Harris&Ewing Ninth Street N.W., Washington, DC 1915

A wonderfully rich, must-read, multi-layered expose of the distance between various groups of Americans. Makes me wish Joe Bageant were still alive to shine his light on the elections.

• Dangerous Idiots: The Liberal Media Elite and Working-Class Americans (Smarsh)

Last March, my 71-year-old grandmother, Betty, waited in line for three hours to caucus for Bernie Sanders. The wait to be able to cast her first-ever vote in a primary election was punishing, but nothing could have deterred her. Betty – a white woman who left school after ninth grade, had her first child at age 16 and spent much of her life in severe poverty – wanted to vote. So she waited with busted knees that once stood on factory lines. She waited with smoking-induced emphysema and the false teeth she’s had since her late 20s – both markers of our class. She waited with a womb that in the 1960s, before Roe v Wade, she paid a stranger to thrust a wire hanger inside after she discovered she was pregnant by a man she’d fled after he broke her jaw.

Betty worked for many years as a probation officer for the state judicial system in Wichita, Kansas, keeping tabs on men who had murdered and raped. As a result, it’s hard to faze her, but she has pronounced Republican candidate Donald Trump a sociopath “whose mouth overloads his ass”. No one loathes Trump – who suggested women should be punished for having abortions, who said hateful things about groups of people she has loved and worked alongside since childhood, whose pomp and indecency offends her modest, midwestern sensibility – more than she. Yet, it is white working-class people like Betty who have become a particular fixation among the chattering class during this election: what is this angry beast, and why does it support Trump?

Former Australian foreign affairs minister and former NSW premier Bob Carr on the future after Trump.

• If You Think Donald Is Bad, Imagine Donald Trump 2.0 (Carr)

Amid the bleakness of Shakespeare’s King Lear one character, Edgar declares: the worst is not/so long as we can say “this is the worst”. Just when you think it can’t get any worse – Trump as candidate – here comes a more troubling prospect: the Trump next time, four years off, who defeats an unpopular President Clinton. It’s easy to tick off what gave the Republican nomination this time to a bossy, ignorant demagogue – the loss of industrial jobs, anxiety over borders and trade, racist resentment of minorities. Perhaps, as well, bewilderment at a multipolar world where America can’t get its way. None of these is about to fade. The anger of white working-class males, incited by Trump, is bound to simmer angrily at a distrusted woman in the White House imposing background checks for gun buyers and appointing three or four liberal justices to the Supreme Court.

After years of decline violent crime is increasing. The cost of Obamacare is rising and will need higher premiums and bigger subsidies. The Congressional Budget Office projects debt to rise from 2.9 to 4.9% of GDP over the decade. The US genius for innovation runs strong but the US system does a lousy job of distributing the gains. Stagnant real wages will feed grievance over immigration and there’s little a president can do about it. The US will continue to be defied – not just by Putin, even by President Duterte of the Philippines. North Korea or Syria are problems without solutions, leaving chauvinists to lament the US has never been more powerless. The truth is this catch cry has been thrown at every president since Harry Truman, including Ronald Reagan in his last years. But the US Right stridently insists America is surrounded by enemies.

The neo-cons who gave us Iraq and unleashed Islamic State are demanding America prove its greatness with new wars in the Middle East. If Clinton takes office on January 20 she will have been defined as “crooked Hillary” by Republican attacks over emails, the family foundation and paid speeches to Wall Street. Only one voter in three sees her as honest or trustworthy and she may have the lowest approval rating of any victor since polls began. No honeymoon. Little goodwill. Add lashings of misogyny to this toxic atmosphere and all is tailored for a Republican revival, and a revival with strong elements of Tea Party radicalism and Trump’s populist white nationalism. As a result the Republican Party of 2020 will be different from that of Reagan, the Bushes and McCain.

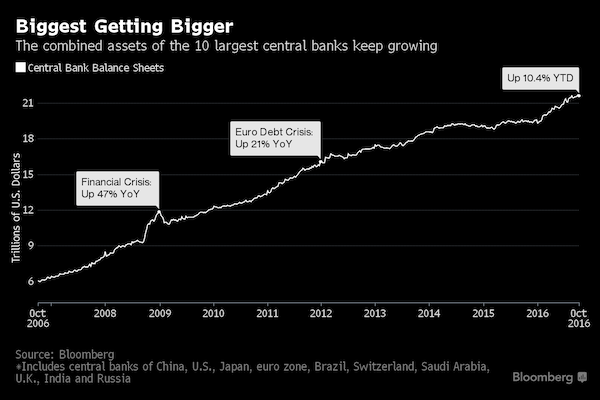

Funny how they stick to the term ‘assets’.

• Big Central Bank Assets Jump Fastest in 5 Years to $21 Trillion (BBG)

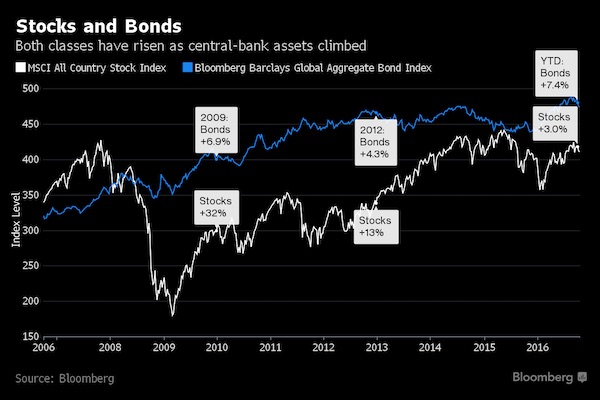

The world’s biggest central banks are bulking up their balance sheets this year at the fastest pace since 2011’s European debt crisis to boost lackluster economic recoveries with asset purchases that are supporting stock and bond prices. The 10 largest lenders now own assets totaling $21.4 trillion, a 10% increase from the end of last year. Their combined holdings grew by 3% or less in both 2015 and 2014. The accelerating expansion of central banks’ balance sheets comes as debate rages over whether their asset purchases and continued low interest rates are creating bubbles, especially in the bond market. Such quantitative-easing programs are aimed at driving up the prices of the securities they purchase to lower bond yields, encourage investment and boost economic growth.

The growth of central-bank holdings has coincided with the mostly upward trend of stock and bond prices. As the top 10 expanded their balance sheets by 265% since mid-October 2006, the MSCI All Country World Index of equities gained 19% and the Bloomberg Barclays Global Aggregate Index of bonds advanced 50%. Over the past decade, the Swiss National Bank expanded its holdings the most among those with the largest portfolios, almost eight-fold in U.S. dollar terms. The Bank of Russia was the least aggressive with a 68% increase. As the biggest banks’ holdings grew 10.4% this year, the stock gauge gained 3% and the bond benchmark jumped 7.4%. The BOJ and the ECB together have expanded their assets by $2.1 trillion since Dec. 31, more than accounting for all of the top 10’s combined increase. The balance sheets of the PBOC and the Fed fell 2% or less as the Swiss and the Central Bank of Brazil boosted their holdings 15% or more.

Ambrose agrees with Issing, but doesn’t like his explanations. The consequences of accepting that the euro has failed are too dire.

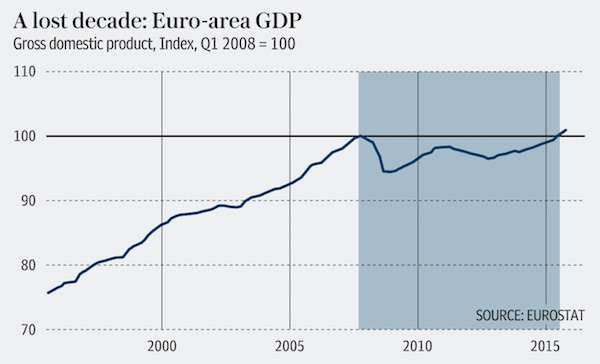

• Euro ‘House Of Cards’ To Collapse, Warns ECB Prophet (AEP)

The ECB is becoming dangerously over-extended and the whole euro project is unworkable in its current form, the founding architect of the monetary union has warned. “One day, the house of cards will collapse,” said Professor Otmar Issing, the ECB’s first chief economist and a towering figure in the construction of the single currency. Prof Issing said the euro has been betrayed by politics, lamenting that the experiment went wrong from the beginning and has since has degenerated into a fiscal free-for-all that once again masks the festering pathologies. “Realistically, it will be a case of muddling through, struggling from one crisis to the next. It is difficult to forecast how long this will continue for, but it cannot go on endlessly,” he told the journal Central Banking in a remarkable deconstruction of the project.

The comments are a reminder that the eurozone has not overcome its structural incoherence. A beguiling combination of cheap oil, a cheap euro, quantitative easing, and less fiscal austerity have disguised this, but the short-term effects are already fading. The regime is almost certain to be tested again in the next global downturn, this time starting with higher levels of debt and unemployment, and greater political fatigue. Prof Issing the lambasted the European Commission as a creature of political forces that has given up trying to enforce the rules in any meaningful way. “The moral hazard is overwhelming,” he said. The ECB is on a “slippery slope” and has in his view fatally compromised the system by bailing out bankrupt states in palpable violation of the Treaties.

“The Stability and Growth Pact has more or less failed. Market discipline is done away with by ECB interventions. So there is no fiscal control mechanism from markets or politics. This has all the elements to bring disaster for monetary union. “The no bail-out clause is violated every day,” he said, dismissing the European Court’s approval for bail-out measures as simple-minded and ideological. The ECB has “crossed the Rubicon” and is now in an untenable position, trying to reconcile conflicting roles as banking regulator, Troika enforcer in rescue missions, and agent of monetary policy. Its own financial integrity is increasingly in jeopardy. The central bank already holds over €1 trillion of bonds bought at “artificially low” or negative yields, implying huge paper losses once interest rates rise again.

[..] “During the first eight years, unit labour costs in Portugal rose by 30pc versus Germany. In the past, the escudo would have devalued by 30pc, and things more or less would be back to where they were.” “Quite a few countries – including Ireland, Italy and Greece – behaved as though they could still devalue their currencies,” he said. The elemental problem is that once a high-debt state has lost 30pc in competitiveness within a fixed exchange system, it is almost impossible to claw back the ground in the sort of deflationary world we face today. It has become a trap. The whole eurozone structure has acquired a contractionary bias. The deflation is now self-fulling. Prof Issing’s purist German ideology has no compelling answer to this.

Ah! Happy days!

• Let The Pound Fall and The Economy Rise (G.)

It has been just like old times. The pound has been falling on the foreign exchanges and, like a patient in intensive care, there are daily bulletins about its health. Charts show that when adjusted for different patterns of trade down the ages it is at its lowest for 168 years. If you have been gouged by a foreign exchange desk at Heathrow airport, this is a bad thing. If you consider sterling to be a symbol of national virility, it is a bad thing. If you think that the future for the UK outside the European Union is unremittingly bleak, it is definitely a very bad thing. But put the Brexit vote to one side for a second and ask yourself the following questions:

Is the economy currently unbalanced? Is growth too dependent on consumer spending and asset price bubbles? Is the productive base of the economy too small? Is it a problem that the UK is running a balance of payments deficit worth 6% of GDP, bigger than ever before in peacetime? If your answer to these four questions is yes – as it should be – then you need to accept that there is an upside to the falling pound. Indeed, many of those who are now talking about a sterling crisis were last year bemoaning the fact that Greece – trapped as it was inside the eurozone – did not have the benefit of a floating currency and so had to use a brutal internal devaluation involving wage cuts, pension reductions and welfare retrenchment to restore its competitiveness.

[..] Britain has discovered a way of living beyond its means. Assets are sold to overseas buyers bringing capital into the country to offset the balance of payments deficit. It is the equivalent of a once well-to-do household that has fallen on hard times pawning the silver to keep up appearances. At some point, referendum or no referendum, the financial markets were going to say enough is enough and it is delusional to think otherwise. Running permanent balance of payment deficits amounts to borrowing growth from the future. Sooner or later, it has to be paid back and Brexit means it will be sooner. A weaker pound works by making exports cheaper and imports dearer.

The effect, as after all the other devaluations and depreciations of the past 100 years – 1931, 1949, 1967, 1976, 1992 and 2007 – will make the economy less dependent on consumers and more reliant on producers. Lord Mervyn King, a former governor of the Bank of England, thinks the latest fall in sterling is a good thing and he is right. There have been suggestions from some in the remain camp that the hollowing out of manufacturing will make it impossible to gain any benefit from the cheaper pound. This, frankly, is nonsense. The current account deficit will shrink as a result of stronger exports from the manufacturing and service sectors, the boost provided to the tourism industry, and because cheaper domestic goods and services will be substituted for more expensive imports. To say that dearer imports will make life more difficult for consumers is to miss the point. That’s how rebalancing works.

“..just two years after the UK similarly rejected the gold standard back in 1931 there were just 12 remaining members versus the 45 that had previously been committed.”

• Europe’s Dramatic Fulcrum Point: Only Precedent Is 1930s (Hugh Hendry)

Since the Brexit referendum we have been developing our thoughts about what the Leave vote might mean, not just for the UK, but for the European project as a whole. An our main conclusion is that by doing the unthinkable and actually voting to leave, Brexit substantially increases the likelihood that other members of the European Union will also seek to break away. Remember, just two years after the UK similarly rejected the gold standard back in 1931 there were just 12 remaining members versus the 45 that had previously been committed. And the so far robust performance of the UK economy since the vote will do little to dissuade others from following suit.

So we have the precedent from a much earlier time (the 1930s) when the defection of just one member from a currency union caused the system to unwind rapidly. And we can clearly sense the seeds of another popular political revolt in other member countries; a flurry of upcoming elections and referendums provides an immediate catalyst. First of all we have the still too close to call US presidential election where a Trump victory would be hailed as a triumph for the same arguments that led to Brexit. Closer to home there is the Italian referendum on constitutional reform set for the first week in December, where it looks increasingly likely the government will be defeated.

Such a defeat would likely force Prime Minister Renzi to step down, potentially allowing populist parties to step into the resulting political vacuum and push a more nationalist agenda. 2017 is a big year for elections on the continent. In France both major parties have yet to decide on who will represent them in next year’s elections. But regardless of who the parties choose to run, both are likely to be pulled towards the distinctly anti-European nationalist agenda of Marine Le Pen who seems almost assured of reaching the second round run-off in the Presidential election next May.

And I kid you not, some people will still fail to see where Brexit came from.

• 43% of Britons and 73% of Londoners Live in Substandard Homes (Ind.)

More than four in 10 homes in Britain are falling short of an acceptable standard to live in, according to an alarming new report from the housing charity Shelter. Britons were asked if their homes met a series of conditions which together make up what Shelter has dubbed the “Living Home Standard”, and 43% said their home failed the test. The charity said it came up with the new criteria for what constitutes an acceptable place to live in consultation with the public. From having an affordable rent to being free from mould, pests and safety hazards, the list sets a “not unreasonable” standard which all homes should be meeting, Shelter said. Yet despite working with thousands of cases every week where homes are not up to scratch, even Shelter was shocked by how far the country was falling short.

Nearly one in five homes failed the Living Home Standard based on a lack of decent conditions. Some didn’t have running hot and cold water, others were not structurally sound, and many had serious pest infestations or issues with mould and damp. The research, conducted by Ipsos Mori, found more than one in four of the nearly 2,000 surveyed said their homes failed basic standards of affordability. In these cases, people had to cut back on essentials like food and heating just to pay their rent or mortgage, or they were worried those payments could rise to a level they would no longer be able to afford. And one in 10 respondents failed the test due to instability, mostly renters on short term contracts worried they could be kicked out of their homes at short notice.

“At Shelter we see all these problems every single day through our services, we help thousands of people every week, but even then – 43% was higher than we imagined,” Anne Baxendale, Shelter’s campaign chief, told The Independent. The problem appears particularly pronounced in London, where a staggering 73% said their home failed the test on some level. “It is really shocking, and it is up and down the country. Yorkshire is least badly affected – and it’s still one in four [failing],” Ms Baxendale said. “It’s affects people living in every kind of home, and people of all ages, but particularly the young. This is the start out in life that we are giving young people.

Comedy: “..the group wants to set a legal precedent in the common law that prevents political leaders from lying to the public..”

• Crowd-Funded Legal Case Wants To See Politicians Jailed For Brexit Lies (Ind.)

A crowd-funded project to prosecute politicians for “lying” during the EU referendum campaign has raised over £175,000 and now wants to see dishonest politicians jailed, the project’s founder has told The Independent. Marcus J. Ball, who founded the Brexit Justice campaign, says his team of lawyers are now building a case to take politicians to court to be held accountable for “dishonest” claims about Brexit. He set up the group online following the EU referendum citing his frustration at what he feels were misleading claims from some politicians during the campaign. After appealing for donations, he received more than £145,000 for legal fees as well as a salary of £32,000 for him to lead the project full time. Speaking to The Independent, Mr Ball admitted the project is a “highly ambitious and difficult challenge”.

However, he believes it is essential to make politicians accountable for broken promises: “We need to end this bizarre relationship we have with politicians, they are not untouchable. They are not above the law.” The 27-year-old, from Norwich, says the group wants to “set a legal precedent in the common law that prevents political leaders from lying to the public in the future. We also want to challenge the legitimacy of Brexit by legally establishing that it resulted from criminal wrongdoing on both sides.” Mr Ball said he is unable to discuss at this stage which politicians he will be singling out as the focus of the legal action. He told The Independent: “Now our solicitors have to build the case and formally instruct barristers, including some formidable QCs”.

I don’t think too many people have signed up to my statement that globalization is over. But Germany leans there, even if it’s heavily dependent on exports.

• Rattled German CEOs Seek “Revival of Germany Inc.” (WS)

About 20 German industry chieftains, rattled by the hits German companies have recently taken, including Deutsche Bank and Volkswagen, spent Saturday and Sunday two weeks ago on the phone with each other. They were fretting about the future of Germany’s export-dependent industry and outlining solutions. Some of the participants have since talked to the German daily, Die Welt, which published its report on Sunday. Participants included Siemens CEO Joe Kaeser, BASF CEO Kurt Bock, Deutsche Bank CEO John Cryan, BDI (Association of German Industry) president Ulrich Grillo, and BDI General Manager Markus Kerber. How to protect key industries in Germany is also topic of a paper being worked on by the Economy Minister Sigmar Gabriel and his folks, the Welt reported.

They’re searching for “protective walls,” and are working on a “list of options for actions to protect key German industries.” Finance Minister Wolfgang Schäuble and Finance State Secretary Thomas Steffen are in on it. For months, top executives and politicians have been discussing the impact of foreign governments on the “pillars of the German economy.” The recent “re-nationalization” of economic policies in many countries, in parallel with the “destabilization of the world,” scares these managers. “We are in a new phase in global politics, in which many countries are reverting to their national interests, where globalization is being turned back,” Kerber explained. Other executives have used similar words in their confidential conversations. Everyone is looking for answers. Nothing has been decided. Solutions are being worked on “behind the scenes.” And it shows, the Welt said, that “protectionism is suddenly no longer a dirty word” in business and politics.

JP Morgan and Qatar want to save Italy’s banks. That should never be allowed.

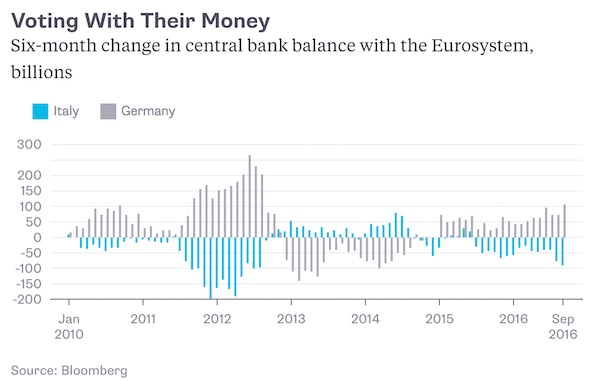

• Will Italy Leave the EU? Follow the Money (BBG)

Will Italy follow the UK’s example and leave the EU? Far-fetched as it may seem, capital flows suggest that some people aren’t waiting to find out. To keep the euro area’s accounts in balance, Europe’s central banks track flows of money among the members of the currency union. If, for example, a depositor moves €100 from Italy to Germany, the Bank of Italy records a liability to the Eurosystem and the Bundesbank records a credit. If a central bank starts building up liabilities rapidly, that tends to be a sign of capital flight. Lately, Italy’s central bank has been building up a lot of liabilities to the Eurosystem.

As of the end of September, they stood at about €354 billion, up €118 billion from a year earlier – and up €78 billion since the end of May, before the U.K. voted to leave the EU. The outflow isn’t quite as large as during the sovereign-debt crisis of 2012, but it’s still significant. The main beneficiary seems to be Germany, which has seen its credits to the Eurosystem increase by €160 billion over the past year. Here’s a chart showing the cumulative six-month flows between Italy and Germany and the rest of the euro area:

Why the accelerating outflows from Italy? One explanation is that people are worried about the state of the country’s banks, which are suffering the consequences of bad lending, poor governance and a new euro-area oversight system that makes rescues difficult. Another is political: Italian PM Matteo Renzi has staked his fate on a December government-reform referendum that, if it goes against him, could strengthen opponents who want to force a vote on whether Italy should remain in the EU. In that context, it’s not surprising that some depositors prefer not to hold Italian euros, given the chance that they might eventually be converted into lira. Either way, the capital flight doesn’t speak well of confidence in the European project – something EU leaders will have to keep in mind as they negotiate the terms of Britain’s exit.

Empty threats.

• 15 Swiss Banks In Money Laundering ‘Red Zone’ (R.)

Roughly 15 Swiss banks are in a “red zone” of lenders particularly exposed to money laundering risks, the head of Swiss banking watchdog FINMA said in a newspaper interview published on Sunday. Swiss federal prosecutors last week said that they have opened criminal proceedings against Zurich-based Falcon Private Bank for alleged failure to prevent suspected money laundering linked to Malaysia’s scandal-tainted 1MDB fund. Falcon is the second Swiss bank, after BSI, to face a criminal investigation by Switzerland’s Office of the Attorney General over links to 1Malaysia Development Berhad (1MDB). The move is partly based on an investigation by FINMA, which has also opened proceedings against several other lenders.

“We have introduced a warning system in relation to money laundering risks,” FINMA Chief Executive Mark Branson said in an interview with Swiss newspaper SonntagsZeitung. “Roughly 15 banks are in the red zone here. That means they are particularly exposed.” Branson did not name the banks concerned but said that most of them are involved in asset management and often have clients from emerging markets, adding that the lenders were from all areas of the country and of various sizes. Asked whether any major Swiss banks were among them, he said: “I would not use the plural, but yes.”

“To rebuild the loyalty of those who would continue to rule in the party’s name, its leaders went on to create the conditions in which officials at all levels could loot state property.”

• China’s Crony Capitalism: The Dynamics of Regime Decay (Econ.)

In 1989 the movement for democracy brought the Chinese Communist Party to within days of extinction. According to official reports, on one day alone, May 22nd, 6m people joined demonstrations in 132 cities across the country. The party’s immediate response was to use the people’s army to crush the people by force, in Tiananmen Square. To rebuild the loyalty of those who would continue to rule in the party’s name, its leaders went on to create the conditions in which officials at all levels could loot state property. Thus, the biggest democracy movement in history was countered by the greatest opportunity for predation the world has ever seen. China has never had a formal privatisation programme.

Instead, as Minxin Pei, a professor of government at Claremont McKenna College in California, writes in “China’s Crony Capitalism”, decentralising the rights of control over state property without clarifying the rights of ownership gave those who rule “maximum advantage to extract wealth from society”. Rights of control have been separated from rights of ownership in China—and where ownership is uncertain, control is key. Mr Pei’s book is quietly devastating. In sober, restrained language, he exposes the full gravity of corruption in China. Presenting a wealth of evidence, he shows that this is not the unfortunate by-product of rapid economic growth but the result of strategic choices by the party. With clinical precision, Mr Pei explains how corruption operates at every level, perverting each branch of the party-state and subverting the political authority of the regime.

The party cannot mitigate, let alone eradicate, “crony capitalism” because, since 1989, it has been “the very foundations of the regime’s monopoly of power”, the author argues. The conclusion, he believes, is that far from saving the regime, President Xi Jinping’s anti-corruption drive may accelerate its demise by creating divisions within the ruling elite even as it reinforces strong popular resentment of corruption. The state continues to hold the residual property rights to at least half of the net worth of the economy. Since 1978, when Deng Xiaoping launched his economic programme, the party-state has jealously guarded this walled garden for its officials and their business cronies. Throughout this time there has been some economic reform but no political reform. Thus the party, as Mr Pei points out, can only protect its interests with the full Leninist range of repressive instruments—and daily displays its willingness to do so.

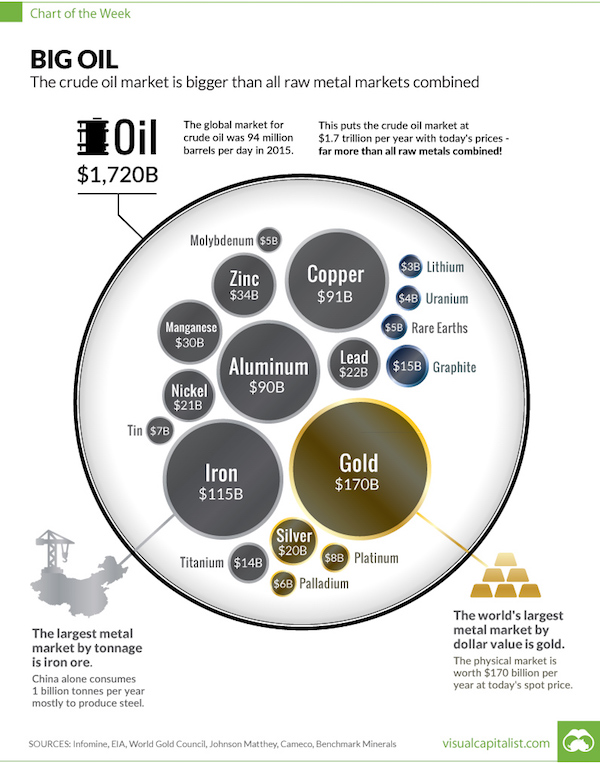

Jeff fails to mention the chemical industry. But great graphics.

• The Oil Market is Bigger Than All Metal Markets Combined (VC)

Ever since the invention of the internal combustion engine, oil has been one of the most crucial commodities on Earth. Without it, modern transportation as we know it would not be possible. Industries such as aviation, aerospace, automobiles, shipping, and the military would look nothing like they do today. Of course, as we now know, this has all come with some extreme drawbacks from an environmental perspective. And while new green technology and the lithium revolution will aid in eventually reducing the role of oil in transportation, the fact is we still use 94 million barrels per day of crude worldwide.

As a result, the energy industry continues to have huge amounts of influence on our lives. Special interest groups with a focus on energy have influence on a domestic level. Meanwhile, from a foreign policy angle, countries like Saudi Arabia and Russia wield additional geopolitical and economic power because of their natural resources. It’s even arguable that everything from the Gulf War to the more recent Middle East interventions in Libya, Syria, and Iraq have been at least partially to do with oil. This week’s chart of the week aims to help explain the influence that oil has on countries and markets by using a very simple perspective: the size of the crude oil market vs. all metal markets combined.