Jack Delano Bridge with 5-ton coal bucket, Milwaukee Western Fuel Co 1942

Why the City of London got so big.

• Britain Is The Heart And Soul Of Tax Evasion (RT)

The British government’s claim to be tackling tax evasion is about as credible as Al Capone claiming to be leading the fight against organized crime. In fact, Britain is at the heart of the global tax haven network, and continues to lead the fight against its regulation. The 11 and a half million leaked documents from Panamanian law firm Mossack Fonseca have proven, once again, what we have already known for some time – that the ‘offshore world’ of tax havens is a den of money laundering and tax evasion right at the heart of the global financial system. Despite attempts by Western media to twist the revelations into a story about the ‘corruption’ of official enemies – North Korea, Syria, China and, of course, Putin, who is not even mentioned in the documents – the real story is the British government’s assiduous cultivation of the offshore world.

For whilst corruption exists in every country, what enables that corruption to flourish and become institutionalized is the network of secretive financial regimes that allow the world’s biggest criminals and fraudsters to escape taxation, regulation and oversight of their activities. And this network is a conscious creation of the British state. Of the 215,000 companies identified in the Mossack Fonseca documents, over half were incorporated in the British Virgin Islands, one single territory in what tax haven expert Nicholas Shaxson calls a “spider’s web” of well over a dozen separate UK-controlled dens of financial chicanery. In addition, the UK was ranked number two of those jurisdictions where the banks, law firms and other middlemen associated with the Panama Papers operate, only topped by Hong Kong, whose institutional environment is itself a creation of the UK.

And of the ten banks who most frequently asked Mossack Fonseca to set up paper companies to hide their client’s finances, four were British: HSBC, Coutts, Rothschild and UBS. HSBC, recently fined $1.9bn for laundering the money of Mexico’s most violent drug cartels, used the Panamanian firm to create 2,300 offshore companies, whilst Coutts – the family bank of the Windsors – set up just under 500. And, of course, David Cameron’s own father was named in the papers, having “helped create and develop” Blairmore Holdings, worth $20million, from its inception in 1982 till his death in 2010.

Blairmore, in which Cameron junior was also a shareholder, was registered in the Bahamas, and was specifically advertised to investors as a means of avoiding UK tax. The Daily Mail noted that: “Even though he lived in London, the Prime Minister’s father would leave the country and fly to Switzerland or the Bahamas for board meetings of Blairmore Holdings – to ensure it would not have to pay UK income tax or corporation tax. He hired a small army of Bahamas residents, including a part-time bishop, to sign its paperwork – as part of another bid to show his firm was not British-based.”

That Britain should emerge as central to this scandal is no surprise. For as Nicholas Shaxson, a leading authority on tax havens put it when I interviewed him in 2011, “The City of London is effectively the grand-daddy of the global offshore system.” Whilst there are various different lists of tax havens in existence, depending on how exactly they are defined, on any one of them explains Shaxson, “you will see that about half of the tax havens on there, of the ones that matter, are in some way British or partly British.” Firstly, are “Jersey, Guernsey and the Isle of Man: the crown dependencies. They’re very fundamentally controlled by Britain.” Then there are the Overseas Territories, such as the Caymans, Bermuda, and the Virgin Islands, in which “all the things that matter are effectively controlled by Great Britain.”

History counts too.

• How a US president and JP Morgan Made Panama and Turned It Into A Tax Haven (G.)

This goes back a long way. The Panamanian state was originally created to function on behalf of the rich and self-seeking of this world – or rather their antecedents in America – when the 20th century was barely born. Panama was created by the United States for purely selfish commercial reasons, right on that historical hinge between the imminent demise of Britain as the great global empire, and the rise of the new American imperium. The writer Ken Silverstein put it with estimable simplicity in an article for Vice magazine two years ago: “In 1903, the administration of Theodore Roosevelt created the country after bullying Colombia into handing over what was then the province of Panama. Roosevelt acted at the behest of various banking groups, among them JP Morgan, which was appointed as the country’s ‘fiscal agent’ in charge of managing $10m in aid that the US had rushed down to the new nation.”

The reason, of course, was to gain access to, and control of, the canal across the Panamanian isthmus that would open in 1914 to connect the world’s two great oceans, and the commerce that sailed them. The Panamanian elite had learned early that their future lay more lucratively in accommodating the far-off rich than in being part of South America. Annuities paid by the Panama Railroad Company sent more into the Colombian exchequer than Panama ever got back from Bogotá, and it is likely that the province would have seceded anyway – had not a treaty been signed in September 1902 for the Americans to construct a canal under terms that, as the country’s leading historian in English, David Bushnell, writes, “accurately reflected the weak bargaining position of the Colombian negotiator”.

Colombia was, at the time, riven by what it calls the “thousand-day war” between its Liberal and Historical Conservative parties. Panama was one of the battlefields for the war’s later stages. The canal treaty was closely followed by the “Panamanian revolution”, which was led by a French promoter of the canal and backed by what Bushnell calls “the evident complicity of the United States” – and was aided by the fact that the terms of the canal treaty forbade Colombian troops from landing to suppress it, lest they disturb the free transit of goods. The Roosevelt/JP Morgan connection in the setting-up of the new state was a direct one. The Americans’ paperwork was done by a Republican party lawyer close to the administration, William Cromwell, who acted as legal counsel for JP Morgan.

JP Morgan led the American banks in gradually turning Panama into a financial centre – and a haven for tax evasion and money laundering – as well as a passage for shipping, with which these practices were at first entwined when Panama began to register foreign ships to carry fuel for the Standard Oil company in order for the corporation to avoid US tax liabilities.

He’s not done answering. In his circles, everyone has offshore accounts. That being PM means holding a higher standard is a mere nuisance to him.

• Cameron Faces Questions Over £200,000 Gift From Mother (Observer)

The prime minister took the unprecedented decision to release his personal tax records on Saturday, as growing anger over revelations in the Panama Papers threatened to derail his premiership. But the extraordinary move seems set to plunge David Cameron into further controversy, as it emerged that his mother transferred two separate payments of £100,000 to his accounts in 2011, allowing the family estate to avoid a potential £80,000 worth of inheritance tax. Four years after first promising to open his financial affairs to public view, Downing Street published a document detailing Cameron’s income and tax payments from 2009-10 to 2014-15. The move came after an emotional Cameron admitted to the Conservative party’s spring forum that he alone was to blame for the furore caused by his failure to be frank about his profits from an offshore investment fund.

On Monday, Cameron will announce the establishment of a taskforce, led by HM Revenue & Customs and the National Crime Agency, to examine the legality of the financial affairs of companies mentioned in the Panama Papers, where documents relating to his father’s offshore fund were discovered by the Guardian and the International Consortium of Investigative Journalists. The taskforce will draw on investigators, compliance specialists and analysts from HMRC, the National Crime Agency, the Serious Fraud Office and the Financial Conduct Authority. There will be new money provided of up to £10m. But following the release of the prime minister’s tax records, Cameron now faces questions over whether his family took elaborate steps to minimise the amount of inheritance tax that would eventually be due on their estate.

The records show that the prime minister received a considerable boost to his savings in 2011. Following the death of his father in 2010, Cameron was left £300,000 tax free as an inheritance. However, his mother also transferred two payments of £100,000 to him in May and July 2011. Inheritance tax is not payable on gifts up to £325,000 that are paid at least seven years before the source of the possession dies, be it property or money. A spokesman for the prime minister said that Cameron’s mother and father had “some years earlier” transferred the family home to their eldest son, Alexander Cameron, and the sums paid in 2011 were considered to be Cameron’s share.

Not going to happen. Too much money means too much power.

• Panama Papers: Act Now. Don’t Wait For Another Crisis (Piketty)

The question of tax havens and financial opacity has been headline news for years now. Unfortunately, in this area there is a huge gap between the triumphant declarations of governments and the reality of what they actually do. In 2014, the LuxLeaks investigation revealed that multinationals paid almost no tax in Europe, thanks to their subsidiaries in Luxembourg. In 2016, the Panama Papers have shown the extent to which financial and political elites in the north and the south conceal their assets. We can be glad to see that the journalists are doing their job. The problem is that the governments are not doing theirs. The truth is that almost nothing has been done since the crisis in 2008. In some ways, things have even got worse.

Let’s take each topic in turn. Exacerbated fiscal competition on the taxing of profits of big companies has reached new heights in Europe. The United Kingdom is going to reduce its rate to 17%, something unheard of for a major country, while continuing to protect the predatory practices of the Virgin Islands and other offshore centres under the British Crown. If nothing is done, we will all ultimately align ourselves on the 12% of Ireland, or possibly on 0%, or even on grants to investments, as is already sometimes the case. In the meantime, in the United States where there is a federal tax on profits, that rate is 35% (not including the taxes levelled by states, ranging between 5% and 10%). It is the political fragmentation of Europe and the lack of a strong public authority which puts us at the mercy of private interests.

The good news is that there is a way out of the current political impasse. If four countries, France, Germany, Italy and Spain, who together account for over 75% of the GDP and the population in the eurozone put forward a new treaty based on democracy and fiscal justice, with as a strong measure the adoption of a common tax system for large corporations, then the other countries would be forced to follow them. If they did not do so they would not be in compliance with the improvement in transparency which public opinions have been demanding for years and would be open to sanctions.

There is still a complete lack of transparency as far as private assets held in tax havens are concerned. In many areas of the world, the biggest fortunes have continued to grow since 2008 much more quickly than the size of the economy, partly because they pay less tax than the others. In France in 2013 a junior minister for the budget calmly explained that he did not have an account in Switzerland, with no fear that his ministry might find out about it. Once again, it took journalists to reveal the truth.

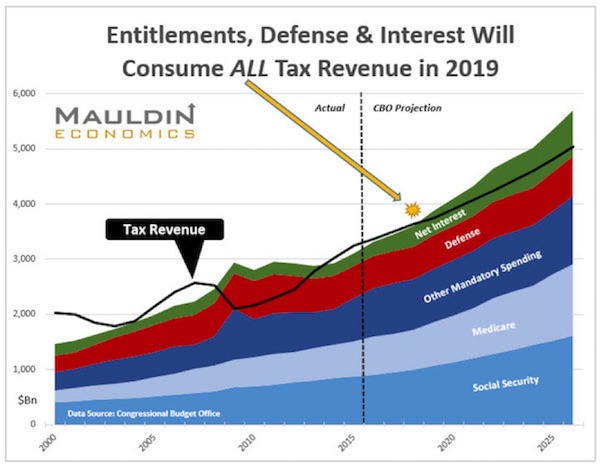

“Next year, the US national debt will top $20 trillion. The deficit is running close to $500 billion, and the Congressional Budget Office projects that figure to rise. Add another $3 trillion or so in state and local debt.”

• The Next Recession Will Blow Out the US Budget (Mauldin)

The weakest recovery in modern history has stretched on for 69 months. By 2017, it will be the third-longest recovery without a recession since the Great Depression. By 2018, it will be the second longest. Only during the halcyon economic days of the 1960s have we seen a longer recovery; but that record, too, will be eclipsed sometime in 2019—if we don’t see a recession first. And note that we were growing at well over 3% in the 1960s, not the anemic 2% we have averaged during this recovery and certainly not the positively puny 1.5% we have endured lately. Global growth is slowing down. Given the limited number of arrows left in the Federal Reserve’s monetary policy quiver, the US is going to have a difficult time dealing with the fallout from a recession. Even worse, a number of factors are coming together that will require serious crisis management.

Next year, the US national debt will top $20 trillion. The deficit is running close to $500 billion, and the Congressional Budget Office projects that figure to rise. Add another $3 trillion or so in state and local debt. As you may imagine, the interest on that debt is beginning to add up, even at the extraordinarily low rates we have today. Sometime in 2019, entitlement spending, defense, and interest will consume all the tax revenues collected by the US government. That means all spending for everything else will have to be borrowed. The CBO projects the deficit will rise to over $1 trillion by 2023. By that point, entitlement spending and net interest will be consuming almost all tax revenues, and we will be borrowing to pay for our defense. Let’s look at the following chart, which comes from CBO data:

By 2019, the deficit is projected to be $738 billion. There are only three ways to reduce that deficit: cut spending, raise taxes, or authorize the Federal Reserve to monetize the debt. At the numbers we are now talking about, getting rid of fraud and wasted government expenditures is a rounding error. Let’s say you could find $100 billion here or there. You are still a long, long way from a balanced budget. But implicit in the CBO projections is the assumption that we will not have a recession in the next 10 years. Plus, the CBO assumes growth above what we’ve seen in the last year or so.

Trouble with Berlin is brewing.

• Schäuble: Time is Near to End Central Banks’ Easy-Money Policies (WSJ)

German Finance Minister Wolfgang Schäuble called on governments in Europe and the U.S. to encourage their central banks to gradually exit easy-money policies, in the strongest sign yet of Berlin’s growing impatience with the ultralow interest rates of the ECB. “There is a growing understanding that excessive liquidity has become more a cause than a solution to the problem,” Mr. Schäuble said, comparing the move away from easy-money policies to ending a drug addiction. The unusually blunt comments from Chancellor Angela Merkel’s closest political ally come as the ECB has repeatedly ramped up its stimulus in recent months, seeking to support economic growth in the face of rising global headwinds and financial-market volatility.

While Mr. Schäuble’s opposition to the ECB’s monetary policy is well known, the veteran politician has voiced his criticism more openly lately, suggesting Berlin is growing impatient amid a mounting popular backlash against a policy that has depleted the returns on the savings of millions of Germans. Government officials and central bankers are preparing to converge on Washington, D.C., next week for the Spring meetings of the IMF, where they are expected to discuss policies to revive global growth. Speaking in Kronberg near Frankfurt late Friday at a prize ceremony organized by a German economic think tank, Mr. Schäuble said he had just discussed central-bank policies with his U.S. counterpart, Treasury Secretary Jacob Lew. “I just said to Jack Lew that you should encourage the Federal Reserve and we should encourage the ECB and the Bank of England in a concerted action, to carefully but slowly exit,” Mr. Schäuble said.

In the U.S., the Treasury secretary doesn’t have authority over the Federal Reserve, which is tasked with setting monetary policy. The ECB has twice ramped up its €1.5 trillion stimulus since December, most recently in March, when it rolled out a series of rate cuts, cheap loans for banks and an acceleration of bond purchases. Top ECB officials have stressed in recent days that they are ready to do even more to support the bloc’s economy. Meanwhile Federal Reserve officials have signaled that the U.S. central bank will raise rates only gradually until the global economy picks up steam, according to the minutes of their March policy meeting. Japan’s central bank stunned the markets in January by setting the country’s first negative interest rates.

Not sure this explains the entire issue.

• Why US Infrastructure Costs So Much (BBG)

The U.S. ought to be spending more on infrastructure. This is the view of all right-thinking people, and as a right-thinking person I of course endorse it. With interest rates near record lows and the working-age population still, by historical and international standards, underemployed, governments (or in some cases entrepreneurs) should be borrowing much more to repave roads, shore up bridges, expand mass-transit systems, build new sewage-treatment plants, replace water mains, you name it. Such borrowing and spending would make the nation richer by stimulating economic activity now and paving the way for stronger economic growth in the future.

That said, the U.S. probably also ought to be spending less on infrastructure. Not overall, but on something like a per-mile basis. Broad international cost comparisons across all kinds of infrastructure don’t seem to be available, but there is a growing body of evidence on one particular infrastructure area that matters a lot to me as a New York City commuter: subways and other rail systems. And it shows that U.S. construction costs are among the world’s highest.

Transportation blogger Alon Levy has probably done the most to raise awareness of this, with five years of posts documenting the cost differences. And last year, Tracy Gordon of the Urban-Brookings Tax Policy Center and David Schleicher of Yale Law School examined 144 planned and finished rail projects in 44 countries and found that the four most expensive on a per-kilometer basis (and six of the top 12) were in the U.S. To put these numbers in global perspective, New York’s Second Avenue Subway will cost roughly eight times more than Tokyo’s Koto Waterfront line and 36 times more than Madrid’s Metrosur tunnels on a per-kilometer, purchasing power parity (PPP) basis.

Why is this? It’s actually pretty hard to answer. Here’s Levy, writing in November 2014: “I try to avoid giving explanations for these patterns of construction costs. If I knew for certain what caused them, I would not be blogging; I would be forming a consultancy and teaching New York and other high-cost cities how to build subways for less than $100 million per kilometer.” Still, others have been willing to offer explanations. In a 2012 Bloomberg View piece, New York land-use and transit writer Stephen Smith blamed over-reliance on outside consultants, overly ambitious station architecture and a legal system that favors contractors over the agencies paying them to build things.

Gordon and Schleicher agreed that the legal system may be an issue, but for other reasons: “Many of the world’s most expensive projects are in the United Kingdom, Australia, and New Zealand, which, like the United States, have common-law systems. So it might be that common-law systems provide legal protections for property owners – allowing more lawsuits over noise, smoke, and other nuisances, as well as limits on eminent domain – that increase costs by forcing the government to pay off opponents or to locate projects inefficiently to avoid angering property owners.” They also cite political fragmentation as a factor that drives up costs – U.S. commuter rail systems often cross city and state lines, which brings coordination challenges – and note that when regional authorities are created to manage these challenges, they can bring a whole new set of problems.

“The agreement is effectively dead and all parties involved are aware of that, even if they are not openly admitting it.”

• SYRIZA, IMF and EU: Gambling With The Future Of Greece (SE)

The latest flare up regarding Greece has followed publication by Wikileaks of illegally taped discussions among IMF officials. To analyse the significance of this event it is vital to bear one point in mind: Greece cannot meet the terms of the bailout agreement struck on July 2015 by Prime Minister, Alexis Tsipras. The agreement is effectively dead and all parties involved are aware of that, even if they are not openly admitting it. To establish this point there is no need to engage either in Debt Sustainability Analysis, or in macroeconomic projections of output. Suffice to mention that the agreement requires Greece to ensure a primary surplus of 3.5% of GDP in 2018.

The Greek economy actually returned to recession in the last quarter of 2015 and the available indicators since the end of 2015 have ranged from bad to appalling: industrial turnover in December was down 13.5%, retail turnover in January down 3.8%, unemployment in the last quarter of 2015 up to 24.4%, job vacancies for the whole of the economy in the last quarter of 2015 stood at a pitiful 3119, and the banking system currently has perhaps €115bn of non-performing exposure, roughly 50% of its loan book. Once the austerity measures of the bailout agreement kick in, substantially reducing aggregate demand for 2016-17 via tax increases and lower pensions, the recession will become deeper. There is no way that this ruined economy could generate a 3.5% primary surplus in 2018. The problems thereby created for all parties to this disastrous bailout are legion.

In the worst position is the Greek government, which signed up to the bailout in direct contravention of everything that it had promised to do in 2015. As the reality of its deception and the harshness of the squeeze have begun to sink in, electoral support for Tsipras has vanished. All competent polls show the opposition New Democracy – with a new leader – comfortably ahead. The outlook has become even worse for SYRIZA via the refugee wave, which has turned Greece into a kind of EU repository for refugees and migrants. For the time being the country has avoided a major crisis, but the situation remains extremely fraught as the deportation of migrants to Turkey has just started.

In this context, the last thing that the Tsipras government would like to do is to impose further pressure on wage earners, or tax payers in an attempt to meet the impossible target of 3.5%. On the contrary, it is extremely keen to complete the first review of the bailout programme on a nod and a wink, pretending that current measures are sufficient to hit the bailout targets. It then hopes to receive a tranche of bailout money that will give it breathing space for a few months. The government’s further hope is that investment will pick up by the end of 2016, possibly through foreign capital inflows, thus allowing the economy to recover somewhat.

He should put his money where his mouth is.

• Lesbos Hopes Pope’s Visit Will Shine Light On Island’s Refugee Role (Observer)

The island of Lesbos tends to go to town when celebrities descend. The last time it welcomed a VIP, the razorwire running along large parts of its infamous detention centre was hastily removed. Angelina Jolie got a brief glimpse of it as she walked in, but reportedly not as she later walked around the camp greeting migrants and refugees. The superstar special envoy of the UN high commissioner for refugees (UNHCR) was instead given an edited view of the camp, volunteers say. It will be different when Pope Francis flies in on Saturday. The purpose of the pontiff’s visit to the Aegean is to see the migrant emergency up close, and the authorities are keen that no blinkers are involved. This time, the island on the frontline of the biggest movement of people in modern times intends to show it as it is.

“We won’t be changing anything,” says mayor Spyros Galinos when asked if municipal workers will at least be cleaning up the graffiti on the camp’s walls. “His visit has huge symbolism. It is what we have wanted, what we have seen in our sleep, what we have dreamed of for years.” For four hours, Francis will grant that wish when he arrives in Greece for what will be a rare papal visit. The leader of the worldwide Catholic church will be accompanied by the Istanbul-based spiritual leader of the world’s 300 million Orthodox Christians, Bartholomew I, and Ieronymos II of Athens, head of the Greek Orthodox church. It will be a whirlwind tour of the island traversed by many of the 1.1 million men, women and children who have streamed into Europe, mostly from Syria but also from other parts of the Middle East, Africa and Asia last year.

The pope has long had refugees in his sights – and encyclicals. The trip, say Vatican officials, is aimed squarely at drawing attention to the centre of Europe’s migration crisis. By highlighting the “increasingly precarious living conditions for thousands of refugees and migrants” who have reached Lesbos, the Holy See’s newspaper, L’Osservatore Romano, said Francis hoped to offer a “Christian response to the tragedy that is unfolding”. [..] “His visit is not going to do anything for one single refugee in this country,” laments Alison Terry-Evans, who runs Dirty Girls, an organisation in Lesbos that launders blankets distributed by the UNHCR and the wet clothes of arriving refugees. “It is so hypocritical that a man who heads a multibillion-dollar corporation like the Vatican is unlikely to take any action that will contribute financially. That is the pity of it. ”

It won’t be fixed. Wanna bet? Europe goes for chaos as a deterrent. The use of the term ‘deportation system’ says it all in all its ugliness.

Meanwhile, this morning FYROM started shooting dozens of tear gas cannisters across its border with Greece to disperse the refugees camped out there.

• Greece Says It Will Take At Least Two Weeks To Fix Deporation System (Kath.)

Greece says it will take at least two weeks to fix the process of deporting migrants from the eastern Aegean islands to Turkey. The country’s deputy foreign minister for European affairs, Nikos Xydakis, admitted as much at a press conference attended also by his colleagues from France, Italy, Malta and Portugal, as well as the foreign ministers of the Netherlands and Slovakia. Deportations from Greece to Turkey have been temporarily halted as most of the 6,750 migrants in the Greek islands are applying for asylum and there is a lack of qualified officials such as translators to process the applications.

Most of the experts promised by the EU have not yet arrived. French European affairs minister Harlem Desir is urging refugees from war-torn Syria and Iraq to follow legal procedures to seek asylum in Europe rather than risk their lives in the perilous sea crossing into Greece, which now leads only back to Turkey, since Balkan countries north of Greece have shut their borders. Desir says France will welcome 200 refugees directly from Turkey “in the coming days and weeks.”