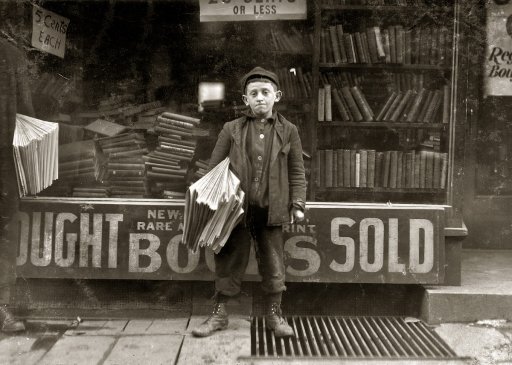

Lewis Wickes Hine 12-year-old newsie, Hyman Alpert, been selling 3 years, New Haven CT 1909

“The oil market is still clearly oversupplied and “it will get more so as refiners go into maintenance..”

• A. Gary Shilling: “Oil Is Headed For $10 To $20 A Barrel” (Bloomberg)

If crude’s slump back to a six-year low looks bad, it’s even worse when you reflect that summer is supposed to be peak season for oil. U.S. crude futures have lost 30% since the start of June, set for the biggest drop since the West Texas Intermediate crude contract started trading in 1983. That beats the summer plunges during the global financial crisis of 2008, the Asian economic slump in 1998 and the global supply glut of 1986. It even surpasses the decline of 2011, when prices fell as much as 21% over the summer as the U.S. and other large oil-importing nations released 60 million barrels of oil from emergency stockpiles to make up for the disruption of Libyan exports during the uprising against Muammar Qaddafi.

WTI, the U.S. benchmark, fell to a six-year low of $41.35 a barrel Friday. It may slide further, according to Citigroup Inc. “Summer is when refineries are all running hard, so actual demand for crude is as good as it gets,” Seth Kleinman at Citigroup said. OPEC’s biggest members are pumping near record levels to defend their market share and U.S. production is withstanding the collapse in prices and drilling. The oil market is still clearly oversupplied and “it will get more so as refiners go into maintenance,” Kleinman said. Oil demand usually climbs in the summer as U.S. vacation driving boosts purchases of gasoline and Middle Eastern nations turn up air-conditioning.

Crude has sunk this year even U.S. gasoline demand expanded, stimulated by a growing economy and low prices. Total gasoline supplied to the U.S. market rose to an eight-year high of 9.7 million barrels a day last month, according to U.S. Department of Energy data. Crude could fall to $10 a barrel as OPEC engages in a “price war” with rival producers, testing who will cut output first, Gary Shilling, president of A. Gary Shilling Co., said in an interview on Bloomberg Television on Friday. “OPEC is basically saying we’re not going to cut production, we’re going to see who can stand lower prices longest,” Shilling said. “Oil is headed for $10 to $20 a barrel.”

“..conditions in the high grade credit market are currently very unusual.”

• US Credit Traders Send Warning Signal to Rest of World Markets (Bloomberg)

Credit traders have an uncanny knack for sounding alarm bells well before stocks realize there’s a problem. This time may be no different. Investors yanked $1.1 billion from U.S. investment-grade bond funds last week, the biggest withdrawal since 2013, according to data compiled by Wells Fargo. Dollar-denominated company bonds of all ratings have lost 2.3% since the end of January, even as the Standard & Poor’s 500 index gained 5.7%. “Credit is the warning signal that everyone’s been looking for,” said Jim Bianco. “That is something that’s been a very good leading indicator for the past 15 years.”

Bond buyers are less interested in piling into notes that yield a historically low 3.4% at a time when companies are increasingly using the proceeds for acquisitions, share buybacks and dividend payments. Also, the Federal Reserve is moving to raise interest rates for the first time since 2006, possibly as soon as next month, ending an era of unprecedented easy-money policies that have suppressed borrowing costs. All of this has corporate-bond investors concerned enough that they’re demanding 1.64 percentage points above benchmark government rates to own investment-grade notes, the highest since July 2013, Bank of America Merrill Lynch index data show.

That’s also the biggest premium relative to a measure of equity volatility since March 6, 2008, 10 days before Bear Stearns was forced to sell itself to JPMorgan, according to Bank of America analysts in an Aug. 13 report. “Unlike the credit market, the equity market well into 2008 was very complacent about the subprime crisis that led to a full blown financial crisis,” the analysts wrote. “While we are not predicting another financial crisis, we believe it is important to keep highlighting to investors across asset classes that conditions in the high grade credit market are currently very unusual.” So if you’re very excited about buying stocks right now, just beware of the credit traders out there who are sending some pretty big warning signs.

Great take down by Stockman.

• The Great China Ponzi – An Economic And Financial Trainwreck (David Stockman)

There is an economic and financial trainwreck rumbling through the world economy. Namely, the Great China Ponzi. In all of economic history there has never been anything like it. It is only a matter of time before it ends in a spectacular collapse, leaving the global financial bubble of the last two decades in shambles. But here’s the Wall Street meme that is stupendously wrong and that engenders blind complacency with respect to the impending upheaval. To wit, the same folks who brought you the myth of the BRICs miracle would now have you believe that China is undergoing a difficult but doable transition – from an economy driven by booming exports and monumental fixed asset investment to one based on steady as she goes US-style consumption and services.

There may well be some bumps and grinds along the way, we are cautioned, such as the recent stock market and currency turmoil. But do not be troubled – the great locomotive of the world economy will come out the other side better and stronger. That’s because the wise, pragmatic and powerful leaders and economic managers who deftly guide China’s version of capitalism have the capacity to make it all happen. No they don’t! China is not a clone-in-the-making of America’s $18 trillion consume till you drop economy – even if that model were stable and sustainable, which it is not. China is actually sui generis – a historical freak accident that has no destination other than a crash landing. It’s leaders are neither wise nor deft economic managers.

In fact, they are a bunch of communist party political hacks who have an iron grip on state power because China is a crude dictatorship. But their grasp of the fundamentals of economic law and sound finance can not even be described as negligible; it’s non-existent. Indeed, their reputation for savvy and successful economic management is an unadulterated Wall Street myth. The truth is, the 25 year growth boom in China is just a giant, credit-driven Ponzi. Any fool can run a central bank printing press until it glows white hot. At the end of the day, that’s all the Beijing suzerains of red capitalism have actually done. They have not created any of the rudiments of viable capitalism. There are no honest financial markets, no genuinely solvent banks, no market driven allocation of capital and no financial discipline which comes from the right to fail as well as succeed.

“..China acted as is if forced lending to a state-run stock buying entity represented real, organic growth in demand for credit.”

• China Says Plunge Protection Team Will Prop Up Stocks “For Years To Come” (ZH)

Perhaps it’s a case of something getting lost in translation (so to speak), but Chinese authorities have a remarkable propensity for saying absurd things in a very straightforward way as though there were nothing at all odd or amusing about them. For example, here’s what the CSRC said on Friday about the future for China Securities Finance (aka the plunge protection team): “For a number of years to come, the China Securities Finance Corp. will not exit (the market).” For anyone who hasn’t followed the story, Beijing transformed CSF into a trillion-yuan state-controlled margin lender after a harrowing unwind in the half dozen or so backdoor leverage channels that helped inflate Chinese equities earlier this year caused stocks to plunge 30% in the space of just three weeks.

CSF has since become something of an international joke, as the vehicle, along with an absurd effort to halt trading in nearly three quarters of the country’s stocks, came to symbolize the epitome of market manipulation – and that’s saying something in a world where everyone is used to rigged markets. And because Beijing wanted to get the most manipulative bang for their plunge protection buck (err… yuan) the PBoC went on to count loans made to CSF by banks towards total loan growth in July. In other words, China acted as is if forced lending to a state-run stock buying entity represented real, organic growth in demand for credit. Now, apparently, the practice of using CSF to “stabilize” stocks and artificially prop up loan “demand” will become standard procedure. Here’s more from AFP:

China’s market regulator on Friday vowed to stabilise the volatile stock market for a “number of years”, saying a state-backed company tasked with buying shares will have an enduring role. “For a number of years to come, the China Securities Finance Corp. will not exit (the market). Its function to stabilise the market will not change,” the China Securities Regulatory Commission (CSRC) said in a statement on its official microblog. The China Securities Finance Corp. (CSF) has played a crucial role in Beijing’s stock market rescue, which was launched after Shanghai’s benchmark crashed 30% in three weeks from mid-June.

The regulator’s comments were the first time it has given any indication of how long it would intervene to support equities. Authorities gave the CSF huge funding to buy shares and subsequent speculation the government was preparing to withdraw from the stock market has spooked investors. The statement added the CSF will only enter the market during times of volatility. “When the market drastically fluctuates and may trigger systemic risk, it will continue to play a role to stabilise the market in many ways,” said the statement, which quoted CSRC spokesman Deng Ge.

From last weekend, but an important additional headache for Beijing. How are they going to control hundreds of cities heavily indebted to shadow banks?

• Hundreds Of Chinese Cities In Precarious Financial State (NY Times)

Although the country escaped the worst of the global financial crisis six years ago, it did so on the back of a borrowing binge by local governments, which spent heavily on new but often unprofitable infrastructure projects. Now, many local governments are mired in debt. In Weifang, a city known for seafood processing and an annual kite-flying festival, rapid urbanization over the last decade has saddled the local government with debts totaling 88.4 billion renminbi, or $14.2 billion, as of June 2013, the most recent data available. Since 2007, China’s overall local government debt has risen at an annual rate of 27%. It now totals almost $3 trillion, according to estimates from the consulting firm McKinsey & Company.

Companies, too, have gorged on cheap credit in recent years. Altogether, China’s total debt stands at 282% of its gross domestic product — a high level that raises the risk of a financial crisis should borrowers prove unable to repay and a wave of defaults ensue. It has created a conundrum for the country. China’s leaders want to wean the country from this debt-fueled growth model. But they also need to continue stimulating the economy, particularly at a time when growth is slowing. Part of Beijing’s solution has been to help local governments lower their borrowing costs through refinancing. Local government-controlled companies that are struggling to pay bonds are being encouraged to exchange them for new loans at lower interest rates from state-run banks.

China’s Ministry of Finance recently expanded this local government debt refinancing program to 3 trillion renminbi, or nearly $500 billion, up from 1 trillion renminbi just a few months ago. China has also begun a national campaign to encourage private investment in local infrastructure projects. In May, the nation’s top economic planning agency released a list of more than 1,000 projects worth 2 trillion renminbi that local governments across the country are seeking to finance with outside investment. Analysts estimate that is on top of roughly 1,500 other projects worth 3 trillion renminbi that had been previously announced by the local authorities.

A decade ago, the MTR Corporation, the Hong Kong subway operator, was an investor in Beijing’s fourth metro line. Beijing had won the right to host the 2008 Summer Olympics and was expanding its transport network at a blinding pace. By the time it opened in 2009, passenger flows on the new line were much higher and revenue much lower than either party had forecast. This prompted huge subsidy payments from the Beijing government to the MTR, which did not sit well with local officials. So city officials simply rewrote the contract. The new terms reduced subsidy payments to the MTR, and were on balance more favorable to the city government. MTR, as the minority shareholder, had little room to object.

Still far from over.

• Euro Ministers Give Blessing To Greek Bailout, Wooing IMF On Debt (Reuters)

Finance ministers from the eurozone gave their final blessing to lending Greece up to €86 billion after the parliament in Athens agreed to stiff conditions overnight. After six hours of talks in Brussels, ministers said in a statement: “The Eurogroup considers that the necessary elements are now in place to launch the relevant national procedures required for the approval of the ESM financial assistance.” Assuming final approval next week by the German and some other national parliaments, an initial tranche of €26 billion would be approved by the European Stability Mechanism next Wednesday. Of that, €10 billion would be reserved to recapitalise Greek banks ravaged by economic turmoil and the imposition of capital controls in June, and €13 billion would be in Athens on Thursday to meet pressing debt payment obligations.

Some issues still need to be ironed out following a deal struck with Greece on Tuesday by the EC, ECB and IMF. They include keeping the IMF involved in overseeing the new eurozone programme while delaying satisfying the Fund’s calls for debt relief for Greece until a review in October. IMF Managing Director Christine Lagarde, who took part in the meeting by telephone, said in a statement that the Fund believed Europe would need to provide “significant” debt relief as a complement to reforms Athens is taking to put Greece’s finances on a sustainable path. “I remain firmly of the view that Greece’s debt has become unsustainable and that Greece cannot restore debt sustainability solely through actions on its own,” she said.

There’s no way back now for Brussels. They can’t un-promise to leave depositors’ money alone. Big move for Greek banks.

• EU Aims To Lure Greek Deposits Back To Banks With Bail-In Shield (Bloomberg)

Euro-area finance ministers shielded Greek bank depositors from any losses resulting from the restructuring of the nation’s financial system, as part of Friday’s deal on an€ 86 billion bailout. Senior bank bondholders will be in the crosshairs if Greek lenders tap into any of the financial stability funds set aside in the new bailout. Euro-area finance ministers agreed to a deal that would next week place €10 billion in Greece’s bank recapitalization fund, with another €15 billion available if needed. “Bail-in of depositors will be explicitly excluded” from EU rules to make private investors share the cost of fixing troubled banks, Eurogroup President and Dutch Finance Minister Jeroen Dijsselbloem told reporters after the six-hour meeting in Brussels.

By shielding all depositors, the euro area will protect small and medium-sized enterprises who have more than 100,000 euros in their accounts and aren’t covered by government deposit insurance, Dijsselbloem said. This prevents “a blow to the Greek economy” that ministers wanted to avoid, he said. Instead, the focus will turn to bond investors. “When so much money must be invested in banks, in the first place, banks must take part of the risks,” Dijsselbloem said. Alpha Bank AE’s €400 million of 3.375 percent notes due 2017 traded at 70.5 cents on the euro Friday to yield 25.4 percent. Those securities are up from a low this year of 27.5 cents in July.

At the start of the new aid program, the bank funds will be placed in a designated account at the European Stability Mechanism, the currency bloc’s firewall fund. Bank supervisors can tap the money as required once Greece’s banks have gone through stress tests and an asset-quality review. After Greece’s lenders are recapitalized, the subsequent bank holdings will be transferred to the nation’s planned privatization fund, which will then be able to sell off the stakes and use the proceeds to pay back bailout funds. By shielding deposits, account holders won’t have “anything to worry about,” Greek Finance Minister Euclid Tsakalotos told reporters. “The process of reversing the negative effects of capital controls will start very quickly and will speedily return the banks to where they were before and hopefully on a far firmer footing.”

I still think he knows he needs this.

• Greek PM Alexis Tsipras Faces Biggest Party Revolt Yet (Reuters)

Greek Prime Minister Alexis Tsipras faced the widest rebellion yet from his leftist lawmakers as parliament approved a new bailout programme on Friday, forcing him to consider a confidence vote that could pave the way for early elections. After lawmakers bickered for much of the night on procedural matters, Tsipras comfortably won the vote on the country’s third financial rescue by foreign creditors in five years thanks to support from pro-euro opposition parties. That cleared the way for euro zone finance ministers to approve the deal. This they did on Friday evening, albeit with stringent conditions. The vote laid bare the anger within Tsipras’s leftist Syriza party at the austerity measures and reforms which he accepted in exchange for the bailout loans.

Altogether 43 lawmakers – or nearly a third of Syriza deputies – voted against or abstained. The unexpectedly large contingent of dissenters, including former finance minister Yanis Varoufakis, heaped pressure on Tsipras to clear the rebels swiftly from his party and call early elections in the hope of locking in popular support. Tsipras remains hugely popular in Greece for trying to stand up to Germany’s insistence on austerity before relenting under the threat of a euro zone exit. He would be expected to win again if snap polls were held now, given an opposition that is in disarray. “I do not regret my decision to compromise,” Tsipras said in parliament as he defended the bailout from euro zone and IMF creditors. “We undertook the responsibility to stay alive over choosing suicide.”

But the vote left the government with support from within its own coalition below the threshold of 120 votes in the 300-seat chamber, the minimum needed to command a majority and survive a confidence vote if others abstain. In response, government officials said Tsipras was expected to call a confidence vote in parliament after Greece makes a debt payment to the ECB on Aug. 20 – a move that could trigger the government’s collapse and snap elections. Still, some of those who rebelled on Friday could still opt to support the government in a confidence vote, as could other pro-European parties such as the centrist Potami and the centre-left PASOK, leaving the final outcome unclear.

Friday’s vote was only the latest in a series of events highlighting the rift within Syriza, which stormed to power this year on a pledge to end austerity once and for all, before Tsipras accepted the new bailout to avoid a banking collapse. The leader of Syriza’s far-left rebel faction, former energy minister Panagiotis Lafazanis, took a step toward breaking away from the party by calling for a new anti-bailout movement. “Syriza accepted a new, third bailout – austerity that goes against its programme and pledges,” Lafazanis told Efimerida Ton Syntakton newspaper, adding that this “will open the way for a mutation of Syriza with an uncertain ending”. Syriza would be weakened by the departure of the faction led by Lafazanis.

“It’s clear that the model of privatisation of water has failed all around the world..”

• Germany’s Hypocrisy Over Greece Water Privatisation (Guardian)

Greek activists are warning that the privatisation of state water companies would be a backward step for the country. Under the terms of the bailout agreement approved by the Greek parliament today, Greece has pledged to support an existing programme of privatisation, which includes large chunks of the water utilities of Greece’s two largest cities – Athens and Thessaloniki. There is an ongoing debate about water privatisation and the role of business. Across Europe a wave of austerity-driven privatisation proposals have led to protests in Ireland, Italy, Greece and Spain. At the same time, some of northern Europe’s largest cities, including Paris and Berlin, are buying back utilities they sold just last decade.

President of the Thessaloniki water company trade union George Argovtopoulos said a move to a for-profit model would raise prices for consumers and degrade services. “It’s not any more a democracy or equality in the European Union. It’s a kind of business,” he said, adding that austerity measures that require water privatisation smacked of a “do as I say, but not as I do” approach from Germany. “We know that in Berlin, just two years ago they remunicipalised the water there, although they paid just under €600m to Veolia [to buy back its stake]. It’s clear that the model of privatisation of water has failed all around the world,” he said.

Deputy finance minister Jens Spahn told German breakfast television on Tuesday that sell offs of the electricity and rail sectors had benefited Germans. “Privatisation isn’t just about raising money, it’s about changing parts of the economy,” he said. The new bailout requires Greece to sell off €50bn worth of public assets. Manuel Schiffler, a former project manager for the World Bank and author of the book Water, Politics and Money, said privatisation only made sense where there was a need to improve efficiency. In the case of Thessaloniki in particular, he said, the water system was already quite well run. “I think it’s a privatisation for the wrong reasons. It’s only for fiscal reasons and not in order to improve the services provided by the utility,” he said.

Maude Barlow, the chair of Food & Water Watch said that years of experimentation with privatisation in developing countries had shown: “The best answer to bad government is good government. Don’t hold out for privatisation. It’s not a perfect system and I know Greece has it’s problems, but privatising their water systems is not a good answer to the crisis there.”

“Germany was the only nation among Gazprom’s key clients that increased Russian gas purchases in the first half.”

• Germany Proves Russia’s Most Loyal Gas Customer as Price Plunges (Bloomberg)

Russia boosted natural gas supplies to Germany by almost 50% in the second quarter as prices plunged, while the world’s largest natural gas exporter struggled with weaker demand from its former Soviet allies. Gazprom’s deliveries to Germany jumped to 11.7 billion cubic meters compared with 7.8 billion a year earlier, the highest quarterly level since at least 2010, according to data on the Moscow-based exporter’s website. Gazprom’s average gas price at the German border fell 36% this year as crude plunged. The European Union, which gets about 30% of its gas from Russia, may be Gazprom’s only growing market this year, the government in Moscow said last month. Gazprom has boosted fuel sales to the 28-nation bloc since the end of May as Brent crude slumped 21%.

Most of the company’s gas contracts are linked to the price of oil. “Germany has been a loyal customer for Russia for years,” said Alexander Kornilov, an oil and gas analyst at Alfa Bank in Moscow. “Such relationships stay in place, though volumes depend on a price – business is business.” Gazprom’s price to Germany fell to $6.68 per million British thermal units in July, the lowest level since December 2009, according to the IMF. Germany is importing almost all of its gas from Russia now, energy broker Marex Spectron said in a July 29 note. Germany was the only nation among Gazprom’s key clients that increased Russian gas purchases in the first half.

The company’s total shipments of the fuel fell 10% to 222.8 billion cubic meters through June, mainly because of lower sales in Italy, Turkey, Central Europe, Ukraine and Russia, Gazprom said in its earnings report under Russian accounting standards on Friday. Gazprom cut its 2015 output forecast for at least the third time this year, reducing its outlook to 444.6 billion cubic meters, according to the report. That’s only 0.1% higher than last year’s record-low output. Russia’s Economy Ministry predicted last month the gas company would cut output to 414 billion cubic meters for 2015.

Beware France.

• Eurozone Economy Sputters As China Risks Loom (Reuters)

Germany enjoyed robust if unspectacular growth in the second quarter while the French economy stagnated, leaving policymakers looking at a fragile euro zone recovery and risks from volatile Chinese markets. The German economy, Europe’s largest, grew by 0.4% on the quarter – a slight acceleration from 0.3% in the first three months of the year but below expectations for a 0.5% expansion as weak investment acted as a drag. In France, a jump in exports was not strong enough to offset the impact of weak consumer spending and changes in inventories and growth came to a standstill after a strong first quarter.

The readouts from the euro zone’s two largest economies came a day after the minutes of the ECB’s last meeting showed it was concerned that volatility in Chinese markets may have more impact than expected on the euro zone. China has seen a run of weak economic data. The ECB described the recovery in the 19-country euro zone as moderate and gradual, a trend it called “disappointing”, and said an increase in U.S. interest rates might slow the upturn. Private sector economists are also concerned that Germany, Europe’s powerhouse economy, is not growing faster despite favorable conditions.

“The fact that record low interest rates, low energy prices and the weak euro have not led to a stronger expansion in our view shows that the German economy has simply reached the end of its long positive virtuous circle of structural reforms and growth,” said Carsten Brzeski at ING. “Normally, such a cocktail of strong external steroids should have given wings to the economy. This is not the case.” Germany’s Federal Statistics Office said weakness in investment and a marked drop in inventories weighed on growth in the second quarter, while the weaker euro helped support exports.

“.. the emergence of a new institution: a truly International Monetary Fund, in place of today’s Euro-Atlantic Monetary Fund.”

• How the IMF Failed Greece (Subramanian)

The reason why an assisted Grexit was never offered seems clear: Greece’s European creditors were vehemently opposed to the idea. But it is not clear that the IMF should have placed great weight on these concerns. Back in 2010, creditor countries were concerned about contagion to the rest of the eurozone. If Grexit had succeeded, the entire monetary union would have come under threat, because investors would have wondered whether some of the eurozone’s other highly indebted countries would have followed Greece’s lead. But this risk is actually another argument in favor of providing Greece with the option of leaving. There is something deeply unappealing about yoking countries together when being unyoked is more advantageous.

More recently, creditor countries have been concerned about the financial costs to member governments that have lent to Greece. But Latin America in the 1980s showed that creditor countries stand a better chance of being repaid (in expected-value terms) when the debtor countries are actually able to grow. In short, the IMF should not have made Europe’s concerns, about contagion or debt repayment, decisive in its decision-making. Instead, it should have publicly pushed for the third option, which would have been a watershed, for it would have signaled that the IMF will not be driven by its powerful members to acquiesce in bad policies. Indeed, it would have afforded the Fund an opportunity to atone for its complicity in the creditor-driven, austerity-addled misery to which Greeks have been subject for the last five years.

Above all, it would have enabled the IMF to move beyond being the instrument of status quo powers – the United States and Europe. From an Asian perspective, by defying its European shareholders, the IMF would have gone a long way toward heralding the emergence of a new institution: a truly International Monetary Fund, in place of today’s Euro-Atlantic Monetary Fund. All is not lost. If the current strategy fails, the third option – assisted Grexit – remains available. The IMF should plan for it. The Greek people deserve some real choices in the near future.

“..economics quite regularly adopts the simplifying assumption that all markets are fully liquid, so that supply always exactly equals demand and markets always clear.”

• Market Liquidity Is Not “Invariably Beneficial” (Perry Mehrling)

The recently released PwC “Global Financial Markets Liquidity Study”, sounds a warning. Financial regulation, while perhaps well-intentioned, has gone too far. Banks may be safer but markets are more fragile. At the moment, this fragility is masked by the massive liquidity operations of world central banks. But it will soon be revealed as, led by the Fed, central banks attempt to exit. Now, before it is too late, additional regulatory measures under consideration should be halted (Ch. 5). And existing regulations should be urgently revisited with an eye to achieving better balance between two social goods, financial stability and market liquidity, rather than the current focus on stability at the expense of liquidity (Ch. 3).

The bulk of the report consists of market-by-market empirical documentation of the reduction in market liquidity in past years (Ch. 4). Pretty much all markets have been affected, even sovereign bond markets, but especially markets that were already not so liquid. “There is clear evidence of a reduction in financial markets liquidity, particularly for less liquid areas of the financial markets, such as small and high-yield bond issues, longer-term FX forwards and interest rate derivatives. However, even relatively more liquid markets are experiencing declining depth, for example US and European sovereign and corporate bonds” (p. 104) “Bifurcation”, meaning widening difference between vanilla markets now supported by central clearing and everything else, is a repeated watchword, as well as “liquidity fragmentation” across different jurisdictions.

Both are taken to be obvious bads. But are they? The central analytical frame of the report is that market liquidity is always and everywhere a good thing, and that more of it is always and everywhere better than less. “We consider market liquidity to be invariably beneficial” (p. 8, 17). “We consider market liquidity to be beneficial in both normal times and times of stress. For this study we therefore work on the premise that market liquidity is invariably beneficial” (p. 23). Accept this premise, and everything else follows. But why accept the premise? To be sure, economics quite regularly adopts the simplifying assumption that all markets are fully liquid, so that supply always exactly equals demand and markets always clear. (On page 17, the report cites the venerable Varian microeconomics text as authority.)

It’s a good assumption if you are concerned about something other than market liquidity. It is a terrible assumption, and a terrible premise, if you are concerned exactly about market liquidity. In fact, the idealization of full liquidity in every market is logically impossible in a world where market liquidity is provided by profit-seeking market makers. In such an ideal world, market-making profit would be zero, so no market-maker would be willing to participate! The idealization thus makes most sense as a world where liquidity is provided for free by government. It is thus quite inappropriate as a measure of how far current reality falls short of optimum.

The stop to Europe’s milk quota reverbs around the world. New Zealand is THE obvious victim.

• Misery On The Farm: Milk Price Slump Raises Spectre Of Ruin (NZ Herald)

“There’s nothing more depressing than knowing when those big tankers come on to your farm you are paying Fonterra to take your milk away.” Depression is not a word New Zealanders associate with dairy farming, but Farmers of NZ operations director Bill Guest is stating the obvious. Fonterra’s price signal for the coming year of $3.85 per kg of milksolids is nearly $2/kg short of what the average dairy farmer needs to cover costs. On an average-size farm with annual costs of around $900,000, that’s an operating deficit of $260,000, Dairy NZ estimates. For most, that spells increased borrowing but that option won’t be there for the heavily indebted. “I would say people with $1 million of debt are not going to survive,” Guest says.

There will scarcely be a profitable dairy farm in New Zealand this year in cashflow terms and the effects of farmer belt-tightening will ripple through service industries and provincial towns and on to the Government’s coffers. The Government may play down the effects – Finance Minister Bill English says the dairy sector accounts for only 20% of exports; Dairy NZ says it’s 29% – but some analysts predict a $1.5 billion fall in GDP. That’s similar to the effect of the one-in-50-year drought that hit rural New Zealand in 2013. Right now, though, all the weight is being borne by dairy farmers as banks ponder the balance sheet implications of another year of low incomes and associated declines in stock and land values.

It’s the lowest farmgate price since 2002, and some analysts say Fonterra will struggle to make the $3.85 forecast. Dairy NZ is estimating $3.65. Last year’s payments were well below recent norms, although the blow was cushioned by deferred payments from the record 2013/14 price. But in July, for the first time, farmers received no retrospective payments – meaning no income until milking gears up. While only a few dairy farms are now on the block, many more farmers are expected to attempt an “orderly exit” from the industry in the coming months – before they are forced out.

“If you can’t explain something simply, you don’t understand it well enough.”

• Economics Jargon Promotes A Deficit In Understanding (James Gingell)

Whether it’s discussion of debt, or the argument for austerity, it’s hard to find good economics communication, where the language is rinsed free of jargon. Take this as an example, from an excited Telegraph journalist describing the Greek financial crisis: “Late on Wednesday night, the governing council of the ECB decided that it would no longer accept Greek sovereign debt as collateral for its loans. Greece’s junk-rated bonds had been the subject of a “waiver”, where the central bank accepted sovereign and bank debt as security in return for cheap ECB funding.” I’m a fairly intelligent man. I am deeply interested in foreign affairs. Yet I have only the vaguest sense of what the above means.

Does “sovereign debt” or “junk-rated bonds” or, in this context, “collateral” mean much to the average person? Have any of these phrases truly entered the public consciousness? I would argue not. A recent survey of 1,500 University of Manchester students would agree with me. Only 40% of them could even properly define GDP. Politicians aren’t much better. Here’s George Osborne presenting his latest budget: “While we move from deficit to surplus, this [new fiscal] charter commits us to keeping debt falling as a share of GDP each and every year – and to achieving that budget surplus by 2019-20 … Only when the OBR judge that we have real GDP growth of less than 1% a year, as measured on a rolling four-quarter basis, will that surplus no longer be required.” Eh?

You could argue that because the Telegraph example featured in its finance pages, some of its technical language could be forgiven on the basis of audience suitability. But Osborne’s budget announcement was to the country. The whole country. The whole country whose lives his decisions profoundly influence. Yet he makes no attempt whatsoever to remove the jargon in order to effectively relay what is essentially a generation-defining message. It’s simply not good enough. So why does he, and many of his establishment peers, do this? Some of the answer can be found in the old Einsteinian cliche: “If you can’t explain something simply, you don’t understand it well enough.”

Economics is clearly very difficult and solving its problems is an extremely demanding task, particularly for someone with no formal training like our dear chancellor. In Osborne’s defence, it seems to me that if the answers were obvious, then more people would agree on them. But because he – like many of his colleagues in Westminster – doesn’t really understand what he is talking about, he simply can’t describe his economic policies in simple enough terms. And into this vacuum of insight George pumps his jargon, which gives him an air of understanding that is just about convincing enough to maintain power. The other part of the explanation is that politicians deliberately use jargon to diffuse our ire and frustrations.

They pitch their speeches and briefings at a level most of us will never understand in order to limit public scrutiny. Their reasoning is thus: if we can’t understand what they’re talking about then how can we possibly begin to question them? Advertisers do the same thing when they use pseudoscience to market their products. They say things like “the pentapeptides in our anti-ageing cream are the active ingredient” or “our makeup remover contains micellar water to give you a fresher look”. Although this is complete drivel, the advertisers know that many of us are happy to accept the claims as fact because we don’t have the capacity to challenge them.

Again: what the EU should be doing. It’s about morals, because it’s about human lives.

• European Entrepreneurs Launch StartupBoat To Address Refugee Crisis (TC)

While many in Europe are sunning themselves on beaches, a group of young tech entrepreneurs and investors have grouped together to address the crisis of refugees, many from Syria, which have come to European shores in wave after wave this Summer. The initiative was started by Paula Schwarz, an entrepreneur based in Berlin, who’s family owns a house on the the Greek island of Samos where thousands of refugees have landed in the last few weeks. Up to 800 people land in Samos every day, according to the island’s mayor Michaelis Angelopoulos. Schwarz brought together people from startups from Germany, Greece and South Africa to tackle the refugee crisis with a typical startup approach, forming a group called Startupboat, to come up with new ideas.

The idea was to conduct research on the status quo of political refugees on Samos Island and “develop tools to improve the status quo of irregular migrants on Greek islands” Web site, Twitter, Facebook). She put out the call to her network and was joined by 20 others, including venture capitalist David Rosskamp, formerly with Earlybird Capital in Berlin and Franziska Petersen, the German client manager for Facebook’s European headquarters in Dublin, Ireland. Rosskamp told me: “People were from Facebook, Saving Global (and formerly Index Ventures), Wings University, other VC funds, Academia, the Lufthansa Innovation Hub, McKinsey and Entrepreneurs from Greece, Berlin and South Africa. We wanted to understand the situation and human tragedy, show civil engagement and think about local help.

On top of this, we feel that the European public is clearly missing a transparent discussion of the issue. Most refugees here are from Syria, they are well educated and could actually be ‘us’.” “We are on Samos as the island is seeing close to 800 refugees per day. They arrive through Turkey and are taken out of the water by the Coast Guards or strand on remote rocks somewhere on the island. From here, their journey through Europe begins. We have followed their odyssey over the island and have organized ad hoc support, including the involvement of local authorities and press to raise awareness and dialogue. We have also set up information websites for both migrants and the Samos public. He says the StartupBoat group is a private initiative. “We saw what was happening on the European borders and got together a set of people equally concerned.”

But the ideas morphed into action as the people — normally used to chatting about business models and innovation — toured the refugee camps and realized they had to do something practical as well. They’ve now launched a website called First-contact. This explains to refugees arriving on Samos what do to do when they arrive, as many of the refugees have cell phones and can go online, according to Schwarz. They’ve ben supplying them with food, speaking to officials and organizing an “awareness walk” through the capital (led by the mayor of the island). [..] Christian Umbach, one of Startupboat’s members who works for Lufthansa Innovation Hub in Berlin, believes the EU should address the issue head on, and also lobby to stop the war in Syria. Quoted in an article in Handelsblatt, Umbach said: “After meeting these people, you start to understand that they don’t come here because they want to benefit economically from us,” he said. “They come here because they are under fire and bomb attacks at home.”

Home › Forums › Debt Rattle August 15 2015