Arnold Genthe San Francisco, “Grant Avenue at Sacramento Street.” 1930

Very, very, good by Patrick Smith. Please read the whole thing.

• Big Banks Run Everything: Austerity, The IMF (Salon)

Fascinating to watch the IMF as it fronts for the U.S. Treasury and international lenders in the Greek and Ukrainian debt crises. In the former, the fund pins the Syriza government to the wall because it dares to represent its electorate. In the latter, it stands by the Poroshenko government because it has no intention of representing anybody other than banks, corporations and the global strategy set. “Fascinating” is one word for this and it holds. “Greed in action” is three but they do a better job. Coincidentally enough, both the Greek and Ukrainian cases now near their respective denouements. Miss this and you miss a singularly plain display of power, the way it works and what it works for in the early 21st century.

Athens has debt payments of €1.6 billion due in June and must make them if it is to receive a further tranche of European and IMF funding. This is essential if Greece is to recover—not from the 2008 financial crash and its economic fallout, which was long ago absorbed, but from the recovery program the fund and the EU imposed in 2012. That is textbook neoliberalism, naturally, and the results are before us. PM Alexis Tsipras calls it “a humanitarian crisis,” and I have heard no one dare counter him on the point. The Kiev government owes international bondholders $35 billion, and $23 billion of it is also due in June. Slightly different situation here: Ukraine, too, needs to shake loose I.M.F. and European funds to revive an economy even worse than Greece’s, but this is not about ameliorating any kind of social crisis.

It is about inducing one, in effect, so the neoliberalization process can be completed and working people in Ukraine are made properly, structurally desperate. It is highly unlikely you will read about these two crises in the same news report—this would be asking too much of media committed to conveying disembodied data without context so that readers and viewers cannot understand what they are (not) being told. Let us, then, treat Greece and Ukraine together. It is where the fascination comes in.

Behavioral economics.

• Investors Helpless Against Wall Street’s Secret Brainwashing Machine (Farrell)

Yes, the new behavioral economics is Wall Street’s secret mind-control brainwashing machine. Call it behavioral economics, psychology of investing, the new science of irrationality, it is Wall Street’s most powerful weapon because you can’t see it. They even try to make you think they’re helping you. Bull. Behavioral economists used to be guardians of America’s 95 million Main Street investors, with an aura of integrity, professionals with a fiduciary responsibility. No more. They’re the investors’ enemy, working for Wall Street banks, for Washington politicians, operating in the shadows, like the NSA, developing tools and technologies to secretly control data, manipulate the brains of savers, voters, taxpayers and investors.

Don’t believe me? At first, I couldn’t believe the con game. Back in 2002 when Princeton psychologist Daniel Kahneman won the Nobel Prize in Economic Sciences we were hopeful. He disproved Wall Street’s oldest fraud, the myth of the “rational investor.” We cheered. Kahneman’s research that proved investors were never rational .. are in fact irrational .. always have been irrational .. and we always will be irrational. At first we assumed humans can change – we can still educate ourselves to be more rational. We even assumed Wall Street’s behavioral economists would help us become “less irrational.”

Fat chance. Since then, behavioral economists have been capitalizing on their newfound power to get personally richer: Getting research grants, speaking fees, university professorships and, of course, consulting contracts with Wall Street banks, Corporate America and Washington politicians. What did we get? In recent years many of their books resemble high school level self-help “Psych 101” books with cute titles like “Freakonomics,” “Nudge,” “Sway,” “Animal Spirits,” “Blink,” “Blunder,” “Beyond Greed & Fear,” “Predictable Irrational,” all cleverly packaged for mass-market consumption, all with implied promise that their book will make you less irrational, ready to beat the Wall Street casino.

And they all just go and claim Q2 will be grand. But wasn’t this supposed to be a recovery? Yeah, yeah, snow, I know.

• US Economy Shrank 0.7% in First Quarter as Trade Gap Jumped (Bloomberg)

The world’s largest economy hit a bigger ditch in the first quarter than initially estimated, held back by harsh winter weather, a strong dollar and delays at ports. GDP in the U.S. shrank at a 0.7% annualized rate, revised from a previously reported 0.2% gain, according to Commerce Department figures issued Friday in Washington. The median forecast of 84 economists surveyed by Bloomberg called for a 0.9% drop. By contrast, the report also showed incomes climbed, fueling the debate on whether GDP is being underestimated. A swelling trade gap subtracted the most from growth in 30 years as the appreciating dollar caused exports to slump while imports rose following the resolution of labor disputes at West Coast ports.

Federal Reserve officials are among those who believe the setback in growth will be temporary, helping explain why they are considering raising interest rates this year. “The numbers show the economy literally collapsed last quarter, but we know there were a lot of special factors,” Jim O’Sullivan at High Frequency Economics said before the report. O’Sullivan was the top forecaster of GDP in the past two years, according to Bloomberg data. “There’s a good chance we’ll see a second-quarter bounce back.” Economists’ forecasts ranged from a decline of 1.2% to an increase of 0.2%. The GDP estimate is the second of three for the quarter, with the third release scheduled for June, when more information becomes available. The economy grew at a 2.2% pace from October through December.

And the rise of margin debt in China must be worse and bigger.

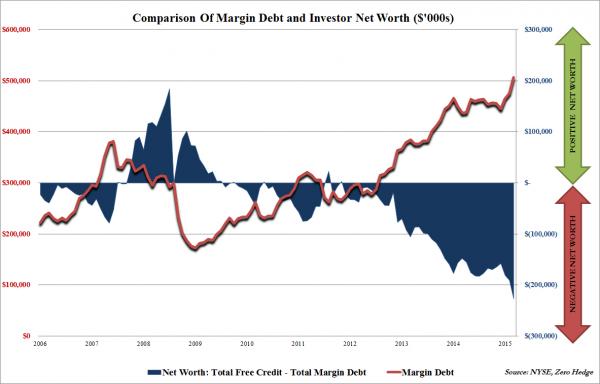

• Margin Debt Breaks Out: Hits New Record 50% Higher Than Last Bubble Peak (ZH)

For a few months in mid/late 2014 there was some concern among those who still don’t get that in this New Paranormal market the only real buyers are central banks, that while the stock market kept on rising, and rising, NYSE margin debt was flat, and in fact the total amount of purchases on margin at the end of 2014 was nearly the same to those in January. Meanwhile the S&P 500 had soared to recorder highs. A few things here: first, as we explained one year ago, in a world in which levered purchases take place via such shadow banking conduits as repo and primary broker arrangements, margin debt has become an anachronism from a bygone generation in which there wasn’t $2.5 trillion in Fed reserves supporting the market, and is now almost entirely meaningless.

But for those who still cling on to margin debt as indicative of anything, the latest NYSE report should provide some comfort: finally the long-awaited breakout in participation has arrived, and after stagnating for over a year, investors – mostly retail – are once again scrambling to buy stocks on margin, i.e., using debt, and as of April 30, the amount of margin debt just hit a new all time high of $507 billion, $30 billion more than the month before, and nearly 50% higher than the last bubble peak reached in October 2007.

It’s not just margin debt that hit a record high. Investor net worth, which is the inverse, or investor cash and credit balances less total margin debt, just dropped to ($227 ) billion, a new record low, meaning not only is the amount of investors leverage at an all time high, but investor net worth is also at an all time low.

Because this is not a revovery.

• No Recovery Has Seen This Many Dips Since The 1950s (MarketWatch)

The U.S. economy has fallen into negative territory three times since the current recovery began in mid-2009, a dubious feat that last occurred more than a half a century ago. What’s to blame for the most up-and-down recovery since the mid-1950s? Serious flaws in how GDPis calculated is one prime suspect. The government’s GDP report appears to have underestimated growth in the first quarter for decades, a problem that has become even more acute. At the same time GDP probably has overstated growth in the second and third quarters, so the underlying U.S. growth rate is probably the same. “The evidence of a seasonal quirk in the first-quarter GDP growth figures is pretty overwhelming,” said Paul Ashworth at Capital Economics. The second culprit – and evident ring leader – is the U.S. economy itself.

Bad policy, back luck or whatever you call it, the economy is no longer growing as fast as it used to. So any time there’s a temporary dip in economic activity because of poor weather, spiking oil prices or some other major event, it’s no surprise that GDP might show a contraction. The U.S. has grown at a mediocre 2.2% annual pace since the first full year of recovery in 2010. That’s just two-thirds as fast as the economy has grown since the government began keeping track in early 1930s. The less the economy grows, the easier it is for quarterly GDP to slip into the red from time to time, especially if some sort of “shock” occurs. The first-quarter suffered from several of them: unusually harsh weather, a dockworker’s strike, a soaring dollar that undercut U.S. exports and a drop in business investment tied to plunging oil prices.

Of course, such shocks are nothing new, and the economy in the past has shown more resistance to them. The U.S. did not experience a single negative quarter, for example, during the last three major economic expansions: the early 2000s, the 1990s and the 1980s. You have to go a lot further back to the weak 1973-75 expansion to find another episode of a quarterly contraction in a recovery phase. Another one occurred in the short-lived 1958-1960 recovery. The last U.S. recovery to include three negative quarters like the current one was from 1954 to 1957. Yet there is one big difference compared to today: the economy back then expanded by leaps and bounds. The U.S. grew at a 3.8% rate during the “Eisenhower recovery” following the end of the Korean War. And the fastest quarter of growth nearly reached 12% — more than twice as strong as the best quarter in the latest recovery.

Only little children and psychopaths dream of superpower.

• The Desperate Plight of a Declining Superpower (Michael T. Klare)

Take a look around the world and it’s hard not to conclude that the United States is a superpower in decline. Whether in Europe, Asia, or the Middle East, aspiring powers are flexing their muscles, ignoring Washington’s dictates, or actively combating them. Russia refuses to curtail its support for armed separatists in Ukraine; China refuses to abandon its base-building endeavors in the South China Sea; Saudi Arabia refuses to endorse the U.S.-brokered nuclear deal with Iran; the Islamic State movement (ISIS) refuses to capitulate in the face of U.S. airpower. What is a declining superpower supposed to do in the face of such defiance?

This is no small matter. For decades, being a superpower has been the defining characteristic of American identity. The embrace of global supremacy began after World War II when the United States assumed responsibility for resisting Soviet expansionism around the world; it persisted through the Cold War era and only grew after the implosion of the Soviet Union, when the U.S. assumed sole responsibility for combating a whole new array of international threats. As General Colin Powell famously exclaimed in the final days of the Soviet era, “We have to put a shingle outside our door saying, ‘Superpower Lives Here,’ no matter what the Soviets do, even if they evacuate from Eastern Europe.”

Strategically, in the Cold War years, Washington’s power brokers assumed that there would always be two superpowers perpetually battling for world dominance. In the wake of the utterly unexpected Soviet collapse, American strategists began to envision a world of just one, of a “sole superpower” (aka Rome on the Potomac). In line with this new outlook, the administration of George H.W. Bush soon adopted a long-range plan intended to preserve that status indefinitely. Known as the Defense Planning Guidance for Fiscal Years 1994-99, it declared: “Our first objective is to prevent the re-emergence of a new rival, either on the territory of the former Soviet Union or elsewhere, that poses a threat on the order of that posed formerly by the Soviet Union.”

H.W.’s son, then the governor of Texas, articulated a similar vision of a globally encompassing Pax Americana when campaigning for president in 1999. If elected, he told military cadets at the Citadel in Charleston, his top goal would be “to take advantage of a tremendous opportunity – given few nations in history – to extend the current peace into the far realm of the future. A chance to project America’s peaceful influence not just across the world, but across the years.”

A simple moral question.

• The Curious Optimism Of The Godfather Of Inequality (Independent)

Before Piketty, there was Atkinson. The subject of inequality is now, perhaps indelibly, associated with the young French economist who burst into the public arena last year and became an unlikely bestselling author across the Anglophone world. But Thomas Piketty himself drew heavily on the work of a British economist – a debt the Frenchman readily admits. “Tony Atkinson is the godfather of historical studies of income and wealth,” he enthused last year. It’s no exaggeration. Sir Anthony Atkinson has been researching inequality since the 1960s and published his first major book on the subject in 1978, when Mr Piketty was still at primary school. The Atkinson index of inequality is named after him. Some scholars expect him to be awarded the Nobel economics prize at some stage.

And now the 70-year-old London School of Economics professor has produced another tome on the subject, Inequality: What can be done?. Yet for all the book’s scholarly virtues and for all the esteem in which Sir Anthony is held within the profession, it seems unlikely it will sell as many copies as Mr Piketty’s blockbuster Capital in the 21st Century. Lightning, after all, rarely strikes twice in the same spot. When I meet Sir Anthony to discuss his latest work, I ask whether it rankles to see another, much more junior colleague become the celebrated face of the subject. Sitting in his rather spartan office just off Lincoln Inn’s Fields, he smiles at the suggestion: “Not at all. He [Piketty] is an amazing character. He’s very inventive. I think he’s managed to present the issue in a way that’s attracted a lot of attention.”

Nevertheless, Sir Anthony stresses that, much as he shares Mr Piketty’s concerns about the level of income inequality across much of the developed world, his own book has a different emphasis. “I think what I would have done differently is discuss more what we can do about it [inequality],” he says. He certainly doesn’t duck the challenge of coming up with constructive policy ideas. The final chapter of his book is overflowing with ideas on how to reduce inequality back to where it stood before what he calls the great “inequality turn” of the early 1980s, when Margaret Thatcher’s government entered office.

“..the foreign exchange market seems to be designed to create opportunities for bad behaviour.”

• If You Ain’t Cheating, You Ain’t Trying – How Forex Has Changed (EconIntersect)

“If you ain’t cheating, you ain’t trying” were the words of one trader working in the foreign exchange market. They belie an attitude that was widespread among traders in this market between 2009 and 2013. Cheating was simply a normal part of a trader’s day job. In fact, not cheating would be to shirk your duties. Widespread cheating in the foreign exchange market has turned out to be very costly indeed. In the past six months, six large banks around the world have paid out US$10 billion in fines over the manipulation of the global foreign exchange market. There have also been fines levied against banks for manipulating other over-the-counter markets such as LIBOR, the ISDAfix and the gold market.

In addition there have been fines for other bad behaviour by banks like money laundering, their role in the sub-prime mortgage crisis, violating sanctions, manipulation of the electricity market, assisting tax evasion, and mis-selling payment protection insurance. This brings the total amount of fines which banks have paid since 2008 to over US$160 billion. To put this in context, this is more than what the UK government spent on education last year. As the cost of misbehaviour mounts, banks are under increasing pressure to clean up their act. Despite widespread public cynicism, much has already changed within the banking sector. Banks have beefed up their risk function and increased oversight of traders.

They have also changed the “tone from the top”. Senior managers of the boom years who promoted a hard-driving, risk-taking culture have largely been replaced by bankers who talk more about ethics, careful risk management and serving the customer. A new legal regime has been put in place to hold senior bank employees personally responsible for wrong-doings on their watch. Banks are required to hold more equity on their balance sheets. There have been new laws which change the way bankers are paid, to emphasise long-term performance rather than short-term risk taking. Riskier trading and investment banking operations are being ring fenced from their more staid retail banks.

All these changes might be making bankers safer, but will they do anything to make the markets which they operate within any less likely to reward bad behaviour? We usually assume a market like foreign exchange emerges from millions of individual decisions. Changing this might sound impossible. But each of these decisions are made within a particular set of constraints. These constraints are the product of deliberate policy design choices. Changing behaviour in a market like foreign exchange involves looking carefully at the design of the market and asking whether this actually does the job it is supposed to do. As it currently stands, the foreign exchange market seems to be designed to create opportunities for bad behaviour..

Depends what the other side demands…

• Greece Open To Compromise To Seal Deal This Week: Interior Minister (Reuters)

Greece’s government is confident of reaching a deal with its creditors this week and is open to pushing back parts of its anti-austerity program to make that happen, the country’s interior minister said Saturday. Greece and its EU/IMF creditors have been locked in talks for months on a cash-for-reforms deal and pressure is growing for a deal, since Athens risks default without aid from a bailout program that expires on June 30. “We believe that we can and we must have a solution and a deal within the week,” Interior Minister Nikos Voutsis, who is not involved in Greece’s talks with the lenders, told Skai television. “Some parts of our program could be pushed back by six months or maybe by a year, so that there is some balance,” he said.

He did not elaborate on what parts of the ruling Syriza party’s anti-austerity program could be pushed back, but the comments suggested a greater willingness to compromise on pre-election pledges. Prime Minister Alexis Tsipras stormed to power in January on promises to cancel austerity, including restoring the minimum wage level and collective bargaining rights. The government earlier this week said it hoped for a deal by Sunday, though international lenders have been less optimistic, citing Greece’s resistance to labor and pension reforms that are conditions for more aid. Voutsis said Athens and its partners agreed on some issues, such as achieving low primary budget surpluses in the first two years.

But they still disagreed on a sales tax, with Greece pushing so any VAT hikes will not burden lower incomes. “A powerful majority in the political negotiations has showed respect for the fact that there can’t be further austerity strategies for the Greek issue, the Greek problem and the Greek people,” he said. [..] In an interview with Realnews newspaper published on Saturday, Economy Minister George Stathakis said Athens had no alternative plan. “The idea of a Plan B doesn’t exist. Our country needs to stay in the eurozone but on a better organized aid program,” he said. Stathakis was confident a deal will be reached. “Otherwise, mainly Greece but the European Union as well will step into unchartered waters and no-one wants that.”

Or it may not. Keep ’em guessing.

• Greece Might Sidestep June 5 IMF Payment Deadline (Reuters)

Cash-strapped Greece could avoid paying back the IMF on June 5 and win more time to negotiate a funding deal without defaulting if it lumps together all IMF repayments due in June and pays them at the end of the month, officials said on Tuesday. Greece has to repay the IMF €300 million on June 5, the first of four instalments due in June that total €1.6 billion. Cut off from markets, Athens has said it will not be able to make the June 5 payment without new loans from the euro zone, which insists it can only lend Greece more if the country agrees to reforms that would make its debt sustainable. “There is the possibility of putting together several payments that Greece would need to make to the IMF in the course of June and then just make one payment,” a senior euro zone official close to the talks with Athens said.

A second official close to the talks also acknowledged that possibility. “That’s basically a technical treasury exercise and they could tell the IMF that this is how they want to do it and the IMF would probably have to be OK with that,” the first official said. But the officials noted that Greece could only use such a trick if there was a credible prospect of a funding deal that could be communicated to markets and its citizens. Otherwise, the missed payment could trigger market panic and a bank run in Greece. “So they would get a few extra weeks. But unless there is some perspective how they would deal with this full payment, it would be a risky thing for the Greeks to do. And the consequences would be unpredictable,” said the first official. “People could want to withdraw their savings and who knows what Greece would have to do.”

Target2 steps into the spotlight.

• Varoufakis’s Great Game (Hans-Werner SInn)

Game theorists know that a Plan A is never enough. One must also develop and put forward a credible Plan B – the implied threat that drives forward negotiations on Plan A. Greece’s finance minister, Yanis Varoufakis, knows this very well. As the Greek government’s anointed “heavy,” he is working Plan B (a potential exit from the eurozone), while PM Alexis Tsipras makes himself available for Plan A (an extension on Greece’s loan agreement, and a renegotiation of the terms of its bailout). In a sense, they are playing the classic game of “good cop/bad cop” – and, so far, to great effect. Plan B comprises two key elements.

First, there is simple provocation, aimed at riling up Greek citizens and thus escalating tensions between the country and its creditors. Greece’s citizens must believe that they are escaping grave injustice if they are to continue to trust their government during the difficult period that would follow an exit from the eurozone. Second, the Greek government is driving up the costs of Plan B for the other side, by allowing capital flight by its citizens. If it so chose, the government could contain this trend with a more conciliatory approach, or stop it outright with the introduction of capital controls. But doing so would weaken its negotiating position, and that is not an option. Capital flight does not mean that capital is moving abroad in net terms, but rather that private capital is being turned into public capital.

Basically, Greek citizens take out loans from local banks, funded largely by the Greek central bank, which acquires funds through the European Central Bank’s emergency liquidity assistance (ELA) scheme. They then transfer the money to other countries to purchase foreign assets (or redeem their debts), draining liquidity from their country’s banks. Other eurozone central banks are thus forced to create new money to fulfill the payment orders for the Greek citizens, effectively giving the Greek central bank an overdraft credit, as measured by the so-called TARGET liabilities. In January and February, Greece’s TARGET debts increased by almost €1 billion per day, owing to capital flight by Greek citizens and foreign investors.

At the end of April, those debts amounted to €99 billion. A Greek exit would not damage the accounts that its citizens have set up in other eurozone countries – let alone cause Greeks to lose the assets they have purchased with those accounts. But it would leave those countries’ central banks stuck with Greek citizens’ euro-denominated TARGET claims vis-à-vis Greece’s central bank, which would have assets denominated only in a restored drachma. Given the new currency’s inevitable devaluation, together with the fact that the Greek government does not have to backstop its central bank’s debt, a default depriving the other central banks of their claims would be all but certain.

The pinnacle question: “How do you deflate a giant bubble without enraging the masses or losing control of the economy?”

• Chinese Stock Market’s Wile E. Coyote Moment (Pesek)

Shanghai’s stock market just experienced a Wile E. Coyote moment. For weeks, investors had been chasing higher and higher returns. On Wednesday, however, they suddenly looked down to find their road had disappeared. The realization came courtesy of China’s central bank, which had decided to drain cash from the financial system, and jittery brokerages, which had just tightened lending restrictions. That one-two punch didn’t just send Chinese stocks down 6.5%, the most in four months. It also raised existential questions about one of modern history’s greatest asset bubbles. And it is a bubble. The 127% gain in the Shanghai Composite Index over the past year defies financial gravity.

It’s been driven not by optimism about China’s economic fundamentals or corporate earnings, but record growth in margin debt. Such lending — fueled by speculation that the People’s Bank of China will soon cut interest rates and reduce lenders’ reserve requirements — exceeded $322 billion as of May 27, five times the level of a year earlier. And that’s just the official tally: China’s shadow banking system is estimated to have created $20 trillion of credit since Lehman Brothers went bankrupt in 2008. What makes China’s bubble unique is the government’s direct role in creating it, feeding it and now managing it. Last August, for example, as the Chinese stock market threatened to sag, state-run media started prodding the Chinese public to pile their life savings into shares.

During a single week in August 2014, Xinhua News Agency put out eight features espousing the wisdom and patriotism of owning equities. Beijing also reduced trading fees and allowed individuals to open as many as 20 accounts. The implicit message was that the Communist Party could and would protect stock investments, if need be. The plan succeeded beyond Beijing’s wildest expectations, leaving it with an epic challenge: How do you deflate a giant bubble without enraging the masses or losing control of the economy?

“Convertible or not, the yuan is too big to ignore.”

• Stop Calling China a Currency Manipulator (Pesek)

Christine Lagarde’s people say China’s currency is no longer undervalued. Jacob Lew’s argue it still is. There’s a lot at stake in the debate: The yuan can’t gain status as a global currency reserve if China is thought to be manipulating its value. So who should we believe, the head of the IMF or the U.S. Treasury Secretary? It’s worth asking Ben Bernanke. Now that the former Fed chairman is in the private sector, he can say what he really thinks — and, as he pointed out in a recent speech in Seoul, it’s not wise to ignore political factors when managing the rise of the Chinese economy. Bernanke argued that if Washington had heeded IMF requests to allow China to play a larger role in global institutions, Beijing wouldn’t now be creating the $100 billion Asian Infrastructure Investment Bank, which threatens to undermine the existing global financial system.

It’s worth extending Bernanke’s point to the yuan debate. Japan’s yen is down 30% since late 2012 (hitting a 12-year low this week) while the yuan has risen during the same period. So the IMF has good reason to contradict America’s assessment and bolster China’s case for reserve currency status. But there are two further reasons why the IMF must stand firm, no matter what U.S. officials and lawmakers say. First, China might go it alone. As Bernanke points out, the West is playing hardball with Beijing at its own risk. The AIIB is already diminishing the relevance of the World Bank and Asian Development Bank. What’s to keep Beijing, flush with $3.7 trillion of reserves, from now opening its own bailout fund for governments facing balance-of-payments shortfalls? China proposed a similar idea during the region’s 1997 economic crisis.

Although the idea died a quick death at that time amid fears the IMF and U.S. Treasury would lose influence, it might attract more interest now – especially if China promises to demand less austerity from needy countries like Greece. “If the IMF were to sidestep the explicitly stated desire of China’s government,” says Eswar Prasad of Cornell University in Ithaca, New York, “it would create more bad blood in an already contentious relationship regarding currency matters.” He worries it would “crystallize emerging market policymakers’ concerns that the IMF remains an institution run by and for the benefit of advanced economies.” That would encourage nations to rally around Beijing’s alternative lending institutions, and could deal a fatal blow to the post-World War II global financial architecture.

Second, Chinese economic reform is accelerating. Bernanke is right that the yuan has a ways to go before it can become a major reserve player. But a new Swift study shows the yuan is Asia’s most-active currency for payments to China and Hong Kong and number five globally. Convertible or not, the yuan is too big to ignore. In that sense, its inclusion in the IMF’s special drawing rights system – along with the dollar, euro, yen and pound – is a matter of when, not if.

France steps out, it’s over.

• French Far-Right Calls For In/Out EU Referendum (EUObserver)

France’s far-right National Front party has called for an in/out referendum on the EU at the same time as the UK holds its vote. Florian Philippot, an MEP and the party’s deputy head, wrote on Thursday (28 May) that president Francois Hollande should “follow the British example” and “follow the calendar outlined by our neighbours across The Channel”. “The time has come to ask everybody in Europe Yes or No – if they want sovereignty to decide on their own future”. He added that British PM David Cameron, who is currently on a tour of European capitals to sound out feeling on a renegotiation of EU powers, “with this referendum … has put himself in a powerful position to demand real reforms”.

He also said that if Hollande declines to do it, the National Front will put an in/out EU vote “at the heart” of its 2017 presidential election campaign. Speaking on BFM-TV earlier in the week, Philippot noted that his party wants a “referendum republic”, in which average people can trigger a popular vote on any subject if they file more than 500,000 signatures. He cited Switzerland as a model and listed French membership in Nato, in the Schengen passport-free area, and the EU-US free trade treaty as other potential votes. For its part, French daily Le Figaro, in an Ifop poll published on Friday, said 62% of French people would vote No to the EU constitution again if they were asked the same question as 10 years ago.

“It represents an almost 30-fold increase on the same period last year..” How dare Europe still not have a comprehensive answer to this?

• Italy Rescues 3,300 Migrants In Mediterranean In One Day (BBC)

Italy helped rescue a total of more than 3,300 migrants trying to cross the Mediterranean on Friday, the country’s coastguard has said. In one operation, 17 bodies were found on three boats. Another 217 people who were on board were rescued.

The coastguard said distress calls were made from 17 different boats on Friday. The International Organization for Migration (IOM) says at least 1,826 people have died trying to cross the Mediterranean so far in 2015. It represents an almost 30-fold increase on the same period last year, the IOM says. The Corriere della Serra newspaper said (in Italian) that most of the rescues on Friday took place close to the Libyan coast.Irish, German and Belgian ships took part in the rescue, the newspaper said. The UN estimates that at least 40,000 people tried to cross the Mediterranean between the start of the year and late April. The rise has been attributed to chaos in Libya – the staging post for most crossings – as well as milder weather. Many migrants are trying to escape conflict or poverty in countries such as Syria, Eritrea, Nigeria and Somalia. On Thursday, the charity Medecins sans Frontieres reported that a 98-year-old Syrian man had been rescued from a boat, having travelled by sea from Egypt for 13 days. He was taken to Augusta in Sicily.

Fear? Fear of what?

• Germany Passes Japan To Have World’s Lowest Birth Rate (BBC)

A study says Germany’s birth rate has slumped to the lowest in the world, prompting fears labour market shortages will damage the economy. Germany has dropped below Japan to have not just the lowest birth rate across Europe but also globally, according to the report by Germany-based analysts. Its authors warned of the effects of a shrinking working-age population. They said women’s participation in the workforce would be key to the country’s economic future. In Germany, an average of 8.2 children were born per 1,000 inhabitants over the past five years, according to the study by German auditing firm BDO with the Hamburg Institute of International Economics (HWWI). It said Japan saw 8.4 children born per 1,000 inhabitants over the same time period.

In Europe, Portugal and Italy came in second and third with an average of 9.0 and 9.3 children, respectively. France and the UK both had an average of 12.7 births per 1,000 inhabitants. Meanwhile, the highest birth rates were in Africa, with Niger at the top of the list with 50 births per 1,000 people. Germany’s falling birth rate means the percentage of people of working age in the country – between 20 and 65 – would drop from 61% to 54% by 2030, Henning Voepel, director of the HWWI, said in a statement (in German). Arno Probst, a BDO board member, said employers in Germany faced higher wage costs as a result. “Without strong labour markets, Germany cannot maintain its economic edge in the long run,” he added. Experts disagree over the reasons for Germany’s low birth rate, as well as the ways to tackle the situation.

Just the first round.

• More Charges Expected In FIFA Case (NY Times)

Chuck Blazer was a powerful figure in international soccer, and he enjoyed the trappings that came with the role: two apartments at Trump Tower in Manhattan, expensive cars, luxury properties in Miami and the Bahamas. But for all of Mr. Blazer’s lavish living, he did not file personal income tax returns. And in August 2011, Steve Berryman, an IRS agent in Los Angeles, opened a criminal investigation. Thousands of miles away in New York, two FBI agents, Jared Randall and John Penza, were working on an investigation of their own, one that had spun off an unrelated Russian organized-crime case in December 2010. The agents on opposite sides of the country were looking at some of the same people.

In December 2011, news reports revealed that the FBI was asking questions about FIFA, global soccer’s governing body, and the California investigators called New York. The two agencies joined forces, setting in motion the sprawling international case that led to the arrests of top soccer officials this week. The investigation, which involved coordination with police agencies and diplomats in 33 countries, was described by law enforcement officials as one of the most complicated international white-collar cases in recent memory. Fourteen people have been indicted in bribery and kickback schemes linked to corruption in the highest echelons of FIFA. And United States authorities say more charges are all but certain.

“I’m fairly confident that we will have another round of indictments,” said Richard Weber, the chief of the I.R.S. unit in charge of criminal investigations. The American government’s aggressive move shocked the soccer world and led to questions about whether the United States had set out on a mission to topple the leadership of FIFA, which has long been troubled by allegations of corruption. But officials at the Justice Department, the F.B.I. and the I.R.S. said the impetus was criminal activity and organized crime that just happened to occur in the soccer world. “I don’t think there was ever a decision or a declaration that we would go after soccer,” Mr. Weber said. “We were going after corruption.” He added, “One thing led to another, led to another and another.”

Still, investigators quickly realized the potential scope of their case. By the time the F.B.I. and the I.R.S. teamed up, an undercover sting operation by the British newspaper The Sunday Times had revealed corruption in FIFA’s highest ranks. Reporters around the globe followed with articles about whether soccer’s top officials could be bought. “We always knew it was going to be a very large case,” Attorney General Loretta E. Lynch said.

Home › Forums › Debt Rattle May 30 2015