Walker Evans Saint Charles Street. Liberty Theatre, New Orleans 1935

With the 3rd US Q1 GDP print coming in at -0.7% (-3% if not for inventories), perhaps the media spotlights – and lively imagination – can move away from Greece for a few weeks. The US has enough problems of its own, it would seem. For one thing, its Q1 GDP is now worse than Greece’s. Of course its debt is also much higher, just not to the IMF and ECB. But let’s leave that one be for the moment. Though a bit of perspective works miracles at times.

Of course it’s not a technical recession yet for the US, which only recently presented a +4% quarter with a straight face, and there’s always the ‘multiple seasonal adjustment’ tool. But still. It’s ugly.

The IMF confirmed on Thursday that Athens has the right to ask for “bundled” repayments in June. “Countries do have the option of bundling when they have a series of payments in a given month … making a single payment at the end of that month,” as per an IMF spokesman. Who added that the last country to do so was Zambia three decades ago.

That leaves Athens, in theory, with a 30-day window, not a 7-day one. This of course takes the pressure cooker away from Athens, and the media attention as well. There is no immediate risk of a default, or a Grexit, or anything like that. The negotiations with the creditors will continue, but the conversation will change with time less of an issue.

One thing that’s changing is that the pressure on the other eurozone countries is rising fast. They might yet get to regret the way ‘their side’ conducts the debt talks with Syriza, in which they are a party through the eurogroup of finance ministers. Because it makes ever more deposits disappear from Greek banks, some €300 million in the past few days alone. That triggers a eurozone ‘program’ entitled Target2. For those who don’t know what it is, I’ll use an explanation by Mish from 2012:

If a Greek depositor sends money to a foreign bank (say a German bank), that bank now has additional deposits. To the extent it doesn’t want to recycle them (in the past, it may have used them to buy Greek government bonds), it deposits them with a national central bank – in this case the Bundesbank. Target claims are created because the Greek bank that loses deposits gets funding via the ECB’s ELA (Emergency Liquidity Assistance) program.

Simply put, the ECB sends money to the Bank of Greece in a kind of open credit line to make up for the cash that left the Greek bank. There are some restrictions, but not many. This is not a major problem unless Greece changes currencies, or defaults. If it does, Greece will repay the credit line with Drachmas, not euros.

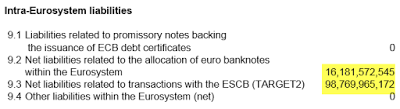

There are quite a few other ways in which the rest to the eurozone is on the hook for Greek debts, but this is a major one. RIght now, so-called ‘Intra-Eurosystem Liabilities’ from the Greek national bank, the Bank of Greece, have risen to €115 billion and counting -fast-. Germany’s on the hook for 27% of that, or €31 billion. While that is not life threatening for Germany, other countries will not feel that comfortable.

Countries like Spain and Portugal may by now scratch their heads about taking a hard line on the Greek issue. They may not have fully realized to what extent the eurozone is indeed a shared commitment. All eurozone nations now have at least another 30 days to think that over. The main risk in that period is that Greece may decide to leave on its own.

The 30-day grace period will probably dampen the deposit outflows for a bit, depending on what both parties have to offer in the way of statements going forward. And the incumbent ‘leaders’ in various countries can use the time to try and tell the troika that they don’t want to explain the potential losses to their voters. There are elections coming up all over, starting with Italy this weekend.

There is another possibility: that the ECB makes good on its long running threat of limiting Greek banks’ access to the ELA program. But, given the 30-day ‘grace’, and given that it would be seen as a political move by at least some parties, that seems unlikely. And it’s not like the entire thing has now become predictable, just that there’s breathing space. In which clearer -and smarter- heads can prevail.

As for the US, it’s spring, the season to adjust. But -0.7% still stings, and things ain’t going well at all no matter what anybody tells you.

Home › Forums › The Pressure Just Shifted from Greece to the US and EU