DPC Pine Street below Kearney after the great San Francisco earthquake and fire 1906

Here we go again. The WuhanCorona virus continues on its record-setting path.

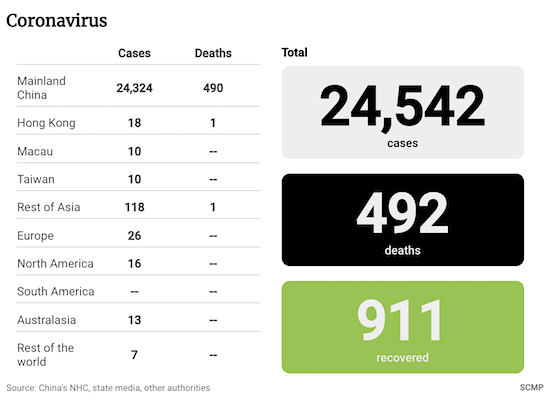

• Total cases 24,542 (+3872)

• 4,105 new cases in China (record daily high)

• 492 deaths (+65, also a record daily high)

• 185,555 cases under medical observation

Note: this pic below comes from a SCMP app that constantly updates. Numbers in articles do not necessarily. Therefore, they don’t always “add up”.

Note also the addition of recovered cases.

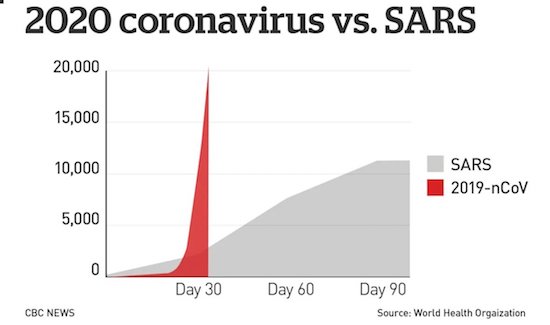

A few pics I picked up. How stark would you like it?

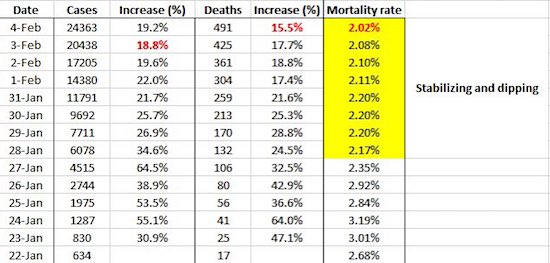

Here someone is trying to make the argument that the mortality rate is falling. That would be great, but I’m not sure it is true. Many factors have changed since the count began.

Gilead’s remdesivir looks like a Hail Mary. Not sure what the new patent application entails. A general anti-viral that came out of Ebola research?!

• China Applies For Drug Patent, Virus Death Toll +65 To 492 (SCMP)

Daily deaths caused by the new coronavirus have reached yet another record high in China, with 65 fatalities – all in Hubei province – confirmed in overnight figures released by health authorities. The newly reported fatalities took the death toll in mainland China to 490. According to data released on Wednesday morning by China’s National Health Commission (NHC), confirmed cases around the country rose by 3,887 – also a daily record high – to 24,324, the majority of which were in Hubei, the epicentre of the outbreak. Cases of the novel coronavirus in Hubei rose by 3,156 to 16,678, according to provincial figures as of midnight on Tuesday. Almost 2,000 of those new cases were confirmed in Hubei’s capital of Wuhan, where the virus is believed to have originated at a seafood and meat market.

China has applied for a new patent on an experimental drug to treat the coronavirus. Wuhan Institute of Virology said in an online notice that a patent application had been filed on January 21 for the use of remdesivir, a drug developed by biopharmaceutical company Gilead Sciences. The drug has not been approved or licensed anywhere in the world, but has been rushed into trials in China after showing signs of effective use on coronavirus patients. Chinese scientists have found remdesivir – and chloroquine, an 80-year-old malaria drug – “highly effective” in laboratory studies aimed at thwarting the coronavirus, they said in a paper published on Tuesday in the journal Cell Research.

The two drugs’ effect on humans required further clinical tests, the Wuhan institute said in the online notice. It made the patent application in the national interest and would not exercise its patent rights if foreign pharmaceutical firms worked with China to curb the contagion, it said.

The only people that can get off the ship are the ones that are confirmed infected. Hell on water.

One 80-year-old tested positive After leaving the ship. Then 273 were tested. When the first 31 results came in, 10 tested positive. That leaces 3,300 untested?

• Cruise Ship Carrying 3,700 Quarantined In Japan After 10 Test Positive (G.)

Thousands of people face spending the next fortnight stuck on a luxury cruise ship quarantined off the Japanese port of Yokohama, after initial results showed 10 passengers have tested positive for the novel coronavirus. The Diamond Princess, with more than 3,700 passengers and crew onboard, had been prevented from sailing on Monday after an 80-year-old passenger who had travelled on the vessel late last month tested positive after he arrived home in Hong Kong. Of a further 273 people on board who have since been tested following health screenings, 31 results had come back – and of those 10 were positive, according to Japan’s health minister, Katsunobu Kato. It is not clear if more tests will be carried out.

Also on Wednesday, health checks began on 1,800 passengers and crew on a second cruise ship docked in Hong Kong, after 30 staff members reported symptoms including fever, according to Reuters. Hong Kong’s health department said that 90% of the passengers were Hong Kongers and no mainland Chinese were on board. Previously, three mainland Chinese that had been on the ship between 19 and 24 January, and were found to have contracted the virus. No passengers have been able to leave the World Dream ship, operated by Dream Cruises, without permission. David Abel, a British passenger who has been on the Diamond Princess for more than two weeks, said that people were now being confined to their cabins.

“We’re not even allowed to open the cabin door to go down the corridor. They bring the food to us – it’s a knock on the door. For the first time ever the crew are masked up,” he said. [..] Two Australians are among the 10 people who have tested positive, the cruise company Carnival confirmed. The other people infected are three Japanese, three from Hong Kong, one American and one Filipino crewmember. The patients, who are reportedly aged in their 50s to their 80s, were being removed from the ship by the coast guard and taken to local hospitals. The ship’s owner, Princess Cruises, said 3,711 people were aboard the ship, consisting of 2,666 guests and 1,045 crew. About half of the passengers are from Japan, with 223 Australians on the vessel.

They’ll be stopped soon enough. There are no other options left.

• China’s Airlines Told Not To Axe Global Flights As Thousands Cut (R.)

China’s civil aviation authority has urged domestic carriers to continue flying international routes as they consider cuts in response to a drop in demand due to the coronavirus outbreak, state news agency Xinhua reported on Tuesday. Airline capacity is being axed in the world’s second largest aviation market with “the most dramatic change in schedules”, OAG Aviation Worldwide Ltd said, adding that more than 25,000 flights to, from or within China will be canceled this week. The coronavirus epidemic, which has killed more than 400 people in China, has resulted in bans or restrictions on travel to and from China imposed by countries including Singapore and Italy. The World Health Organization’s director-general, Tedros Adhanom Ghebreyesus, had said travel bans were unnecessary.

The Civil Aviation Administration of China’s appeal to the country’s airlines was reported on Xinhua’s account on Chinese messaging app Weibo. Data from aviation statistics provider VariFlight showed 41 Chinese carriers canceled nearly two-thirds of the 16,623 planned flights for Tuesday as of 10:30 a.m. Beijing time (0230 GMT). In addition, 10 regional airlines from Hong Kong and Taiwan had canceled 162 flights, while 37 airlines from other countries canceled 168 flights on the same day, VariFlight said. It also said that some 90,000 flights were canceled between Jan. 10 and Feb. 3, and that about 10,000 planned flights on average have been scrapped each day since the start of February.

But Hong Kong’s airline is not listening…

• Cathay Pacific Asks All 27,000 Employees To Take 3 Weeks Unpaid Leave (SCMP)

Cathay Pacific is asking all of its 27,000 employees to take three weeks of unpaid leave over the coming months, the company’s CEO told staff on Wednesday, as Hong Kong’s flagship carrier reels from the devastating impact of the deadly coronavirus on air travel. “I am appealing to each and everyone one of you to help,” said Augustus Tang Kin-wing in a taped video recording. “The situation now is just as grave.” On Tuesday, Hong Kong’s flagship carrier unveiled massive cuts to flying schedules, by 30 per cent worldwide for two months, including in mainland China which would see 90 per cent of its capacity cut during that period.

Grace, Nancy. It has a place. You lost your gamble, and the way you take your losses tells people a lot about you.

• Trump-Pelosi Feud Erupts During SOTU As Impeachment Trial Nears End (R.)

A bitter feud between U.S. President Donald Trump and top Democrat Nancy Pelosi boiled over at his State of the Union speech on Tuesday, with Trump denying her a handshake and Pelosi ripping apart a copy of his remarks behind his back. Trump avoided the subject of his impeachment drama in a pugnacious 80-minute speech, but the raw wounds from the battle were evident with fellow Republicans giving him standing ovations while rival Democrats for the most part remained seated. The Republican-led Senate was expected to acquit him of charges he abused his powers and obstructed Congress during a vote beginning at 4 p.m. EST on Wednesday.

How some Republicans watched SOTU

Seeing Pelosi, the U.S. House of Representatives speaker, for the first time since she stormed out of a White House meeting four months ago, Trump declined to shake her outstretched hand as he gave her a paper copy of his remarks before starting to speak. Despite having not spoken to Trump since their last meeting, Pelosi appeared to be taken aback. She avoided citing the customary “high privilege and distinct honor” that usually accompanies the speaker’s introduction of the president to Congress. “Members of Congress, the President of the United States” was all she said in introducing Trump.

When his speech ended, Pelosi stood and tore up her copy of the remarks he had handed her, later telling reporters it was “the courteous thing to do, considering the alternative.” Kayleigh McEnany, Trump’s campaign spokeswoman, said of Pelosi: “Her hatred for @realdonaldtrump has blinded her to the repulsive nature of her smug, elitist behavior.” After the event, Pelosi tweeted a photo of her with her hand reaching out to Trump and said, “Democrats will never stop extending the hand of friendship to get the job done #ForThePeople. We will work to find common ground where we can, but will stand our ground where we cannot. #SOTU”

Not you Nancy

pic.twitter.com/ywry3QMzDf— James Hirsen (@thejimjams) February 5, 2020

Preaching only to her own little crowd, empty virtue signals. Same as Pelosi: grace has its place.

• Ocasio-Cortez Among 10 Democrats Planning To Boycott State Of The Union (G.)

At least 10 Democrats have said they will boycott Donald Trump’s State of the Union address on Tuesday night on the eve of a Senate impeachment trial vote that is expected to acquit him. Congresswoman Alexandria Ocasio-Cortez, of New York, said she would not be attending because she did not want to normalize Trump’s “lawless conduct” and “subversion of the constitution”. Ayanna Pressley of Massachusetts issued a statement explaining her decision, saying: “The State of the Union is hurting because of the occupant of the White House, who consistently demonstrates contempt for the American people, contempt for Congress, and contempt for our constitution – strong-arming a sham impeachment trial in the Senate. This presidency is not legitimate.”

“On the eve of Senate Republicans covering up transgressions and spreading misinformation, I cannot in good conscience attend a sham State of the Union when I have seen firsthand the damage Donald J Trump’s rhetoric and policies have inflicted on those I love and those I represent.” Both women attended Trump’s State of the Union speech last year just a month after taking office, but have since been the target of his racist attacks. The two other members of “the Squad” of progressive freshman congresswomen who were also subjected to those attacks, Rashida Tlaib of Michigan and Ilhan Omar of Minnesota confirmed they would attend the address.

Biden is gone. Buttigieg is suspicious. It’s not about the party’s reputation anymore, it’s about the Party itself.

• Joe Biden Flopped In Iowa. And So Did The Democratic Party’s Reputation (G.)

If you’re the type of person who thinks the Democratic party is a creaking, incompetent entity whose leadership needs overthrowing, the Iowa caucuses certainly validated your point of view. None of us knew who would win, but we had at least expected a result. We didn’t get one, at least not on caucus night. State Democratic party officials announced that due to “quality control” issues, release of the result would be indefinitely delayed. On a conference call with representatives of the candidates, party officials hung up the phone when asked when the totals would be released. So what do we know? Well, one thing we can say confidently is that “frontrunner” Joe Biden flopped.

There were places where Biden didn’t even meet the 15% threshold needed to maintain viability from the first round to the second round – at one caucus site, the attorney general of Iowa had to switch from Biden to Buttigieg when Biden was disqualified. It explains why Biden’s surrogate John Kerry was heard on the phone the other day asking whether it would be possible for him to enter the race at the last minute to save the Democratic party from being conquered by Sanders. Internal numbers released by the Sanders campaign, showing results from 40% of caucus sites, showed Sanders winning with approximately 30% of the vote, Pete Buttigieg coming in second with 25%, Elizabeth Warren third with 21%, and Joe Biden a very distant fourth with 12%.

If those numbers match the ultimate totals, they are great for Sanders and absolutely horrific for Biden. Sanders will have kicked the crap out of the frontrunner, Barack Obama’s former vice-president and the man most favored to win the nomination. It would be a stunning upset. But Biden caught a lucky break. With the party not releasing the actual result, his campaign sent a letter demanding that the result be suppressed until such time as the “quality control issues” were resolved. If it takes long enough to get the official count, Biden may hope that Iowa is old news, or that the issues surrounding the caucus are discussed far more than the actual result. (That’s one reason we need to make sure we don’t get bogged down too much in talking about the procedural issues rather than the actual outcome.)

[..] If you’re a Sanders supporter, you have reason to be suspicious. We had already seen the Des Moines Register suppress the results of its “gold standard” poll on the eve of the election, after a complaint from Buttigieg. And with 0% of caucus results in, Buttigieg declared himself “victorious”, praising the “incredible result” and saying Iowa had “shocked the nation”. The only thing that had shocked the nation at this point was Iowa’s total inability to perform the relatively simple task of counting people’s votes. But Buttigieg, good McKinseyite that he is, was getting a head start on deploying the PR spin.

So in the incomplete results, Buttigieg got fewer votes, and Sanders gets the same amount of delegates, but Sanders lost? https://t.co/pl3e4AcAvC

— German Lopez (@germanrlopez) February 5, 2020

“..cutting-edge technology to stymie a Trump re-election..”

• The Big Tech Money Behind The App That Brought Chaos To The Iowa Caucus (F.)

The smartphone app that caused a major delay in reporting results during Iowa’s Democratic caucus was funded by both Democratic presidential candidates and Silicon Valley veterans anxious to use cutting-edge technology to stymie a Trump re-election. The app that was supposed to count and report caucus results was created by Shadow Inc., a for-profit tech company cofounded in February 2019 by former Google engineer Kirsta Davis and Gerard Niemira, an engineer who worked at San Francisco microlender Kiva.org. Both later worked on Hillary Clinton’s failed 2016 presidential campaign.

Washington D.C.-based Shadow was acquired last year by Acronym, a nonprofit also based in D.C. and founded in March 2017 by former journalist Tara McGowan to advance “progressive causes through innovative communications, advertising and organizing programs.” It has an affiliated political action committee called Pacronym. Silicon Valley heavyweights make up the liberal-leaning roster of Pacronym’s backers. One supporter is billionaire Michael Moritz, a partner at Sequoia Capital, whose net worth of $4.1 billion stems from his early bets on Google, LinkedIn and PayPal. According to Federal Election Committee data, he gave $1 million to Pacronym, or 12.8% of the $7.8 million that it has raised since early 2019.

Mighty OPEC loses to tiny virus.

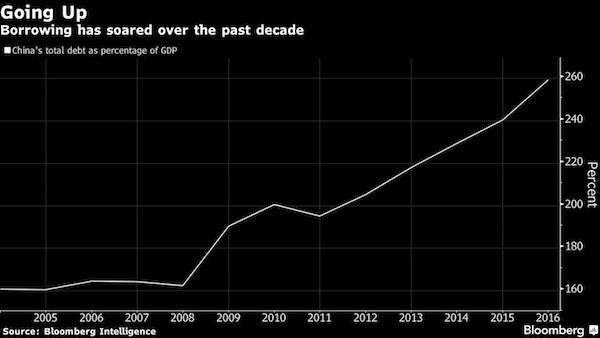

• Oil Flips Into Contango, Indicating Months Of Surplus (R.)

The oil market looks set for at least four months of depressed demand because of China’s coronavirus outbreak, with a large crude surplus not expected to clear at least until August, analysts and traders said. Fears of a virus-related slump in global energy demand have flipped the market into contango this week – a structure in which longer-dated oil futures trade at a premium that encourages traders to keep crude in storage for more profitable resale in the future. Brent crude has not been in contango since July 2019. On Tuesday the benchmark was in contango for as much as $0.40 a barrel between prices for closest trading month April and August. For U.S. West Texas Intermediate (WTI) crude the contango between March and July prices was $0.60 a barrel.

The structure of the market has significant implications. Besides encouraging storage of oil, contango also hurts financial investors who have to pay a premium every month they renew a futures contract. [..] Goldman Sachs, meanwhile, said the flip of time spreads into contango is consistent with the physical market suddenly shifting into a large surplus. “While deferred Brent time spreads are too discounted in our view, evidence that Chinese refiners are pushing back on crude shipments and Atlantic loadings points to ongoing weakness for nearby Brent time spreads,” Goldman said in a market note. China has been the main driver of global energy demand growth in recent years and ING Bank said the market is clearly worried that Chinese refinery demand will retreat.

“The issue for the market is if travel restrictions continue for an extended period … demand loss will become increasingly difficult for the market to swallow,” ING said, adding OPEC+ could come under increasing pressure to cut output by more than laid out in their existing supply pact.

Until you have been explained exactly where the electricity will come from, this is nothing but a swindle. Do you like being swindled?

• Britain To Ban New Petrol And Hybrid Cars From 2035 (R.)

Britain will ban the sale of new petrol, diesel and hybrid cars from 2035, five years earlier than planned, in an attempt to reduce air pollution that could herald the end of over a century of reliance on the internal combustion engine. The step amounts to a victory for electric cars that if copied globally could hit the wealth of oil producers, as well as transform the car industry and one of the icons of 20th Century capitalism: the automobile itself. Prime Minister Boris Johnson is seeking to use the announcement to elevate the United Kingdom’s environmental credentials after he sacked the head of a Glasgow U.N. Climate Change Conference planned for November known as COP26.

“We have to deal with our CO2 emissions,” Johnson said at a launch event for COP26 at London’s Science Museum on Tuesday. “As a country and as a society, as a planet, as a species, we must now act.” The government said that, subject to consultation, it would end the sale of new petrol, diesel and hybrid cars and vans in 2035, or earlier if a faster transition was possible. Countries and cities around the world have announced plans to crack down on diesel vehicles following the 2015 Volkswagen emissions scandal and the EU is introducing tougher carbon dioxide rules. The mayors of Paris, Madrid, Mexico City and Athens have said they plan to ban diesel vehicles from city centres by 2025. France is preparing to ban the sale of fossil fuel-powered cars by 2040.

Trading hot air.

• Tesla Shares March Toward $1,000 (R.)

Shares of Tesla Inc surged 20% on Tuesday to hit $940, extending a stunning rally that has more than doubled the company’s market value since the start of the year as more investors bet on Chief Executive Elon Musk’s vision. The latest surge was partly fueled by Panasonic saying on Monday its automotive battery venture with Tesla was in the black for the first time. “Investors are now starting to believe that Tesla can make mass-volume electric vehicles, and automakers, battery makers and suppliers can make money from EVs,” said Cho Hyun-ryul, analyst at Samsung Securities. Some analysts have attributed the rally to short covering as well. Short interest in Tesla stood at 13.8% as of Jan. 30, according to Refinitiv data.

Shares of heavily shorted companies can at times get pushed higher as traders rush to buy stock to cover their short bets, triggering what is known as a “short squeeze”. Panasonic shares closed up 10%, while those of Tesla’s Asian suppliers South Korea’s LG Chem and China’s CATL also closed higher. Tesla’s surge on Tuesday valued the company at nearly $170 billion, nearly double the combined market capitalization of General Motors and Ford Motor. Tesla last week reported a second consecutive quarterly profit and said it would comfortably make more than half a million vehicles this year. Billionaire investor Ron Baron, whose firm holds a nearly 1% stake in Tesla, said he will not be selling a single Tesla share, adding he believes the carmaker could hit $1 trillion in revenue in 10 years.

Fridges for Inuit.

• Musk’s Tesla Stake Worth $30 Billion After Electrifying Stock Surge (R.)

Tesla is making Elon Musk a lot richer without paying him a dime. A blistering stock rally has bolstered the value of CEO Musk’s 19% stake in the electric car maker by $16 billion since the start of 2020, to $30 billion. Tuesday’s steep climb in the share price could sweeten Musk’s payday under his record-breaking compensation package, which is built on stock options that rely on market value targets. Two milestones have now been achieved that could see Musk unlock options worth $1.8 billion. The controversial chief executive, who is also the majority owner and CEO of rocket maker SpaceX, recently testified that he did not have a lot of cash as he successfully defended himself in a defamation lawsuit. He previously has taken loans using his Tesla shares as collateral.

Musk does not take a salary, choosing instead a risky options package that envisions the stock market value of Tesla rising to $650 billion over 10 years, a prospect that was derided by some investors when the deal was announced in 2018. That target now looks less crazy. Shares of Tesla have rallied over 50% since the company posted its second consecutive quarterly profit last Wednesday, which was viewed as a major accomplishment for a company competing against established automotive heavyweights including General Motors Co and BMW. Tesla shares have climbed about 400% since early June, helped by the company’s better-than-expected financial results and ramped-up production at its new car factory in Shanghai. [..] Musk’s Tesla stake worth $30 billion after electrifying stock surge

Now apply the Force.

• Council of Europe Sides With Julian Assange (IA)

The attitude of European institutions is changing after years of silence. In this case, it was Andrej Hunko and Gianni Marilotti that convinced the European Assembly to speak up. The moment that press freedom advocates have been waiting for so long has finally arrived. The European institutions are starting to officially state that they don’t want Julian Assange to be extradited to the U.S. The Parliamentary Assembly of the Council of Europe (PACE) has become the first one to step in and call for Assange’s immediate release, joining the call of the United Nations Special Rapporteur on Torture, Nils Melzer, who some months ago clearly stated that Assange should walk free.

The call was made on the 28th of January, 2020, when the PACE was debating on a resolution for the Member States included in a report on Threats to Media Freedom and Journalists’ Security in Europe. Drafted by the Labour member of the British House of Lords, George Foulkes, the document opens stating that the Council of Europe and its Assembly are firmly committed to strengthening media freedom in all its aspects, including the right to access to information, the safeguard of editorial independence and of ‘the ability to investigate, criticise and contribute to public debate without fear of pressure or interference’. Several amendments to the report were proposed inside the PACE Committee on Culture, Science, Education and Media, and Lord Foulkes, who is part of it, was happy to accept the one on Assange.

Lord Foulkes said: “UK colleagues supported it because we don’t want to see him extradited by the UK Government to the United States and facing centuries in prison.” The Council of Europe is the continent’s leading institution on human rights and includes 47 member states, 28 of which are also part of the European Union. What this Parliamentary Assembly, made up of members of national legislatures says about freedom of the press is something civil society should take notice of. In this light, you would hope that the work of Wikileaks and his founder can hardly be forgotten. Or maybe it could — it seemed to be surprisingly off the agenda until some weeks ago, but January 2020 seems to have marked a change of course.

Every color is home to 1 billion people. Find Wuhan on the map.

Please donate what you can.