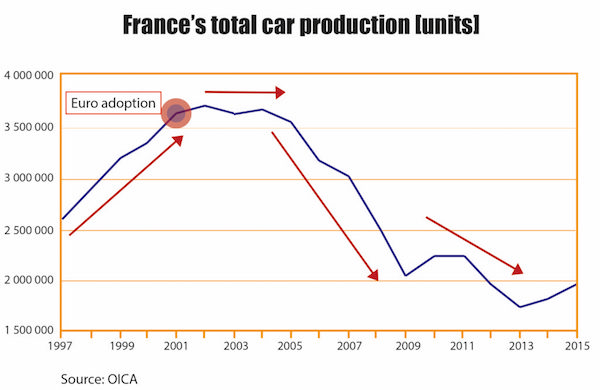

• The End of a Great Industrial Power: France Car Production Collapses (Gef.)

French industry has been contracting since the adoption of the euro. It was not able to recover after either of the 2001 or 2008 crises because the euro, a currency stronger than the French franc would be, has become a burden to France’s economy. The floating exchange rate works like an indicator of the strength of the economy and like an automatic stabilizer. A weaker currency helps to regain competitiveness during a crisis, while a stronger currency supports consumption of foreign goods. China has been accused of artificial devaluation of its currency to prop up exports, while the ECB’s policy has had an opposite effect for the economy of France and some South European countries: the euro has become too strong; whereas for Germany’s it has become too weak.

That is why the common currency has increased consumption and imports in less productive countries and strengthened German competitiveness and exports. Because of the euro France could not regain international competitiveness in the world’s market after the 2001 crisis, so its industry has been slowly dying ever since. What we are saying is not that weakening your currency is a solution to boost a never-ending growth. The floating exchange rate is a great tool for bad times, which is excellently known in Poland, where there was no recession because of, among others, a temporarily weaker national currency. France and South European countries have just given this tool over to the ECB and they were not able to have a quick recovery. Just like Germany has had with an undervalued euro in their case.

Today, according to the Eurostat, industry (except construction) makes up 14.1% of the French total gross value added, while in 1995 it was 19.2%. The EU’s average is still 19.3%, but in Germany 25.9%. Moreover, the share of industry in total employment in France is only 11.9%, also under the EU’s average (15.4%) and the German level (18.8%). One of the imprints of the dying French manufacturing under the ECB rules is automotive sector collapse. According to OICA data, the world’s car production almost doubled in the years 1997-2015 from 53 million vehicles produced yearly to 90 million. At the same time, Germany increased its car production by 20% from 5 to 6 million. What happened in France, once the proud producer of beautiful and modern vehicles?

Deflation.

• The Sad Case Of Japan Should Serve As A Warning For China (BBG)

China and Japan may seem to inhabit alternative economic universes. After more than two decades of stagnation, Japan is a fading global power that can’t seem to revive its fortunes no matter what unorthodox gimmicks it tries. By contrast, China’s ascent to superpower status appears relentless as it gains wealth, technology, and ambition. Yet these Asian neighbors have a lot in common, and that doesn’t bode well for China’s economic future. The sad case of Japan should serve as a cautionary tale for China’s policymakers. Beijing pursued almost identical economic policies to Tokyo’s to generate its rapid development. Now China’s leaders are repeating the missteps the Japanese made that tanked Japan’s economy and thwarted its revival.

30 years ago, few foresaw the decline of Japan, either. Japan was the East Asian giant poised to overtake the U.S. as the world’s top economy. Driving that ascent was an economic system that many considered superior to laissez-faire American capitalism. By fostering close, cooperative ties among the state, big corporations, and banks, Japan’s policymakers encouraged investment and guided a national industrial strategy. Bureaucrats in Tokyo interfered with markets to a degree unthinkable in the U.S. by protecting nascent industries and directing financing to favored sectors and companies. Backed by such support, Japanese companies burst onto the world stage and pushed their American competitors to the wall. But even as Japan appeared destined for greatness, its economy was, in reality, starting to rot.

Those clubby ties among finance, business, and government misallocated capital and led to wasteful investments. Growth was given a boost by cheap credit in the second half of the 1980s, but that also helped inflate debt levels and stock and property prices. When this “bubble economy” burst in the early 1990s, the financial industry was flattened. Japan has yet to fully recover. [..] The methods Beijing employed to generate rapid growth—directing finance, nurturing targeted industries, and promoting exports—are replicas of Japan’s. And since the state in China’s “state capitalism” plays an even larger economic role than Japan’s officious bureaucracy does, the Chinese government interferes with markets to a greater degree.

More record lows every day.

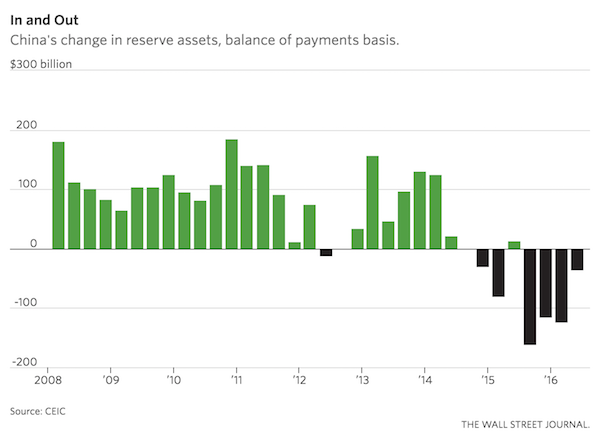

• China Faces Looming Bulge in Currency Pressure (WSJ)

Markets have grown more accustomed to the slow-motion decline in the value of the Chinese yuan. The currency’s next milestone, however, may usher in a more challenging period. China’s currency has fallen nearly 4% against the dollar this year, with a chunk of that move taking place over the past month, though there has been a small recovery in recent days. Recent dollar strength is certainly a factor in the minds of China’s currency managers in deciding when to intervene and when to let the yuan slide. Beijing has spent more than $500 billion in reserves to manage the yuan’s slide over the past two years on a balance-of-payments basis. Still, the yuan has slipped from 6.06 a dollar to above 6.75. That is getting close to 6.82, the level around which the yuan was pegged for an extended period from 2008 until 2010.

Currency traders could be accused of overplaying such historical levels having an effect on current trading. But in this case, it may have more than just a psychological impact. The two years in which the yuan was stuck around 6.82 was also the period of the largest inflows into the Chinese economy, to the tune of $764 billion, noted Kevin Lai of Daiwa Securities. Quantitative easing in the U.S. was in full effect and trillions flowed to emerging markets, especially China. Individuals and companies that borrowed in dollars or brought money in as a carry trade may have hung on until now, figuring they haven’t lost money on the exchange rate. But seeing the yuan get back to the rate when they brought it in could hasten transfers.

Unlike the period from 2008 to 2010, when interest-rate differentials vastly favored bringing money to China, and the exchange rate was pegged, the difference between dollar rates and yuan rates have narrowed substantially, plus the Chinese have to account for the possibility the yuan will weaken further. That explains why Federal Reserve rate increases have such a powerful effect on China’s capital flows. [..] It isn’t inevitable that the bulge of money that flowed in from 2008 to 2010 will necessarily leave. But outflows do continue to bubble below the surface. The ghosts of inflows past may yet haunt China’s future.

Lagarde poking a stick into a hornest nest.

• Egypt Central Bank Devalues Currency By 48% In Exchange For IMF Loan (AlJ.)

Egypt has devalued its currency by 48%, meeting an important demand set by the IMF in exchange for a $13bn loan over three years to overhaul the country’s economy. Thursday’s much anticipated decision by the Egyptian Central Bank followed a sharp and sudden decline this week in the value of the dollar in the unofficial market, dropping from an all-time high of 18.25 pounds to around 13 to the US currency. The devaluation pegs the Egyptian pound at 13 to the dollar, up from nearly nine pounds on the official market. The IMF’s executive board has yet to ratify the $12bn loan provisionally agreed by Egypt and the IMF in August.

Egypt’s central bank increased interest rates by three percent to rebalance currency markets following weeks of turbulence. A shortage of dollars in the economy had put the currency under intense downward pressure in recent months. A rapid slide on the black market to 18 earlier this week pushed the importers to cease buying, with the rate strengthening to 13 late on Wednesday, creating a rare opportunity for the central bank to devalue. The central bank said the new exchange rate was non-binding and would serve as “soft guidance to jumpstart the market”.

Even this can be turned into an anti-everyone-but-Hillary piece, as the Guardian proves.

• ‘The FBI Is Trumpland’: Anti-Clinton Atmosphere Spurred Leaks (G.)

Deep antipathy to Hillary Clinton exists within the FBI, multiple bureau sources have told the Guardian, spurring a rapid series of leaks damaging to her campaign just days before the election. Current and former FBI officials, none of whom were willing or cleared to speak on the record, have described a chaotic internal climate that resulted from outrage over director James Comey’s July decision not to recommend an indictment over Clinton’s maintenance of a private email server on which classified information transited. “The FBI is Trumpland,” said one current agent. This atmosphere raises major questions about how Comey and the bureau he is slated to run for the next seven years can work with Clinton should she win the White House.

The currently serving FBI agent said Clinton is “the antichrist personified to a large swath of FBI personnel,” and that “the reason why they’re leaking is they’re pro-Trump.” The agent called the bureau “Trumplandia”, with some colleagues openly discussing voting for a GOP nominee who has garnered unprecedented condemnation from the party’s national security wing and who has pledged to jail Clinton if elected. At the same time, other sources dispute the depth of support for Trump within the bureau, though they uniformly stated that Clinton is viewed highly unfavorably. “There are lots of people who don’t think Trump is qualified, but also believe Clinton is corrupt. What you hear a lot is that it’s a bad choice, between an incompetent and a corrupt politician,” said a former FBI official.

Sources who disputed the depth of Trump’s internal support agreed that the FBI is now in parlous political territory. Justice department officials – another current target of FBI dissatisfaction – have said the bureau disregarded longstanding rules against perceived or actual electoral interference when Comey wrote to Congress to say it was reviewing newly discovered emails relating to Clinton’s personal server. [..] Comey’s decision to tell the public in July that he was effectively dropping the Clinton server issue angered some within the bureau, particularly given the background of tensions with the justice department over the Clinton issue. A significant complication is the appearance of a conflict of interest regarding Loretta Lynch, the attorney general, who met with Bill Clinton this summer ahead of Comey’s announcement, which she acknowledged had “cast a shadow” over the inquiry.

It’s only a poll of 1000, but perhaps the US voter is not completely stupid.

• US Voters Fear The Media Far More Than Russian Hackers (WE)

Voters fear the media far more than Russian hackers when it comes to tampering with election results. According to a Suffolk University/USA Today poll, 46% of likely voters believe the news media is “the primary threat that might try to change the election results.” The national political establishment was the second most-suspected group at 21%, and another 13% were undecided. Foreign interests, including “Russian hackers,” ranked fourth with 10% and “local political bosses” came in last with 9% of likely voters as the main threat to truthful election results. The poll results found 51% of likely voters were either “very concerned” or “somewhat concerned” about the possibility of violence erupting on election day or afterwards.

The poll of 1,000 likely voters was taken between Oct. 20 and Oct. 24 and followed the release of private emails by the hacking group WikiLeaks that revealed cozy relationships between some prominent media stars and the Clinton campaign. The WikiLeaks dump also discovered Donna Brazile, the interim chairwoman of the Democratic National Committee, forwarded a debate question to Clinton that was later asked at a CNN Democratic town hall. Brazile at the time was a CNN contributor. The poll found 39% of likely voters believe the media is coordinating coverage with individual political campaigns, while 48% said the media is reporting “completely of its own accord.” The Gallup Poll has found trust in the media to have sunk to an historic low. A September Gallup survey found just 32% of American adults saying they have a great deal or fair amount of trust in the media,” a number that has dropped 8 %age points from last year.

“.. keeping Boobus Americanus fooled into believing that that guy in the black pajamas with the giant sword will be in their neighborhood next week..”

• Trump is Half Right and Half Wrong about Mosul (Di Lorenzo)

In his campaign stump speech Donald Trump ridicules Obama for publicly announcing four months in advance that “we” will be invading Mosul, Iraq to kick out ISIS there and capture its leaders. No element of surprise there. Twelve minutes after the announcement, said Trump, and the ISIS leaders were gone. Trump is right to mock this foolish talk. The element of surprise is what military commanders dream about. Stonewall Jackson’s famous flanking maneuver at the Battle of Chancellorsville (VA), where his 60,000-man army outflanked and surprised the 133,000-man Army of the Potomac with a crushing defeat is still to this day taught at military academies around the world.

But Obama is not that stupid. He’s just not interested in winning the “war on terra,” as Dub-Yuh called it. His main interest is keeping Boobus Americanus fooled into believing that that guy in the black pajamas with the giant sword will be in their neighborhood next week chopping off heads if we ever stop intervening in the Middle East. It’s all theater, in other words. That’s why the regime announces some big new military escalation every few months, lest Boobus forgets that he’s supposed to be frightened into acquiescing in the never-ending explosive growth of the military-industrial complex and the relentless growth of the state in general that it nourishes.

The mess will only get deeper unless Brits stop blaming each other.

• Tory MPs Warn High Court Trio Of Early Election If They Don’t Back Down (DM)

Theresa May could be forced to hold an early election if judges and Remain campaigners do not back down in the war against Brexit, Tory MPs warned last night. On a frantic day at Westminster, the Prime Minister vowed to appeal yesterday’s High Court verdict which would allow Parliament to frustrate or even scupper the process of Britain leaving the EU. No 10 sent a clear message to the courts that 17.4 million voters had backed Brexit and that they should not get in the way of ‘delivering the best deal for Britain’. David Davis, the Brexit Secretary, said that – if yesterday’s verdict was upheld by the Supreme Court – a full Act of Parliament would be required to trigger Brexit.

This would allow MPs or unelected peers to table amendments that could dictate the terms of Brexit or even halt the process. But Mr Davis warned that heading down this path would be a huge mistake. And senior Tories said that, if MPs and peers did try to frustrate Brexit, a General Election was almost inevitable, suggesting Mrs May would have no option but to trigger an ‘immediate’ poll in early 2017. Last night, Mr Davis said: ‘Parliament voted by six to one to give the decision to the people, no ifs or buts, and that’s why we are appealing this to get on with delivering the best deal for Britain. ‘Parliament is sovereign and has been sovereign, but of course the people are sovereign.

‘The people are the ones who parliament represents…17.4 million of them, the biggest mandate in history, voted for us to leave the EU. ‘We’re going to deliver on that mandate in the best way possible for the British national interest. ‘The people want us to get on with it and that is what we intend to do.’ Ex-justice minister Dominic Raab said the verdict had opened ‘Pandora’s box’. He added: ‘I think the elephant in the room here is if we get to the stage where [Remainers] allow this negotiation to even begin, I think there must be an increased chance that we will need to go to the country again. ‘I think that would be a mistake and I don’t think those trying to frustrate the verdict in the referendum will be rewarded.’

A global phenomenon. “..the political process [..] actually rewards those who underfund the present and defray costs onto future generations.”

• Government Pension Plans Are Headed For Disaster (Mises Inst.)

The combined debt held by U.S. public pension plans will top $1.7 trillion next year, according to a just-released report from Moody’s Investors Services. This “pension tsunami” has already forced towns like Stockton, California and Detroit, Michigan into bankruptcy. Perhaps no government mismanaged their pension as badly as Puerto Rico, where a $43 billion pension debt forced the commonwealth to seek protection from the federal government after having defaulted on its obligations to bondholders — a default which is expected to spread to retirees in the form of benefit cuts. While the disastrous outcome of Puerto Rico’s pension plan – which is projected to completely run out of assets by 2019 – represents the worst-case scenario, the same series of events that led to its demise can be found in most public pension plans nationwide.

There are three primary culprits that can be found in nearly every state suffering from a public pension crisis: 1) The use of accounting gimmicks that are designed to shift costs onto future generations – an approach outlawed for private pension plans and rejected by both public and private plans in Canada and Europe. 2) Lawmakers, acting in their political self-interest, who have catered to the past demands of government unions to enrich their members’ benefits while passing the costs onto future generations. 3) A broken governance structure where public pension board members are actually penalized in tangible ways for acting responsibly, and are rewarded by choosing to delay the day of reckoning. Perhaps the most concise assessment of public pensions came from the former chief actuary for the nation’s largest public pension fund – CalPERS – who noted simply that: “Politics and pensions just don’t mix.”

And it’s not just “liberal” states like California who have succumbed to the siren call of public pensions. My home state of Nevada – historically thought to be a bastion of limited government thought – is in a proportionally deeper hole than our California neighbors! [..] In theory, government is ostensibly designed to override the allegedly short-sighted, greedy nature of individual actors with policies that are long-term oriented and designed to maximize the general welfare. Yet, as the case of public pensions (not to mention infrastructure spending, the national debt, entitlements, etc.) reveals, the political process actually does the exact opposite: it actually rewards those who underfund the present and defray costs onto future generations.

Just ask yourself: who profits?

• Toronto Home Prices Surge in October, Undaunted by New Rules (BBG)

Toronto home sales rose to a record and prices surged in October, showing little effect so far from new government rules designed to bring stability to the market. Sales in Canada’s biggest city rose 12% to 9,768 transactions from the same month a year earlier, while average prices jumped 21% to C$762,975 ($569,852), according to the Toronto Real Estate Board. The average price of a detached home was C$1,034,077, up 26% on the year. New listings rose 0.9% to 13,377 homes. “Until we experience sustained relief in the supply of listings, the potential for strong annual rates of price growth will persist, especially in the low-rise market segments,” Jason Mercer, the board’s director of market analysis, said in a statement on Thursday.

The market remained hot even as Finance Minister Bill Morneau unveiled new federal rules in October that included a stress test for home-loan borrowers and came into effect halfway through the month. The rules also stiffened requirements for low-ratio mortgage insurance and closed a tax loophole. Toronto’s march higher contrasts with Vancouver’s continued sales decline since the provincial government enacted a tax on non-Canadian home buyers. Sales in the west coast city fell 39% in October over the prior year, while prices for all residential properties climbed to an average of C$919,300, a 25% jump from a year earlier and a 0.8% decline from September.

The west uses the Kurds when it comes to fighting ISIS, but leaves them hanging when it comes to Erdogan’s delusions.

• Turkey Police Round Up Kurdish Party Leaders in Midnight Raids (BBG)

Turkish police began rounding up Kurdish lawmakers in post-midnight raids on Friday, extending a crackdown on the opposition as President Recep Tayyip Erdogan consolidates power following a July 15 coup attempt. Selahattin Demirtas and Figen Yuksekdag, co-chairs of the Peoples’ Democratic Party, also known as the HDP, were among those detained, according to CNN-Turk. At Erdogan’s request, parliament had passed a law in May stripping the party’s lawmakers of their immunity from prosecution, which allows them to be charged with terrorism-related offenses. Last year, Demirtas looked to be a rising political star in Turkey. He led a pro-Kurdish party to win seats in parliament for the first time, passing the threshold of 10% of the national vote.

He also ran for president in 2014, and campaigned on a promise to prevent Erdogan from winning the power he seeks to transfer the seat of power in Turkey from parliament to an enhanced executive presidency. The police raids were carried out in Diyarbakir, Turkey’s largest Kurdish-majority city, and in the capital Ankara, according to Haberturk newspaper. Sirri Sureyya Onder, a member of parliament representing Istanbul, was also detained in Ankara, it said. Over the weekend, police arrested the elected mayors of Diyarbakir and later replaced them with government appointees. Demirtas had said that members of his party wouldn’t abide by orders to appear before courts, saying they’d become servants of the ruling party and were illegitimate.

Erdogan says the HDP is merely a front for the Kurdistan Workers’ Party, or PKK, a group classified by Turkey and allies – including the U.S. and EU – as a terrorist organization. The HDP is the third-largest party in Turkey’s parliament, holding 59 of the legislature’s 550 seats.

Could still be an incident, but it would fit the pattern.

• Turkey Appears To Have Closed Most Of The Internet (Ind.)

Much of the internet appears to have gone down in Turkey. People in the country are having problems accessing much of the internet’s biggest websites and services, including Facebook, WhatsApp, YouTube, Twitter and more. The website Down Detector confirmed problems in the country, particularly in the west. Some have reported that the sites are simply slow, but that it is still possible to access them. Others say they are down entirely. It isn’t clear whether the outage has been caused by an intentional ban, a cyber attack or just an accident. Some reported that issues with Turk Telecom appeared to be the cause of the problems.

Turkey Blocks, a website that tracks issues with the internet in Turkey, claimed that web traffic including that for WhatsApp was subject to throttling, where connections are slowed down to the point they are unusable. It claimed that the internet ban was related to the arrest of some political activists the night before the outage went into effect. The issue began overnight but has been going on throughout the day, according to local reports. The internet in general seems to be having a rocky few weeks – recently, it went down for almost a full day after a strange cyber attack on the internet’s infrastructure that appeared to be executed by webcams.

Yeah, yeah, CON21. Mankind is capable of producing huge amounts of hot air in more ways than one.

• Historic Climate Pact Enters Into Force (AFP)

A hard-fought pact to stave off worst-case-scenario global warming enters into force Friday after record-fast ratification by nations reassembling next week for a fresh round of UN climate talks. Dubbed the Paris Agreement, it is the first-ever pact binding all the world’s nations, rich and poor, to a commitment to cap average global warming by curbing planet-warming greenhouse gases from burning coal, oil and gas. “Humanity will look back on November 4, 2016, as the day that countries of the world shut the door on inevitable climate disaster,” UN climate chief Patricia Espinosa said. While cause for celebration, “it is also a moment to look ahead with sober assessment and renewed will over the task ahead,” she said.

This meant drastically cutting emissions in the short term, “certainly in the next 15 years,” Espinosa pointed out a day after a UN report said current trends were steering the world towards climate “tragedy”. By 2030, said the UN Environment Programme, annual greenhouse gas emissions will be 12 to 14 billion tonnes of carbon dioxide equivalent (CO2e) higher than the desired level of 42 billion tonnes. The 2014 level was about 52.7 billion tonnes. 2016 is on track to become the hottest year on record, and carbon dioxide levels in the atmosphere passed an ominous milestone in 2015. On Friday, the Eiffel Tower in Paris as well as government and public buildings in Marrakesh, New Delhi, Sao Paulo and Adelaide, among others, will be lit up in green to mark the entry into force of the historic pact.

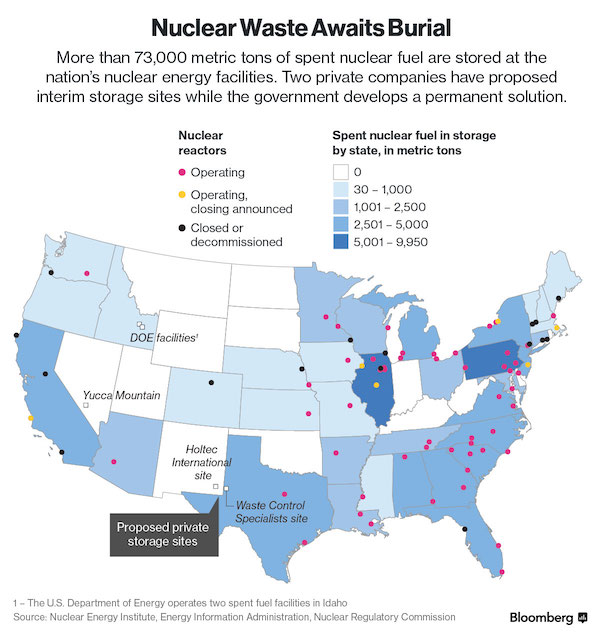

“..interim storage sites while the government develops a permanent solution..” Baloney. There is no permanent solution. Yucca Mountain was discarded after a judge ruled the government had to guarantee safe storage for 100,000 years. There is no such guarantee.

• Early Closings Of US Nuclear Plants Leave Toxic Waste With Nowhere To Go (BBG)

Under a 1982 law, the U.S. government, not the utilities, is responsible for disposing of radioactive waste that can take thousands, even hundreds of thousands, of years to degrade. But more than a half-century after nuclear energy powered the first American home, the U.S. Department of Energy still doesn’t have a permanent solution for the waste left behind. It’s a problem that will only get worse. On October 24, the Fort Calhoun Nuclear Generating Station near Blair, Nebraska, became the fifth nuclear plant to close in five years. Of 119 reactors in the U.S., 20 are now being decommissioned and a half-dozen more are expected to close prematurely, nudged out by cheap natural gas and growing use of renewables.

Beyond that, “the big wave of retirements really starts coming in around 2030,” Energy Secretary Ernest Moniz warned last month at an event in Washington. Among experts, the nuclear waste debate invariably turns on the fleeting nature of human institutions in dealing with an element that the Environmental Protection Agency has said must be isolated for 10,000 years to protect humans and the environment from toxic radiation. “The problem with federal agencies is that the management structure changes every few years,” said Allison Macfarlane, a former chairman of the Nuclear Regulatory Commission (NRC), which licenses and regulates civilian use of radioactive material. “In hundreds of years, will these institutions be there, will they care, will they pay?” That’s one issue. A second is where exactly to put the waste.

The safest thing to do is to bury it deep underground, below the water table and within a stable rock formation. Congress picked such a site in 1987: a desert ridge in Southern Nevada known as Yucca Mountain. The site abuts a nuclear weapons testing ground where 928 atomic tests were conducted between 1951 and 1992. While a few Nevada counties agreed with the selection, the state government didn’t, and the Yucca solution soon devolved into a decades-long political fight that crossed party lines and spanned presidential administrations. In 2010, President Barack Obama finally scrapped the plan altogether, declaring the site unworkable.