Tamara de Lempicka The refugees 1937

Illegals

🚨WATCH: America's illegal immigration crisis is shattering century-old records with alarming numbers.

2023: 3,201,144

2022: 2,766,582

2021: 1,956,519

2020: 405,036

2019: 859,501

2018: 404,142

2017: 310,531

2016: 415,816

2015: 337,117

2014: 486,651

2013: 420,789

2012: 364,768… pic.twitter.com/9NGhmmnlf6— KanekoaTheGreat (@KanekoaTheGreat) January 31, 2024

Poll

https://twitter.com/i/status/1752450941633335551

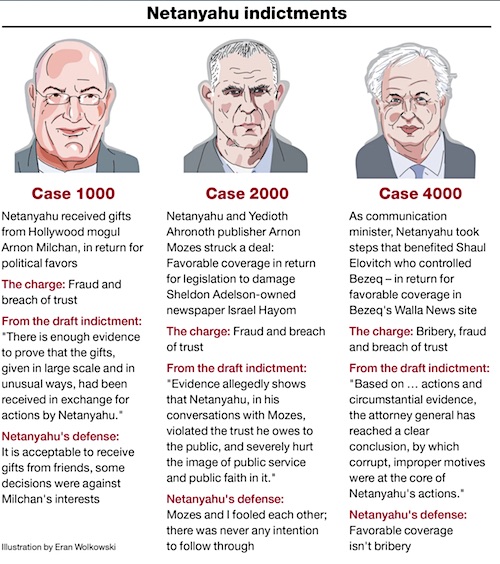

A Delaware judge just retroactively voided Elon’s $55B Tesla pay package from 2018 where shareholders voted in favor for it, all milestones were hit, and Tesla stock is up 800% since then.

Elon Musk:”Never incorporate your company in the state of Delaware.”

Cybertruck

Prob the coolest looking Cybertruck I’ve ever seen thus far

— Teslaconomics (@Teslaconomics) January 30, 2024

Tucker Russell Brand

Ep. 70 Governments colluded to shut down and destroy Russell Brand. This is his first interview since that happened. Watch it when you get a minute. It's one of the most brilliant explanations of the modern world you'll ever hear. pic.twitter.com/bCZDTYfZAZ

— Tucker Carlson (@TuckerCarlson) January 30, 2024

https://twitter.com/i/status/1752487123528093806

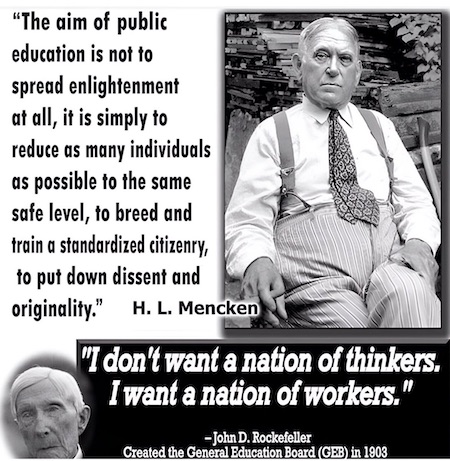

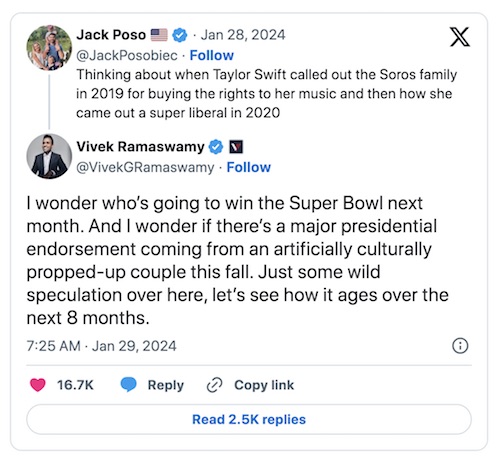

Joe Biden, George Soros and Taylor Swift. What a plotline.

“Joe Biden is in [a] hole with young people, he knows it. And if he thinks Taylor can get him out of that hole, he’s gonna go for it.”

• Biden Wants Taylor Swift To Sing For Him – NYT (RT)

US President Joe Biden is pursuing an endorsement from global pop superstar Taylor Swift ahead of November’s election, the New York Times has claimed. The Democratic leader’s campaign is reportedly seeking to counter flagging polls that show him trailing likely Republican candidate, Donald Trump. Trump’s strong performances in early Republican primaries and caucuses have suggested that a rematch of the 2020 election is the most likely scenario at the US ballot box later this year. As such, Biden’s staff plan to rehash tactics that proved successful in the caustic battle with Trump four years ago, the New York Times said on Monday. Principally, this is said to involve painting the former president as a threat to American democracy, along with a heavy focus on abortion rights as part of a broader appeal to voters against alleged conservative efforts to restrict personal freedoms.

One influential voice the Democrats again intend to harness is that of Swift, arguably the most famous popstar on the planet. Perhaps more specifically, her 280 million Instagram followers are of significant interest, the report claims. Swift publicly backed Biden and his vice-presidential candidate Kamala Harris in 2020, saying that she would “proudly vote” for the Democratic ticket because “under their leadership, I believe America has a chance to start the healing process it so desperately needs.” Last year, a single social media post from Swift led to the registration of 35,000 new voters in the US, the NYT report said, and Democrats are keen to secure her backing to expand this enthusiasm to a national scale. It is also predicted that fund-raising appeals from the singer could boost Biden’s campaign to the tune of millions of dollars.

“Taylor Swift stands tall and unique,” California’s Democratic governor, Gavin Newsom, said last year. “What she was able to accomplish just in getting young people activated to consider that they have a voice and that they should have a voice in the next election, I think, is extremely powerful.” Perhaps courting Swift’s backing, the White House last week condemned salacious fake AI images of the singer that have been circulating on social media in recent days. Fox News anchor Jeanine Pirro, a vocal backer of Trump, on Monday warned Swift not to “get involved in politics.” “We don’t want to see you there,” Pirro said on the news network’s ‘The Five’ show. “Joe Biden is in [a] hole with young people, he knows it. And if he thinks Taylor can get him out of that hole, he’s gonna go for it.” Trump, though, is also no stranger to leaning on popular culture for support. He has previously boasted of backing from the likes of Kanye West and Kid Rock. The latest polling data shows Trump holding an advantage of between 1 and 5 percentage points over Biden in a head-to-head race.

FLASHBACK: Taylor Swift: “After I was denied the chance to purchase my music outright, my entire catalog was sold to Scooter Braun’s Ithaca Holdings in a deal that I’m told was funded by the Soros family, 23 Capital and the Carlyle Group,” pic.twitter.com/CLQE7bgQcX

— Benny Johnson (@bennyjohnson) January 30, 2024

https://twitter.com/i/status/1752521142831562803

“..has been pitched by legacy media as finally finding the “perfect match”: Kansas City Chiefs Travis Kelce. The relationship doesn’t pass the sniff test..”

• Is There A Taylor Swift Psyop? (ZH)

Welcome to the matrix. The current news cycle gives the impression that Taylor Swift is everywhere. According to Bloomberg data, corporate media headlines featuring “Taylor Swift” began ramping up in the first half of 2023 and hit new record highs later in the year. The singer, who has made an entire career whining about having chosen the wrong men, has been pitched by legacy media as finally finding the “perfect match”: Kansas City Chiefs Travis Kelce. The relationship doesn’t pass the sniff test, given Taylor’s terrible choices with men. Let’s begin with Michael Benz, a former Trump admin State Department official whose work has been cited in congressional hearings, posted on X a video from 2019 featuring the Pentagon’s psychological operations research that pitched the idea of turning Taylor into an asset to combat “disinformation.”

Watch the incredible moment that a rep from the Pentagon's psychological operations research firm pitched NATO's military psyops center on turning Taylor Swift into an asset for the Western military alliance to stop "disinformation" on the Internet. https://t.co/BYIordpx18 pic.twitter.com/ThXhnjiFMD

— Mike Benz (@MikeBenzCyber) January 9, 2024

Back to Taylor’s relationship with Kelce. Consider this:

https://twitter.com/i/status/1752042447088017527

And there’s this.

We’re not alone. Fox News’ Jesse Watters also asked: “Why is Taylor Swift Everywhere?” Perhaps it’s not by chance that the story count in corporate media for Taylor has exponentially exploded, averaging above 1,000 per day since late September. Taylor’s surge comes as legacy corporate media is terrified about the rise of alternative media. Wall Street Journal Chief Emma Tucker warned WEF elites at Davos this month: “We no longer own the news.” [..] While it remains to be seen if Taylor has become a NATO asset. Certainty Democrats appear to be salivating all over her ahead of the presidential election to turn ‘Swifites’ into blue voters.

“Joe Biden” will seize an excuse to declare a national emergency and subject the US to some manner of martial law..”

• The Next Big Thing (Jim Kunstler)

I’m sure you can see exactly where all this is going. By all this, I refer to the cortège of disasters orchestrated by “Joe Biden” and associates — with help from a power-crazed globalist cabal — hauling our country at a gallop now to the graveyard of empires. Is there any question that they are out to wreck Western Civ? And speeding up the action because too many actual citizens are rising to oppose their degenerate wickedness? Most particularly, the people who have not surrendered their reason to the Woke-Marxist mind-fuck that calls itself “progressivism” have had enough of the purposeful inflow of something like ten-thousand fake asylum-seekers a day across the border, mostly men, a lot of them from China, and many more of them mutts from faraway lands where Jihad is the order of the day — meaning the crusade to exterminate the people of Western Civ. We’re supposed to be okay with that.

This deliberate, treasonous policy was rightfully declared an “invasion” last week by the Governor of Texas, requiring the human wave to be met with real force, not the welcome wagon that the federal border patrol has been turned into. The result so far is a real-live Mexican stand-off between the regime in Washington and the state of Texas, joined by twenty-five other sympathetic US states willing to send men and matériel to seal the border. None of this is reported in Monday morning’s New York Times, by the way, though you can read Is Dying Your Hair Bad for Your Health there. Nor will you read about the caravan of American truckers striking out from all points around the country to “peacefully protest and pray” at the border while Texas attempts to settle its hash with “Joe Biden.” Nor will you read about the uprising of European farmers blocking highways to protest ruinous EU rules on food imports, diesel fuel prices, carbon emissions inanity, and, of course, the officially-enabled tide of Africans and jihadists flooding into EU member states.

“Joe Biden’s” response so far is to say he’ll attend to the border situation only if Congress green-lights another massive aid package for Ukraine, a dishonest proffer from any angle. Ukraine is a lost cause that should never have been a cause of ours in the first place. Yet securing the US border is a principal duty of the executive branch, not some optional fringe benefit to be used as leverage for other projects. Congress has already got impeachment articles ready for Homeland Security Secretary Mayorkas, who has lied repeatedly under oath about the border being “secure.” But it’s obviously not enough. The failure is entirely “Joe Biden’s” and warrants his impeachment on its face, aside from all the evidence of bribery and racketeering among him and his family.

The best move would be to impeach both the president and his proclaimed “border czar” Veep Kamala Harris — which would put Speaker Mike Johnson in the oval office. But the impeachment process is too slow and awkward for that. So, now I will tell you where all this is actually going: “Joe Biden” will seize an excuse to declare a national emergency and subject the US to some manner of martial law. The excuse could be an outbreak of violence in the quarrel between the states and the feds over the border. Or it could be a widening of the war in the Middle East, a direct confrontation with Iran that would draw in Russia and Turkey and kickoff World War Three, a war we would have an excellent shot at losing, considering our DEI-ravaged, over-vaxxed army, our obsolete naval carrier groups that can be sunk by hypersonic missiles, and our depleted reserves of armaments already fobbed off by Ukraine and, lately, given to Israel in the Gaza campaign to destroy Hamas.

If such a war didn’t set off a world-ending exchange of nukes, it would at least collapse the economies of Europe and America and, with that, many governments, including possibly ours. And what role might all those recently-arrived illegal aliens play in such a fiasco? Any way you cut it, we’d be in for chaos and hardship. Or, if we somehow avert major war, “Joe Biden” can try the national emergency ploy when the much-heralded (by the WHO) “Disease X” trots onstage. (And we must ask whether that will just be a delayed side-effect of the mRNA vaccine deaths?) Ultimately, the purpose of any national emergency at this moment in history, whatever prompts it, will be to suspend the 2024 elections. The Democratic Party has gone so completely off-the-rails psychologically that it will do anything to avert losing control of the government.

What it’s all about. The bottom line.

• US Foreign Arms Sales Rocket to Record Highs (Sp.)

Capitalizing on armed conflicts across the world is not uncommon for Washington, something that is confirmed by the fact that the US’ foreign military sales (FMS) reached $80.9 billion in fiscal year 2023, soaring almost 56% from the previous year to set a new record. Apart from FMS, America’s so-called direct commercial sales (DCS) likewise increased last year to $157.5 billion from $153.6 billion in fiscal 2022, the State Department said in a statement. A record total of FMS and DCS in FY2023 stands at about $238 billion. The total $80.9 billion figure for FMS last year includes $62.25 billion in arms sales funded by US allied and partner nations, as well as $3.97 billion through the Title 22 Foreign Military Financing program, according to data released. An additional $14.68 billion was funded through other Department of State and Department of Defense programs, including the Ukraine Security Assistance Initiative.

Poland made some of the biggest purchases, buying Apache helicopters for $12 billion and also paying $10 billion for High Mobility Artillery Rocket Systems (HIMARS). Germany spent $8.5 billion on Chinook helicopters while Bulgaria paid $1.5 billion for Stryker armoured vehicles and Norway bought $1 billion worth of multi-mission helicopters. The Czech Republic bought $5.6 billion in F-35 jets and munitions. Outside of Europe, the State Department data indicated that South Korea paid $5 billion for F-35 fighter jets and Australia spent $6.3 billion on C130J-30 Super Hercules planes. Also, Japan reached a $1 billion deal for an E-2D Hawkeye surveillance plane. E�x�a�m�p�l�e�s� �o�f� �l�a�s�t� �y�e�a�r�’s� �m�a�j�o�r� �D�C�S� �C�o�n�g�r�e�s�s�i�o�n�a�l� �N�o�t�i�f�i�c�a�t�i�o�n�s� �i�n�c�l�u�d�e� �a� �h�e�f�t�y� �a�g�r�e�e�m�e�n�t� �w�i�t�h� �t�h�e� �U�k�r�a�i�n�i�a�n� �D�e�f�e�n�s�e� �M�i�n�i�s�t�r�y� �t�o� �s�u�p�p�l�y� �N�a�t�i�o�n�a�l� �A�d�v�a�n�c�e�d� �S�u�r�f�a�c�e� �t�o� �A�i�r� �M�i�s�s�i�l�e� �S�y�s�t�e�m� �(�N�A�S�A�M�S�)� �w�o�r�t�h� �$�1�.�2� �b�i�l�l�i�o�n�.�

�O�t�h�e�r� �a�g�r�e�e�m�e�n�t�s� �w�o�r�t�h� �a�p�p�r�o�x�i�m�a�t�e�l�y� �t�h�e� �a�b�o�v�e��-�m�e�n�t�i�o�n�e�d� �s�u�m� �p�e�r�t�a�i�n� �t�o� �I�t�a�l�y�,� �I�n�d�i�a�,� �S�a�u�d�i� �A�r�a�b�i�a�,� �S�i�n�g�a�p�o�r�e�,� �S�o�u�t�h� �K�o�r�e�a�,� �a�n�d� �N�o�r�w�a�y�,� �p�e�r� �t�h�e� �S�t�a�t�e� �D�e�p�a�r�t�m�e�n�t�.� It’s safe to assume that commercializing wars has become a trend in US policy. In the same vein, in a 2022 extensive report by the Washington-based Quincy Institute for Responsible Statecraft think tank, the authors urged the Biden administration “to address a number of key issues if US policy on arms sales is to be made consistent with long-term US interests.”

“The key policy consideration is how to restrict sales to those that will help allies defend themselves without provoking arms races or increasing the prospects for conflict,” the report pointed out, referring to the AUKUS submarine deal, which “will benefit US contractors but risks fueling arms competition and increasing tensions with China.” On the “rapid” US military assistance to Ukraine, the report underscored that “the United States has failed to offer an accompanying diplomatic strategy aimed at ending the war before it evolves into a long, grinding conflict or escalates into a direct US-Russian confrontation.” Moscow has repeatedly warned the US and its allies that sending arms to Kiev would only prolong the Ukraine conflict. The authors warned that foreign arms sales can also pose risks to US security “by fueling conflicts, provoking American adversaries, stoking arms races, and drawing the US into unnecessary or counterproductive wars.”

Works for the industry.

• Stoltenberg: Weapons for Ukraine Are ‘the Way to Peace’ (Sp.)

NATO Secretary General Jens Stoltenberg said during a press briefing that supporting Ukraine goes beyond charity, serving as an investment into global security. “Supporting Ukraine is not a charity, it is an investment in our own security,” Stoltenberg said during a press briefing on Monday. Stoltenberg also suggested that arms for Ukraine are “the way to peace.” In October, the White House requested from Congress supplemental funding of for more than $100 billion, including more than $60 billion for Ukraine, but Republican lawmakers have refused to approve the request without including substantive measures to strengthen US border security and address record levels of illegal immigration into the United States.

Western countries have been providing military aid to Ukraine since the start of Russia’s special military operation in February 2022 in the amount of hundreds of billions of dollars. The aid evolved from artillery munitions and training in 2022 to heavier weapons, including tanks, advanced air-defense systems, cluster munitions and missiles later that year and in 2023. The Kremlin has consistently warned against the West’s continued arms deliveries to Ukraine. Moscow has repeatedly stated that Western military supplies do not bode well for Ukraine and only prolong the conflict. In addition, vehicles carrying supplied weapons are a legitimate target for the Russian Army.

“In accordance with this certificate, the recipient of the weapon does not have the right to resell it or redirect it anywhere without the consent of the supplier country..”

• West Asks Countries To Secretly Send Russian Weapons To Ukraine – Lavrov (RT)

Moscow has become aware of several cases of Western powers asking certain countries to secretly donate Russian-made weaponry to Kiev for use in the Ukraine conflict, Foreign Minister Sergey Lavrov has said. The Russian diplomat’s comments come as Kiev ramps up its demands for more military aid, citing acute shortages in hardware and ammunition. The US and its allies have also been seeking to approve further financial and military support for Ukraine. Speaking at a roundtable meeting with the heads of foreign diplomatic missions in Moscow on Tuesday, Lavrov stated that Russia has been in contact with “certain countries” that the West has been trying to convince to hand over Russia-supplied weapons to Ukraine, without informing Moscow of such transfers.

The minister noted that there have been “several cases of this kind” recorded by Moscow over the past year and a half, and stressed that Russia will continue to demand that all international obligations regarding weapons transfers be observed. Lavrov pointed out that when a foreign country legally acquires Russian arms, the shipments come with a certain package of documents, including an end-user certificate. “In accordance with this certificate, the recipient of the weapon does not have the right to resell it or redirect it anywhere without the consent of the supplier country,” the minister explained.

At the same time, Russia’s top diplomat noted that the West has been pretending not to notice that its own weapons, which it has supplied to Ukraine, have already spread to war zones across the world, where they are frequently being used by extremists and terrorists. “The weapons that the West supplies to the Ukrainian regime have been found not only in conflict zones in the Middle East, but in illegal shipments that have been recorded in Finland, Sweden, Denmark, the Netherlands, and Gaza,” Lavrov said. Last week, speaking at a UN Security Council meeting, Lavrov reiterated Moscow’s claims that Kiev has been reselling Western weapons on the black market, and expressed disbelief that Ukraine’s backers were unaware of this. Russia has repeatedly condemned Western weapons deliveries to Ukraine, insisting that such shipments only serve to prolong the fighting and lead to more bloodshed without affecting the eventual outcome.

“..the United States is expected to station B61-12 gravity bombs, which are three times more powerful than the atomic bomb dropped on Hiroshima, at the Lakenheath base for the first time in 15 years..”

• Russia Warns US Against Returning Tactical Nuclear Weapons to UK (Sp.)

Russia strongly warns the US against returning its tactical nuclear weapons to the territory of the UK, Russian Deputy Foreign Minister Sergey Ryabkov said on Tuesday.”Regarding the hypothetical return of US tactical nuclear weapons to the UK territory, I would like to strongly warn against this destabilizing step,” Ryabkov told reporters. The move would not strengthen the security of either the UK or the US, but would increase the level of escalation and threat in Europe, the diplomat said. “We assume that despite the rather sad experience, from the point of view of ensuring European security, the experience of recent years in London and Washington, hotheads are not drawing any lessons from this, so this scenario is quite possible,” he added.

The Telegraph reported on January 26 that the United States is expected to station B61-12 gravity bombs, which are three times more powerful than the atomic bomb dropped on Hiroshima, at the Lakenheath base for the first time in 15 years after Washington decided to remove its nuclear arsenal from the United Kingdom in 2008. A Pentagon spokesperson, commenting on the development, said in a statement to Sputnik that it is a US policy to neither confirm nor deny the presence or absence of nuclear weapons at a specific location amid reports that Washington plans to station its nuclear weapons in the United Kingdom.

“It is U.S. policy to neither confirm nor deny the presence or absence of nuclear weapons at any general or specific location,” the statement said. The statement noted that the United States “routinely upgrades its military facilities in allied nations. Russian Foreign Ministry spokeswoman Maria Zakharova has said that the Kremlin would view the deployment of US nuclear weapons in the United Kingdom as an escalatory action.

“.. it ordered Israel should facilitate the entry of humanitarian aid, it actually said, “You have to cease fire because there is no [other] way of doing that.”

• The Palestinians Won in The Hague: So Did the Rest of Us (Patrick Lawrence)

Half a dozen years ago I sat in the lobby lounge at the Algonquin Hotel in Manhattan talking at length with Richard Falk, the scholar, lawyer, U.N. rapporteur, and advocate of Palestinian rights. Inevitably, the conversation turned for a time to international law, a topic on which Falk has long been a recognized authority. Here is a little of what he said as we took our afternoon tea: When international law is on the side of the geopolitical actors, then they are very serious about its relevance. When the American embassy was seized in Tehran after the Iranian Revolution, they talked about the flouting of international law as if that was the most sacred body of law that ever existed. International law is used very instrumentally. If you’re protecting private investment in Venezuela or Chile, then it’s barbaric not to uphold it. But if it’s blocking the pursuit of some kind of interventionist project, then it’s flaky or irrelevant to talk about it …

I thought about that exchange over the weekend, as I considered the International Court of Justice’s ruling last Friday that the apartheid state of Israel may be guilty of genocide against Gaza’s Palestinian population, as South Africa charges, and that the case Pretoria brought last month must proceed. Later Friday, the estimable Phyllis Bennis quoted Falk in a piece she wrote for In These Times. Falk called the decision the court’s “greatest moment,” and went on to explain, “It strengthens the claims of international law to be respected by all sovereign states—not just some.” Consistency of thought: It does not get more admirable than this. There are many, many ways to look upon the ICJ’s ruling, many things worth saying. The very first of these is that the significance of the ICJ’s interim finding lies beyond dispute.

Will the barbarities of a nation self-evidently suffering a collective psychosis now stop? No. What Dick Falk said six years ago still holds: Israel has already made clear it will ignore The Hague’s judgment. But what “the Jewish state” does this week or next is not for the moment our question. What are the enduring consequences of this ruling for the global order? How shall we situate the court’s judgment? Where does its importance lie? These are our questions. And Falk was right last Friday, too: The ICJ has begun the work—the long work—of restoring international law as a foundational feature of a world order worthy of the term. Having made this point, I must immediately note the abject deflections we find in the reports of our corporate media—which, nearly to a one, urge their readers, listeners, and viewers to dismiss the ICJ’s interim finding as, borrowing from Falk, more or less flaky and irrelevant.

In the second paragraph of its main story Friday, The New York Times, fairly bursting to get the point across, wrote, “The court did not rule on whether Israel was committing genocide, and it did not call on Israel to stop its campaign to crush Hamas…” Three untruths here, straight off the top. One, the South Africans did not ask The Hague to issue a ruling on genocide one way or the other. In the cause of expedience, to stop the savagery as quickly as possible, it asked for what it got—a swift interim judgment so the court could order Israel to stop the violence and that the larger case on genocide could proceed. Two, a mountain has been made of the fact that the ICJ did not, in so many words, call upon Israel to cease fire in Gaza. This is preposterously misleading.

Peruse the six stipulations that comprise the ruling, the first of which reads, “Israel shall take all measures within its power to prevent all acts within the scope of Genocide Convention, Article 2.” Here I defer to Raz Segal, an Israeli historian who professes at Stockton University in New Jersey. This is from a segment of Democracy Now!, distributed last Friday: We’re already seeing headlines in The New York Times today which frame this as, “The court did not issue an order for a ceasefire”—which, in effect, it actually did, because if it ordered that Israel should cease from genocidal acts, and it ordered Israel should facilitate the entry of humanitarian aid, it actually said, “You have to cease fire because there is no [other] way of doing that.”

“It’s the starter’s pistol of a global clampdown, which will impact humble Israelis as their economy tumbles and life gets tougher..”

• ICJ Ruling Is What It Is: Symbolic. But What Happens Next Is Critical (Jay)

All eyes now will be on Joe Biden to see what card he will play next after he has cut UNRWA aid – a despicable move which will haunt him until his dying days For many, the ruling of the ICJ in the Hague was surreal as it swiftly delivered a judgement against Israel for its genocide in Gaza. Yet even though the interpretation from around the world was that the conclusion of the court was unequivocal, the only real way of judging the validity of both the court and its judgement is with its impact. One has to wonder why the court, for example, didn’t use the word “genocide” and also why it stopped short of calling for an all-out ceasefire. For those naïve enough to believe that the court is entirely independent, the decision by the U.S. to veto any decision made by the United Nations Security Council should set minds at rest. We know that the Americans will do nothing at all, but there might be plans, however, for other countries to use the ruling as a basis for a host of actions against Israel, beyond merely legal ones.

The Americans were quick to point out on the day of the ruling that the court did not rule that Israel carried out a genocide. And so, by definition, it didn’t. This mentality, which is popular among gangsters, is really all that matters and is what those seeking justice will have to grapple with now.But the ruling did throw a spotlight on just how desperate both the Americans and Israelis are becoming as the stunt they pulled on the same day of the ruling, to distract media attention away from the court case and its significance, is telling.UNRWA is the UN agency, which takes care of the Palestinians, not only in Israel but in other countries like Lebanon, Syria and Jordan. For the Biden administration to entirely pull its funding of this agency, the last lifeline for thousands of Palestinians who rely on it even for food aid, is desperate, pathetic and despicable.

For those wondering what this stunt was intended to do, all they had to do is watch BBC news and see how this once fine international broadcaster has become a propaganda channel for U.S. hegemony. Eight minutes were given to why the Biden administration took the decision and only a couple of minutes given to the court decision itself.The Americans and Israel are still fighting a media war, which, for them, must feel like flogging a dead horse, despite most analysts acknowledging that all of the West’s media giants are completely supportive of israel. Israel clearly prepared the dossier and tortured its Palestinian prisoners to fabricate a story about UNRWA workers being complicit with the October 7th attacks in a confession signed in blood. Shamefully, this “evidence” which wouldn’t stand up in any court in the U.S. or UK, was all it took for Biden to go ahead with the plan, which leading commentators like George Galloway in the UK have already called an act of genocide in itself.

The UNRWA stunt is absolutely disgusting as it is craven and an all-time new low point for Biden. It paints Biden as a U.S. president who is happy to play his role in murdering thousands of civilians all in the name of fighting the media and controlling the debate. Some commentators will no doubt note the irony that the Gaza campaign started with claims by Israel of Hamas beheading babies and Israeli women being raped – the latter claim just retracted by the New York Times in recent days – and is now noted for Israel’s baptism of fake news as it struggles now even to get the upper hand in Gaza amidst reports of Hamas fighters returning to northern Gaza.

The ruling however will send shockwaves around the world for Israel to deal with. Certainly most of the countries, which make up the UN General Assembly, which has a good working relationship with the court, will not keep quiet about a U.S. veto in the Security Council. The boycott of goods may well be cranked up to official sanctions on Israel’s goods, visas and even the entity’s participation of international events. But for Netanyahu, this is not a badge of honour. He knows that the ruling will only compound his all-time low ratings in his own country. It’s the starter’s pistol of a global clampdown, which will impact humble Israelis as their economy tumbles and life gets tougher. Biden of course, could use the ruling to leverage Bibi to call a ceasefire. That is of course if you believe the reports that sleepy Joe really wants one, or is just bluffing once again, using his own journalists to help him with this deception.

Oh, they know.. Admitting it is something else.

• West Starts to Understand That Ukraine Project ‘Failing’ – Lavrov (Sp.)

The West is beginning to understand that the “Ukraine project” is failing but can not stop assisting Kiev because of its economic benefit and fear of losing “prestige,” Russian Foreign Minister Sergey Lavrov said on Tuesday. “The figures that are hidden in Ukraine, they speak a lot about how important it is for the West to prevent the ‘failure’ of their ‘Ukraine project’. Moreover, they already understand that the failure has already begun. But nevertheless they cannot stop. And not only for reasons of prestige … And also from the point of view of economic benefits,” Lavrov said during a meeting with foreign diplomats in Moscow. Addressing the UN Security Council meeting on January 22, 2023, Lavrov emphasized that there are no interests – and there never were – in the conflict with Russia in favor of the Ukrainian people.

There are only “the interests of the Anglo-Saxons, their henchmen and the criminal, rotten Kiev elite, which is tied to the West by mutual responsibility and which is afraid of being swept away the day after the end of the war.” The Russian top diplomat pointed out that Moscow has never given up on a peaceful resolution to the Ukraine conflict. “We never gave up on the peaceful resolution, we are always ready to negotiate — negotiate not about how to keep the leadership of the Kiev regime in place but about overcoming the inheritance of a decade-long destructive looting of the country and violence against the people, removing the reasons for the tragic Ukrainian situation,” Lavrov said. However, the key factor hindering a resolution of the conflict in Ukraine is the continued support of the West, he added.

Without those claims, what is left?

• Lavrov Blasts ‘Absurd’ Claims That Russia Will Attack NATO (RT)

Speculation in the West that Russia could attack the Baltic and Nordic states once the Ukraine conflict ends is pure fiction, Foreign Minister Sergey Lavrov has said. Speaking to the heads of diplomatic missions on Tuesday, Lavrov said the US had gathered a group of 54 countries to provide military, technical and intelligence aid to Ukraine to help it fight Russia. “All this is being done to prevent Russia from claiming victory,” he added. He said Western countries were claiming that “if Russia wins and asserts its interests in this war, the Baltics, Sweden, and Finland will be next.” Three Baltic nations became NATO members in the early 2000s, more than a decade after the collapse of the Soviet Union. Both Helsinki and Stockholm applied to join the bloc after the start of the Ukraine conflict, although only Finland’s application has been ratified so far.

Lavrov noted that this view was shared by Joe Biden, referring to remarks by the US president in early December, when he said that “if [Russian President Vladimir] Putin takes Ukraine, he won’t stop there” and could proceed to attack a NATO country. Moscow said at the time that such comments were “unacceptable for a responsible nuclear state.” The Russian foreign minister said that “the absurdity of such statements is clear to anyone who understands the slightest bit of history and the goals of the special military operation in Ukraine, which we announced openly and without hiding.” Russian officials have repeatedly said that Moscow is seeking the “denazification” and “demilitarization” of Ukraine, as well as an arrangement guaranteeing that the country would not join NATO, and would instead recommit to neutrality.

Lavrov further noted that the military campaign against Kiev is aimed at eliminating “historical injustice.” According to the minister, Moscow is fighting attempts to rewrite history, as well as efforts to turn territories where Russians and other peoples of Russia have lived for centuries “into a springboard for US-led NATO to be used to threaten the [country’s] security.” Last month, Putin said Moscow had no interest whatsoever in launching an offensive against the bloc. He added that the president of the United States – which he called the “master” of NATO – surely knows that “Russia has no interest… geopolitically, economically or militarily… in waging war against [the bloc].”

When you lose, escalate.

• Zelensky Ready To Further Fuel Ukraine Conflict (Sp.)

Doubts about the West’s willingness to further prop up the Kiev regime may drive Ukrainian President Volodymyr Zelensky to stir up the Ukraine conflict even further by ordering riskier attacks against Russia, Time magazine reported. Zelensky is already taking “bigger risks” in order to turn the conflict around and bolster his political standing at home, according to the publication. Every one of these actions is ripe with the potential for Russian retaliation, which may in turn deepen the hostilities and directly drag in NATO, Time magazine notes, adding that neither Moscow nor Brussels wants such a development. Armed conflicts “take on a life of their own, particularly with one of the key players -in this case, Zelensky- b�e�c�o�m�i�n�g� �a� �w�i�l�d�/ c�a�r�d� �t�o� �w�a�t�c�h�,� �t�h�e� �m�a�g�a�z�i�n�e� �c�o�n�c�l�u�d�e�d�.�

�T�h�i�s� �f�o�l�l�o�w�s� �K�r�e�m�l�i�n� �S�p�o�k�e�s�m�a�n� �D�m�i�t�r�y� �P�e�s�k�o�v� �t�e�l�l�i�n�g� �r�e�p�o�r�t�e�r�s� �t�h�a�t� �Z�e�l�e�n�s�k�y� �i�s� �c�u�r�r�e�n�t�l�y� �i�n� �a� �t�i�g�h�t� �s�p�o�t� �b�e�c�a�u�s�e� �n�o� �o�n�e� �i�s� �p�r�o�v�i�d�i�n�g� �h�i�m� �w�i�t�h� �m�o�n�e�y� �a�n�d� �U�k�r�a�i�n�e� �i�s� �u�p� �a�g�a�i�n�s�t� �a� �c�r�i�s�i�s� �a�t� �t�h�e� �m�o�m�e�n�t�.� “Zelensky is in a tough position. He has stopped receiving money, there are not enough shells for him abroad, he is also facing a tense situation inside the country, and many people are dissatisfied. In order to cloak his positions, he resorts to disguising them with utterly ludicrous decrees. It is unlikely that this can help the Kiev regime in any way, [so] the difficulties will only mount. This is despite the fact that there certainly are still more or less bright minds who understand what needs to be done to get out of this situation,” Peskov said, commenting on Zelensky’s decree entitled “On the territories of the Russian Federation historically inhabited by Ukrainians.”

Time’s report comes after The American Conservative pointed out that Zelensky has issued frenzied orders to attack civilians in order to fuel the conflict and secure further assistance from the West. On January 21, 27 people were killed and 25 more wounded when Ukrainian troops shelled the Kirovsky district of the city of Donetsk, according to head of the Donetsk People’s Republic Denis Pushilin. The shelling was preceded by the Ukrainian military’s strike on the Russian city of Belgorod on December 30, which killed 25 civilians and wounded 109 others. Moscow excoriated the murderous attack, slamming it as an act of terrorism. Also in December, President Vladimir Putin stressed in an interview with Russian media that Moscow has “no reason and no interest – neither geopolitical, nor economic, political, and military – to fight with NATO countries.” Russia and NATO members do not have any territorial claims against one another, Putin noted, adding that Moscow is unwilling to spoil relations with the alliance.

“..Many soldiers reportedly continue to speak Russian on the front lines..”

• Ukraine To Teach Troops To Speak Ukrainian (RT)

Special courses will be created for Kiev’s troops so that they can improve their command of the Ukrainian language, government official Taras Kremen has said.Kremen, who is Ukraine’s language ombudsman, made the announcement as he met with servicemen at a Territorial Defense Forces training center on Monday, his office said in a statement.Violations of the country’s language law, which among other things obliges the military to use Ukrainian, have been recorded in a large number of units, including in the capital Kiev, according to the commissioner.Ukraine historically has a large Russian-speaking population, especially in its eastern regions. Many soldiers reportedly continue to speak Russian on the front lines. In a 2001 census, more than 14.2 million Ukrainian citizens (almost 30% of the population) called Russian their native language.

During the meeting with servicemen, it was “agreed to open language courses for military personnel who want to improve their knowledge and properly prepare for the exam to determine the level of proficiency in the state language,” Kremen said. “I will be happy to assist in the creation of such a network [of courses] in other military units as well,” the commissioner added. Signed by then President Pyotr Poroshenko in 2019, the language law established Ukrainian as the sole state language and made it obligatory for use in all areas of social life. It was a continuation of Kiev’s policy of forcing out the Russian language, pursued by the authorities after the violent Western-backed coup in 2014.Since 2021, passing a Ukrainian language exam has been mandatory to become a government employee or to obtain Ukrainian citizenship.

“Nobody there [in the conflict zone] speaks Ukrainian,” a sniper from Kiev’s forces told the TSN media outlet in October. Despite concealing his identity, the serviceman enjoyed a certain celebrity status in Ukraine due to his regular interviews and podcast appearances.He claimed that Russian was common in all sections of the front line that he had been posted to. In his own unit, “two people speak the harshest Surzhik [a mix of Russian and Ukrainian] and, probably, two or three others [use] Ukrainian language. All the rest are Russian-speaking,” the sniper insisted. Moscow has repeatedly denounced Kiev’s clampdown on Russian culture and language, insisting that the “forced Ukrainization” violates international law and infringes upon the rights of native Russian speakers, who make up around a quarter of the population.

“..It now amounts to about $102,000 for an average American family of three..”

• US Facing ‘Death Spiral’ Of Swelling Debt – Nassim Taleb (RT)

The burgeoning US debt pile is akin to a “death spiral” that only a “miracle” could extract the country from, economist and ‘Black Swan’ author Nassim Taleb said at a business event on Monday, as quoted by Bloomberg. Taleb defined the expanding US debt load as a “white swan,” meaning a risk event that is highly predictable and more probable than a “black swan” event, a metaphor describing an occurrence that comes as a complete surprise. “So long as you have Congress keep extending the debt limit and doing deals because they’re afraid of the consequences of doing the right thing, that’s the political structure of the political system, eventually you’re going to have a debt spiral,” Taleb said. “And a debt spiral is like a death spiral.” Earlier this week, US Treasury Secretary Janet Yellen said that the absolute level of US public debt looks like “a scary number.”

US government federal debt topped $34 trillion for the first time in history at the end of December. It now amounts to about $102,000 for an average American family of three. In 2023 alone, it grew by more than $4 trillion.According to Taleb, a former trader who is best known for publishing several bestselling books on economics, white swans include both the US deficit and the American economy that has grown more vulnerable to shocks than in previous years. He called such vulnerability a feature of globalization, as problems in one region can ricochet around the world.When asked how the US “debt spiral” could play out, Taleb said, “we need something to come in from the outside, or maybe some kind of miracle,” adding that this makes him “kind of gloomy about the entire political system in the Western world.”

“..a classified cable that was sent to Islamabad by the Pakistani ambassador to Washington in 2022, which allegedly suggested that the US wanted Khan ousted over his neutrality in the Ukraine conflict.”

• Imran Khan Sentenced To Ten Years In Prison (RT)

A Pakistani court has sentenced former prime minister Imran Khan to ten years behind bars. He has been charged with leaking state secrets, according to the spokesman for the politician’s Pakistan Tehreek-e-Insaf party (PTI). On Tuesday, Zulfiqar Bukhari said, as quoted by AP, that the verdict was announced at a prison in the northern city of Rawalpindi, not far from the capital, Islamabad. The same sentence was also imposed on former Foreign Minister Shah Mehmood Qureshi. The charges relate to the so-called cipher, a classified cable sent to Islamabad by the Pakistani ambassador to Washington in 2022, shortly after the start of the Ukraine conflict. The document allegedly suggested that the US wanted to remove Khan over his neutrality regarding the hostilities.

The ex-Pakistani PM called the cipher case on Tuesday “false,” adding that it “is being completed in violation of constitutional requirements and legal regulations.” “This is not a trial but a fixed match outcome of which was predetermined,” he added. Echoing those comments, his party PTI noted that “there can be no more ridiculous case than the cipher.” “What can be more ridiculous than that Pakistan has imprisoned its prime minister and foreign minister for exposing the foreign conspiracy!” Khan, a former professional cricket player who became prime minister in 2018, was ousted in 2022 in a non-confidence vote. The opposition accused him of poor governance, as well as of mismanaging the economy and foreign policy. At the time, he claimed that he had been toppled as a result of a US conspiracy.

The controversy around the politician did not end there, however, with Khan becoming a target of dozens of cases, sparking mass street protests organized by his supporters, which resulted in dozens of casualties. In August 2023, the politician was sentenced to a three-year jail sentence on charges related to what prosecutors argued was an attempt to conceal receiving state gifts while Khan was serving as PM. The country’s judiciary, however, later suspended the sentence, granting him bail. Khan still remained incarcerated on other charges.

And one day later, there’s more…

• Imran Khan Sentenced To 14-year New Jail Term (RT)

Former Pakistani Prime Minister Imran Khan and his wife have been sentenced to 14 years in prison in a corruption case. This comes after another court ruling in which Khan was given ten years for leaking state secrets. The politician and his wife, Bushra Bibi, were sentenced by a Pakistani accountability court on Wednesday in the city of Rawalpindi, not far from the capital, Islamabad. Both were charged with the illegal sale of state gifts while Khan was prime minister from 2018 to 2022. In addition to the sentence, the two have been barred from running for public office for ten years and fined $2.7 million.

This comes after Khan was sentenced to ten years on Tuesday for leaking state secrets. The charges are related to a cipher, a classified cable that was sent to Islamabad by the Pakistani ambassador to Washington in 2022, which allegedly suggested that the US wanted Khan ousted over his neutrality in the Ukraine conflict. Commenting on the verdict, Khan’s Pakistan Tehreek-e-Insaf party (PTI) denounced what it called the “complete destruction of every existing law in Pakistan in two days.” “Imran Khan and Bushra Bibi have faced yet another kangaroo trial in which no right to defense was given to both. Like cipher, this case has no basis to stand in any higher court.”

Both sentences come ahead of parliamentary elections scheduled for February 8. The PTI said the “atrocities against [Khan] will be avenged by the power of the vote.” Khan, a former cricketer-turned-politician, was ousted in a no-confidence vote in 2022, with the opposition accusing him of mismanaging the economy and foreign policy. Khan claims that he was overthrown as a result of a US conspiracy. Since then, the former leader has fought dozens of legal battles. Islamabad’s attempts to prosecute him sparked massive public unrest with numerous casualties.

In the earliest days of space exploration, most calculations for early space missions were done by “human computers,” and most of these computers were women. These calculations helped the U.S. launch its first satellite, Explorer 1, 65 years ago #Today.

Stonehenge

How the ancient Stonehenge works with the sun and seasons pic.twitter.com/HJy2h1BCBE

— Historic Vids (@historyinmemes) January 30, 2024

Paris

https://twitter.com/i/status/1752419193520115948

Big baby

Big baby 🐯 pic.twitter.com/Pb7dMH6Qlc

— Nature is Amazing ☘️ (@AMAZlNGNATURE) January 30, 2024

Hummingbird

Helping a thirsty hummingbird on a hot day

pic.twitter.com/EOk7A7sn9F— Science girl (@gunsnrosesgirl3) January 30, 2024

Baby elephant

https://twitter.com/i/status/1752315809270206564

Baby Elephant taking a bath in a little bath tub will make your day pic.twitter.com/I3lEnTTpl6

— Nature is Amazing ☘️ (@AMAZlNGNATURE) January 31, 2024

Finch

Colorful Gouldian finch.. 😊 pic.twitter.com/CjqYiVrkvc

— Buitengebieden (@buitengebieden) January 30, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.