Ben Shahn Quick lunch stand in Plain City, Ohio 1938

At least if you read the Automatic Earth this is no shock.

• Moody’s Warns Of Global Shockwaves From China Slowdown (CityAM)

Global economic stability is at risk from financial shocks in the face of a bigger-than-expected fallout from China’s slowing growth, a new report from Moody’s has warned. The credit ratings agency also said that policymakers may find it difficult to act against potential shockwaves as they “lack the ample fiscal and monetary policy buffers” needed to stave off troubles. “Global economic growth will not support significant reductions in government debt or increases in interest rates by major central banks,” said Moody’s global macro outlook. “As a result, authorities lack the ample fiscal and monetary policy buffers usually created at the top of the business cycle, leaving growth and global financial stability particularly vulnerable to shocks for an extended period of time.”

The report comes a day after the OECD cut its global growth forecast, citing a “deeply concerning” slowdown in emerging markets. Although growth in western economies has been on a steady upward trajectory over the past few years, Moody’s warned that authorities lack the fiscal and monetary ammunition to sustain growth and to mitigate mounting corporate and national debt piles. “Advanced economies would be unable to do much to shore up global growth, given policymakers’ limited room for manoeuvre on fiscal and monetary policy and the high leverage we’re seeing in a number of sectors and countries,” said Marie Diron, senior vice president at Moody’s Investors Service.

But still manages to see higher growth ahead. That would mean the factors playing now would be mostly finished next year? That China’s giant bubble is done deflating?!

• OECD Rings Alarm Bell Over Threat Of Global Growth Recession (Ind.)

China’s economic slowdown is set to drag the global economy to the verge of recession, according to the latest forecasts from the Organisation for Economic Co-operation and Development (OECD). The Paris-based multilateral organisation said the world economy will expand by just 2.9% this year, slipping below the 3% level often used to classify a global “growth recession”. The OECD’s latest forecast is lower than the already gloomy 3.1% estimate from the IMF. And it would represent the weakest level of global output expansion since 2009, when the world was in the midst of the biggest financial crisis since the 1930s. The OECD said China’s domestic economic deceleration was “at the heart” of the downgrade in its twice-yearly global outlook.

Global trade is set to expand by just 2% this year, a pace described by Catherine Mann, the OECD’s chief economist, as “deeply concerning”. Ms Mann noted there have been just five years in the past half century in which trade growth was so weak. “World trade has been a bellwether for global output” she warned. “The growth rates of global trade observed so far in 2015 have, in the past, been associated with global recession”. The OECD said the trade deceleration was largely explained by a sharp decline in Chinese imports. China’s slowing levels of domestic investment have led to a collapse in the global price of commodities ranging from oil to copper, hammering emerging market exporters from Brazil to Russia and wreaking havoc among commercial commodity producers.

The OECD forecast global growth to pick up to 3.3% in 2016 and 3.6% in 2017. But Angel Gurria, the OECD’s secretary general, noted that by historical standards even this was lacklustre. “Ten years after the onset of the crisis we still would not have achieved the global rate of growth enjoyed before the crisis,” he said. Mr Gurria also remarked that “Even this improvement hinges on supportive macroeconomic policies, investment, continued low commodity prices for advanced economies and a steady improvement in the labour market.”

And not a little either: “The producer-price index fell 5.9%, its 44th straight monthly decline.”

• China Deflation Pressures Persist As Producer Prices Fall 44th Month (Bloomberg)

China’s consumer inflation waned in October while factory-gate deflation extended a record streak of negative readings, signaling policy makers may need to hit the gas again to ease deflationary pressures. The consumer-price index rose 1.3% in October from a year earlier, according to the National Bureau of Statistics, missing the 1.5% median estimate in a Bloomberg survey and down from 1.6% in September. The producer-price index fell 5.9%, its 44th straight monthly decline. The lingering deflation risks, along with weakening trade, open the door for additional stimulus as inflation remains about half the government’s target pace. The People’s Bank of China – which has cut interest rates six times in the past year – is seeking to stabilize the economy without fueling a renewed surge in debt.

“The risk of deflation has accentuated,” said Liu Li-Gang, the chief Greater China economist at Australia & New Zealand Banking in Hong Kong. “This requires the PBOC to engage in more aggressive policy easing.” China’s stocks halted a four-day rally after the data, with the Shanghai Composite Index losing 0.2%. Food prices rose 1.9% from a year earlier, from 2.7% in September. Non-food prices climbed 0.9%. Prices of consumer goods increased 1%, while services increased 1.9%, the data showed. The inflation reading follows a tepid trade report that suggested the world’s second-biggest economy isn’t likely to get a near-term boost from global demand. Overseas shipments dropped 6.9% in October in dollar terms while weaker demand for coal, iron and other commodities from declining heavy industries helped push imports down 18.8%, leaving a record trade surplus of $61.6 billion..

All -industrial- commodities, raw materials.

• Copper Sinks to Six-Year Low as Chinese Demand Slumps (WSJ)

Copper prices skidded to a six-year low and mining shares tumbled on Monday after China’s import data showed declining demand from the world’s top buyer of the industrial metal. China’s imports of copper and copper products for the first 10 months of 2015 fell 4.2%, to 3.82 millions tons, from the year-earlier period, the country’s General Administration of Customs said Monday. Imports are on track for their first year-on-year drop since 2013. “This is further evidence of that slowing in China and that their demand for copper is going to continue to decline,” said Paul Nolte, a portfolio manager with Kingsview Asset Management in Chicago. “Obviously, declining demand is going to keep the pressure on copper prices.”

China accounts for about 40% of global copper demand and the import data highlighted long-running concerns that the country’s economic slowdown would translate into lower copper imports. Recent reports showed that Chinese factory activity continues to contract and construction starts lag behind last year’s pace. Monday’s fall in copper prices rattled the mining sector, which has been battered by a prolonged slump in prices of metals and other commodities. The S&P Metals and Mining Select Index, which tracks the share prices of 30 companies, fell 1% on Monday, bringing year-to-date losses to 46%. Shares of Glencore, one of the world’s largest copper producers, declined 5.3%. Copper’s selloff has been particularly painful for Glencore, which got 20% of its operating income from copper production in the first half of 2015.

The dollar comes home.

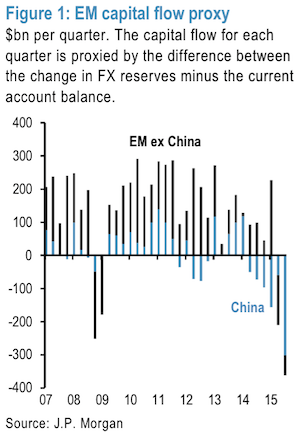

• Emerging Economies See Half Trillion In Capital Flight in 6 Months (Zero Hedge)

When Janet Yellen and the rest of the Eccles cabal decided to stay on hold in September, the “new” reaction function was all anyone wanted to talk about. Of course, the idea that the Fed was to that point “data dependent” (versus market dependent) was something of a joke in the first place, but the specificity the FOMC employed when referring to global financial markets still took some observers off guard. The worry for the Fed revolved primarily around the possibility that a hike could accelerate EM capital outflows at a time when a series of idiosyncratic factors (like a civil war in Turkey, a political crisis in Brazil, and the 1MDB scandal in Malaysia) had already pushed the emerging world to the brink of crisis. Enormous outflows from China as a result of the yuan deval didn’t help.

In short, the theory was that even a “symbolic” 25 bps hike had the potential to trigger an EM exodus that would make the taper tantrum look like a walk in the park as a soaring dollar exacerbated an already tenuous scenario playing out across the space. Now, as we look back at Q2 and Q3, we learn that all told, well more than a half trillion in capital fled EM over six months. Here’s JP Morgan who calls the capital flight “unprecedented”: “Recent capital outflows from EM have raised fears of a potential credit crunch, which if it materializes, could exacerbate the economic downshifting of EM economies. On our estimates $360bn of capital left China during the previous two quarters and an additional $210bn left from the rest of EM.” This of course led directly to a massive FX reserve drawdown and indeed, over the past 18 or so months, the end of the so-called “Great Accumulation” of USD assets has come to a rather unceremonious end.

Sounds hollow. Protectionism is not as easy as it sounds.

• EU Leaders Vow Measures To Halt Cheap Chinese Steel Imports (Guardian)

European politicians have promised “full and speedier” measures to stem the tide of cheap Chinese imports blamed for bringing Britain’s steel industry to its knees. The pledge came as Europe’s largest steelmakers called for immediate action to save an industry that has shed 85,000 jobs across the continent since 2008. It followed a crunch EU summit on Monday attended by the Conservative business secretary, Sajid Javid, amid fierce criticism of the UK government’s handling of the steel crisis. UK steel companies have announced 5,000 job cuts in a matter of weeks, blaming unfairly subsidised Chinese imports, high energy costs and business rates, and a strong pound. Unions have expressed huge disappointment at the outcome of the meeting.

Roy Rickhuss, general secretary of the Community union, said: “Council ministers and the (European) Commission have clearly failed to grasp the urgency of the current situation. Steelworkers whose jobs are at risk and who are seeing the impact of the dumping of cheap steel will take very little comfort from the conclusions of today’s meeting. “We need action now and would have at least expected a clear statement of intent from the meeting that they will speed up reform of trade defence instruments or introduce other measures so that European steel producers are better protected from dumping. “The promise of yet another meeting of steel stakeholders only delays the action the industry requires. The summit also failed to give a proper view on the impact of China gaining market economy status, which will pose an existential threat to the European steel industry.

VW still gets to be its own cop, juror and judge. That is so insane.

• Volkswagen Moves To Appease Angry Customers, Workers (Reuters)

Volkswagen took new steps on Monday to appease U.S. customers and German union leaders unhappy with the company’s response to a sweeping emissions cheating scandal that claimed another high-profile executive. Volkswagen is offering a $1,000 credit, of which half is to be spent at VW and Audi dealerships, to U.S. owners of certain diesel models that do not comply with government emissions standards, VW’s U.S. subsidiary said. The automaker said eligible U.S. owners of nearly 500,000 VW and Audi models equipped with 2.0 liter TDI diesel engines can apply to receive a $500 prepaid Visa card and a $500 dealership card, and three years of free roadside assistance services.

The move was the latest attempt to pacify owners who have been frustrated by how the German automaker plans to fix affected models. The company has warned it could rack up multi-billion-euro costs to remedy the issue and repair the damage to its reputation. “I guess it’s a very small step in the right direction. But far from what I’d like to see in terms of being compensated,” said Jeff Slagle, a diesel Golf owner in Wilton, Connecticut. The scandal erupted in September when VW admitted it had rigged U.S. tests for nitrogen oxide emissions. The crisis deepened last week when it said it had understated the carbon dioxide emissions and fuel consumption of vehicles in Europe.

VW said on Monday it continues to discuss potential remedies with U.S. and California emissions regulators, including the possibility that some of the affected cars could be bought back from customers. In Washington, Democratic Senators Richard Blumenthal and Edward Markey on Monday decried VW’s consumer program as “insultingly inadequate” and “a fig leaf attempting to hide the true depths of Volkswagen’s deception.” The senators said VW “should offer every owner a buy-back option” and “should state clearly and unequivocally that every owner has the right to sue.” Slagle, who bought his vehicle in 2011, said he was surprised there was still no plans for how to fix the cars: “Even though they’re clearly culpable, somehow they’re in the driver’s seat.”

What does it matter? They’d still be TBTF.

• World’s Largest Banks to Be Forced to Hold Big Capital Cushions (WSJ)

Global financial regulators published new rules aimed at stopping banks from becoming “too big to fail,” which could force the world’s largest lenders to raise as much as $1.19 trillion by 2022 in debt or other securities that can be written off when winding down failing banks. The rules, published Monday, are intended to prevent a repeat of the 2008 financial crisis, when taxpayers had to bail out banks whose collapse would have threatened large-scale financial panic. The plan, drawn up by the Financial Stability Board in Basel, Switzerland, is meant to ensure that the world’s biggest lenders maintain sizable financial cushions that can absorb losses as a bank is failing, without threatening a crisis in the broader banking system.

The new standards aim to make banks change the way they fund themselves to better weather a crisis, and to ensure that the cost of a giant bank’s failure will be borne by its investors, not taxpayers. The rules will apply to the world’s top 30 banks, such as HSBC, J.P. Morgan and Deutsche Bank, which the FSB classifies as “systemically important.” Banks are considered to be systemically important if their failure would pose a broad threat to the economy. “The FSB has agreed [to] a robust global standard so that [systemic banks] can fail without placing the rest of the financial system or public funds at risk of loss,” said Mark Carney, governor of the Bank of England and chairman of the FSB. The rules “will support the removal of the implicit public subsidy enjoyed by systemically important banks,” he said Monday.

The standard, which comes seven years after the 2008 financial crisis, “is an essential element for ending too-big-to-fail for banks,” he added. The FSB rule doesn’t have any legal force until it is implemented by regulators in the countries where the affected banks reside. In the U.S., where eight of the banks are located, the Federal Reserve earlier this month proposed a somewhat stricter version of the regulation. But the Fed estimated that those eight U.S. firms had a collective shortfall of about $120 billion in debt or other securities – a figure that equals roughly 10% of the FSB’s estimate for the 30 affected global banks. That suggests the other 22 global banks have more ground to make up to comply than their U.S. counterparts.

Why are Chinese state owned banks included? To show us the political power our own banks also have?

• Banking Giants Learn Cost of Preventing Another Lehman Moment (Bloomberg)

Banking behemoths led by HSBC and JPMorgan now know the cost they’ll have to shoulder so the global financial system doesn’t have another Lehman moment. The Financial Stability Board, created by the Group of 20 nations in the aftermath of the crisis, published its plan for tackling banks seen as too big to fail. The most systemically important lenders must have total loss-absorbing capacity equivalent to at least 16% of risk-weighted assets in 2019, rising to 18% in 2022, the FSB said on Monday. A leverage ratio requirement will also be imposed, rising from 6% initially to 6.75%. The shortfall banks face under the 18% measure ranges from €457 billion to €1.1 trillion, depending on the instruments considered, according to the FSB. Excluding the four Chinese banks in the FSB’s list of the world’s 30 most systemically important institutions, that range drops to €107 billion to €776 billion.

“The TLAC announcement is hugely important; it’s a milestone of the first order in bank reform and ending too big to fail,” Wilson Ervin, vice chairman of the Group Executive Office at Credit Suisse, said before the announcement. “There are a lot of important details to consider and hopefully improve, but the big picture is, if you have a bank rescue fund with $4 trillion to $5 trillion of resources, you can break the back of this problem.” [..] The FSB rules separate the liabilities needed to keep a bank running from purely financial debts such as notes issued for funding. By “bailing in” the bonds — writing them down or converting them to equity — regulators aim to ensure a lender in difficulty has the resources to be recapitalized without using public money, and to allow the resolved firm to continue to operate. In a departure from previous practice, senior debt issued by banks is explicitly exposed to loss.

Presented as an opportunity.

• Saudi Arabia To Tap Global Bond Markets As Oil Fall Hits Finances (FT)

Saudi Arabia has decided to tap international bond markets for the first time, in a sign of the damage lower oil prices are inflicting on its public finances. Saudi officials say the kingdom could increase debt levels to as much as 50% of gross domestic product within five years, up from a forecasted 6.7% this year and 17.3% in 2016. Work on finalising the bond programme is likely to start in January, according to a senior official. While banks have yet to receive any mandates, some lenders have already sent unsolicited proposals to guide the kingdom in approaching international markets. The authorities are in the meantime looking to set up a debt management office to help oversee the process of raising local and international bonds.

“Debt levels are still very low — tapping international debt markets will be an important way to fund spending without absorbing liquidity from domestic banks,” said Monica Malik at Abu Dhabi Commercial Bank. The decision to tap bond markets underscores the impact on the kingdom’s revenues from the plunge in the oil price, from $115 a barrel last year to $50 now, as well as Riyadh’s expensive military intervention in Yemen. Over the past year, Saudi Arabia has seen its foreign reserves decline from last year’s high of $737bn to a three-year low of $647bn in September. Riyadh started to issue domestic bonds in the summer to fund its budget deficit. The government could continue to issue domestically for another 12 to 18 months, officials say, but it will need to diversify globally to leave liquidity available for private sector lending.

“‘We don’t have a coup here: we have democracy. Whoever lacks the votes in the national assembly cannot govern,’ says the leader of the Left Bloc.”

• Germany Loses Key Ally In Portugal As Austerity Regime Crumbles (AEP)

Portugal’s Communists and radical Left Bloc are poised to take power in a historic departure as part of an anti-austerity coalition led by the Socialists, despite being branded too dangerous for office by the country’s president just 11 days ago. While it is not a replay of the “Syriza moment” in Greece last January, the ascendancy of the Left marks a clear break with the previous austerity regime and with the policies of the now-departed EU-IMF Troika. “Political risks are rising,” said Alberto Gallo from RBS. While Portugal has been a model of good behaviour in the eurozone until now, largely immune to radical politics, it has extremely high debt levels. He warned that the country may be skating on thin ice. The bond markets reacted badly to news that the three rival parties had overcome bitter differences and struck a definitive deal on a detailed governing programme.

Yields on 10-year Portuguese bonds jumped 21 basis points to 2.86pc. The risk-spread over German Bunds has risen 68 points since March. A Socialist-led government under Antonio Costa will deprive Germany of a stalwart ally in its efforts to uphold fiscal discipline and drive reform in the eurozone. It has always been crucial to the German political narrative of the EMU debt crisis that the pro-austerity arguments should be made for them by political leaders in the peripheral states. The change of regime in Lisbon could usher in a clean sweep by Left-leaning forces across southern Europe if the Spanish Socialists unite with the country’s new insurgent parties to dislodge the Right in the country’s elections next month. The race is currently too close to call.

There would then be an emerging “Latin bloc” with the heft to confront Germany and push for a fundamental overhaul of EMU economic strategy. At the very least, the political chemistry of the eurozone would change beyond recognition. Portugal’s Left-wing alliance won a majority in the country’s parliament last month but was initially rebuffed by President Anibal Cavaco Silva, who insisted on re-appointing a conservative government even though it had lost its working majority, and even though the political centre of gravity in the country has shifted markedly to the Left, and austerity fatigue is palpable. In an incendiary speech he incited Socialist deputies to break ranks with their own party and the support the Right, arguing that it was in effect a national emergency. This high-risk gambit failed totally. The triple-Left has held together, overcoming bitter differences in the past.

Beware the Spanish army. They’ve been threatening Catalonia for years.

• Catalonia Votes To Start Breakaway Process From Spain (Reuters)

Catalonia’s regional assembly voted on Monday in favor of a resolution to split from Spain, energizing a drive towards independence and deepening a standoff with central government in Madrid. The declaration, which pro-independence parties in the northeastern region hope will lead to it splitting from Spain altogether within 18 months, was backed by a majority in the regional parliament. The fraught debate over Catalan secession has railroaded campaigning for national elections on December 20, away from the country’s lopsided emergence from an economic crisis. “The Catalan parliament will adopt the necessary measures to start this democratic process of massive, sustained and peaceful disconnection from the Spanish state,” the resolution, in Catalan, said.

Parties favoring independence from Spain won a majority of seats in the Catalan assembly, representing one of Spain’s wealthiest regions, in September. But the Spanish constitution does not allow any region to break away and the center-right government of Prime Minister Mariano Rajoy has repeatedly dismissed the Catalan campaign out of hand. The government would file an appeal with the Constitutional Court to ensure that Monday’s resolution had “no consequences,” Rajoy said. “I understand that many Spaniards have had a bellyful (…) of this continued attempt to delegitimise our institutions.” Polls show that opposition to Catalan independence is a vote winner across the political spectrum in the rest of Spain.

Catalan secessionists argue that they have tried to persuade the government to discuss the independence issue and have been blocked by unionist parties. The declaration said it considered that judicial decisions “in particular those of the Constitutional Court” were not legitimate, setting the region and Madrid on a collision course.

Slow torture. The love of thumbscrews.

• Eurozone Finance Ministers Press Greece to Move Forward With Overhauls (WSJ)

Eurozone finance ministers on Monday said Greece needs to deliver on new foreclosure rules and other promised overhauls within a week to get a delayed slice of financial aid valued at €2 billion. The ministers, at their monthly meeting in Brussels, also urged Athens to deliver swiftly on overhauls to its financial system, including measures aimed at strengthening bank governance, in order to proceed with the recapitalization of its banks. Under the €86 billion bailout deal reached this summer, Greece has to implement around 50 promised overhauls, known as milestones, in return for loans meant to help the government pay salaries and bills, and settle domestic arrears.

But while progress has been made on some issues—including measures to substitute a tax on private education, the governance of the country’s bailed-out banks and the treatment of overdue loans—ministers said Athens was falling behind in putting some promised measures into action. “Implementation needs to be finished over the course of the coming week,” said Dutch Finance Minister Jeroen Dijsselbloem, who presides over the meetings with his eurozone counterparts. He added that senior officials from eurozone finance ministries would meet early next week to assess whether Greece delivered on the overhauls and sign off on the disbursement of €2 billion in financial aid.

Mr. Dijsselbloem also said €10 billion in bailout funds set aside for the recapitalization of Greek banks would be disbursed once Athens completed the agreed overhauls and delivered some key financial-sector measures, including on bank governance. “Next thing to do is to have all the financial sector measures in place before the completion of the recapitalization process,” he said. Thanks to recent stress tests that uncovered lower-than-expected capital requirements at Greece’s banks and new forecasts that predict the economy will shrink less than previously expected, pressure on the government in Athens has eased in recent months. But the disagreement over overhauls is also putting off talks on how to reduce the country’s debt load.

At the same time, postponing payments to government employees and contractors risks weighing on Greece’s economic recovery. Under this summer’s agreement, Athens was meant to implement a full set of overhauls by mid-October. But national elections in September and disagreements over some unpopular and painful measures have held up talks with creditors. Key among these is a new set of rules for when banks can foreclose on homeowners who haven’t been paying their mortgages. Greece’s left-wing Syriza government wants to protect citizens at risk of losing their primary residence and had initially asked banks not to take possession of homes worth less than €300,000—an amount creditors have deemed too high.

Takeaway: France has no voice in Europe.

• Greece Wants Political Solution On Bad Debt Dispute Blocking Review (Reuters)

Greece said on Monday it would take a political decision to overcome a dispute with international lenders over the treatment of non-performing loans at Greek banks, an issue it says threatens less well-off homeowners. Athens insists resolving the issue should not result in thousands of poor Greeks at risk of losing their homes and says a deal may have to be taken by Europe’s leaders to bridge the dispute. “The thorny issue is the distance that separates us on the issue of protecting primary residences,” Economy Minister George Stathakis told Real FM radio. “I think the negotiations we conducted with the institutions has closed its cycle .. so its a political decision which must be taken,” he said.The comments came ahead of a euro zone finance ministers’ meeting in Brussels which is to assess if Athens qualifies for more bailout funds.

Stathakis said that there was progress on most of the remaining issues holding up the review and that “a compromise will be reached” on the regulation of tax and pension fund arrears. The country’s progress in meeting the terms of the bailout is due to be assessed at the Eurogroup later on Monday. An accord would have released €2 billion to Athens, part of an initial tranche of €26 billion under the bailout, worth in total up to €86 billion. Greek Prime Minister Alexis Tsipras and European Commission President Jean-Claude Juncker discussed the bad-loans issue by telephone on Sunday. French President Francois Hollande and German Chancellor Angela Merkel also talked about it by phone. “Greece is making considerable efforts. They are scrupulously respecting the July agreement,” French Finance Minister Michel Sapin told reporters. “I want an agreement to be reached today. France wants an agreement today.”

Just like CDS are supposedly insurance against volatility, but are really just a way to hide losses.

• Hedge Funds Give Politicians Cover To Short-Change Pension Plans (Ritholtz)

A new report poses an interesting question: “Would public pension funds have fared better if they had never invested in hedge funds at all?” This is a subject we have investigated numerous times. The conclusion of the report confirms our earlier commentary: a small number of elite funds generate alpha (market-beating returns) after fees for their clients while the vast majority underperform yet still manage to overcharge for their services. One wouldn’t imagine that a market pitch built around “Come for the poor performance; stay for the excessive fees” would work. And yet the industry continues to attract assets. This year, gross hedge fund assets under management crossed the $3 trillion mark.

[..] People do care about performance, as well as fees. It is just that in the hierarchy of public-pension fund needs, both take a back seat to expected returns. This is because the higher the expected return, the lower the capital contributions required of some obligated public entity. Here is the punchline: Those expected returns are a myth. They don’t exist, except for the most elite funds, which are a tiny percentage of the industry. A few can generate alpha; most of the rest are mere wealth-transfer machines. As the chart below shows, none of the major classes of hedge funds beats the market. In other words, hedge funds aren’t used to generate higher returns; they simply make it possible for some public entity to reduce contributions to the underlying pension. This is the primary driving force in the rise of hedge funds for public pensions.

This fiction has been perpetuated by consultants and others with a vested interest. The myth has been swallowed whole by politicians, who can make the finances of the local and state governments they oversee appear better than they really are. I have yet to find the source of the idea that hedge funds outperform the market. It was created out of whole cloth as a sales pitch. There is no basis in accepted academic theory or actual practice to expect the hedge-fund industry to deliver returns above beta (market-matching returns). But the huge gap between pension-fund obligations and their actual assets has encouraged fund managers to invest more in hedge funds because of these inflated return expectations. This misrepresentation is creating an even bigger shortfall in the future for pension funds. The sooner they figure this out, the better off they will be.

Oliver Twist redux.

• Housing Next Target In Cameron’s Dismantling Of The Welfare State (Guardian)

Before he was elected, David Cameron had Harold Macmillan’s picture on his desk to show he, too, was a one-nation, noblesse oblige, postwar consensus sort of politician – part of his “big society” disguise. But how misleading to choose Macmillan – who, appalled by what he’d seen of the great depression while MP for Stockton-on-Tees, built a record 350,000 council homes a year as prime minister. Now Cameron has embarked on the abolition of social housing, both council- and housing association-owned. This isn’t an accident of the cuts, but a deliberate dismantling of another emblem of the 1945 welfare state. Instead of social housing for rent, the only money is for starter homes and shared ownership, out of reach of most average and below-average earners.

A third of the population can never own, without some radical redistribution of earnings and wealth currently flowing the other way. But plummeting home ownership is all that worries this government. Those who can never own will only have an unregulated private sector of rising rents, with housing benefit failing to keep up, and insecure six-month tenancies, where 1.5 million children are already at risk of regularly moving and shifting school. This is the end of a 70-year era of secure tenancies in social housing. This makes political sense as part of Cameron and George Osborne’s still under-recognised attempt to reduce the state permanently to 35% of GDP, a level below anything resembling British and European standards for public services.

As with tax credits, Osborne’s spending review cuts this month may prove politically impossible, but he will hope areas such as social housing are invisible, certainly to most Conservative voters. Osborne has purloined the word “affordable” to mean the opposite – an 80% of market rent that typical council renters can’t afford. The housing and planning bill, now in the Commons, is designed to finish off social renting. It carries out the manifesto pledge of a right to buy housing association properties at heavy discounts. Local authorities have to sell their most valuable homes to pay towards that discount – so two social homes are lost for every one sold.

“The world is bankrupt after thirty years of borrowing from the future to throw a party in the present, and the authorities can’t acknowledge that. But they can provide the conditions for disguising it…”

• The Leviathan (Jim Kunstler)

The economic picture manufactured by the national consensus trance has never been more out of touch with reality in my lifetime. And so the questions as to what anyone might do can hardly be addressed. How can I protect my savings? Who do I vote for? How do I think about where my country is going? Incoherence reigns, especially in the circles ruled by those who guard the status quo, which includes the failing legacy news media. The Federal Reserve has morphed from being a faceless background institution of the most limited purpose to a claque of necromancers and astrologasters, led by one grand vizier, in full public view pretending to steer a gigantic economic vessel that has, in fact, lost its rudder and is drifting into a maelstrom.

For more than a year, the fate of the nation has hung on whether the Fed might raise their benchmark interest rate one quarter of a %. They talk about it incessantly, and therefore the mob of financial market observers has to chatter about it incessantly, and the chatter itself has appeared to obviate the need for any actual action on the matter. The Fed gets to influence markets without ever having to do anything. And mostly it has worked to produce the false narrative of an advanced economy that is working splendidly well to the advantage of the common good.

This is all occurring against the background of a larger global network of economic relations that is quite clearly breaking apart. The rising tensions between the US, Russia, China, and the Euro Union grew out of monetary mischief “innovated” by our central bank, especially the shenanigans around debt monetization, which have created dangerous distortions in markets, trade, and perceptions of national interest. Nations are rattling sabers at one another and bluster is in the air. The world is bankrupt after thirty years of borrowing from the future to throw a party in the present, and the authorities can’t acknowledge that.

But they can provide the conditions for disguising it, especially in the statistical hall of mirrors that once-upon-a-time produced meaningful signals for the movement of capital. Instead of reality-based choices and decisions, the task at hand for the people in charge has been the ever more baroque elaboration of a Potemkin economic false-front, behind which lies a landscape of ruin scavenged by desperate racketeers. That this racketeering has moved so seamlessly into the once-sacred precincts of medicine and higher ed ought to inform us how desperate and perilous it has become.

“The Texas attorney general, Ken Paxton, said in a statement that the ruling meant the state, which has led the legal challenge, “has secured an important victory to put a halt to the president’s lawlessness”.

• Court Again Blocks Obama’s Plan To Protect Undocumented Migrants (Reuters)

Barack Obama’s executive action to shield millions of undocumented immigrants from deportation has suffered a legal setback with an appeal to the supreme court now the administration’s only option. A 2-1 decision by the fifth US circuit court of appeals in New Orleans has upheld a previous injunction – dealing a blow to Obama’s plan, which is opposed by Republicans and challenged by 26 states. The states, all led by Republican governors, said the federal government exceeded its authority in demanding whole categories of immigrants be protected. The Obama administration has said it is within its rights to ask the Department of Homeland Security to use discretion before deporting non-violent migrants with US family ties.

The case has become the focal point of the Democratic president’s efforts to change US immigration policy. Seeing no progress on legislative reform in Congress, Obama announced in November 2014 that he would take executive action to help immigrants. He has faced criticism from Republicans who say the program grants amnesty to lawbreakers. Part of the initiative included expansion of a program called Deferred Action for Childhood Arrivals, protecting young immigrants from deportation if they were brought to the US illegally as children. In its ruling the appeals court said it was denying the government’s appeal to stay the May injunction “after determining that the appeal was unlikely to succeed on its merits”. Republicans hailed the ruling as a victory against the Obama administration.

The incompetence is blinding.

• EU Plans New Refugee Centers as Influx Overwhelms Greece (Bloomberg)

European Union governments acknowledged that policies to channel migration aren’t working, announcing new processing centers to deal with refugees who slip through Greece without being registered. With little more than 100 of a planned 160,000 asylum-seekers sent from Greece and Italy to future homes in other European countries and winter setting in, EU interior ministers said the record-setting influx threatens to overwhelm some governments. “It is time to shift gears and start delivering on all fronts,” EU Home Affairs Commissioner Dimitris Avramopoulos told reporters Monday after the ministers met in Brussels. “We have talked a lot, it is the moment to deliver.”

European clashes over sheltering the mostly Muslim, mostly poor newcomers were accompanied by warnings of the risk to the system of passport-free travel between most EU countries, which is regularly hailed as one of the bloc’s greatest achievements. “There can be a Europe without internal borders only if Europe’s external borders are secured,” Austrian Interior Minister Johanna Mikl-Leitner said. EU leaders will grapple with refugee policy Wednesday and Thursday in Malta, at a summit with African officials that was called in April when the biggest numbers were coming across the central Mediterranean Sea. Now most are fleeing Syria’s civil war, traveling through Turkey, entering the EU in Greece and moving further northwest.

Some 200,000 came ashore on the Greek island of Lesbos in October alone, making it impossible for economically strapped Greece to cope, Luxembourg Foreign Minister Jean Asselborn said. “It’s an illusion, it’s impossible to ask a country, especially Greece, to welcome 10,000 people a day and to manage the screening,” said Asselborn, who chaired the meeting. New processing centers will be set up further north, to screen and register asylum-seekers who make it through Greece without stopping at reception centers dubbed “hotspots” in EU jargon.

Please watch. Eric Kempson is a 60-year old British artist who lives on Lesvos and devotes his life to saving refugees. This is what he has to say about aid agencies. Lots of F words.

• Major Aid Agencies Are Deceiving The General Public on Refugees (Kempson)

When the agancies finally made it to Lesvos a year late, they turned out to be horrible failures. UNHCR, Red Cross, just take it in…

Home › Forums › Debt Rattle November 10 2015