NPC “.. the hearty cereal beverage with flavor and tang, Altemus-Hibble truck” 1920

As I said a hundred times: it’s no use talking about China’s economy without including the shadow banks.

• China Faces $15 Trillion Bombshell As Shadow Banking Sector Collapses (ZH)

We’ve spent more time than most documenting China’s wealth management product problem. WMPs are part and parcel of Beijing’s sprawling shadow banking complex which, until 2014 that is, helped pump trillions of yuan into China’s economy and shouldered the burden when it came to propping up the most important economy on the planet. But WMPs are dangerous. In fact, we flagged them as an 8 trillion black swan back in August on the way to asking what would happen if China’s shadow banking sector were to collapse altogether. This is space that’s running what amounts to an enormous maturity mismatched fraud. Of course this describes the entire fractional reserve banking system, but in the case of China’s WMPs, it’s all on the verge of implosion.

Don’t believe us? Just ask anyone who bought into products sold by Fanya Metals’ Shan Jiuliang. This is a very real threat to the Chinese banking sector. The multifarious nature of the space’s liabilities makes it virtually impossible for anyone to assess what the embedded risks are. As we first documented last summer, some 40% of credit risk is carried off balance sheet and that figure might well have grown recently, especially considering mid-tier bank’s propensity to extend new credit through new cateogries of channel loans that are classified as “investments” and “receivables” In any event, China is desperate to revive the credit impulse and that means keeping the shadow banking space alive. Here’s BofA with more on China’s ticking WMP time bomb:

• Growth rate accelerated. By the end of 2015, WMP balance reached Rmb23.5tr, up 56.46% YoY. Astonishingly, growth rate accelerated last year compared to the year before despite a high base – in 2014, the balance grew from Rmb10.2tr to Rmb15.0tr, up 47.25% YoY. The key drivers of this accelerated growth are joint stock banks whose WMP balance rose from Rmb5.67tr to Rmb9.91tr, up 74.8% YoY; city commercial banks, Rmb1.7tr to Rmb3.07tr, up 80.6% YoY. On the other hand, the big four state-owned enterprise (SOE) banks’ balance rose by a more moderate 53.2% YoY (from Rmb6.47tr to Rmb8.67tr) while foreign banks’ balance declined by 25.6% (from Rmb0.39tr to Rmb0.29tr).

• Liquidity risk is rising. The outstanding balance of open WMPs, of which buyers can subscribe or redeem largely at will, reached Rmb10.32tr, up 96.95% YoY. They accounted for 44% of bank-run WMPs balance as of Dec 2015, up from 35% a year earlier. The increased share of open WMPs adds to the duration mismatch in the shadow banking sector and makes the system more prone to liquidity shock in our view. In 2015, banks issued Rmb158.41tr worth of WMPs, i.e., Rmb13.2tr a month on average. If WMP buyers decide to ‘go on strike’ for whatever reason, a liquidity crunch in the shadow banking sector could quickly develop in our view.

• Implicit guarantee still largely in place. Only Rmb1.37tr worth of open WMPs, representing 13% of the total, are priced based on NAV. Also, the portion of closed WMPs that are priced similarly is tiny. This means that the vast majority of WMPs are still sold with the so-called “expected return”, which is largely viewed as promised return by WMP buyers by our assessment. In 2015, only 44 WMP products, or 0.03% of matured products during the year, caused investors to lose money. This loss ratio appears unusually low in our view. It is interesting to note that most of the 44 products were sold by foreign banks.

• Individual buyers still dominant. As of Dec 2015, individual investors, including high net-worth individual investors, accounted for Rmb13.34tr WMP balance, or 56.6% of the total (institutional investors, 30.6%; inter-banks, 12.8%). They subscribed to Rmb101.49tr of the newly issued WMPs during the year, representing 64.1% of the total. Mood of individual investors are more volatile than institutions in general.

The bottom line is this: if this implodes, it will not only tank the entire Chinese banking system but the global economy as well, as the amount of liabilities here is quite frankly enormous.

Read more …

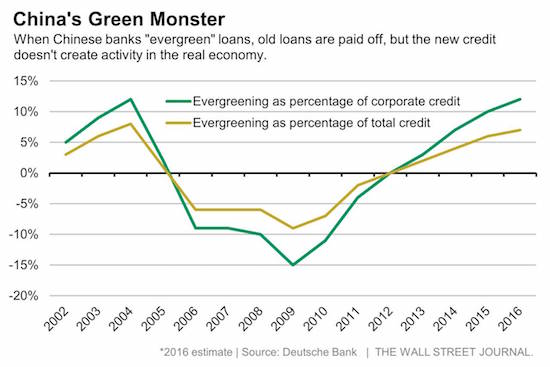

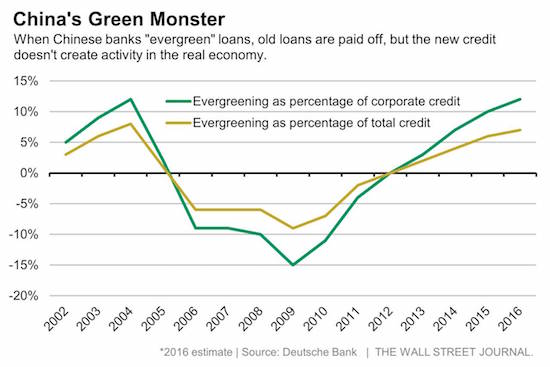

Paying off old debt with new.

• China’s Big Lending Push Comes Up Short (WSJ)

China still has room to cut, but it may not be having much effect other than hiding the economy’s pain. The People’s Bank of China waited until the Group of 20 financial bigwigs were safely out of Shanghai to resume its easing campaign Monday, cutting the reserves banks are required to hold with the central bank by half a percentage point. As moves go, it is pretty standard and expected given China’s sluggish economy. The cut follows up on what has looked like a strong start to lending this year, something that has provided a palpable sense of relief in some markets. In reality, more credit in China isn’t all that stimulative. A concerted lending boom in theory could jump-start growth as it did in 2009 in the aftermath of the global financial crisis. Iron ore prices, for instance, have rallied sharply on expectations of renewed Chinese demand.

The problem is that China has reached an inflection point. A substantial chunk of new debt is increasingly going to pay old debt, creating less activity in the real economy aside from bankers’ fees and commissions. Like a patient with a headache who has already taken aspirin, more medicine won’t dull the pain much, but it may lead to complications. A measurable effect is the so-called evergreening of credit, where lenders essentially roll loan maturities or provide credit simply to pay off old debt. Deutsche Bank measures this by estimating what’s owed each year by companies in terms of principal payments and interest expenses. It then assesses the resources to make those payments, namely operating cash flow, freshly raised equity and excess cash not earmarked for general expenses like salaries.

The result is a massive shortfall in the debt service compared with the sources of cash, to the tune of about 10% of corporate debt last year. That gap is filled with more borrowing. Five years ago, Chinese companies were generating excess cash to pay off debts, so new debt could be used to invest. The most egregious evergreeners are state-owned companies in industries with massive overcapacity issues. Coal mining and metals, for instance, account for 30% of evergreening, according to Deutsche. What could alleviate the evergreening problem? A positive step would be to allow companies in those problem sectors to enter painful restructuring. This would at least remove a source of demand for evergreening loans.

Read more …

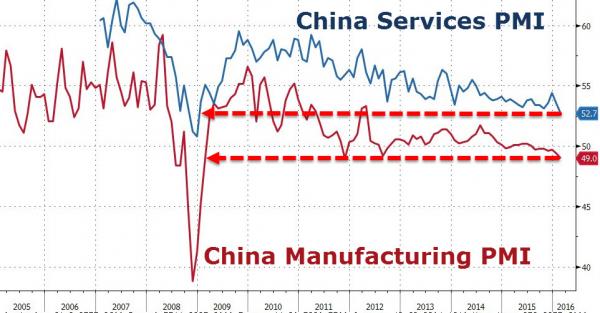

Expected by economists, that is.

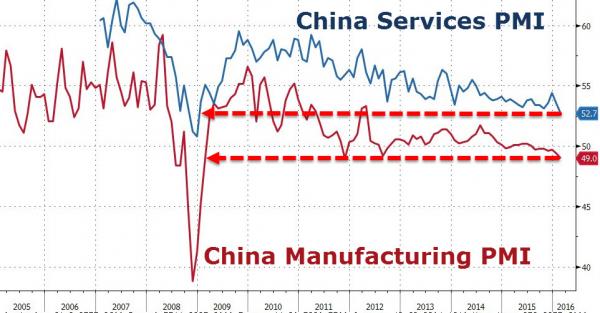

• China Factory Activity Shrinks More Than Expected (Reuters)

Activity in China’s manufacturing sector shrank more sharply than expected in February, surveys showed on Tuesday, prompting smaller companies to shed workers at the fastest pace in seven years and suggesting Beijing will have to ramp up stimulus to avoid a deeper economic slowdown. Some investors had been bracing for weak readings after the central bank unexpectedly eased policy late on Monday, injecting an estimated $100 billion worth of cash into the banking system to cushion the pain of upcoming reforms such as restructuring bloated state enterprises. The official Purchasing Managers’ Index (PMI) fell to 49.0 in February from January’s reading of 49.4 and below the 50-point mark that separates growth from contraction. Economists polled by Reuters had expected only a slight dip to 49.3.

It was the lowest reading since November 2011. “The PMI came in much weaker than markets expected, hinting that recent easing measures have had limited impact in turning around the weakening manufacturing sector,” wrote senior emerging markets economist Zhou Hao at Commerzbank in Singapore. “We think PBoC will cut policy rates by 25 basis points in the first quarter and lower RRR (banks’ reserve requirement ratio) by another 100-150 basis points this year.” The private Caixin/Markit China Manufacturing Purchasing Managers’ Index (PMI), which focuses more on small to medium- sized, private firms, showed activity contracted for a 12th straight month. It fell to 48.0, below market expectations of 48.3 and January’s reading of 48.4. [..] The official PMI survey, which tends to focus on larger, state firms, has shown persistent declines in employment for the last 3-1/2 years.

Read more …

In a system packed with bad loans, you lower the reserve requirement. Sure.

• China Attempts To Boost Economy With Cash Injection (Guardian)

China’s central bank has stepped up action to bolster its cooling economy by loosening the rules on banks’ cash reserves in the hope that they will offer cheaper loans. By cutting the reserve requirement ratio (RRR) – the amount of cash that banks must hold as reserves – the People’s Bank of China has in effect injected $100bn (£72bn) of long-term cash into the economy, experts said. The central bank hopes its cut, effective from 1 March, will boost liquidity in the financial sector, following signs that the world’s second-biggest economy is continuing to slow. The move, which came as a surprise to many investors, would stabilise the Chinese financial system, said Duncan Innes-Ker of the Economist Intelligence Unit. But it would not be enough on its own.

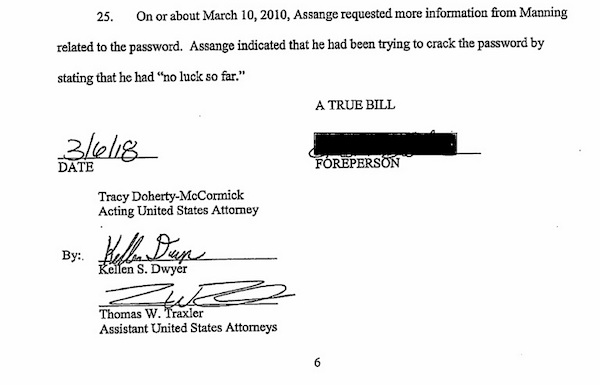

“The latest cut in the RRR shows the central bank straining to maintain loose monetary conditions in a difficult economic climate,” he said. “The move will partly offset the effects of capital outflows from China and the provisioning requirements that are forcing banks to lock up more funds as non-performing loans climb. “However, the surge in loans in January highlighted concerns that bank lending may be spiralling out of control. Ultimately, China’s economy cannot grow on credit alone. It needs further reforms to unlock productivity growth.”

Read more …

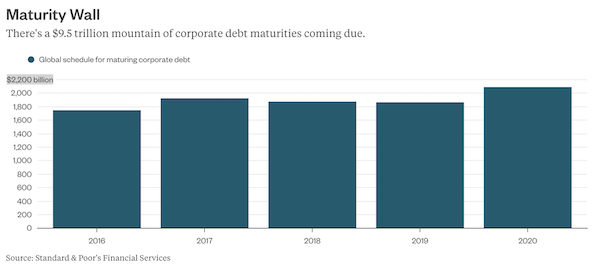

This gets ever harder to roll over.

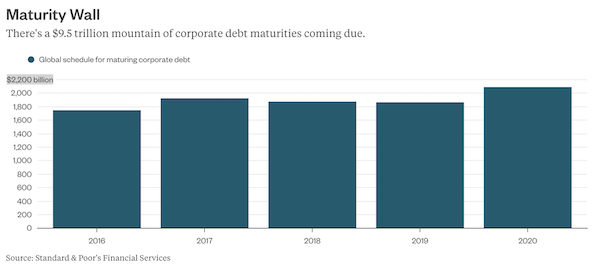

• Global Companies Face a $9.5 Trillion Debt Wall (BBG)

Companies still have a little time before they must pay down the bulk of $9.5 trillion of debt maturing in the next five years. That’s the good news. But it’s not getting any easier for these corporations to borrow, at least not in the U.S. In fact, many of these obligations are becoming harder and more expensive to repay at a time when companies face a historic pile of bonds and loans coming due. This wave of debt coming due through 2020 is bigger than previous five-year schedules of debt maturities in 2013, 2014 and 2015, according to Standard & Poor’s data. It includes about $2.3 trillion of junk-rated debt, with about $418 billion of that rated B- or lower. And it peaks in 2020, with $2.1 trillion of debt coming due, which is greater than the peaks of the most recent previous maturity walls.

U.S. companies account for $4.1 trillion of the debt coming due through 2020, while European issuers are responsible for $3.7 trillion, S&P data show. More than half of all the debt coming due belongs to nonfinancial corporations.

All this is potentially bad news for a global economy that already appears to be losing momentum, especially because central bankers seem to be running out of ways to push investors into riskier securities. The default rate has already started ticking up as the bust in commodity prices forces companies to restructure or file for bankruptcy.And it’s not just oil drillers and miners that are struggling. Solera Holdings, the subject of one of last year’s largest leveraged buyouts, is struggling to raise money in credit markets and has been forced to cut the amount of debt it plans to sell. Corus Entertainment pulled a C$300 million ($221.9 million) junk-bond offering backing a takeover because of difficult market conditions.

While the majority of debt that needs to be repaid is investment grade, it’s unclear whether it’ll remain so by the time it matures. In just eight weeks, credit investors have witnessed more fallen angels, or investment-grade companies getting downgraded to junk, than in any calendar year since 2009, Barclays analysts Jeffrey Meli and Bradley Rogoff wrote in a report on Friday.It’s not terribly surprising that companies have a bigger debt load to pay down. They borrowed trillions of dollars on the heels of unprecedented stimulus efforts started by the Federal Reserve at the end of 2008 during the worst financial crisis since the Depression. They kept piling on the leverage as central banks around the world doubled down on low-rate policies and kept purchasing assets to encourage investors to buy riskier securities.

Read more …

We’re all out of feel-good stories.

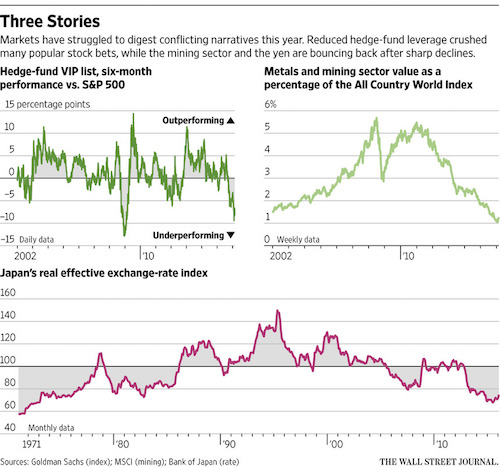

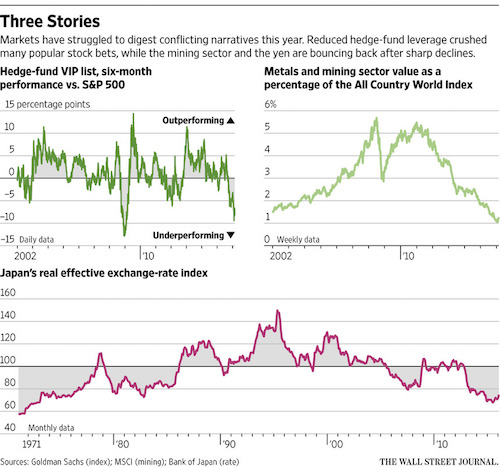

• The Worst Market of All: One Without a Story (WSJ)

Markets don’t just love a good tale, they need a good tale. There are happy stories for bulls, sad endings to cheer bears or sci-fi horrors about algorithms running wild. Investors devour them all. This year has provided too many interlocking story lines, though. Yarns have been spun about China, negative rates, tightening dollar liquidity, tumbling U.S. profits, impending recession, oil, sovereign-wealth funds, geopolitics and the rise of populist politicians. The problem is that all these plots and subplots left investors without a clear narrative to follow. No one can say what’s going on, and investors have responded by reducing the risk they take. One response: The most popular trades went into sharp reverse, with some apparently perverse outcomes.

Perhaps the best measure of the reverse is the impact on stocks popular with hedge funds. A Goldman Sachs index of the 50 U.S. shares most widely held by hedge funds just had its worst six-month underperformance since the financial crisis of 2008-09. It figures: The stocks least liked by hedge funds, as measured by another Goldman index, just recorded their best six-month relative return. Hedge funds borrow to invest, and have been reducing their debts as their managers worry about the uncertainties ahead. That means selling some of their favorite positions and closing short trades by buying back those stocks they had bet against. Selling by mutual funds and oil-fueled sovereign-wealth funds added to the pressures.

The result was a violent shift: The big winners of 2015 became losers, and the most-hated stocks and sectors are now outperformers. Few stocks back up the story of lower leverage as much as the FANGs. The four stocks which led the U.S. market and were loved by hedge funds last year were Facebook, Amazon.com, Netflix and Google. This year only Facebook has beaten the broader market, with Amazon and Netflix both down more than 17% as of Friday. Biotechnology deserves a chapter to itself: After an extraordinary run-up in prices, U.S. biotech has just had its worst six-month performance since 2002 both in absolute and relative terms. The most-hated sector in 2015 was mining. MSCI data show that by mid-January of this year, the sector’s market value had declined to a smaller percentage of global stocks since the dot-com bubble, when old-economy miners were out of fashion.

Read more …

Every bank that publishes numbers loses big.

• Barclays Shares Fall 7.5% In London After Profit Drops 56% (BBG)

Barclays Plc said it will sell down the stake in its Africa business and reorganize the company into two divisions, as fourth-quarter profit fell by more than half. The bank will sell down its 62% stake in Barclays Africa Group Ltd. over the next two to three years to a level that allows it to deconsolidate the business, according to a statement Tuesday. Adjusted pretax profit, including restructuring costs, fell 56% to £247 million ($344 million) in the quarter from £563 million in the year-earlier period, according to the filing. The moves are meant “to accelerate our strategy and simplify the group, as we prepare for regulatory ring-fencing requirements,” Chief Executive Officer Jes Staley, 59, said in the statement.

Staley is counting on his first results announcement and a revised strategy to reassure investors, who have been demanding bold moves to boost capital and returns as the bank languishes at its lowest valuation in more than three years. In addition to selling down the African stake, the CEO has moved to address the underperforming investment bank. He previously announced 1,200 job cuts, the exit from seven countries in Asia, a hiring freeze and cutting the bonus pool to trim costs. Barclays Africa Group Ltd. “is a well-diversified business and a high quality franchise,” Staley said in the statement. “However the stake in BAGL presents specific challenges to Barclays as owners, such as the level of capital held in respect of BAGL, the international reach of the U.K. bank levy” and other reasons.

Read more …

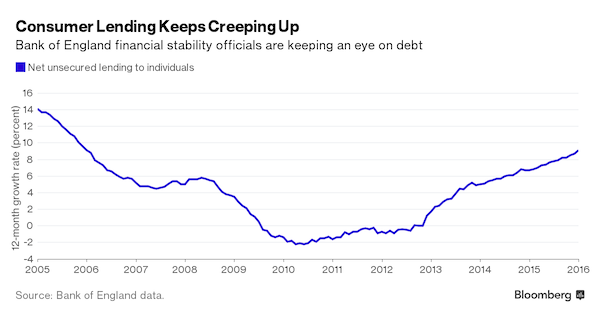

Splurging on debt.

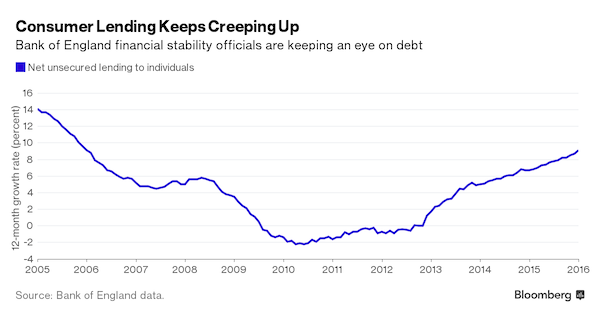

• UK Credit Card Bills a Problem Waiting to Bite (BBG)

The pace of consumer borrowing may raise a few eyebrows at the Bank of England if it keeps rising unchecked. Unsecured lending — such as on credit cards — jumped an annual 9.1% in January, the fastest in a decade, according to data on Monday. In total, consumers took out 1.6 billion pounds ($2.2 billion) more than they repaid, the second-highest since mid-2005. Back then, the country was in its 14th year of uninterrupted growth, and we’re nowhere near that now. While Mark Carney has said U.K. spending is being largely fueled by incomes, he and his fellow policy makers are still a little wary of where the borrowing numbers are going. Here’s the BOE governor earlier this month: “ They are still relatively indebted, and we want to make sure that, the collective, we do not repeat the mistakes of the past of getting too indebted and then getting shocked – shocked – by movements on rates.”

With record employment and cheap money encouraging borrowing — the average rate on a new unsecured loan is at a three-year low — that’s good for Britain’s economy at a time of deepening troubles in the world economy and questions over business investment in the run-up to the European Union referendum. But it means the foundations of the expansion are not as solid as they could be. “While the rapid growth in unsecured lending will support growth in the near term by propping up consumer spending, it could pose a risk to financial stability further down the line,” said Niraj Shah, an economist at Bloomberg Intelligence in London.

Read more …

Where was Lord King when it mattered?

• Alchemy Should Be Squeezed Out Of The World’s Banking System (Mervyn King)

For centuries, alchemy has been the basis of our system of money and banking. Governments pretended that paper money could be turned into gold even when there was more of the former than the latter. Banks pretended that short-term riskless deposits could be used to finance long-term risky investments. In both cases, the alchemy is the apparent transformation of risk into safety. For much of the time the alchemy seemed to work. From time to time, however, people realised that the Emperor had far fewer clothes than the Masters of the Universe wanted us to believe. The pretence that the illiquid real assets of an economy – the factories, capital equipment, houses and offices – can suddenly be converted into money or liquidity is the essence of the alchemy of the present system.

Banks and other financial intermediaries will always try to finance illiquid assets by issuing liquid liabilities because they make profits by paying less on the latter than they earn on the former. The problem is that the liquidity promised to investors or depositors can be supplied only if at each moment a small number of people wish to convert their claim on the bank into cash. Liquidity simply disappears if everyone wishes to convert their claim into money at the same time. What may be possible for a small number of people is self-evidently impossible for the community as a whole. And the problem is made worse by the fact that if a depositor believes that others are likely to try to take their money out, it is rational for him or her to do the same and get to the front of the queue as soon as possible – a bank run.

Liquidity is, however, only one aspect of the alchemy of our present system. Risk, and its impact on the solvency of banks, is the other. And in the recent crisis, concern about solvency was the main driver of the liquidity problems facing banks. When creditors started to worry that bank equity was insufficient to absorb potential losses, they decided that it was better to get out while the going was good. Concerns about solvency, especially in a world of radical uncertainty, generate bank runs. To reduce or eliminate alchemy, we need a joint set of measures to deal with both solvency and liquidity problems.

Read more …

“The European Commission is, after all, a branch of corporate power.”

• We Are Being Led By Imbeciles (Bill Mitchell)

I was reading John Maynard Keynes recently – circa 1928 – that is, 8 years before the publication of the General Theory with his Treatise on Money intervening. He was railing against the principles and practice of ‘sound finance’, which he noted had deliberately caused billions of pounds in lost income for the British economy. He urged the Treasury and the Bank of England to abandon their conservative (austerity) approach to the economy and, instead, embark on wide-scale fiscal stimulus to create jobs and prosperity. He concluded that with thousands of workers idling away in mass unemployment that it was “utterly imbecile to say that we cannot afford” to stimulate employment via large-scale public works – building infrastructure etc. He considered the policy makers who opposed such options were caught up in “the delirium of mental confusion”. The stark reality is that 88 years later, he could have written exactly the same article and would have been ‘right on the money’. We are being led (euphemism) by imbeciles.

Earlier this month (February 12, 2016), Eurostat told us that – Industrial production down by 1.0% in both euro area and EU28. The report said that: “…In December 2015 compared with November 2015, seasonally adjusted industrial production fell by 1.0% in both the euro area (EA19) and the EU28 … In November 2015 industrial production fell by 0.5% in both zones … Among Member States for which data are available, the largest decreases in industrial production were registered in the Netherlands (-9.4%), Estonia (-8.8%) and Germany (-2.3%) …” Which means that the overall monetary union is back in recession if industrial production is considered.

The other point to note is that the dominant neo-liberal narrative in Europe (and elsewhere) in relation to the ongoing consequences of the GFC focuses on individual nation failings – such as, lack of competitiveness, excessive wage rates, excessive regulation, etc – and the need for so-called ‘internal devaluation’ as a way of restoring ‘competitiveness’ and structural reform aimed at boosting productivity. The problem with this narrative is that it is hard to maintain when industrial production is falling across a number of nations including Germany and the Netherlands, which are meant to be competitive leaders in the Eurozone. The structural ‘reform’ agenda seems very transparent when confronted with this type of reality. Its aim is to redistribute national income in favour of capital and force workers to labour longer and harder for less reward. The European Commission is, after all, a branch of corporate power.

On July 31, 1928, John Maynard Keynes wrote a short article in the Evening Standard entitled – How to Organize a Wave of Prosperity. I have created a PDF version of the article because it is not easily assessable to those without expensive library subscriptions. The context was the slowdown in British industry in that year and the subsequent rise in mass unemployment. Keynes wrote: “…Moreover, the more successful the efforts which are being made to restore the margin of profits by ‘rationalisation’, the greater the likelihood – at first anyhow – of increasing unemployment. And the more successful the efforts of the Treasury, in the pursuit of so-called `Economy’, to damp down the forms of capital expansion which they control – telephones, roads, housing, etc., again the greater the certainty of increasing unemployment….” The resonance with contemporary events some 88 years later is frightening.

Read more …

They will never speak the same language. They just pretend to when it seems profitable.

• EU’s Tower of Babel May Fall While Leaders Distracted (Reuters)

It’s little wonder the European Union can’t find common solutions to Europe’s urgent problems when its main members are having such different national conversations. Like the biblical Tower of Babel, Europe’s ambitious construction is in danger of toppling because its peoples are not speaking the same political language. Tune in to Germany and the fierce debate is all about how to cope with an influx of a million migrants, whether to limit the numbers and, in some quarters, how to stop them coming. Switch to France and you’re listening to a nation that thinks it is at war, still living under a state of emergency and in shock after last November’s attacks by Islamist militants that killed 130 people in Paris. Flip to Britain and the talk is all of national sovereignty and a possible Brexit in the build-up to a June referendum that might end the country’s schizophrenic membership of the EU.

Look east to Poland and people are arguing over the new government’s moves to curb the media and the constitutional court, over who may have been a Communist informer 40 years ago, and over the perceived Russian threat to eastern Europe today. Around central Europe the discussion is about how to resist German pressure to take in a share of refugees. Turn south and the Italians and Portuguese are engrossed in domestically focused debates about how to revive economic growth despite the EU’s budgetary corset while cleaning up legacy bank problems. Spain meanwhile is preoccupied by Catalan separatism, political paralysis and the risk of a breakup of the country. When those countries’ leaders come to Brussels, they often cannot even agree what they should be discussing.

For the last two EU summits, Britain wanted the focus to be on its demands for a renegotiation of its membership terms to give Prime Minister David Cameron a “new settlement” he can sell in a June 23 referendum on whether to stay in the bloc. He secured a deal on Feb. 19, but many fellow leaders were frustrated at having to spend time on what they see as side issues and rhetorical formulations when their house is on fire. “Everyone in the room and corridors was rather irritated that here we are dealing with some rather obscure issues of child benefits indexation, while we have real problems in Syria, member states closing borders, major issues we should really be on instead of this,” a diplomat involved in the talks said.

German Chancellor Angela Merkel, fighting for her political life against domestic critics of her open door for refugees, wanted the EU to concentrate on urgent measures to secure Europe’s external borders, register migrants, send home rejected asylum seekers and share out refugees among EU states. Desperate to find a common “European solution” to the migration crisis, she has forced yet another European summit on March 7 with Turkey, days before three German regional elections in which anti-immigration rightists could make big gains.

Read more …

Lone voice.

• Canada Meets Target To Resettle 25,000 Syrian Refugees (AP)

Canada’s immigration minister said on Monday the country has reached a significant milestone with the arrival of 25,000 Syrian refugees. Immigration minister John McCallum said work continues to integrate the Syrians into the community. McCallum was at Toronto’s Pearson airport as the last two government-arranged refugee flights were arriving as part of the Liberals’ $678m (US$501m) settlement plan. The refugee resettlement program was launched in November, after prime minister Justin Trudeau came to power and promised to bring in 25,000 government-sponsored refugees by the end of 2015 amid an intense debate in the West over what to do with people fleeing violence in the Middle East. Trudeau later pushed back the date by two months.

In the United States, the Obama administration plans to take in 10,000 Syrian refugees. But several Republican governors have tried to stop the arrival of Syrian refugees in their states in the wake of the deadly attacks in Paris and California. Canada’s commitment reflects the change in government after October’s election. The previous Conservative government declined to resettle more Syrian refugees, despite the haunting image of a drowned three-year-old Syrian boy, Alan Kurdi, washed up on a Turkish beach. The boy had relatives in Canada, and the refugee crisis became a major campaign issue. McCallum previously said he hopes to bring in between 35,000 and 50,000 Syrian refuges by the end of the year.

Read more …

Insane.

• Clashes As Authorities Demolish Homes In Calais ‘Jungle’ Camp (Guardian)

Clashes between police and migrants continued into Monday evening after authorities moved in earlier in the day to dismantle parts of the refugee camp known as the Jungle. The homes of up to 200 people of the approximately 3,500 people living in the camp had been demolished by the middle of the day, according to a British refugee aid group, as smoke went up from blazes engulfing makeshift shelters. Some homes appeared to have been set alight by the heat of teargas canisters fired at crowds by riot police, said a spokeswoman for the British volunteer group Help Refugees, while some residents seem to have set others on fire in protest. Video footage from a volunteer inside the camp showed residents running away from clouds of teargas.

Reuters said police fired teargas at about 150 people and activists who threw stones, and at least three shelters were on fire. The clashes continued into the evening near a motorway heading to the port of Calais, where vehicles were blocked by migrants on the stretch of road overlooking a piece of ground which had previously been part of the camp. Strewn with debris, the port road was eventually taken back by police, who arrested one person and three members of the No Borders activist group.The work began in the early morning, with orange-vested work crews dismantling several dozen makeshift wood-and-tarpaulin shacks by hand before two diggers loaded the debris into large trucks.

Police in riot gear shielded the work, and initially there were no reports of unrest beyond a report of one British activist being arrested. Volunteer groups said the work began with officials telling residents they had an hour to leave before their home was demolished. Reacting to the demolitions, Amnesty International said that both the French and UK governments had to live up to responsibilities in relation to those who were evicted, including facilitating access to asylum proceedings in France and visas to the UK for those with family members there. “Although it’s taking place across the Channel, this is not an issue that the UK can wash its hand of,” said Amnesty International’s Europe and central Asia director, John Dalhuisen.

Read more …

More insane.

• As Europe Bickers, Macedonia Police Fire Tear Gas On Migrants (Kath.)

Police in Former Yugoslav Republic of Macedonia (FYROM) fired tear gas to disperse hundreds of migrants who stormed the border from Greece on Monday as a deeply divided Europe traded barbs over the biggest humanitarian crisis in decades. As frustrations boiled over at restrictions imposed on people moving through the Balkans, migrants trapped on the Greece-FYROM border tore down a metal gate in the barbed wire fence. A Reuters witness said FYROM police fired several rounds of tear gas into the crowd and onto a railway line where other migrants sat refusing to move, demanding to cross into the country. Greece raced to set up temporary accommodation for a build-up of thousands of migrants stranded in the country after Austria and countries along the Balkans migration route imposed restrictions on their borders, limiting the number of migrants able to cross.

Many of the migrants, fleeing war and poverty in the Middle East and North Africa, hope to reach Germany, which last year took in 1.1 million asylum seekers. There were an estimated 22,000 migrants and refugees trapped in Greece on Monday, some sleeping rough in central Athens, some in an abandoned airport and at the 2004 Olympic Games venues. Greece’s migration minister said without any outlet, that figure could rise as high as 70,000 in coming days. More than one million migrants passed through Greece last year, prompting criticism from other European nations that Athens simply waved people through. “These people do not want to stay here,” said Thodoris Dritsas, Greece’s shipping minister. “Even if we had a system in place for them to stay here permanently it wouldn’t work.”

German Chancellor Angela Merkel, facing the biggest test of her decade in power, on Sunday defended her open-door policy for migrants, rejecting any limit on the number of refugees allowed into her country despite divisions within her government over the issue. “There are many conflicting interests in Europe,” she told state broadcaster ARD. “But it is my damn duty to do everything I can so that Europe finds a collective way.” That was lacking on Monday, a week before European Union leaders were due to meet with Turkey on how it could help quell the flow of migrants from its shores. In an increasingly shrill debate, Austria’s defence minister suggested Merkel take in all those who were stranded in Greece. “The German chancellor … said that formally there is no upper limit in Germany. Then, I would invite her to take the people, who arrive in Greece now and whom she wants to take care of, directly to Germany,” Hans Peter Doskozil told Austrian’s Oe1 radio.

Read more …

Spraying tear gas on children.

• Europe’s Crisis Worsens: Refugees Face Razor Wire, Tear Gas (AP)

Pressed against coils of razor wire and shouting “Help us!,” refugees and migrants at Greece’s northern border were pushed back by Macedonian police using tear gas and stun grenades, as authorities here raced to build more camps to shield the escalating number of stranded people from winter. A top European Union official prepared to visit the region Tuesday to try and ease the crisis that produced more scenes of chaos: Syrian and Iraqi refugees and others forced their way through part of a Macedonian border fence, some clutching infants or struggling to free duffel bags caught in the razor-wire. They were met by Macedonian riot police.

Volunteer doctors said at least 22 migrants, including 12 children, were treated for breathing difficulties and cuts. Authorities in Macedonia said one policeman was injured and that dozens of special forces officers were flown in by helicopter to help quell a refugee protest. “Tragically, there seems to be more willingness among European countries to coordinate blocking borders than to provide refugees and asylum-seekers with protection and basic services,” said Giorgos Kosmopoulos, head of Amnesty International in Greece. Some 7,000 migrants, mostly from Syria, Iraq and Afghanistan, are crammed into a tiny camp at the Greek border village of Idomeni, and hundreds more are arriving daily.

The Greek army completed more temporary shelters in northern Greece over the weekend, and at the government’s request, local authorities in central Greece, opened indoor stadiums, conference centers, and hotels that have gone out of business to house migrants, while the Education Ministry called on school children to join the effort with donation drives. “Of course Greece over the next one or two months will do what it can to help these people. But it must be made clear that the burden of this crisis must be distributed in Europe,” Greek Prime Minister Alexis Tsipras said in an interview with private Star television. [..] Wolf Piccoli of advisory firm Teneo Intelligence, said the EU was making a “risky bet” with its strategy on migration. “The EU is betting on incremental steps, hoping that the backlog will deter potential migrants before tensions in Greece raise concerns over the country’s institutions,” he said.

Read more …

“..You don’t understand. I don’t have any money left. I have four children. I don’t have any other plan.”

• Most Of The Refugees Stuck In Greece Are Now Women And Children (WaPo)

In a cold drizzle, Aziza Hussein, a 30-year-old Syrian widow traveling with her four children, stood amid a surge of migrants trapped at the northern Greek border. Her way forward blocked by armed Macedonian troops, police dogs and a razor-wire fence, she stood in the middle of the chaotic scrum of refugees, clutching her 5-year-old son. “What are we going to do?” she said, shielding her eyes with a trembling hand as she cried. In recent days, European nations have moved more aggressively than ever to shut down the route used by more than a million migrants fleeing war and poverty in the Middle East and beyond. Yet even as they do, the region is confronting a new kind of migrant flow — waves of women and children.

Last year, most of the asylum seekers fleeing to Europe were men, many of them young and single. But in the past several weeks, the balance has shifted, with women and their children, as well as unaccompanied minors, now accounting for roughly 57% of asylum seekers. The surge of the vulnerable comes at the worst possible time — just as European nations are barring their doors and 25,000 refugees are suddenly trapped in near-bankrupt Greece, a country that was once merely an entry point. Refugees say the sudden exodus of women and children was sparked by a rising fear that the path to sanctuary will soon close completely. “My cousins, my neighbors, everyone told us, ‘Go now. There isn’t much time, because they will shut the door,’ ” said Hussein, who left the Syrian city of Hasakah three weeks ago in a desperate bid to make it to Germany.

“We crossed the sea,” she said, pausing to wipe away tears. “But they won’t let us through. You don’t understand. I don’t have any money left. I have four children. I don’t have any other plan.” Now, the EU’s most troubled member – Greece – is scrambling to cope with a mounting humanitarian crisis the rest of the continent has left on its doorstep. With 2,000 migrants a day still arriving in rickety boats in the Greek islands via Turkey, Greek officials are warning that the number of stranded migrants could surge to 70,000 within 30 days, turning pockets of this troubled country into sprawling refugee camps.

[..] In recent days, Macedonian authorities have begun sharply limiting the number and type of migrants allowed through — a response to the same action by Austria, Slovenia, Croatia, Serbia and other Balkan nations. Macedonian authorities on Monday resorted to tear gas, firing canisters at migrants as they tried to force their way through a section of border fence with a battering ram. Hours later, children could still be seen rubbing at irritated eyes. “We treated women and children today because of tear gas,” said Vicky Markolefa, a visibly frustrated official with Doctors Without Borders, which is running an overburdened clinic here. “Yes, that’s right. Women and children. They were choking. They had stinging eyes. They inhaled that smoke. Some of them were infants.”

Read more …