John Collier FSA housing project for Martin aircraft workers, Middle River, MD 1943

“..the US government and the Federal Reserve have spent, borrowed, and printed so much that there is no future left to mortgage.”

• Rogoff’s Cashless Society Proposal Is An Admission Of US Insolvency (Sprott)

Ken Rogoff is by all accounts a brilliant man. The Harvard professor and former IMF chief economist is a chess grandmaster. His thesis committee included current Fed vice-chair Stanley Fischer. But like many survivors of Ivy League hoop jumping, the poor fellow appears to have emerged punch drunk. That’s the only conclusion to be drawn from Rogoff’s new book, The Curse of Cash , which, in effect, proposes a ban on paper currency. It’s terrifying piece of work, for several reasons. [..]

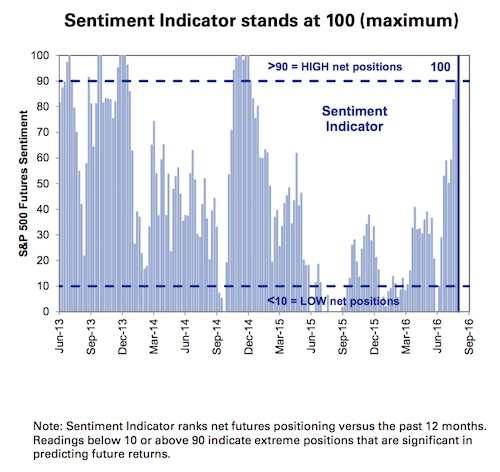

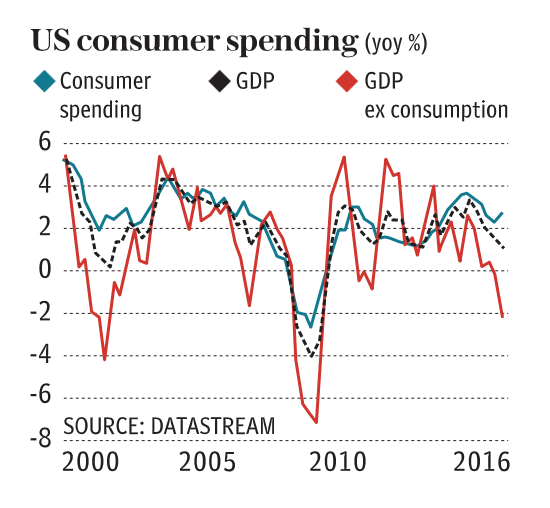

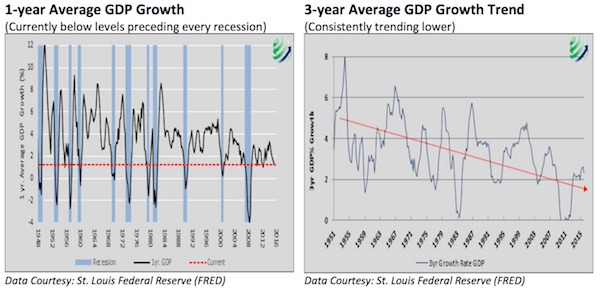

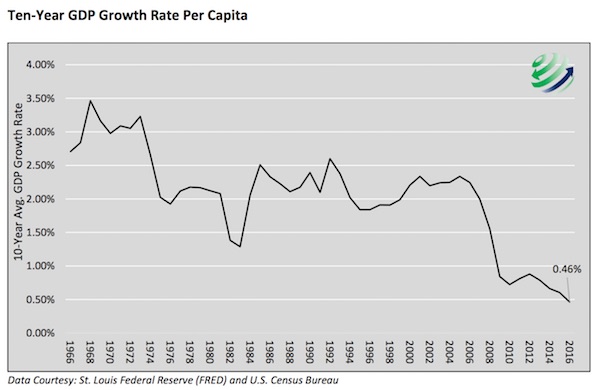

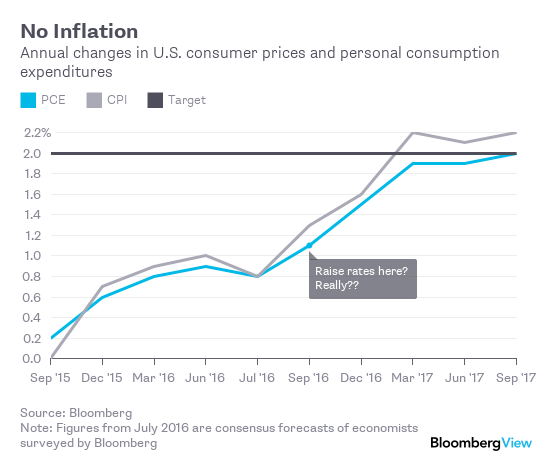

Rogoff’s “cashless society” is an elegant solution to a key problem bedeviling the Federal Reserve: with interest rates at the zero bound, the US central bank has no ammunition left to fight the next recession – because if cuts rates below zero, savers will withdraw their cash and put it under their mattresses. “In principle, cutting interest rates below zero ought to stimulate consumption and investment in the same way as normal monetary policy,” Rogoff writes. “Unfortunately, the existence of cash gums up the works.” That argument is spurious at best. By now, it is fairly clear from experiences in Japan and the US since 2008 that below neutral level interest rates provide little or no net new economic stimulus. At best, easy monetary policy brings forward spending and investment from the future into the present.

However, the US government and the Federal Reserve have spent, borrowed, and printed so much that there is no future left to mortgage. Rogoff, one of the country’s top economists, knows this; which is an important clue that there is much more to his proposals than meet the eye. It seems clear that Rogoff’s negative interest rate/cashless society proposal is structured to engineer a back-door US government debt default. Over the long term, by forcing savers, businesses, and banks to give the US government their money, and allowing Washington to repay less of that money each year, the US can legally default – on all that it owes. More worrying for investors: the fact that Rogoff, Ben Bernanke and others are proposing negative rates despite the considerable evidence that they will do no economic good suggests that they believe that the US government cannot pay back its debts – that it is already insolvent.

[..] maybe Rogoff is just as good a player on the public policy front as he is on the chess board. There is a possibility that he wrote The Curse of Cash as a quasi-job application for a higher government post, possibly as Treasury Secretary in a Clinton Administration. “If you give me the job, I’ll help make sure that government can borrow all it wants and it won’t have to pay any of it back,” may be the sub-text to Rogoff’s book. There is a precedent for this. Ben Bernanke’s 2002 “helicopter money” speech is widely credited with having set the ground for his appointment as Fed Chairman several years later. Brilliant? Cynical? Delusional? Or maybe all three? Take your pick. Either way, you haven’t heard the last of Ken Rogoff.

“Speculation has mounted that the Bank of Japan could undertake an “inverse twist,” shifting its bond purchases away from the longer end of the yield curve. ..”

• How A ‘Twist’ By The Bank Of Japan Could Upstage The Fed (MW)

News reports paint a picture of a Bank of Japan board that remains solidly in favor of maintaining an ultra-easy monetary policy, but is sharply divided over the best way to proceed as the country’s banking sector feels the pinch of low rates and a flat yield curve. Ideas the Bank of Japan could ultimately move to adjust its program in a way designed to further steepen the yield curve are behind recent market moves, analysts said, and could pave the way for further steepening of yield curves around the world, including U.S. Treasurys. Speculation has mounted that the Bank of Japan could undertake an “inverse twist,” shifting its bond purchases away from the longer end of the yield curve.

That would be a mirror image of a Federal Reserve maneuver dubbed “Operation Twist” that the central bank used in 1961 and 2011 to flatten the yield curve by buying long-term debt and selling short term debt. Bond yields move inversely to prices. There are other measures the Bank of Japan could take to try to steepen the yield curve, including simply changing the mix of maturities it buys or setting a yield target. Christoph Rieger at Commerzbank urged against undertaking an inverse twist, noting that Kuroda has expressed concerns that a “bear steepening” of the yield curve—a phenomenon in which long-term rates rise faster than short term rates—tends to tighten monetary conditions. Obviously, that would blunt the impact of the BOJ’s easing efforts and prove unwelcome in an economy that’s contracting.

“The (stock) market exploded to the upside and then crashed dramatically. That money had to go somewhere, so it washed around the system … so a lot of it has gone into housing.”

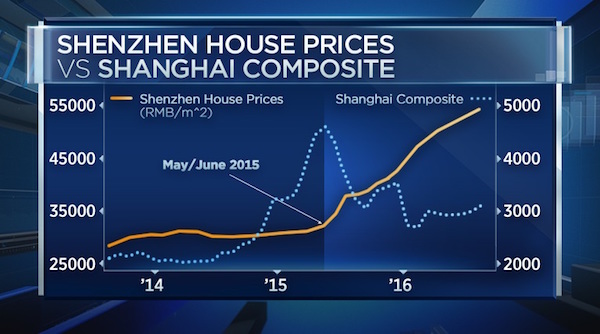

• China ‘Tulip Fever’ Sees House Prices Skyrocket 76% (CNBC)

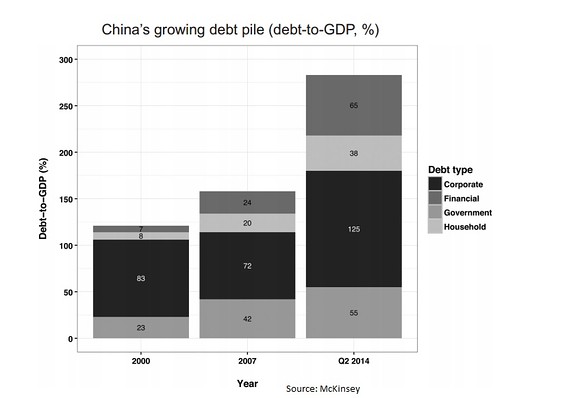

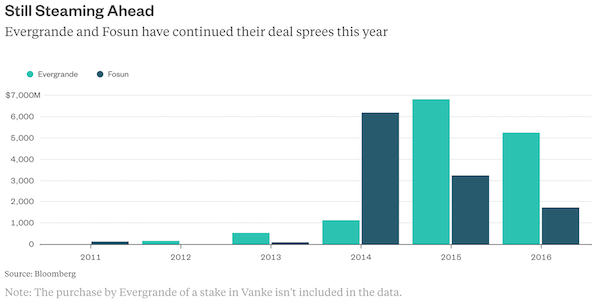

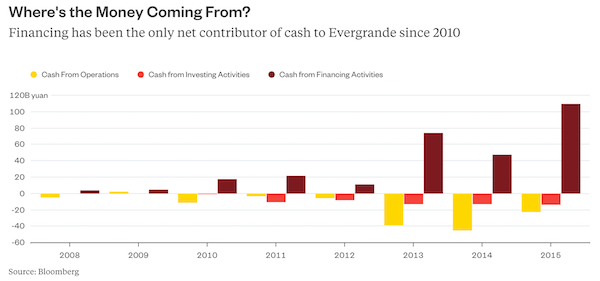

Housing in major cities in China has seen price hikes over the last year that resemble the famous Dutch “Tulip Fever” bubble of 1637, according to new research by economic consultancy firm Longview Economics. “I think what’s going on in China is troubling … some of the valuations there are really quite extraordinary,” Chris Watling, the CEO of Longview Economics, told CNBC Thursday. “We’ve double checked these numbers about seven times, because I found them quite hard to believe.” The firm’s research found that only San Jose in the Silicon Valley is more expensive than Shenzhen. The Chinese city has seen prices rise 76% since the start of 2015, with the acceleration beginning in April 2015 as the country’s stock market was nearing its peak.

The situation in Beijing and Shanghai is similar, albeit less extreme, the company states. “Housing in some of the tier 1 cities is more expensive than it is in London, which I think itself is on a bubble, Watling added. “The (stock) market exploded to the upside and then crashed dramatically. That money had to go somewhere, so it washed around the system … so a lot of it has gone into housing.” The analysis suggests that the typical home in Shenzhen costs approximately $800,000. Watling said that the house-income ratio in Shenzhen is now running at 70 times, compared to around 16 times in somewhere like London.

China, the biggest economic story of the last 30 years, has soured in the eyes of many analysts. A stock market crash that began in the country last summer has highlighted the vast difficulties Chinese lawmakers are now facing. Watling said Chinese housing was a story built on credit, lots of liquidity and lots of debt. He added that all bubbles, though, once established, will eventually burst and deflate. “It’s simply a question of when,” Watling said in a research note earlier this week, adding that the removal of cheap money would be the likely scenario that would lead to the beginning of the tightening and subsequent prices falls.

“.. the collapse of Unicredit, which has vast, sprawling operations across Germany and Eastern Europe, would threaten the stability of the entire Eurozone.”

• Italian Banking Crisis Turns into Mission Impossible (DQ)

[..] for Monte dei Paschi’s latest rescue plan to have any chance of working, both parts of the plan — Part A and Part B — must succeed. Part A consists of a €28 billion bad-loan sale for which JP Morgan Chase, Citi and Italian investment bank Mediobanca are already assembling a bridge loan, in return for very handsome fees. Atlante, Italy’s deeply opaque, Luxembourg-based bank rescue fund, has reportedly agreed to buy the so-called mezzanine tranche in Monte dei Paschi’s bad loan securitization. Apparently demand for heavily discounted, slowly-decomposing bank debt in Italy is high, which is great news considering Italy is purportedly home to roughly a third of all of the bad debt at EU banks.

In a perfect sign of our yield-starved times, last week saw around 250 global investors converge on Venice to attend Banca Ifi s SpA’s “Non-performing Loan” conference. That’s twice as many as last year, reports Bloomberg. In other words, Part A of the rescue plan seems to be coming along nicely — as long as no one asks who will make up the difference between the book value of the bank’s toxic assets and the discount value at which they’re now being sold. As for Part B of the Plan — MPS’ €5 billion cash call scheduled for the end of this year — it’s going nowhere fast. Twice-bitten, thrice-shy investors are no longer buying the hype. Gennaro Pucci at London-based PVE Capital said that even if a significant proportion of MPS’ bad loans were “spun off into a special vehicle,” he would not buy more MPS shares out of fear that the bank could suffer further losses from the remaining soured debt.

This is a serious problem in today’s Italy: as long as the economy continues to stagnate, much of the supposedly good debt currently on the banks’ books will also, sooner or later, end up putrefying. It’s already happened to Banca Popolare di Vicenza, a regional lender that was rescued from bankruptcy late last year by the Atlante fund, but which is already in need of fresh funds. So, too, is Italy’s biggest and only global systemically important financial institution, Unicredit, which has a staggering €80 billion in bad debt on its balance sheets — more than any other European bank. While the downfall of MPS would be enough to cause serious damage to Italy’s already fragile financial system, the collapse of Unicredit, which has vast, sprawling operations across Germany and Eastern Europe, would threaten the stability of the entire Eurozone.

But first a fire sale.

• Most Likely Scenario For Hanjin Is Liquidation (WSJ)

Debt-ridden Hanjin Shipping is working on a restructuring plan that calls for the drastic reduction of its owned fleet and returning the vast majority of the ships it charters to their owners, according to people with direct knowledge of the matter. Despite the efforts, these people say the most likely scenario is still that the Korean operator— the world’s seventh-biggest in terms of capacity—will be liquidated, marking one of the shipping industry’s biggest failures. Hanjin filed for bankruptcy protection last month. The South Korean government has strongly indicated it has no plans to bail out the company. A Korean court will decide in December whether to accept the plan or let the company go under, according to court officials in Seoul.

One person with knowledge of Hanjin’s efforts to restructure said the operator is considering a number of scenarios but focusing on one that involves Hanjin keeping up to 15 of its 37 ships, and returning to owners almost all of the 61 chartered vessels. Under that scenario, which is subject to approval by the bankruptcy court, “Hanjin will emerge as a small regional operator in Asia that will move a small part of Korea’s exports,” the person said. [..] Hanjin’s main charterers, including Danaos, Navios and Seaspan, with a combined exposure of more than $1 billion to Hanjin, were hoping for a last-minute intervention by the Korean government that would allow Hanjin to honor its vessel-leasing commitments. That looks less and less likely.

“Hanjin now has two alternatives: either to drastically downsize or to liquidate,” said Iraklis Prokopakis, Danaos’s COO. “We have eight ships chartered to Hanjin and five will be returned. The other three still have cargo on them so I don’t know what will happen.” Danaos has a $560 million exposure to Hanjin. Mr. Prokopakis said the key issue at the December court hearing will be whether Hanjin has enough cash to continue operating, even at a much smaller scale.

“Yesterday, US-backed FSA “moderate” opposition troops chased US Special Forces out of one town in Syria.”

• US Bombs Assad’s Troops, ISIS Makes Dramatic Advance as Result (McAdams)

The US military has bombed Syrian government positions in the eastern province of Deir el-Zour today, where the Syrian military had been battling ISIS. According to the report, the US attack on Syrian troops “enabled an [ISIS] advance on the hill overlooking the air base.” This is the second time US forces have directly targeted Syrian government troops inside Syria. It would be the first time such an attack produced a battlefield advantage to ISIS. The US attack has killed at least 62 and perhaps as many as 100 Syrian government troops. Earlier today it was reported that the Syrian government had sent some 1,000 members of the elite Republican Guard into the Deir el-Zour province, as battles with ISIS in the area increase.

This US attack has wiped out perhaps 10% of this force and has obliterated Syrian army weapons and other materiel. The US government has admitted to the attack, but claims it was all a mistake. As some observers have pointed out, however, ISIS does not behave as traditional military units. They do not generally gather in large numbers like this or establish “bases.” The US Central Command released a statement earlier today claiming that the US coordinated the strike with the Russians, but Moscow has vehemently denied the claim. In fact, spokesman for the Russian Foreign Ministry Maria Zakharova was quoted by the state news agency Tass as saying that “after today’s attack on the Syrian army, we come to the terrible conclusion that the White House is defending the Islamic State.”

This dramatic development comes as the latest ceasefire begins to crumble. Russia has condemned Washington’s refusal to implement a key component of the agreement, to press US-backed rebels to cease fighting alongside al-Qaeda; and the main US-backed “moderate” Islamist group, Ahrar al-Sham, has refused to take part in the ceasefire at all. Yesterday, US-backed FSA “moderate” opposition troops chased US Special Forces out of one town in Syria. Is today’s attack a turning point in the war, where the US will begin to strike Syrian government forces more frequently? If so, how will Russia and Iran react to this overt shift in US strategy? Is this the flashpoint?

But that’s all he’s going to get.

• Italian PM Renzi Says He Is Tired Of Wasting Time At European Summits (DW)

Italian Prime Minister Matteo Renzi blasted the latest European Union summit in Bratislava on Saturday, effectively labeling Friday’s high-level meeting a waste of time. “I don’t think it would be right for Italy to pretend not to notice when things are not getting any better,” Renzi said at a conference in Florence. Hours earlier, he criticized the summit in an interview with TV broadcaster RTV38. “As Italy, we strongly believe that the EU has a future, but we need to be doing things for real, because we have no use for staged events,” he said. Renzi also said he did not partake in the closing press conference with Angela Merkel and Francois Hollande because he was unhappy with the decisions reached concerning economic and migrant policy.

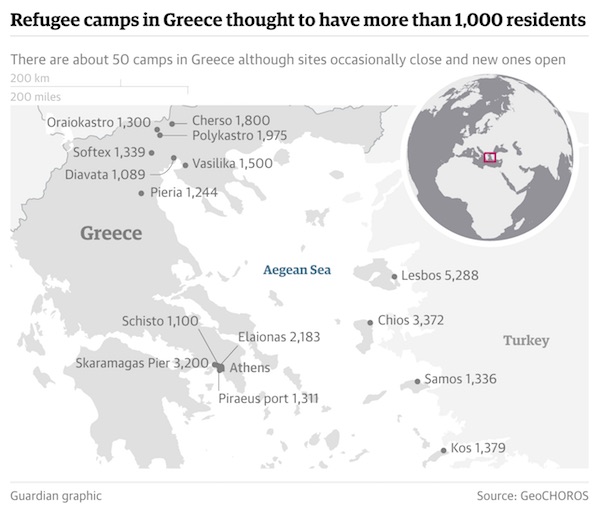

Renzi said Italy would not “serve as a fig leaf” for the likes of France or Germany. In what was the first European summit without the United Kingdom in over four decades, European leaders sought to show unity in the wake of this summer’s Brexit vote. This, Renzi said, “signals a small step forward, but it is still a rather long way away from the idea of Europe that we have in mind.” Renzi castigated the summit for not raising the African migrant issue. The documents “didn’t even mention Africa,” he said. As the first European destination for migrants arriving from Africa, Italy has been left to cope with the influx of refugees largely on its own while politicians debate how to address refugees in Turkey and along the so-called Balkan Route though Greece, eastern and central Europe.

Italy has long pushed for an international agreement with African states that would close migrant routes to Europe in exchange for increased investment. Renzi repeated his critiques of the EU’s austerity policy. While the country is respecting the EU’s strict budget disciplinary rules, he said Italy retains the right to stress that the rules are not working and it is not prepared “to pretend not to notice.”

Insult to injury. It never stops. Electricity prices were raised 4-5% in Greece. Who can afford that?

• Greek Public Assets Being Sold For A Fraction Of Their Actual Value (Kath.)

Public properties, including real estate assets, are very often sold for extremely low prices, as the political risk factor supersedes even the crucial financial risk that comes with investing in Greece. The Hellenic Federation of Enterprises (SEV) this week commented on the issue, saying that this institutional shortfall of the Greek state and the lack of trust this generates in the three pillars of power (legislative, executive, judiciary) have turned the optimum utilization of state property into “a political point-scoring battle among parties.” As SEV pointed out, “in many instances we see the state’s assets devalued, owing to the delays that political tensions bring about in privatizations, so that they are sold off at particularly low prices. In other instances the prevailing criterion becomes the price of the privatization, without taking into consideration any distortions created in the market from incomplete planning.”

For the industrialists’ association there is no doubt that “the correct utilization of public property along clear and stable rules and terms of economic efficiency, both for state revenues and for the operation of markets, can become a key growth factor for the economy.” All this becomes clearer when one considers the tenders that the state privatization fund (TAIPED) has been conducting for the concession of real estate assets. As property market professionals observe, in most cases the prices investors offer – particularly in instances of plot development – are just a fraction of each asset’s actual value. The reason for that is not to be found in the financial crisis and the drop in market prices, but in investors’ need to factor the political risk into their calculations regarding the sustainability of their chosen investment, in order to secure the desired returns.

CNBC tries an odd twist by claiming it’s not really a TTiP protest, but a form of general ‘easy anti-Americanism’. The same tactics as used in Brexit and the US elections. Curious to see when these people will realize these are losing tactics.

• Hundreds Of Thousands Take To Streets In Germany To Protest TTiP (CNBC)

Hundreds of thousands of Germans took to the streets Saturday, in protest of pending trade deals with the United States and Canada. The deals in question are the Transatlantic Trade and Investment Partnership (TTIP) between the U.S. and the European Union and the Comprehensive Economic and Trade Agreement (CETA) for the Canadian-EU relationship. Neither free trade agreement has been ratified yet, but popular outcry has been growing for the last few years. The demonstrations took place in seven cities throughout Germany: Berlin, Frankfurt, Hamburg, Cologne, Leipzig, Munich and Stuttgart. Organizers told CNBC that the official estimate is 320,000 demonstrators across Germany.

In Berlin, where discussions of trade policy are frequently overheard in cafes and most available surfaces are plastered in posters and stickers against the deals, the largest demonstration of the day took place with about 70,000 attendees, according to the organizers. Earlier, local reports had indicated there could be as many as 80,000 in the German capital, but a heavy downpour close to the start time may have depressed turnout. A broad coalition of organizations helped plan the event, but the stated rationale for opposing the agreements centers on the belief that such deals “primarily serve the interests of powerful economic interest groups, and thus only cement the imbalance between the common good and economic interests,” according to one organization.

Under TTiP, this would have been impossible.

• France Bans All Plastic Cups, Plates And Cutlery (Ind.)

France has passed a new law to ensure all plastic cups, cutlery and plates can be composted and are made of biologically-sourced materials. The law, which comes into effect in 2020, is part of the Energy Transition for Green Growth – an ambitious plan that aims to allow France to make a more effective contribution to tackling climate change. Although some ecologists’ organisations are in favour of the ban, others argue that it has violated European Union rules on free movement of goods. Pack2Go Europe, a Brussels-based organization representing European packaging manufacturers, says it will keep fighting the new law and hopes it doesn’t spread to the rest of the continent. “We are urging the European Commission to do the right thing and to take legal action against France for infringing European law,” Pack2Go Europe secretary general Eamonn Bates told AP. “If they don’t, we will.”