F.A. Loumis, Independence (Bastille?!) Day 1906

Excellent. We’re far too independent on the idiocy of 10,000 mile shipping lines. They’re heavily polluting (in more ways than one) and entirely unnecessary.

• Collapse of Hanjin, World’s 7th-Biggest Shipping Line, Upsets Global Trade (R.)

The collapse of South Korea’s Hanjin Shipping sent ripples though global trade on Thursday, as the country’s largest port turned away its ships and as some manufacturers scrambled for freight alternatives. Hanjin on Wednesday filed for court receivership after its banks decided to end financial support, and ports from China to Spain, the United States and Canada have refused entry to Hanjin vessels in what is traditionally the industry’s busiest season ahead of the year-end holidays. An official with Hanjin Shipping in Busan confirmed that its vessels were not entering the southern city’s port as container lashing providers deny service on concerns that they will not be paid. The company was also worried that the ships may be seized by creditors.

LG Electronics, the world’s No.2 maker of TVs, told Reuters it was cancelling orders with Hanjin and was seeking alternatives to ship its freight. An executive at the Korea International Freight Forwarders Association said on Wednesday he had been inundated with calls from cargo owners worried about the fate of their shipments in transit to the United States and Europe. While mobile phones and semiconductors are carried by air, other electronics like home appliances are shipped by sea. “This will have an impact on the entire industry,” the official said.

South Korea’s maritime ministry said on Wednesday that Hanjin’s woes would affect cargo exports for two or three months, with about 540,000 TEU of cargo already loaded on Hanjin vessels and facing delays. It would be difficult to find alternative ships given high seasonal demand from August to October. The ministry said it would ask local rival Hyundai Merchant Marine to supply vessels to cover some of Hanjin’s routes to the United States and Europe, while also seeking help from overseas carriers.

How central bankers kill pensions.

• Investors Miss Out On $500 Billion As Global Bond Yields Plunge (CNBC)

Investors have seen their interest income squeezed as global bond yields plunge. On the flipside, governments aren’t complaining. Relative to yields in 2011, global investors are foregoing more than $500 billion in annual income on roughly $38 trillion in sovereign debt that is outstanding, Fitch Ratings said in a report on Wednesday. “Cash flow benefits have effectively been transferred from global investors to sovereign issuers, as sovereign borrowing costs have dropped in response to central bank monetary stimulus,” Fitch said in the report. “This has posed new challenges for income-reliant investors, such as insurers and pension funds, while enabling governments to borrow at increasingly attractive rates.”

Borrowers would realize benefits only slowly, however, as bonds with higher coupon rates matured and newer bonds with lower interest rates were issued, the rating agency said. According to Fitch, investors who tended to buy assets and hold them onto maturity would have to invest new cash in bonds that paid lower interest rates, blunting the money they earned from coupon payments. Government bond yields, which move inversely to prices, have plummeted around the world as central banks in many developed economies scooped up bonds in order to provide stimulus to their economies. These purchases have sparked a scramble for government debt, enabling many countries to flog bonds while cutting the interest rates they have to pay to lure investors.

In itself a reasonable argumant re the history of spreads, but that does not make the conclusion alright, or logical.

• In Case Of Recession, The Fed Might ‘Need’ To Cut Rates To Minus 2% (CNBC)

The U.S. Federal Reserve might need to cut interest rates to as low as negative 2%, far lower than levels other global central banks have tested, a former Fed economist said. That’s what would likely be needed to engineer a recovery if the U.S. economy were to fall into a recession in the next couple of years, Marvin Goodfriend, who was an economist and policy advisor at the Federal Reserve’s Bank of Richmond from 1993-2005, told CNBC’s “Squawk Box” on Thursday. Goodfriend, who is currently a professor of economics at Carnegie Mellon University, pointed to data on the eight recessions in the U.S. since 1960.

“In eight of those recessions, the Fed had to push the short rate 2.5 percentage points below the long term rate. Today, the 10-year rate in the U.S. is 1.5%,” he noted, saying that would indicate that during the next recession, the Fed would need to cut rates as low as minus 1% at a minimum. “In five of those recessions, the Fed had to push the federal funds rate 3.5 percentage points below the 10-year bond rate,” he said. “So if that happens this time around, we would have to push the federal funds rate to minus 2%.” That’s well below where any other central banks have ventured so far. Sweden’s central bank, an early adopter of negative rates, has set its benchmark at negative 0.5%.

The Bank of Japan’s rate was set at minus 0.1% earlier this year, while the ECB, which first moved its rates into negative territory in 2014, currently has a deposit rate of negative 0.4%. The Fed funds rate has remained in positive territory, with the U.S. central bank last increasing interest rates in December of 2015, its first hike since 2006. That raised the Fed’s target rate to a range of 0.25 to 0.5%. To be sure, Goodfriend didn’t expect the Fed would be headed there anytime soon, noting that he believed the central bank should actually raise rates before the end of the year.

More more more.

• Eurozone Core Inflation Fall Raises Prospect Of ECB Stimulus Measures (G.)

Speculation is growing that the European Central Bank could take action to stimulate the eurozone economy after official figures showed an easing in underlying inflation last month. Pressure on the ECB increased when the European commission’s statistical agency, Eurostat, published figures that showed core inflation in July was lower than in same month last year, despite aggressive action by the Frankfurt-based bank over the past 18 months. With concerns that the eurozone recovery was losing momentum, Eurostat said the headline rate of inflation remained unchanged at 0.2% in August. Core, or underlying inflation, which excludes energy, goods, alcohol and tobacco, fell from 0.9% in July to 0.8%.

Separate Eurostat data showed that eurozone unemployment was unchanged at 10.1% in July, the latest month for which figures are available for all 19 countries that use the euro. The jobless rate in the eurozone has fallen from 10.8% over the past year, but financial markets had been expecting the reduction to continue to 10% last month. The ECB has been using negative interest rates and quantitative easing in an attempt to increase activity and push inflation back towards its target of just below 2%. Analysts said the inflation and unemployment figures would be discussed when the ECB meets to discuss policy options next week.

Stephen Brown of consultancy Capital Economics said: “The unchanged headline inflation rate in August highlights the fact that price pressures in the eurozone remain weak and boosts the case for more monetary easing from the ECB. “With [the] survey data also pointing to a marked slowdown in growth ahead, there is a strong case for the ECB to announce further policy easing. This could come as soon as the bank’s meeting next week.”

Abe and Kuroda won’t even take it serious.

• Bank of Japan Has an $84 Billion Yen Gap in Balance Sheet (BBG)

There’s an 8.7 trillion yen ($84 billion) gap between the value of government bond holdings on the Bank of Japan’s balance sheet and their face value. While not an immediate problem because the BOJ’s income can cover the losses, the widening gap raises questions about the sustainability of the central bank’s bond purchases, which Governor Haruhiko Kuroda has said could be expanded. The costs of the central bank’s record stimulus are mounting, while its chief goal – spurring inflation to 2% – appears as far away as it was when Kuroda took the helm in 2013. The BOJ is in the midst of reviewing its policy before a board meeting later this month, but the governor has said there will be no scaling back of his monetary program.

“These numbers show the distortions of the BOJ’s current policies,” said Sayuri Kawamura, a senior economist at the Japan Research Institute in Tokyo. “The annual amortization losses are going to increase and consume the BOJ’s profits, and the risk is increasing that the bank’s financial stability will be shaken.” The bonds the BOJ owns are worth almost 326.7 trillion yen when taken at face value, but were marked at almost 335.4 trillion yen on the balance sheet in August. That gap is 42% bigger than before the introduction of negative rates in January, according to an analysis of the balance sheet and list of the bonds the central bank owns. Tadaaki Kumagai, a spokesman for the central bank, said “the BOJ releases half-yearly and yearly accounts,” while declining to comment further.

The gap exists because, unlike the Federal Reserve, the BOJ counts its bond holdings at the purchase price, minus amortization costs. This number is diverging more from the face value because the central bank’s purchases and negative rate policy are pushing up prices. The face value is what the BOJ will receive when the bonds mature. At the end of the 2015 fiscal year on March 31, the gap between the two valuations was 6.4 trillion yen and the BOJ wrote down 874 billion yen, according to documents seen by Bloomberg. That was covered by the 1.29 trillion yen in coupon income the bank received that year, a situation that may not continue indefinitely.

Groupthink is all they have.

• Admitting Ignorance Is Better Than Groupthink For Central Bankers (BBG)

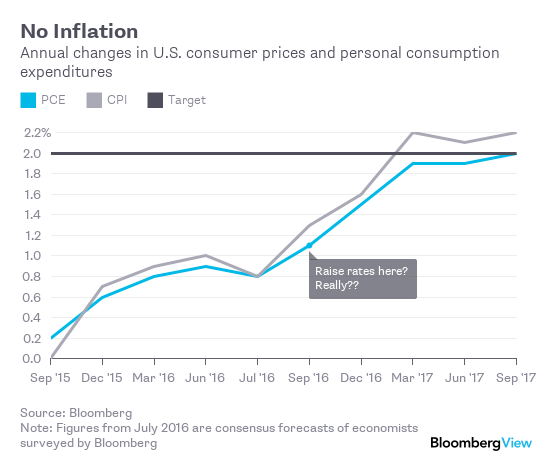

If the Fed’s objective last week was to put its September meeting back into play as the potential venue for a rate increase, it can claim a partial success. Prices in the futures market show traders now see about a 34% chance of a hike on Sept. 21, up from 22% two weeks ago. But you still have to go out to December before the likelihood rises above 50%. There’s a very good reason for that market skepticism. Raising rates at a time when inflation is dormant and miles away from the central bank’s 2% target seems somewhat perverse, especially when the forecast is for prices to remain subdued for many months to come:

The Jackson Hole Symposium (and let us note in passing what a great word symposium is, adding gravitas to what would otherwise be a mere conference) was an opportunity, as the event title said, to consider “Designing Resilient Monetary Policy Frameworks for the Future.” Instead, Fischer’s comment suggests it’s business as usual at the Federal Open Market Committee, with no room at present for such innovations as changing the inflation goal or targeting nominal GDP. That’s a shame. There’s a consensus that monetary policy is becoming impotent, and that governments need to step in with fiscal stimulus. But until central banks admit that their firepower is waning, politicians can continue to evade responsibility. “You can’t expect us to do the whole job,”

Christopher Sims, a Nobel Prize-winning economist from Princeton University, said at Jackson Hole last week. “Fiscal expansion can replace ineffective monetary policy at the zero lower bound. So long as the legislature has no clue of its role in these problems, nothing is going to get done. Of course, convincing them that they have a role and there is something they should be doing, especially in the U.S., may be a major task.” Finance – particularly in an era of fractional reserve banking – is essentially a confidence trick. Depositors have to be confident their money will be there when they try to withdraw it. Businesses have to be confident that the economy is on a sound footing otherwise they won’t invest and hire. Central bankers aren’t just economists and policy makers; they’re also salespeople, selling a story.

China is a giant debt bubble.

• An 809% Debt Ratio And Investors Are Serene? It Must Be China (BBG)

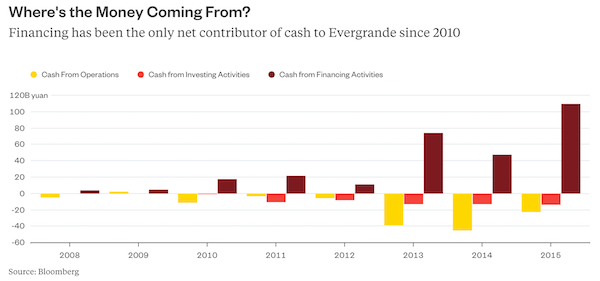

Prudence dictates that a compulsive shopper who runs up a hazardous amount of debt should think about cutting the credit card in half and staying home for a while. Try telling that to China’s acquisition-hungry companies.Two prime examples were on show this week when China Evergrande Group, one of the nation’s biggest developers, and Fosun International, an expanding Shanghai-based conglomerate, reported first-half earnings. The results show just how hard it is to kick the buying habit in an environment where compliant lenders stand ready to advance seemingly unlimited sums. Total borrowings at junk-rated Evergrande jumped by 28% from the end of December to 381 billion yuan ($57 billion).

That pushed the Guangzhou-based company’s ratio of net debt to shareholders’ equity to 142%, above the average 108% for China’s overleveraged property developers, according to data compiled by Bloomberg. Count Evergrande’s perpetual bonds as debt rather than equity and even that ratio starts to look benign. The total debt to common equity ratio rose to 809% at the end of June, from 582% six months earlier. The developer added about 40 billion yuan more perpetual notes during the period. So, time to rein things in somewhat?

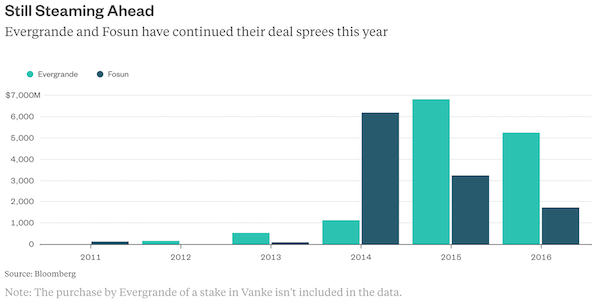

Not a bit of it. Evergrande wants to acquire brokerage and trust companies as well as smaller rivals, Chief Executive Officer Xia Haijun told reporters in Hong Kong Tuesday. That would be on top of more than $5 billion of purchases so far this year, including building a stake in larger developer China Vanke and acquiring a chunk of Shenyang-based Shengjing Bank. First-half profit, meanwhile, fell 23% excluding property revaluations and foreign-exchange losses.The debt buildup wouldn’t be so striking if Evergrande were acquiring cash-generating assets that can help pay down borrowings. If anything, things seem to be moving in the opposite direction.

Good. Kill that too.

• Austria Says Will Start ‘Conflict’ In EU About Canada Trade Deal (R.)

Austria is ready to confront other European Union members states over its opposition to a free trade deal with Canada, Chancellor Christian Kern said, because it sees it containing many of the same problems as one being negotiated with the United States. “This will be difficult, this will be the next conflict in the EU that Austria will trigger… We must focus on making sure… we don’t shift the power balance in favor of global enterprises,” Kern told broadcaster ORF late on Wednesday. Austria opposes a proposed free trade deal with the United States, and Kern said the deal with Canada, called the Comprehensive Economic and Trade Agreement (CETA), bore many of the same problems.

Ministers from Germany and France have also called for a halt in negotitations on the EU-U.S. deal, the Transatlantic Trade and Investment Partnership (TTIP). “We will have to see where the weaknesses of (CETA) are. Many are the same as with TTIP,” Kern, a social-democrat, said, without elaborating. Kern is expected to address issues surrounding TTIP at a news conference on Friday. There are widespread concerns in Austria that the TTIP could compromise food safety standards. Kern also opposes the idea that the agreement could allow companies to challenge government policies if they feel regulations put them at a disadvantage.

There are multiple truths in this case. In the end, though, this is about Brussels seeking to supersede member states’ sovereign law. For that, the constitutions of 27 nations should be held to the light. I would venture that what Brussels does here, and in many other fields, violates a fair number of these constitutions. And that is not legal no matter what their respective governments say or do. That’s an issue for their judicial systems. There’s a reason why the political and judicial systems have been made separate entities.

• Apple Travesty Is A Reminder Why Britain Must Leave The Lawless EU (AEP)

Europe’s Competition Directorate commands the shock troops of the EU power structure. Ensconced in its fortress at Place Madou, it can dispatch swat teams on corporate dawn raids across Europe without a search warrant. It operates outside the normal judicial control that we take for granted in a developed democracy. The US Justice Department could never dream of acting in such a fashion. Known as ‘DG Comp’, it acts as judge, jury, and executioner, and can in effect impose fines large enough to constitute criminal sanctions, but without the due process protection of criminal law. It misused evidence so badly in pursuit of the US chipmaker Intel that the company alleged a violation of human rights. Apple is just the latest of the great US digital companies to face this Star Chamber.

It has vowed to appeal the monster €13bn fine handed down from Brussels this week for violation of EU state aid rules, but the only recourse is the European Court of Justice. This is usually a forlorn ritual. The ECJ is a political body, the enforcer of the EU’s teleological doctrines. It ratifies executive power. We can mostly agree that Apple, Google, Starbucks, and others have gamed the international system, finding legal loopholes to whittle down their tax liabilities and enrich shareholders at the expense of society. It is such moral conduct that has driven wealth inequality to alarming levels, and provoked a potent backlash against globalisation. But the ‘Double Irish’ or the ‘Dutch Sandwich’ and other such tax avoidance schemes are being phased out systematically by the G20 and by a series of tightening rules from the OECD.

The global machinery of “profit shifting” will face a new regime by 2018. We can agree too that Apple’s cosy EU arrangements should never have been permitted. It paid the standard 12.5pc corporate tax on its Irish earnings – and is the country biggest taxpayers – but the Commission alleges that its effective rate of tax on broader earnings in 2014 was 0.005pc, achieved by shuffling profits into a special ‘stateless company’ with its headquarters in Ireland. “The profits did not have any factual or economic justification. The “head office” had no employees, no premises and no real activities,” said Margrethe Vestager, the EU competition chief.

Someone will find a way to blame this on Brexit.

• UK Defined Benefit Pension Fund Deficit Grows By £100 Billion In A Month (G.)

The combined deficit of the UK’s 6,000 defined benefit pension funds has grown by £100bn in the last month, bringing the total deficit to £710bn, according to a new report. The research, by the accountants PricewaterhouseCooper, found that the pension schemes have total assets of £1,450bn but are liable to pay out about £2,160bn in contractual promises to existing and former workers. Pension deficits have worsened since the EU referendum because companies use the interest rate on gilts, otherwise known as the yield, as the main tool in estimating how much they will have to pay out in pensions in the future. The lower the gilt yield, the more that companies have to set aside to meet their future costs.

The scale of the problems facing companies offering final salary pension schemes was underlined on Wednesday by the Yorkshire-based manufacturer Carclo, which issued a statement to the stock exchange to say that the recent increase in its pension deficit meant that a dividend payout to shareholders announced in June and due to be paid in October could not now go ahead. Carclo, which is based near Leeds and employs about 1,300 people making plastics and LED products, said in its statement: “If the corporate bond yield remains at its current low level then this will result in a significant increase in the group’s pension deficit.” It said this would have the effect of “extinguishing the company’s available distributable reserves”. The announcement immediately wiped almost 15% off the company’s share price.

How to kill a city, Chapter 826.

• London’s Elite ‘Pushed Out Of Exclusive Postcodes By Super Rich’ (G.)

London’s traditional elite, such as lawyers, architects and academics, are being pushed out of their enclaves in Mayfair, Chelsea and Hampstead by an influx of global super rich investors, causing a chain reaction of gentrification across the capital, according to research by the London School of Economics. An influx of extremely wealthy overseas buyers is leading the old elite to sell up and move from London’s most exclusive postcodes and buy in areas they previously considered undesirable, said Dr Luna Glucksberg, of the LSE’s International Inequalities Institute. This displacement of old money and affluent middle class professionals is in turn pricing neighbourhoods in south and east London out of the reach of average Londoners and threatening to push those on low incomes to the margins of the city and beyond, she added.

“The changes happening at the top end of the market are real, and although they do not affect large numbers of people directly, the ripple effects they generate do resonate across London,” Glucksberg said. “In terms of the impact on London as a whole, this represents a very different kind of ‘trickle down’ effect from what politicians across the spectrum have long argued would be the benefit of the ‘super rich moving into our city’,” said Glucksberg. “Affordability for average Londoners in the rest of the city is likely to become an even more difficult issue to solve.” The trend was contributing to dramatic house price rises in areas ranging from Battersea and Clapham to Acton, as the old elite bought property there with the significant profits – usually in the millions – made from selling up to the global uber wealthy, the researcher found.

“The study shows that the wealthy individuals and families that live in London’s most exclusive areas no longer feel able to compete at the top end of the capital’s property market,” said the researcher. “Instead they feel like they are being pushed out of elite neighbourhoods. For the first time, this elite group are buying flats for their children in areas they never would have previously considered.”

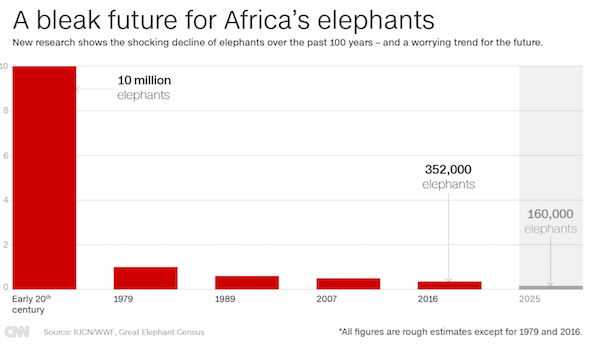

We need the death penalty for poachers and buyers, the entire chain, not just in Africa but everywhere, also in China and Japan. If they don’t comply, no more trade and full isolation.

• A Third Of Africa’s Elephants Were Wiped Out In Just 7 Years (CNN)

Scanning Botswana’s remote Linyanti swamp from the low flying chopper, elephant ecologist Mike Chase can’t hide the anxiety and dread as he sees what he has seen too many times before. “I don’t think anybody in the world has seen the number of dead elephants that I’ve seen over the last two years,” he says. From above, we spot an elephant lying on its side in the cracked river mud. From a distance it could be mistaken for a resting animal. But the acrid stench of death hits us before we even land. Up close, it is a horror. He was a magnificent bull right in his prime, 45 to 50 years old. To get at his prized ivory tusks, poachers hacked off his face. Slaughtered for their ivory, the elephants are left to rot, their carcasses dotting the dry riverbed; in just two days, we counted the remains of more than 20 elephants in a small area.

Visitors and managers at the tourist camps here are frequently alarmed by the sound of gunshots nearby. And Chase worries that if Botswana can’t protect its elephants, there’s little hope for the species as a whole. Chase, the founder of Elephants Without Borders (EWB), is the lead scientist of the Great Elephant Census, (GEC) an ambitious project to count all of Africa’s savannah elephants – from the air. Before the GEC, total elephant numbers were largely guesswork. But over the past two years, 90 scientists and 286 crew have taken to the air above 18 African countries, flying the equivalent of the distance to the moon – and a quarter of the way back – in almost 10,000 hours.

Prior to European colonization, scientists believe that Africa may have held as many as 20 million elephants; by 1979 only 1.3 million remained – and the census reveals that things have gotten far worse. According to the GEC, released Thursday in the open-access journal PeerJ, Africa’s savannah elephant population has been devastated, with just 352,271 animals in the countries surveyed – far lower than previous estimates. Three countries with significant elephant populations were not included in the study. Namibia did not release figures to the GEC, and surveys in South Sudan and the Central African Republic were postponed due to armed conflict. In seven years between 2007 and 2014, numbers plummeted by at least 30%, or 144,000 elephants.

Home › Forums › Debt Rattle September 1 2016