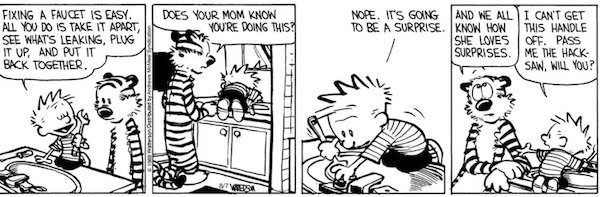

Salvador Dalí Figure at a window 1925

Fani Willis and her beau were there, but so was Letitia James. It was all coordinated.

Trump

BREAKING: Judge Arthur Engoron bans Trump from speaking or giving closing remarks at his civil trial in NY pic.twitter.com/bK6nAv87Rg

— End Wokeness (@EndWokeness) January 10, 2024

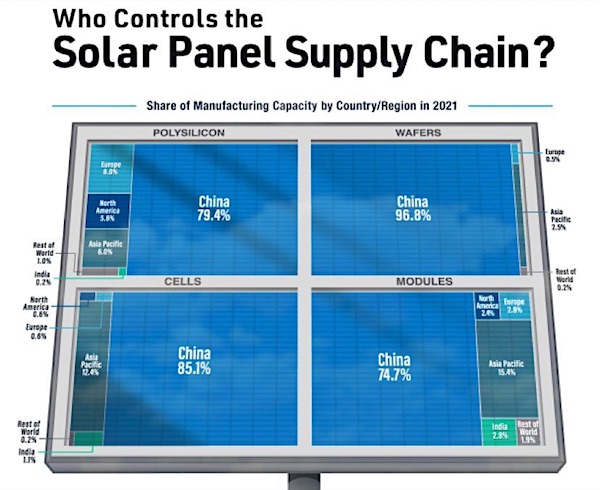

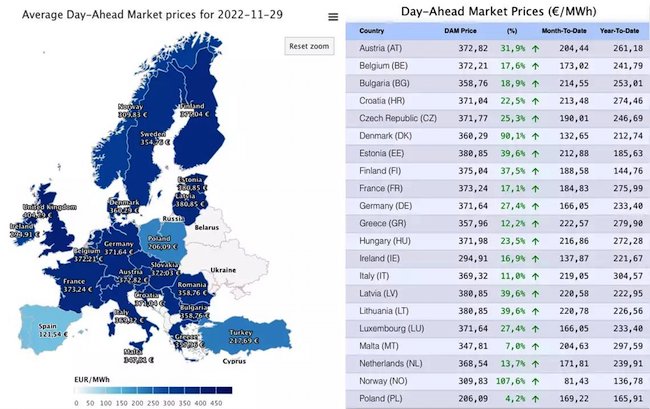

Before: Russia exported cheap energy to European industries & imported European industrial goods. Now: Russia exports cheap energy to Asia & imports Asian industrial goods.

Hunter

JUST IN – Reporter heard asking Hunter Biden: "Are you on crack today?"

— Insider Paper (@TheInsiderPaper) January 10, 2024

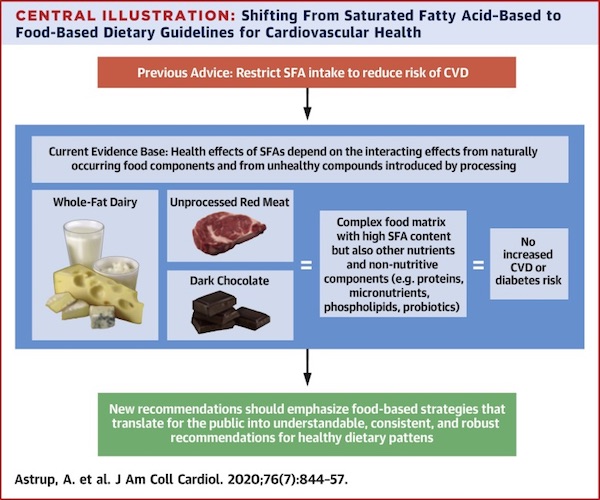

Rogan study

Joe Rogan on the New Study Which Claims Hydroxychloroquine Caused 17,000 Deaths During COVID

"I asked Robert Kennedy Jr. about this and he sent me the actual study, and he sent me what the results were and here's what was wrong with them. First of all, they administered it to… pic.twitter.com/mWWz3jm8nT

— Chief Nerd (@TheChiefNerd) January 9, 2024

LGBTs

Oh man.

Y’all ain’t ready for a new generation of anti-woke comedy.

— Benny Johnson (@bennyjohnson) January 9, 2024

Poland

https://twitter.com/i/status/1745104202597081348

“Both Pretoria and Tel Aviv are members of the ICJ – so the rulings are binding..”

But are they enforcable?

• BRICS Member South Africa Takes Zionism To Court (Pepe Escobar)

Nothing less than the full concept of international law will be on trial this week in The Hague. The whole world is watching. It took an African nation, not an Arab or Muslim nation, but significantly a BRICS member, to try to break the iron chains deployed by Zionism via fear, financial might, and non-stop threats, enslaving not only Palestine but substantial swathes of the planet. By a twist of historical poetic justice, South Africa, a nation that knows one or two things about apartheid, had to take the moral high ground and be the first to file a suit against apartheid Israel at the International Court of Justice (ICJ). The 84-page lawsuit, exhaustively argued, fully documented, and filed on 29 December 2023, details all the ongoing horrors perpetrated in the occupied Gaza Strip and followed by everyone with a smartphone around the planet.

South Africa asks the ICJ – a UN mechanism – something quite straightforward: Declare that the state of Israel has breached all its responsibilities under international law since 7 October. And that, crucially, includes a violation of the 1948 Genocide Convention, according to which genocide consists of “acts committed with intent to destroy, in whole or in part, a national, ethnical, racial or religious group.”South Africa is supported by Jordan, Bolivia, Turkiye, Malaysia, and significantly the Organization of Islamic Cooperation (OIC), which combines the lands of Islam, and constitutes 57 member states, 48 of these harboring a Muslim majority. It’s as if these nations were representing the overwhelming majority of the Global South. Whatever happens at The Hague could go way beyond a possible condemnation of Israeli for genocide. Both Pretoria and Tel Aviv are members of the ICJ – so the rulings are binding.

The ICJ, in theory, carries more weight than the UN Security Council, where the US vetoes any hard facts that tarnish Israel’s carefully constructed self-image. The only problem is that the ICJ does not have enforcement power. What South Africa, in practical terms, is aiming to achieve is to have the ICJ impose on Israel an order to stop the invasion – and the genocide – right away. That should be the first priority. Reading the full South African application is a horrifying exercise. This is literally history in the making, right in front of us living in the young, tech-addicted, 21st century, and not a science fiction account of a genocide taking place in some distant universe.

Pretoria’s application carries the merit of drawing The Big Picture, “in the broader context of Israel’s conduct towards Palestinians during its 75-year-long apartheid, its 56-year-long belligerent occupation of Palestinian territory, and its 16-year-long blockade of Gaza.” Cause, effect, and intent are clearly delineated, transcending the horrors that have been perpetrated since the Palestinian resistance’s Operation Al-Aqsa Flood on 7 October, 2023. Then there are “acts and omissions by Israel which are capable of amounting to other violations of international law.” South Africa lists them as “genocidal in character, as they are committed with the requisite specific intent (dolus specialis) to destroy Palestinians in Gaza as a part of the broader Palestinian national, racial and ethnic group.”

“..originally intended to be about post-war plans — a topic the prime minister appears reluctant to tackle given the potential risks to his political and personal future..”

• The War Within Israel’s War Cabinet (Cradle)

Three months into Israel’s longest and costliest unconventional war, the country’s armed forces have emerged as a significant indirect source of pressure on Prime Minister Benjamin Netanyahu’s extremist government. This development comes at a crucial juncture, both politically and in terms of security, for Tel Aviv. Amid ongoing internal differences over post-Gaza war strategies and proposed resolutions for Hamas’s prisoner exchange demands, the negative shift in international and regional public opinion over Israel’s 13-week Gaza assault has generated further stressors. At the same time, the escalating situation on the northern front with Hezbollah has compelled the Israeli army to establish a committee to investigate the political, security, and military shortcomings that led to the 7 October Al-Aqsa flood operation.

This decision by the Israeli army has triggered a political uproar, particularly from a faction uncertain about how to deal with intensifying Palestinian resistance activities brought on by the formation of Netanyahu’s coalition government – which is marked by extremism and controversial decisions, even by Israeli standards. During a recent cabinet meeting, far-right and nationalist Zionist ministers slammed army Chief of Staff Herzi Halevi’s decision to probe intelligence and operational failures leading up to the 7 October resistance operation, claiming that forming an inquiry commission during the ongoing Gaza war damages army and soldier morale. Some cabinet members rallied to scuttle the selection of former Minister of Defence Shaul Mofaz as head of the inquiry commission, largely because of his role in Israel’s unilateral Gaza disengagement plan in 2005.

The timing of the investigative committee’s formation is underscored by Defense Minister Yoav Galant and emergency cabinet member Benny Gantz’s vigorous defense of Halevi’s decision. They emphasize its importance in learning from past mistakes, addressing security gaps, and preparing for potential wider conflicts, particularly with Hezbollah in Lebanon. Less clear, however, is Netanyahu stance on the matter, despite the fact that he scheduled the session which was originally intended to be about post-war plans — a topic the prime minister appears reluctant to tackle given the potential risks to his political and personal future.

Netanyahu’s right-wing cabinet members view the inquiry as a tool to further undermine an already precarious government. They recognize that the findings of the commission could be especially damning for their governing coalition, which, since its formation, has implemented an agenda focused on the oppression of Palestinians living under occupation and the strangulation of their national aspirations. It is an agenda which security and military experts in Israel have consistently warned could heavily exacerbate the level of retaliatory violence against settlers and inflame the security situation, whether in the Gaza Strip or in the occupied West Bank and Jerusalem.

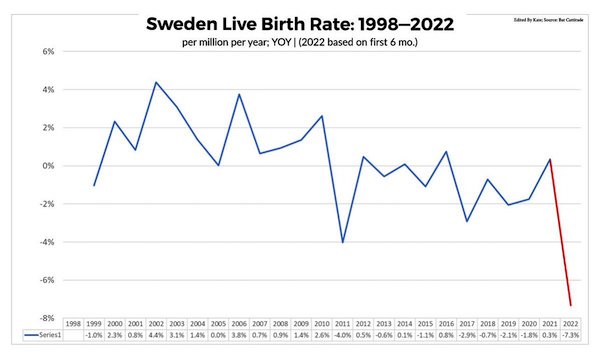

In other news, Sweden is telling its people to prepare for war with Russia.

• Ukraine Conflict Drove Up Ammo Prices Tenfold – Sweden (RT)

The deficit of ammunition in Europe has led to inflated prices as Western nations scramble to support Ukraine in its fight against Russia, the chief of staff of the Swedish Armed Forces has said. Speaking to Sveriges Radio national broadcaster on Tuesday, Michael Claesson said the conflict had led to a surge in demand in a very short period of time. He described the increase as “dramatic.” “I won’t give exact figures, but we are talking about an increase of between five to ten times compared to the time before the war started,” he said, noting that it impacted not only ammunition, but also other military materiel. According to Claesson, artillery shells for the Swedish-designed Archer 155mm self-propelled howitzer are now eight times more expensive than in 2021.

He told the broadcaster that the development had been caused by a significant rearmament campaign underway both in Sweden and other European countries. “All this creates an enormous demand and competition, essentially as if people were standing in a queue.” Commenting on weapons procurement in late December, Swedish Defense Minister Pal Jonson admitted that his country found itself in a “difficult situation” because it had not only to support Ukraine, but also take care of its own security. As of December, Stockholm has provided Kiev with $2.2 billion in military assistance. On Sunday, speaking online at the Society and Defense conference held in Sweden, Ukrainian President Vladimir Zelensky urged his European partners to “create an arsenal for the defense of freedom” by stepping up joint arms production.

Russian officials have repeatedly said that the Western push to arm Ukraine will only prolong the conflict while becoming a burden on ordinary taxpayers. In October, Kremlin Press Secretary Dmitry Peskov stated that “the potential of the collective West to produce munitions is limited,” saying that it would have to spend a lot of time mobilizing its resources, an effort he suggested could cause “certain points of friction.” Meanwhile, Ukrainian Foreign Minister Dmitry Kuleba admitted last month that Kiev senses a growing “war fatigue” in the West, and acknowledged that the country’s much-hyped counteroffensive had failed to produce swift and decisive results. Moscow has described Kiev’s push as a complete fiasco, claiming that Ukraine lost some 160,000 troops over the six months of the offensive.

Secret meeting to discuss Zelensky’s “peace plan”, “that Kiev be given control over its pre-2014 borders, while calling for the prosecution of the Russian leadership and reparations from Moscow..”

• Lavrov Knew of ‘Secret’ Ukraine Meeting Weeks Before Bloomberg Report (Sp.)

Russian Foreign Minister Sergey Lavrov spilled the beans on the much-touted “secret meeting” of Ukrainian, Western, and Global South countries’ national security advisors in Riyadh on December 16 weeks before Bloomberg’s report on the gathering, telling Rossiya Segodnya chief Dmitry Kiselev about it on December 28. “Considering our good relations [with Global South countries, ed.], I can say that another meeting like this took place 10 days ago – the G7 plus the leading developing nations. Not all countries from the world majority attended. Some turned down their invitations. The meeting took place in complete secrecy. Nothing was reported about it; there were no leaks,” Lavrov said at the time. “But you know about it,” Kisilev interjected.

“Yes, we do. Our close allies and associates who attended that meeting did not promise to keep an issue that concerns Russia secret from us. Another meeting is scheduled to take place in January 2024 and a ‘peace summit,’ where [Ukrainian President Volodymyr] Zelensky’s ‘peace formula,’ is to be approved in February 2024,” Lavrov said. Commenting on Bloomberg’s report and the absurdity of organizing “peace talks” aimed at resolving the Ukraine crisis without inviting Moscow to the table, Russian Foreign Ministry spokeswoman Maria Zakharova told Radio Sputnik on Wednesday that the “secret meeting” had less to do with ending the conflict, and more to do with pumping up Mr. Zelensky’s ego.

“This is a well-worn concept of attracting political attention specifically to the Zelensky regime. This is PR for the Zelensky regime. Speaking in terms used in political science, [the talks] were about maintaining a sense of constant activity in the information and political space, at the center of which is Zelensky,” Zakharova stressed. “This has nothing to do with resolving the Ukrainian crisis. These are two completely different topics.” In fact, the spokeswoman suggested, holding “peace talks” without Russia, and on maximalist terms which Russia would never accept only serves to weaken the possibility of peace actually being reached.

“Because resolving the situation in Ukraine is, of course, painstaking work. This is work on the political and diplomatic track. This is negotiations, contacts and so on. This is not about the fate of one person, 10 people or their commercial, financial and economic interests, but about the fate of peoples and nations. That’s if we’re talking about the situation in Ukraine and a real resolution [to the crisis]. The PR around Zelensky, his so-called peace initiatives, his endless statements, appearances at various places and platforms – all this hype is created precisely to maintain the illusion of some kind of political activity while diverting the world’s attention from real processes of a possible settlement,” Zakharova said.

“..an “unfunny parody of a dictator..”

• Ukrainians Will Benefit From Zelensky’s Fall – Medvedchuk (RT)

President Vladimir Zelensky has antagonized all his allies, both domestic and foreign, and is doomed to be ousted this year, exiled Ukrainian opposition leader Viktor Medvedchuk has said. But his failure will be good for the Ukrainian people, he added. Medvedchuk was the leader of the Opposition Platform – For Life party, which Zelensky’s government banned for allegedly being “pro-Russian.” He was arrested and forced out of Ukraine in a prisoner exchange with Moscow. The politician has since been promoting a project, which would make his home nation a neutral state, prioritizing national interests, as opposed to being a Russian enemy. In a column published on Wednesday, Medvedchuk blasted the incumbent Ukrainian president, branding him an “unfunny parody of a dictator,” whose weakness sends a signal to all “political predators to eat him.”

“Zelensky has antagonized everyone he could: big businessmen, whom he blacklisted as traitors and oligarch, professional Nazis, who see his cowardice, the military, who sees his incompetence, and last but not least the people, who see his indifference and cruelty,” he wrote. Ukraine is in a deep crisis that is bound to lead to a national disaster once Western funding for the proxy war against Russia is reduced, he claimed. And Ukrainian citizens need to realize that Zelensky’s downfall “does not necessarily mean a defeat of the Ukrainian people.” Instead, the opposite is true, according to Medvedchuk. It will be a victory for them, since the president “has long betrayed them and is selling them out for cannon fodder.”

The column predicted hard times for the US, which Medvedchuk believes has lost its direction, and the EU, which he expects to be sacrificed by Washington to support the American economy. For Ukraine, it means no EU membership, and its citizens should know that “Europeans will have to give their financial goodies to the American elites, not Ukrainian refugees.” Medvedchuk believes that Russia may serve as an alternative to “impoverishing Europe.” He expects that “the number of Ukrainians in Russia will increase in 2024, benefiting not just them, but everyone.” Russia has become a major destination for Ukrainian nationals, with officials estimating that as many as five million fled eastwards after the hostilities erupted in 2022. Russian President Vladimir Putin has said he considers Russians and Ukrainians brotherly peoples. He described as tragic the fact that Kiev’s divisive policies after the 2014 armed coup had led to bloodshed between these peoples.

“..in two or three years we will still be where we are now,” Fico predicted. “The EU alone will be perhaps 50 billion euros lighter, and in Ukraine, cemeteries will be full with thousands more dead soldiers.”

• West Got Ukraine ‘Painfully Wrong’ – Slovak PM Robert Fico (RT)

Funding and arming Ukraine is a “futile waste of human resources and money” that will serve only to fill Ukrainian cemeteries with “thousands of dead soldiers,” Slovak Prime Minister Robert Fico wrote in an op-ed on Tuesday. Fico’s article was a rebuttal to his country’s president, who has urged him to send weapons to Kiev. Following his party’s electoral victory in September, Fico immediately cut off Slovakia’s military aid to Ukraine and vowed to block Kiev’s accession to NATO. Slovak President Zuzana Caputova, however, has called for Ukraine to be given “the means needed to defend itself,” while pro-Western pundits in Slovakia have accused Fico of cozying up to the Kremlin. “I will no longer be subject to stupid liberal and progressive demagoguery,” Fico wrote in Slovakia’s Pravda newspaper. “It is literally shocking to see how the West has repeatedly made mistakes in assessing the situation in Russia.”

Despite pumping Ukraine with tens of billions of dollars’ worth of weapons and sanctioning Moscow’s economy, “Russia completely controls the occupied territories militarily, Ukraine is not capable of any meaningful military counter-offensive, [and] it has become completely dependent on financial aid from the West with unforeseeable consequences for Ukrainians in the years to come,” he explained. “The position of the Ukrainian president is shaken, while the Russian president increases and strengthens his political support,” Fico continued, pointing out that “neither the Russian economy nor the Russian currency collapsed, [and] anti-Russian sanctions have increased the internal self-sufficiency of this huge country.”

Should the West continue along the path desired by Caputova, “in two or three years we will still be where we are now,” Fico predicted. “The EU alone will be perhaps 50 billion euros lighter, and in Ukraine, cemeteries will be full with thousands more dead soldiers.” Fico’s Slovak Social Democracy (SMER-SD) faction currently leads a three-party coalition government, while Caputova is the co-founder of the Progressive Slovakia party. Caputova’s role as president is largely ceremonial, and Fico claimed in his op-ed that she is “impatiently waiting” for the end of her term this year so that she can re-enter parliamentary politics.Fico has labeled Caputova an “American agent” on several occasions. After consulting the American Embassy in Bratislava last summer, Caputova sued Fico over the remarks, Slovakia’s SITA news agency reported.

“..Ukrainians living abroad who have not registered for military service may end up being denied both consular and banking services under the new law..”

• Ukrainians In UK Told To Register For Military Service (RT)

Ukrainians living abroad must register for military service, according to a recently adopted government decree, the consulate in the UK has said. In a statement released on Wednesday, it explained that the move is in response to numerous inquiries from Ukrainians residing in the country. According to the new rules, Ukrainian nationals must register for the military “in case of staying outside Ukraine for a period of more than three months,” the consulate stated. New arrivals must show up at Ukrainian diplomatic institutions within a week of entering Britain, it added. Currently, there are no penalties for avoiding military registration, the diplomatic body said, adding that rumors of consular services being denied to people who do not sign up are not true.

The situation, however, could change if these provisions are included in the new mobilization law, which is currently being considered by the Ukrainian parliament, it warned. Previously, Batkivshchyna party MP Vadim Ivchenko, who sits on the parliamentary committee on National Security, Defense and Intelligence, warned that Ukrainians living abroad who have not registered for military service may end up being denied both consular and banking services under the new law. It remains unclear whether the provisions will be included in the new legislation, which is expected to be voted on in the first reading on Thursday. The mobilization law was introduced in the Ukrainian parliament late last year. It proposes lowering the draft age from 27 to 25, eliminating exemptions for some categories of disabled people, and other measures to bolster the ranks of the military.

Shortly before the mobilization bill was put forward, Ukrainian President Vladimir Zelensky said the military had asked him to round up another 450,000 to 500,000 soldiers. This claim has been disputed by Ukraine’s top general, Valery Zaluzhny, who insisted the military had not come up with exact figures, but wanted the government to ensure a steady flow of recruits to meet its combat needs and make up for losses. Kiev has never officially disclosed the country’s casualties amid the conflict with Russia, yet the tally is widely believed to be in the hundreds of thousands. According to the latest estimates by Russian Defense Minister Sergey Shoigu provided on Tuesday, Ukraine lost more than 215,000 troops and 28,000 pieces of military hardware last year alone. Last month, the minister said that Kiev lost more than 383,000 service members, killed or wounded, since the beginning of the hostilities, with more than half of the casualties sustained during its summer counteroffensive, which was launched early last June.

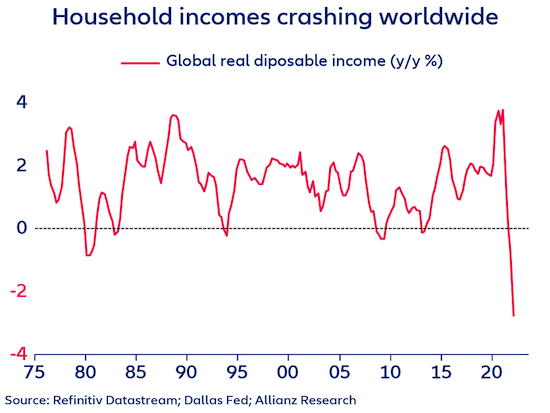

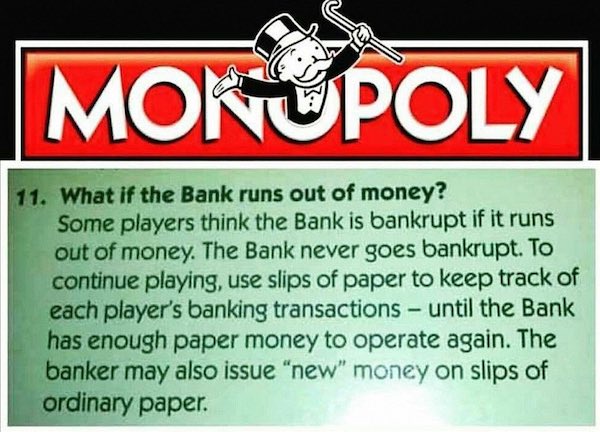

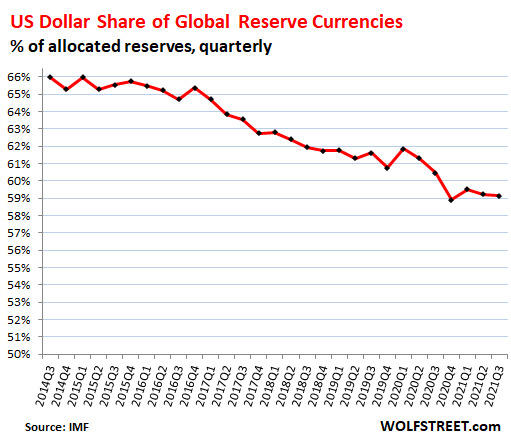

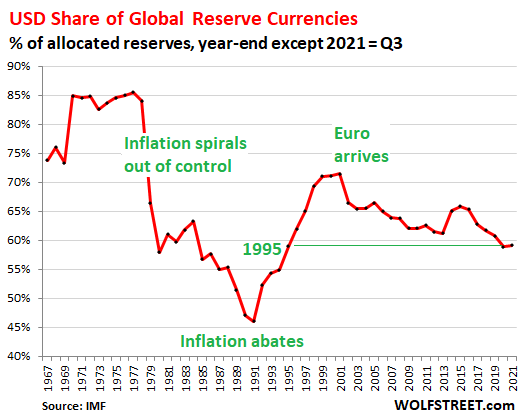

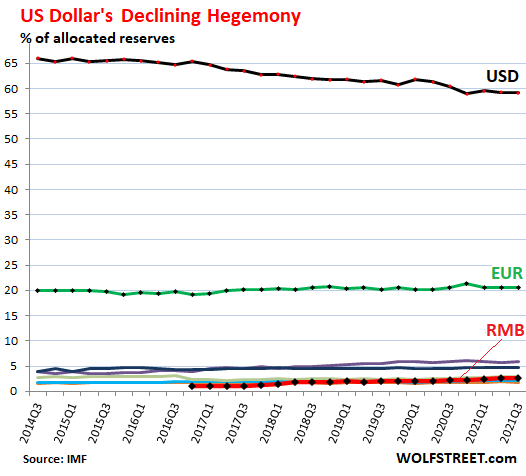

“The excessive debt was accumulated at low rates but needs to be refinanced at high rates that limit economic activity and reduce cash flow..”

• US Government Debt Biggest Threat To Global Economy – Russian NGO (RT)

US government debt and Washington’s budget deficit present the biggest threats to the global economy this year, Russian government agency Roscongress has warned. Washington’s $34 trillion burden is mathematically impossible to pay off, Roscongress has claimed in a report it published on Wednesday. The agency based its estimate on the current ratio between the size of the debt, the rate at which it is growing, and budget revenues. “The excessive debt was accumulated at low rates but needs to be refinanced at high rates that limit economic activity and reduce cash flow. In the medium term, the servicing of US debt will cost $1 trillion a year,” reads the report, titled ‘Key Events – 2024. Geoeconomics. Forecasts. Major risks’.

The US government cannot solve the problem by restarting the printing press this year because that would lead to higher inflation, the report added. The country saw consumer prices shoot up to the highest levels in decades in 2022, prompting the Federal Reserve to embark on a series of rate hikes to tame inflation. US government federal debt toped $34 trillion for the first time in history at the end of December. It now amounts to about $102,000 for every man, woman, and child in the country. US total public debt is roughly equivalent to the economies of China, Germany, Japan, India, and the UK combined, as pointed out by the Peter G. Peterson Foundation, a nonpartisan fiscal policy group in New York.

Among other threats to the global economy, Roscongress identified the global real estate bubble, mentioning the high-profile bankruptcies of Chinese property developers Country Garden and Evergrande; the volatility of the US stock market; and demographic issues, namely the shrinking of China’s population. The Roscongress Foundation was established in 2007 and is a key organizer of nationwide and international congresses and exhibitions with an economic and social focus. Among the events it hosted recently is the Russia-Africa forum in St. Petersburg in July, a high-profile international gathering attended by dozens of delegations from African nations.

As I said the other day, Cameron was hired as war secretary, not Foreign Secretary.

• China Has Become More Aggressive – UK Foreign Secretary (RT)

British Foreign Secretary David Cameron has claimed that China has become more “aggressive and assertive” in the years since he headed the UK government and tried to build warm relations with Beijing. Speaking in front of the UK Foreign Affairs Committee on Tuesday, Cameron, who was prime minister from 2010 to 2016, said that while there had been a lot of incentives for the UK to develop business relations with China in the previous decade, “a lot has changed” since then. The diplomat pointed to China’s alleged repression of Uyghur Muslims in Xinjiang province, which Beijing denies, as well as its policies in Hong Kong and its “wolf warrior diplomacy” as some of the primary examples of the country’s aggressive and assertive attitude.

Nevertheless, Cameron insisted that it was still crucial to engage with Beijing on various policy issues because China represented “a fifth of humanity.” “We’re not going to solve climate change without talking with the Chinese. We’re not going to work out the rules of the road on AI without at least engaging with the Chinese,” Cameron said, noting that he believes this is the foreign policy the UK should pursue. Meanwhile, China reported on Monday that it had detained the head of an overseas consulting firm for allegedly gathering sensitive data on the Asian nation on behalf of the British Secret Intelligence Service MI6.

Beijing’s Ministry of National Security accused the UK spy agency of hiring a man identified as Huang Moumou, who it claims was recruited by MI6 in 2015. He had allegedly been ordered to travel to China to collect state secrets and identify personnel to “incite rebellion.” The ministry added that London had provided Huang with intelligence training in the UK and other places, and with special spy equipment. The UK has so far declined to comment on the incident. In October, however, the British Security Service MI5 warned of the “epic scale” of Chinese espionage, claiming that more than 20,000 people in the UK had been approached by operatives who sought to acquire various secrets. China has consistently denied that it is engaged in spying against the US and UK.

“..the fairytale that Germany’s crises are just a string of bad luck as opposed to the result of government policy..”

• Germany’s ‘Krisenmodus’ Has No End in Sight (Conor Gallagher)

The Association for the German Language chose the term Krisenmodus as the ‘Word of the Year’ for 2023. I’m not sure they’ve ever awarded a back-to-back winner, but krisenmodus (crisis mode) looks to have a chance to repeat in 2024. The current government coalition has lost almost all trust from the public, yet they soldier on determined to make things worse for the vast majority of Germans. The Greens push for more war, the Free Democrats want more social spending cuts, and Chancellor Olaf Scholz and his Social Democratic Party (SPD) are in the middle adopting the worst from both sides and leading Germany to ruin. The chancellor’s decision making likely won’t get any better after a Christmastime bout with Covid-19 – if he sticks around much longer.

On the international front, Deutsche Welle declares that this year “Berlin must find ways to deal with two wars, an increasingly aggressive China, and a world order in transition.” Led by the ill-equipped and overconfident Green, Annalena Baerbock, Germany’s foreign policy has been disastrous and has spilled over into the domestic arena. Severing itself from Russian energy drained government coffers; at the same time, in addition to the money and weapons already sent to Ukraine, Berlin wants to increase military spending and become more interventionist. After running up the tab in these areas, there are now calls for a renewed fiscal responsibility, which means social spending cuts at home. A botched energy transition led by the Greens, which has industry collapsing and higher prices for consumers, militarization, and austerity – has proved to be an awful combination for the average citizen. And the data is grim.

Inflation continues to be problematic, the economy is contracting as industry shrinks, exports to China are declining and there is constant pressure from Atlanticists to self-impose a further reduction, living standards are declining, political paralysis reigns on most matters except social cuts and more military spending, wealth inequality grows, and industry continues to leave the country. Farmer protests are also now taking place across the country in response to the government’s decision to phase out a tax break on agricultural diesel. Scholz paid homage to the krisenmodus in his New Year’s address (including erroneously blaming Putin for “turn[ing] off the tap on our gas supplies”), centered around the fairytale that Germany’s crises are just a string of bad luck as opposed to the result of government policy.

He concluded with the following: “If we realize this, if we treat each other with this respect, then we don’t need to be afraid of the future, then the year 2024 can be a good year for our country, even if some things turn out differently than we expected today, on the eve of this New Year.” Such vacuous rhetoric is a sign that Scholz knows the path the country is currently on is doomed and yet plans nothing to change it. If anyone was watching, it was another reminder why Scholz’s approval rating has sunk to a miserable 26 percent and he and/or his government could soon be headed for an early exit.

Tucker Vlaar

The biggest protests in modern German history. What’s happening? Eva Vlaardingerbroek is there. pic.twitter.com/uAtmkUme5Q

— Tucker Carlson (@TuckerCarlson) January 10, 2024

“Team Scholz is making one of the most productive elements of German society pay a heavy price for its own relentless screwups..”

• German Government Is Ripping Off The Farmers Who Feed The Country (Marsden)

Farmers and their tractors started gathering on Monday here in Berlin as well as in cities across all of Germany’s federal states, including Hamburg, Cologne, and Bremen. The culmination, a massive planned protest, is set for Monday, January 15. The aim? To get Chancellor Olaf Scholz’s coalition government to backtrack on its decision to eliminate tax breaks on the diesel fuel used for farming – a sector already struggling with high energy costs as a result of the government’s de facto policy to screw itself and its own citizens over “for Ukraine” by cutting off cheap fuel from Russia because Brussels ordered it to. And then deciding that it’s cool because gas isn’t “green” enough anyway. Who knew that the German economy couldn’t just run on wind and sun? Not this government, apparently.

Feeling the heat, Team Scholz has already said that it’ll now just slow roll the cuts to subsidies. Apparently he’s never tried removing a band-aid really slowly. The farmers responded with some slow rolling of their own – right down the Autobahn and up to the Brandenburg Gate. The other issue is a road tax exemption for agricultural vehicles that the government decided to reimpose. Well, at least the farmers are getting their money’s worth this week by taking their tractors out for a spin along roads they probably never would have bothered with, just to join up with the protests.

This whole mess is a result of Team Scholz’s own screwup. What else is new? Pretty standard operating procedure for the Western establishment: they screw up, then the cost of their mess gets dumped onto the average person. Scholz quietly took €60 billion ($65 billion) from a Covid recovery slush fund and plonked it into a fund for the much put-upon German industry. But only for the “green” industrials. Everyone else can just shove off. Which is also the arrogant attitude being bandied about by some establishment figures when it comes to farm diesel subsidies. Anyway, Scholz was ordered by the courts to put the misappropriated cash back – lest the government run the risk of incurring a debt. Whoops, too late. Berlin ended up €13 billion short in repaying it. So then the government had to figure out who it was going to have to screw over in an attempt to drum up some quick cash. Apparently those who literally feed the German people were identified as viable cash cows.

The government can now hear and see the honking tractors and big rigs from the Bundestag, gathering just a stone’s throw away from the epicenter of the protests at Brandenburg Gate. But Scholz has been talking instead about the need for European nations to mirror Germany in devoting more money to Ukraine – like he has nothing else going on inside his own country. You’d think that if he didn’t keep loading Ukraine up with cash and weapons then Russian tanks would just roll right into Berlin. He really should be more concerned about the German tractors and trucks that are already nearly right up under his office window. Germany doubled its Ukrainian military aid to €8 billion just before the New Year. Compare that with the €900 million that its rolled back tax breaks on farmers are expected to save them.

If Team Scholz was so blasé about shuffling money around in the creation of this whole debt problem, you’d imagine it would be easy enough at the very least just to hold onto that cash for Ukraine and take the jackboots off the necks of the farmers. It seems that German farmers may have to move to Ukraine to get treated fairly by their own government. Team Scholz is making one of the most productive elements of German society pay a heavy price for its own relentless screwups. The precise cost amounts to €10,000 annually for some farmers, who say it represents a potentially catastrophic loss for them. But the message being peddled by government officials is that farmers are already subsidized enough. You’d think they were just rolling in cash. Clearly, the reality is quite the opposite when €10,000 represents a make-or-break scenario.

“..temporarily fixing problems as they appear is costing the British taxpayer £2 million ($2.54 million) per week..”

• UK Parliament Cold, Damp, and Infested With Mice – Politico (RT)

Politicians and aides alike “dread” coming to work at Westminster Palace, Politico reported on Tuesday, describing how the crumbling Victorian building is driving them to work elsewhere in order to avoid the cold, the mold, and the rodents. British lawmakers returned to work at the House of Commons on Monday, as the Met Office warned that freezing temperatures will linger for the next week. Westminster Palace offers little respite from the winter weather, multiple staffers told Politico, citing persistent heating failures, power cuts, and moldy bathrooms. A report compiled by the GMB trade union – which represents parliamentary aides – in 2022 also noted crumbling masonry and falling glass even in one of the more modern buildings of the complex, as well as an outbreak of the legionella bacteria in showers on the estate.

“If it wasn’t a protected heritage site, there would be absolutely no way – with the current health and safety regulations – that we would be allowed to even set foot in a building this broken and damaged,” a Conservative Party staffer told Politico. “I would never go in again [if I could],” a Labour Party staffer said. “I think there is a sense that parliament is a very important building, you’re very lucky to be here – but there are basic standards, actually.” Much of Westminster Palace was built in the 19th Century and has not been renovated since before World War II. Some politicians have been demanding restoration works for years, but a vote authorizing this work will not be held until at least 2025. In the meantime, temporarily fixing problems as they appear is costing the British taxpayer £2 million ($2.54 million) per week, an anonymous official told Politico last September.

“This building is falling down and becoming a hazard to all those who work here,” Scottish National Party MP Pete Wishart said in an address in 2019. “It is so overrun with vermin that even the mice in this place now wear overalls.” Earlier this year, the Public Accounts Committee warned in a report that there is a “real and rising danger” that the building could be destroyed by a “catastrophic incident” before repairs take place. Labour leader Keir Starmer has almost completely eschewed working in the palace, multiple officials told the news site. Instead, he chooses to work up to three days per week at the party’s newly-built headquarters in Southwark, around a mile away. “It doesn’t feel as imposing, it’s not freezing cold, and it’s much more modern,” a Labour staffer said of the new building, describing it as “good for morale.” Despite the litany of complaints, politicians are unlikely to advocate too loudly for renovations these days, a GMP representative told Politico. “I don’t think that the general public have a lot of sympathy for politicians and their staff complaining about being cold at work… when there’s a lot worse things going on in other workplaces,” she said.

“Yes, but why did you talk to him during business meetings if he had nothing to do with your business?”

• Hunter Biden Defends Including Father On Business Calls (Fox)

Hunter Biden defended including his father on business calls with Ukrainian associates while speaking to a FOX Business reporter on Wednesday. Hunter Biden was questioned by FOX Business’ Hillary Vaughn after walking out of a House hearing as Rep. Marjorie Taylor Greene, R-Ga., began to question him about President Biden’s ongoing impeachment probe. “Why did you put your dad on speakerphone during these business meetings if he had nothing to do with your business?” Vaughn asked as Biden left the Rayburn office building on Capitol Hill. “Do you have a dad? Does he call you?” the first son asked in reply. “Yes,” Vaughn said. “Do you answer the phone?” Biden continued. “Yes,” Vaughn answered. “OK,” Biden said. “Yes, but why did you talk to him during business meetings if he had nothing to do with your business?” Vaughn pressed.

Devon Archer, a former best friend and business associate of Hunter Biden in Ukraine, testified to lawmakers in July that President Biden met with dozens of Hunter’s business associates while he was serving as vice president between 2009 and 2017. Archer testified about meetings he witnessed attended by both Bidens — Hunter and Joe — either in person or via telephone. During the meetings, Hunter would specifically introduce his father to foreign business partners or prospective investors, Archer claimed. Archer said Hunter put his father, then the vice president, on speakerphone while meeting with business partners at least 20 times. He described how Joe Biden was put on the phone to sell “the brand.”

Crack

“What kind of crack do you normally smoke Mr. Biden?!"

I hereby nominate this journalist for the Pulitzer Prize.pic.twitter.com/S9dsOqluLl

— Western Lensman (@WesternLensman) January 10, 2024

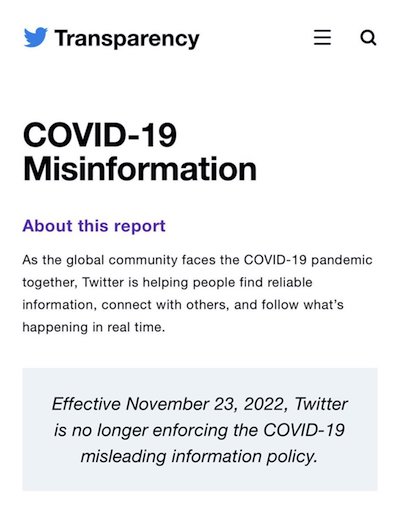

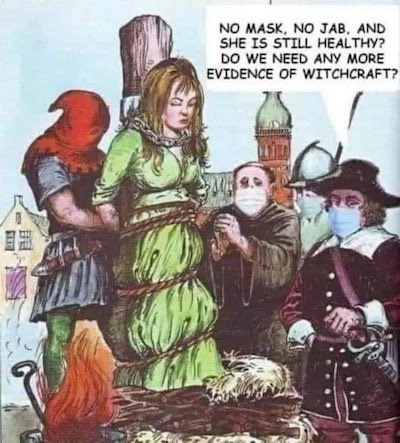

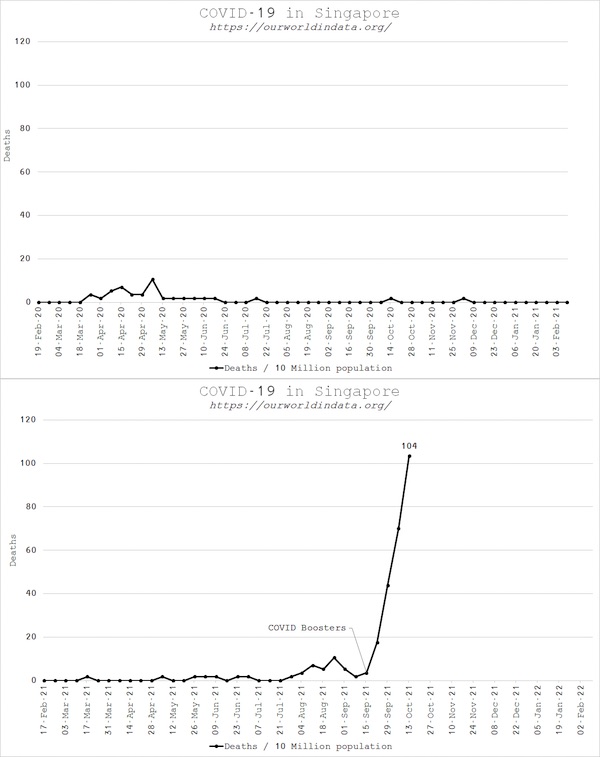

“..there is to be no more accountability for Big Pharma’s mass murder than there is for Israel’s mass murder of Palestinians..”

• Can Big Pharma Be Held Accountable? (Paul Craig Roberts)

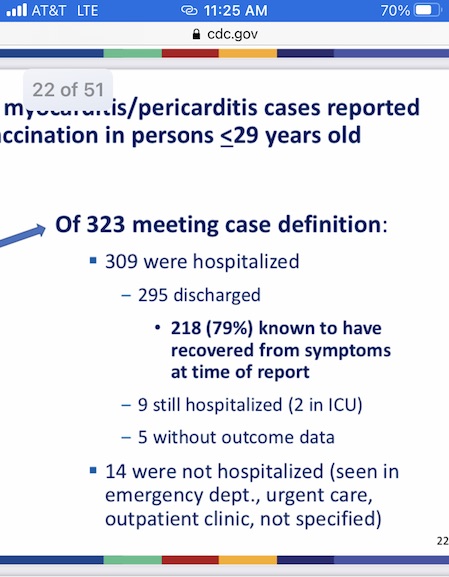

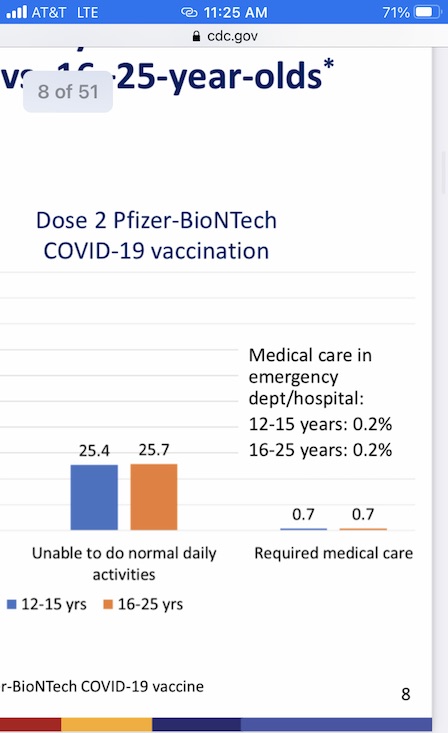

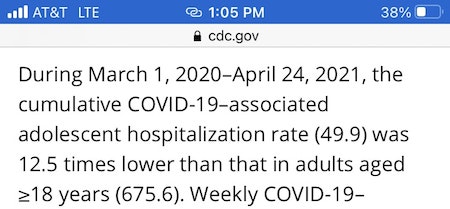

In 1935 Trofim Lysenko, a fraudulent agronomist took control of Soviet genetics and agronomy and destroyed the science with political and ideological explanations. With biology under Lysenko’s dominance, the principles of Mendel’s classical genetics were banned, and real scientists suffered political repression. The Lysenko affair exemplifies my point that without truth there can be no science and no scholarship. Tony Fauci and his puppet-masters introduced their own form of Lysenkoism with the Covid campaign. It was early apparent to independent scientists that the virus was a manufactured one made in a laboratory and that the “vaccine” was more dangerous than the virus. The distinguished scientists who sounded the alarm were suppressed, deplatformed, fired, prosecuted, and stripped of medical licenses. Big Pharma was a modern day Lysenko, and the large part of the medical profession under Big Pharma’s control discredited distinguished scientists by branding them spreaders of disinformation. The useless media did no investigation.

The Cleveland Clinic has shown that the “vaccine” actually makes it easier to catch the virus, and the excess deaths on the heels of mass vaccination demonstrate the killing and health injury power of the Covid mRNA “vaccines.” Professors Angus Dalgleish and Paul Goddard have just published a book, The Death of Science. Big Pharma has taken over regulatory agencies such as FDA, NIH, CDC, and controls with research grants the findings published in medical journals and the curriculums of medical schools. The fraud is far more extensive than the fraud imposed by Lysenko. We are in danger of losing medical science altogether as the young entering the profession are Big Pharma indoctrinated. When older generations such as Dalgleish and Goddard pass, there will be none to take their place. Medical science will die with them.

Congress and medical schools can do nothing about it as both are dependent on Big Pharma’s money. Scientists are not always adept at speaking to the public. If you have any doubts that a deadly world-wide fraud was perpetrated in service to private agendas, read The Death of Science. This is my only posting for today. Because of its importance, I do not want to distract you with multiple offerings. Dr. Reiner Fuellmich, a world-renowned international trial lawyer who was leading an organized effort to hold Big Pharma accountable is sitting in a German prison detained on false charges orchestrated in order to stop a campaign that was nearing success. In other words, there is to be no more accountability for Big Pharma’s mass murder than there is for Israel’s mass murder of Palestinians. When mass murderers cannot be held accountable, what is the prospect for humanity?

It’s almost funny.

• Trump Says Georgia Case ‘Totally Compromised’ (ET)

Ms. Willis brought the case against President Trump and more than a dozen co-defendants under Georgia’s Racketeer Influenced and Corrupt Organizations (RICO) Act, a law drafted to fight organized crime. The indictment accuses President Trump, and 18 others, of being part of a “criminal organization” that sought to overturn the Georgia results of the 2020 presidential election by unlawful means. “It’s illegal. What she did is illegal. So we’ll let the state handle that, but what a sad situation it is,” President Trump added.Ms. Willis’s office did not respond to a request for comment from The Epoch Times, though a spokesperson for her office told media outlets that she would “respond through appropriate court filings.” Ms. Willis brought the case against President Trump and more than a dozen co-defendants under Georgia’s Racketeer Influenced and Corrupt Organizations (RICO) Act, a law drafted to fight organized crime. The indictment accuses President Trump, and 18 others, of being part of a “criminal organization” that sought to overturn the Georgia results of the 2020 presidential election by unlawful means.

Mr. Roman, who faces seven charges in the Georgia election interference case, served on President Trump’s 2020 campaign as director of Election Day operations. In Monday’s court filing, Mr. Roman cited “discussions with individuals with knowledge” about Ms. Willis and Mr. Wade allegedly being “romantically involved” before the special prosecutor was brought onto the case by Ms. Willis. “Sources close to both the special prosecutor and the district attorney have confirmed they had an ongoing, personal relationship during the pendency of the special prosecutor’s divorce proceedings,” states the filing, which also accuses Ms. Willis of bringing Mr. Wade on as a special counsel without obtaining proper government authorization. The filing further states that Mr. Wade allegedly had a “lack of relevant experience” although he was paid hundreds of thousands of dollars by the county.

Mr. Roman’s filing also accused Ms. Willis of having potentially committed “an act to defraud the public of honest services” due to what he called an “intentional failure” to disclose her alleged relationship with Mr. Wade, which she “personally benefitted from.” Records obtained by a local media outlet show that Mr. Wade was paid over $650,000 in legal fees since January 2022 and that the district attorney is the one who authorizes it. Mr. Roman’s filing alleges that checks sent to Mr. Wade from Fulton County and vacations that he purchased with Ms. Willis could amount honest services fraud, which is a federal crime.

“Willis has benefitted substantially and directly, and continues to benefit, from this litigation because Wade is being paid hundreds of thousands of dollars to prosecute this case on her behalf,” the filing states. Mr. Roman’s filing states that Ms. Willis and Mr. Wade could be prosecuted under a federal racketeering statute. Besides the public comments President Trump made on Tuesday in response to Mr. Roman’s filing, he also took to Truth Social to post that the case “should be immediately dropped” and that Ms. Willis should apologize. Earlier court filings by President Trump’s co-defendants have alleged that Mr. Wade’s work is “void as a matter of law” because he allegedly failed to file his oath of office paperwork in time to formally join Ms. Willis’ team.

Ad

I promise, you absolutely can’t predict the plot twist in this ad. 10/10, no notes. pic.twitter.com/VQeNDjBAoz

— Ilayda Arden (@IlaydaArden) January 10, 2024

Fave

This is my favorite video on the internet!! pic.twitter.com/2dvGeuc3HD

— Nature is Amazing ☘️ (@AMAZlNGNATURE) January 10, 2024

Tiger and her cubs drinking from a creek in the forests of India. – Ricky Patel

Ocean

The incredible power of the ocean- could you do this for a living?

pic.twitter.com/eIU2eyoFGL— Science girl (@gunsnrosesgirl3) January 10, 2024

Cheetah

Cheetahs try to avoid conflict, preferring flight and are anxious even in captivity, emotional support dogs help them mellow pic.twitter.com/twx6pj1uwx

— Science girl (@gunsnrosesgirl3) January 10, 2024

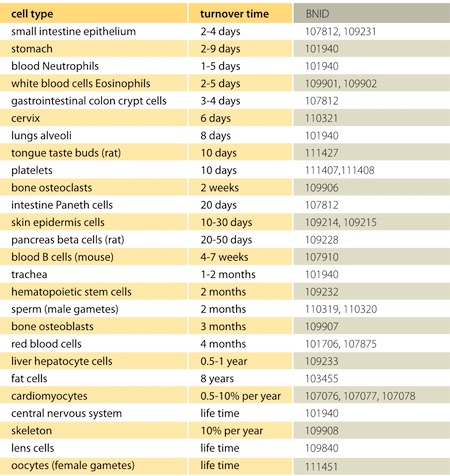

Most of you is 10 years old or less, because your cells are always renewing. The epidermis recycles every 2-4 weeks, red blood cells every 4 months, and your skeleton every 10 years.

Plastics water

New discovery shows water bottles contain quarter of a million microplastics

It’s an unsettling discovery, a single bottle of water could contain nearly a quarter of a million microscopic particles of plastic. It’s much more plastic than first thought but the impact it could have… pic.twitter.com/ngF88s93SX— Camus (@newstart_2024) January 11, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.