René Magritte Golconda 1953

“It’s barely a correction, technically speaking..”

• 438 Stocks on the NYSE Plunged 40%-94% from 52-Week Highs (WS)

It’s barely a correction, technically speaking, with the S&P 500 down 9.9% from its all-time closing high, the Dow down 9.2%, the Nasdaq down 14%, and the Russell 2000 small-caps index down 15%. But beneath the surface, there has been some serious bloodletting for many stocks. For example, 438 stocks among the 2,051 or so stocks traded on the New York Stock Exchange (NYSE) have plunged between 40% and 94% from their 52-week highs. This does not include any stocks traded on the Nasdaq. They have their own blacklist.

Those 438 plungers on the NYSE include a bunch of foreign companies trading on the NYSE (some are trading as ADRs). They include lots of companies in the oil-and-gas sector, homebuilders, gold miners, retailers, aluminum and steel makers, a weed company (other NYSE-listed weed companies are only down 30% to 40% and didn’t make this blacklist), financial services firms and banks, including some of the biggest in the world. Here is a brief rundown. Below is the complete list. Note that some of these stocks – such as GE, which is also on this blacklist – have plunged far more from their all-time highs established in prior years.

Tempting to bring up Lehman, but if anything it’s starting to feel like Lehman cubed.

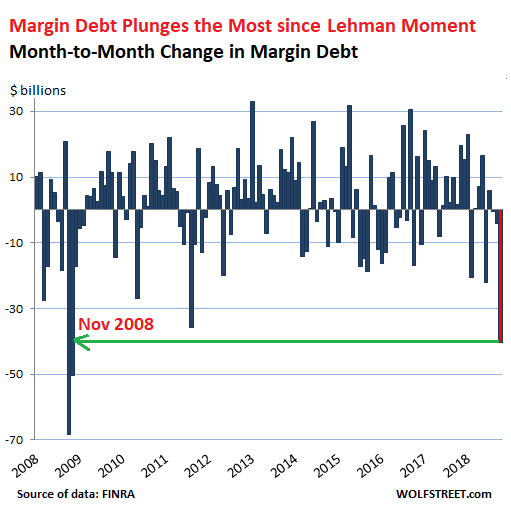

• Margin Debt Plunges, Next Up: Margin Calls (WS)

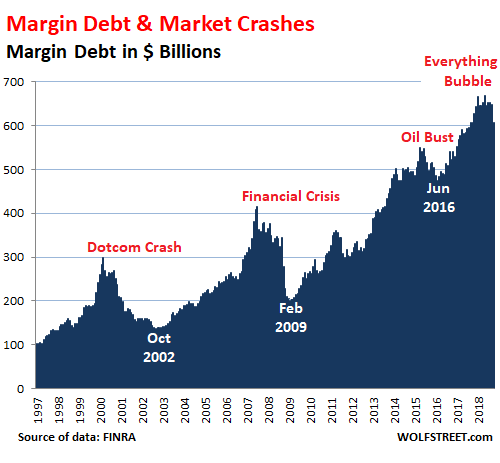

There are many ways to use leverage to fund stock holdings, including credit card loans, HELOCs, loans at the institutional level, loans by companies to its executives to buy the company’s shares, or the super-hot category of SBLs, where brokers lend to their clients. None of them are reported on an overall basis. The only form of stock market leverage that is reported monthly is “margin debt” – the amount individual and institutional investors borrow from their brokers against their portfolios. Margin debt is subject to well-rehearsed margin calls. And apparently, they have kicked off. In the ugliest stock-market October anyone can remember, margin debt plunged by $40.5 billion, FINRA (Financial Industry Regulatory Authority) reported this morning – the biggest plunge since November 2008, weeks after Lehman Brothers had filed for bankruptcy:

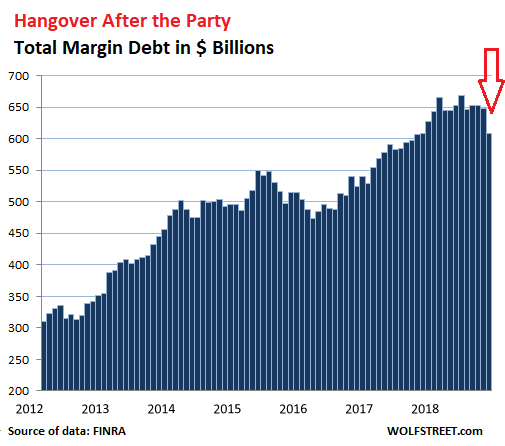

During the stock market boom since the Financial Crisis, this measure of margin debt has surged from high to high, reaching a peak in May 2018 of $669 billion, up 60% from the pre-Financial Crisis peak in July 2007, and up 117% since January 2012. Since the peak in May, margin debt has dropped by $62 billion (-9.2%). Note the $40.5-billion plunge in October:

In the two-decade scheme of things, the relationship between stock market surges and crashes and margin debt becomes obvious. Back during the dot-com bubble, dot-com stocks, traded mostly on the Nasdaq, included what today are booming survivors like Amazon, barely hangers-on like RealNetworks, or goners like eToys. At the time, these stocks soared by stunning amounts, and people, such as myself, used margin debt, to enhance their returns. When stocks plunged, the margin calls came, and these people had to sell their holdings into an illiquid and plunging market. They ended up selling their best and most liquid stuff first and watched their trash get trashed further. When it was over by October 2002, the Nasdaq had plunged 78%. Over the same period, margin debt plunged 54%.

“..who will purchase the roughly €275 billion of government securities Italy is forecast to issue in 2019?”

• QE Created Dangerous Financial Dependence, Italy Hooked, Withdrawal Next (DQ)

The Bank of Italy, on behalf of the ECB, has bought up more than €360 billion of multiyear treasury bonds (BTPs) since the QE program was first launched in March 2015. In fact, the ECB is now virtually the only significant net buyer of Italian bonds left standing. This raises a key question, Nowotny said: With the ECB scheduled to exit the bond market in roughly six weeks time, “who will purchase the roughly €275 billion of government securities Italy is forecast to issue in 2019?”

With foreigners shedding a net €69 billion of Italian government bonds since May, when the right-wing League and anti-establishment 5-Star Movement took the reins of government, and Italian banks in no financial position to expand their already bloated holdings, it is indeed an important question (and one we’ve been asking for well over a year). According to former Irish central bank governor and ex-member of the ECB’s Governing Council Patrick Honohan, speaking at an event in London, when the ECB’s support is removed, “the yield on Italian government bonds will be much more vulnerable.”

[..] Perhaps the biggest risk the ECB runs in this latest escalation of tensions with Italy’s populist government is in reminding investors just how much governments in the Eurozone have come to depend on the ECB’s QE program. But it’s not just Italian bonds that are hooked on QE. In the past three years the ECB has spent €512 billion gobbling up German bonds (current 10-year yield: 0.35%); €416 billion on French bonds (10-year yield: 0.76%); €256 billion on Spanish bonds (1.62%); €114 billion on Dutch bonds (0.52%); €72 billion on Belgian bonds (0.83%); €57 billion on Austrian bonds (0.61%), and €36 billion on Portuguese bonds (1.98%).

So far, crypto fails to replace whatever it is that is failing.

• Bitcoin Price Crash Causes Bankruptcy And Mass Mine Closures (Ind.)

Bitcoin mining operations in the US and China are facing closures after the plummeting price of bitcoin means they may no longer be profitable. The world’s most valuable cryptocurrency is currently trading at around $4,500, having lost almost a third of its value in the space of a week. Bitcoin mining – the process of generating new units of the cryptocurrency by solving complex puzzles – requires vast amounts of electricity to power the computers performing the calculations. This means that the profitability of mining falls when bitcoin’s price drops, and if the price falls too far then operations may no longer be economically viable.

The biggest casualty so far may be the US-based mining firm Giga Watt, which was forced to file for Chapter 11 bankruptcy this week after it was unable to pay debts of around $7 million. “The corporation is insolvent and unable to pay its debts when due,” the filing stated, according to CoinDesk. The majority of bitcoin mining operations are based in China, where electricity costs are some of the lowest in the world. Yet despite the cheap electricity, images and videos of mining operations shutting down in the country have been spreading across social media. Hong Kong-based mining platform Suanlitou announced this week that it was unable to cover electricity fees for a 10-day period in November, according to the South China Morning Post.

This is Theresa May’s prime achievement, and it’s hard to see why nobody calls her on it. The application of austerity and the Hostile Environment on Britain is her baby.

• UK’s Poorest Dying Nearly 10 Years Younger Than Rich (Ind.)

The poorest groups in society are dying almost a decade earlier than the richest, new research shows, prompting concern that welfare cuts and a rising cost of living are leaving the most vulnerable “out of the collective gain”. The study by academics at Imperial College London revealed the life expectancy gap between the most affluent and most deprived sections of society increased from six years in 2001 to eight years in 2016 for women, and from nine to 10 years for men. Women in the most deprived communities in 2016 lived until an average 79 years old, compared with 87 years in the most affluent group, while for men, the life expectancy was 74 years among the poorest, compared with 84 years among the richest.

The findings, published in the journal Lancet Public Health, also reveals that the life expectancy of England’s poorest women has fallen in the last seven years – having dropped by three months since 2011. Child mortality rates were also considerably higher among deprived communities, with poorer children two-and-a-half times more likely to die before they reach adulthood than their peers from affluent families. The findings show that people in the poorest sectors died at a higher rate from all illnesses – but that a number of diseases showed a particularly stark difference between rich and poor, notably respiratory diseases, heart disease, lung and digestive cancers and dementias.

One step up and two steps back every step of the way.

• MPs Unite To Condemn May’s ‘Blindfold Brexit’ (Ind.)

MPs of all parties accused Theresa May of delivering a “blindfold Brexit” after she admitted her deal left the public in the dark on a range of vital questions about Britain’s future. Decisions about future trade, the Irish border backstop, fisheries and whether the UK will remain tied to EU rules until after the next general election have all been shelved, a 26-page “political declaration” struck with the EU revealed. The admission came as the deal still looked doomed to defeat in a landmark vote next month – as both pro- and anti-EU Tories attacked it during feisty Commons exchanges in which few supporters spoke up.

Significantly, two leading Brexiteers praised by Ms May for working with her on the document – Iain Duncan Smith and Owen Paterson – said they could not back it unless the backstop was stripped out. More than 80 Tories have criticised the package, pointing to a heavy defeat and a constitutional crisis, unless most can be talked around in the next few weeks of frantic arm-twisting.

Merkel is a disaster “..but we’re going to miss her because whatever comes next will be worse.“

• Yanis Varoufakis: “The EU Declared War And Theresa May Played Along” (NS)

In 2016, shortly before the EU referendum, Yanis Varoufakis warned that the UK was destined for a “Hotel California Brexit”: it could check out but it could never leave. The former Greek finance minister spoke from experience. In 2015, his efforts to end austerity – “fiscal waterboarding” – were thwarted by the EU. Theresa May’s draft Brexit deal confirmed Varoufakis’s prophecy: the UK would be condemned to purgatory. With fortuitous timing, on the evening that May’s agreement was published, Varoufakis delivered an Oxford Union lecture on Europe’s future. The 57-year-old Marxist and game theorist wryly remarked that Conservative cabinet ministers praised his analysis in private.

“The UK should never have entered the negotiations,” he told me when we met afterwards. “You do not negotiate with the EU because the EU does not negotiate with you. It sends a bureaucrat, in this case it was Mr Barnier…they could have sent an android, or an algorithm.” May’s fatal error, Varoufakis said, was to accept a two-phase negotiation: a divorce agreement followed by a new trade deal. “This was a declaration of war because Barnier said: ‘You will give us everything we want: money, people, Ireland. And only then will we discuss what you want.’ Well, that isn’t a negotiation, that’s a travesty. And Theresa May agreed to play along.” But Varoufakis, who helped persuade Jeremy Corbyn to support Remain in 2016, has little sympathy for the “People’s Vote” movement.

“It’s offensive. What was the first vote? Wasn’t it a people’s vote? To call it a people’s vote is to try and delegitimise the original vote – to say it was dictatorial, it was rigged.” He added: “You have to explain two things: first, how are you going to get the referendum completed before the Article 50 period is over? Secondly, how can you have a binary choice between five or six options? Explain those things and I’m with you.” [..] I asked Varoufakis how he viewed the liberal adulation of [Angela Merkel]. “I’m a dialectician: she has been a disaster and we’re going to miss her. She is a disaster because she squandered immense political capital that could have been used to reshape Europe. But we’re going to miss her because whatever comes next will be worse.”

“Punishments [..] are also believed to include slowing internet speeds, reducing access to good schools for individuals or their children, banning people from certain jobs, preventing booking at certain hotels and losing the right to own pets.”

• China Bans Millions From Flights As ‘Social Credit’ System Introduced (Ind.)

Millions of Chinese nationals have been blocked from booking flights or trains as Beijing seeks to implement its controversial “social credit” system, which allows the government to closely monitor and judge each of its 1.3 billion citizens based on their behaviour and activity. The system, to be rolled out by 2020, aims to make it “difficult to move” for those deemed “untrustworthy”, according to a detailed plan published by the government this week. It will be used to reward or punish people and organisations for “trustworthiness” across a range of measures. A key part of the plan not only involves blacklisting people with low social credibility scores, but also “publicly disclosing the records of enterprises and individuals’ untrustworthiness on a regular basis”.

The plan stated: “We will improve the credit blacklist system, publicly disclose the records of enterprises and individuals’ untrustworthiness on a regular basis, and form a pattern of distrust and punishment.” For those deemed untrustworthy, “everywhere is limited, and it is difficult to move, so that those who violate the law and lose the trust will pay a heavy price.” The credit system is already being rolled out in some areas and in recent months the Chinese state has blocked millions of people from booking flights and high-speed trains. According to the state-run news outlet Global Times, as of May this year, the government had blocked 11.14 million people from flights and 4.25 million from taking high-speed train trips.

[..] People are awarded credit points for activities such as undertaking volunteer work and giving blood donations while those who violate traffic laws and charge “under-the-table” fees are punished. Other infractions reportedly include smoking in non-smoking zones, buying too many video games and posting fake news online. Punishments are not clearly detailed in the government plan, but beyond making travel difficult, are also believed to include slowing internet speeds, reducing access to good schools for individuals or their children, banning people from certain jobs, preventing booking at certain hotels and losing the right to own pets.

Admit it or not, but it’s a very small step from China to Google.

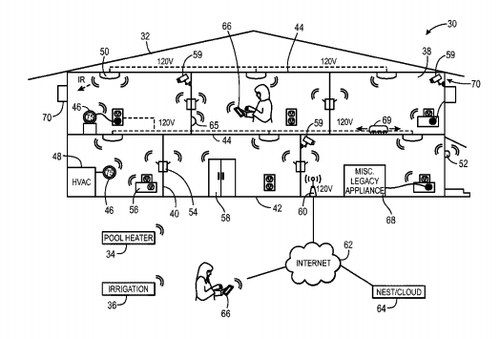

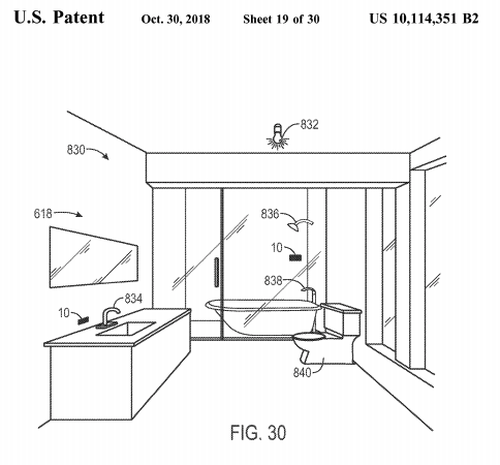

• Google Wants To Data Mine Your Home And Kids’ Bedroom (ZH)

New patents show Google is quietly developing a smart-home automated system that will routinely eavesdrop on your daily life. The patents describe how cameras and sensors will be mounted in almost every room of the house, scanning and analyzing every movement a human makes. According to the patent description, the smart cameras could recognize Will Smith’s face on a T-shirt. After cross-referencing this data against the human’s browser history, the smart-home might announce or send them a message, “You seem to like Will Smith. His new movie is playing in a theater near you.”

By blending that with an in-depth analysis of other electronic devices in the home, and audio signatures to determine gender, Google will have enough data to create a corporate profile on the human and even their family. The system will then calculate “fashion tastes” by scanning the human’s outfit, and could even determine their income or social class based on any “expensive mechanical and/or electronic devices” it detects. Even creepier, the smart-home will track audio signatures too, could be used to identify users, but also determine gender and age. With a treasure trove of data mined from every room of the home, the smart-home will then tell the human what to watch, what to eat, where to go, and what to buy.

If this all seems invasive, it is essential to understand that tech companies are already data mining you, it just happens to be online: “Google and Facebook both record and analyze user behavior, use it to sort people into categories, and then target them with ads and other content. Facebook likely knows your race and religion, while Google uses your emails and search history to sort you into ad-ready brackets. Netflix infers all types of data on users based on what they watch, then serves back hyper-specific movie and TV categories. This patent simply expands the areas in which your behavior is already mined and recorded from your phone and laptop to your bedroom,” wrote The Atlantic.

“Washington didn’t intend Thanksgiving to be a day for offering up glib platitudes that require no thought, no effort and no sacrifice.”

• How Do You Give Thanks For Freedoms That Are Constantly Being Eroded? (RI)

Listen: I know it’s been a hard, heart-wrenching, stomach-churning kind of year. It’s been a year of hotheads and blowhards and killing sprees and bloodshed and takedowns. It’s been a year in which tyranny took a few more steps forward and freedom got knocked down a few more notches. It’s been a year with an abundance of bad news and a shortage of good news. It’s been a year of too much hate and too little kindness. It’s been a year in which politics and profit margins took precedence over decency, compassion and human-kindness. We’ve been operating in this soul-sucking, topsy-turvy, inside-out, upside-down state for so long that it’s hard not to be overwhelmed by all that is wrong in the world in order to reflect and give thanks for what is good.

And now we find ourselves at this present moment, more than 200 years after George Washington issued the first Thanksgiving proclamation as a time to give thanks for a government whose purpose was to ensure the safety and happiness of its people and for a Constitution designed to safeguard civil and religious liberty. But how do you give thanks for freedoms that are constantly being eroded? How do you express gratitude for one’s safety when the perils posed by the American police state grow more treacherous by the day? How do you come together as a nation in thanksgiving when the powers-that-be continue to polarize and divide us into warring factions?

Washington didn’t intend Thanksgiving to be a day for offering up glib platitudes that require no thought, no effort and no sacrifice. He wanted it to be a day of contemplation, in which we frankly assessed our shortcomings, acknowledged our wrongdoings, and resolved to be a better, more peaceable nation in the year to come.

Nice new tidbits every single day. “CIA has more wiretapped phone calls at hand than the public knows about.”, “Khashoggi was barred from media appearances after criticizing Trump in late 2016..”

• CIA Holds ‘Smoking Gun Phone Call’ Of MbS On Khashoggi Murder (Hurriyet)

The CIA is in possession of a phone call recording of Saudi Crown Prince Mohammed bin Salman in which he is heard giving an instruction to “silence Jamal Khashoggi as soon as possible,” Hürriyet columnist Abdulkadir Selvi wrote on Nov. 22. According to Selvi, CIA Director Gina Haspel “signalled” during her trip to Ankara last month the existence of the wiretapped phone call between Crown Prince Mohammed and his brother Khaled bin Salman, who is Saudi Arabia’s ambassador to the United States. Citing unidentified sources, the Turkish columnist wrote that the two Saudi officials are heard in the CIA recording discussing the “discomfort” created by Khashoggi’s public criticism of the kingdom’s administration.

[..] “It is said that the crown prince gave an instruction to silence Jamal Khashoggi as soon as possible and this instruction was captured during the CIA wiretapping. The subsequent murder is the ultimate confirmation of this instruction,” Selvi added, stressing that an international investigation into the murder, if opened, “can reveal more jaw-dropping evidence, as CIA has more wiretapped phone calls at hand than the public knows about.” [..] Trump declared on Nov. 20 that he will not further punish Saudi Arabia for the murder, making clear in an exclamation-filled statement that the benefits of good relations with the kingdom outweigh the possibility its crown prince ordered the killing. Khashoggi was barred from media appearances after criticizing Trump in late 2016, according to the U.S. State Department.

There may not be enough time before the new Congress is sworn in. It may become up to the Senate.

• Comey, Loretta Lynch Subpoenaed To Testify Before Congress (AFP)

Former FBI director James Comey and former attorney general Loretta Lynch have been subpoenaed to testify before Congress next month before Republicans relinquish control of the House, documents showed Thursday. Comey confirmed he had received a subpoena from the House Judiciary Committee but said he would resist if made to answer questions behind closed doors. “I’m still happy to sit in the light and answer all questions,” he said on his Twitter account. “But I will resist a ‘closed door’ thing because I’ve seen enough of their selective leaking and distortion. Let’s have a hearing and invite everyone to see.”

Lynch, who served under former president Barack Obama, did not immediately comment, but copies of the subpoenas made public Thursday show she was summoned to testify on December 4. Comey was ordered to appear before the committee on December 3. US President Donald Trump has repeatedly accused Comey and Lynch of covering for Hillary Clinton in an investigation into her use of a private server for emails while she was secretary of state. He has often leveled charges of bias in countering a probe by Special Counsel Robert Mueller into whether the Trump campaign colluded with a Russian effort to sway the 2016 elections in the Republican’s favor.

This is not just revisionist hypocrisy, this is Orwell.

• Hillary Clinton: Europe Must Curb Immigration To Stop Rightwing Populists (G.)

Europe must get a handle on immigration to combat a growing threat from rightwing populists, Hillary Clinton has said, calling on the continent’s leaders to send out a stronger signal showing they are “not going to be able to continue to provide refuge and support”. In an interview with the Guardian, the former Democratic presidential candidate praised the generosity shown by the German chancellor, Angela Merkel, but suggested immigration was inflaming voters and contributed to the election of Donald Trump and Britain’s vote to leave the EU. “I think Europe needs to get a handle on migration because that is what lit the flame,” Clinton said, speaking as part of a series of interviews with senior centrist political figures about the rise of populists, particularly on the right, in Europe and the Americas.

“I admire the very generous and compassionate approaches that were taken particularly by leaders like Angela Merkel, but I think it is fair to say Europe has done its part, and must send a very clear message – ‘we are not going to be able to continue provide refuge and support’ – because if we don’t deal with the migration issue it will continue to roil the body politic.” [..] “The use of immigrants as a political device and as a symbol of government gone wrong, of attacks on one’s heritage, one’s identity, one’s national unity has been very much exploited by the current administration here,” she said.

“There are solutions to migration that do not require clamping down on the press, on your political opponents and trying to suborn the judiciary, or seeking financial and political help from Russia to support your political parties and movements.” Brexit, described by Clinton as the biggest act of national economic self-harm in modern history, “was largely about immigration”, she said.

There are many more in this list, the former left sold out everywhere.

We came, we saw, we became irrelevant.

And Hillary is still entirely clueless about Trump’s appeal.

• Clinton, Blair, Renzi: Why We Lost, And How To Fight Back (G.)

Hillary Clinton, Tony Blair, Matteo Renzi: three of rightwing populism’s greatest scalps. Clinton admits she was left dumbfounded by her 2016 election defeat at the hands of Donald Trump. Renzi’s centre-left party was defeated this year after a surge in the anti-establishment vote in Italy, a country he calls “the incubator” of populism. Blair may not have lost at the ballot box, but his legacy, particularly on Europe, was upended in the Brexit referendum. All three are shunned by sections of their own party that accuse them of being responsible for the failure of the centre-left to offer a sufficiently radical alternative.

But all three are still thinking deeply about rightwing populism – its causes and the threat it poses – the mistakes of the centre left, including their own, and how modern politics appears to be mobilising resentment towards a perceived elite. [..] All three interviewees argue that one significant problem for mainstream politicians is that detailed, reasoned arguments stand little chance against the antics of the populist, whose simplified, amplified rhetoric is apt to drown out costed healthcare programmes or earnest paeans to liberal values. And politicians are no longer held to their promises. “The press does not know how to cover these candidates who are setting themselves on fire every day, who are masters of diversion and distraction,” Clinton said. “That is new.

“I always believed in the [2016 US presidential] campaign … the moderators would ask the hard questions, they would force us to respond and they would draw out the differences. That never happened. Because the guy I was running against is a master at just waving his hands and tweeting and insulting, and dominating the news cycles.”

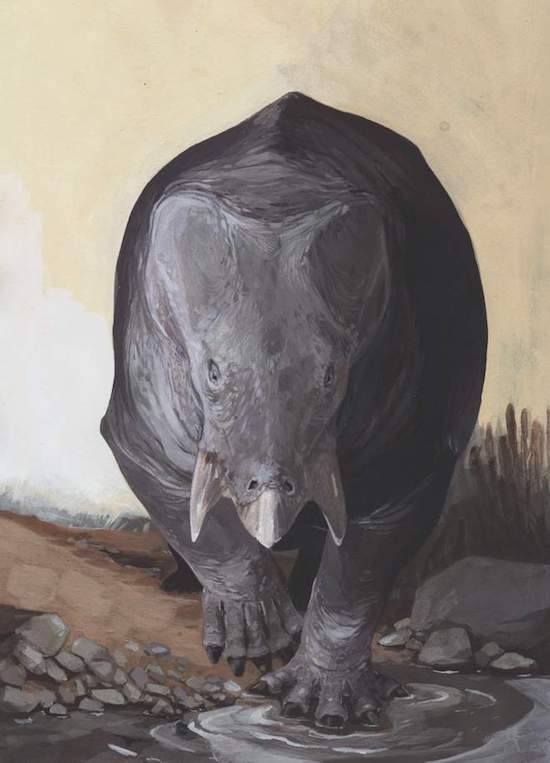

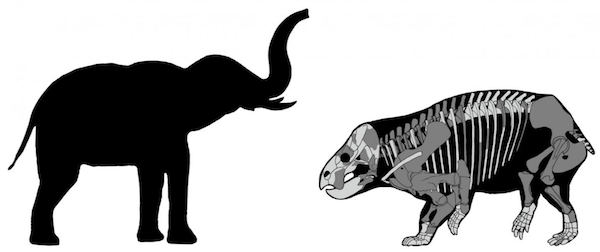

Mammals lost out for about 150 million years, came back only when the dinosaurs were wiped out. Mammals would need to rule for another 100 million years or so to match the dinosaur rule.

• Elephant-Sized Mammal Cousin Lived Alongside Dinosaurs (R.)

A stoutly built mammal cousin the size of an elephant that munched on plants with its horny beak roamed the European landscape alongside dinosaurs during the Triassic Period about 205 million to 210 million years ago, scientists said on Thursday. Scientists announced the surprising discovery in Poland of fossils of a four-legged beast called Lisowicia bojani that demonstrated that dinosaurs were not the only behemoths on Earth at that time and that the group of mammal-like reptiles to which Lisowicia belonged, called dicynodonts, did not die out as long ago as previously believed. “We think it’s one of the most unexpected fossil discoveries from the Triassic of Europe,” said paleontologist Grzegorz Niedzwiedzki of Uppsala University in Sweden.

A comparison of the Lisowicia bojani with a recent elephant. Tomasz Sulej and Grzegorz Niedzwiedzki/Handout via REUTERS

Lisowicia, the largest-known non-dinosaur land animal alive at its time, was about 15 feet (4.5 meters) long, 8.5 feet (2.6 meters) tall and weighed 9 tons. The only other giants around at the time were early members of the dinosaur group called sauropods that had four legs, long necks and long tails. “The Lisowicia skull and jaws were highly specialized: toothless and the mouth was equipped with a horny beak, as in turtles and horned dinosaurs,” Niedzwiedzki said, adding that it was unclear whether it had tusks as some of its relatives did. The Triassic was the opening chapter in the age of dinosaurs, followed by the Jurassic and Cretaceous periods. The first dinosaurs appeared roughly 230 million years ago. Many of the earliest dinosaurs were modest in size, overshadowed by big land reptiles including fearsome predators called rauisuchians and crocodile-like phytosaurs.