J.J. Grandville ‘A Comet’s Journey’, Illustration from ‘Un Autre Monde’ 1844

Fani

https://twitter.com/i/status/1758242279196672503

Fani Willis Set Up Her Own Perjury Trap and Walked Right Into it@Article3Project founder @mrddmia called Fulton County District Attorney Fani Willis' testimony today the worst he has ever seen from anyone in any court proceeding…ever. "A homeless man with a knife going into… pic.twitter.com/KyPR9seFxe

— Real America's Voice (RAV) (@RealAmVoice) February 15, 2024

Yeartie

https://twitter.com/i/status/1758162535197376793

BREAKING: Nathan Wade testifies that he paid for all the vacations he took with Fani Willis with his business credit card.

And that she then reimbursed him in CASH.

This what at a time he was getting paid by Willis' office for the prosecution of Trump. pic.twitter.com/9DUq3hedOX

— Greg Price (@greg_price11) February 15, 2024

Terrence Bradley informed the court that the National Bar Association gave him legal advice on how not to answer questions on Fani Willis and Nathan Wade. What’s happening in Fulton County, Georgia, is corruption at the highest levels. pic.twitter.com/xUfh8Dn8mw

— Charles R Downs (@TheCharlesDowns) February 15, 2024

Tucker radicalized

Tucker Carlson grocery shopping in Russia. This is so interesting.

— Juanita Broaddrick (@atensnut) February 15, 2024

https://twitter.com/i/status/1758104468971769856

Mastery

Finnish operator Renkivain is an excavator perfectionist: their videos show the extreme and satisfying vituosity achieved with a volvo-ewr150e and its different toolspic.twitter.com/klElJJcCno

— Massimo (@Rainmaker1973) February 15, 2024

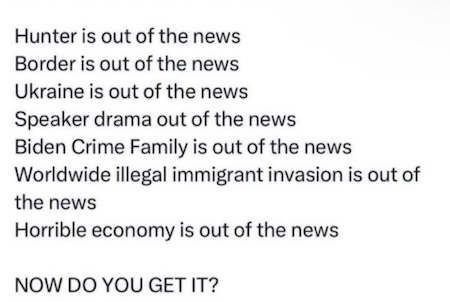

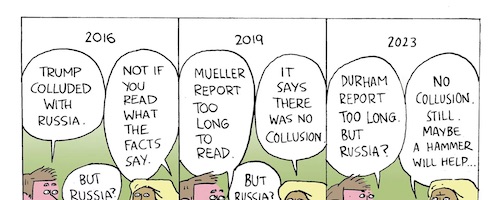

The levels of collusion are out of this world. And still, “Stormy Daniels” is the only case left that still seems alive.

• Prosecutors Reportedly Met with Biden Admin Before 3 Trump Indictments (BB)

Three separate prosecutors reportedly met with White House aides before indicting former President Donald Trump, President Joe Biden’s political opponent. The reported meetings suggest a coordinated attack against Biden’s 2024 rival. If coordination occurred, it lends credence to Trump’s belief that the indictments are election interference. The timing of the indictments are peculiar. After Trump announced a reelection bid against Biden, four indictments hit Trump in four separate jurisdictions, each following revelations about the Biden family business. In three cases, prosecutors reportedly met with the Biden administration before indicting Trump:

Alvin Bragg: New York – “Stormy Daniels” Case (state)

Jack Smith: Miami – “Documents” Case (federal)

Fani Willis: Fulton County, Georgia (state)First Case: “Stormy Daniels”

The first indictment occurred on April 4, 2023, the same day that former Biden aide Kathy Chung testified about Joe Biden’s mishandling of classified documents, contradicting Biden’s version of events. On March 17, 2023, Bragg asked for a meeting with federal law enforcement ahead of the Trump indictment Trump, a court source told Fox News. A year earlier, Bragg’s office hired a former senior Department of Justice (DOJ) official Matthew Colangelo, who spent years targeting Trump at the Justice Department. He also attacked Trump in his role in the New York Attorney General’s office. “Bragg has been very discredited by the indictment because the people that read it, even Democrats—they’re saying this is not an indictment,” Trump exclusively told Breitbart News after the indictment: Some are saying this is unconstitutional because there’s no crime. He’s been absolutely discredited. It’s a shame. They’re willing to destroy our country. This is all run by the White House, by the way, just in case you have any questions. In fact, they put a man from the White House into one of the top White House/DOJ officials is right there—Matthew Colangelo. He’s the one that’s leading it. He was sitting in the front row in the court during the whole thing. He was in the front row. This is all done by the White House because they don’t want to run against us.Second Case: “Documents”

Smith filed the second indictment on June 8, 2023, the same day an FBI 10-23 form surfaced alleging Joe Biden was bribed $5 million. Later in June, Smith filed a superseding indictment in the case the day after Hunter Biden’s sweetheart plea deal in Delaware fell apart. Months prior, in March, a member of Biden’s counsel’s office met with a top member of Smith’s team, just nine weeks before he indicted Trump in the classified document case, Breitbart News reported. The meeting “raises obvious concerns about visits to the White House after [Bratt] began his work with the special counsel,” George Washington University law professor Jonathan Turley told the Post. “There is no reason why the Justice Department should not be able to confirm whether this meeting was related to the ongoing investigation or concerns some other matter.” Trump slammed the indictment as election interference. Biden does not want to “run” against him, Trump exclusively told Breitbart News in July. “They didn’t want to run against me. That’s why they did it,” he said. “They did this so I wouldn’t get the nomination… They don’t want to run against me, that’s why they did it.”Third Case: Georgia Case

Willis filed the third indictment against Trump on August 14, 2023. The official court website of Fulton County, Georgia, published what appeared to be an indictment against Trump before deleting it. Months before the indictment, Willis’ top county prosecutor met twice with Biden’s White House counsel on May 23 and November 18, 2022, a year before Trump’s August indictment, Breitbart News reported. Willis’ prosecutor reportedly charged Fulton County taxpayers $2,000 for each meeting, billing $250 an hour for eight hours. Neither Willis nor the prosecutor dispute the allegations, but a spokesperson for Willis’s office told the Atlanta Journal-Constitution she would later respond in court filings. “[T]he district attorney was totally compromised. The case has to be dropped,” Trump told reporters in Washington, DC. “They say she’s in far more criminal liability than any of the people she’s looking at.” Once again, the timing of the indictment was suspect. Willis indicted Trump on the same day former FBI supervisory special agent confirmed Biden’s 2020 transition team was tipped off about its plan to interview Hunter Biden.

“He has since been indicted in Florida, Georgia, and Washington D.C. – which has only propelled him to new heights in the polls.”

• Judge Denies Trump Motion To Dismiss Stormy Daniels ‘Hush Money’ Case (ZH)

The judge in former President Donald Trump’s New York hush-money trial says the case will go forward as scheduled, with jury selection beginning on March 25. The decision by Judge Juan Manuel Merchan was made after consulting with the judge in Trump’s now-delayed federal election interference case in Washington DC. Trump was in attendance on Thursday for the hearing to determine whether Trump is guilty of 34 counts of falsifying business records in an alleged scheme to conceal stories about alleged extramarital affairs which former porn actress Stormy Daniels and former Playboy model Karen McDougal sprung on the billionaire during the 2016 election. Thursday marked Trump’s first return to the court in the New York criminal case since he became the first ex-president indicted in US history. He has since been indicted in Florida, Georgia, and Washington D.C. – which has only propelled him to new heights in the polls.

Sparks flew in the coutroom, as Trump’s attorneys blasted the decision to keep the March date – arguing that Trump will have to stand trial in New York while simultaneously attempting to seal the Republican nomination. “It is completely election interference to say ‘you are going to sit in this courtroom in Manhattan,” said defense attorney Todd Blanche. Merchan at one point told Blanche “Stop interrupting me.” In recent weeks, Merchan has taken steps to prepare for the trial – which would be the first for Trump of his several cases, AP reports. Over the past year, Trump has lashed out at Merchan as a “Trump-hating judge,” asked him to step down from the case and sought to move the case from state court to federal court, all to no avail. Merchan has acknowledged making several small donations to Democrats, including $15 to Trump’s rival Joe Biden, but said he’s certain of his “ability to be fair and impartial.”

Thursday’s proceeding is part of a busy, overlapping stretch of legal activity for the Republican presidential front-runner, who has increasingly made his court involvement part of his political campaign. The recent postponement of a March 4 trial date in Trump’s Washington, D.C. election interference case removed a major hurdle to starting the New York case on time. -AP. Trump has denied any of the alleged sexual encounters. At the time, Trump’s lawyer and fixer Michael Cohen paid Daniels $130,000, and arranged for the publisher of the National Enquirer tabloid to pay McDougal $150,000 in a practiced coined “catch-and-kill.” Trump’s company then paid Cohen $420,000 and marked the payments as legal expenses vs. reimbursements, according to prosecutors.

Why the Five Eyes? “..the US was not able to spy on Trump legally [through] the intelligence community,” McAdams said. “So they asked their allies, ‘Hey, spy on someone and tell us what’s going on.’”

• Obama CIA Colluded with Foreign Powers in Massive Spy Op Against Trump (Miles)

New reporting suggests the lengths the US deep state went to to undermine former US President Donald Trump. Since 2016, Democratic Party officials have accused former US President Donald Trump of illegally colluding with the Russian government as part of the discredited “Russiagate” narrative. Now, it appears such claims may represent a case of projection on the part of Trump’s critics. That’s the takeaway from a bombshell report by “Twitter Files” journalists Matt Taibbi and Michael Shellenberger this week that suggests that CIA officials under former US President Barack Obama worked through English-speaking intelligence partners to spy on Trump’s presidential campaign. The report alleges that the CIA under intelligence chief John Brennan worked with Five Eyes intelligence partners to circumvent legal restrictions against domestic spying by the agency. Five Eyes is an alliance of intelligence agencies in the United States, the UK, Australia, Canada, and New Zealand.

Brennan’s CIA allegedly colluded with these foreign intelligence agencies to conduct surveillance on the Trump campaign. The spy agency also reportedly targeted prominent people associated with the campaign, operating from a list of 26 figures that intelligence assets could attempt to extract information from. Attorney Steve Gill and analyst Daniel McAdams joined Sputnik’s Fault Lines program on Thursday to discuss the shocking revelations. “It’s now becoming clear that despite all the claims that Trump didn’t know what he was talking about when he said that his campaign operatives were being spied on by the federal government – they were,” noted Gill. “It is deplorable that we have a federal government that is spying on our citizens, not because of a legitimate national security interest, but because the deep state is trying to protect their interests rather than the interests of fair and free elections,” he added.

“You know, they’re targeting their political opponent. This is the stuff that you see in third-world countries and allegedly in Russia, and it is despicable that it’s not getting the backlash from the public and the media that it deserves.” Host Jamarl Thomas then cut to a clip of a 2020 appearance by Trump on the 60 Minutes television program. “The biggest scandal was when they spied on my campaign,” said Trump to reporter Leslie Stahl. “They spied on my campaign.” An argument then ensued between Trump and Stahl over whether the alleged spying actually took place. “He was right,” Thomas observed after playing the clip. “Leslie Stahl should be fired by 60 Minutes today,” said Gill.

“All these people that have collected their Emmys and their awards for their journalistic integrity and their successes, including those that denied that the Russia hoax was being pushed by Hillary Clinton… at the very least they should be turning in their awards as they exit their positions of power in the media.” Daniel McAdams, the executive director of the Ron Paul Institute for Peace and Prosperity, also commented on the bombshell report during the final hour of the program Thursday. “The revelations about the spying on the Trump campaign now that have come out thanks to Matt Taibbi and Michael Shellenberger… [are] astonishing because it tells you that the US was not able to spy on Trump legally [through] the intelligence community,” McAdams said. “So they asked their allies, ‘Hey, spy on someone and tell us what’s going on.’”

“Congress should be interested in whether the origins for the Russian investigation began with nudges from American intelligence in 2016 to the “Five Eyes.”

• US Intel Asked Foreign Countries to Surveil Trump Associates (Turley)

There is a disturbing report published on Michael Shellenberger’s Public Substack detailing how the U.S. intelligence community called upon foreign governments to target associates of Donald Trump before the 2016 election. The request to the “Five Eyes” agencies (the United States, United Kingdom, Canada, Australia and New Zealand) appears to have come from Obama’s CIA Director, John Brennan. According to Shellenberger, Matt Taibbi and Alex Gutentag, foreign intelligence agencies were asked to conduct the surveillance, including “bumping” the associates — a term for making contact with or casually engaging a target to generate intelligence. These encounters may also have been used to generate intelligence reports used to support further intelligence efforts by the United States in the Russian investigation. The journalists reported that Britain’s Government Communications Headquarters intelligence apparatus, or GCHQ, went ahead in contacting the Trump’s associates as early as March 2016.

Keep in mind that this was the same month that George Papadopoulos joined the Trump campaign as an adviser. It was also when Papadopoulos met a London-based professor, Josef Mifsud, who Papadopoulos was led to believe had “substantial connections to Russian government officials.” On March 21, 2016, Trump identified Papadopoulos and Carter Page as members of his foreign policy team. If true, the question is the basis for such surveillance of U.S. citizens associated with the opposing political party and a presidential campaign. The role of Brennan is intriguing. Brennan was the one who briefed President Barack Obama on Hillary Clinton’s alleged “plan” to tie then-candidate Donald Trump to Russia as “a means of distracting the public from her use of a private email server.”

It was also Brennan who later declared during the Trump Administration that a press conference with Vladimir Putin was “nothing short of treason.” He later said that he did not mean real treason when he said it was nothing short of treason. Brennan also signed the infamous letter warning that the Hunter Biden laptop had all of the markings of Russian intelligence, a letter that he later admitted was “political.” Now these sources are claiming that agents from the Five Eyes “were making contacts and bumping Trump people going back to March 2016.” Former FBI lawyer Kevin Clinesmith was sentenced to probation in 2021 after admitting that he falsified evidence to renew a wiretap against former Trump campaign adviser Carter Page.

Shellenberger and Taibbi have a record of investigating in areas long avoided by other journalists, particularly in exposing the massive censorship system funded and coordinated by the government. There is much to learn about these allegations and their underlying support. If proven, it would appear that neither the Inspector General nor John Durham were given the full picture of the origins of the Russian investigation. Moreover, there are intriguing questions over a referenced binder that sources said contained much of this intelligence and analysis. That binder or binders allegedly disappeared from the CIA. Once again, this is still the early reporting and we need to have more confirmation on these facts. However, Congress should be interested in whether the origins for the Russian investigation began with nudges from American intelligence in 2016 to the “Five Eyes.”

“..intelligence indicates that Russians viewed Clinton as manageable and likely to continue existing US policies, the report said..”

• US Intel Fabricated Claim Putin Preferred Trump Over Clinton in 2016 (Sp.)

The US intelligence community fabricated claims that Russian President Vladimir Putin preferred Donald Trump over Hillary Clinton in the 2016 US presidential election, journalists Michael Shellenberger, Matt Taibbi and Alex Gutentag reported on Thursday. An Intelligence Community Assessment (ICA) published by the US Director of National Intelligence in January 2017 purported that Putin wanted Trump to win the election. However, the assessment’s authors fabricated the intelligence on the claim, the report said, citing sources close to a House Permanent Select Committee on Intelligence (HPSCI) investigation into the origins of the Trump-Russia scandal. The findings of the HPSCI investigation are being blocked from release, according to the report. Evidence indicates that Putin actually preferred Clinton, the report said.

The House investigators found that US intelligence analysts had information about Russians calling Trump unreliable and unsteady, the report said. In contrast, intelligence indicates that Russians viewed Clinton as manageable and likely to continue existing US policies, the report said. Former CIA Director John Brennan led the attempt to frame Trump as Putin’s preferred candidate in the ICA, the report said. The HPSCI investigation determined that the intelligence community conducted the assessment for political purposes, the report said. On Wednesday, Putin said in an interview with Russian media that it would be better for Russia for current US President Joe Biden to remain in office because he is more predictable. Trump called Putin’s remarks a “great compliment” and said that Biden would give up everything to Russia.

Russia will work with any president elected by US citizens, Putin added. In the wake of the 2016 election campaign, former President Trump was investigated by federal agencies for possible ties between his aides and Russia. Both Trump and Russia denied allegations of collusion. A four-year investigation by US Special Counsel Robert Mueller into the allegations found no evidence of a criminal conspiracy. A subsequent investigation by US Special Counsel John Durham concluded that the FBI should have never launched the probe into the collusion allegations.

“..why are authorities finally giving Bobulinski an audience only now?”

• Will Bobulinski’s Testimony End Joe Biden’s 2024 Presidential Bid? (Sp.)

Former head of the Sinohawk company Tony Bobulinski testified behind closed doors before US lawmakers in the House impeachment inquiry on February 13. Commenting on the testimony, House Oversight Committee Chairman James Comer told Just the News on Wednesday that Bobulinski had revealed that “Joe Biden knew [Tony] was going in business with Hunter and with [Joe’s brother] Jim Biden, and he knew that the business was selling the Biden brand.” In an explosive opening statement, Bobulinski alleged that Joe Biden could be probed in relation to the Foreign Agents Registration Act (FARA), Anti-Corruption and Public Integrity statutes, the Foreign Corrupt Practices Act (FCPA), and the Racketeer Influenced and Corrupt Organizations Act (RICO). “From publicly available information alone, it seems clear that the Biden family monetized Joe’s public offices for decades, just as the Clinton family seems to have done, albeit on a much smaller scale than the Clintons,” Wall Street analyst and investigative journalist Charles Ortel told Sputnik.

“We also know from [Joe Biden’s] tax returns that he declared very low incomes for decades. Miraculously after he left the vice presidential mansion on January 20, 2017, his declared income soared. But the murky ventures that may have paid him millions of dollars have never accurately been explained. Like other corrupt, dynastic families in both political parties, the Bidens, until now, have never been forced to explain how they obtained their mansions and other assets, and whether they have paid all required income and other taxes on these cash flows.” Ortel drew attention to the fact that Bobulinski has been trying to make his case against the Biden family “business” for years; and yet over the same period, the FBI, Department of Justice and Internal Revenue Service have refused to prosecute many Biden family members and associates for corruption, influence peddling, money-laundering and income tax evasion.

“The really damning questions here include why did government officials protect so many potential, high-level defendants and who has been involved in this decision-making process?” the Wall Street analyst asked. “As in my case in December 2018, when I tried to persuade the FBI to investigate Clinton Foundation crimes unsuccessfully, I think the real timing question is why are authorities finally giving Bobulinski an audience only now?” There are crucial questions concerning Bobulinski’s interaction with the Biden family and Chinese business tycoons which require answers, according to Jason Goodman, a US investigative journalist and founder of CrowdSource the Truth. “Bobulinski was in business with an individual who was addicted [Hunter Biden] to crack which is obviously illegal and dangerous,” Goodman told Sputnik. “Either he didn’t notice this, or he knew and didn’t think it was a concern. Either reflects poorly on his judgment.

Even without the crack, a reasonable person might have questions about getting into business with a bunch of Chinese nationals and the vice president’s moron son who clearly was doing exactly nothing for the business. It really is a very strange circumstance and hard to understand how a legitimate businessperson could find themselves in such a situation.” Charles Ortel also wonders “why [Bobulinski] agreed, initially, to get anywhere near the Biden family in these ‘ventures’. “Having stepped forward with his explosive allegations, Bobulinski runs the risk of being hunted by the Biden administration’s “justice machine”, according to Sputnik interlocutors. “One hopes Bobulinski is safe, but I believe another Biden accuser who deserves a fair hearing – Tara Reade – fled to Russia in fear of being attacked,” Ortel remarked. “Bobulinski will be repeatedly audited and harassed by the IRS. Also, given personal experience, his computer will be hacked by government operatives,” suggested retired certified public accountant Robert Bishop in an interview with Sputnik.

“..Harris was polling at 1% when she dropped out of the presidential nominee race in 2019..”

• A Kamala Harris Presidency Would Be The Death Of The Democrats (Bridge)

With President Joe Biden’s advanced age and cognitive decline taking central stage just months before the presidential election, Democrats need to discuss ‘the Kamala problem.’ As the US speeds towards the 2024 presidential election, the Democrats find themselves in a rather untenable position. Not only is the incumbent US President Joe Biden suffering visibly on the mental front – reminiscing aloud over meetings he’s never had with long-dead world leaders – but his second in command lacks the essential support of the Democratic base. While Biden’s approval rating sits in the basement at 39%, Vice President Kamala Harris has managed to outdo him with 37.5%. This should come as no surprise considering that Harris was polling at 1% when she dropped out of the presidential nominee race in 2019. How did she manage to alienate so many people within her own party?

Earlier in her career as California’s district attorney, Harris, the child of immigrants from Jamaica and India, had a reputation as a ‘top cop’ who worked against the interests of victims. She frequently failed, for example, to exercise her authority to investigate charges of misconduct and abuse by police and prosecutors. At the same time, she often kept people – many of them poor black people – behind bars even when there was ample evidence of wrongful convictions, while opposing legislation that would have demanded her office to investigate fatal police shootings. During the 2019 Democratic presidential debate, Representative Tulsi Gabbard called out Harris over her record. “She put over 1,500 people in jail for marijuana violations, and then laughed about it when she was asked if she ever smoked marijuana,” Gabbard said. “She blocked evidence that would have freed an innocent man from death row until the courts forced her to do so. She kept people beyond their sentences to use them as cheap labor for the state of California. And she fought to keep cash bail systems in place that impacts poor people in the worst possible way.”

Harris never denied the charges, only saying that she was responsible for “reforming California’s justice system.” More recently, Harris’ popularity has taken a hit because she has failed to show any real accomplishments in the past four years on the VP job. On the most important issue that Biden tasked Harris with, which was to investigate what was driving waves of illegal immigrants to America, she dropped the ball, neglecting to even visit the US-Mexico border. A former Biden administration senior official told Axios: “She’s been at best ineffective, and at worst sporadically engaged and not seeing [the border] was her responsibility. It’s an opportunity for her, and she didn’t fill the breach.” This is what happens when you elect a candidate based on their identity, not their competence – it’s nearly impossible to relieve them of their duties.

Should the Democratic Party take the decision to replace Harris, 59, at this particular juncture, the fallout would be fierce and swift. Anyone who dares criticize Harris, the first woman and first Black American to hold the office of vice president, will be accused of holding her to a higher standard than past (male, white) politicians. As far as Harris is concerned, she firmly believes that she can lead the nation should something untoward happen to Joe Biden. “I am ready to serve. There’s no question about that,” Harris told the Wall Street Journal in an interview last week, just days before the release of a damning report emphasizing her boss’ failing memory. The report, penned by Special Counsel Robert Hur after an investigation into Biden’s mishandling of classified documents, said Biden displayed “diminished faculties” in interviews and derided him as an “elderly man with a poor memory.”

The public relations fallout has become so critical for the White House that there are rumors of invoking the 25th Amendment, which outlines presidential succession. This empowers the vice president and cabinet to remove the president from office through a majority vote in the event it’s determined he or she is no longer fit to hold office. The amendment has never been invoked in US history, and it probably won’t be invoked now since the specter of a Harris presidency is even less attractive than sitting through a Biden speech. Whatever the case may be, Donald Trump will not miss an opportunity to throw a spotlight on Harris and her inglorious stint as vice president, nor should he, considering that chances are high that Biden won’t serve out his term through age 86. In other words, Trump would be reminding Americans that a vote for Joe Biden is essentially a vote for Kamala Harris. Such a strategy will likely attract many swing voters into the Trump camp.

And peace is of course bad.

• Trump Could Force Ukraine To Make Peace – Bloomberg (RT)

Republican presidential frontrunner and ex-US leader Donald Trump is planning to pressure Ukraine to negotiate peace with Russia if he wins an expected rematch against incumbent Joe Biden for the White House, Bloomberg reported on Thursday, citing sources. Should Trump become president, he may also retract a number of defense commitments to some NATO allies, according to reports. People familiar with the matter said Trump advisers had talked about ways of bringing Ukrainian President Vladimir Zelensky and his Russian counterpart to the negotiating table shortly after the potential inauguration. One adviser, according to Bloomberg, suggested that Washington could push Kiev to engage with Moscow by threatening to cut massive military assistance, adding that Russia could be swayed by the threat of increasing that aid instead.

Bloomberg sources also stressed that Trump aides had not discussed the matter with Russian officials, as it would be illegal for private US entities to negotiate with foreign governments on behalf of the administration. Russian officials have repeatedly said they are open to talks with Ukraine, but noted that any dialogue would take place only after Zelensky cancels his decree banning negotiations with the current leadership in Moscow. The Ukrainian leader introduced the ban last autumn after four of Kiev’s former regions overwhelmingly voted to join Russia. Another facet of Trump’s presumed foreign policy appears to be a concept of “a two-tiered NATO alliance” in which a common defense clause would be applied only to those nations that had reached a certain defense-spending threshold, Bloomberg reported, adding that no final decision had been made on the matter.

Still, the agency noted that such an approach could “upend decades of US policy” while risking “fracturing” the defense alliance. During his term as president, Trump repeatedly pushed NATO countries to increase military spending to 2% of GDP, a threshold many have struggled to reach. As of July, only 11 NATO members had met or exceeded that level. Bloomberg’s report came after Trump claimed last week that, while in office, he had threatened not to defend those ‘delinquent’ NATO members that did not pay their fair share of defense spending if they were attacked by Russia. His remarks triggered condemnation both from the White House and NATO Secretary General Jens Stoltenberg. Moscow has repeatedly said it has no plans or interest in attacking the US-led military bloc.

“I’ve never seen the nursing home known as the United States Senate work harder than when it comes to spending the American people’s money for foreign wars..”

• Texas Should Be Renamed ‘Ukraine’ – Rep. Chip Roy (RT)

Republican congressman Chip Roy from Texas has slammed the US Senate for passing a $95 billion bill for Ukraine and Israel without including provisions for securing the southern border, calling the bill an “abomination.” The Democratic-led upper house passed the international security assistance package on Tuesday with a 70-29 vote after a group of Republican lawmakers broke ranks to back the measure – but it has yet to be approved by the House of Representatives. Speaking to Fox News on Tuesday, Roy proposed submitting a bill to rename the state of Texas as Ukraine, quipping that “then, maybe this administration and senators will work on securing the border of the United States.” “I’ve never seen the nursing home known as the United States Senate work harder than when it comes to spending the American people’s money for foreign wars,” the Republican lawmaker said.

Roy went on to call out GOP senators who supported the Senate bill, and who argued that much of the $60 billion for Ukraine would in fact support the US defense-industrial base and help American business. “Since when do we have economic development that is being driven by funding war overseas?” the congressman asked, insisting that “anybody that’s sane and sees what’s happening at our southern border would know that you cannot fund foreign wars, while our border is wide open and exposed to criminals and lawlessness and terrorists.” Roy stated that border security remains a priority for the American people as well as for Republicans in Congress, and vowed to block the Senate-approved bill when it gets to the House.

House speaker Mike Johnson has strongly opposed further funding for Ukraine unless it is tied to border security and tougher immigration laws. Meanwhile, US President Joe Biden has been urging Congress to speed up approval of the aid for Ukraine, arguing that stalling the funds plays into the hands of Russian President Vladimir Putin and increases the likelihood of a direct confrontation with Moscow in the future. Biden has claimed the Russia could attack a NATO state if it manages to defeat Ukraine, which would require Washington to intervene, in line with the bloc’s mutual defense guarantee. Moscow, in turn, has repeatedly denied having any intention to attack NATO – with Putin stressing that Russia has “no interest… geopolitically, economically or militarily” in doing so, and would only engage in hostilities if attacked first.

“It’s clear that the White House is trying, by hook or by crook, to push Congress to vote on a bill to approve funding [for Ukraine]. We’ll see what tricks the White House will use..”

• Kremlin Responds To Rumors Of Russian Space Nukes (RT)

Western media reports claiming that Russia could place nuclear weapons in space are nothing more than a ploy by the White House to convince US lawmakers to approve further military aid to Ukraine, Kremlin spokesman Dmitry Peskov has said. Citing sources, several US media outlets reported this week that American intelligence had obtained information on purported Russian plans to deploy a nuclear anti-satellite system in orbit, although the idea supposedly remains at the developmental stage. ABC News claimed that while the system would not be used to attack targets on Earth, US officials still consider it “very concerning and very sensitive.” Responding on Thursday, Peskov suggested that the administration of US President Joe Biden is using the issue to force a vote to approve Ukraine aid. Moscow, however, will wait and see what comes from an upcoming White House briefing on the topic, Peskov added.

“It’s clear that the White House is trying, by hook or by crook, to push Congress to vote on a bill to approve funding [for Ukraine]. We’ll see what tricks the White House will use,” he said. Nuclear weapons in space are banned under the Outer Space Treaty, which was opened for signature by the US, Soviet Union, and the UK in 1967, as Moscow and Washington sought to ease tensions during the Cold War. More than 100 countries have since joined the treaty. On Wednesday, Republican congressman Mike Turner, who chairs the House Intelligence Committee, claimed to have shared information “concerning a serious national security threat” with US lawmakers, while urging Biden to declassify the relevant materials. National Security Advisor Jake Sullivan is scheduled to brief congressional leaders on security issues on Thursday.

When pressed on whether he would address Turner’s concerns, he declined to respond, noting he was “surprised” by the statement, given the upcoming meeting on the matter. His comments came after the New York Times suggested, citing sources, that Turner – whom it described as the administration’s ally on Ukraine aid – had pushed the nuclear issue into the spotlight, to “perhaps to create pressure” on lawmakers to approve $60 billion in supplemental funding for Kiev. The Biden administration has been urging Congress to approve more aid for Ukraine since the autumn. Its efforts have been met with opposition from Republicans, who have demanded that the White House do more to improve security on the southern US border in return.

“..Wray promised to conduct an internal investigation to “figure out if there is more information we can provide.”

• Epstein Victims Sue FBI (RT)

A dozen victims of Jeffrey Epstein have sued the FBI, alleging that the agency failed to properly investigate the notorious sex offender. They claim that the FBI sat on reports about Epstein’s activities for two decades, allowing the victims to be “trafficked, abused, raped, tortured and threatened.” The lawsuit was filed in a federal court in New York on Wednesday by 12 women, all of whom are referred to in the document as anonymous Jane Does. “For over two decades, the Federal Bureau of Investigation permitted Jeffrey Epstein to sex traffic and sexually abuse scores of children and young women by failing to do the job the American people expected of it,” the complaint alleges. “As a result of the continued failures of the FBI, Jane Does 1-12 bring this lawsuit to get to the bottom – once and for all – of the FBI’s role in Epstein’s criminal sex trafficking ring.”

According to the lawsuit, the FBI began receiving tips, reports, and complaints about Epstein’s alleged trafficking and abuse of minors in 1996, but failed to open a case or share this information with other law enforcement agencies. The FBI eventually opened a case in 2006, two years before Epstein pleaded guilty to a child prostitution charge in Florida. A controversial plea deal saw Epstein register as a sex offender and serve 13 months on supervised release in lieu of a possible life sentence. Despite the fact that he had been convicted for one offense and dodged a litany of other sex-trafficking charges, the FBI continued to ignore tips that flowed in over the next decade, the lawsuit claims. “As a direct and proximate cause of the FBI’s negligence, plaintiffs would not have been continued to be sex trafficked, abused, raped, tortured and threatened,” the complaint said. Epstein was eventually arrested in 2019 and charged with the trafficking of dozens of minors. He died awaiting trial in a Manhattan jail cell a month later, with his death officially ruled a suicide.

Epstein’s girlfriend and “madam,” Ghislaine Maxwell, was sentenced to 20 years behind bars for child sex trafficking in 2022. According to testimony from victims, Epstein and Maxwell recruited girls to perform sexual acts on themselves and their rich and powerful associates, and instructed these girls to recruit additional victims. Among the powerful men accused of abusing the girls was Britain’s Prince Andrew, who settled out of court with an accuser in 2022. The plaintiffs behind the latest lawsuit are seeking an unspecified amount in compensation and damages from the US government. The FBI has already been accused of negligence in its handling of the Epstein case. In a Senate Judiciary Committee hearing in December, agency Director Christopher Wray was asked why the FBI didn’t do more to stop the notorious pedophile. Wray promised to conduct an internal investigation to “figure out if there is more information we can provide.”

Egypt has started building refugee camps.

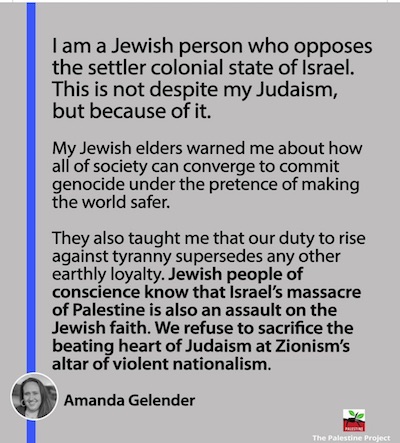

• Over a Million Palestinians to be Forced Into Egypt at Gunpoint (Mike Whitney)

Here’s a blurb from Israel’s first prime minister David Ben-Gurion who said: “You are no doubt aware of the [Jewish National Fund’s] activity in this respect. Now a transfer of a completely different scope will have to be carried out. In many parts of the country new settlement will not be possible without transferring the Arab fellahin.” He concluded: “Jewish power [in Palestine], which grows steadily, will also increase our possibilities to carry out this transfer on a large scale.” (1948) This same line of reasoning has persisted through the decades although today’s Zionists tend to express themselves more brashly and with less restraint. Take, for example, popular conservative pundit Ben Shapiro who presented his views in an article titled “Transfer is Not a Dirty Word”. Here’s what he said:

“If you believe that the Jewish state has a right to exist, then you must allow Israel to transfer the Palestinians and the Israeli-Arabs from Judea, Samaria, Gaza and Israel proper. It’s an ugly solution, but it is the only solution. And it is far less ugly than the prospect of bloody conflict ad infinitum…. The Jews don’t realize that expelling a hostile population is a commonly used and generally effective way of preventing violent entanglements. There are no gas chambers here. It’s not genocide; it’s transfer…. It’s time to stop being squeamish. Jews are not Nazis. Transfer is not genocide. And anything else isn’t a solution”. Transfer is Not a Dirty Word, Narkive “Squeamish”? Shapiro thinks that anyone who recognizes the appalling moral horror of driving people off their land and forcing them into refugee camps is squeamish?

This is the essence of political Zionism and it dates back to the very beginning of the Jewish state. So, when critics claim that Netanyahu has assembled the “most right-wing government in Israel’s history”, don’t believe them. Netanyahu is no better or worse than his predecessors. The only Prime Minister who veered even slightly from this ‘iron law’ of Zionism, was Yitzhak Rabin who was (predictably) assassinated by an opponent of Oslo. What does that tell you?It tells you there was never going to be a “two-state” solution; it was a charade from the get-go. And (as Netanyahu intimated recently) Israeli leaders merely played along with the hoax in order to buy-time to prepare for the solution that is being imposed today. Have you ever wondered why so many Israelis support Netanyahu’s murderous rampage in Gaza?

(Hint) It’s not because Israeli Jews are homicidal maniacs. No. It’s because they know what he is doing. They’re not taken-in by the “Hamas” diversion, that is merely propaganda pablum for the West. They know that Netanyahu is implementing a plan to seize all the land between the Jordan River and the Mediterranean Sea. And, in doing so, he is achieving the territorial ambitions of his Zionist ancestors. So, even though the majority of Israelis despise Netanyahu and think he should be prosecuted for corruption, they are willing to look the other way while he does their bidding. What onlookers need to realize is that the current strategy is not new at all, in fact, it has a 75 year-long pedigree that aligns with the demographic objectives of the Zionist leadership. None of this of course has anything to do with Hamas which is merely the pretext for the eradication of the indigenous people. What we are seeing is the actualization of the Zionist dream, the modern version of Plan Dalet, the original roadmap for ethnic cleaning that was drawn up in 1948.

“He was the largest donor of the 2022 US midterm election season, funneling $128 million to Democratic candidates and organizations..”

• Soros Could Take Control Of Hundreds Of US Radio Stations (RT)

Liberal financier George Soros has bought a major stake in the US’ second-largest radio company and could gain “effective control” of more than 220 stations across the country, the New York Post reported on Wednesday. Soros Fund Management purchased around $400 million of debt owed by the Audacy media group during its bankruptcy process, the newspaper reported, citing court filings. The billionaire bought the debt at roughly 50 cents on the dollar from hedge fund HG Vora, the report continued, noting that once the deal is approved by a bankruptcy court, Soros will own about 40% of Audacy’s overall debt. While 40% is not a majority stake, a source told the New York Post that Soros could nevertheless gain “effective control of the media giant when it emerges from bankruptcy.”

Audacy owns 227 music, sports, and talk radio stations in 45 US states. The company also owns CBS Radio, which operates 11 news stations including San Francisco’s KCBS and New York’s WCBS. After years of declining revenue, Audacy filed for bankruptcy early last month with $1.9 billion in debt. Should the deal go ahead as reported, Audacy will be the latest addition to Soros’ growing media empire. Soros Fund Management joined a consortium of creditors to purchase Vice Media last summer, paying $350 million to acquire a former media juggernaut once valued at $5.7 billion. An “insider source” cited by the New York Post described the Audacy deal as “scary,” saying he believed that Soros intended to use his stake to influence public opinion ahead of this year’s presidential election.

A hedge fund manager who shot to infamy for crashing the British pound in 1992, Soros is among the wealthiest men on earth, with an estimated net worth of around $7 billion. That’s on top of the $32 billion he’s donated to a web of NGOs, charities and political campaigns through his Open Society Foundations. Soros is an advocate for mass immigration to Western countries, European federalism, and economic and political liberalism. He was the largest donor of the 2022 US midterm election season, funneling $128 million to Democratic candidates and organizations. As well as direct donations to candidates and activist groups, Soros reportedly gave $300,000 to a group of TikTok influencers who collaborated with the White House to promote President Joe Biden’s policies. The Open Society Foundations announced last year that Soros, who is 93 years old, would step down from the helm of the organization and hand control to his 38-year-old son, Alex.

“..“no one is buying European or German products,” he claimed, contributing to “a really critically-wounded Europe.” “We are in for very rocky times..”

• Europe ‘In For Very Rocky Times’ After Failed Sanctions on Russia (Miles)

Beijing reacted angrily Wednesday to reports that the European Union plans to target three Chinese companies as part of the bloc’s 13th round of sanctions against Russia. The move by the EU follows claims that Chinese and Indian businesses have helped Russia “circumvent” European sanctions by providing them with electronic components used in the manufacturing of drones and other military equipment. The EU has imposed sanctions on Russia since the intensification of the Donbass conflict in early 2022. Beijing blasted the EU restrictions as “illegal” and criticized the “long-arm jurisdiction” against Chinese companies. China has benefited in recent months as Western sanctions against Russian energy have hampered European competitiveness, forcing companies in Germany and other EU nations to raise prices as they rely on more expensive American liquified natural gas.

Seen in this light, the EU’s attempts to punish Chinese businesses may be viewed as a desperate attempt to hobble the competition as Europe increasingly faces economic crisis and deindustrialization. Economist Richard Wolff joined Sputnik’s The Critical Hour program on Wednesday to discuss the grim economic outlook for the continent. “Europe, which has been kind of a dominant player in the whole world for a couple of thousand of years, is in what I believe to be – and I’m far from the only one – a crisis so profound it may be what we look back on and call the terminal crisis, the last one, because it literally cannot survive,” Wolff speculated. “On the one hand, it is being outcompeted by the United States, which has dominated it for the last 75 years anyway,” he noted. “But now the new player in the world economy, the People’s Republic of China and its allies, known generally as the BRICS, competing and challenging Europe, from the other side of the planet, if you like, means that Europe is caught between them.”

Wolff claimed the cultural, historical, and linguistic differences between EU countries have undermined the continent’s attempts to unify in recent decades. Now, Europe is a “junior partner” Wolff claimed, caught between the US-led G7 economic bloc and the China-led BRICS countries. While Europe previously benefited from its relationship with Russia in the form of cheap natural gas, Russia has now turned towards China and the other nations of the BRICS bloc after being “betrayed by the rest of Europe.” If the solidifying of new alliances has economically harmed Europe, it has benefitted Russia, Wolff claimed, which has been able to sell its oil and gas to India and China. “The Russian ruble is in fine shape. The Russian economy is growing faster than last year, [faster] than the United States is and is in no way falling apart,” the economist insisted. Meanwhile “no one is buying European or German products,” he claimed, contributing to “a really critically-wounded Europe.” “We are in for very rocky times,” Wolff warned ominously.

“.. in the event of the bankruptcy of a major financial institution, derivative claimants are put first in line to grab the assets — not just the deposits of customers but their stocks and bonds..”

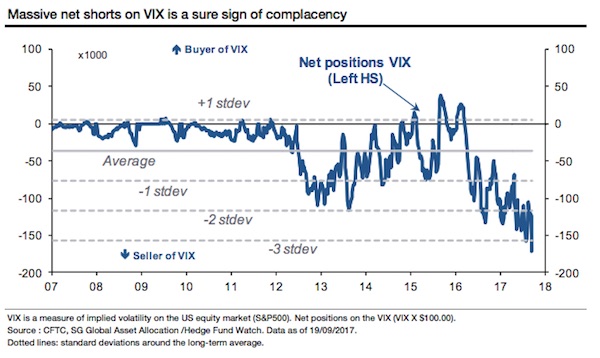

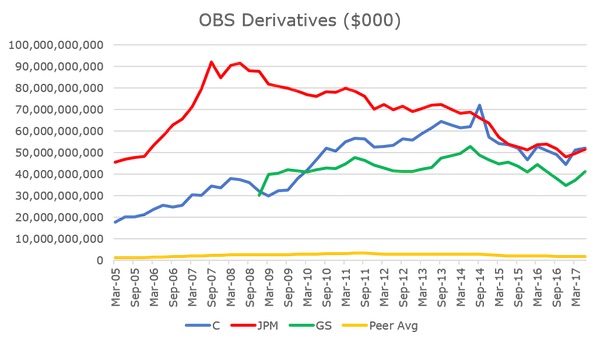

• Defusing the Derivatives Time Bomb (Ellen Brown)

This is a sequel to a Jan. 15 article titled “Casino Capitalism and the Derivatives Market: Time for Another ‘Lehman Moment’?”, discussing the threat of a 2024 “black swan” event that could pop the derivatives bubble. That bubble is now over ten times the GDP of the world and is so interconnected and fragile that an unanticipated crisis could trigger the collapse not just of the bubble but of the economy. To avoid that result, in the event of the bankruptcy of a major financial institution, derivative claimants are put first in line to grab the assets — not just the deposits of customers but their stocks and bonds. This is made possible by the Uniform Commercial Code, under which all assets held by brokers, banks and “central clearing parties” have been “dematerialized” into fungible pools and are held in “street name.”

This article will consider several proposed alternatives for diffusing what Warren Buffett called a time bomb waiting to go off. That sort of bomb just detonated in the Chinese stock market, contributing to its fall; and the result could be much worse in the U.S., where the stock market plays a much larger role in the economy. A Jan.30 article on Bloomberg News notes that “Chinese stocks’ brutal start to the year is being at least partly blamed on the impact of a relatively new financial derivative known as a snowball. The products are tied to indexes, and a key feature is that when the gauges fall below built-in levels, brokerages will sell their related futures positions.” Further details are in a Jan. 23rd article titled “’Snowball’ Derivatives Feed China’s Stock Market Avalanche.” It states, “China’s plunging stock market is leading to losses on billions of dollars worth of derivatives linked to the country’s equity indexes, fuelling further selling as retail investors offload their positions…. Snowball products are similar to the index-linked products sold in the 2008 financial crisis, with investors betting that U.S. equities would not fall more than 25% or 30%,” which they did.

The Chinese stock market is much younger and smaller than that in the U.S., with a much smaller role in the economy. Thus China’s economy remains relatively protected from disruptive ups and downs in the stock market. Not so in the U.S., where speculating in the derivatives casino brought down international insurer AIG and investment bank Lehman Brothers in 2008, triggering the global financial crisis of 2008-09. AIG had to be bailed out by the taxpayers to prevent collapse of the too-big-to-fail derivative banks, and Lehman Brothers went through a messy bankruptcy that took years to resolve. In a December 2010 article on Seeking Alpha titled “Derivatives: The Big Banks’ Quadrillion-Dollar Financial Casino,” attorney Michael Snyder wrote, “derivatives were at the heart of the financial crisis of 2007 and 2008, and whenever the next financial crisis happens, derivatives will undoubtedly play a huge role once again…. Today, the world financial system has been turned into a giant casino where bets are made on just about anything you can possibly imagine, and the major Wall Street banks make a ton of money from it. The system … is totally dominated by the big international banks.”

Ron Paul Assange

An overwhelming majority in the Australian parliament has voted to request that charges against Julian Assange be dropped and that he be allowed to return to his native country.

The UK high court will hold hearings next week on whether Assange can continue to argue his case… pic.twitter.com/jza6cNs6rf

— Ron Paul (@RonPaul) February 15, 2024

Baby rhino

Baby rhino pestering his mom. pic.twitter.com/OrIJicQOdA

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 15, 2024

Bear and Moose

This is Bear and Moose. They wanted to come back inside but couldn't get past security. 13/10 for all pic.twitter.com/1JgKI00PvA

— WeRateDogs (@dog_rates) February 15, 2024

Lion turtle

https://twitter.com/i/status/1758108922764804147

Dinosaur

https://twitter.com/i/status/1758103418093064324

India and Pakistan

https://twitter.com/i/status/1758122937905820057

Bach

In 2011, Japanese telecom company Docomo created one of the most beautiful adverts we've ever seen.

A giant xylophone in Kyushu playing Bach's "Jesu, Joy of Man's Desiring" with a wooden ball rolling down its keys. https://t.co/bqjinVPcdh

— Massimo (@Rainmaker1973) February 15, 2024

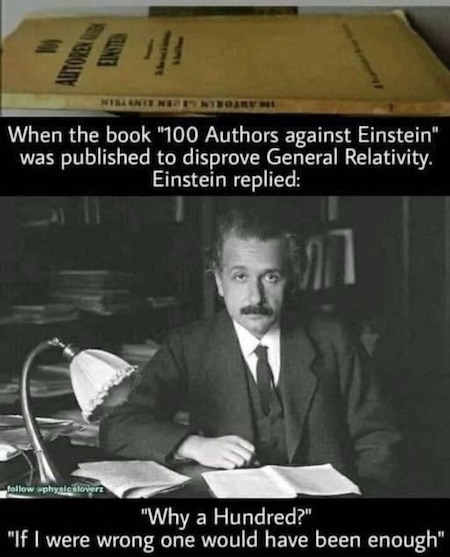

Legend

Hahaha Legendddd pic.twitter.com/OESvlZ9LmY

— Enez Özen | Enezator (@Enezator) February 15, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.