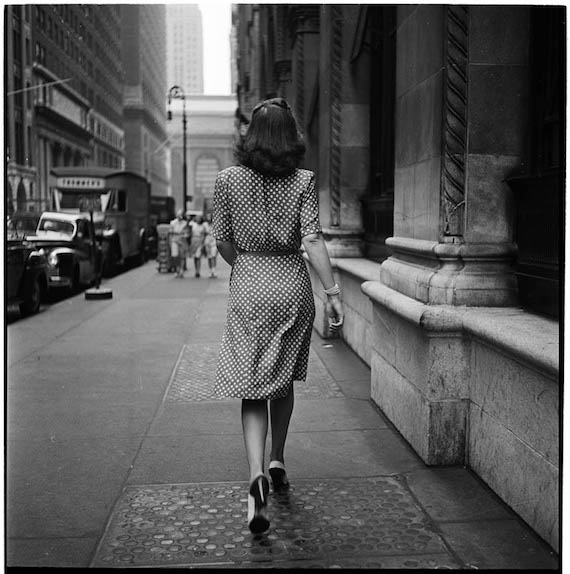

Stanley Kubrick Walking the streets of New York 1946

Feels like we’re being prepared, or maybe set up is a better way to put it. They’re going to take over everything, criminalize anything they can’t control. All for your own good. Rogoff is one scary dude.

• Prepare For Negative Interest Rates In The Next Recession – Rogoff (Tel.)

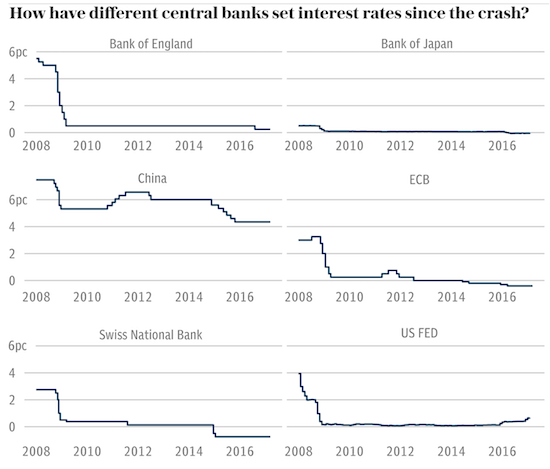

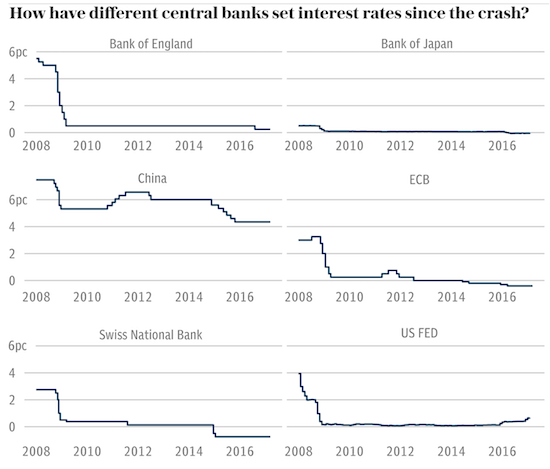

Negative interest rates will be needed in the next major recession or financial crisis, and central banks should do more to prepare the ground for such policies, according to leading economist Kenneth Rogoff. Quantitative easing is not as effective a tonic as cutting rates to below zero, he believes. Central banks around the world turned to money creation in the credit crunch to stimulate the economy when interest rates were already at rock bottom. In a new paper published in the Journal of Economic Perspectives the professor of economics at Harvard University argues that central banks should start preparing now to find ways to cut rates to below zero so they are not caught out when the next recession strikes. Traditionally economists have assumed that cutting rates into negative territory would risk pushing savers to take their money out of banks and stuff the cash – metaphorically or possibly literally – under their mattress.

As electronic transfers become the standard way of paying for purchases, Mr Rogoff believes this is a diminishing risk. “It makes sense not to wait until the next financial crisis to develop plans and, in any event, it is time for economists to stop pretending that implementing effective negative rates is as difficult today as it seemed in Keynes time”, he said. The growth of electronic payment systems and the increasing marginalisation of cash in legal transactions creates a much smoother path to negative rate policy today than even two decades ago. Countries can scrap larger denomination notes to reduce the likelihood of cash being held in substantial quantities, he suggests. This is also a potentially practical idea because cash tends now to be used largely for only small transactions. Law enforcement officials may also back the idea to cut down on money laundering and tax evasion.

The key consequence from an economic point of view is that forcing savers to keep cash in an electronic format would make it easier to levy a negative interest rate. “With today’s ultra-low policy interest rates – inching up in the United States and still slightly negative in the eurozone and Japan – it is sobering to ask what major central banks will do should another major prolonged global recession come any time soon,” he said, noting that the Fed cut rates by an average of 5.5 percentage points in the nine recessions since the mid-1950s, something which is impossible at the current low rate of interest, unless negative rates become an option. That would be substantially better than trying to use QE or forward guidance as central bankers have attempted in recent years.

Read more …

If we don’t take away political power from banks and central banks, we’re doomed.

• We’re Still Not Ready for the Next Banking Crisis (BBG)

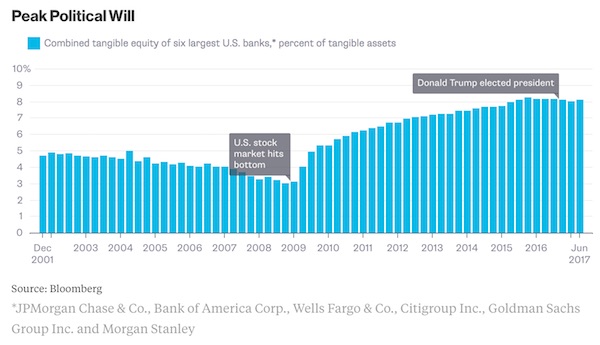

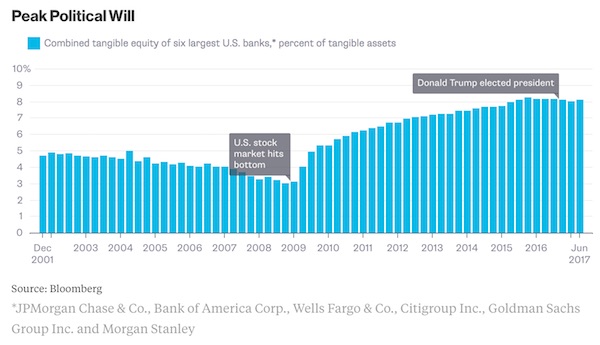

The 10th anniversary of the financial crisis has prompted a lot of analysis about what we’ve learned and whether we’re ready for the next one. Pretty much everything you need to know, though, can be found in one chart: the capital ratios of the largest U.S. banks. Capital, also known as equity, is the money that banks get from shareholders and retained earnings. Unlike debt, it has the advantage of absorbing losses, a feature that makes individual banks and the whole system more resilient. Bank executives typically prefer to use less equity and more debt – that is, more leverage – because this magnifies returns in good times. Hence, capital levels can serve as an indicator of the balance of power between bankers and regulators concerned about financial stability. Here’s a chart showing tangible common equity, as a percentage of tangible assets, at the six largest U.S. banks from December 2001 to June 2017:

The downward slope in the first several years demonstrates the extent to which leverage got out of hand before the crisis. As late as 2008, when the financial sector was already in distress, the Federal Reserve was still allowing banks to pay out capital in the form of dividends, even though some had equity of less than 3% of assets. That proved to be a fatal miscalculation: By 2009, forecasts of total losses on loans and securities reached 10% of assets. A crippled banking system tanked the economy and had to be rescued at taxpayer expense. After the crisis, regulators pushed banks to get stronger. The biggest U.S. institutions more than doubled their tangible common equity ratios – to an average of about 8% of assets (or, by international accounting standards, closer to 6% of assets). That’s an achievement, and better than in Europe, but the starting point was so low that they still fall short of what’s needed. Researchers at the Minneapolis Fed, for example, estimate that capital would have to more than double again to bring the risk of bailouts down to an acceptable level.

Read more …

How crime got re-defined. Poor conduct. Orwell.

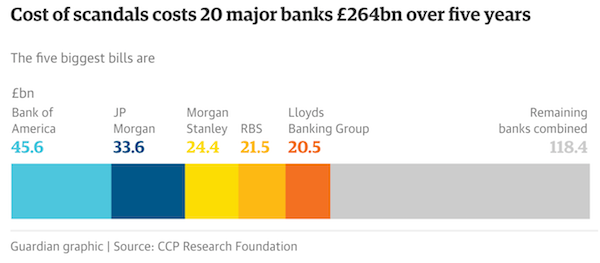

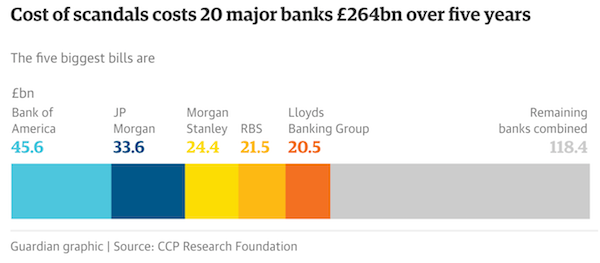

• World’s Biggest Banks Face £264 Billion Bill For Poor Conduct (G.)

Fines, legal bills and the cost of compensating mistreated customers reached £264bn for 20 of the world’s biggest banks over the five years to 2016, according to new research that raises doubts about efforts by the major financial services players to restore trust in the sector. This figure is higher than in the previous five-year period – when the costs amounted to £252bn – and is up 32% on the period 2008-12, the first time the data was collated by the CCP Research Foundation, one of the few bodies that analyses the “conduct costs” of banks. The report said the data showed that 10 years on from the onset of the financial crisis, the consequences of misconduct continue to hang over the banking sector. The latest analysis shows that in 2016 the total amount put aside by the banks surveyed rose to more than £28.6bn – higher than in the previous year when there had been a fall from a peak of £63bn in 2014.

Chris Stears, research director of the foundation, writes in the latest report: “Trust in, and the trustworthiness of, the banks must surely correlate to, and be conditional on, banks’ conduct costs. And persistent level of conduct cost provisioning is worrying. “It remains to be seen whether or not the provisions will crystallise in 2017 [or later] and what effect this will have on the aggregated level of conduct costs.” Two UK high street banks – Royal Bank of Scotland and Lloyds Banking Group – are in the top five of banks with the biggest conduct costs. RBS set aside extra provisions for fines and legal costs largely related to a forthcoming penalty from the US Department of Justice for mis-selling toxic bonds in the run-up to the financial crisis. That residential mortgage bond securitisation mis-selling scandal is responsible for £66bn of the costs incurred during the five-year period and the single largest factor, according to the foundation.

Read more …

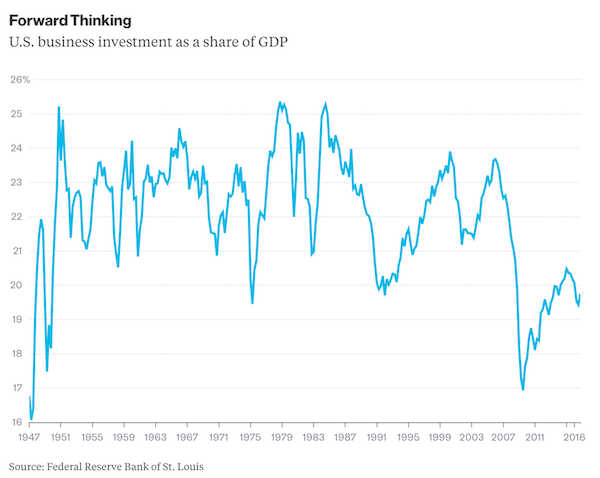

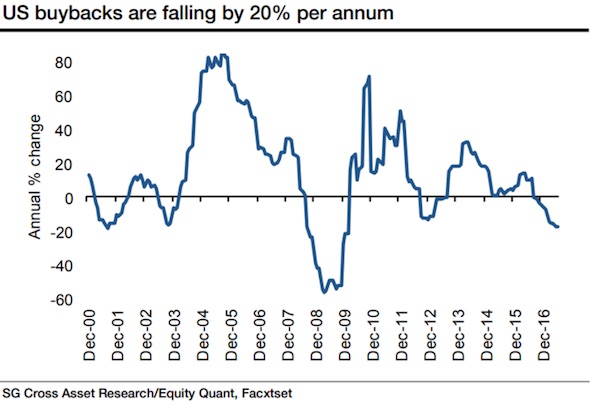

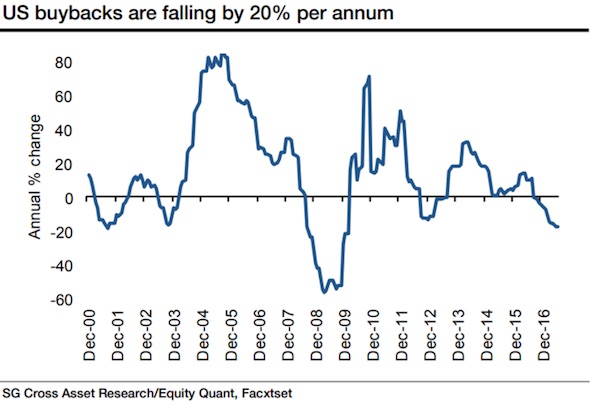

The only thing that propped up stocks is vaporizing.

• US Stock Buybacks Are Plunging (BBG)

U.S. stocks have been able to hit fresh highs this year despite a dearth of demand from a key source of buying. Share repurchases by American companies this year are down 20% from this time a year ago, according to Societe Generale global head of quantitative strategy Andrew Lapthorne. Ultra-low borrowing costs had encouraged large firms to issue debt to buy back their own stock, thereby providing a tailwind to earnings-per-share growth. “Perhaps over-leveraged U.S. companies have finally reached a limit on being able to borrow simply to support their own shares,” writes Lapthorne. Repurchase programs account for the lion’s share of net inflows into U.S. equities during this bull market. Heading into 2017, equity strategists anticipated that the buyback bonanza would continue in earnest, fueled in part by an expected tax reform plan that would provide companies with repatriated cash to invest.

Read more …

Deflation.

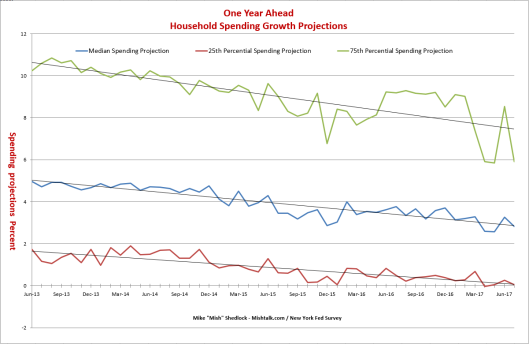

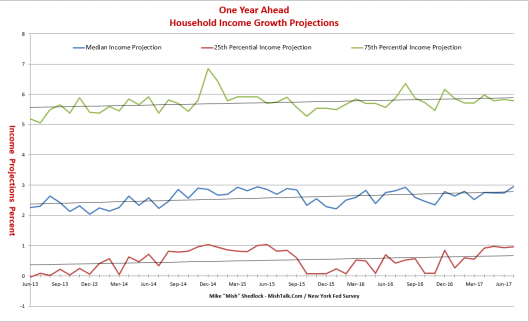

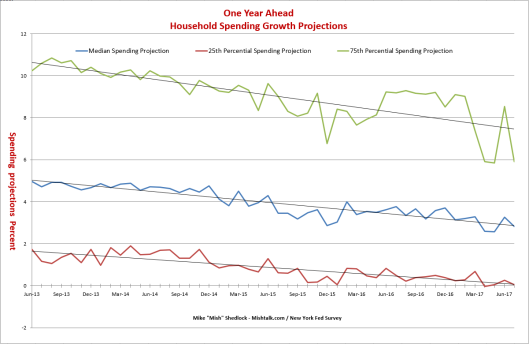

• Consumer Spending Expectations Down Again (Mish)

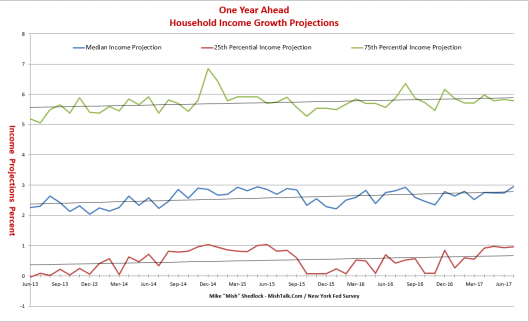

Fed Chair Janet Yellen keeps citing consumer confidence and jobs as reasons consumer spending and inflation will pick up. Curiously, the New York Fed Survey on Consumer Spending Expectations keeps trending lower and lower, despite survey-high expectations for wage growth. The report for July 2017 was released today. I downloaded the survey results and produced the following charts.

Household Spending Projections

Household Income Projections

Income projections are volatile but at least they are trending higher across the board. Spending projections are less volatile and trending lower at every level. At the 25th%ile level, a group that no doubt spends every cent they make, spending expectations are zero. Those projections were in negative territory in April. Fed Chair Janet Yellen does not believe the Fed’s own reports. Instead, she relies on consumer confidence numbers that tend to track the stock market or gasoline prices more than anything else. Perhaps New York Fed President William Dudley does believe in the report.

Read more …

If you weren’t scared yet…

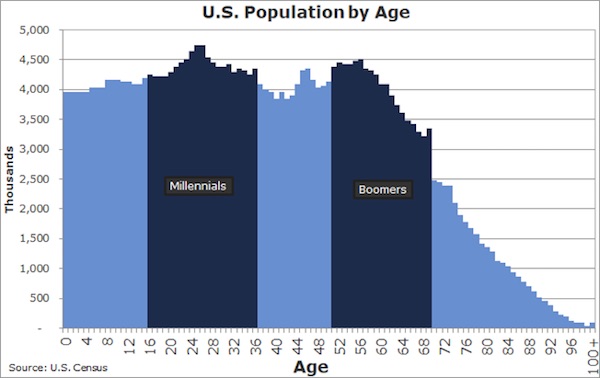

• Dow 30,000, Not If Demographics Have Anything To Say (SA)

Nowadays, it is easy to get caught up in the day to day of markets with main stream media pumping the hot stock or warning of market crashes that rarely come. Focusing on the longer term cycles is how you stay with the trend, reduce portfolio churn and costs. I am not advocating for a purely passive strategy as I think the current state of passive investing is contributing to over-valuation and a lack of pricing discovery, which is another topic I won’t get into in this piece. Longer term cycles are largely influenced by demographics. Boomers were entering the workforce in the 1970s and started having children (Millennials) in the early 1980s. The surge in home purchases, appliances, and the multitude of things you buy for kids helped drive the economy for 30 years. The giant buildup in credit that I have covered in a previous article is another reason for a 35-year bull market.

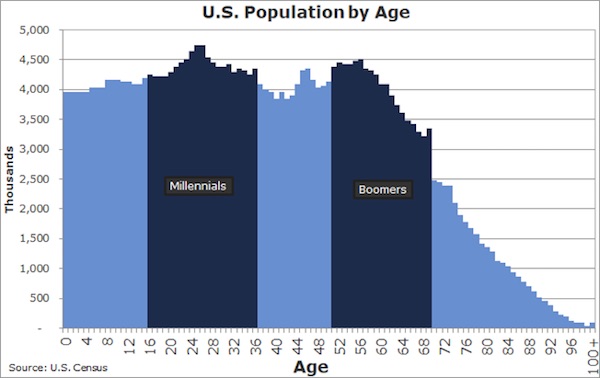

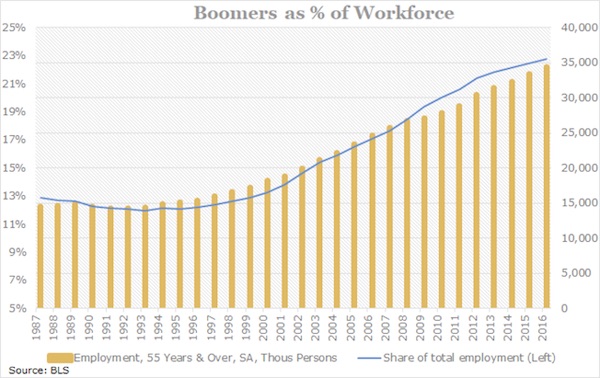

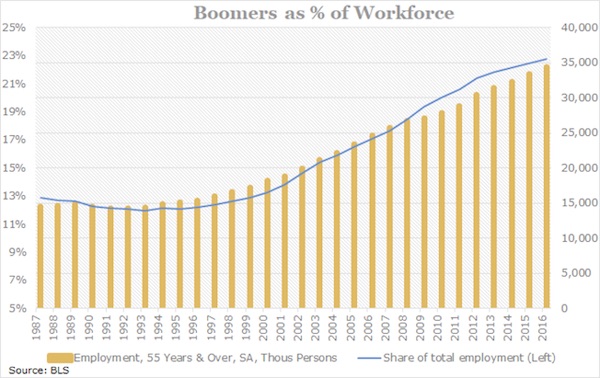

The potential problem now is Boomers are hitting retirement, and roughly 10,000 Boomers retire each day. The above chart is the age distribution of the U.S. population by age. You can see the cliff of Boomers that are turning 70 this year. There are a couple ramifications of Boomers retiring. First is the moment they quit their job or sell their business, they are on a finite budget from there on out. Second, fewer people will be available for work down the road leaving less tax payers contributing to already stressed government budgets. Lastly, Boomers are incentivized to retire at 70.5 due to social security rules and will also start drawing on pensions. What makes matters worse is the majority of Boomers have less than $200k saved for retirement and a large portion have less than $50k saved per PWC’s Annual survey. This means that Boomers are heavily relying on Social Security or they have to work longer, which is currently evidenced by the following chart from the BLS.

Boomers have essentially garnered the majority of wage gains and now are working longer either out of necessity or preference. You might be thinking the surge in Millennials entering the work force will save the day, but due to the above facts, younger generations have to wait longer to move up the corporate ladder or have to attain levels of higher education to receive an adequate salary. As a result, student debt has risen exponentially in the U.S. jeopardizing the future of many starting their professional lives.

Read more …

“Debt racked up through the greed of financiers being dumped on the poor, the young and people with disabilities in what must rank as the biggest bait and switch in postwar Britain.”

• Ten Years After The Crash, There’s Barely Suppressed Civil War In Britain (G.)

All history now, isn’t it? The credit crisis that began in August 2007, the ensuing banking crash and global recession. One bumper episode from the long-ago past, when the iPhone was a newborn and Amy Winehouse still made records. Now done, dusted, reformed and resolved. Or so one assumes, from the official self-congratulation. The European commission marks the 10th anniversary of the credit crisis by trumpeting: “Back to recovery thanks to decisive EU action.” Yes, the same clapped-out European establishment that has spent the last decade kicking a can down the road. The head of the derivatives industry body, ISDA, admits: “We sometimes forget to articulate the social value of what we do.” Indeed so: before the crash, bankers emailed each other about how the derivatives that they were paid so much to flog were “crap” and “vomit”.

Everyone knows history is written by the victors, but this is something else: bullshit recounted by the bullshitters. Even the banks are back to bragging how many billions they generously chip in to Her Majesty’s Exchequer, presumably hoping no one will point out that they took £1.3tn from taxpayers in just a few months in 2008. Let’s get three things straight. First, it was working- and middle-class Britons who paid for the mess, who are still paying for it now and who will keep paying for it decades from now. Second, the crash has prompted almost no fundamental reckoning or reform. And, most importantly, the combination of those first two factors means the crash that began in 2007 cannot be consigned to the past. Today’s politics – from Brexit to Trump and the collapse of centrism – is just one of its products.

For politicians and financiers to treat the crash as history brings to mind Stephen Dedalus in Ulysses: “History is a nightmare from which I am trying to awake.” Here’s the stuff of historical bad dreams: at the height of the banking crisis in 2008, every man, woman and child in Britain handed over £19,721 each to bankers. The economy tanked, Gordon Brown got booted out – and David Cameron pretended a private banking catastrophe was a crisis of a supposedly profligate public sector. You know what happened next: first the kids’ Sure Start centre closed, then the library; your mum waited ages to get her hip replacement; the working poor had their social security stolen, and the local comp began sending begging letters. Debt racked up through the greed of financiers being dumped on the poor, the young and people with disabilities in what must rank as the biggest bait and switch in postwar Britain.

I say that, but we have only had seven years of austerity. If Philip Hammond stays in No 11 and sticks to plan (one must hope he does neither), the cuts will continue until the middle of the next decade. After 2025, who knows what will remain of our councils, our welfare state and our public realm. One truism of this era is that the average British worker earns less after inflation than they did when RBS nearly died. Most of us have seen not a recovery, but a ripping up of our social contract – so that over 7 million Britons are now in precarious employment. But the highest earners are way ahead of where they were in 2008. Finance-sector bonuses are as generous as they were during the boom, while a bad year for the average FTSE boss is one in which he or she pulls in a mere £4.53m.

And so we remain reliant on debt – aptly termed “the raw material for bubbles and crashes” by Daniel Mügge at the University of Amsterdam. According to the Bank for International Settlements, the UK is far deeper in the red now than it was when Northern Rock collapsed. Government debt has shot up under the Conservatives, but so too has household borrowing. Were the UK to crash again, its government no longer has the political capital nor the fiscal headroom to save the financial system.

Read more …

“The deterioration and widening dispersion in market internals is no longer subtle.”

• Broadening Internal Dispersion (Hussman)

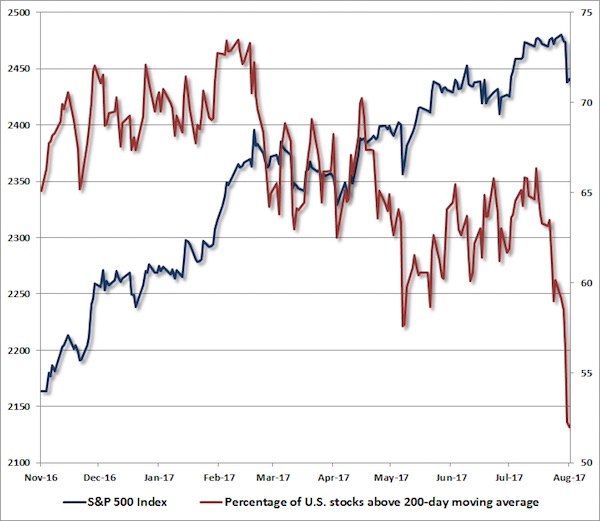

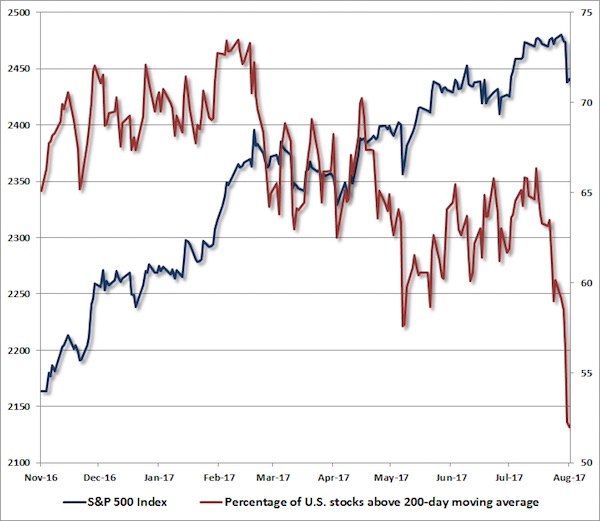

It’s important to observe that if short-term interest rates were still at zero and market internals were favorable, even the most extreme overvalued, overbought, overbullish syndromes we identify would not be enough to push us to a hard-negative market outlook. That, in a nutshell, is the central lesson from quantitative easing, and is one that could alone have dramatically altered our own challenging experience in the recent speculative half-cycle. At present, however, we observe not only the most obscene level of valuation in history aside from the single week of the March 24, 2000 market peak; not only the most extreme median valuations across individual S&P 500 component stocks in history; not only the most extreme overvalued, overbought, overbullish syndromes we define; but also interest rates that are off the zero-bound, and a key feature that has historically been the hinge between overvalued markets that continue higher and overvalued markets that collapse: widening divergences in internal market action across a broad range of stocks and security types, signaling growing risk-aversion among investors, at valuation levels that provide no cushion against severe losses.

[..] Again, the principal lesson of the recent half-cycle was that in the face of zero interest rates, even the most extreme “overvalued, overbought, overbullish” syndromes were not enough to anticipate steep market losses (as they typically were in prior market cycles). Instead, investors were driven to believe that they had no other alternative but to continue their yield-seeking speculation. In the face of zero interest rates, one had to wait for market internals to deteriorate before adopting a hard negative market outlook. At present, we observe neither zero interest rates, nor uniformly favorable market internals. In the current environment, we expect that obscene valuations and severe “overvalued, overbought, overbullish” syndromes are likely to be followed by the same outcomes that have attended similar conditions across history. The chart below shows the percentage of U.S. stocks above their respective 200-day moving averages, along with the S&P 500 Index. The deterioration and widening dispersion in market internals is no longer subtle.

Read more …

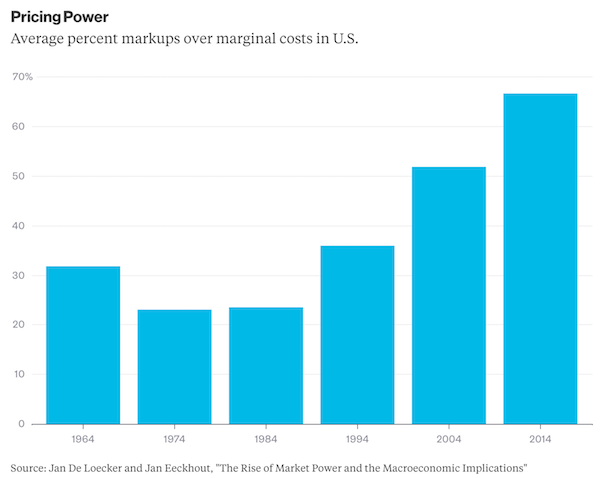

It’s about Apple and Google.

• Trump Orders Probe Of China’s Intellectual Property Practices (R.)

President Donald Trump on Monday authorized an inquiry into China’s alleged theft of intellectual property in the first direct trade measure by his administration against Beijing, but one that is unlikely to prompt near-term change. Trump broke from his 17-day vacation in New Jersey to sign the memo in the White House at a time of heightened tensions between Washington and Beijing over North Korea’s nuclear ambitions. The investigation is likely to cast a shadow over relations with China, the largest U.S. trading partner, just as Trump is asking Beijing to step up pressure against Pyongyang. U.S. Trade Representative Robert Lighthizer will have a year to look into whether to launch a formal investigation of China’s trade policies on intellectual property, which the White House and U.S. industry lobby groups say are harming U.S. businesses and jobs.

Trump called the inquiry “a very big move.” Trump administration officials have estimated that theft of intellectual property by China could be as high as $600 billion. Experts on China trade policy said the long lead time could allow Beijing to discuss some of the issues raised by Washington without being seen to cave to pressure under the threat of reprisals. Although Trump repeatedly criticized China’s trade practices on the campaign trail, his administration has not taken any significant action. Despite threats to do so, it has declined to name China a currency manipulator and delayed broader national security probes into imports of foreign steel and aluminum that could indirectly affect China.

[..] The Information Technology Industry Council, the main trade group for U.S. technology giants, such as Microsoft, Apple and Google, said it hoped China would take the administration’s announcement seriously. “Both the United States and China should use the coming months to address the issues causing friction in the bilateral trade relationship before Presidents Trump and Xi have their anticipated meeting ahead of the November APEC leaders meeting,” ITI President Dean Garfield said in a statement.

Read more …

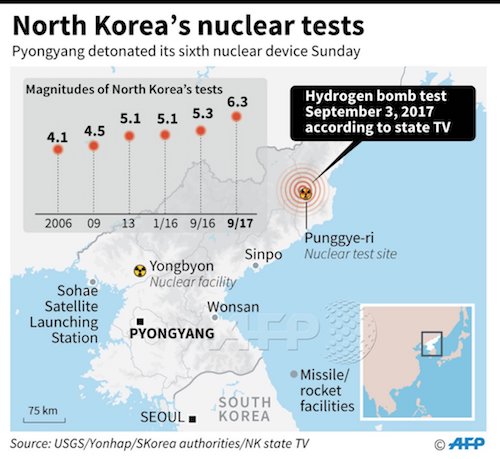

“On August 15, a full ban on imports of coal, iron, iron ore, lead, lead ore, seafood from North Korea is introduced..”

• China Imposes Ban on Imports From North Korea, Yields to Trump’s Calls (Sp.)

China is introducing a ban on imports of some goods from North Korea in line with a UN Security Council resolution, the Chinese Commerce Ministry said Monday. US President Donald Trump has repeatedly called on Beijing to increase economic pressure on North Korea as China is Pyongyang’s biggest trade partner. “On August 15, a full ban on imports of coal, iron, iron ore, lead, lead ore, seafood from North Korea is introduced,” the ministry said in a statement. According to the statement, North Korean products arrived at Chinese ports before the ban would be allowed to enter the country. Import applications of products from North Korea will be halted from September 5. Meanwhile, Chinese companies are still allowed to import coal from third countries via the North Korean port of Rason. However, Chinese importers need to apply for approval from a UN committee set up under the UN Security Council resolution 1718.

Interestingly, Beijing’s move came amid media speculations that Trump is mulling a trade crackdown on China. China is by far the largest trading partner of North Korea. In April, the Chinese General Administration of Customs said trade between the two countries in the first quarter increased 37.4% year-over-year, even despite the UN sanctions on North Korean supplies of coal, the country’s top export earner. The tensions around North Korea have been high over the recent months and they have escalated further after the tightening of economic sanctions against North Korea by the United Nations Security Council (UNSC) last week in response to July’s launches of ballistic missiles by Pyongyang. On August 5, new UNSC sanctions against North Korea could cut the nation’s annual export revenue by $1 billion.

Read more …

Saving face.

• Kim Jong-un Holds Off On Guam Plan (R.)

North Korea’s leader received a report from his army on its plans to fire missiles toward Guam and said he will watch the actions of the United States for a while longer before making a decision, the North’s official news agency said on Tuesday. North Korea said last week it was finalizing plans to launch four missiles into the waters near the U.S. Pacific territory of Guam, and its army would report the strike plan to leader Kim Jong Un and wait for his order. Kim, who inspected the command of the North’s army on Monday, examined the plan for a long time and discussed it with army officers, the official KCNA said in a report. “He said that if the Yankees persist in their extremely dangerous reckless actions on the Korean peninsula and in its vicinity, testing the self-restraint of the DPRK, the latter will make an important decision as it already declared,” the report said.

The DPRK stands for North Korea’s official name, the Democratic People’s Republic of Korea. Pyongyang’s detailed plans for the strike near Guam prompted a surge in tensions in the region last week, with U.S. President Donald Trump warning he would unleash “fire and fury” on North Korea if it threatened the Unite States. South Korean and U.S. officials have since sought to play down the risks of an imminent conflict, helping soothe global concerns somewhat on Monday. Kim said the United States should make the right choice “in order to defuse the tensions and prevent the dangerous military conflict on the Korean peninsula,” the KCNA report said.

Read more …

Oh, get real: “..poised to benefit from the tailwind of a much improved global backdrop.”

• Australia’s Central Bank Renews Alert on Mounting Household Debt (G.)

Australia’s central bank renewed its focus on mounting household debt, even as the outlook for the nation’s economy improved, according to the minutes of this month’s policy decision where interest rates were left unchanged. RBA noted “need to balance the risks associated with high household debt in a low-inflation environment” in its decision to stand pat on policy. Better hiring this year meant “forecasts for the labor market were starting from a stronger position”. The bank reiterated GDP growth was expected to rise to around 3% in 2018 and 2019, supported by low rates; faster growth in non-mining business investment is expected. The main change is one of emphasis after the Reserve Bank of Australia removed the labor market and added household balance sheets – where debt is currently at a record 190% of income – to its key areas of concern alongside the residential property market.

But the minutes convey rising confidence that Australia’s economy will strengthen and is poised to benefit from the tailwind of a much improved global backdrop. Yet areas of substantial uncertainty remain: how China manages the trade-off between growth and the build-up of leverage; the fact the forecasts for the domestic economy are based on no change in the exchange rate in the period through 2019; and whether better employment would lead to higher household income and increased consumption, or whether ongoing weak wage growth and high household debt would cut into consumption.

Read more …

Neither country seems to know how one gets a passport down under. Curious.

• Australia Says New Zealand Opposition Trying To Bring Down Government (G.)

Australia and New Zealand have become embroiled in an extraordinary diplomatic spat over claims the New Zealand opposition colluded with the Australian Labor party (ALP) in an attempt “to try and bring down the government”. During a febrile day of politics in both countries, Australia’s foreign affairs minister, Julie Bishop, said New Zealand’s opposition party was threatening the stability of a usually robust partnership between the two nations. She said she would find it “very hard to build trust” if New Zealand’s opposition Labour party were to win the general election in September. Her comments came only 24 hours after it was revealed that Australia’s deputy prime minister, Barnaby Joyce, held New Zealand citizenship and may be ineligible to sit in parliament under the Australian constitution, which disqualifies dual nationals.

Malcolm Turnbull’s government currently commands a majority of one seat in the House of Representatives. But Australia’s ruling coalition has now accused the opposition Labor party of planting a question in the New Zealand parliament in order to extract the information about Joyce’s nationality. Australian government minister Christopher Pyne accused the ALP of being part of a conspiracy to bring down the government. “Clearly the Labor party are involved in a conspiracy using a foreign government, in this case New Zealand, to try and bring down the Australian government,” he said. “How many other foreign governments, or foreign political parties in other countries, has the Labor party been colluding with to try to undermine the Australian government? “Has he been talking to the people in Indonesia, or China, or the Labour party in the UK?”

Joyce made the admission after media inquiries on the subject, but it subsequently also emerged that on 9 August the New Zealand Labour MP Chris Hipkins submitted two written questions to the internal affairs minister, Peter Dunne, in parliament, both of an unusual nature. “Are children born in Australia to parents who are New Zealand citizens automatically citizens of New Zealand; if not, what process do they need to follow in order to become New Zealand citizens?” Hipkins asked. He also asked: “Would a child born in Australia to a New Zealand father automatically have New Zealand citizenship?”

Read more …

What austerity also does.

• Greek Population Set To Shrink Up To 18% By 2050 (K.)

A new study released by the Berlin Institute for Population and Development suggests that Greece is set to lose up to 18% of its population by the middle of the century. The deep economic crisis – which has hit young people especially hard and is identified as a key reason behind the country now having one of the lowest birth rates in the world – is cited as the primary cause of this decline, which has accelerated in recent years. According to the study, Greece had already lost nearly 3% of its population between 2011 and 2016. In 2016, Greece’s population stood at 10.8 million. That is expected to drop to 9.9 million by 2030 and 8.9 million by 2050. That is a nearly 18% decline in the country’s population over the next 33 years. Greece also has a rapidly aging population, with 21% already over the age of 65 and fewer than 100,000 babies being born each year. This percentage is currently the second highest in Europe, after Italy. Greece will have the highest ratio of pensioners to workers in Europe by 2050.

Read more …

They’re stuck in hell.

• Sharp Fall In Number Of Refugees, Migrants Arriving In Italy (AFP)

Italy has seen a sharp fall in the number of migrants arriving on its shores, a decline that has left experts scrambling for an explanation. Summer is traditionally the peak season for migrants attempting the hazardous crossing of the Mediterranean from North Africa to Europe. But, to much surprise, only 13,500 have arrived in Italy since July 1, compared to 30,500 over the same period in 2016 – a year-on-year fall of more than 55%. Many migrants are from poor sub-Saharan Africa, fleeing violence in their home country or desperate for a better life in prosperous Europe. “It’s still too early to talk of a real trend,” cautions Barbara Molinario, a spokeswoman for the UN High Commissioner for Refugees (UNHCR).

One mooted reason for the fall is tougher action by the Libyan coastguard. The force which has been strengthened by help from the European Union (EU), which trained about 100 personnel over the winter, while Italy has provided patrol vessels, recently supported by Italian warships in Libyan waters. But according to figures from UN’s International Office of Migration (IOM), the Libyan coastguard have intercepted fewer than 2,000 migrants since early July, compared to more than 4,000 in May. Another reason put forward to explain the decline is tougher action by NGOs who have been accused by critics of colluding with smugglers to pick up migrants at sea to prevent them from drowning. But these organisations have been involved in only a fraction of migrant rescues – and three NGO vessels are still operating in the hope of picking up those in need.

[..] Since 2014, 600,000 migrants have landed in Italy, but more than 14,000 have died. Italian newspapers which, just a few weeks ago, were accusing NGOs of abetting an influx that seemed uncontrollable have now switched to reports on the terrifying conditions faced by migrants in Libya. “Sending them back to Libya right now means sending than back to Hell,” the deputy foreign minister, Mario Giro, said earlier this month.

Read more …