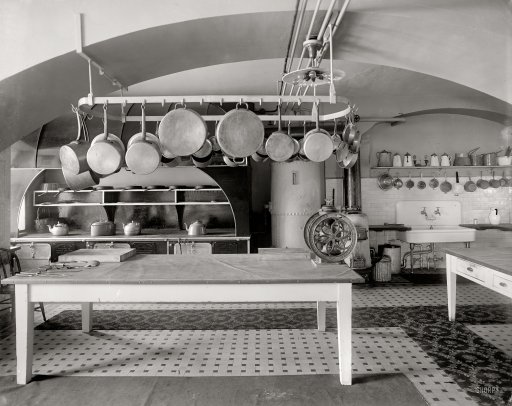

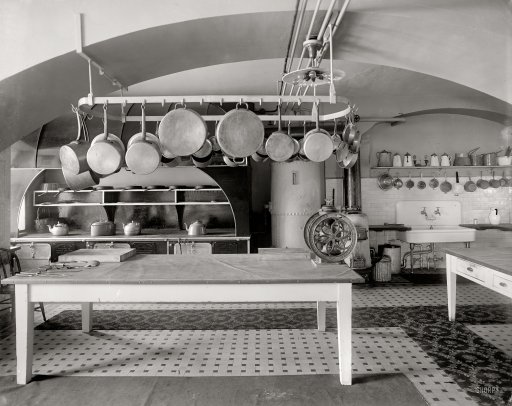

Harris&Ewing The White House kitchen, Washington DC 1909

The Greeks better be fast then, or there’ll be nothing left to nationalize. The banks are part of the €50 billion asset sales plan.

• Greek Banks Face Full Nationalisation (BBC)

Just because the doors of Greek banks are open today, don’t be fooled into thinking they and the Greek economy are anywhere near back to recovery. There are still major restrictions on the ability of their customers to obtain their cash or move it around: a) withdrawals per week are capped at €420; b) there is a ban on using deposits to repay loans early (because many Greeks would rather repay debts than risk seeing their savings wiped out in a bank crash or in a so-called bail-in which would see savings converted to bank shares of dubious value); c) it is still incredibly difficult for small and medium size businesses to purchase vital raw materials or other goods from abroad, because banks won’t make new loans and there are severe restrictions on foreign payments.

The symbolic importance of the ECB turning on the emergency lending tap again was important, but it has only been turned on a fraction. It has given enough additional Emergency Liquidity Assistance, €900m, to keep the banks alive in a technical sense. There is no possibility of them thriving for months and even possibly years. To put it in a Hellenic nutshell, the banks and the Greek economy remain in intensive care. The transmission of money is being facilitated in the most basic way, but there is no creation of new credit; and this credit freeze is a major impediment to consumer spending, and – perhaps more importantly – will lead to many businesses going bust in the coming weeks and months.

Which gives a certain frisson to a statement made only in May by Europe’s top banking supervisor, Daniele Nouy, chair of the so-called Single Supervisory Mechanism, the bank supervisory arm of the ECB. She said of Greek banks, in an interview with the Wall Street Journal, that “these banks have gone through important restructuring, important recapitalisations and a redefinition of their business models. They have never been better equipped to go through this kind of stressful situation”. Really? Just a few days ago, eurozone leaders and the IMF more or less pronounced the entire Greek banking system kaput, with their declaration that the banks need additional capital of €25bn euros – which, relative to the size of the Greek economy, represents one of the biggest banking black holes in the history of capitalism.

Read more …

“The Greek banks, stripped of many of their assets by the ECB, will need the ECB to make a reappearance in Athens to aid their recovery.”

• Greek Banks Face Stress Tests At The Worst Time (Guardian)

Plenty of dangers lie in wait for Greek banks. Already short of cash, they may need lots more when stress tests of their solvency are carried out in a month or two. And unable to access the international money markets, they will be in a similar position to the Greek god Telephus, who was wounded by Achilles and yet needed Achilles to return as a doctor before he could be healed. The Greek banks, stripped of many of their assets by the ECB, will need the ECB to make a reappearance in Athens to aid their recovery. On a day when the Greek banks opened their doors for the first time in three weeks, the debate about future funding needs seemed far away.

Allowing access to the unknown treasures found in countless deposit boxes triggered a cheer, especially among the better off over-60s, if a quick glance at the queues outside branches was anything to go by. A couple of months from now, the story could take a grim turn. Not only will hundreds of millions of deposits have been withdrawn in that time, the weakening effects of a broader economic slowdown will have taken their toll. For one thing, the economy is likely to be another 5% smaller by the autumn than when the banks were stress-tested last time. Many businesses and personal customers will have acquired bigger debts with their banks. Others will have declared themselves bankrupt.

And this deterioration in loan quality will be reflected in a lower credit rating and a bigger need for replacement funding. The big four – Piraeus, Alpha Bank, Eurobank and National Bank of Greece – are already underpinned by €130bn of ECB funds. As their liquidity squeeze intensifies, that figure could soar. Swiss investment bank UBS warned that the stress tests may reveal a situation that is so bad the government will be forced to follow Cyprus and impose a haircut on all deposit accounts containing more than €100,000 . Even the hint of such a move will cause more panic. No doubt the ECB is working hard to limit any further harm.

Read more …

“As sophisticated investors in financial institutions, our clients would consider increasing their financial commitments to NBG under appropriate circumstances..” Appropriate meaning “All Your Base Are Belong To Us”

• National Bank of Greece Creditors Offer Funds to Prevent Losses (Bloomberg)

A group of senior creditors to National Bank of Greece said they’ll consider recapitalizing the troubled lender to avoid incurring losses on their bonds. “As sophisticated investors in financial institutions, our clients would consider increasing their financial commitments to NBG under appropriate circumstances,” Shearman & Sterling LLP, the law firm representing the group, wrote in a July 17 letter to international creditors including the ECB and obtained by Bloomberg. “Our clients intend to ensure that their rights under all applicable laws are fully respected.” Greece’s tentative bailout deal puts senior bank bondholders explicitly in line for losses because it requires the country to adopt the EU’s Bank Resolution and Recovery Directive as a condition for aid.

Greece’s existing insolvency law excludes a bail-in of the debt, according to Fitch Ratings. The bondholders are seeking to ensure that Greece explores private-sector solutions before resorting to a bank resolution and that senior creditors are protected should it come to that, according to the letter, which was also addressed to the European Stability Mechanism, the vehicle set up to finance loans to distressed euro area countries, the president of the Eurogroup and the governor of the Bank of Greece. The group holds about 25% of NBG’s €750 million of senior bonds due April 2019, according to a person familiar with the matter who asked not to be identified because the information is private.

The bonds rose to 37 cents on the euro today after dropping by more than 70% since the start of the year to a record 21 cents on July 8, according to data compiled by Bloomberg. The notes represent about 40% of the €1.9 billion of privately-held senior debt issued by Greece’s four major banks, according to data compiled by Bloomberg. “The recent crisis arose entirely from decisions made by Greek and European political and monetary authorities that were wholly outside of NBG’s control,” the letter said. “Before additional capital and liquidity can be made available to Greek banks such as NBG, investors such as our clients, must have confidence in the Greek and European supervisory and resolution frameworks, and be assured of fair treatment.”

Read more …

“What worries me is that some people still think that there would be no austerity if we were out of the euro. This argument is absolutely false,” said state minister Nikos Pappas.”

• Greece: Plea For Unity As Banks Reopen (Guardian)

The reopening of banks and repayment of debts returned Greece to a semblance of normality on Monday but the ruling Syriza party admitted it faced considerable political challenges in pushing through reforms. After a drama-filled month that saw the country come close to being ejected from the eurozone, the government, led by the prime minister, Alexis Tsipras, appealed for unity as it faced another make-or-break vote in Athens on Wednesday. As customers queued outside banks – after lenders opened their doors for the first time in three weeks – officials warned that the left-led coalition could fall if dissidents failed to endorse reforms set by international creditors as the price of further aid.

“What worries me is that some people still think that there would be no austerity if we were out of the euro. This argument is absolutely false,” said state minister Nikos Pappas, one of Tsipras’s closest aides. Addressing reporters, the foreign minister Nikos Kotzias said he believed fresh elections were “inevitable” in September or October because the government could not continue depending on the political opposition for support. The first package of reforms voted through by the Greek parliament last week was passed with the backing of three opposition parties, which have argued that Greece must be kept in the eurozone at any cost. But government officials have said elections could be held as early as 13 September amid fears that such an arrangement cannot last in the long term.

Amid mounting talk of early elections, Nikos Filis, the ruling Syriza party’s chief parliamentary representative, highlighted the dangers that lay ahead, saying the government would collapse if rebels rejected the measures. “When a government does not have [the support of] 120 MPs, legally there is no issue but politically there is,” he said. Last week, Syriza saw its support being whittled down from 149 to 123 MPs as lawmakers broke ranks over the controversial terms of an aid package worth as much as €86bn (£60bn) to keep the insolvent country afloat. The reforms included changes to the Greek pension system and VAT regime. The loss of support has meant that Tsipras now has a two-pronged battle on his hands: to meet the exacting terms of creditors while convincing increasingly hostile members of his own party to back them.

By Wednesday, the Greek parliament must, as requested by creditors, pass a law to overhaul its civil justice system, with the aim of speeding up processes and reducing costs. The government must also transpose the EU’s bank recovery and resolution directive into law. This law was part of Europe’s response to the 2008 banking crisis and should have been put into national law months ago.

Read more …

Excuse me? “Savers formed long queues in front of ATMs..”? Huh? How stupid does that sound?

• How Bad Things Were for Greek Banks When Capital Controls Were Introduced (BBG)

Today the Greek central bank released its monthly balance sheet for June 2015. The balance sheet is dated to June 30—the day after capital controls were introduced in Greece. The seven-month jog on Greek lenders was about to turn into a full blown bank run during that last weekend of June, after Prime Minister Alexis Tsipras broke talks with creditors and called a referendum over the terms attached to the country’s bailout. Savers formed long queues in front of ATMs as doubts over the country’s place in the euro area spurred them to withdraw their cash from banks. The new data from the central bank shows that the total value of banknotes in circulation in Greece reached an all time high of €50.5 billion. That’s an increase of more than €5 billion in the month of June alone.

Tsipras was forced to impose a limit on withdrawals on June 28, after the ECB capped Emergency Liquidity Assistance (ELA) for Greek lenders, refusing to plug the hole from continuing deposit outflows. Much of the damage had been done already as Greek bank reliance on ECB operations, including ELA, meant that Greek Target2 liabilities with the rest of the eurosystem reached an all-time high at the end of the month. With the ECB limit on ELA, nobody, not even ordinary depositors, wanted to be exposed to Greek banks. Capital controls were the only option. That Tsipras and his then-finance minister were willing to allow things to get this serious before introducing capital controls underscores the high-risk strategy they were engaged in at the time.

Greek banks reopened this Monday, following a three-week forced holiday and only after Tsipras capitulated to creditors’ demands and committed to more austerity measures and structural economic overhauls. Still, draconian capital controls, including restrictions on withdrawals and transfers of money abroad, remain in place, and Greeks queued outside branches to get only basic services from their lenders.

Read more …

“Syriza inherited a non-state, a completely dilapidated administrative apparatus with civil servants shivering in fear over who will be next to lose his/her job..”

• Syriza Inherited A Non-State (Fouskas and Dimoulas)

Obviously, without Keynesian instruments at the national level and without a European federal state at the European level you cannot have any form of Keynesian policies. Too much reliance on the ECB – which, first and foremost, is a bank – and the “good will of European partners”, coupled with lack of institutional preparation to return to a national currency, has brought Syriza’s negotiating team to a standstill. Others, quite rightly, have argued that there has been no real negotiation since Syriza assumed office back in January 2015. The Germans, this argument goes, wanted regime change as they could not agree with the Greek Finance Minister’s reasonable demands – which included restructuring of the debt, ie debt relief.

In fact, this insight is correct: after the referendum of 5 July, the Greek PM sacked Finance Minister, Yanis Veroufakis, in order to keep his cabinet in place and avoid being pushed out by the creditors (mainly via financial and media warfare and permanently blocking liquidity to the Greek banks). Yet, what we have not seen being tackled is the following really dramatic issue. The creditors seem to be of the opinion that there is a Greek state in place that can implement and a Greek society that can accept the new austerity measures. This is reminiscent of the gruelling rationale behind America’s various wars post-9/11, but also before: we go to Afghanistan, Iraq and elsewhere to bring about the lights of liberal democracy, human rights and free market freedom capitalism.

This indicates total ignorance of the concrete societies and states they supposedly want to change and improve. In fact, wherever American power went, it only made things worse. Greece and the European periphery should be seen in the same light. Greek political elites, mixed with big comprador and corrupt interests, as well as the institutional materiality of the state as such, have always been fragmented, deeply inefficient and in the service of clientelist, corrupt and nepotistic deals and practices. But Syriza did not inherit just this. Syriza inherited a non-state, a completely dilapidated administrative apparatus with civil servants shivering in fear over who will be next to lose his/her job. Society itself, with 27% unemployment and 57% youth unemployment and unpaid salaries for months, swims in this strange mixed mood of anger, radicalization and demoralisation.

Recent administrative reforms in municipalities (the “Kapodistrias” and “Kallikratis” plans) caused havoc, further distancing the citizen from the state. Add to this the factional warfare within Syriza and the government and you will have one of the most inefficient ‘ruling’ machines in the west. In other words, Syriza’s state cannot reach the 1% primary surplus fiscal target; it will be unable to effect privatizations and other neo-liberal reforms required by the creditors in order to receive bail-out funds. The new anti-austerity package will fail. Even Syriza MPs who voted for it in the parliament may well boycott it. The PM himself said publicly that he does not believe it is a good deal.

Equally and arguably, for the same reason, a debtor-led default and exit from the Euro-zone will fail. A transition to the national currency requires a strong and well-organised state apparatus to lead an impoverished society through hardship to eventually achieve renewal and something positive at the end of a long and arduous journey. We argue that there is not enough state capacity in place to hold sway over the implementation of a new austerity package or indeed to buttress and deliver Grexit. So what is to be done now and in order to avoid a new election in Greece that is bound to achieve nothing of substance?

Read more …

Zombie money going “Poof”… Or, if you will, liquidity is drying up fast.

• Commodity Rout Worsens as Prices Tumble to Lowest Since 2002 (Bloomberg)

The rout in commodities deepened with prices touching the lowest since 2002 as the prospect of higher U.S. interest rates sent gold tumbling. Raw materials are losing favor with investors as the dollar gains amid signals from Federal Reserve Chair Janet Yellen that the central bank may raise rates this year on the back of an improving U.S. economy. Higher borrowing costs curb the attractiveness of commodities such as gold, which doesn’t pay interest or give returns like assets including bonds and equities. The Bloomberg Commodity Index dropped as much as 1.4%, falling for a fifth day in the longest stretch of declines since March.

Gold futures sank to the weakest in more than five years while industrial metals, grains, Brent crude and U.S. natural gas also slid as a measure of the dollar climbed to the highest since April 13. “Any increase in U.S. interest rates should further strengthen the dollar, prompting more fund outflows from commodities, metals and emerging-market assets,” Vattana Vongseenin, the chief executive officer of Phillip Asset Management in Bangkok, said by phone. The Bloomberg Commodity Index slid 1.3% to 96.2949 at 10:10 a.m. New York time, after touching 96.1913, the lowest since June 2002. With raw materials fetching lower prices, shares of commodity producers are tumbling. The 15-member Bloomberg Intelligence Global Senior Gold Valuation Peers Index, which includes AngloGold Ashanti Ltd. and Newcrest Mining Ltd., dropped as much as 8.4%.

Read more …

Not a lot of objective opinions about why this is happening.

• Gold, Silver Near Five-Year Lows in Asia Trade (WSJ)

Gold and silver prices continued to trade close to their lowest level in five years in Asia trade Tuesday amid rising expectations the U.S. Federal Reserve will raise interest rates later this year. Gold dipped below the psychological mark of $1,100 an ounce in early Asia hours, but quickly nudged above that level on bargain hunting. It was recently trading at $1,104.08/oz. “I think there is still going to be a little bit of pressure,” said Victor Thianpiriya, a commodity strategist at ANZ Bank. “Prices could head lower.” Mr. Thianpiriya said the yellow metal could test $1,000/oz in the near term, a level at which several mining companies might find it difficult to profit from extracting the commodity.

The gold market has turned bearish, with hedge funds that invest huge sums in gold futures reducing their long positions to nine-year lows. At the same time, speculators’ short positions—bets that gold could be bought cheaper in the future—have jumped in recent days. Analysts say a sustained rebound in gold prices is unlikely any time before the U.S. raises interest rates, a decision that is expected later this year after comments from U.S. Federal Reserve Chairwoman Janet Yellen last week. A rising dollar makes raw materials less affordable to overseas investors, while higher interest rates tend to draw money into yield-bearing assets and away from commodities, which pay their holders nothing and often carry storage costs.

Gold gained investors’ favor because of its safe-haven appeal after the 2008 financial crisis, but investors’ risk appetite seems to have increased with a modest economic recovery under way in the U.S. Moreover, the cost of holding gold looks set to increase because of an expected rise in U.S. interest rates. Other precious metals such as silver, platinum and palladium have fallen in gold’s slipstream. Silver prices nudged up from the opening price of $14.63 a troy ounce to $14.76 Tuesday, close to levels seen in early 2010. Platinum prices are at $974.70 a troy ounce, close to a six-and-half-year low, while palladium is near its lowest level since November 2012 at $605/oz.

Read more …

This is just one opinion. We are far more neutral.

• Why Gold Is Falling And Won’t Get Up Again (MarketWatch)

Do you remember gold? It was kind of an analog bitcoin. It was a universal legal tender. Governments held it in forts. Your bank kept it in a safe. It was the most precious of precious metals. And investors bought gold GCQ5, -0.11% for safety’s sake when markets and economies crashed and the value of paper currency was in doubt. But that was a long time ago. Gold is down 40% from its financial-crisis peak in 2011. As Jeff Reeves notes in his column Monday: “The long-term trend remains decidedly against gold.” Reeves honorably calls himself a gold “agnostic” because he doesn’t want to get into conspiracy theories and some of the nonsense that surrounds the gold market. He wants to talk about the investment. I want to talk about the investors.

Because I don’t think it’s possible to separate the two. Gold has always been the favorite commodity of a fringe crowd that doesn’t trust governments, central banks, politicians and the financial system. This part of the gold market drives a lot of the buying and selling; it whips up a lot of frenzy. I don’t have any hard evidence, but I’d argue that gold’s value is inflated by people who aren’t investing in a commodity but in a belief system that may or may not include black helicopters and a U.S. invasion of Texas. The sad part is that gold always has been a sucker’s bet. It’s supposed to protect against inflation. It doesn’t. It’s supposed to retain its value. It doesn’t. For those reasons, gold is supposed to be the ultimate currency. It’s not. As fund manager and blogger Barry Ritholtz said of gold’s fundamentals: “It has none.”

Wall Street, of course, welcomes the business. Gold, after all, is hardly a useful commodity. If it had significant real purpose, it wouldn’t be sitting in vaults around the world. But, hey, we’ll trade it. We’ll trade anything. By and large, these special breed of gold bugs have ignored history. In the past century, gold has bubbled and popped at least a half dozen times, with crashes coming in 1915-20, 1941, 1947, 1951-66, 1974-76, 1981, 1983-85, 1987-2000 and 2008. If many of those dates seem to have a common thread, it’s because they do. They were, for the most part, periods of economic expansion. Who wants gold, when the stock market is booming or housing prices are soaring? Fundamentally, today’s gold market is no different. Stocks are holding near all-time highs. Interest rates could rise before the end of the year. Gold, on the other hand, is slip-sliding away.

What is different is how deep and long this gold bottom could go. As we move into an ever-techier world, gold has more competition: namely cryptocurrencies such as bitcoin that cater to the new generation of skeptics. The bitcoin market touts itself as an alternative to the currency markets and a hedge against inflation. Bitcoin’s value, like gold, is based on the confidence of the buyer, nothing more. Cryptocurrencies may also even prove to be useful (at which point they most likely will be unattractive to bitbugs).

Read more …

“When everything costs me 10% more, isn’t my pension’s buying power much weaker? It’s like a pension cut..”

• Greek VAT Rise Hurts As Bailout Terms Start To Bite (Reuters)

To tourists wandering the narrow streets of central Athens, 20 cents on the price of souvlaki – a Greek favourite of grilled meat on a skewer – may not seem much. But for waiter Stavros Giokas, Monday’s jump in value-added tax is a big worry. The VAT rise, demanded by Greece’s lenders in return for a rescue deal, forced the restaurant where Giokas works to push up the price of souvlaki – wrapped in flatbread with salad and drizzled in tzatziki garlic yogurt – to €2.40 from €2.20. While a bargain for well-to-do northern European visitors, for Greeks worn down by years of austerity, the price increase is one more reason not to eat out. “People are counting every cent, not just for souvlakis,” Giokas said as he waited for customers, surrounded by empty tables decked in yellow and green tablecloths.

Some big, foreign-owned firms will absorb the rise in VAT on processed food and public transport from 13 to 23% without passing it on to customers. Other businesses may simply try to dodge paying the tax on some of their sales, a widespread practice that has contributed to Greece’s economic problems. But for many of those that do pay, there may be no other option than to pass on the rise to clients. “We can’t absorb the cost. Everything is getting more expensive: tomatoes, onions, tzatziki,” Giokas said. The tax hike will affect not only the cost of restaurant meals, processed food in shops and even salt, but also taxi fares and private school fees.

VAT jumped less than a week after the rise was approved in parliament as the leftist government of Prime Minister Alexis Tsipras tries to show other euro zone countries he is serious about reforms required to start talks on an 86 billion euro bailout deal that Greece needs to stay afloat. But across the country, workers, pensioners and economists alike worried about the impact of the increase on a population suffering from unemployment of over 25% and on an economy that was already forecast to contract this year. “When everything costs me 10% more, isn’t my pension’s buying power much weaker? It’s like a pension cut,” 65-year-old Nikos Koulopoulos said.

Read more …

“It’s not true we did not have a Plan B. We had a Plan B.” “We, in the Ministry of Finance, developed it. Under the egis of the Prime Minister, who ordered us to do this, even before we came in the Ministry of Finance.”

• Yanis Varoufakis: Greece ‘Made Mistakes, There’s No Doubt’ (CNN)

Greece’s divisive former finance minister, Yanis Varoufakis, admitted on Monday that Greece made mistakes over its bailout negotiations, but he continued to lay the preponderance of blame for the Greek woes on the country’s creditors. “We made mistakes, there’s no doubt about that,” he told CNN’s Christiane Amanpour in his first international TV interview since stepping down earlier this month. “And I hold myself responsible for a number of them.” “But the truth of the matter, Christiane, is that the very powerful troika of creditors were not interested in coming a sensible, honorable, mutually beneficial agreement,” he said, referring to the IMF, the ECB, and the EC.

“I think that close inspection is going to reveal the truth of what I am saying: They were far more interested in humiliating this government and overthrowing it, or at least making sure that it overthrows itself in terms of its policies, than they were interested in an agreement that would for instance ensure that they would get most of their money back.” “It’s very hard for me, however much I would like to, to take responsibility for a policy over which I resigned.” Greece last week accepted terms for a third bailout that many say was on harsher terms than the potential deal that was on the table earlier this year. Varoufakis’ casual style, leather jackets, and motorcycle riding won him newspaper covers, but his negotiating style grated on his counterparts. He made sure to emphasize that he “resigned,” and was not “dismissed.”

He stepped down on the night of a controversial referendum, introduced by Prime Minister Alexis Tsipras, in which the majority of Greeks rejected the harsh austerity the government would later accept. “The people voted ‘no’ to this extending and pretending, but it became abundantly clear to me on the night of the referendum that the government’s position was going to be to say yes to it.” Despite his resignation of conscience, Varoufakis said he had sympathy for his former boss. “He was faced with a choice: Commit suicide or be executed.” “Alexis Tsipras decided that it [would] be best for the Greek people for this government to stay put and to implement a program which the very same government disagrees with.” “People like me thought that it would be more honorable, and in the long term more appropriate, for us to resign. This is why I resigned. But I recognize his arguments as being equally powerful as mine.”

[..] “It’s not true we did not have a Plan B. We had a Plan B.” “We, in the Ministry of Finance, developed it. Under the egis of the Prime Minister, who ordered us to do this, even before we came in the Ministry of Finance.” “Of course, you realize that these plans – Plan Bs – are always, by definition, highly imperfect, because they have to be kept within a very small circle of people, otherwise if they leak, a self-fulfilling prophecy emerges.” That plan, he said, was not for Greece to leave the Eurozone, a Grexit, but rather for the government to create “euro-denominated currency” – in other words, for the government to print its own, temporary currency, pegged to the value of the euro. “The fact of the matter is that that Plan B was not energized — I didn’t get the green light to effect it, to push the button, if you want.” That, he said, was one of the “main reasons why I resigned.”

Read more …

I love the absurdity embedded in the term “predictable chaos”.

• In Greek Crisis, One Big Unhappy EU Family (Reuters)

The latest paroxysm of Greece’s debt crisis has exposed growing rifts in the euro zone which, unless addressed soon, could lead to the break-up of European monetary union, the EU’s most ambitious project. The most worrying sign for European leaders is that public opinion and domestic politics are pulling them increasingly in opposing directions – not just between Greece and Germany, the biggest debtor and the biggest creditor, but almost everywhere. Germans, Finns, Dutch, Balts and Slovaks no longer want taxpayers’ money to go to bail out Greeks, while the French, Italians and Greeks feel the euro zone is all about austerity and punishment and lacks solidarity and economic stimulus.

With central and east European states growing more assertive and the Dutch and Finns facing mounting domestic constraints, a compromise between euro zone leaders Germany and France, increasingly hard to find over Greece, is no longer sufficient to settle the problems. There are so many stakeholders with divergent views that crisis management is becoming ever more difficult. A far-reaching reform of the 19-nation currency area’s flawed structure seems a remote prospect. After weeks of late-night emergency meetings of leaders and finance ministers, culminating in a tense all-night summit, the euro zone produced a fragile deal to keep Greece afloat by making it a virtual protectorate under intrusive supervision. Few, if any, of the main protagonists think it will work.

Greek Prime Minister Alexis Tsipras said it was a bad deal that would make life worse for Greece but he had swallowed it because the alternative was worse. German Finance Minister Wolfgang Schaeuble said Athens would have done better to leave the euro zone – “temporarily” – to get a debt write-off. Chancellor Angela Merkel, Europe’s dominant leader, made clear the main virtue of the deal was to avoid something worse. “The alternative to this agreement would not be a ‘time-out’ from the euro … but rather predictable chaos,” she said. A senior EU official involved in brokering the compromise, who spoke on condition of anonymity, said there was now a “20, maybe 30% chance of success”. “When I look at the next two to three years, the next three months, I see only black clouds,” the official said. “All we succeeded in doing was to avoid a chaotic Grexit.”

Read more …

“..if implemented this plan, the streets of Athens will sound tracks of tanks.”

• “Athens Streets Will Fill With Tanks”: Kathimerini Reveals Grexit Shocker (ZH)

And it wasn’t just outside observers drawing up Grexit plans. Despite the fact that EU officials denied the existence of a “Plan B” right up until German FinMin Wolfgang Schaeuble’s “swift time-out” alternative was “leaked” last weekend, no one outside of polite eurocrat circles pretends that a Greek exit wasn’t contemplated all along and indeed Yanis Varoufakis contends that Athens was threatened with capital controls as early as February if it did not acquiesce to creditor demands. Now, in what is perhaps the most shocking revelation yet about what EU officials really thought may happen in the event Greece crashed out of the EMU and unceremoniously reintroduced the drachma, Kathimerini is out with a description of what the Greek daily calls the “Grexit Black Book,” which purportedly contained the suggestion that civil war would breakout in Greece in the event the country was forced out of the currency bloc. Here’s more (Google translated):

“On the 13th floor of the building Verlaymont in Brussels, a few meters from the office of the European Commission President, Jean-Claude Juncker, stored in a special security room and in a safe Greece’s exit plan from the Eurozone. There, in a multi-page volume, written in less than a month from 15-member team of the European Commission, answered questions on how to tackle such an outflow, including, as shocking as it may sound, even the possibility of the country out of the Schengen Treaty, and not only being driven outside the euro, but also outside the EU.

According to European official, in that the European Commission Summit already had a bound volume, a multi-page document, which described the Greek prime minister, before the start of the session, by the same Mr. Juncker with all the details of a Grexit , giving him to understand the legal and political context of such a decision. In multipage document in accordance with European official who has the ability to know its contents, there are detailed answers to 200 questions that would arise in case Grexit. These questions, as he explains official, are interrelated, as an exit from the euro would create a cascade of events, which would evolve in a relatively short time. From the drachmopoiisi economy to foreign exchange controls that would take place at the country’s borders and which will ultimately lead at the exit of Greece from the Schengen Treaty.

The authors of the draft, according to European official, conducted under conditions of absolute secrecy. A special group of 15 people of the European Commission, by direct contact with Greece started to prepare, and was also in direct contact with a number of senior officials and DGs in the European Commission who had expertise in specific areas. The writing of the project started when the expiry date of the program (end of June) was approaching, so it is the Commission prepared for every eventuality, and by the time the referendum was announced, Friday, June 26, the relevant procedures were accelerated. The weekend of the work referendum intensified, so now two days later, Tuesday of that Synod, the project has been finalized.

According to well-informed source, involved in creating the plan worked “suffer the pain” as typically describe the “K” and “overwhelmed” because they could not believe that things had reached this point, and most of them had direct involvement with the Greek rescue programs. The European Commission also was hoped that even until the last minute solution would be found as members of this group knew better than anyone the consequences exit of Greece from the Eurozone and understand the cost of such a decision. One of those involved with direct knowledge of Greek reality in the critical phase of the training, he said the rest of the group that “if implemented this plan, the streets of Athens will sound tracks of tanks.”

Read more …

Merkel equals spineless.

• German Government Divided Over Greece (Handelsblatt)

Angela Merkel was understandably cautious in her response: “Nobody came to me and asked for any kind of dismissal,” the German chancellor said in an interview with public broadcaster ARD on Sunday. The question was about Wolfgang Schäuble, her finance minister and fellow Christian Democratic Party (CDU) member, who in an interview with Germany’s Der Spiegel magazine on Sunday said he was prepared to resign if ever forced to take a position on Greece that he didn’t agree with. “We have a joint result, and the finance minister will now lead these negotiations just as I will,” Ms. Merkel said. She added, firmly: “We will now work together in this coalition and of course together in the [Christian Democratic] Union.”

These words were aimed as much at her fiercely independent finance minister as anyone else, and were designed to smooth over the massive gulf of opinion within her own party over Greece. The issue of Greece, and whether or not the troubled country deserves its third bailout in five years to stave off bankruptcy, has opened up a chasm in Ms. Merkel’s governing coalition. On the one side is Mr. Schäuble and the right wing of the CDU party. While Ms. Merkel says a “Grexit” has been off the table since euro zone leaders agreed to give Greece a third, final bailout last week, her finance minister believes it remains very much in the cards. On the other side is Ms. Merkel’s junior coalition partner, the Social Democrats, led by deputy chancellor and economics minister Sigmar Gabriel.

Sources in Berlin say that the relationship between Mr. Schäuble and Mr. Gabriel has been irreparably damaged by the Greece crisis. For now, Ms. Merkel’s coalition is holding. The German parliament, the Bundestag, voted overwhelmingly on Friday in favor of the E.U. starting talks with Greece over a third bailout aimed at keeping Greece inside the 19-nation currency bloc. The vote removed a final stumbling block, allowing E.U. negotiators to this week get down to the business of ironing out the details of the bailout package. But, like Mr. Schäuble, many parliamentarians remain hugely skeptical that the negotiations will really bear fruit. Significantly 65 members of the CDU did not back the government on Friday in the Greek vote.

Read more …

More of the “Greece should be like Germany” meme.

• How Can Greece Take Charge? (New Yorker)

Even if Greece gets the debt relief that the IMF is recommending, the next few years will be grim. As James Galbraith, an economist at the University of Texas at Austin, who assisted the former Greek finance minister during this year’s negotiations, told me, “What’s going to happen in Greece is going to be very sad.” So what can Greece do? It really has only one option—to make the economy more productive and, above all, to export more. It’s easy to focus on Greece’s huge pile of debt, but, according to Yannis Ioannides, an economist at Tufts University, “debt is ultimately the lesser problem. Productivity and the lack of competitive exports are the much more important ones.”

There are structural issues that make this challenging. Greece is never going to be a manufacturing powerhouse: almost half of all Greek manufacturers have fewer than fifty employees, which limits productivity and efficiency, since they don’t enjoy economies of scale. Greece also has a legal and business environment that discourages investment, particularly from abroad. Contractual disputes take more than twice as long to resolve as in the average E.U. country. Greece has been among the most difficult European countries in which to start and run a business, and it has myriad regulations designed to protect existing players from competition. All countries have rules like this, but Greece is an extreme case. Bakeries, for instance, can sell bread only in a few standardized weights.

Recently, Alexis Tsipras, the Greek Prime Minister, had to promise that he would “liberalize the market for gyms.” The scale of these problems makes Greece’s task sound hopeless, but simple reforms could have a big impact. Contrary to its image in Europe, Greece has already made moves in this direction: between 2013 and 2014, it jumped a hundred and eleven places in the World Bank’s “ease of starting a business” index. And reform doesn’t mean Greece needs to abandon the things that make it distinctive. In fact, in the case of exports, the country has important assets that it hasn’t taken full advantage of. Greek olive oil is often described as the best in the world. Yet 60% of Greek oil is sold in bulk to Italy, which then resells it at a hefty markup.

Greece should be processing and selling that oil itself, and similar stories could be told about feta cheese and yogurt; a 2012 McKinsey study suggested that food products could add billions to Greece’s G.D.P. Similarly, tourism, though it already accounts for 18% of G.D.P., has a lot more potential. Most tourists in Greece are Greek themselves, a sign that the country could do a much better job of tapping the booming global tourism market. Doing so would require major investments in improving ports and airports, and in marketing. But the upside could be huge. Greece also needs to stem its current brain drain. It produces a large number of scientists and engineers, but it spends little on research and development, so talent migrates abroad. And there are other ways that Greece could capitalize on its climate and its educated workforce; as Galbraith suggests, it’s an ideal location for research centers and branches of foreign universities.

Read more …

“People turn away because they have been bypassed..” So you just bypass them some more?

• Hollande Calls For Vanguard Of States To Lead Strengthened Eurozone (EUOberver)

French president Francois Hollande has called for a stronger more harmonised eurozone following a politically turbulent few weeks in which crisis with Greece has exposed the fault-lines in how the single currency is managed. “What threatens us is not too much Europe, but too little Europe,” he said in a letter published in the Journal du Dimanche. He called for a vanguard of countries that would lead the eurozone, which should have its own government, a “specific budget” and its own parliament. “Sharing a currency is much more than wanting convergence. It is a choice that 19 countries have made because it is in their interest,” he wrote adding that this “choice” requires a “strengthened” organisation.

French prime minister Manuel Valls Sunday said the vanguard should include the six founding countries of the EU: France, Germany, Italy, Belgium, Luxembourg and the Netherlands. He said France would prepare “concrete proposals” in the coming weeks. “We must learn the lessons and go much further,” he added, referring to the Greek crisis. “Europe has let its institutions weaken and the 28 governments struggle to agree to move forward. Parliaments are too far from decisions. People turn away because they have been bypassed,” said Hollande. He added that “populists” have seized upon this “disenchantment” with Europe. Hollande’s calls come as the eurozone is locked in recriminations over its handling of Greece.

The country is set to get a third bailout following eleventh hour negotiations last week however neither the Athens government nor Berlin, the main architect of the bailout programme, believe it will be a success. It exposed divisions between a camp of hardliners led by Germany, whose finance minister advocated a eurozone exit for Greece, and a camp led by France and Italy, which argued that the EU as a whole would be damaged if Greece left the euro.

Read more …

” The Fed “clearly intends the very largest U.S. banks to buckle under this new capital regime, restructuring quickly and dramatically..”

• Fed Tells Big Banks to Shrink (WSJ)

Federal Reserve sent a message to the largest U.S. financial firms: Staying big is going to cost you. The Fed’s warning, articulated in a pair of rules it finalized Monday, is among the central bank’s starkest postcrisis regulatory moves pressing Wall Street banks to reconsider their size and appetite for risk. The Fed completed one rule stating that the eight largest banks in the country should maintain an additional layer of capital to protect against losses, its plainest effort yet to encourage them to shrink. At the same time, it offered a reprieve to General Electric’s finance unit from more-intensive regulation, after the company promised to cut its assets by more than half. The moves reinforce the central mandate of the Dodd-Frank financial overhaul law signed by President Barack Obama five years ago.

Regulators have pushed big banks to expand their capital buffers to better absorb losses, reduce their reliance on volatile forms of funding, improve their risk management and cut back on risky assets. So-called stress tests measure banks’ resilience each year and can restrict shareholder payouts at firms that don’t pass. For Wall Street banks and their investors, the emerging regime presents a series of choices: specifically whether to pay the cost of new regulation, which will fall to the bottom line, or change their business models by shedding businesses or withdrawing from certain markets, such as owning commodities. The Fed “clearly intends the very largest U.S. banks to buckle under this new capital regime, restructuring quickly and dramatically,” said Karen Petrou at Federal Financial Analytics.

J.P. Morgan Chase, the largest U.S. bank with assets worth $2.449 trillion, will have to maintain more capital than any of its peers, with its minimum capital requirement raised by 4.5% of assets under management as a result of the new rule. J.P. Morgan has resisted calls from lawmakers and others to break up its operations, and instead has jettisoned or adjusted businesses to comply with the new mandates. “Everything’s doable—it just costs money,” said Glenn Schorr, a banking-industry analyst with Evercore ISI. Mr. Schorr said banks could hold less capital but would have to cut parts of their business.

Read more …

You’d be forgiven for presuming they already did that.

• US Banks Prepare For Oil And Gas Company Loans To Worsen (Reuters)

U.S. banks are setting aside more money to cover bad loans to energy companies after oil prices plunged over the last year, raising the possibility that deteriorating loans could start to weigh on their earnings, some analysts said. Loan credit quality for U.S. banks has been improving since the financial crisis. In the first quarter, 2.49% of loans on banks’ books were delinquent, the lowest level since the fourth quarter of 2007, according to the Federal Reserve, which hasn’t released second quarter data. The rate peaked at 7.4% in the first quarter of 2010. Weakness among energy company loans could be a sign that overall credit quality among U.S. banks has little room to improve, analysts said.

Executives from both JPMorgan Chase and Wells Fargo told investors last week, when posting earnings, that they were increasingly concerned about loans to oil and gas companies. Texas bank Comerica on Friday set aside about three times as much money to cover bad loans as analysts had expected, sending the regional bank’s shares lower by more than 6% after the bank reported earnings Friday. Setting aside more money, known as “provisioning,” hurts earnings. “The banks really have very low credit costs and those can go higher,” said Fred Cannon, who heads research at Keefe Bruyette & Woods. While “energy overall is not a life threatening issue for the banks, it is earnings threatening,” he said.

JPMorgan said on Tuesday it provisioned another $252 million to cover potentially bad wholesale business loans in the quarter, with $140 million of that related to oil and gas lending. Oil prices rallied in March and April, but in recent weeks have fallen again on expectations that loosened sanctions against Iran create the potential for greater supplies. U.S. crude oil prices fell below $50 a barrel on Monday for the first time since April.

Read more …

This could come back to hurt the west a lot.

• BRICS Countries Launch New Development Bank In Shanghai (BBC)

The Brics group of emerging economies on Tuesday launched its New Development Bank (NDB) in Shanghai. The bank is backed by Brazil, Russia, India, China and South Africa – collectively known as Brics countries. The NDB will lend money to developing countries to help finance infrastructure projects. The bank is seen as an alternative to the World Bank and the IMF, although the group says it is not a rival. “Our objective is not to challenge the existing system as it is but to improve and complement the system in our own way,” NDB President Kundapur Vaman Kamath said. The Brics nations have criticised the World Bank and the IMF for not giving developing nations enough voting rights. The bank is expected to issue its first loans early next year.

The opening comes two weeks after the last Brics summit in the Russian city Ufa, where the final details were discussed. At the time, Russian Foreign Minister Sergei Lavrov said that the five countries “illustrate a new polycentric system of international relations”.

The bank is to start out with a capital of $50bn though the amount is to be doubled in the coming years. The biggest contributor will be the world’s second largest economy China, which also led the establishment of another new international bank, the Beijing-based Asian Infrastructure Development Bank. The NDB is to be headed by a rotating leadership with the first president, Mr Kamath, coming from India. It was first proposed in 2012 but protracted negotiations over headquarters, management and funding have long delayed the actual launch.

Read more …

Farrell keeps at it.

• Pope Francis Leading The New American (Socialist) Revolution (Paul B. Farrell)

Yes, Pope Francis is encouraging civil disobedience, leading a rebellion. Listen closely, Francis knows he’s inciting political rebellion, an uprising of the masses against the world’s superrich capitalists. And yet, right-wing conservatives remain in denial, tuning out the pope’s message, hoping he’ll just go away like the “Occupy Wall Street” movement did. Never. America’s narcissistic addiction to presidential politics is dumbing down our collective brain. Warning: Forget Bernie vs. Hillary. Forget the circus-clown-car distractions created by Trump vs. the GOP’s Fab 15. Pope Francis is only real political leader that matters this year. Forget the rest. Here’s why:

Pope Francis is not just leading a “Second American Revolution,” he is rallying people across the Earth, middle class as well as poor, inciting billions to rise up in a global economic revolution, one that could suddenly sweep the planet, like the 1789 French storming the Bastille. Unfortunately, conservative capitalists — Big Oil, Koch billionaires, our GOP Congress and all fossil-fuel climate-science deniers — are blind to the fact their ideology is on the wrong side of history, that by fighting a no-win battle they are committing suicide, self-destructing their own ideology. The fact is: The era of capitalism is rapidly dying, a victim of its own success, sabotaged by greed and a loss of a moral code. In 1776 Adam Smith’s capitalism became America’s core economic principle.

We enshrined his ideal of capitalism in our constitutional freedoms. We prospered. America became the greatest economic superpower in world history. But along the way, America forgot Smith’s original foundation was in morals, values, doing what’s right for the common good. Instead we drifted into Ayn Rand’s narcissistic “mutant capitalism,” as Vanguard’s founder Jack Bogle called the distortion of Adam Smith’s principles in his classic, “The Battle for the Soul of Capitalism.” The battle is lost. In the generation since the Reagan Revolution, America’s self-centered, consumer-driven, mutant capitalism lost its moral compass, drifting: Inequality explodes, income growth stagnates, the poor keep getting poorer. Yet across the world, billionaires have explode from 322 in 2000 to 1,826 in 2015, with 11 trillionaire capitalist families predicted to control the planet by 2100.

But not for much longer, as Pope Francis’ revolution accelerates, as his relentless socialist message of sacred rights for all people makes clear. Why? Our mutating capitalist elite have triggered a massive backlash, a “profound human crisis, the denial of the primacy of the human person. The worship of the ancient golden calf has returned in a new and ruthless guise in the idolatry of money.”

Read more …

“..sea level rise of at least 10 feet in as little as 50 years.”

• Earth’s Most Famous Climate Scientist Issues Bombshell Sea Level Warning (Slate)

In what may prove to be a turning point for political action on climate change, a breathtaking new study casts extreme doubt about the near-term stability of global sea levels. The study—written by James Hansen, NASA’s former lead climate scientist, and 16 co-authors, many of whom are considered among the top in their fields—concludes that glaciers in Greenland and Antarctica will melt 10 times faster than previous consensus estimates, resulting in sea level rise of at least 10 feet in as little as 50 years. The study, which has not yet been peer reviewed, brings new importance to a feedback loop in the ocean near Antarctica that results in cooler freshwater from melting glaciers forcing warmer, saltier water underneath the ice sheets, speeding up the melting rate.

Hansen, who is known for being alarmist and also right, acknowledges that his study implies change far beyond previous consensus estimates. In a conference call with reporters, he said he hoped the new findings would be “substantially more persuasive than anything previously published.” I certainly find them to be. To come to their findings, the authors used a mixture of paleoclimate records, computer models, and observations of current rates of sea level rise, but “the real world is moving somewhat faster than the model,” Hansen says. Hansen’s study does not attempt to predict the precise timing of the feedback loop, only that it is “likely” to occur this century. The implications are mindboggling: In the study’s likely scenario, New York City—and every other coastal city on the planet—may only have a few more decades of habitability left.

That dire prediction, in Hansen’s view, requires “emergency cooperation among nations.”We conclude that continued high emissions will make multi-meter sea level rise practically unavoidable and likely to occur this century. Social disruption and economic consequences of such large sea level rise could be devastating. It is not difficult to imagine that conflicts arising from forced migrations and economic collapse might make the planet ungovernable, threatening the fabric of civilization.”

Read more …