Paul Wolff Frankfurt Opera House 1934

“Once you are in the Sydney housing market, you are pretty well set then for the rest of your life.”

• ‘Buy Property In Sydney And You’re ‘Pretty Well Set For Life’ (WS)

How far can a desperate government go to keep the whole overleveraged edifice of a housing bubble from tumbling down and doing God-knows-what to the economy and the banks? Australia is trying to find out. The housing bubble in Sydney and Melbourne, by now among the top in the world, is taking on grotesque proportions, not only in price increases, but also in political pronouncements. So much of the economy depends on this bubble that no politician can imagine bringing it down to earth. Prices for all types of homes in Sydney jumped 19% in March year-over-year, according to CoreLogic, with houses up nearly 20% and “units” (we’d call them condos) up 15%. Sydney’s home prices have nearly doubled since 2008. In Melbourne, overall home prices jumped 16%, with houses up 17%, and condos up 5%. The index for all dwellings in Canberra and Hobart also rose in the double-digits.

In Adelaide and Brisbane, prices rose in the mid-single digits. Perth and Darwin showed declines in the 4.5% range. The CoreLogic index is not based on sales pairs, such as the Case-Shiller index in the US, or on median prices, but on its own “hedonic methodology,” which, like the other two methods, has plenty of critics. The government has its own Residential Property Price Indexes. The latest edition, released on March 21, was for Q4 2016, so a little slow. Based on the median price, the index for Sydney jumped 10.3% and for Melbourne 10.8%. Real estate is highly leveraged, and household debt is at an all-time high. Wages even in Sydney haven’t risen at the same pace. So the inevitable is beginning to happen. Affordability becomes a political issue, and delinquencies become a financial issue.

[..] On February 24, Anthony Roberts, New South Wales Minister for Planning and Housing, was speaking at the launch of a 690-unit apartment development at Olympic Park, a suburb of Sydney, heaping praise on the developer for having committed to offer 60 units first to first-time buyers. A new policy on housing affordability would be announced in the “very near future,” Roberts said. But as a first step, he threw in an incentive for first-time buyers. Instead of the normal 10% down payment, they’d only need to make 5%. “This is the beginning, this is the start,” he said. And in hyping the Sydney housing market and the importance of getting in now or be priced out forever, he also said this: “This is about fairness, and this is about enabling people to get into the Sydney housing market. Once you are in the Sydney housing market, you are pretty well set then for the rest of your life.

Get out while you can.

• Sydney Property Prices Rise Almost 20% In Past 12 Months (G.)

Sydney property prices have increased by almost 20% in just 12 months, putting the city at the front of a nationwide trend that has seen dwelling values increase by 12.9% on average. Sydney house values soared by 19.65% in the past year, and unit values increased by 15.27%. New data from CoreLogic, released on Monday, shows house values in Melbourne (up 17.15%), Canberra (13.64%), and Hobart (11.05%) have followed Sydney’s rapid rise. Only homes in Perth (-4.68%) and Darwin (-4.41%) have bucked the trend, slipping backwards over the past year. CoreLogic’s five capital city aggregate – which includes Sydney, Melbourne, Brisbane and the Gold Coast, Adelaide and Perth – shows prices for houses and units rose 12.9% on average last year.

But the news comes as the ratings agency Moody’s warned an increasing number of borrowers have fallen behind on their mortgage and car repayments, saying more borrowers are set to join them amid rising underemployment, record-low wages growth and a more difficult housing market. On Monday, Moody’s said delinquencies for prime residential mortgage-backed securities increased to 1.61% in January, from 1.57% in December, while 30-day delinquencies for car loan asset-backed securities rose to 1.80%, from 1.54% over the same period. “Weaker economic conditions in states reliant on the mining industry, rising underemployment, weak wages growth and less favourable housing market conditions will drive delinquencies higher,” vice president and senior analyst Alena Chen said on Monday.

More like no instruments at all: “..limit new interest-only loans to 30% of total new mortgage lending..”

• Australia Sticks With Blunt Instruments To Battle Housing Bubble (R.)

In their struggle to cool red-hot property prices in Australia’s big cities, authorities are ratcheting up measures that could dent the whole market but avoiding more targeted steps that have had some success in New Zealand and China. Australian regulators first focused on reining in investment loans nationally in 2015, by imposing an annual limit of 10% on how much banks could expand their investor loan book. Those steps worked for a while, but the heat is on again in Sydney, where prices are rising almost 20% a year, having more than doubled since 2008, and Melbourne, where the pace is over 15%, according to property consultant Core Logic.

That and all-time high household debt prompted the Australian Prudential Regulatory Authority (APRA) to move again on Friday, asking banks to limit new interest-only loans to 30% of total new mortgage lending, from 40% now, and promising a lot of “monitoring”, “scrutinizing” and “observing”. Industry players doubt that will do the trick. “I personally don’t think this will have a material impact,” said Simon Orbell at mortgage broker Smartmove, as prices kept rising even though it was already a tough lending market. “Maybe more needs to be done,” he added. [..] There has been market speculation that the Reserve Bank of Australia will be forced to hike interest rates, a yet blunter instrument, though record low inflation and weak wages growth make that an unattractive option. There is also political resistance to measures that could make prices actually fall, with two thirds of households owning their homes.

Too much uncertainty to unleash it.

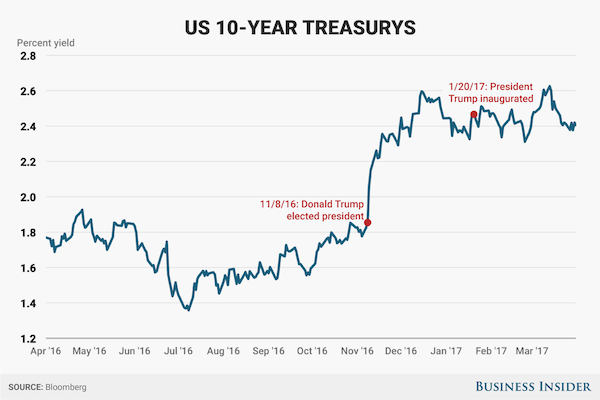

• A ‘Sleeping Beast’ In The Markets Is About To Be Unleashed – SocGen (BI)

The bond market has been quiet. Too quiet in fact. That’s about to change, says Societe Generale’s fixed income team led by Vincent Chaigneau. “Spring is likely to be more threatening for bond investors as US data improves, political risk in Europe ebbs and investors refocus on a slow central bank exits,” the team wrote in a note to clients on Thursday. The note is titled “The Sleeping Beast.” In the wake of the U.S. Presidential election, traders priced in the prospect that Donald Trump’s agenda of a protectionist trade policy, cutting taxes, rolling back regulations, and massive infrastructure would bring back inflation to the United States. Reflecting this, the yield on 10-year Treasurys rallied more than 80 basis points, reaching a high of 2.64%, in the weeks following the election.

But for the last few months, the yield has been trapped in a tight 35 basis point range as traders take a wait-and-see approach in regards to Trump’s ability to execute his proposed agenda. “We expect that to reverse in spring, especially if Trump proves a little more effective in pushing his agenda through Congress,” Societe Generale wrote. “Treasuries too present some seasonal patterns: the average of the past five years shows the 10yT reaching a low around mid-April before bearish forces start to take over.”

America turns on the mall.

• Commercial Real Estate Is The Next ”Big Short” (F.)

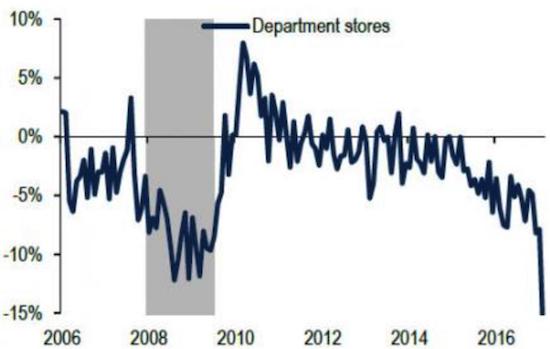

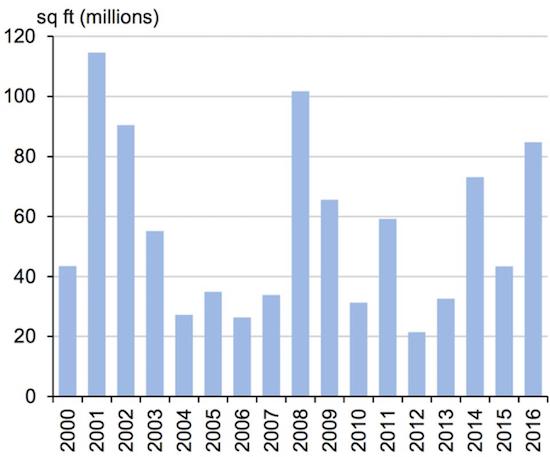

A small but growing group of hedge funds are positioning themselves to profit from the collapse of the real estate market. Sounds like 2007, right? It’s actually happening right now. But this time, hedge funds (along with Deutsche Bank and Morgan Stanley) aren’t targeting subprime mortgages—they’re going after commercial real estate. It’s no secret retailers and malls have been struggling for years, but it looks like the perfect storm is set to hit them in 2017. Bearish bets against commercial loans jumped 50% year-over-year in February—and with problems piling up for malls, it’s no wonder. Around $3.5 billion in retail loans were liquidated in 2016. Investment firm Gapstow Capital said losses on mall loans have been “meaningfully higher than in other areas.” This is because malls are reliant on retailers like Macy’s, J.C. Penny and Sears. Unfortunately for these landlords, their tenants’ businesses are failing, which brings us to…

As a result of falling sales, retailers are shutting up shop at a rate that has not been seen since the 2008 financial crisis.

…and they plan to close hundreds more over the coming years, which is very bad news for malls. Most malls are dependent on one or more of these big retailers. When anchor stores close, it reduces foot traffic, and that hurts other retailers. This begins a cycle of blight, leading other tenants to leave. Alder Hill (a hedge fund started by associates of billionaire David Tepper) is bearish on commercial loans and expects 2017 to be a “tipping point.” Morningstar Credit Ratings estimates roughly 40% of the loans due this year won’t be paid. This comes at a bad time for the industry. Commercial real estate prices have been on a tear since 2009, but with vacancies rising, prices have stagnated.

This, coupled with new rules that came into effect in December (which force banks to hold at least 5% of the loans they make on their books), has caused loan growth to stall. As a result, leading retail analyst Jan Rogers Kniffen expects around one-third of American malls to close in the coming years. So, what are the implications of this commercial collapse?

But the French love the euro. Hard sell.

• Euro Is A ‘Knife In The Ribs’ Of The French Says Le Pen (R.)

French presidential candidate Marine Le Pen told a political rally on Sunday that the euro currency which she wants France to ditch was like a knife in the ribs of the French people. The leader of the eurosceptic and anti-immigrant National Front (FN) also told the rally in the city of Bordeaux that the forthcoming election for president could herald a “change in civilization”. Encouraged by the unexpected election of Donald Trump in the United States and by Britain’s vote to leave the European Union, Le Pen hopes to profit from a similar populist momentum in France, though opinion polls suggest she will lose the May 7 run-off. “We are at the mercy of a currency adapted to Germany and not to our economy. The euro is mostly a knife stuck in our ribs to make us go where others want us to go,” Le Pen said to loud cheers and applause.

Reiterating her anti-globalization and anti-immigration views, she declared: “We do not want France to be open to all commercial and human flows, without protection and borders.” A government under Le Pen’s presidency would take France out of the euro zone and bring back a national currency, hold a referendum on its EU membership and slap taxes on imports and on companies hiring foreigners. Le Pen says she would curb migration, expel all illegal migrants and restrict certain rights now available to all residents, including free education, to French citizens. She hit out at her two main opponents in the French election, independent centrist Emmanuel Macron and conservative candidate Francois Fillon, saying they belonged to “the same system” “The system is panicking because it sees people are waking up,” she said.

Draghi slays austerity?

• ECB Leads The Cure For Euro-Pessimism (CNBC)

The euro-sclerosis and the euro-pessimism are only a few of the old neologisms that got a new lease on life thanks to “reformers” and “crisis managers” who devastated the euro area economy with their – take a deep breath – “austerity growth model,” consisting of deep public spending cuts, tax hikes, jobs-destroying structural reforms and a monetary policy that should look the other way. Predictably, the area’s economy took it on the chin and went down for the count, with millions of lives destroyed by soaring poverty and destitution – until the ECB stepped in to provide the antidote to that cruel nostrum and to begin a long process of healing and recovery.

The ECB’s intervention eventually stiffened the spines, and gave some oxygen, to scared and disoriented political leaders in France, Italy, Spain and Portugal – exactly one-half of the euro area’s GDP – who abandoned the fiscal madness and structural destruction to latch on to the life jacket thrown at them by their lender of last resort. The economic recovery we see now is a result of that policy mix. At 1.7%, the euro area growth last year matched the pace of the U.S. economy and seems poised for further gains in the months ahead. The ECB-driven recovery was also reflected in steadily rising asset values. As of last Friday, the euro area equity prices (Euro Stoxx 50 in dollar terms) were 17.3% above their year-earlier level, with nearly half of that increase (7.6%) recorded since the beginning of this year.

[..] France is the next political test with the first round of elections on April 23. Again, anybody betting against the euro and the EU will lose big. According to the French media, voters are largely indifferent toward the presidential candidates, but the economy is improving and low credit costs have unleashed a real estate boom that’s triggering solid consumer spending. The French are also great fans of the euro: An opinion poll published last Tuesday (March 25) shows that 75% of the French like the European currency, and half of them are pleased with the EU, although they believe that some of their neighbors were greater beneficiaries of the whole project. The French, of course, have Germany in mind. They are looking at Germany’s huge trade surpluses and the industrial takeover by the world-beating manufacturing companies across the Rhine.

It should be investigating British war crimes.

• Scotland Yard Examines Allegations Of Saudi War Crimes In Yemen (G.)

Scotland Yard is examining allegations of war crimes by Saudi Arabia in Yemen, the Guardian can reveal, triggering a possible diplomatic row with Britain on the eve of Theresa May’s visit to the Arab state. The Metropolitan police confirmed that their war crimes unit was assessing whether criminal prosecutions could be brought over Saudi Arabia’s devastating aerial campaign in Yemen. The force’s SO15 counter-terrorism unit revealed to a London human rights lawyer that it had launched a “scoping exercise” into the claims before Maj Gen Ahmed al-Asiri’s visit to the capital last week. The revelation comes as May plans to underline Britain’s close relationship with the Saudi royal family on her visit to the Arab state this week, in which tackling the terror threat from Islamic State will be a key factor.

Speaking in advance of the trip, in which she will also visit Jordan, the prime minister said she wanted to “herald a further intensification in relations between our countries and deepen true strategic partnerships”. She argued that the intelligence relationship with Saudi Arabia had been critical, potentially saving hundreds of lives in the UK, and claimed there were huge possibilities for closer trade links as the UK moves towards leaving the European Union. May plans to stress the need for collaboration in the wake of the Westminster terror attack, while also pledging humanitarian support to Jordan to help it handle the huge volumes of refugees displaced by the Syrian conflict.

But the trip comes under the shadow of a war in Yemen that has killed more than 10,000 civilians and displaced more than 3 million people. The Saudi-led coalition has been accused of killing thousands of civilians and triggering a humanitarian catastrophe in one of the region’s poorest countries. The UK, which along with the US supports the Saudis against the Houthis, has been urged to reconsider its arms exports to Saudi Arabia in light of the bloody air campaign.

Austerity kills people and economies.

• Greek Households Spend €40 Less Per Month On Supermarket Purchases (KTG)

A significant decrease of 13% has been recorded in the amount Greek households spend for daily purchases at the country’s supermarkets. This is the logical consequence caused by low wages, high unemployment rates and increased direct and indirect taxes. Factors that have lead to impoverishment of large groups of the Greek society. Worth mentioning are the extra charges (special consumption fees) imposed as of 1.1.2017 in a variety of supermarket products like coffee. Greek households spend monthly forty euros less for their shopping at the supermarket than in the previous year. The average monthly expenditure of households at the supermarket amounts to 274 euros from 310 last year.

According to research conducted by the Economic University of Athens, the expenditure decrease has been confirmed also by the turnover of the supermarkets. The decrease in sales was 10% in January 2017. The was a slight increase of 2.9% in February, but a serious decline of 15% in March. 63% of respondents said they buy fewer products. 45.8% said they restricted to what is necessary. At the same time, 54.4% said that buy cheaper products especially following a market investigation and that they chase discount offers and products of private label. 81.5% said that they compare prices before they decide which product they will pick up from the supermarket shelf.

99.2% of consumers stated that they do research before going to the supermarket, they know in advance what to buy and they avoid impulse purchases. 38% of respondents said that they would make fewer purchases in 2017, 5% that they will increase their purchases. 57% estimate that their purchases will remain unchanged. The average expenditure per supermarket visit remains almost unchanged. Expenditure in 2017 is at an average of €50.4 euros. It was at 49.5 euros in 2016. However, the frequency of visits has declined down to 6.8 visits per month from 8.5 visits last year.

Yes, it can still get worse.

• Greece To Accelerate Return Of Migrants To Turkey As Arrivals Pick Up (K.)

As the inflow of undocumented migrants to the islands of the eastern Aegean rises with the improving weather, the government is planning action to ease the pressure on increasingly overcrowded reception centers. In the coming days, Migration Minister Yiannis Mouzalas is expected to issue a circular, banning migrants who appeal against a rejection of their application for political asylum from a voluntary repatriation scheme being run by the International Organization for Migration (IOM). Meanwhile police on the islands are boosting efforts to locate and detain migrants who face deportation to Turkey in line with an agreement signed last year between Ankara and Brussels.

Last week, a new detention center opened on Kos, the function of which will be to detain migrants facing deportation. Others awaiting the outcome of asylum applications or inclusion in the IOM’s repatriation scheme are to remain in the island’s main reception center. A similar “closed” center for migrants awaiting deportation is operating on Lesvos. However, police face a problem on Chios, which has seen arrivals from Turkey intensify in recent days, and where local residents vehemently oppose the creation of such a center. A police official told Kathimerini that the main police precinct on the island is already full of migrants and there are no other facilities to accommodate new arrivals. “We don’t know what to do,” he said.