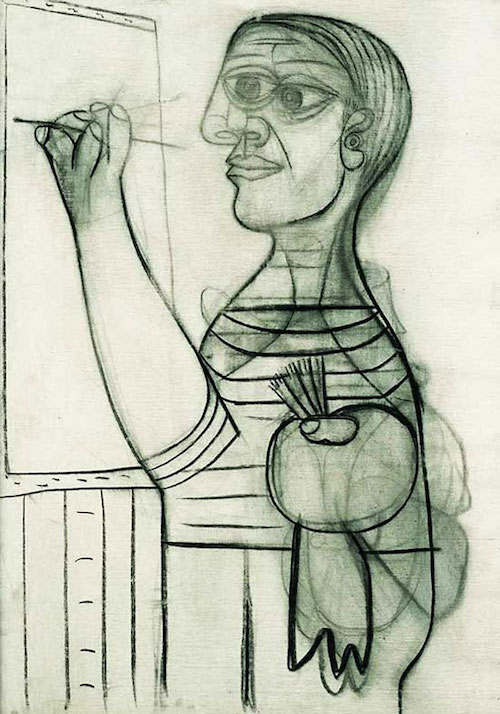

Pablo Picasso Le repos 1932

This painting has a story. It’s very funny. Read below.

Bill Gross’s wife. About the Picasso above.

• Bill Gross’s Wife Paints Fake Picasso, Swaps It With Real Thing In Divorce (NYP)

A woman locked in a contentious divorce with her bond-trader husband took a Picasso off his wall and replaced it with a forgery she made herself. Sue Gross didn’t wait until she and Wall Street titan Bill Gross had finalized their split, swapping out a 1932 Pablo Picasso painting entitled “Le Repos” hanging in their bedroom with her own rendering. The original is expected to fetch as much as $35 million at Sotheby’s Monday evening. The painting, which depicts Picasso lover Marie-Thérèse Walter, had belonged to them jointly. But a coin flip in August 2017 amid the couple’s divorce proceedings awarded Sue full custody of Picasso’s depiction of his sleeping mistress, which the couple had owned since 2006.

After the flip, Bill Gross tried to make arrangements for the piece to be transferred from his Laguna Beach, Calif., house to his ex-wife, sources told The Post. But the ex-Mrs. Gross said that was unnecessary; she already had taken the real thing. The couple’s art collection had been appraised by Sotheby’s in January 2017 amid the divorce proceedings, but Bill learned only later the Picasso was appraised in a different location than Laguna Beach. Bill was shocked Sue already had the piece, a source said, adding that Bill said, She stole the damn thing. In November testimony, the ex-wife readily admitted to swiping the Picasso, citing an e-mail Bill sent to her where he instructed her to “take all the furniture and art that you’d like”.

“And so I did,” she said. But it wasn’t quite that simple, as testimony revealed the ex-wife’s prowess for both painting and artful deception. “Well, you didn’t take it and leave an empty spot on the wall, though, did you?” lawyers for Bill Gross asked. “No,” Sue responded. “You replaced it with a fake?” the lawyer asked. “Well, it was a painting I painted,” Sue responded. “A replication of the Picasso?” the lawyer asked. “A replication, yes,” Sue answered. “And it had the Picasso signature and everything, didn’t it?” the lawyer asked. “Not exactly . . .” she said. “Whose signature was it? Sue Gross?” the lawyer asked.

“I don’t remember how I signed it. Bill will remember because I painted it at home years ago,” she said. “Did you tell him that you took the Picasso?” the lawyer asked. “No. We didn’t speak for a year and a half,” she answered just before the line of questioning turned to a 7-foot, 300-pound rabbit sculpture she also admitted taking.

“..it’s very rare that the Fed engineers soft landings, and I’m not a believer that they’re going to do it again this time.”

• Fed To Deliver ‘Punch In The Face’ Markets Aren’t Prepared For – Boockvar (CNBC)

Markets already know the Federal Reserve will deliver more rate hikes this year. They’re just not prepared for how much it will hurt, according to Peter Boockvar, chief investment officer of Bleakley Advisory Group. “The Fed is trying to ease the effect of their rate hike cycle by being very transparent,” Boockvar told CNBC’s “Futures Now” this week. It is “trying to convince us that quantitative tightening is like watching paint dry.” Fed chair Jerome Powell is carrying on Janet Yellen’s legacy of full transparency by prepping the markets as best as he can for inevitable monetary tightening. The Fed’s message of ‘steady-as-she-goes’ rate increases has calmed Wall Street into thinking this will mostly be a smooth path higher.

Boockvar expects tighter monetary policy will have a far greater impact than the Fed is telegraphing, and the market is anticipating. “Regardless of how they tell us, regardless of how they do it, there’s still a rise in the cost of capital, there’s still a drain of liquidity,” he said. He used a colorful analogy for the shock the markets will be dealt, even with the Fed’s fair warning. “If I gave you a month’s notice that I’m going to punch you in the face, when I punch you in the face, it’s still going to feel the same, it’s still going to hurt,” he said. Even worse, it’s more like two blows: While the Fed hikes interest rates, it’s also shrinking its balance sheet, Boockvar points out. “The biggest risk to the market is that they’re really tightening twice through the reduction of the size of their balance sheet,” said Boockvar.

[..] “At the same time, they’ll likely raise two more times this year, so the rise in interest rates to me is very noteworthy,” said Boockvar. “In a very over-levered, credit-dependent economy, that is my main concern because it’s very rare that the Fed engineers soft landings, and I’m not a believer that they’re going to do it again this time.”

Spain.

• Who’s Most Afraid of a Latin American Debt Crisis? (DQ)

Economic history appears to be rhyming once again in Latin America. Perennial credit-basket-case Argentina was one of the first countries to suffer a major currency crisis this century. Now, its government has asked the IMF for a brand-new bailout. But if this classic last-gasp fix was meant to calm the markets, it isn’t working. Previous Latin American debt crises have taught us two things: • The direct impact on the general populace, already suffering from sky-high poverty rates, is devastating; • Once the first domino falls, contagion can spread like wildfire. The debt crisis of the early 1980s, which spread to virtually all corners of the region, famously paved the way to Latin America’s “lost decade.”

Mexico’s Tequila Crisis of 1994-5 at one point became so serious that it almost brought down some of Wall Street’s biggest banks. At the moment, as long as the US dollar and US yields continue to rise, emerging market jitters can be expected to grow. As British financial correspondent Neal Kimberley notes, markets often behave like predators, running down what they perceive as the weakest prey first — a role being filled, with usual aplomb, by Argentina. Emerging market weakness is by now a generalized trend. The jitters could soon spread to Latin America’s two largest economies, Brazil and Mexico, which between them account for close to 60% of Latin America’s GDP. Both of the countries face general elections in the next two months.

[..] But it’s not just countries that are at risk of contagion; so, too, are global companies with a big stake in the affected markets. Few companies are more exposed to Latin America than large Spanish ones. Some were already burnt in Argentina’s last crisis and default. But in the aftermath of Spain’s real estate collapse, opportunities at home dried up to such an extent that access to Latin America’s fast-growing economies became a godsend. But it could soon become a curse.

What makes austerity dangerous.

• Can We Blame The Bankers? (Pettifor)

At a Rethinking Economics conference in Oslo last month I pointed out that western politicians and economists are repeating policy errors of the 1930s. The pattern of a global financial crash, followed by austerity in Europe and the UK, led in those years to the rise of populism, authoritarianism and ultimately fascism. The scale of economic and political failures and missteps led in turn to a catastrophic world war. Today that pattern – of a global financial crash, austerity and a rise in political populism and authoritarianism – is evident in both Europe and the US. And talk of war has risen to the top of the US political agenda. Why have we not learnt lessons from the past?

The “fount and matrix” (to quote Karl Polanyi) of the international financial system prior to its collapse in 1929, was the self-regulating market. The gold standard was the policy by which the private finance sector, backed by economists, central bankers and policy-makers, sought to extend the domestic market system to the international sphere – beyond the reach of regulatory democracy. In the event, the 1929 stock market crash put an end to the delusional aspirations of Haute Finance: namely that financiers could detach their activities from democratic, accountable political oversight. (Polanyi, The Great Transformation 1944).

Between 1929 and 1931 the losses from the US stock market crash were estimated at $50bn. It was the worst economic failure in the history of the international economy. Within three years of the crash millions of Americans were unemployed, and farmers were caught between rising debts and deflating commodity prices. In Germany between 1930 and 1932, Heinrich Brüning, the Chancellor, with the tacit support of Social Democrats, imposed a savage austerity programme that led to high levels of unemployment and cuts in welfare programmes. This in turn led to the demise of social democracy, the rise of fascism and ultimately a global war.

Again, austerity. Theresa May trumps Napoleon.

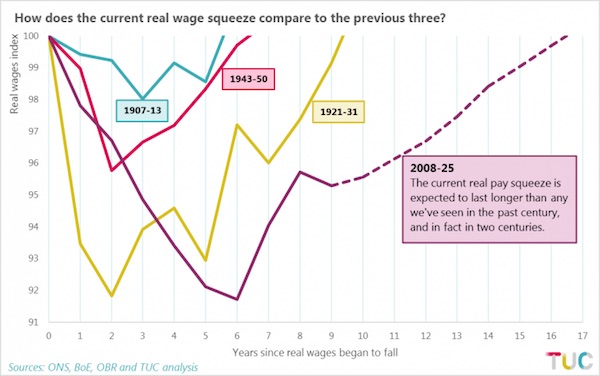

• UK’s 17-Year Wage Squeeze The Worst In Two Hundred Years (Tily)

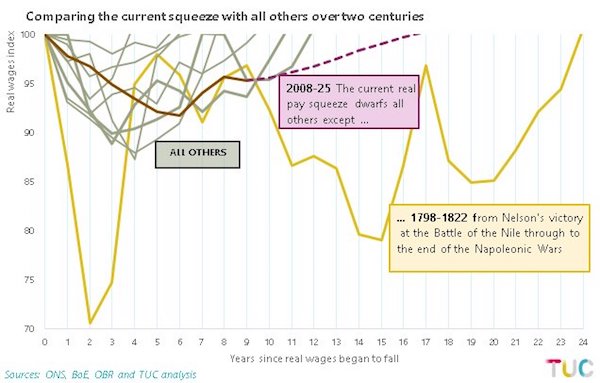

A decade on from the financial crisis, real wages today are still worth £24 a week less than they were in 2008. By the time they’re forecast to return to their pre-crash level in 2025, real wages will have been in decline for 17 years – the longest period since the beginning of the nineteenth century. The TUC compared the current wage squeeze (including the forecast) with every major earnings crisis over the past two centuries. We found that the only slump longer than the one we’re experiencing today was the 24 years between 1798 and 1822, a period when Europe was ravaged by the Napoleonic Wars and their aftermath. In fact, real wages even recovered faster during the Great Depression (10 years) and after the Second World War (7 years), as the chart below shows:

Year zero is the pre-crisis peak. Outcomes in subsequent years are measured as an index relative to that point. The real wage index returns to 100 when the crisis is over.

The current crisis not only dwarfs all others during the last century; it is the biggest since the period between 1798, when Nelson destroyed the French Fleet at the Battle of the Nile, and 1822, when the economy finally began to recover from the devastation of the Napoleonic Wars:

What’s the difference?

• EU Set To Push For 6-Month Extension To Brexit Transition Period (Ind.)

The EU is to push for an optional six-month extension to the Brexit transition period to be built in to the UK’s withdrawal agreement, The Independent understands. European Commission officials will seek the extension to give the EU added flexibility, but it comes as key figures in the UK also look to extend the transition to give time to implement new customs arrangements. Next week a crunch meeting will see Theresa May’s top ministers try to agree what kind of customs relations to seek in negotiations, with both of her proposed options potentially needing more time than the current transition allows. The Independent has been told by two sources in Brussels that the EU wants the six-month extension to protect its own interests, as Brexit negotiations come to their most critical phase.

One said: “Of course they are aware of the sensitivity around the issue in London, but it is about giving the commission more leeway if needed, at the end of the transition to get things in place.” A second official in Brussels said it would be normal for the commission to seek the added time, simply as a safety precaution given the uncertainty surrounding the British position. The commission is expected to try to put the optional six-month extension into the withdrawal agreement late on in the negotiations process, in order to maximise the chance of it being accepted. According to the current withdrawal agreement text, the transition period is set to last around 18 months from the end of March 2019 until December 2020 – to give time for both sides to get their houses in order before new legal and trade systems come into play.

They have no clue how to solve this. This whole Brexit preparation thing is just a waste of time.

• The Hard Border Is Too Hard A Question (G.)

[..] it would be satisfying to rewind and show that the reason many now believe Britain must stay connected to the EU for five years or so relates to complex customs rules and how they cannot be reconciled with open borders. Parliament only took notice when MPs on the Brexit select committee damned the government’s dithering. The committee’s message was that keeping the Irish border open and at the same time installing border controls with the EU couldn’t work. Ever since their report last December, the border contradiction has travelled through Whitehall like a virus, forcing civil servants to drop what they are doing in a desperate bid to find a cure. As one senior civil servant put it, officials are too busy finding a way to put the right export stamp on a sheep’s backside to think about anything else.

So far, no cure has been found and the situation is looking desperate. Foreign companies have virtually switched off the stream of investment into the UK. By the end of last year, OECD figures show foreign direct investment down by half on the average seen from 2012 to 2015 and by 90% on the bumper inflow of funds seen in 2016. [..] Even the most confident Brexiters have noticed the economy flagging under the weight of the customs union uncertainty. It’s such a quandary that last week Tory MPs were openly considering adding another three years to the transition deal just to give the brightest minds in the civil service enough time to sort it out. That would take the UK’s membership of the customs union to 2023.

They recognise that any attempt to stay inside an economic zone with the EU – whether that be the “Norway option”, under the banner of the European Economic Area, or the “Swiss option”, which involves negotiating upwards of 100 separate trade agreements – comes with a demand for free movement of labour. That, as we know, is an unacceptable outcome for Leave voters.

Throwing away much of a generation. Just like in Greece.

• Half A Million ‘Hidden’ Young People In UK Left Without State Help (Ind.)

Almost half a million young people are at risk of “a life of unemployment and poverty” after being left without any state help to survive and find work, ministers have been warned. The alarm has been raised over a staggering number of “hidden jobless” who have “fallen off the government radar”, despite promises of intensive support to achieve their potential. The new research has found that 480,000 16- to 24-year-olds are missing out on both benefits and advice – no less than 60 per cent of the official total of young jobless. Strikingly, many of them have good job prospects, boasting impressive GCSE qualifications and having continued with their education beyond 16.

But they refuse to go to job centres because they are “unhelpful” or they “fear being treated badly” – due to the threat of sanctions – while others lack the necessary documents. A senior MP has now demanded answers from ministers, while campaigners are urging the government to let them plug the gap where the state is failing young people. Frank Field, the chairman of the Commons Work and Pensions Committee, told The Independent: “It seems as though a small army of unemployed young people have fallen through the gaps in the safety net without any official data recording whether they are destitute. “If we are to prevent them from being consigned to a life of unemployment and poverty, a first move must involve gathering accurate data on which young people are without either a job or an income, so they can then receive appropriate support.”

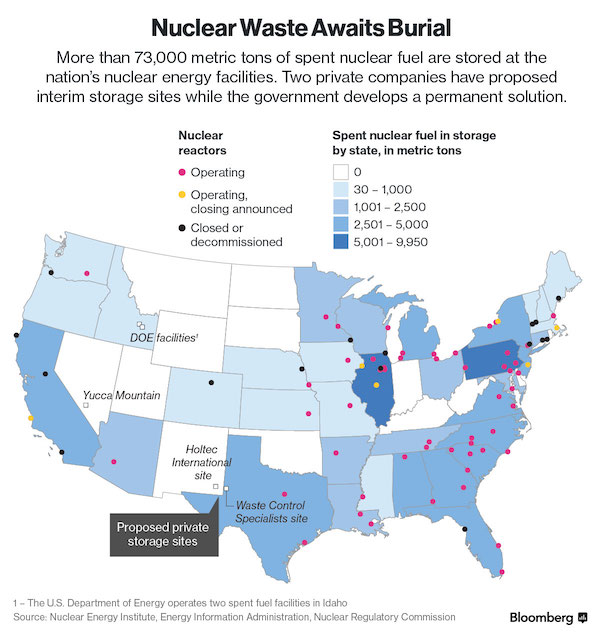

One word: Yucca.

• UK Campaigners Slam £1 Million Incentive To Store Nuclear Waste (G.)

MPs from both major parties have attacked the government’s latest incentive to entice communities into volunteering to host Britain’s first deep underground store for nuclear waste as “completely inadequate”. Ministers have offered up to £1m per community for areas that constructively engage in offering to take part in the scheme, and a further sum of up to £2.5m where deep borehole investigations take place. The aim is to find a permanent underground geological disposal facility (GDF) that could store for thousands of years the waste from Britain’s nuclear energy and bomb-making programmes. The scheme could involve building stores under the seabed to house highly radioactive material. It is predicted that the UK is likely to have produced 4.9m tonnes of nuclear waste by 2125.

But critics say the inducements offered by the government – part of the consultations it launched this year – to ensure local cooperation are “simply not good enough”, and point to the example of France, which has a similar amount of nuclear waste. It offers around €30m (£26.5m) a year as local support for districts neighbouring the site at Bure, in north-east France, and has also offered €60m in community projects. [..] The government is seeking to dispose of the UK’s nuclear waste underground because current storage facilities are both ineffective and expensive to maintain. A GDF would involve sealing the waste in rock for as long as it remains a hazard. The plan was also criticised by the Conservative MP Zac Goldsmith, who said the UK should stop making nuclear waste and stop building new reactors.

“We are still pouring untold billions of taxpayer money into propping up an industry that the free market would have killed off years ago,” he said. “In return, we will be compounding the catastrophe of a nuclear waste build-up, which we are no closer to solving than we were when the industry was born.” Nina Schrank, energy campaigner at Greenpeace UK, added: “The lack of seriousness with which the UK government treats nuclear legacy issues makes it predictable that their quest for a suitable site has been so unsuccessful that they are looking again at the Irish Sea, which Sellafield turned into one of the most radioactively contaminated seas in the world.”

“..we all know what usually happens when the EU goes on the ballot (see France and Netherlands in 2005, Ireland in 2008, Britain in 2016, pick your year in Denmark)”

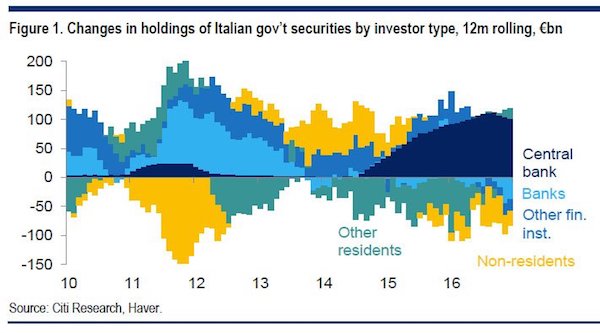

• Italy Could Blow Up Europe As We Know It (Pol.eu)

As Italy’s leading vote-getters work through the weekend to hammer out a coalition deal — about time, some might add, two months after the election — the EU and Brussels establishments are in a state of heightened anxiety. A government of the 5Stars (anti-establishment, in media shorthand) and the League (far right, ditto) together, or somehow alone, is unprecedented. Never before in any of the six original EU countries, much less one of its leading powers, have parties deeply skeptical toward the EU grabbed the reins of power. If that happens, the consequences for Italy and the EU could be felt for months and years to come. But the appetizer has been served. A surprise election outcome that sidelined Italy’s more traditional left and right parties and catapulted this odd couple into the limelight is disrupting European politics in unexpected ways.

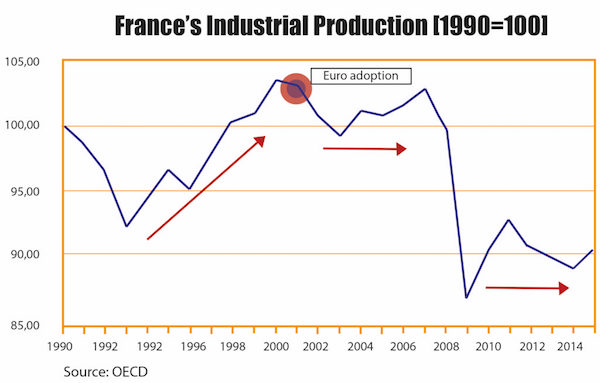

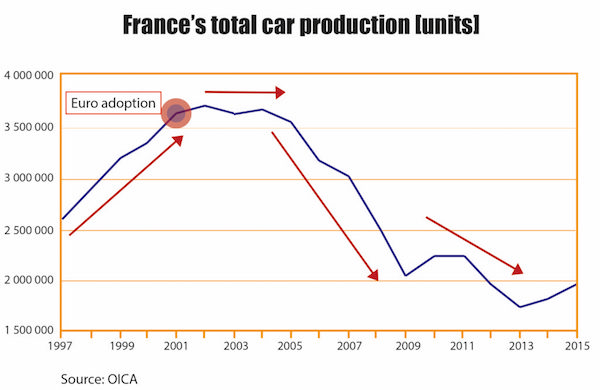

[..] an Italian euro-exit is hardly off the table either. Beppe Grillo, the 5Stars’ founder, last week revived the idea of forcing a referendum on Italy’s membership in the single currency. It is, after all, in the party’s DNA — and we all know what usually happens when the EU goes on the ballot (see France and Netherlands in 2005, Ireland in 2008, Britain in 2016, pick your year in Denmark). Italy’s high debt, low growth and terrible demographics make it an unhappy fit in a eurozone dominated by northern economic powerhouses. If anything, the speculation about the intentions of any government with the 5Stars in it hardly helps boost investor confidence in Italy.

[..] The success of these two parties brings home the changed mood among Italians. That’s especially true for the young. In a 2017 poll, just over half of people under 45 said they would vote to leave the EU if Italy holds a referendum on EU membership (while 68 percent of respondents over 45 supported staying in the bloc). Young adults in Italy have memories only of economic stagnation and crisis. While domestic politics and finance can be blamed for much of that, the heavy hand of the EU is often present in the tale of woe.

Just yesterday, Berlusconi got permission to run again. So maybe no new government yet?

• Italy’s Radical M5S And League On Verge Of Forming Government (G.)

When Italians went to the polls in early March, the message was loud and clear: it was time for the parties that had dominated politics since the early 1990s to vacate the stage. Over 50% of voters backed two outsider parties, the anti-establishment Five Star Movement (M5S) and the far-right League. Over two months later, the pair are on the verge of forming a coalition government that could break decisively with the centrist policies that went before. Matteo Salvini, leader of the League (formerly the Northern League), and his M5S counterpart, Luigi di Maio, have been thrashing out a deal that could be revealed as soon as Sunday. “The Italian people want this government,” said Mattia Diletti, a professor at Sapienza University in Rome.

“They want to see something new, and I think Sergio Mattarella [Italy’s president] understands this.” Salvini and Di Maio, an odd couple who have spent most of the past two months hurling insults at each other, are working to put together a policy document and are expected to update Mattarella on Sunday. Di Maio has said that “considerable steps forward” have been made on a policy programme, with agreement on issues such as tougher laws on immigration, reform of pensions, a flat tax and a universal basic income. But it is unclear who Italy’s next prime minister will be. The names mooted in the Italian press include the League’s deputy leader, Giancarlo Giorgetti; Giampiero Massolo, chairman of shipbuilder Fincantieri and ex-chief of the secret service, and Elisabetta Belloni, the foreign ministry’s secretary general.

In any event, the candidate is likely to be someone who will heed Mattarella’s thinly disguised warning to the coalition on Thursday against retreating from Europe. M5S has softened its stance on the EU, saying it would like to open discussions on “some treaties” rather than pull Italy out, while Salvini has said he wants to “defend Italy” within the bloc.

Hmmm…doubtful at best: .. the secret of change — and we need change — is to put all energies not in destroying the old, but rather in building the new.

So change, but decided by the same people…

• EU’s Mogherini: Iran Nuclear Deal Will Hold (Pol.eu)

The Iran nuclear deal can survive without the United States’ support, Federica Mogherini, the EU’s foreign policy chief, said Friday. Speaking at a State of the Union conference, Mogherini said she has received assurances from Iranian President Hassan Rouhani that the country would stand by the agreement, despite U.S. President Donald Trump’s decision to withdraw and reimpose sanctions on Iran earlier this week. “We are determined to keep this deal in place,” Mogherini said, adding that only Iran has the power to unilaterally wreck the deal.

The Italian diplomat will meet with the foreign ministers of Germany, France and the United Kingdom — the three European powers that brokered the nuclear deal along with the EU, U.S., China and Russia — in Brussels Tuesday to discuss the future of the agreement. The European diplomats will also meet with Iranian Foreign Minister Mohammad Javad Zarif. Europeans are seeking to demonstrate that they can still deliver most of the economic benefits Tehran was promised in exchange for giving up its nuclear weapons program and allowing a robust system of international inspections, as well as persuade European companies active in Iran not to abandon their deals out of fear of being penalized by the U.S.

In her speech, Mogherini took several shots at Trump, though she did not mention the U.S. president by name, saying: “It seems that screaming, shouting, insulting and bullying, systematically destroying and dismantling everything that is already in place, is the mood of our times. While the secret of change — and we need change — is to put all energies not in destroying the old, but rather in building the new. “This impulse to destroy is not leading us anywhere good,” she added. “It is not solving any of our problems.”

And he’s going to make closing it into a wonderful ceremony. Everyone’s welcome.

• Damage To North Korea’s Nuclear Test Site Is Worse Than Anyone Thought (Ind.)

The damage to North Korea’s nuclear test site after its latest missile firing is believed to be worse than previously thought, it has been reported. Space-based radar showed that after the initial impact of the blast, which took place in September 2017, a large part of the underground Punggye-ri test site caved in. Chinese scientists had previously said that due to a partial collapse of a mountain near the test region that part of the site was no longer useable. The new research, from a study published in Science magazine, confirms this is likely to be the case. Sylvain Barbot, one of the authors of the study, said: “This means that a very large domain has collapsed around the test site, not merely a tunnel or two.”

I made that title up.

• Bad Bitches From Mars (Jim Kunstler)

I sense that with Schneiderman we’ve reached the zenith in this comic phase of American cultural collapse. The same week, Vanity Fair Magazine ran this item about the pop star Rihanna: Rihanna’s lingerie collection will drop on Friday [today], and there’s one very special addition that is making people lose their minds: her line, Savage x Fenty, will feature handcuffs. [Fenty is Ms. Rihanna’s surname.] Just days after she reimagined the Pope at the Met Gala, Rihanna is reminding us that this is still her week. She told Vogue that it was only natural that Fenty Beauty, which launched last fall, feature a lingerie line for women who want to express agency over their own looks and bodies…. ‘Women should be wearing lingerie for their damn selves,’ Rihanna [told Vogue]. I want people to wear Savage x Fenty and think, I’m a bad bitch.’”

[..] The Martian in me sees America turning into something like a Fellini movie, a panorama of fabulous excess and sinister fantasy, with the more malign forces of commerce propelling the garbage barge to ever darker extremes at the edge of a flat earth. On one part of the edge stands President Trump, all greatness and little goodness; and on the other edge stand characters like Eric Schneiderman and Harvey Weinstein, deposed champions of social justice — now cultural blood-brothers in the Sexual Predators Hall of Infamy. Mr. Schneiderman was all set to drag Mr. Weinstein, figuratively speaking, over several miles of broken glass and old Gillette blue blades in the state courts, and now it looks like the former NY AG himself may submit to a death of a thousand cuts by civil litigation, or maybe even a trip to one of his old criminal courtrooms, if the ever-vengeful Governor Andrew Cuomo has his wicked way.

If America were an X-rated billiard parlor, I’d think it had run the table on political sex stories, with nothing but the eight-ball of doom left on the table, and a wrathful deity — the Pope’s boss, shall we say — standing there chalking up his cue stick. When he sinks that last shot, a new game will get underway. I believe it will have to do with financial markets and currencies, and a lot more will hang on the outcome. The break itself should be a doozy — all those colored balls banging into each other and dropping into oblivion.

For your Sunday calm: Philip Glass paints both the river flowing by, and the traffic of New York City, all at the same time. For him, in the end, it’s the same thing.