SalvadorDali Girl At The Window 1925

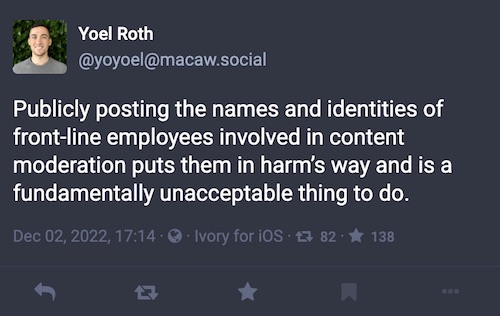

Tucker

Abortion has gone from being tolerated to celebrated. What kind of sick people would tell you that killing your baby is a pathway to joy? pic.twitter.com/ohaYtnITPr

— Tucker Carlson (@TuckerCarlson) September 25, 2023

GOPUkr

The main argument for American support of the war is not that it helps Ukrainians but that it hurts Russians. Just watch the video. pic.twitter.com/GII4qdOTT6

— Max Abrahms (@MaxAbrahms) September 24, 2023

American troops in Ukraine?

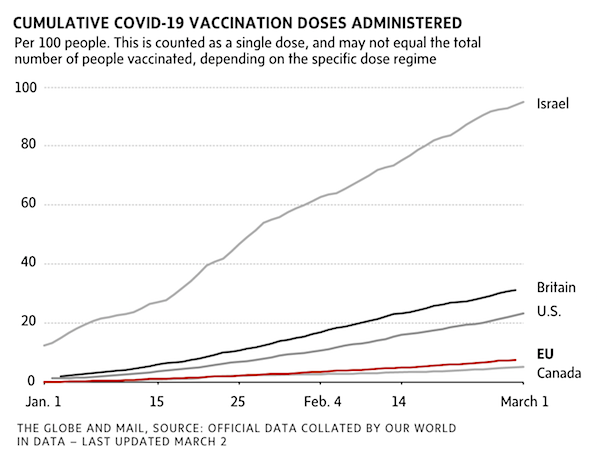

Effective

https://twitter.com/i/status/1706178028018008199

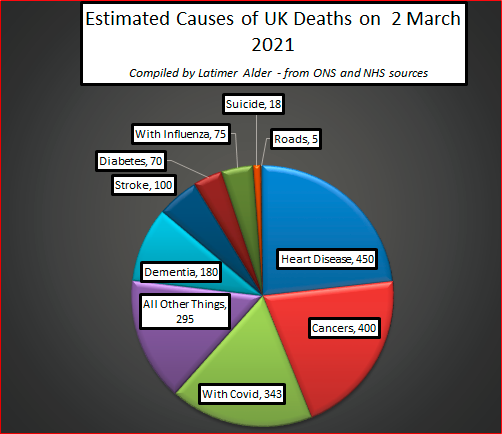

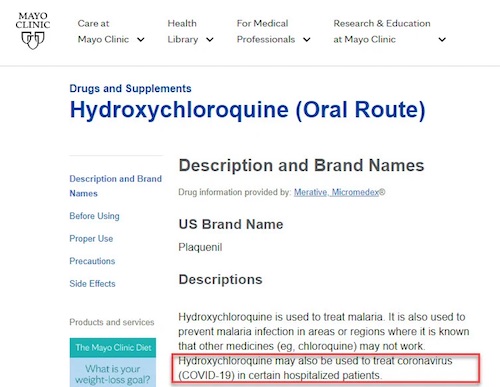

CIA Covid

Still no arrests. pic.twitter.com/FHvXzDS3oh

— Dr. Anastasia Maria Loupis (@DrLoupis) September 24, 2023

USGovLie

Misinformation used by the American government became illegal in the 1930s.

Obama changed this law to make it legal to LIE to the American people. pic.twitter.com/my0gmvNP2z

— illuminatibot (@iluminatibot) September 25, 2023

Hmmm. Let’s see it first.

• Zelensky’s Failed Visit to US Shows ‘End is Coming’ for Ukraine (Sp.)

Ukrainian President Volodymyr Zelensky’s lackluster receptions in Washington and at the UN in his trip to the US last week, and inability to achieve major objectives, shows that his moment has passed and the end is near for Kiev, experts told Sputnik. Zelensky visited Washington on Thursday for the second time since Russia launched its special military operation. Unlike his Democratic predecessor Nancy Pelosi, House Speaker Kevin McCarthy declined Zelensky’s request to address a joint session of Congress. It also came as the lower congressional chamber is struggling to pass a short-term spending plan to avoid a government shutdown at the end of the month, with continued financial support for Kiev being one of the sticking points among Republicans.

Biden did announce a new security package for Kiev, although it did not include the ATACMS long-range missiles Zelensky sought. However, according to media reports, Biden during the visit informed Zelensky that the US will send a small number of ATACMS to Ukraine for the first time. A White House National Security Council spokesperson declined a Sputnik request to confirm and comment. Retired US Army Lt. Col. and international consultant Earl Rasmussen, former Vice President of the Eurasia Institute, said Ukraine’s leader failed to achieve many objectives during his trip to the US, including isolating Russia at the Security Council and securing greater international support. Nor did he receive a strong reception from US Congress, Rasmussen observed. One would assess the US adventure as one absent of excitement and a definite disappointment, Rasmussen continued.

“There were no mass pro-Ukrainian or anti-Russian demonstrations in New York or Washington. The UN Assembly Hall was at best half full for his presentation, which seemed more based on an alternative universe,” Rasmussen told Sputnik. “Essentially this visit was a non-event with even The New York Times publishing a critical article the day before his appearance in the UN. Coincidence? Likely not.” This all comes to mean one thing – a reality that Ukraine should grasp by now, Rasmussen said. “The end is rapidly coming both for Zelensky and Ukraine,” Rasmussen said. “A military defeat is near… The question is do we seek a settlement and end the killing, or do we escalate more to try to prolong the conflict and as a result see even more lives lost and an increased chance of direct conflict.”

Former Pentagon analyst Chuck Spinney speculated that Zelensky might even be realizing his chance to rally the West behind his cause once again has come and gone. “I think Zelensky’s phony ‘Churchillian Moment’ has passed,” Spinney told Sputnik. “His body language suggests that he knows he is losing touch with his audience.” Nicolai Petro, who serves as a professor of political studies at the University of Rhode Island, said Zelensky’s trip to the United States revived public interest in the issue of Ukraine, but that he had to endure complaints from some of his sponsors about Ukraine’s lack of military success and corruption. “Alas, there is little that can be done about either of these,” Petro said. “The fact that lax oversight controls over funding and military shipments to Ukraine predictably resulted in a significant percentage of it disappearing was not revealed yesterday – sources in the White House were aware of it in April 2022 and CBS News reported on it in August 2022.” The widespread corruption that guaranteed the waste and misuse of US and NATO-supplied weapons systems would likely continue unabated, Petro predicted.

His safe way out?

• Zelensky’s Wife Unsure If He Will Seek Reelection (RT)

Ukrainian President Vladimir Zelensky might not run for reelection next year, his wife, First Lady Elena Zelenskaya, told CBS’ Face the Nation on Sunday. The difficulties of organizing elections amid a military conflict, with millions of eligible voters scattered all over the surrounding continents, might influence her husband’s decision on whether to run again, Zelenskaya said. She added that she would nevertheless “support him whatever decision he takes.” “It will also depend whether our society would need him as a president, if he will feel that Ukrainian society would no longer wish him to be the president, he will probably not run,” she added, admitting that she was uncertain of her husband’s intent.

While Zelenskaya claimed she “didn’t fully endorse” his first attempt at the presidency, she acknowledged that a second try would be “not as scary” due to the couple’s experience. She called the moderator’s question – about how she would feel if Zelensky launched a reelection bid – a “difficult” one. The Ukrainian head of state visited the US last week to meet with President Joe Biden and other leaders, coming back with a pledge of “up to $325 million” for “critical security and defense needs” from the White House, after reportedly warning American lawmakers that Kiev may lose to Russia otherwise. Washington has reportedly handed over $75 billion to Kiev in the last two years, with most of that – $46.6 billion – being military aid.

A survey published earlier this month revealed nearly eight in 10 Ukrainians blame Zelensky for the rampant corruption that plagues their country – another reason the president might be apprehensive about running for reelection. He has also complained about weakening Western support as well, using an interview with the Economist to denounce his unfaithful erstwhile benefactors as closet Russia supporters and threaten them with losses in their own elections if Kiev succumbs militarily, and social problems, should the millions of Ukrainian refugees scattered throughout Europe get unruly.

Ukrainian martial law prohibits elections, and Ukrainian security officials recently acknowledged to the Washington Post that a vote would be essentially impossible with most of the population deployed on the front lines or living outside the country. However, Kiev is facing increasing pressure from the West to at least maintain the appearance of a functioning democracy, a demand the government cannot afford to dismiss outright given the degree to which it is financially dependent on American and European largesse. In June, Zelensky acknowledged a vote could only take place after the conflict was settled, only to reverse course in August and say it was possible – as long as he got an additional $135 million.

“Ukraine has lost 53.7% of its population since 2014..”

• Ukraine To Surrender On Moscow’s Terms Or Cease To Exist – Duma Speaker (TASS)

Ukraine is fated either to capitulate on Moscow’s terms or cease to exist as a state, Vyacheslav Volodin, speaker of the Russian State Duma (lower house of parliament), said. “When speaking about the conflict in Ukraine, [US President Joe] Biden, [NATO Secretary General Jens] Stoltenberg and other Western officials have started calling it ‘a war of attrition.’ They have put huge amounts of money into militarizing the Kiev regime. Where has it gotten them? The simple facts are these: the West is experiencing weapons and ammunition shortages, people in Europe and the US have lost trust in politicians, and the Kiev regime’s counteroffensive has failed,” Volodin stated.

According to him, the outcome of the “war of attrition” also includes economic problems in Europe and the US, a lack of manpower for the Ukrainian armed forces, and ultimately bankruptcy and demographic disaster for Ukraine. “These seven facts speak for themselves: Ukraine will cease to exist as a state unless the Kiev regime capitulates on Russia’s terms,” Volodin stressed. “More than 10.5 million people have fled Ukraine. Another 11.2 million residents of Crimea, Sevastopol, the Donetsk and Lugansk people’s republics and the Zaporozhye and Kherson regions decided to join Russia. Ukraine has lost 53.7% of its population since 2014,” the State Duma speaker highlighted.

Volodin noted that, in June, then-British Defense Minister Ben Wallace stated that Western countries had run out of stockpiles of those weapons that they could send to Kiev from their own national arsenals. Biden, in turn, admitted in July that the decision to provide Ukraine with cluster munitions had been driven by the fact that stocks of conventional ammunition were exhausted. “The approval ratings of EU and US leaders have hit historical lows. The share of people who disapprove of their leaders’ performance stands at 57% for Biden, at 69% for [French President Emmanuel] Macron, and at 72% for [German Chancellor Olaf] Scholz. The majority of people in the United States and European countries oppose weapons supplies to Ukraine,” the Duma speaker added.

In addition, the senior lawmaker emphasized that the NATO-backed Ukrainian military had suffered huge troop and equipment losses, while “the lack of achievements has disappointed [Kiev’s] Western sponsors.” “The economies of the Eurozone countries are going through a recession. The costs of Ukraine’s militarization have forced Germany to cut benefit payments to poor families. France has reduced the number of beneficiaries; people in need no longer receive food packages and reimbursements for drug costs. International agencies have downgraded the United States’ long-term investment rating as they expect the financial situation in the country to worsen in the next three years,” Volodin said.

“..the moral, political, intellectual, social, and economic multi-level crisis plaguing the bulk of the collective West.”

• How to Prevent a Third World War (Sp.)

The unfolding Ukraine crisis could be a prologue for a larger and more dangerous conflict, according to Russian political scientist Sergei Karaganov. “In Ukraine, we have finally stood up to the United States/West, but we have so far let them grab the initiative in matters of escalation,” Karaganov wrote in his new article. “They continuously expand and deepen their aggression by supplying increasingly deadly and dangerous weapons.” This situation is further aggravated by the evident degradation of Western elites, according to the political scientist. He particularly referred to “the moral, political, intellectual, social, and economic multi-level crisis plaguing the bulk of the collective West.” “It will only get worse in the foreseeable future,” warned Karaganov.

“Each new call from Western leaders is more foolish, reckless, and ideologically charged than the previous one, making it more dangerous for the world. They are consciously fuelling the disintegration of their societies by promoting anti-human values.” Meanwhile, modern information technology and the internet has become a convenient tool for demonization and manipulation of public perceptions. “Even now, to fight the hated Russians, hundreds of thousands of Ukrainians are being sent to their deaths,” wrote the scholar. “Clearly, many more are dying from the collapse of infrastructure and healthcare. These victims are either completely forgotten or deliberately downplayed. Clearly, there is an even worse attitude toward demonized Russians. Russophobia has reached almost unprecedented proportions, perhaps comparable to how the Nazis viewed Slavs and Jews.”

This is happening against the backdrop of a broken dialogue system and the collapse of the arms control system, which, while not always useful and sometimes even harmful in the past, at least provided channels of communication between leading military powers, according to Karaganov. Meanwhile, a global realignment is underway with the West waging a “desperate final battle to preserve its dominance,” as per the Russian scholar. “A seismic shift is taking place in global geopolitics, geostrategy, and geoeconomics, and it is gaining momentum. New continents are rising, and global problems are worsening. The emergence of new sources of friction and conflicts is inevitable,” he wrote. Amid this unprecedented rapid redistribution of global power from the West to the global majority, Russia has become historically designated as “its military and political core,” according to Karaganov.

[..] “Humanity is facing an existential challenge to prevent the inexorably approaching catastrophe of the Third World War within the next decade or so by forcing the West, primarily the United States, to step back and adapt to the new reality. To achieve this, we need to compel their ‘deep state’ to refresh, as much as possible, the ruling elites, whose low quality does not meet the challenges facing humanity today. The falling West may drag everyone along, including its deep state,” he highlighted. To that end, Western elites should once again realize that nuclear armageddon poses a real threat to the world, according to the scientist.

“Never in history has such a move into tyranny been fronted by such an embarrassingly un-charismatic empty vessel..”

• Slouching Towards Beelzebub (Kunstler)

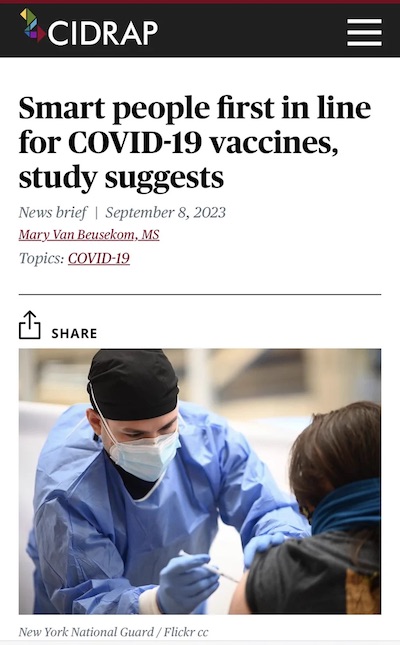

From early on, our government lied about the safety of the vaccines, at the same time that they lied and confabulated about the origins of the Covid-19 virus. They continue lying about all of this to this day even as they appear to prepare for a replay of a pandemic. Now that the weekend is over, you will not read about any of this in The New York Times. Why is that? I will offer my theory: that newspaper’s business model, based on pages and pages of print advertising, is completely broken and it is on financial life-support from the CIA and / or DARPA, probably facilitated by private sector cut-outs laundering the money. That’s how dishonorable the flagship of the US news media is.

And, of course, there is the added layer of government-directed censorship, also through private sector cut-outs, that is aimed at suppressing the truth about Covid from every angle, especially the vaccines. Doesn’t all of this look rather sinister? Choose one of two possible explanations: 1) the Covid-19 episode from the beginning was a fantastic fiasco of blundering incompetence by hundreds of officials from many agencies plus elected leaders, and at every stage was made worse by additional incompetent actions aimed at concealing massive chains of prior misdeeds producing more misdeeds resulting in the wholesale collapse of authority in our country. In other words, an epic clusterfuck.

Or 2) The entire Covid episode is a chain of crimes committed deliberately with malicious intent to kill and injure large numbers of people while contriving to deprive the survivors of their basic liberties and their property. Because identical events are seen in all the other nations of Western Civ, it would be reasonable to infer some kind of coordination managed by a supervisory force or entity. What we see is a globalist coalition formed of the World Economic Forum (WEF), the World Health Organization (WHO), The European Union (EU), the United Nations (UN), the pharmaceutical industry, the “Five Eyes” intel alliance, the global banking establishment, The Democratic Party, and scores of well-endowed non-governmental agencies such as the George Soros constellation of councils and foundations. What else is unseen?

One conspicuously strange element of the whole picture is the phantom leadership of the supposed world hegemon USA in the figurehead, “Joe Biden.” Never in history has such a move into tyranny been fronted by such an embarrassingly un-charismatic empty vessel. Never in our country’s history have our affairs whirled in such a mystifying flux of bewildering forces. Even our Civil War was a more straightforward clash of interests. Events are moving quickly now. They’re setting up the steam-table for that banquet of consequences.

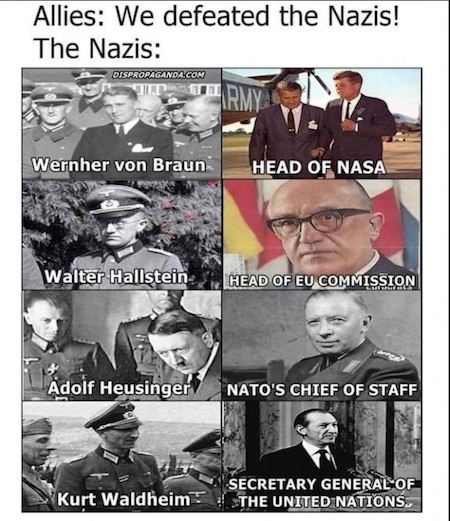

“There are even monuments honoring Nazi collaborators and Ukrainian Insurgent Army criminals still standing in Canadian cities..”

NOTE: Trudy saying he didn’t know who the guy was is nonsense. He met him the day before.

• Canada Saluting A Ukrainian Nazi Was No Coincidence (Eva Bartlett)

The stomach-churning scene of the Canadian parliament giving a standing ovation three days ago to a former Waffen SS Nazi has by now made the rounds on the internet. During Ukrainian President Vladimir Zelensky’s visit to Canada, and following his predictably bombastic pan-handling speech, House Speaker Anthony Rota went on to gush praise over a Ukrainian-Canadian in parliament that day: Yaroslav Hunka, a World War II-era Nazi, calling him “a Ukrainian hero, a Canadian hero” and thanking him for his service. Two days later, Rota issued an apology for lauding the man, saying he had “recognized an individual in the gallery” and had subsequently become aware of “more information which causes me to regret my decision to do so.”

Just to be clear – since Rota was not – the individual he meekly referred to was Yaroslav Hunka, and the information which made Rota remorseful was that Hunka had been a voluntary member of 1st Galician Division of the Waffen SS – you know, the one accused of mass murdering Poles, Jews and Ukrainians in Ukraine and Poland, as well as committing other atrocities. Whereas Rota claims he was unaware of Hunka’s service as a Nazi, given that he had also praised Hunk for fighting “for Ukrainian independence against the Russians,” one can assume this is the service he referred to. In his apology, Rota stated, “no one, including fellow parliamentarians and the Ukraine delegation, was aware of my intention or of my remarks before I delivered them.”

Canadian Prime Minister Justin Trudeau’s office denied any knowledge of Hunka and his Nazi service, stating, “The Speaker had his own allotment of guest seating at Friday’s address, which were determined by the Speaker and his office alone.” Whether Trudeau (and his Stepan Bandera-sympathizing deputy PM Chrystia Freeland) knew about Yaroslav Hunka or not, the question remains: why was he never brought to justice? He, or any of the other 2,000 SS Nazis Canada reportedly took in in the years following WW2. Having been accepted as anti-communist refugees with little to no scrutiny, these suspected war criminals and collaborators have been allowed to live out the rest of their days in peace, and most of them have done so openly under their own names, as the Simon Wiesenthal Center has repeatedly reported.

There is much to be said about Canada’s history with Ukrainian Nazis. Not only did it take them in after WW2, but the government-backed Ukrainian Canadian Congress, which, until recently, listed Nazi-collaborator veterans organizations as members, as well as government-funded Ukrainian ‘youth centers’ that celebrate Nazi collaborators like Stepan Bandera and Roman Shukhevich. There are even monuments honoring Nazi collaborators and Ukrainian Insurgent Army criminals still standing in Canadian cities. Canada has also supported modern-day Nazis in Ukraine itself, by training members of the neo-Nazi Azov Battalion on Canadian soil, although Canadian corporate media has in recent years attempted to downplay this.

Radio Canada reported in April 2022 that the Canadian Armed Forces, “did contribute to the training of soldiers of the Azov regiment in 2020, to the point where this unit is now boasting of being able to train its own soldiers according to Western standards.” The Ottawa Citizen, writing about this report, cited a 2017 briefing by Canada’s Joint Task Force Ukraine as saying, “Multiple members of Azov have described themselves as Nazis.” In November 2021, the same Ottawa Citizen journalist wrote about Canadian officials meeting with leaders from the Azov Battalion in June 2018. Canadian officers and diplomats, “did not object to the meeting and instead allowed themselves to be photographed with battalion officials despite previous warnings that the unit saw itself as pro-Nazi.”

Hunka

https://twitter.com/DD_Geopolitics/status/1706215091878744123

“When the news of her relative’s true past leaked out, Ottawa immediately characterized it as a “Russian disinformation” campaign aimed at “destabiliz[ing] Western democracies..”

• How Canada Became a Safe Haven for Ukrainian WWII-era Nazis (Sp.)

Before World War II, Ukrainian Canadians were among the most tightly knit, pro-labor, pro-Moscow, and anti-fascist migrant communities living in the True North Strong and Free. That began to change after the war and the arrival of thousands of Ukrainian Nazi collaborators wanted for war crimes across Eastern Europe. This is their story. The scandal over the Canadian parliament’s move to honor Ukrainian Waffen SS veteran Yaroslav Hunka continues to swirl, with Canada’s opposition leader, Poland, Jewish groups, Russia and the United Nations demanding accountability. Hunka, 98, was in attendance during Ukrainian President Volodymyr Zelensky’s address to the House of Commons last Friday, and was introduced to lawmakers as a veteran of the “struggle for Ukrainian independence against the Russians during the Second World War.” He received a standing ovation from the legislature.

It soon emerged that the former soldier carried out his “struggle for Ukrainian independence” as a member of the infamous 14th Waffen Grenadier Division of the Nazi SS, also known as 14th SS-Volunteer Division Galicia. Formed in 1943 and made up mostly of ethnic Ukrainians, the Wehrmacht-subordinated fighting formation was recruited from among fascist radicals, and was responsible for the mass murder of anti-fascist and communist Ukrainians, Red Army troops, anti-fascist partisans, and Polish, Jewish, Russian and Slovak civilians. Between 1943 and its surrender to the Western allies in May 1945, 14th SS-Volunteer Division Galicia rampaged through Eastern Europe. It was used for “police actions” against Polish and Soviet partisans in western Ukraine and eastern Poland, deployed to wipe out up to hundreds of civilians at a time in the Polish settlements like Huta Pieniacka, Podkamien, Chodaczkowo Wielkie, Prehoryle, Smogligow, and Borow, and thrown into meat grinders against the Red Army (where it took heavy losses approaching 75 percent during brutal fighting at Brody, Lvov region in July 1944).

The remnants of the division were evacuated and deployed in Slovakia in the late summer of 1944 to put down the Slovak National Uprising, and then sent to suppress partisan operations in Yugoslavia in January 1945. In March 1945, the formation retreated to Austria, taking heavy losses while trying to hold back Soviet forces in and around Graz during the desperate closing months of the war. Ukrainian fascist forces later incorporated into the division also took part in the suppression of the Warsaw Uprising between August and September of 1944, although the division itself did not take part. [..] The scandal surrounding Hunka is not the first of its kind. In 2017, independent media outlet Consortium News was attacked by Canadian authorities after revealing that Chrystia Freeland, the senior Trudeau cabinet member then serving as Canada’s Minister of Foreign Affairs, had attempted to cover up her grandfather Mykhailo Khomiak’s past as an editor of a Nazi newspaper in occupied Poland during WWII.

Canadian media later followed up on the allegations, confirming the information, and revealing that Freeland not only knew of her grandfather’s dark past, but helped edit an academic article in the Journal of Ukrainian Studies by her uncle, John-Paul Kimka, professor emeritus at the University of Alberta, in the 1990s a bid to whitewash the Nazi propagandist’s activities. When the news of her relative’s true past leaked out, Ottawa immediately characterized it as a “Russian disinformation” campaign aimed at “destabiliz[ing] Western democracies,” with Freeland claiming her grandparents fled the war in 1939 as “political exiles with a responsibility to keep alive the idea of an independent Ukraine.” After the escalation of the Ukrainian crisis in early 2022, Freeland, now deputy prime minister, got into more trouble after tweeting (and after public outrage deleting) a photo of herself holding a banner sporting the colors of the notorious fascist militant formation known as the Ukrainian Insurgent Army (Ukrainian acronym UPA), along with the UPA’s slogan “Slava Ukraini” (lit. “Glory to Ukraine”).

I’m not terribly unpopular. That can’t be it. People love me.

• Hillary Clinton Claims Russia Seeks to Meddle in 2024 Election (Tweedie)

Failed presidential runner Hillary Clinton has repeated her discredited claims of Russian interference in US elections. Clinton dusted off the 2016 ‘Russiagate’ conspiracy theory she used to explain her defeat by Donald Trump in an interview with MSNBC’s Jen Psaki — the former White House press secretary renowned for her inability to answer journalist’s questions. Psaki claimed that Russian President Vladimir Putin had “interfered in our elections in the past” — directly contradicting the findings of special counsel John Durham’s inquiry that the claim was “uncorroborated” — and asked Clinton if she feared it would happen in 2024. “I don’t think, despite all of the deniers, there is any doubt that he interfered in our election, or that he has interfered in many ways in the internal affairs of other countries, funding political parties, funding political candidates, buying off government officials in different places,” Clinton claimed.

Her tone became increasingly paranoid as she went on. “He hates democracy. He particularly hates the West and he especially hates us,” Clinton ranted. “And he has determined that he can do two things simultaneously. He can try to continue to damage and divide us internally, and he’s quite good at it.” The former secretary of state and senator, the wife of disgraced ex-president Bill Clinton, even believed that Putin had a personal grudge against her. “Part of the reason he worked so hard against me is because he didn’t think that he wanted me in the White House,” Clinton complained. “Part of the challenge is to continue to explain to the American public that the kind of leader Putin is.” She then reeled off a series of unproven allegations against the Russian president, including that he was responsible for the deaths of opposition figures and journalists — and interfered in the 2016 US elections to ensure she lost to Trump.

“I fear that the Russians will prove themselves to be quite adept at interfering, and if he has a chance, he’ll do it again,” Clinton concluded. Durham’s report, finally released in June 2023, found that former Federal Bureau of Investigations (FBI) Director James Comey’s operation Crossfire Hurricane probe — oddly named after a Rolling Stones lyric — was founded on “raw, un-analyzed and uncorroborated” intelligence and should never have been launched. It said the FBI was guilty of misconduct and was in need of reform, but did not lay individual blame on any of the numerous officials involved — from Comey to Peter Strzok and Lisa Page, two agents entwined in an extra-marital affair at the federal agency.

JUST IN: Hillary Clinton (@HillaryClinton) claims Putin might be trying to interfere in the 2024 US election as he 'did' in 2016, as claimed by her and the Democrats. WATCHpic.twitter.com/Ozadfj03EL

— Simon Ateba (@simonateba) September 24, 2023

Brussels sold out the EU.

• EU to Rely on US LNG ‘For Decades’ (Sp.)

The European Union’s much-touted self-harming intention to diversify from Russian natural gas means it will be forced to rely on America’s liquefied natural gas (LNG) for decades to come, the bloc’s top energy official has admitted. The EU’s ambitious climate goals and pledge to phase out fossil fuels are also likely to be shoved on the back burner, as Ditte Juul Jorgensen, director general for energy at the European Commission, told a media report that the bloc’s reliance on exports of US LNG was not going away any time soon. While the official touted “conservation” and more renewable energy, such as wind and solar, as the “instruments” at the disposal of the EU that would allow it to survive another energy crisis in the coming winter, she added: “We will need some fossil molecules in the system over the coming couple of decades. And in that context, there will be a need for American energy,” said Jorgensen in an interview in New York.

Last year, when Brussels cobbled together package after package of sanctions targeting Russia over Ukraine, anyone with a clear understanding of the energy needs of the 27-member bloc could have foreseen that it was backing itself into a corner. The EU’s proclaimed decision to wean itself off Russian gas, along with “net zero carbon emissions by 2050” goals were a tough act to follow through on. Sure enough, now, for all intents and purposes, Brussels will continue to consume expensive US LNG beyond the end of the decade, to the frustration of politicians and environmental campaigners. Brussels waded into an agreement with the administration of US President Joe Biden in March 2022 to “work toward the goal of ensuring, until at least 2030, demand for approximately 50 billion cubic metres (bcm) of additional US LNG.” At the time, the pact was struck on the basis that it was consistent with EU and US shared climate goals.

“We aim to reduce this dependency on Russian fossil fuels and get rid of it. This can only be achieved through… additional gas supplies, including LNG deliveries,” EU Commission head Ursula von der Leyen said at a joint news conference with Joe Biden at the time. Jorgensen’s new statements will help European buyers “clear the path forward” now, the report added, citing initial evidence of reluctance to sign deals with US suppliers past the 2030 deadline. America’s LNG exports to EU member states surged more than twofold last year, reaching 56 bcm in 2022. Just a year before that, the shipped amount had been 22 bcm annually. There has been an echo of frustrated voices from some European politicians complaining that US LNG contracts are fraught with risks to the EU’s climate goals. But the reality is that US LNG companies are signing increasingly more long-term supply deals with Europe. Thus, America’s largest LNG exporter – Cheniere Energy – has struck a deal for two contracts with Europe-based Equinor and BASF to ship 2.55mn tons annually far into the 2040s.

“Russian production is less than demand in developing countries.”

• Diamonds Aren’t Forever For The Belgians – War Against Russia Instead (Helmer)

[..] the US-NATO blockade of the Russian tanker trade is Napoleonic in the obviousness of the miscalculation; it is also Napoleonic in the magnitude of losses on the NATO side — and the acceleration of profits on the Russian side. In today’s new episode, the battleground is the diamond trade based in Antwerp, Belgium. Almost $14 billion worth of diamonds are imported annually for cutting, polishing, and trading there, and about the same value is exported. In their rough form, most of the diamonds in the Belgian market have been mined in Russia, and either sent direct to the Antwerp diamond market, or indirectly through India. Most of the diamonds exported from Antwerp have been going to India, United Arab Emirates (UAE), and Israel. The Israeli diamond processing business exports mostly to the US jewellery market.

The diamond trade in Europe has traditionally been a Jewish operation; until the Germans arrived in 1940 that was based in Amsterdam, Netherlands, for four hundred years. German race hatred wiped out the Jews of Amsterdam; Belgian race hatred for Russians is about to wipe out the Antwerp diamond market. The Jewish business is about to become an Arab one. As one Antwerp diamantaire described the situation, “if the Belgian government thinks it’s giving the finger to the Russians, all that will happen is that the diamond on that finger will move, and the finger will be what Dubai will be pointing.” Martin Rapaport’s price sheet for the trade in Tel Aviv and New York reports that in Belgium “sentiment [is] very low. Serious concerns for coming months.

0.50 and 1 ct. [carat] diamonds especially weak due to sluggish US orders. Many hope holiday activity will kickstart trading. Uncertainty surrounds Russian diamonds as fresh sanctions loom.” Rapaport, a dual Israeli-American citizen and self-reported “world’s largest and most trusted marketplace for diamonds & jewelry”, has been promoting fresh sanctions against Russian diamonds to cut the volume of Russian rough in the global market; these have been causing diamond inventories to overflow, diamond prices to fall, and Israeli margins to shrink. “Russia was the wild card in 2022. Whereas it was assumed the sanctions imposed in February by the US on Russian-sourced diamonds would lead to shortages, the goods continued to enter the market — propping up polished inventories.”

[..] “The G7 countries account for about 80-90 million carats of diamond consumption per year. As for India and China, this figure is at the level of 60 million carats. That is, the Group of Seven is ahead in this area, but taking into account the fact that Russia produces about 40 million carats annually, India and China can take all this volume. As for the possible restrictions in this industry, I think the situation will be similar to similar sanctions against oil, which is now being quietly sold to India and China, albeit at a certain discount to the world price. As far as I understand, after cutting, it is quite difficult to separate diamonds of Russian origin from other stones. But if, after all, technology will somehow control the process of selling diamonds, then the Russian Federation, taking into account the capacity of the markets, can really send supplies to developing countries. Russian production is less than demand in developing countries.”

“..dangling an enticing Divide and Rule carrot that promises Things That Cannot Be Delivered..”

• War of Economic Corridors: the India-Mideast-Europe Ploy (Pepe Escobar)

The India-Middle East-Europe Economic Corridor (IMEC) is a massive public diplomacy op launched at the recent G20 summit in New Delhi, complete with a memorandum of understanding signed on 9 September. Players include the US, India, UAE, Saudi Arabia, and the EU, with a special role for the latter’s top three powers Germany, France, and Italy. It’s a multimodal railway project, coupled with trans-shipments and with ancillary digital and electricity roads extending to Jordan and Israel. If this walks and talks like the collective west’s very late response to China’s Belt and Road Initiative (BRI), launched 10 years ago and celebrating a Belt and Road Forum in Beijing next month, that’s because it is. And yes, it is, above all, yet another American project to bypass China, to be claimed for crude electoral purposes as a meager foreign policy “success.”

No one among the Global Majority remembers that the Americans came up with their own Silk Road plan way back in 2010. The concept came from the State Department’s Kurt Campbell and was sold by then-Secretary Hillary Clinton as her idea. History is implacable, it came down to nought. And no one among the Global Majority remembers the New Silk Road plan peddled by Poland, Ukraine, Azerbaijan, and Georgia in the early 2010s, complete with four troublesome trans-shipments in the Black Sea and the Caspian. History is implacable, this too came down to nought. In fact, very few among the Global Majority remember the $40 trillion US-sponsored Build Back Better World (BBBW, or B3W) global plan rolled out with great fanfare just two summers ago, focusing on “climate, health and health security, digital technology, and gender equity and equality.”

A year later, at a G7 meeting, B3W had already shrunk to a $600 billion infrastructure-and-investment project. Of course, nothing was built. History really is implacable, it came down to nought. The same fate awaits IMEC, for a number of very specific reasons. The whole IMEC rationale rests on what writer and former Ambassador M.K. Bhadrakumar deliciously described as “conjuring up the Abraham Accords by the incantation of a Saudi-Israeli tango.” This tango is Dead On Arrival; even the ghost of Piazzolla can’t revive it. For starters, one of the principals – Saudi Crown Prince Mohammad bin Salman – has made it clear that Riyadh’s priorities are a new, energized Chinese-brokered relationship with Iran), with Turkey, and with Syria after its return to the Arab League.

Moreover, both Riyadh and its Emirati IMEC partner share immense trade, commerce, and energy interests with China, so they’re not going to do anything to upset Beijing. At face value, IMEC proposes a joint drive by G7 and BRICS 11 nations. That’s the western method of seducing eternally-hedging India under Modi and US-allied Saudi Arabia and the UAE to its agenda. Its real intention, however, is not only to undermine BRI, but also the International North-South Transportation Corridor (INTSC), in which India is a major player alongside Russia and Iran. The game is quite crude and really quite obvious: a transportation corridor conceived to bypass the top three vectors of real Eurasia integration – and BRICS members China, Russia, and Iran – by dangling an enticing Divide and Rule carrot that promises Things That Cannot Be Delivered.

How did Brzezinski and Fukuyama ever become so influential?

• The ‘Last Man’ Teleology and the Fall of the West (Alistair Crooke)

As is well known, the Mackinder ‘Pivot of History’ doctrine (1904) of ‘he who controls the Asian heartland controls the world’ was cemented into the U.S. zeitgeist as the unassailable doctrine that a united Heartland – which might challenge the U.S. – must never be allowed. To which Brzezinski, President Carter’s National Security Adviser, added that the Ukraine, by virtue of its divided national identities, entwined in old complexities, should be seen as the hinge around which heartland power revolved: ‘Absent Ukraine, Russia would never become the heartland power; but with Ukraine, Russia can and would’, Brzezinski averred. Well, that was the idea – to mobilise fierce Ukrainian ultranationalism versus a weak Russia, and put them to fight each other.

But the evolution of the ‘Brzezinski doctrine’ – quite surprisingly – segued into a series of western mythological errors: First, that Russia was easily defeated in Afghanistan, by a few lightly armed jihadists (not true). Secondly, that the Soviet Union and its satellites were overthrown by ‘Revolutions from Below’ (also not true). And thirdly, that a powerful U.S. Security-State ‘Leviathan’ could ensure U.S. hegemony (through mounting ‘Revolutions from Below’). Brzezinski’s prime intent may originally have been to keep Russia and China divided from each other. But the Soviet Union’s sudden implosion (unrelated to Afghanistan) was crafted narratively to lend credence to Francis Fukuyama’s End of History and the Last Man meme. After the Cold War and the Soviet communist empire’s collapse, the American political, cultural and economic model was widely held to be the ‘Last Man Standing’.

‘Afghanistan’ also fostered the myth of Islamic insurgents as the ideal solvents for ‘backward’ states needing new western, forward-thinking leaders. (It was Brzezinski who persuaded Carter to insert Islamic radicalism into Afghanistan to undermine the Russian-supported, socialist Najibullah). ‘Afghanistan’ effectively was the pilot for the ‘Arab Spring’ – a global ‘house-cleaning’ that, it was claimed, would end vestiges of earlier Soviet influence, and create new stability. The excitement in neo-con circles was palpable. And America’s Cold War success was attributed (apart from western culture’s ‘genetic’ advantages) to the empowerment of the military-security apparati. In theory, the end to the Cold War might have been an opportunity to return to the U.S. Founders’ original principles of distance from European conflicts and of caution toward military and security Leviathans.

The Soviet implosion seemed a harbinger of global tensions vented; pressures released. But then, ‘something’ extraneous, out-of-the-blue, happened; something that in a stroke, reversed the logic of the Cold War expected ‘peace dividend’ by “invigorating the military-security state to new heights”, Gordon Hahn notes. The power of the military-security state began, from this point onward, to be deployed abroad – in the service of the globalising cultural war. What had happened was ‘9/11’. But then a new ‘twist’ took America away, on an entirely different path. Barack Obama infused new energy into the military-security state. The Obama administration however, was not so much motivated by overseas hegemony (though not opposed to it). The focus though was on bringing forward the cultural revolution underway in the U.S. What had happened? And how is Ukraine connected to this?

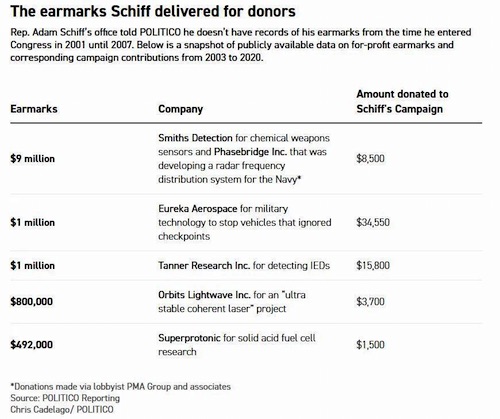

“..Menendez pursued gifts with a reckless abandon, endangering others whose corruption was more circumspect..”

• Senator Menendez Broke the ‘Goldilocks Rule’ of Corruption (Turley)

In 2010, I defended a federal judge, Thomas Porteous, in his impeachment trial, against charges that he had taken gifts and misused his office for personal gain. The curious thing about Senate trials is that you have a jury composed of people you could strike for cause in a real court. Menendez was among those sitting in judgment of Porteous, but he wasn’t just another face in the Senate crowd — he stood out. It was like arguing a piracy case with Captain Jack Sparrow sitting on the jury. Menendez himself would later go on trial in 2017 in a major bribery and fraud case involving luxury gifts allegedly exchanged for official favors. Most of us expected the worst when, during jury deliberations, one juror asked the court, “What is a senator?” Menendez dodged the bullet. The jury hung and the Justice Department dropped all charges.

Now Menendez has been slapped with a massive new bribery indictment. The facts are all too familiar, with a long list of lavish gifts allegedly made in exchange for favors. The indictment details gold bars, hundreds of thousands of dollars, furnishings and other gifts. His wife was allegedly actively involved in this corruption conspiracy and is also facing criminal charges. During the Porteous trial, I noted that, at the time of the underlying acts, the senators themselves were accepting free lunches. It was not until later that the rules changed on such gifts. Menendez now stands accused of accepting a host of gifts at that time, including an $8,000 free flight in October 2010, in addition to luxury trips to Paris and a Caribbean villa.

Yet Menendez still demanded the conviction of Porteous, even though the judge was never charged with bribery, and free lunches and the other gifts would not be enough to even register with Menendez. The question is whether this level of corruption is now enough for Democrats. California Gov. Gavin Newsom (D) recently suggested a type of Goldilocks rule for corruption. He warned that people in Washington had better be careful if they want to crack down on the Biden family’s influence-peddling. “If that’s the new criteria, there are a lot of folks in a lot of industries — not just in politics — where people have family members and relationships and they’re trying to parlay and get a little influence and benefit in that respect. That’s hardly unique.” It would appear that the question is not corruption, but when a little corruption is “just right.”

If these allegations against Menendez are proven, then he violated Washington’s Goldilocks rule. It would mean that Menendez pursued gifts with a reckless abandon, endangering others whose corruption was more circumspect. Consider the timeline: It would mean that during the Porteous trial, Menendez was allegedly accepting gifts while condemning and removing from office a judge accused of receiving gifts. Later, after the jury hung in his first corruption trial, Menendez (according to the Justice Department) almost immediately started taking gifts from new sources. In a town known for a certain finesse in influence peddling, Menendez broke with industry custom by allegedly accepting direct items like gold and a car. This is classic bribery stuff. There was no labyrinth of shell companies and accounts — just crude old-school corruption, with cash stuffed in clothing and gold bars squirreled away for a rainy day.

“..under the Gene Technology Act (2000) definition, the DNA contamination is a genetically modified organism (GMO)..”

• Scientists ‘Shocked’ And ‘Alarmed’ At What’s In The mRNA Shots (Barnett)

Early in 2023, genomics scientist Kevin McKernan made an accidental discovery. While running an experiment in his Boston lab, McKernan used some vials of mRNA Pfizer and Moderna Covid vaccines as controls. He was ‘shocked’ to find that they were allegedly contaminated with tiny fragments of plasmid DNA.McKernan, who has 25 years’ experience in his field, ran the experiment again, confirming that the vials contained up to, in his opinion, 18-70 times more DNA contamination than the legal limits allowed by the European Medicines Agency (EMA) and the Food and Drug Administration (FDA). In particular, McKernan was alarmed to find the presence of an SV40 promoter in the Pfizer vaccine vials. This is a sequence that is, ‘…used to drive DNA into the nucleus, especially in gene therapies,’ McKernan explains.

This is something that regulatory agencies around the world have specifically said is not possible with the mRNA vaccines. Knowing that the contamination had not been disclosed by the manufacturers during the regulatory process, McKernan raised the alarm, posting his findings to Twitter (now X) and Substack with a call-out to other scientists to see if they could replicate his findings. Other scientists soon confirmed McKernan’s findings, though the amount of DNA contamination was variable, suggesting inconsistency of vial contents depending on batch lots. One of these scientists was cancer genomics expert Dr Phillip Buckhaults, who is a proponent of the mRNA platform and has received the Pfizer Covid vaccine himself. In September of this year, Dr Buckhaults shared his findings in South Carolina Senate hearing.

‘I’m kind of alarmed about this DNA being in the vaccine – it’s different from RNA, because it can be permanent,’ he told those present. ‘There is a very real hazard,’ he said, that the contaminant DNA fragments will integrate with a person’s genome and become a ‘permanent fixture of the cell’ leading to autoimmune problems and cancers in some people who have had the vaccinations. He also noted that these genome changes can ‘last for generations’. Dr Buckhaults alleges that the presence of high levels of contaminant DNA in the mRNA vaccines ‘may be causing some of the rare but serious side effects, like death from cardiac arrest’. He added, ‘I think this is a real serious regulatory oversight that happened at the federal level.’ Dr Buckhaults’ concerns are shared by McKernan, who presented his findings to the FDA in June.

At the time of writing, McKernan had not received any response from the FDA on the matter. Dr Buckhaults said in the Senate hearing that he had emailed his findings to the FDA, but he had not received a response either. In Australia, the Therapeutic Goods Administration (TGA) maintains that Covid vaccines cannot alter a person’s DNA. A spokesperson for the TGA stated, ‘The mRNA in the vaccines does not enter the nucleus of cells and is not integrated into the human genome. Thus, the mRNA does not cause genetic damage or affect the offspring of vaccinated individuals.’ They also said, ‘All batches of Covid vaccines distributed to Australians have been tested for the presence of contaminants including residual DNA template levels.’

However, a legal case filed in the Australian Federal Court in July of this year alleges that the TGA is not the appropriate regulator of Covid mRNA vaccines because, under the Gene Technology Act (2000) definition, the DNA contamination is a genetically modified organism (GMO). The plaintiff, Victorian doctor and pharmacist Dr Julian Fidge, is seeking an injunction to stop Pfizer and Moderna from distributing their mRNA Covid vaccines because they never obtained a license from the Office of the Gene Technology Regulator (OGTR), which is the agency that oversees all GMO related products. The TGA did not require tests for genotoxicity or carcinogenicity before providing provisional approval and, eventually, full registration of both the Moderna and Pfizer Covid vaccines.

OGTR guidance strongly suggests such tests should be undertaken where there exists a risk of harm to human health. McKernan, who provided expert advice on the case, agrees that the DNA contamination in the mRNA vaccines fits the Australian legal definition of a GMO. But there is also a second component of the mRNA vaccines that fits the definition. That’s the mRNA itself, which is actually modified RNA wrapped in lipid nanoparticles (LNPs). The case argues that this ‘LNP-mod-RNA complex’ falls under the legal definition of a GMO and that, like the DNA contamination, it has the capacity to enter the cell nucleus and integrate into the human genome.

"The Pfizer vaccine is contaminated with plasmid DNA, it's not just mRNA, it’s got bits of DNA in it." – Professor Phillip Buckhaults, Phd in Biochemistry and Molecular Biology. He does cancer genomics research at the University of South Carolina. pic.twitter.com/7gElKcus0t

— illuminatibot (@iluminatibot) September 24, 2023

Hoof

Beautifully done pic.twitter.com/VGgnidfAth

— slaterjonathan (@paulsla1539372) September 24, 2023

Drink my house

https://twitter.com/i/status/1706211277100536040

PianoElephant

Paul Barton, once a concert-pianist, lives in the jungle of Thailand where he plays music to blind, injured and orphaned elephants with extraordinary resultspic.twitter.com/6uQwjYi2Ve

— Massimo (@Rainmaker1973) September 25, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.