Brassaï The Sun King 1930

And says it’s a “substantial undercount”.

• CDC: More Than 10,000 Covid-19 Vaccine Breakthrough Infections (JTN)

More than 10,000 vaccine breakthrough infections have been reported in the U.S. in individuals who had already been fully vaccinated against COVID-19, according to the U.S. Centers for Disease Control and Prevention. “A total of 10,262 SARS-CoV-2 vaccine breakthrough infections had been reported from 46 U.S. states and territories as of April 30, 2021,” the government agency said. The report covered the period from January 1 to April 30 this year. More than half (63%) of the breakthrough cases happened in females, according to the CDC. Preliminary data indicated that more than a quarter (27%) of the cases were asymptomatic and 160 people (2%) passed away. But 28 of the deceased were asymptomatic or passed away due to a cause not connected to coronavirus. The median age for the deceased was 82.

The CDC noted that the quantity of reported vaccine breakthrough cases probably falls far short of the actual amount of breakthroughs among the vaccinated. “The findings in this report are subject to at least two limitations. First, the number of reported COVID-19 vaccine breakthrough cases is likely a substantial undercount of all SARS-CoV-2 infections among fully vaccinated persons. The national surveillance system relies on passive and voluntary reporting, and data might not be complete or representative. Many persons with vaccine breakthrough infections, especially those who are asymptomatic or who experience mild illness, might not seek testing. Second, SARS-CoV-2 sequence data are available for only a small proportion of the reported cases,” the agency noted.

They know it’s a “substantial undercount” because they keep changing their methods: “the CDC has taken their “substantial undercount”, and then slashed it by 90%.”

• More Flagrant Data Manipulation From The CDC (OffG)

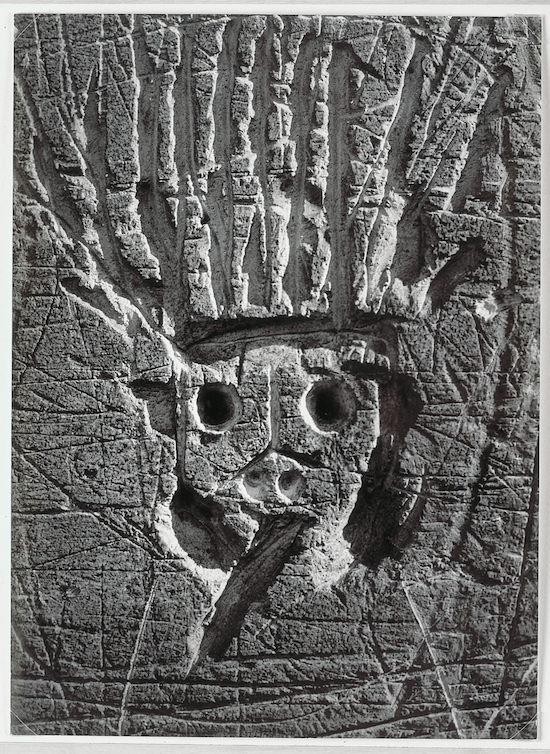

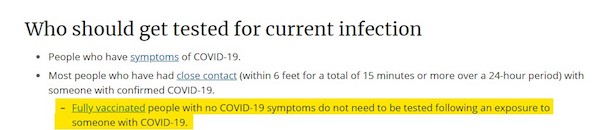

A new report, published just yesterday, has provided yet more evidence that the CDC is manipulating data to conceal the number of “breakthrough infections”. A “breakthrough infection” (or “breakthrough case”) is defined as a person who tests positive for Sars-Cov-2 infection, despite already being fully vaccinated. And this new report finds that the CDC’s official record of breakthrough cases is: “likely a substantial undercount.” Going on to explain: “The national surveillance system relies on passive and voluntary reporting, and data might not be complete or representative. Many persons with vaccine breakthrough infections, especially those who are asymptomatic or who experience mild illness, might not seek testing.” Which is partially accurate, but also a pretty major lie by omission. It is probably true that vaccinated people with no symptoms are unlikely to seek testing, but it is also true that, on March 17th, the CDC updated their advice on testing policy to specifically exclude such people from testing protocols:

So, while it’s certainly true that “breakthrough cases” are likely a substantial undercount, it is dishonest to pretend that this is just an accident of the system. Rather, the system is specifically designed to hide such cases. Of course, this report only goes up to the end of April, the “undercount” will only have gotten worse since then, because the CDC changed their rules AGAIN to make it even harder to keep an accurate count of breakthrough cases. As we wrote last week, as of May 1st the CDC will no longer be counting mild or asymptomatic cases as “breakthrough infections”, choosing to focus only on hospitalisations and deaths. According to the CDC’s own report, though, over a quarter (27%) of breakthrough infections were asymptomatic, and a further 61% were only mildly ill. Conversely, only 10% of them were ever hospitalised, and only 2% died: “Based on preliminary data, 2,725 (27%) vaccine breakthrough infections were asymptomatic, 995 (10%) patients were known to be hospitalized, and 160 (2%) patients died.”

So, the CDC has taken their “substantial undercount”, and then slashed it by 90%. The official figures, moving forward, will be so inaccurate as to be completely useless. The CDC claims these changes “will help maximize the quality of the data collected on cases of greatest clinical and public health importance.” But that is an obvious and absurd lie. Statistical studies have shown up to 86% of Covid “cases” never experience symptoms. To exclude such cases from your vaccine effectiveness studies is to poison your data in order to prop up a pre-determined conclusion. It is, at the very best, extremely poor science.

How many deaths and injuries will it take before the “vaccines” are banned?

• DOD Tracking 14 Cases of Heart Inflammation in Troops After COVID-19 Shots (M.com)

The Defense Department is tracking 14 cases of heart inflammation, or myocarditis, in military health patients who developed the condition after receiving either the Pfizer or Moderna COVID-19 vaccine. The rare disorder, usually caused by a virus, has been linked to COVID-19. But following a number of reports from Israel of patients developing the inflammation in conjunction with receiving vaccines, the Israeli Health Ministry is exploring a possible link, Israel’s Channel 12 reported Friday, according to the Jerusalem Post. Myocarditis is an inflammation of the heart muscle, the myocardium, that can reduce the heart’s ability to function or cause abnormal heart rhythms.

The first report of myocarditis in a patient who received a COVID-19 vaccine was published in Israel on Feb. 1. Another case of myocarditis in a 39-year-old male was reported in Revista Española de Cardiología in early March. The DoD has been tracking myocarditis cases through March, according to spokesman Peter Graves. Of the 14 cases, one patient, who tested positive for COVID-19 three months ago, developed myocarditis after their first dose of vaccine. The remaining 13 patients developed myocarditis after their second vaccine doses. Eleven received the Moderna vaccine; three got Pfizer.

Ha!

• Dr. Fauci Gets In Heated Debate With 17 Previous Versions Of Himself (BBee)

After a brief temporal anomaly occurred in Washington, D.C., causing a version of Dr. Fauci from just two weeks ago to materialize in the city, the current Dr. Fauci got in a heated debate with the manifestation of himself from the past. “The virus was created in a lab!” present-day Fauci said indignantly, causing past Fauci to wag his finger and shake his head emphatically. “No, no, no, that’s a deranged conspiracy theory!” past Fauci said. “It’s practically alt-right! Didn’t you check Snopes? Anyway, at least we can agree we should wear double masks forever.” “No, masks aren’t necessary anymore!” said current Fauci. “We just wear them for political theater.” “That’s insulting! They’re absolutely not theater!” said early May Fauci.

At that moment, another version of Fauci suddenly appeared from March 2020, agreeing with current Fauci but taking it a step further, saying, “Masks are useless. They just make people feel better!” Both of the other Faucis then ganged up on March 2020 Fauci, calling him an “anti-science mask denier.” Another Fauci then appeared, and then another, and then another, and all heck broke loose, with the Faucis screaming at one another and calling each other “Q anon crazies” and “progressive totalitarians,” depending on the version of Fauci. Finally, an uneasy truce was called, as all the Faucis agreed they at least all wanted the same thing: to stay in the spotlight forever.

From yesterday’s Comment section.

• Covid Spike Protein, In All Vaccines, Is What Causes Deadly Blood Clots (NN)

The prestigious Salk Institute, founded by vaccine pioneer Jonas Salk, has authored and published a bombshell scientific article revealing that the SARS-CoV-2 spike protein is what’s actually causing vascular damage in covid patients and covid vaccine recipients, promoting the strokes, heart attacks, migraines, blood clots and other harmful reactions that have already killed thousands of Americans (source: VAERS.hhs.gov). Critically, all four covid vaccine brands currently in widespread use either inject patients with the spike protein or, via mRNA technology, instruct the patient’s own body to manufacture spike proteins and release them into their own blood. This floods the patient’s body with the very spike protein that the Salk Institute has now identified as the smoking gun cause of vascular damage and related events (such as blood clots, which are killing many people who take the vaccines).

Put simply, it means the vaccines were designed to contain the very element that’s killing people. The false assumption of the vaccine industry and its propagandists is that the spike protein is “inert” and harmless. The Salk Institute proves this assumption to be dangerously inaccurate. [..] the virus spike proteins (which behave very differently than those safely encoded by vaccines) also play a key role in the disease itself. The paper, published on April 30, 2021, in Circulation Research, also shows conclusively that COVID-19 is a vascular disease, demonstrating exactly how the SARS-CoV-2 virus damages and attacks the vascular system on a cellular level.

“A lot of people think of it as a respiratory disease, but it’s really a vascular disease,” says Assistant Research Professor Uri Manor, who is co-senior author of the study. “That could explain why some people have strokes, and why some people have issues in other parts of the body. The commonality between them is that they all have vascular underpinnings.” …the paper provides clear confirmation and a detailed explanation of the mechanism through which the protein damages vascular cells for the first time. In the new study, the researchers created a “pseudovirus” that was surrounded by SARS-CoV-2 classic crown of spike proteins, but did not contain any actual virus. Exposure to this pseudovirus resulted in damage to the lungs and arteries of an animal model—proving that the spike protein alone was enough to cause disease. Tissue samples showed inflammation in endothelial cells lining the pulmonary artery walls.

The team then replicated this process in the lab, exposing healthy endothelial cells (which line arteries) to the spike protein. They showed that the spike protein damaged the cells by binding ACE2. This binding disrupted ACE2’s molecular signaling to mitochondria (organelles that generate energy for cells), causing the mitochondria to become damaged and fragmented. Previous studies have shown a similar effect when cells were exposed to the SARS-CoV-2 virus, but this is the first study to show that the damage occurs when cells are exposed to the spike protein on its own. [..] covid vaccines are inducing vascular disease and directly causing injuries and deaths stemming to blood clots and other vascular reactions. This is all caused by the spike protein that’s deliberately engineered into the vaccines.

[..] any person who actually survives the covid vaccine only does so because their innate immune system is protecting them from the vaccine, not with the vaccine. The vaccine is the weapon. Your immune system is your defense. [..] The covid vaccine, built with the spike protein that causes vascular damage. The number of Americans who died after taking covid vaccines is already in the thousands, and realistic estimates put that number at tens of thousands (with more dying each day). The mechanism is now well understood: The covid vaccine injects the patient with spike proteins, the spike proteins proceed to cause vascular damage and blood platelet aggregation, this leads to blood clots which circulate around the body and lodge in different organs (the hart, lungs, brain, etc.), causing deaths that are attributed to “strokes” or “heart attacks” or “pulmonary embolism.”

The common cause is the vascular damage stemming from the spike protein. In essence, millions of people are being injected with artificial blood clotting factors and then dying from blood clots, all while the disastrously dishonest corporate media claims all covid vaccines are completely “safe” and have harmed no one.

From India.

• Does Ivermectin Really Work Against Covid-19? (IT)

Q.Is Ivermectin, a drug that has traditionally been used to treat parasitic infections in humans, effective against Covid-19?

The World Health Organization recently issued guidelines saying Ivermectin should only be used on Covid-19 patients in clinical trial settings, saying there was a ‘very low certainty of evidence’ on Ivermectin’s effects on mortality rates and its ability to purge the virus from the body. After this, many state governments in India have rejected its use for Covid-19 patients. This has caused confusion and worry among patients and providers alike. However, [I believe] there is enough evidence to show the effectiveness of the drug. A study published in the American Journal of Therapeutics clearly mentions a large number of randomised and observational controlled trials of Ivermectin that repeatedly reported large improvements in clinical outcomes. Numerous prophylaxis trials demonstrate that regular use of Ivermectin leads to large reductions in virus transmission. Moreover, a comprehensive review of the available efficacy data as of December 12, 2020, taken from in-vitro, animal, clinical and real-world studies, all show the above impacts of Ivermectin in treating cases of Covid-19.

Q. How does Ivermectin help Covid patients? Here are few points worth considering. Since 2012, multiple in-vitro studies have demonstrated that Ivermectin inhibits the replication of many viruses, including those that cause Influenza, Zika, Dengue, and others. Ivermectin inhibits SARS-CoV-2 replication and binding to host tissue through several observed and proposed mechanisms. Ivermectin also has anti-inflammatory properties that prevents viral replication, and it hastens recovery and prevents deterioration in patients in mild to moderate cases of the disease, if they are treated early after symptoms appear.

Q. So should all Covid patients take Ivermectin as part of their treatment?

Having said the above, anything used in excess or abused is harmful to health. Providers need to careful while prescribing these drugs as they are still under review. The best way is to be wise and not let panic take precedence over logical reasoning. Most repurposed drugs have pros and cons when used to treat Covid-19, and this needs to be explained to patients while prescribing treatment. We have to be cautious but wise too—let us all make informed choices and ensure that we come out of this crisis stronger and more empowered.

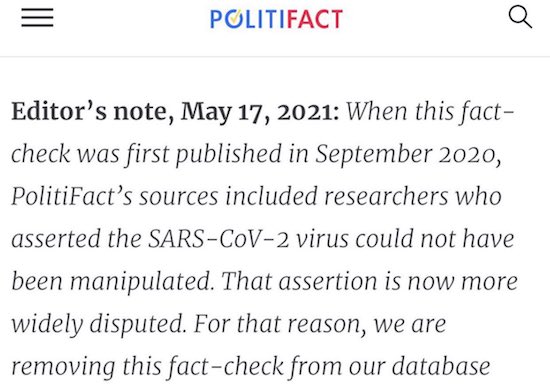

“Did COVID escape from a Wuhan lab? Well, it depends! Did a Republican say it?”

• Snopes Introduces New Rating: ‘False For Now’ (BBee)

World-renowned fact-checking website Snopes has unveiled a brand new fact check rating called “False For Now.” This will allow them to provide a rating for claims that are just conspiracy theories uttered by deranged far-right people until they later turn out to be true. “At Snopes, it’s important for us to keep up with the undulating, ever-changing ocean of truth claims as they fluctuate across different official narratives we approve of,” said Snopes founder David Mikkelson. “Did COVID escape from a Wuhan lab? Well, it depends! Did a Republican say it? Does it serve the official narrative of trusted sources like CNN? We have to keep all these important questions in mind as we continue to live our truth, which is what Snopes is all about.”

To save time, Snopes will just attach this rating to everything said by someone on the Right until a mainstream, unbiased source like The New York Times approves it to be upgraded to “Mixture”. Snopes also announced they will be attaching a rating of “Not Funny” to all Babylon Bee articles.

Imagine getting your news from Facebook.

• Facebook No Longer Treating ‘Man-Made’ Covid As A Crackpot Idea (Pol.)

Facebook will no longer take down posts claiming that Covid-19 was man-made or manufactured, a company spokesperson told POLITICO on Wednesday, a move that acknowledges the renewed debate about the virus’ origins. A narrative in flux: Facebook’s policy tweak arrives as support surges in Washington for a fuller investigation into the origins of Covid-19 after the Wall Street Journal reported that three scientists at the Wuhan Institute of Virology were hospitalized in late 2019 with symptoms consistent with the virus. The findings have reinvigorated the debate about the so-called Wuhan lab-leak theory, once dismissed as a fringe conspiracy theory. President Joe Biden said Wednesday that he has ordered the intelligence community to “redouble” its efforts to find out the virus’ origin and report back in 90 days.

Biden also revealed that the intelligence community is split between two theories about Covid-19’s origin, and said the review will examine “whether it emerged from human contact with an infected animal or from a laboratory accident.” Bipartisan support is also building on Capitol Hill for a congressional inquiry. But the focus of late has been on the notion that the virus may have accidentally escaped from the lab, not that it was man-made or purposely released — theories that could now propagate on Facebook. Genetic studies of the virus have found flaws in the protein it uses to bind to human cells. Those are features that someone trying to engineer a bioweapon likely would have avoided. Shifting definitions on social media: Facebook announced in February it had expanded the list of misleading health claims that it would remove from its platforms to include those asserting that “COVID-19 is man-made or manufactured.”

The tech giant has updated its policies against false and misleading coronavirus information, including its running list of debunked claims, over the course of the pandemic in consultation with global health officials. But a Facebook spokesperson said Wednesday that the origin language had been stricken from that list due to the renewed debate about the virus’ roots. “In light of ongoing investigations into the origin of COVID-19 and in consultation with public health experts, we will no longer remove the claim that COVID-19 is man-made from our apps,” the spokesperson said in an emailed statement. “We’re continuing to work with health experts to keep pace with the evolving nature of the pandemic and regularly update our policies as new facts and trends emerge.”

Smokescreen?!

• Senate Unanimously Passes Hawley Bill Declassifying Intel On Wuhan Lab (F.)

The U.S. Senate on Monday unanimously approved a bill to require the federal government to declassify information about any links between China’s Wuhan Institute of Virology and Covid-19 following reporting by the Wall Street Journal that three researchers at the lab were hospitalized with Covid-like symptoms in November 2019. The bill requires the Director of National Intelligence to declassify “any and all information” about links between the lab and the virus within 90 days. The bill also calls for the DNI to make “as much information as possible” about the origin of the virus publicly available, in order to identify the origin “as expeditiously as possible.” Introduced by Sen. Josh Hawley (R-Mo.) and cosponsored by Sen. Mike Braun (R-Ind.), the bill passed Wednesday night by unanimous consent, meaning no senator objected.

While support has grown among Democratic lawmakers to investigate the origins of Covid-19, House leaders have not yet said whether it will get a vote in the lower chamber and the White House hasn’t said if President Joe Biden will sign it. Theories that the virus was man-made as opposed to naturally occurring have been cast as fringe for much of the pandemic. However, the Journal’s revelation this week has caused experts to concede the “lab leak” theory – which remains unproven – can’t be ruled out. 90. That’s how many days the intelligence community has been given by Biden to “bring us closer to a definitive conclusion” on the origins of the virus, the president said in a statement Wednesday. Biden said he asked for the inquiry to include “specific questions for China” and a look at “work by our National Labs.”

Prediction: Shell will appeal, and appeal, and…

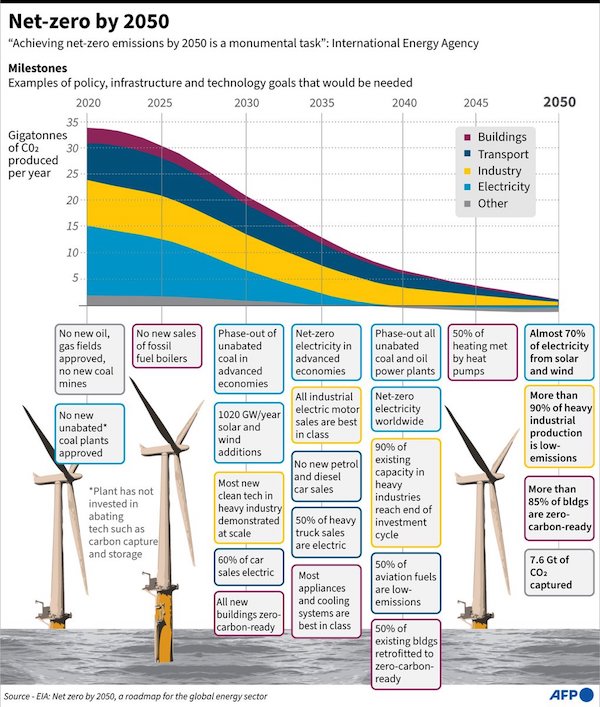

• Netherlands Court Orders Shell To Cut Emissions By 45% (BBC)

A court in the Netherlands has ruled in a landmark case that the oil giant Shell must reduce its emissions. By 2030, Shell must cut its CO2 emissions by 45% compared to 2019 levels, the civil court ruled. The Shell group is responsible for its own CO2 emissions and those of its suppliers, the verdict said. It is the first time a company has been legally obliged to align its policies with the Paris climate accords, says Friends of the Earth (FoE). The environmental group brought the case to court in 2019, alongside six other bodies and more than 17,000 Dutch citizens. Though the decision only applies in the Netherlands, it could have wider effects elsewhere. BBC Netherlands correspondent Anna Holligan tweeted that it was a “precedent-setting judgement”.

A Shell spokesperson said they “fully expect to appeal today’s disappointing court decision” and added that they are stepping up efforts to cut emissions. “Urgent action is needed on climate change, which is why we have accelerated our efforts to become a net-zero emissions energy company by 2050,” the spokesperson said, adding that Shell was investing “billions of dollars in low-carbon energy, including electric vehicle charging, hydrogen, renewables and biofuels”. “This is really great news and a gigantic victory for the earth, our children and for all of us,” FoE director Donald Pols said in a statement. “The judge leaves no doubt about it: Shell is causing dangerous climate change and must now stop it quickly.” Under the terms of the Paris Agreement on climate change, nearly 200 nations agreed to keep global temperatures “well below” 2C above pre-industrial levels.

The legally binding treaty came into force on 4 November 2016. The US withdrew under former President Donald Trump but has since rejoined under President Joe Biden. A number of groups around the world are now trying to force companies and governments to comply with the accords through the courts. Shell has previously said it wants net zero emissions for itself and from products used by its customers by 2050. In December its defence lawyers told the Dutch court the company was already taking “serious steps” to move away from fossil fuels, and said there was no legal basis for the case.

“At ExxonMobil, two board nominees from activist group Engine No. 1 won enough votes to secure board seats..”

• ExxonMobil, Chevron Investors Vote For More Action On Climate Change (Y!)

Investors rejected the responses of US oil giants to climate change Wednesday, installing activist board members at ExxonMobil and directing Chevron to deepen emissions cuts. The dual decisions at the two biggest US oil giants’ annual meetings are clear evidence that addressing climate change has moved from being an environmentalist cause to one championed by mainstream investors. At ExxonMobil, two board nominees from activist group Engine No. 1 won enough votes to secure board seats. Shareholders also backed a proposal requiring a report on the oil giant’s lobbying activities on climate change.

At Chevron, a majority of investors approved an activist proposal calling on the company to reduce “scope 3” emissions, which encompass energy products. Earlier in the day, a Dutch court ordered oil giant Shell to slash its greenhouse gas emissions by a net of 45 percent by the end of 2030 following a challenge launched by environmental group Friends of the Earth. “Today’s Exxon vote sends the unmistakable signal that climate action is a financial imperative,” said Fred Krupp, president of Environmental Defense Fund. “Now Exxon’s board has an important responsibility to help the company transform its approach to the climate crisis and energy transition.”

Miranda Devine is working on a book, “Laptop From Hell”, due out in September.

• Hunter Biden’s Ukraine Salary Was Cut In Half After Joe Biden Left Office (NYP)

The Ukrainian energy company that was paying President Biden’s son Hunter $1 million a year cut his monthly compensation in half two months after his father ceased to be vice president. From May 2014, Burisma Holdings Ltd. was paying Hunter $83,333 a month to sit on its board, invoices on his abandoned laptop show. But in an email on March 19, 2017, Burisma executive Vadym Pozharskyi asked Hunter to sign a new director’s agreement and informed him “the only thing that was amended is the compensation rate.” “We are very much interested in working closely together, and the remuneration is still the highest in the company and higher than the standard director’s monthly fees. I am sure you will find it both fair and reasonable.”

After the email, the amount listed on Hunter’s monthly Burisma invoices was reduced to $41,500, effective from May 2017. The amount was paid in Euros, at the rate of between 35,000 Euros and 36,100 Euros per month, based on currency fluctuations at the time. No reason is given for the decrease in salary. The only change in circumstance appears to be that Hunter’s father was no longer in office. In 2016, Hunter’s total income from Burisma was $999,996. In 2017 it dropped to $665,000, and then $498,000 in 2018. Hunter resigned from the Burisma board in April 2019, according to his lawyer George Mesires, after his controversial business dealings dogged his father’s presidential campaign.

Lukashenko has already used this to defend his actions.

• US-Funded Belarus Activist Arrested On Plane Joined Neo-nazis In Ukraine (GZ)

A high-profile Belarusian regime-change activist whose detention on a forcibly grounded airplane caused an international scandal has extensive links to neo-fascist groups, which his political sponsors in Western capitals have conveniently overlooked. Right-wing activist Roman Protasevich was traveling on the Irish airliner Ryanair on May 23 when the plane crossed into Belarusian airspace and was ordered to land by state authorities. Protasevich was subsequently taken off the aircraft and arrested. The incident triggered a wave of denunciations by Western governments, and a new round of aggressive sanctions on Belarus. Many anti-interventionist critics pointed out the hypocrisy of the US government’s condemnations, recalling how, in 2013, it forcibly grounded the plane of Bolivian President Evo Morales in an egregious violation of international law because it wrongly suspected he was harboring NSA whistleblower Edward Snowden.

Effortlessly ignoring Washington’s own precedent, Western governments and major corporate media outlets blasted the government of Belarusian President Alexander Lukashenko as a brutal dictatorship while lavishing praise on Protasevich, portraying the high-profile opposition figure as a heroic human rights defender. What they refused to acknowledge is Protasevich’s recent history serving with a neo-Nazi militia in Ukraine, and his extensive ties to other far-right extremist organizations. A leader of Ukraine’s notorious Azov Battalion, an explicitly neo-Nazi militia that uses white supremacist imagery, publicly acknowledged that Protasevich joined the fight alongside Azov. A Ukrainian newspaper reported that Protasevich worked with the neo-Nazi militia’s press service.

Protasevich personally admitted in an interview to traveling to Ukraine and spending a year battling pro-Russian forces in the eastern war zone of Donbas. He is even suspected of possibly posing with an assault rifle and a military uniform on the front of Azov’s propaganda magazine, which is emblazoned with a large neo-Nazi symbol. The influence of Azov and similar ultra-nationalist groups in Ukraine has extended well outside of its borders, spilling over into neighboring countries in Eastern Europe, while also influencing politics in Canada and even Hong Kong, where Azov extremists joined a Western-backed “color revolution” operation targeting China.

Like Azov, Protasevich has benefited from direct support from Western governments. Just as the neo-Nazi Ukrainian militia received weapons and military training from the United States in order to fight in its proxy war against Russia, Protasevich’s media career was launched by a US government-backed outlet, Radio Free Europe / Radio Liberty, which was created by the CIA as part of an information war against Moscow.

The banks are now the victims? Vraiment?

• Billionaires’ Secretive Speculation Threatens Next Financial Meltdown (MW)

Here’s the recipe: Start with a few billionaires. Next, let them put trillions of dollars in unregulated pools of capital. Next, add a dash of pandemic speculation. What could possibly go wrong? Meet the family office, the last known vestige of the shadow financial system—and a potential cause of the next meltdown. Super-rich individuals—those with over $250 million—form these secretive offices (sometimes called “family funds”) in order to bring their wealth management, tax planning, and sometimes charitable activities under one private roof. There are now an estimated 7,000 to 10,000 family offices managing an estimated $6 trillion. For perspective, the global hedge-fund industry manages $3.6 trillion.

The spotlight is shining on family offices thanks to the sudden collapse of Bill Hwang’s Archegos Capital, which cost Credit Suisse and Morgan Stanley $10 billion in bank losses—and plunged the value of stocks the office held by $33 billion. ‘This has to be one of the single greatest losses of personal wealth in history,’ says stock-market pro of Archegos margin call. Unlike hedge funds, family offices aren’t required to register with the Securities and Exchange Commission (SEC) or publicly report certain option and stock positions. That’s no accident—during the 2009 Dodd-Frank financial reform after the 2008 crash, family offices successfully lobbied and fended off oversight. That lack of transparency is precisely what makes them so dangerous. Because Archegos didn’t have to disclose their highly leveraged positions, the banks that were lending to it were completely in the dark.

How is UniCredit still a going concern in 2021? I know cats with fewer lives.

• Chaos Erupts After Stiffed UniCredit Bondholders Get Fat-Fingered Payment (ZH)

Step aside Citigroup, and your erroneous $500MM transfer to Revlon bondholders: there is an even dumber “fat finger” in town. Late last week the financial world was shocked when Andrea Orcel, the new CEO of Italy’s second largest bank UniCredi, decided not to make a €30MM debt coupon payment on the grounds that the bank made a loss last year, even though investors had been assured of the cash. Then, on Tuesday, the financial world was even more shocked when the news broke that despite the bank’s decision, some bondholders said they had received notice of payment after all. And while UniCredit insists it didn’t pay it, raising Citigroup-esque dejavi questions about how the payment was made, Orcel’s calculated show of strength has “rapidly descended into a farce”, according to Bloomberg.

What happened? It all started last Friday when UniCredit made the shocking decision to skip the payment of coupons on some financial instruments, in a U-turn that sent he bond in question into a tailspin and hurt some other debt sold by Italy’s No. 2 bank. Just back in February, when presenting full-year results, Finance Chief Stefano Porro had told analysts the bank expected to pay a coupon on the legacy bond it issued over a decade ago, as well as on Additional Tier 1 bonds. But a spokesman on Friday said UniCredit would not do so after posting a 2.79 billion euro ($3.4 billion) loss last year. As Reuters noted, UniCredit has withheld coupon payments on the CASHES notes in the past after ending the year in the red, but the latest decision, taken by new Chief Executive Andrea Orcel barely a month after his arrival, took bond investors by surprise.

However, some bond investors were even more surprised when they woke up on Tuesday to find that their bank accounts had been properly debited with the required coupon payment from the UniCredit bonds. Initially there was much confusion who was responsible for the payment or where it came from, even if the confusion was understandable: the 2.98 billion euro bond’s complicated structure meany that there are several players involved, and the error could have come from any one of them. The CASHES, short for Convertible and Subordinated Hybrid Equity-Linked Securities, have different banks serving as depository and fiduciary for the instruments.

The confusion went away this morning when we learned that Euroclear – Europe’s largest bond custodian and settlement agent of securities transactions – said it had mistakenly credited client accounts with funds for a coupon payment on UniCredit bonds that the bank had decided not to honor. The flub by Euroclear added a fresh – and confusing – twist to the surprise decision by new UniCredit Chief Executive Officer Andrea Orcel not to pay the debt coupon of about 30 million euros.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.