Henri Cartier Bresson Paris 1952

Obama Bush https://twitter.com/i/status/1703116084801413435

Tucker Carlson: “Criticize the drug companies, question the war in Ukraine, and you can be pretty sure this is going to happen.”

This is happening pic.twitter.com/N8zIKLbJN2

— Russell Brand (@rustyrockets) September 15, 2023

Russell

Many are now saying that this video clip might be why Russell Brand is "being attacked." WATCH pic.twitter.com/vE2n4ciyRf

— Simon Ateba (@simonateba) September 16, 2023

Captcha https://twitter.com/i/status/1703082692609204482

I’ve come to the conclusion that America today is the living manifestation of “Universe 25”. Russia is not. Unless we change course, and get back to basics, we’re screwed. Russia wins by default—meaning that they’re not even trying to win. We’re just losing on our own. – Scott Ritter

“America is looking more like a bona-fide banana republic than ever before.”

• BLM vs Proud Boys: The Shocking Hypocrisy Of US Law (Robert Bridge)

Between May 2020 and January 6, 2021, the United States experienced two tumultuous events – one at the hands of liberals, the other of conservatives – that resulted in many millions of dollars in property destruction, as well as injuries and loss of life. Yet just one side in those battles suffered severe legal consequences for its actions. During the Black Lives Matter/Antifa riots that swept the US in the summer of 2020 following the police killing of George Floyd, protesters went on a rampage and stormed various government buildings in Portland, Oregon. One of the attackers, Kevin Benjamin Weier, 35, was arrested for setting fire to the federal courthouse. Many (right-wing) commentators have described that willful destruction of government property, and the assorted acts of violence by other protesters, as seditious acts against the US government.

For over 100 days the protesters kept Portland residents under a state of siege, as Democratic Mayor Ted Wheeler seemed unwilling or unable to halt the violence. That should come as no surprise considering that the Portland City Council slashed millions from the police budget, and even ordered the police to stop using tear gas in a futile attempt to appease the mob (Note to Portland: it’s impossible to appease a mob). Finally, President Donald Trump shocked liberal sensitivities by sending in federal agents to help restore order and arrest the perpetrators. So what happened to Antifa member Kevin Benjamin Weier and his motley crew of anarchists? While many protesters around the country had their prison bail paid by Hollywood celebrities, Mr. Weier, whose felony charge made him eligible for 10 years in the slammer, together with a hefty $250,000 fine, was ultimately sentenced to two years’ probation and a $200 fine. In other words, about the same slap on the wrist that a Los Angeles shoplifter could expect to receive.

Just six months after the BLM/Antifa protests had subsided, the American people were treated to yet another historic display of pent-up passions as thousands of disaffected Trump supporters descended upon the Capitol Building in Washington, DC to express their outrage over an election they believed had been stolen. While there were many scenes of chaos and pandemonium, with rioters breaching the entrance and carrying out acts of vandalism and looting, everything was not quite as it had seemed. Two years after the storming of the Capitol Building, 40,000 hours of surveillance videotape from that day were finally released, and the images show that the establishment media had been cherry-picking the worst scenes for public consumption.

“Taken as a whole, the video record does not support the claim that January 6th was an insurrection,” remarked Tucker Carlson, the first journalist to expose the tapes in their entirety. “In fact, it demolishes the claim.” Although there was undoubtedly a group of hooligans among the thousands of January 6th protesters responsible for wreaking a lot of havoc, the overwhelming majority of the participants “were not insurrectionists,” Carlson continued. “They were orderly and meek. They were sightseers.” Such a conclusion will be very difficult for most people to believe, but that’s only because the media continually broadcasted the most damning images from the Capitol Building, reinforcing the narrative of seditious rioters.

Now compare that harsh ‘made for television’ portrayal of January 6 with CNN’s “Fiery But Mostly Peaceful Protests” style of reporting it used to downplay the severity of the George Floyd protests. And while the Democrats and aligned media continue to sell the January 6 riot as a violent right-wing insurgency, as they pursue their primary goal of putting ‘dictator’ Donald Trump behind bars, the only person to suffer a violent death on January 6 was a protester named Ashli Babbitt, a 36-year-old military veteran. A Capitol Police officer shot her in the neck, with a later explanation by the department stating that he had “potentially saved Members [of Congress] and staff from serious injury and possible death.”

All things considered, the damage done by left-wing protesters during the George Floyd protests were far worse than the crimes committed by the Trump supporters on Capitol Hill. That becomes more evident when it is considered that acts of arson, vandalism, and looting that occurred between May 26 and June 8 caused approximately $1-2 billion in damages nationally, the highest recorded amount from civil disorder in US history. Meanwhile, the monetary damage caused by the Capitol Building protesters was just over $2.7 million. Meanwhile, as we have already discussed, there have been no serious criminal charges filed against the members of Black Lives Matter and Antifa, which brings us to the most hypocritical part of this story.

This week, Enrique Tarrio, the former chairman of the far-right organization Proud Boys, who wasn’t even in Washington, D.C. on January 6, was sentenced to 22 years in prison for plotting to keep Trump in power by force after he lost the 2020 election to Joe Biden. Stewart Rhodes, the founder of the similar-minded group the Oath Keepers, and one-time Proud Boys leader Ethan Nordean, were both handed 18-year sentences. The three men were found guilty of breaking the seditious conspiracy law, which was enacted after the Civil War to arrest Southerners who continued to take up arms against the US government.

In order for prosecutors to win a seditious conspiracy case, they must prove that two or more people conspired to “overthrow, put down or to destroy by force”the US government, or that they plotted to use force to challenge government authority. Although the case has already been settled, the jury is still out for many political pundits who, pointing to the January 6 surveillance videos, argue that the case for violent insurrection is weak at best. Now, with former President Donald Trump heading for court on March 4, 2024, just eight months before the presidential election, America is looking more like a bona-fide banana republic than ever before.

Read more …

“This is all about the Presidential Records Act,” President Trump said. “I’m allowed to have these documents. I’m allowed to take these documents, classified or unclassified. And frankly, when I have them, they become unclassified. “People think you have to go through a ritual—you don’t. At least, in my opinion, you don’t.”

“Hillary Clinton destroyed documents while under subpoena—while under subpoena—and wasn’t even charged. … Does it make you angry?” “Yeah,” he replied. “Yeah, it makes me angry.”

• Trump Decries ‘Double Standard’ in Documents Case (ET)

President Trump is facing criminal charges in two federal cases relating to his handling of classified documents and his challenge of the 2020 presidential election results. Two additional cases have been brought by Democrat prosecutors in New York and Atlanta, though the former president holds that those cases were also brought in coordination with the Biden Department of Justice. “These are Biden indictments,” he said. “This is a guy that is grossly incompetent—I don’t even believe it’s him. It’s the people, the fascists that’s around him. Because I don’t believe he’s smart enough to do this, if you want to know the truth.” In the documents case, brought by Justice Department special counsel Jack Smith, President Trump stands accused of willful retention of national defense information, obstruction, and making false statements.

But the case, according to the former president, revolves around a “fake crime.” “They create a fake crime, and then they say, ‘Oh, you obstructed.’ This is a fake thing that they’ve done,” he said. Pointing to the Presidential Records Act of 1978, he contended that the law gives him the authority to decide which records he can keep. As support for those claims, President Trump cited a similar case involving audio recordings that President Bill Clinton kept in a sock drawer. The recordings were made during President Clinton’s time in office, but when government watchdog group Judicial Watch sued to obtain access to them, a federal judge dismissed the case. The 42nd president, the judge ruled, had the authority to decide which records qualified as personal and which were presidential.

“This is all about the Presidential Records Act,” President Trump said. “I’m allowed to have these documents. I’m allowed to take these documents, classified or unclassified. And frankly, when I have them, they become unclassified. “People think you have to go through a ritual—you don’t. At least, in my opinion, you don’t.” Further noting that the statute in question is civil rather than criminal, he asserted, “I did absolutely nothing wrong.” President Trump has pleaded not guilty to all of the charges filed against him. But while he may not be worried about a conviction, one emotion he admitted to feeling was anger. Ms. Kelly, noting that he had not been accused of destroying classified documents, said: “Hillary Clinton destroyed documents while under subpoena—while under subpoena—and wasn’t even charged. … Does it make you angry?”

“Yeah,” he replied. “Yeah, it makes me angry.” President Trump noted that Ms. Clinton smashed her cell phones and destroyed tens of thousands of emails after receiving a congressional subpoena, yet former FBI Director James Comey concluded that “no reasonable prosecutor” would bring charges against her. “Yeah, there’s a double standard in this country, and the people aren’t standing for it,” he said. “People get it.”

Read more …

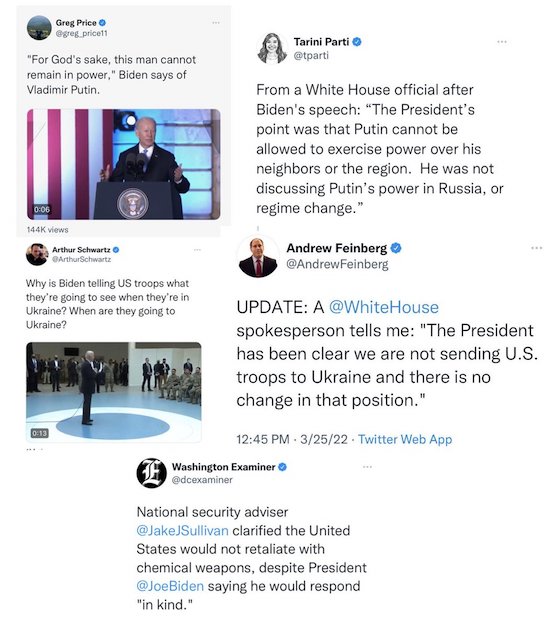

“X lost its appeal and was found to be in contempt of court for delaying its compliance with the search warrant, leading to the $350,000 fine being imposed.”

• Court Documents Reveal Number Of Trump Private Messages Disclosed By X (RT)

X, the social media network formerly known as Twitter, provided access to at least 32 of Donald Trump’s private messages as part of an investigation into the former US president’s alleged efforts to overturn the results of the 2020 election, according to recently unsealed court filings. Separate court documents from August previously stated that federal prosecutors had received“some volume” of Trump’s private messages. The exact number – 32 – was revealed on Friday as part of a court filing submitted by X, in which it is seeking to appeal a $350,000 fine for failing to comply with the terms of a search warrant. The content of the messages remains unclear. The warrant, which was served on the social media giant in January, gave X ten days to submit Trump’s data from between October 2020 and January 2021, a time span which the filing noted “includes the November 2020 presidential election and the January 6 insurrection at the Capitol.”

In addition to the search warrant, X was also issued with a so-called nondisclosure order designed to ensure that Trump was not aware that prosecutors had gained access to his private messages. This was, the court filing said, to prevent “destruction of or tampering with evidence, intimidation of potential witnesses or serious jeopardy to this investigation.” However, X told the investigation that it would be unable to comply with the search warrant as it had not been given enough time to do so. The company also objected to the nondisclosure order due to what it said was the “intense publicity around the investigation.” “Indeed, the materials Twitter produced to the government included only 32 direct-message items, constituting a minuscule proportion of the total production,” prosecutors said.

They added that the nondisclosure request was not a “hypothetical consideration” given alleged attempts by Trump to obstruct another federal investigation into his supposed mishandling of classified government documents at his Mar-a-Lago estate in Florida. Trump denies all wrongdoing in each of the cases against him. “The former president propagated false claims of fraud (including swearing to false allegations in a federal court filing),” prosecutors wrote in a legal brief, adding that he had “pressured state and federal officials to violate their legal duties, and retaliated against those who did not comply to his demand, culminating in violence at the US Capitol on January 6.” X lost its appeal and was found to be in contempt of court for delaying its compliance with the search warrant, leading to the $350,000 fine being imposed.

Read more …

“The more energetic and dynamic part of the world, the faster growing part of the world quantitatively, is not on the US-European side of the story..”

• Jeffrey Sachs: US Sanctions Against Russia and China Destined to Fail (Sp.)

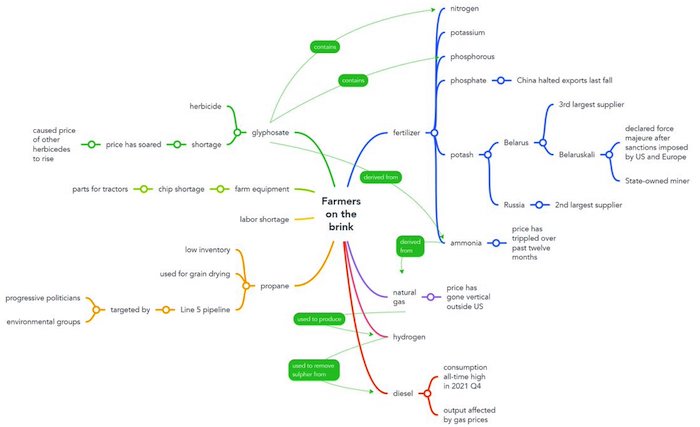

Sanctions have failed to bring Russia to its knees, as the nation’s economy has proved to be far more resilient than Western policymakers ever imagined. Back in March-February 2022 they projected that a bunch of restrictions would be effectively a knockout punch against the Russian economy, that they would bring military production to a halt and that they could even potentially cause mass political unrest. None of that has materialized. Why did Western analysts get Russia so wrong? “When it comes to Russia, the idea that this would be some kind of a ‘knockout blow’ for the conflict in Ukraine was utterly naive and predictably a failure,” renowned economist and Columbia University Professor Jeffrey Sachs told Sputnik. “But I think the Russian economy also was clearly vastly underestimated. And what the West gets wrong on all aspects of the Ukraine crisis is that the world is not united with the West. The West is just a small part of the world. Most of the world wants to stay clear of this crisis.”

[..] While Western sanctions have failed to cripple Russia’s economy and hinder China’s rise, they at the same time have given a boost to the development of the two countries, prompting them to explore new markets, develop new technologies and forge new partnerships. For instance, over the past two years, one has seen Chinese auto companies become major players on the international market, even overtaking German car producers. And one of the major markets for Chinese cars has been the Russian market, in large part because last year a lot of Western brands, a lot of Japanese brands left the Russian market, which created a void that the Chinese companies could fill. “Well, I think certainly there is a huge boomerang effect of these sanctions. Europe is the biggest loser of the sanctions, this is for sure, because Russia’s low-cost production, both of primary energy certainly, but also of fertilizers and many other commodity-based manufactured goods going to Europe are now going to China and going to the rest of Asia. And Europe is in outright recession,” said Sachs.

“If there is a particular loser from all of this, it’s the German industry which had probably the closest symbiotic relationship with the Russian economy over the last 30 years,” added the professor. Germany is the only G7 nation that will see economic contraction this year, according to the IMF. The IMF attributes the trend to weak production output as well as a contraction in two consecutive quarters (Q4 in 2022 and Q1 in 2023). The latter factor prompted international economists to conclude in mid-July that the country had fallen into a technical recession. The destruction of the Nord Stream natural gas pipelines, as well as Berlin’s decision to follow in Washington’s footsteps and slap energy sanctions on Russia, backfired on German manufacturers, leading to relocation of businesses and, eventually, deindustrialization.

“All of the fervor against Nord Stream, for example, was a part of the US desire to ensure that Germany and Russia never got too cozy economically,” Sachs remarked. “And as Russia therefore turns to the broader BRICS world and the rest of the world, it’s those countries that benefit from these linkages,” the professor continued. “And it’s Europe that is absolutely left behind. One of those beneficiaries is China. Clearly. Because China is a crowded, densely populated economy with natural resources, but on a per capita basis, relatively low. So it’s very complementary with Russia. Add in the common shared high-tech element, and that’s an added benefit of this increasingly strong relationship between China and Russia on the economic side, because there is a lot of technology transfer that can go in both directions.

Add in the building of infrastructure across Eurasia, connecting Russia and China in a number of ways. That also is of great strength.” So, in the end, the Western sanctions policy has not led to any kind of a deep, prolonged crisis for either Russia or China. Quite the contrary, according to the professor. “The more energetic and dynamic part of the world, the faster growing part of the world quantitatively, is not on the US-European side of the story,” Sachs concluded.

Read more …

Terror strikes and long-range missiles do not win a war….

• ‘Ground War’ in Ukraine May Be Over – Macgregor (Sp.)

The ongoing conflict in Ukraine may be about to move to a new phase amid the severe losses sustained by the Kiev regime forces, warns former senior Pentagon adviser Col. Douglas Macgregor. With thousands of Ukrainian losses during the ongoing “counteroffensive”, Kiev appears to be “desperate for manpower” and is trying to rectify this problem by “forcing people into uniform inside the country that are not really capable of fighting” and attempting to repatriate Ukrainians of military age from overseas, Macgregor said during an interview with Norwegian political scientist Glenn Diesen. “So I think the Ukrainian ground war, for all intents and purposes, is either at a standstill or perhaps even over,” he remarked.

Macgregor did point out, however, that Kiev may instead resort to attacking Russia with long-range weapons acquired from Western sponsors, such as Storm Shadow and Taurus missiles, with the colonel suggesting that the recent Ukrainian attack on Sevastopol was an example of such a strike. He noted that this course of actions does not bode well for Ukraine as it essentially helps convince Moscow that the Ukrainian conflict can only be resolved through military means. Macgregor also lamented that the US leadership mulls what other armaments “short of a nuclear weapon” they can use via the Ukrainians instead of attempting to negotiate a peaceful solution to the Ukrainian conflict with Russia. “The Russians would love to sit down and talk to somebody who is willing to examine where we stand – no one will do it,” he said. “So this is why I call this phase of the war, it’s no longer the Ukrainian phase, it is now the Biden phase of the war. And the Biden phase of the war is long range strikes.”

He warned that such long range strikes into the Russian territory will not convince the Russians to acquiesce to the US’ demands, as the strategists in Washington apparently believe. “If anything, it is going to persuade the Russians that they must attack and attack decisively to the west,” Macgregor stated. Finding itself unable to defeat the Russian forces on the battlefield, the regime in Kiev has resorted to carrying out terror strikes against population centers and civilian infrastructure in Russia. While so far these attacks were mostly conducted using drones and Soviet-era ordnance, as well as by sending teams of Ukrainian terrorists across the border, odds are high that Kiev may also start actively using for these purposes the long-range missiles provided by its NATO sponsors.

https://twitter.com/i/status/1703157539041407084

Read more …

Again, this would take years to address.

• Kiev’s Requests for Arms Exceed NATO’s Production Capacity (Sp.)

Chair of the NATO Military Committee Adm. Rob Bauer on Saturday admitted that Ukraine’s requests for weapons and ammunition, as well as the volume of defense production used in Ukraine, are “huge” and exceed the production capabilities of the alliance. “The volume of the weapons and the ammunition that Ukraine requires is huge … The scale and the volume of what is used is going beyond our production capacity,” Bauer said at a press conference in Norway. The Military Committee Chair also said that NATO countries that decide to supply weapons and ammunition to Ukraine have to think about the risks for their own security.

“When they think about giving away weapons or ammunition, they have to think on the decision itself, ‘Am I giving away?’. Second, what is the risk that I take against my own readiness in NATO, in my own country,” Bauer said. In this regard, the military official called on the NATO countries to address issues of increasing production capacity in the defense sector more quickly and efficiently. Moscow has condemned foreign military supplies to Ukraine. In April 2022, Russia sent a diplomatic note to all NATO countries on the issue of arms supplies to Ukraine. Russian Foreign Minister Sergey Lavrov has warned that any cargo containing weapons for Ukraine will become a legitimate target for Russia.

Read more …

… and we’re out of soldiers.

“..out of 100 people who joined the units last fall, 10-20 remain, the rest are dead, wounded or disabled.”

“..conscription of people with such severe conditions as hepatitis, HIV without symptoms, and clinically treated tuberculosis..”

• Ukrainian Army Lost 9 Out Of Every 10 Troops – Conscription Officer (RT)

Up to nine out of ten Ukrainian draftees who joined the army a year ago were either killed or wounded in action, a senior conscription officer in the Poltava Region said on Friday, according to local media. Speaking at a meeting of Poltava City Council, Lt. Colonel Vitaly Berezhny, who serves as acting head of the territorial center of recruitment and social support, admitted that local authorities are struggling with their conscription campaign, having fulfilled the mobilization plan by only 13%, which puts the city in last place in the whole region. Berezhny was quoted by local media outlet Poltavshina as saying the military urgently needs reinforcements, as “out of 100 people who joined the units last fall, 10-20 remain, the rest are dead, wounded or disabled.”

To remedy the manpower shortage, the officer suggested rolling out draft notification posts in a bid to “establish the presence of conscripts.” He added that the region was also planning to create a large mechanized brigade, and urged local deputies to assist in the effort. Ukraine announced a general mobilization shortly after the start of Russia’s military campaign in February 2022, banning most men aged 18 to 60 from leaving the country. In August, former Ukrainian Defense Minister Alexey Reznikov said Kiev had not yet fulfilled its existing mobilization plan, suggesting there was no need for another draft drive. However, earlier this month, Ukraine’s Defense Ministry issued a decree allowing the conscription of people with such severe conditions as hepatitis, HIV without symptoms, and clinically treated tuberculosis.

At the same time, Ukrainian authorities embarked on a massive campaign against corruption in the country’s conscription system, with President Vladimir Zelensky recently firing all regional military conscription officials. Berezhny’s acknowledgment comes amid Ukraine’s counteroffensive that has been underway for more than three months but has failed to gain significant ground. Earlier this week, Russian President Vladimir Putin estimated Ukraine’s losses at more than 71,000 troops. He also suggested that Kiev could enter into negotiations with Moscow only when it comes close to running out of resources to throw at Russian defences, but concluded that Ukraine would need those talks only to restore its battered military potential.

Read more …

Please don’t ask how battle-ready those troops would be… Good thing nobody is planning to attack NATO.

Logos: “.. you do not have the time to prepare for an attack if the attack happens. And it is not us planning the attack, it is the opponent planning the attack. If they attack, you have to be ready..”

• NATO Says It Can Deploy 3.5 Million Soldiers If Attacked (RT)

NATO, in accordance with its new defense plans, can deploy 300,000 soldiers in the first month of a potential attack on the bloc, while the total number of the alliance’s military personnel could reach 3.5 million people, Chair of the NATO Military Committee Adm. Rob Bauer said, Report informs via Sputnik. “If we are talking about collective defense, you do not have the time to prepare for an attack if the attack happens. And it is not us planning the attack, it is the opponent planning the attack. If they attack, you have to be ready. Therefore, we need more soldiers at high readiness … We are talking, in NATO as a whole if Finland and Sweden have joined, of about 3.5 million soldiers in the alliance. So the 300,000 is the number … that we foresee at high readiness available for basically the first 30 days if it is necessary,” Bauer told reporters at a press conference with Norwegian Chief of Defense Gen. Eirik Kristoffersen.

Read more …

“We won’t listen to Berlin, von der Leyen… because it’s in the interest of the Polish farmers.”

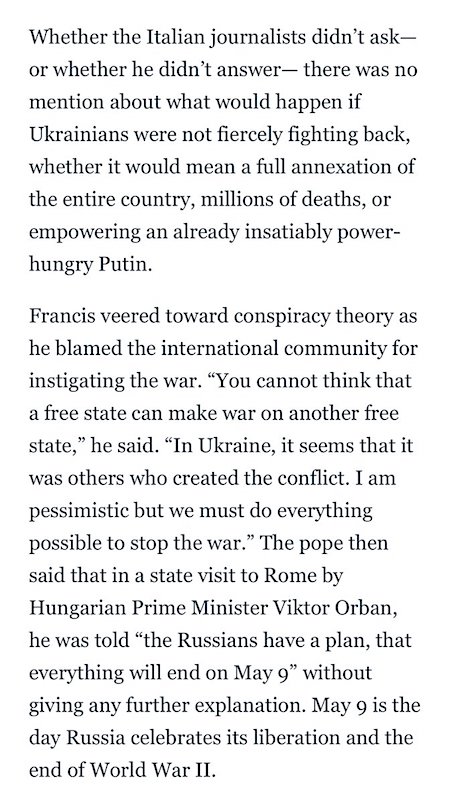

• Zelensky Issues Warning To EU Neighbors (RT)

Kiev will respond if EU countries decide to impose unilateral restrictions on Ukrainian grain in contravention of decisions made in Brussels, President Vladimir Zelensky has said. On Friday, the European Commission opted not to extend a ban on deliveries of Ukrainian wheat, maize, rapeseed, and sunflower seeds to Poland, Hungary, Romania, Bulgaria and Slovakia. The curbs, which were introduced in May, expired on September 15. While the Bulgarian authorities supported the move, the other four EU member states said they would now introduce restrictions at national level due to the need to protect their agricultural industries. Zelensky wrote on Telegram that he had talked to European Commission President Ursula von der Leyen on the phone, telling her that he was “deeply grateful” to her for “keeping her word and maintaining the rules of the free market.”

The decision by Brussels not to extend the ban “is an example of true unity and trust between Ukraine and the EU. Europe always wins when the rules work and the treaties are fulfilled,” he said. However, the Ukrainian leader added that “now it’s important [to make sure] European unity also works on a bilateral level; that the neighbors support Ukraine” amid its conflict with Russia. If Poland, Hungary, Romania or Slovakia make decisions that “violate EU law, Ukraine will respond in a civilized way,” Zelensky warned, without specifying the countermeasures to which Kiev may resort to protect its interests. After learning about the ruling by the European Commission on Friday, Polish Prime Minister Mateusz Morawiecki said Warsaw would “extend the ban on Ukrainian grain. We won’t listen to Berlin, von der Leyen… because it’s in the interest of the Polish farmers.”

Hungarian Prime Minister Viktor Orban announced a similar plan, saying he was preparing for “a serious fight in Brussels” over the grain issue. Warsaw and Budapest have vigorously resisted deliveries of Ukrainian grain, despite having quite opposite views on the conflict between Moscow and Kiev. Poland has been one of the main backers of Ukraine in the EU, providing the country with weapons and insisting on increasingly harsh measures against Russia, while the Hungarian authorities have consistently criticized the bloc’s sanction on Moscow as ineffective, and insist on a diplomatic solution to the crisis.

Read more …

He banned almost all opposition. And the one he didn’t touch now turns out to be a Russian collaborator?!

• Zelensky Political Rival Charged With Treason (RT)

Member of the Ukrainian parliament and former emergency-services minister Nestor Shufrich has been arrested and is being held on charges of treason issued by a court in Kiev, the country’s capital. According to footage from Friday’s hearing published by outlet RBK-Ukraine, the judge has ruled that Shufrich will stay behind bars for the next two months. The politician, who was a member of the Opposition Platform-For Life party before it was banned as pro-Russian on the orders of Ukrainian President Vladimir Zelensky last summer, has also been denied bail. Earlier in the day, masked operatives from Ukraine’s Security Service (SBU) arrived at the MP’s home, informing the 56-year-old that he’s suspected of treason and searching the premises.

The SBU said in a statement that its investigators have “collected a well-argued evidence base about the anti-Ukrainian activities” of Shufrich. According to the agency, the parliamentarian was an agent of Moscow whose main task was to promote pro-Russian sentiment in Ukraine through his media appearances. “He systematically disseminated the Kremlin’s narratives, that the Ukrainian state is allegedly an artificial entity, that Ukraine and Russia have a single history, and that Ukrainians and Russians are supposedly ‘one nation,’” the SBU claims. According to local media, items with Soviet and Russian symbols, including medals, ID cards and the Saint George’s ribbons with which Russians celebrate World War II victory, were found in the search of Shufrich’s home.

The lawmaker also allegedly owned a collection of Russian military uniforms. The investigators also reportedly found a 2014 document that details a plan for the autonomy of Donetsk and Lugansk Regions. Both territories, as well as Zaporozhye and Kherson Regions, officially became part of Russia last year after referendums. Kiev and its Western backers have labeled the votes a “sham.” Shufrich has been an MP since 1998, appearing in six iterations of the Verkhovna Rada. He also held the post of Ukraine’s Emergency Services Minister in 2006-2007, and in 2010, and was also deputy head of the country’s National Security and Defense Council, from 2010 to 2012.

Russian political analyst and former MP Sergey Markov suggested that Shufrich’s arrest might be a sign that Ukraine is preparing to stage a presidential election next year after all. President Zelensky said earlier that the vote will not be held as the country is under martial law. Shufrich used to be “one of the most pro-Russian MPs and one of most vivid critics of Zelensky,” but amid the conflict between Moscow and Kiev he “fully backed” the president, Markov wrote on Telegram. The analyst said that the MP is being detained by Ukrainian authorities over concerns that he “could suddenly run [in the election] and steal some of the Zelensky’s former voters,” who are disappointed in the president.

Read more …

“If there is something that might force European capitals to reconsider their position on the conflict, it is the further deterioration of the economic situation on the continent..”

• Orban Explains What Might Force West To Want Peace In Ukraine (RT)

European nations might eventually forgo their support for Kiev’s military efforts in the ongoing conflict with Russia due to their own economic hardships, Hungarian Prime Minister Viktor Orban told nationwide Kossuth Radio on Friday. The conflict that has lasted for more than a year and a half is affecting the European economy, which “will not be like we want it to be” for as long as it goes on, Orban told the radio’s ‘Good Morning, Hungary!’ show. Yet, “war supporters are in the overwhelming majority” among EU governments, he pointed out. If there is something that might force European capitals to reconsider their position on the conflict, it is the further deterioration of the economic situation on the continent, the prime minister believes.

Most people in Europe already share Hungary’s position on the issue, which is anti-war, he claimed. Economic setbacks could force these people to “exert pressure” on their governments, he added. “Deterioration of the economic situation in the West will force countries to stand up for peace,” Orban said. According to the Hungarian prime minister, the outcome of next year’s US presidential elections might also heavily affect the West’s general position on the issue. “There are two possibilities: … the presidential candidates will either support the war or announce the end of the war,” he said. Orban said he believes that a US president is fairly capable of “putting an end” to the conflict.

That does not mean that Europe should just “wait for a fairy to end the war with a magic wand,” he added. The prime minister criticized the European approach to the conflict so far by saying that “181 billion of European money” has been spent on supporting Kiev but “we have not come any closer to peace.” It is unclear if he referred to dollars or euros. According to Ukraine Support Tracker data regularly published by Germany’s Kiel Institute for the World Economy, the EU institutions and EU nations together pledged a total of €131.9 billion ($139.8) for Ukraine between January 2022 and July 2023.

The UK, Norway and Switzerland, which are not part of the EU, together pledged an additional €23.31 billion ($24.8 billion) over the same period, bringing the total amount of European commitments to €155.21 billion ($165.66), data provided by the Kiel Institute showed. Viktor Orban has long maintained that the West was making a mistake by pursuing military confrontation with Russia in Ukraine. He has repeatedly stated that there could be no military solution to the conflict, adding that the US and its allies need to stop arming Kiev and seek peace with Russia instead.

Read more …

“It allows for the creation and destruction of credit determined solely by the needs of the Russian people, both as businessmen and consumers.”

• Currency Wars Versus Gold Standards (Macleod)

In the middle of a war, usually a government suspends its gold standard. This would suggest that Russia can only consider a gold standard after its special operation in Ukraine is over. But the modern equivalent of a gold standard, the currency board, has been successfully established in modern times in nations with far worse budget deficits than Russia. Russia was in the fortunate position of a budget deficit of only 2.3% of GDP last year, despite military spending. This year, military spending has soared, and at a guess the deficit will be about 5% of GDP this year, but government debt to GDP will still be about 20%.

Anything other than ball-park numbers for the Russian economy are difficult to come by, and the volatility of the rouble is a further analytical hazard. But some of these numbers are not substantially different from where Britain was economically in 1816, when a return to the gold standard was planned — the exception being her estimated debt to GDP number, which at nearly 200% was ten times that of Russia today. Therefore, there is no reason why Russia cannot put the rouble onto a gold standard immediately.

In doing so, the objective is simple: to ensure that the purchasing power of circulating credit retains its value in terms of goods and services with as little fluctuation as possible. It would allow savers to accumulate credit balances in their bank accounts, and for businessmen to calculate the profitability of their investments with greater certainty. With income tax currently at a flat 13% rate and corporation tax at 20%, in these conditions economic progress will advance surprisingly rapidly. And there is every reason to expect Russia would quickly become an economic counterweight to the sheer power of China, rather than living off the depletion of her natural resources. It is necessary not just for Russia to distance herself from the fate of the western fiat currency system, but also for President Putin’s legacy.

The method of ensuring monetary stability is equally simple: to bind credit denominated in roubles to gold, which both in law and naturally is the money of the people. It is the highest form of credit, there being no counterparty risk. Its purchasing power in the general sense has held steady through millennia. Importantly, it removes the currency from political control and dollar influences. It allows for the creation and destruction of credit determined solely by the needs of the Russian people, both as businessmen and consumers.

Read more …

Message to Macron.

• Mali, Burkina Faso, Niger Sign Charter to Create Defense Alliance (Sp.)

The leaders of Mali, Burkina Faso and Niger have signed a charter establishing an alliance of Sahel states to create a collective defense architecture, Mali’s interim president for the transitional period, Assimi Goita, said on Saturday. “I have signed today with the leaders of Burkina Faso and Niger the Liptako Gourma Charter, establishing the Alliance of Sahel States to create an architecture of collective defense and mutual assistance for the benefit of our people,” Goita said on X. An attack on the sovereignty or territorial integrity of one or more parties to the charter will be regarded as aggression against the other parties and will require their assistance, including the use of military force, the document read. The parties also commit to fighting terrorism and organized crime on the territory of Sahel states, the charter added.

Read more …

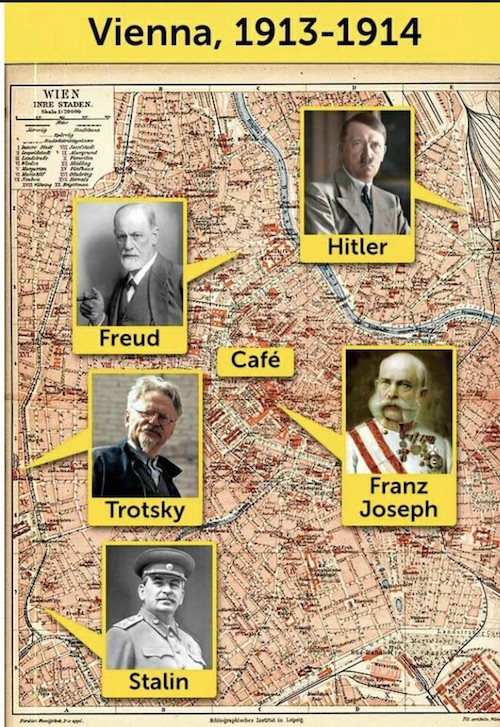

In 1913 Hitler, Trotsky, Tito, Freud and Stalin all lived together in Vienna

Gorilla babies

Gorilla babies curiously check a wildlife photographer bowing his head to avoid intimidation. Parent Gorilla uses body language to tell them to be gentle against him.pic.twitter.com/LsHmaPUUWb

— Figen (@TheFigen_) September 16, 2023

Buffalo

The way this buffalo defends its friend pic.twitter.com/z7tu5qOCX6

— Science girl (@gunsnrosesgirl3) September 16, 2023

Flik flak https://twitter.com/i/status/1702752462971572660

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.