Edgar Degas The laundress 1873

Some memes are stronger than others.

And this time for real. Until now it was only 2 states.

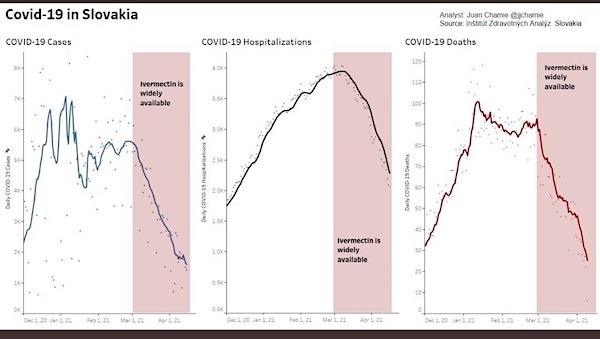

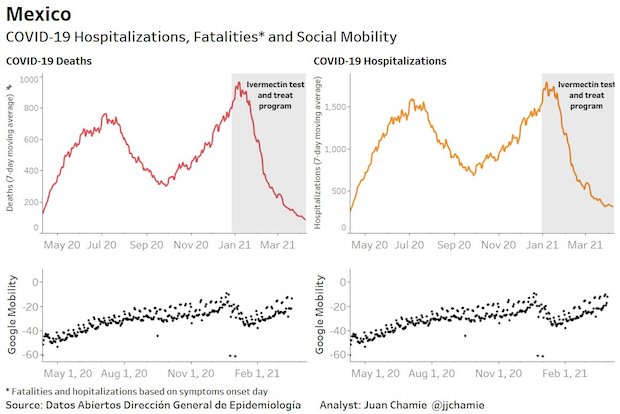

• India Latest Country to Approve Use of Ivermectin to Treat Covid-19 (NC)

[..] the huge uncontrolled wave of infections hitting India is having all sorts of implications for the Modi government. In its desperation to regain control of the virus, India’s government quietly changed its treatment guidelines last week. The new guidelines include the option of prescribing two repurposed medicines for mild Covid patients: budesonid and ivermectin. The former is an inhaled steroid that has been shown to reduce the time to recovery and need for urgent medical care. The latter is an off-patent anti-parasitic that has been discovered to have powerful anti-viral and anti-inflammatory properties. India is no stranger to ivermectin. The medicine has been used as an anti-parasitic for decades. It has also been used in the fight against malaria.

Two of its regions, Uttar Pradesh (population: 230 million) and Bihar, have been using the medicine since August, to dramatic effect. By the end of 2020, Uttar Pradesh (UP) — which distributed free ivermectin for home care — had the second-lowest fatality rate in India at 0.26 per 100,000 residents. Only the state of Bihar, with 128 million residents, had less. But Uttar Pradesh (UP) did more than treat 300,000 mild cases at home through 2020; it also opted to use ivermectin to prevent infection. COVID response teams began taking the drug and they did not catch the illness. The same thing was reported in a study of frontline critical care workers in Argentina. U.P. then had contacts of COVID patients take it, with similar success. “Recognizing the sense of urgency,” Amit Mohan Prasad, a U.P. health official, wrote in a Dec. 30 article, “we decided to go ahead.”

Yet UP’s remarkable success at controlling the virus did not inform national policy — at least not until now. The Indian Council of Medical Research declined in October to recommend ivermectin nationwide, citing, like so many health regulators, the need for more data. But all that changed last week as India became the biggest country on the planet to adopt nationwide use of ivermectin against Covid-19. More than 20 countries are now using ivermectin to treat Covid-19 to one degree or another, with promising results, despite the fact the World Health Organization has not approved its use. They include Mexico, Guatemala, Argentina, Brazil, Bolivia, Slovakia, the Czech Republic, Portugal, Nigeria, South Africa and Egypt.

”..the shot is one hundred times more dangerous than the disease..”

• Do Stupid Things, Win Stupid Prizes (Denninger)

It’s ok folks, it’s very “rare”. Uh huh, sure it is. High school senior Emma Burkey received her “one and done” Johnson & Johnson coronavirus vaccine on March 20, and within two weeks was in an induced coma following seizures and clotting in her brain. “She’s making a slow recovery, having recently been transfered from the hospital to a rehabilitation center, and the first round of bills totaled $513,000. The 18-year-old’s family friends in the Las Vegas area started a GoFundMe account to help with medical expenses from the very rare vaccine reaction.” An 18 year old, according to the CDC, has a roughly 1/50,000 risk of being killed by Covid-19 assuming the FDA’s and CDC’s “standard of care” which prohibits the use of budesonide, ivermectin, monoclonal antibodies and a whole host o other drugs which we know work.

One of them, budesonide, has a roughly 90% efficacy in preventing hospitalization (and of course death usually is preceded by that if you get Covid); the others also have some efficacy. Stacking just those three likely winds up around 95-99% effective, so your actual risk, if you’re not a dumb-ass and are both young and get Covid-19 is more like 1/500,000. And that’s if you get Covid. The CDC says about 1/10 people have over a year’s time, so your risk as a healthy 18 year old is approximately 1/5,000,000 since to be exposed to the risk of death you first must get the disease and that is not certain. Remember, according to the CDC if you die while Covid-19 positive then your death was caused by Covid-19, even though this is not scientifically proved. This is the same standard that VAERS uses for vaccine death; you died associated with receiving the shot; it is not proved it was caused, but if that’s good enough for the CDC to claim the Coof killed you then it sure as hell is good enough to claim the vaccine killed you.

By the CDCs VAERS numbers and the number of delivered shots into arms the risk of the shot killing you is approximately 1/45,000 and if you take the shot the hazard is 100% probable to be undertaken, obviously. So if you’re not specifically morbid the shot is one hundred times more dangerous than the disease. Oh, and we know the VAERS reports are wildly understated. Why? Because it’s a voluntary system; there is no mandate on any person or health provider to report potential adverse connected effects. While you (as the impacted individual) can report to the system obvious doing that if you’re dead is somewhat difficult. Were this a mandatory system where any death within “X” time of an inoculation had to be reported, with a criminal penalty for not doing so by health providers, we might have a more-full picture. But unlike death certificates which must be issued, and the CDC rules for Covid-19 that say if you were positive any time in the last 28 days, or at death, your death is ruled Covid-related there is no such mandate for VAERS.

Maybe health insurance will pay Emma’s bill, at least in part. What’s Emma’s deductible, if she has insurance? Will she be eating that deductible every year for the rest of her life with a continuing care requirement? Will her insurer refuse to pay entirely, since these were experimental shots? What happens if Emma wants to start a family and tries to get life insurance down the road? Will it be available at any reasonable price? Has her ability to bear a child been damaged or destroyed? What about her ability to enjoy all the things she used to enjoy; will she, for example, still be able to go for a nice jog? Can she hold a driver license? What about a CDL or pilot’s license? What about something as simple as driving a forklift in a warehouse? Have the seizures permanently destroyed those options for Emma?

Not supposed to be completed until 2023. Nothing matters anymore. All those carefully crafted procedures are just a hindrance.

• Pfizer Will File For Full FDA Approval By End Of May (F.)

Pfizer and BioNTech, the manufacturers of one of the three authorized Covid-19 vaccines in the U.S., plan to file for full approval from the Food and Drug Administration by the end of May as they expect the vaccine to generate about $26 billion in revenue this year. Pfizer and German drug manufacturer BioNTech announced their plan to ask the FDA for full approval of its vaccine in its quarterly earnings report. The vaccine, the first Covid-19 jab to be authorized for emergency use in the U.S., was given its emergency use authorization in December, and is currently authorized to be administered to Americans over the age of 16. The vaccine brought it $3.5 billion in revenue in the first three months of 2021. The FDA is expected to expand eligibility for the Pfizer vaccine to adolescents between the ages of 12 and 15 as soon as this week.

Full FDA approval would allow Pfizer to market its vaccine directly to consumers, and could help make Pfizer Covid-19 booster shots–something Pfizer CEO Albert Bourla has said will be necessary–available to the public without needing another emergency use authorization from the FDA. The FDA grants emergency use authorizations when the Secretary of Health and Human Services deems it “appropriate” for the FDA to “authorize unapproved medical products or unapproved uses of approved medical products” when there are few or no alternatives. Vaccination EUA proposals must include “safety data accumulated from phase 1 and 2 studies” and “with an expectation that phase 3 data” will include follow up information on trial subjects. The FDA can then grant an EUA when an FDA panel determines the “known and potential benefits outweigh the known and potential risks.”

It’s likely that all Covid-19 vaccine manufacturers with EUAs will go on to file for full FDA approval because emergency use authorizations can be revoked once a public health crisis subsides. Both Pfizer and Moderna have released phase 3 trial information for their vaccines that showed high levels of protection against Covid-19, which allow them to move forward with filing for full FDA approval. Some health experts hope that full FDA approval for Covid-19 vaccines will help lessen vaccine hesitancy in the U.S. Former U.S. Surgeon General Dr. Jerome Adams wrote in The Washington Post: “Many people who are lower risk understandably ask if the benefits justify taking a medication that has not received the full and traditional FDA stamp of approval,” and wrote “further studies” will “help show skeptics that the authorized COVID vaccines are safe.”

Surprising they don’t use “sustainable”.

• Pfizer Sees Covid-19 As ‘Durable’ Revenue Stream As Profits Rise (Y!)

Pfizer sharply increased its 2021 profit projections on Tuesday, citing much higher Covid-19 vaccine sales which are on track to provide a “durable” revenue stream in the wake of the pandemic. The drugmaker reported a jump in first-quarter profits based on surging revenues, with nearly one-fourth of sales coming from Covid-19 vaccines. With German partner BioNTech, the pharma giant is ramping up vaccine production and now estimates 2021 revenues of $26 billion from the vaccine, up from the $15 billion projected in February. But the surging profits have drawn criticism as governments face pressure to step in to ensure vaccines are provided to underserved countries.

Pfizer, which says it is on the cusp of winning US approval for individuals 12 to 15 years old to receive its vaccine, is holding talks with “basically all governments of the world” about providing booster shots through 2024, Chief Executive Albert Bourla told analysts on a conference call Tuesday. The company is studying the efficacy of giving the jabs six or more months after the second vaccine dose, and developing doses that could be stored at standard refrigerated temperature for up to 10 weeks. Bourla expects “durable demand” for Covid-19 vaccines, similar to that of the flu vaccine. “It is our hope that the Pfizer-BioNTech vaccine will continue to have a global impact by helping to get the devastating pandemic under control and helping economies around the world not only open, but stay open,” Bourla said in prepared remarks.

That would create “a scenario in which Pfizer can continue to be both a leader and a beneficiary,” he said. Pfizer has won wide praise for its technological prowess in developing a game-changing vaccine in record time. However, critics called the profits troubling given the divide in vaccine availability between rich and poor countries. World Health Organization chief Tedros Adhanom Ghebreyesus last month decried a “shocking imbalance in the global distribution of vaccines” and called for efforts to fortify the WHO’s Covax programs, which aims to ensure that poorer nations can access the shots. India and South Africa are leading an effort in the World Trade Organization to waive intellectual property and patent rules, at least temporarily, which would open the door to broader production of vaccines at a time when the virus is causing mass misery in India and some other countries.

President Joe Biden said Tuesday he had not made a decision on whether to support a vaccine waiver, but that the United States was moving “as quickly as we can” to export doses. Biden also said he was ready to “immediately” begin vaccinations for 12 to 15-year-olds as soon as Pfizer’s Covid shot is approved by regulators for the age group. Pfizer reported net income of $4.9 billion, up 45 percent from the same period of the prior year. Revenues also jumped 45 percent to $14.6 billion, including $3.5 billion in Covid-19 vaccine sales.

You mean the investors who make obscene profits?

• ‘Obscene’ Bonus Hike For AstraZeneca Boss Prompts Investor Anger (G.)

AstraZeneca is facing mounting opposition over its plans to award its chief executive, Pascal Soriot, a big increase in bonuses, with three investor advisory groups calling on shareholders to vote against the policy. Pirc, Glass Lewis and Institutional Shareholder Services (ISS) have all flagged concerns over moves to raise the maximum share bonus Soriot can receive under a long-term plan from 550% of his £1.3m base salary to 650%. AZ also plans to hoist Soriot’s maximum annual bonus to 250% of salary from 200%, depending on performance targets being hit. The advisory groups recommended investors vote against the pay policy at next Tuesday’s annual meeting.

Neville White, the head of responsible investment policy and research at EdenTree Investment Management, which holds AstraZeneca shares, described the proposed bonus increases as “obscene” and said he would vote against them. He added: “It is obviously tricky, because Pascal is both a hero and an antihero at the moment.” The pay vote comes at a sensitive time, as AstraZeneca has faced a barrage of criticism over its coronavirus vaccine after supply shortages and, in rare cases, a potential link to blood clots. It has, however, pledged to supply the vaccine on a not-for-profit basis during the pandemic, and lost money making it in the first quarter of the year. Soriot has been paid more than £15m in each of the last two years, after overseeing a turnaround as he rebuilt AstraZeneca’s drug portfolio. The firm has faced down several shareholder pay revolts over the years.

“Podcast host Dave Rubin suggested headlining the Blitzer-Fauci interview, “Drunk on power, highest-paid person in government egomaniac talks to synthetic humanoid news anchor on fake news channel using sports imagery.“

• Fauci Tells CNN We’re ‘At Least Halfway Through’ The Covid-19 Pandemic (RT)

White House health expert Anthony Fauci may have quite some time remaining to rule as “master” of all things Covid-19 as he told CNN that Americans are “at least halfway through” the pandemic. “We’ve really got to not declare victory prematurely,” Fauci told CNN host Wolf Blitzer on Tuesday. “So we’re in the late innings, but it’s not over. That’s the thing we’ve got to get people to appreciate.” Pressed by Blitzer to be more specific, in baseball terms, how soon the pandemic will end for Americans, Fauci said, “the bottom of the sixth.” That would mean the battle is more than 60% completed – unless the game can somehow be extended into extra innings. Critics of Fauci, who is chief medical adviser to President Joe Biden, found no encouragement in the doctor’s comments.

“Time to pull Dr. Fauci off the mound,” US Representative Jim Jordan (R-Ohio) said on Twitter, continuing with the baseball analogy. Fauci has a history of flip-flopping on his Covid-19 advice and moving the goalposts at various stages of the pandemic. What started as “15 days to slow the spread” has turned into a 14-month battle, with the doctor calculating another nine to 14 months to go. He admitted last December to purposely deceiving the public about vaccine herd-immunity projections to manipulate opinions. Biden on Tuesday set a new goal of having 70 percent of adults vaccinated with at least one Covid-19 jab by July 4. Earlier in 2020, Fauci said the US could achieve herd immunity once 60-70 percent of the population was fully vaccinated. But he repeatedly moved that target back as the year wore on, going to as high as 85 percent in December.

“We’re going in the right direction,” Fauci said in Tuesday’s CNN interview. “We’re seeing the light at the end of the tunnel, but now’s not a time to declare victory. It’s a time to get more and more people vaccinated.” Fauci has enjoyed rock-star status during the pandemic, being showered with awards and mainstream-media adulation. A children’s book that’s scheduled for release in June bestows him the title “America’s doctor.” His 80th birthday was celebrated as Dr. Anthony Fauci in Washington, DC, and he was serenaded with the birthday song by Biden, then president-elect, and future First Lady Jill Biden. Podcast host Dave Rubin suggested headlining the Blitzer-Fauci interview, “Drunk on power, highest-paid person in government egomaniac talks to synthetic humanoid news anchor on fake news channel using sports imagery.”

“..the rate has been sliding for more than 10 years and last year dropped to about 1.6, the lowest rate on record..”

• US Birth Rate Sees Biggest Fall For Nearly 50 Years (G.)

The US birth rate has fallen 4% in the largest single-year drop in nearly 50 years, according to a government report. The rate dropped for mothers of every major race and ethnicity, and in nearly all age groups, falling to the lowest point since federal health officials started tracking it more than a century ago, the report due to be published on Wednesday said. Births have been declining in younger women for years, as many postponed motherhood and had smaller families. Birth rates for women in their late 30s and in their 40s have been inching up. But not last year. The US once was among only a few developed countries with a fertility rate above the 2.1 children per woman that ensured each generation had enough children to replace itself.

But the rate has been sliding for more than 10 years and last year dropped to about 1.6, the lowest rate on record. “The fact that you saw declines in births even for older moms is quite striking,” said lead author of the report, Brady Hamilton, of the US Centers for Disease Control and Prevention. The figures suggest that the current generation will not have enough children to replace itself. The CDC report is based on a review of more than 99% of birth certificates issued last year. The findings echo a recent Associated Press analysis of 2020 data from 25 states showing that births had fallen during the coronavirus outbreak. The pandemic contribute to last year’s big decline, experts said. Anxiety about Covid-19 and its impact on the economy likely caused many couples to think that it was not the right time to have a baby.

It’s a symbiosis. The MSM only caters to the “left”, which demands ever scarier stories. Happy to provide.

• The Liberals Who Can’t Quit Lockdown (Atl.)

Lurking among the jubilant americans venturing back out to bars and planning their summer-wedding travel is a different group: liberals who aren’t quite ready to let go of pandemic restrictions. For this subset, diligence against COVID-19 remains an expression of political identity—even when that means overestimating the disease’s risks or setting limits far more strict than what public-health guidelines permit. In surveys, Democrats express more worry about the pandemic than Republicans do. People who describe themselves as “very liberal” are distinctly anxious. This spring, after the vaccine rollout had started, a third of very liberal people were “very concerned” about becoming seriously ill from COVID-19, compared with a quarter of both liberals and moderates, according to a study conducted by the University of North Carolina political scientist Marc Hetherington.

And 43 percent of very liberal respondents believed that getting the coronavirus would have a “very bad” effect on their life, compared with a third of liberals and moderates. Last year, when the pandemic was raging and scientists and public-health officials were still trying to understand how the virus spread, extreme care was warranted. People all over the country made enormous sacrifices—rescheduling weddings, missing funerals, canceling graduations, avoiding the family members they love—to protect others. Some conservatives refused to wear masks or stay home, because of skepticism about the severity of the disease or a refusal to give up their freedoms. But this is a different story, about progressives who stressed the scientific evidence, and then veered away from it.

For many progressives, extreme vigilance was in part about opposing Donald Trump. Some of this reaction was born of deeply felt frustration with how he handled the pandemic. It could also be knee-jerk. “If he said, ‘Keep schools open,’ then, well, we’re going to do everything in our power to keep schools closed,” Monica Gandhi, a professor of medicine at UC San Francisco, told me. Gandhi describes herself as “left of left,” but has alienated some of her ideological peers because she has advocated for policies such as reopening schools and establishing a clear timeline for the end of mask mandates. “We went the other way, in an extreme way, against Trump’s politicization,” Gandhi said. Geography and personality may have also contributed to progressives’ caution: Some of the most liberal parts of the country are places where the pandemic hit especially hard, and Hetherington found that the very liberal participants in his survey tended to be the most neurotic.

Some things have changed for good.

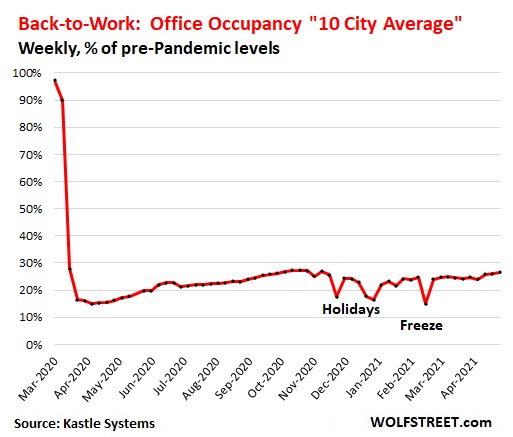

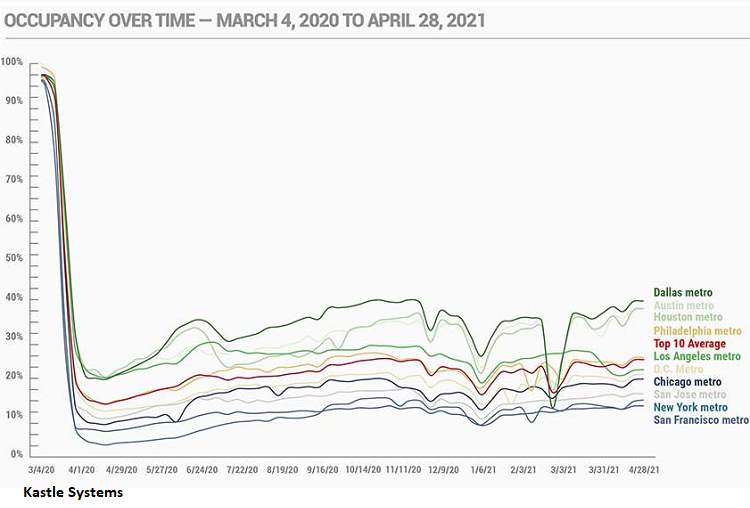

• The Dynamics Behind the Ugly Amount of Empty Office Space (WS)

Companies are not massively defaulting on their office leases, and that’s the good thing. But they have put a historic amount of vacant office space on the sublease market, while continuing to pay rent to the landlord. They decided they no longer need that much space, now that some form of flexible work, or hybrid work-from-home, or even permanent work-from-anywhere is being integrated into office real estate plans, cost cutting efforts, and footprint-reduction strategies. Now, 14 months into the Pandemic, office occupancy – workers actually showing up at the office – is still dreadfully low. As of the end of April, office occupancy in the 10 largest metros averaged only 26.5% of where it had been just before the Pandemic, according to Kastle Systems today, whose electronic access systems secure thousands of office buildings around the country. In other words, the number of people entering these offices was still down by 73.5% from pre-pandemic levels and has barely made headway in recent months:

The epicenters of work-from-home show the biggest drops in office occupancy rates, according to Kastle’s “Back to Work Barometer” at the end of April: in San Francisco, the occupancy rate was at 14.8% of the pre-Pandemic level, in New York City at 16.2%, and in San Jose at 18.0%. Among tech companies, 95% expect remote work for at least a few days a week; 9% said that they will never return to the office at all; another 47% said that they will need less office space; only 13% said they would need more office space, according to a survey by Savills.A survey of Californian residents found that 82% of the employees who now work at home want to continue working at home at least some of the time. Only 18% don’t want to work at home at all. But even at the top end of office occupancy, working remotely is still king. In Dallas, office occupancy is at 41.2% of where it was pre-Pandemic, and in Austin at 40.2% :

“Biden is the epitome of the empty, amoral creature produced by our system of legalized bribery.”

• Don’t Be Fooled By Joe Biden (Chris Hedges)

Don’t be fooled by Joe Biden. He knows his infrastructure and education bills have as much chance at becoming law as the $15-dollar minimum wage or the $2,000 stimulus checks he promised us as a candidate. He knows his American Jobs Plan will never create “millions of good paying jobs – jobs Americans can raise their families on” any more than NAFTA, which he supported, would, as was also promised, create millions of good paying jobs. His mantra of “buy American” is worthless. He knows the vast majority of our consumer electronics, apparel, furniture and industrial supplies are made in China by workers who earn an average of one or two dollars an hour and lack unions and basic labor rights.

He knows his call to lower deductibles and prescription drug costs in the Affordable Care Act will never be permitted by the corporations that profit from health care. He knows the corporate donors that fund the Democratic Party will ensure their lobbyists will continue to write the laws that guarantee they pay little or no taxes. He knows the corporate subsidies and tax incentives he proposes as a solution to the climate crisis will do nothing to halt oil and gas fracking, shut down coal-fired plants or halt the construction of new pipelines for gas-fired power plants. His promises of reform have no more weight than those peddled by Bill Clinton and Barack Obama, who Biden slavishly served and who also promised social equality while betraying working men and women.

Biden is the epitome of the empty, amoral creature produced by our system of legalized bribery. His long political career in Congress was defined by representing the interests of big business, especially the credit card companies based in Delaware. He was nicknamed Senator Credit Card. He has always glibly told the public what it wants to hear and then sold them out. He was a prominent promoter and architect of a generation of federal “tough on crime” laws that helped militarize the nation’s police and more than doubled the population of the world’s largest prison system with harsh mandatory sentencing guidelines and laws that put people in prison for life for nonviolent drug crimes, even as his son struggled with addiction. He was a principal author of the Patriot Act, which began the stripping away of our most basic civil liberties. And there has never been a weapons system, or a war, he did not support.

What a dynamic this is. Lying to the FBI doesn’t matter anymore. Not at CNN.

• CNN Turns To Disgraced FBI Official For Legal Analysis On Rudy Giuliani (TP)

Disgraced former FBI official Andrew McCabe provided legal analysis on CNN Friday morning of ongoing investigations into former Trump lawyer Rudy Giuliani and Republican Rep. Matt Gaetz. Unmentioned in McCabe’s “New Day” segment was that he was fired by the FBI in 2018 for lying to government officials about his authorization of leaks to the media. Federal prosecutors also opened a grand jury investigation into whether McCabe made false statements to FBI and Justice Department officials about the leaks. The FBI raided Giuliani’s apartment in New York City this week as part of an investigation into whether he violated foreign agent laws through his Ukraine-related work in 2019 and 2020. Federal prosecutors are reportedly looking into whether Gaetz had a sexual relationship with an underage girl.

Both Giuliani and Gaetz have denied any wrongdoing and have both said they are being targeted for political reasons. McCabe addressed reports that the FBI gave so-called defensive briefings to Giuliani and Wisconsin Sen. Ron Johnson in late 2019 about Russia’s efforts to sow disinformation about Joe Biden. McCabe called the briefing “a big deal,” saying that it shows that the FBI had “a significant amount of information” that Russia was using Giuliani to disseminate information about Biden. McCabe said that the FBI often observes the recipients of the defensive briefing to see how they respond to the information. “If you cut off your interactions with them, that’s a good sign. If you continue to interact with them, which we know Rudy Giuliani did here, that’s a very bad sign,” McCabe said.

They don’t really want you to know what they know about you.

• The Instagram Ads Facebook Won’t Show You (Signal)

Companies like Facebook aren’t building technology for you, they’re building technology for your data. They collect everything they can from FB, Instagram, and WhatsApp in order to sell visibility into people and their lives. This isn’t exactly a secret, but the full picture is hazy to most – dimly concealed within complex, opaquely-rendered systems and fine print designed to be scrolled past. The way most of the internet works today would be considered intolerable if translated into comprehensible real world analogs, but it endures because it is invisible. However, Facebook’s own tools have the potential to divulge what is otherwise unseen. It’s already possible to catch fragments of these truths in the ads you’re shown; they are glimmers that reflect the world of a surveilling stranger who knows you. We wanted to use those same tools to directly highlight how most technology works. We wanted to buy some Instagram ads.

We created a multi-variant targeted ad designed to show you the personal data that Facebook collects about you and sells access to. The ad would simply display some of the information collected about the viewer which the advertising platform uses. Facebook was not into that idea. Ad account disabled. This ad account, its ads and some of its advertising assets are disabled. You can’t use it to run ads. Facebook is more than willing to sell visibility into people’s lives, unless it’s to tell people about how their data is being used. Being transparent about how ads use people’s data is apparently enough to get banned; in Facebook’s world, the only acceptable usage is to hide what you’re doing from your audience. So, here are some examples of the targeted ads that you’ll never see on Instagram. Yours would have been so you.

By no means only Free Speech Advocates either.

• Facebook’s New Campaign Should Have Free Speech Advocates Nervous (Turley)

In 1964, Stanley Kubrick released a dark comedy classic titled “Dr. Strangelove or: How I Learned to Stop Worrying and Love the Bomb.” The title captured the absurdity of getting people to embrace the concept of weapons of mass destruction. The movie came to mind recently with the public campaign of Facebook calling for people to change her attitudes about the Internet and rethink issues like “content modification” – the new Orwellian term for censorship. The commercials show people like “Joshan” who says that he was born in 1996 and grew up with the internet.” Joshan mocks how much computers have changed and then asks why our regulations on privacy and censorship cannot evolve as much as our technology.

The ads are clearly directed at younger users who may be more willing to accept censorship than their parents who hopelessly cling to old-fashioned notions of free speech. Facebook knows that it cannot exercise more control over content unless it can get people to stop worrying and love the censor. There was a time when this would have been viewed as chilling: a corporate giant running commercials to get people to support new regulations impacting basic values like free speech and privacy. After all, Joshan shows of his first computer was a “giant behemoth of a machine” but that was before he understood “the blending of the real world and the internet world.”

The Facebook campaign is chilling in its reference to “privacy” and “content modification” given the current controversies surrounding Big Tech. On one level, the commercial simply calls for rethinking regulatory controls after 25 years. However, the source of the campaign is a company which has been widely accused of rolling back on core values like free speech. Big Tech corporations are exercising increasing levels of control over what people write or read on the Internet. While these companies enjoy immunity from many lawsuits based on the notion of being neutral communication platforms (akin to telephone companies), they now censor ideas deemed misleading or dangerous on subjects ranging from climate denial to transgender criticism to election fraud.

Moreover, Facebook knows that there is ample support for increasing censorship and speech regulation in Congress and around the world. Free speech is under attack and losing ground — and Facebook knows it. The rise of the corporate censor has challenged long-standing assumptions of the free speech community. Our Constitution and much of free speech writings are focused on the classic model of government censorship and state media. What we have seen in the last few years is that corporations have far greater ability to curtail speech and that you can have a type of state media without the state.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.