DPC “Grant’s Tomb. Rubber-neck auto on Riverside Drive, New York” 1911

I’d say steel AND oil. And copper.

• Steel Is the Poster Child For Oversupplied Commodity Markets (Bloomberg)

The collapse in oil prices following the shale revolution has stolen the limelight for investors mulling the end of the commodities supercycle. But the real “poster child for problems in commodities markets is perhaps the global steel industry,” according to Macquarie analysts led by Colin Hamilton, the firm’s global head of commodities research. The front-month contract for U.S. hot-rolled coil steel futures traded on the New York Mercantile Exchange is down nearly 40% year-over-year/ Forecasts for a boom in Chinese consumption helped spur a rise in production that left the segment with a massive glut. The successful realization of economic rebalancing in China, meanwhile, necessarily entails a material slowdown in that nation’s demand for steel. Macquarie observes that global steel consumption has contracted on an annual basis throughout 2015.

“With 1.6 billion tonnes of consumption globally, steel remains the lynchpin of industrial growth,” wrote Hamilton. “However, the growth part of this equation is an increasing problem, and not only in China.” India, which has the potential to buoy demand for steel, is also contributing significantly to supply growth. Bloomberg Intelligence’s Yi Zhu notes that 37 million metric tons of production capacity in India are currently under construction or in planning to be added. “The only people who still seem to think there is significant upside in global steel consumption akin to the past decade are the major iron ore producers—for example BHP’s belief global steel consumption will hit 2.5 billion tonnes by 2030—just a further 50% upside required there!” Hamilton wrote in a separate note.

Arguably, overcapacity across the commodity complex is a perverse side effect of years of near-zero interest rates and asset purchases by the Federal Reserve. Lower input prices, however, can have a silver lining. For example, the collapse in oil prices, in simple terms, represents a transfer of wealth from major oil conglomerates to consumers. The largest positive effects accrue to lower-income households that spend a heftier portion of take-home pay on energy costs. “A world of cheap money not only sees new capacity built, it also means existing capacity doesn’t disappear,” explains Hamilton. “While most regions are well off their peak production levels over the last decade, permanent capacity closures have been few and far between.”

Speculator pessimism.

• Oil Approaching $40 Deepens Investor Pessimism on Recovery (Bloomberg)

Hedge funds have turned more pessimistic on oil as prices flirted with $40 a barrel for the first time since August. “The speculators keep trying to pick the bottom and keep getting burned,” Michael Lynch, president of Strategic Energy & Economic Research said. Money managers’ short bets in West Texas Intermediate crude surged 21% in the week ended Nov. 10, according to data from the Commodity Futures Trading Commission. The net-long position dropped 16%. The release of the figures was delayed because of Veterans Day on Nov. 11. Oil inventories in developed countries have expanded to a record of almost 3 billion barrels because of massive supplies from both OPEC and non-OPEC producers, the International Energy Agency said in a report on Nov. 13.

WTI slipped to the lowest level since August before the CFTC release Monday. Thirty-nine oil tankers are waiting near Galveston, Texas, up from 30 in May, according to vessel-tracking data compiled by Bloomberg. “There’s been concern about excess supply in the market for a while now and that’s been strengthened by the IEA report,” Lynch said. [..] Oil inventories surged because of increased global production, OPEC said on Nov. 12. U.S. crude supplies rose to 487 million barrels as of Nov. 6, the highest for this time of year since 1930, the Energy Information Administration reported on Nov. 12. “We think the next few months will be very weak,” Sarah Emerson, managing director of ESAI Energy said by phone. “The market is focused on inventories. Prices shouldn’t rally in the coming year unless we have a disruption.”

The regime puts itself in grave danger. This could blow up much faster than presumed.

• The Saudis Are Stumbling – And May Take The Middle-East Down With Them (Hallina)

When the Arab Spring broke out in 2011, Saudi Arabia headed it off by pumping $130 billion into the economy, raising wages, improving services, and providing jobs for its growing population. Saudi Arabia has one of the youngest populations in the Middle East, many of whom are unemployed and poorly educated. Some 25% of the population lives in poverty. Money keeps the lid on, but – even with the heavy-handed repression that characterizes Saudi political life – for how long? Meanwhile they’re racking up bills with ill-advised foreign interventions. In March, the kingdom intervened in Yemen’s civil conflict, launching an air war, a naval blockade, and partial ground campaign on the pretense that Iran was behind one of the war’s factions – a conclusion not even the Americans agree with.

Again, the Saudis miscalculated, even though one of their major allies, Pakistan, warned them they were headed for trouble. In part, the kingdom’s hubris was fed by the illusion that US support would make it a short war. The Americans are arming the Saudis, supplying them with bombing targets, backing up the naval blockade, and refueling their warplanes in midair. But six months down the line the conflict has turned into a stalemate. The war has killed 5,000 people (including over 500 children), flattened cities, and alienated much of the local population. It’s also generated a horrendous food and medical crisis and created opportunities for the Islamic State and al-Qaeda to seize territory in southern Yemen. Efforts by the UN to investigate the possibility of war crimes were blocked by Saudi Arabia and the US.

As the Saudis are finding out, war is a very expensive business – a burden they could meet under normal circumstances, but not when the price of the kingdom’s only commodity, oil, is plummeting. Nor is Yemen the only war that the Saudis are involved in. Riyadh, along with Qatar and the United Arab Emirates, are underwriting many of the groups trying to overthrow Syrian president Bashar al-Assad. When antigovernment demonstrations broke out there in 2011, the Saudis – along with the Americans and the Turks – calculated that Assad could be toppled in a few months. But that was magical thinking. As bad as Assad is, a lot of Syrians – particularly minorities like Shiites, Christians, and Druze – were far more afraid of the Islamists from al-Qaeda and the Islamic State than they were of their own government.

So the war has dragged on for four years and has now killed close to 250,000 people. Once again, the Saudis miscalculated, though in this case they were hardly alone. The Syrian government turned out to be more resilient than it appeared. And Riyadh’s bottom line that Assad had to go just ended up bringing Iran and Russia into the picture, checkmating any direct intervention by the anti-Assad coalition. Any attempt to establish a no-fly zone against Assad will now have to confront the Russian air force – not something that anyone other than certain US presidential aspirants are eager to do.

Smart move. There is more sympathy for ISIS in Saudi Arabia than in any other country. And a lot of -private- Saudi capital goes towards funding it. And we sell them smart bombs.

• US Approves Sale Of Smart Bombs To Saudi Arabia (Reuters)

The U.S. State Department has approved the sale of thousands of smart bombs worth a total of $1.29 billion to Saudi Arabia to help replenish supplies used in its battle against insurgents in Yemen and air strikes against Islamic State in Syria, U.S. officials familiar with the deal said on Monday. The Pentagon’s Defense Security Cooperation Agency (DSCA), which facilitates foreign arms sales, notified lawmakers on Friday that the sales had been approved, the sources said. The lawmakers now have 30 days to block the sale, although such action is rare since deals are carefully vetted before any formal notification.

The proposed sale includes thousands of Paveway II, BLU-117 and other smart bombs, as well as thousands of Joint Direct Attack Munitions kits to turn older bombs into precision-guided weapons using GPS signals. The sales reflect President Barack Obama’s pledge to bolster U.S. military support for Saudi Arabia and other Sunni allies in the Gulf Cooperation Council after his administration brokered a nuclear deal with their Shiite rival Iran. The weapons are made by Boeing and Raytheon, but the DSCA told lawmakers the prime contractors would be determined by a competition.

I brought this up the other day: how much control over the yuan does Beijing give up with its desired inclusion in the ‘SDR basket’? And how does that play out when things go downhill for China?

• Yuan’s Offshore Discount Widens as IMF Nod May Curb Intervention (Bloomberg)

The offshore yuan’s discount to the onshore spot rate widened to the most this month amid speculation the People’s Bank of China will rein in intervention now that the currency is on the cusp of winning reserve status. The difference between the yuan’s exchange rates in Hong Kong and Shanghai rose to as much as 417 pips on Monday, data compiled by Bloomberg show. It last exceeded 400 pips on Oct. 28, prompting suspected intervention by the PBOC the following day. [..] IMF Managing Director Christine Lagarde said late Friday that her staff have recommended the yuan be included in its Special Drawing Rights basked, as all operational issues including a sufficient gap between the onshore and offshore rates had been solved.

The Washington-based lender’s board will vote to approve inclusion on Nov. 30. “As the yuan’s inclusion is largely a done deal, we expect the PBOC to reduce foreign-exchange intervention and allow a wider spread between the onshore and offshore yuan,” said Ken Cheung, a Hong Kong-based currency strategist at Mizuho Bank Ltd. The central bank’s tolerance level may have widened to 500 pips from 400 pips before the IMF announcement and it will probably allow more depreciation via weaker fixings, he said.

Wasn’t India supposed to pick up global growth where China left off?

• India Exports Fall 17.5%, Imports Down 21.2% (LiveMint)

India’s merchandise exports contracted for the eleventh consecutive month in October, as shipments of petroleum products continued to decline on lower crude oil prices, and external demand remained weak amid tepid global economic recovery. Exports contracted 17.5% from a year ago to $21.3 billion while imports shrank 21.2% to $31.1 billion, leaving a trade deficit of $9.8 billion, data released by the commerce ministry showed on Monday. In comparison, China’s October exports fell 6.9% from a year ago, down for a fourth month, while imports slipped 18.8%, leaving the country with a record high trade surplus of $61.64 billion. India’s dip in exports was driven mainly by a 57.1% drop in shipments of petroleum products to $2.5 billion.

The ministry has sent a cabinet note on the long-pending interest subsidy scheme for providing rupee credit to exporters at a subsidized interest rate. However, the cabinet is yet to take a view on it. India aims to take exports of goods and services to $900 billion by 2020 and raise the country’s share in world exports to 3.5% from 2% now. Exports in the past four fiscal years have been hovering at around $300 billion. India’s current account deficit (CAD) further contracted in the first quarter of 2015-16, as lower global crude oil prices helped rein in India’s import bill.

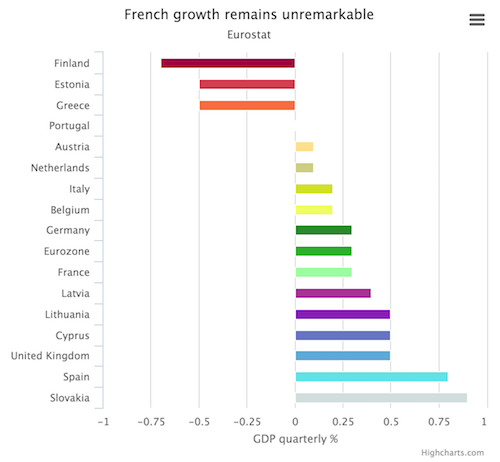

Big deal: if budget rules are no longer applicable to France, they are to nobody. Schengen is gone, budget restrictions are gone; why still have an EU?

• France Swats Aside EU Budget Rules In Rearmament Blitz (AEP)

France has invoked emergency powers to sweep aside EU deficit rules and retake control over its economy after the terrorist atrocities in Paris, pledging a massive in increase and security and defence spending whatever the cost. President Francois Hollande said vital interests of the French nation are at stake and there can be no further justification for narrowly-legalistic deficit rules imposed by Brussels. “The security pact takes precedence over the stability pact. France is at war,” he told the French parliament. Defence cuts have been cancelled as far out as 2019 as the country prepares to step up its campaign to “eradicate” ISIS, from the Sahel in West Africa, across the Maghreb, to Syria and Iraq. At least 17,000 people will be recruited to beef up the security apparatus and the interior ministry, fast becoming the nerve centre of the country’s all-encompassing war against the ISIS network.

The new forces include 5,000 new police and gendarmes, 1,000 customs officials, and 2,500 prison guards. “I assume it will lead to an increase in expenses,” he said. The combined effect amounts to a fiscal stimulus and may ultimately cushion the economic damage of terrorist attacks for the tourist industry, but the “rearmament” drive spells the end of any attempt to meet deficit limit of 3pc of GDP enshrined in the Stability and Growth Pact. With France in open defiance, the reconstituted pact is now effectively dead. The European Commission expects the French deficit to be 3.4pc of GDP next year and 3.3pc in 2017, but the real figure is likely to be much higher and will last through to the end of the decade. The concern is that this could push the country’s debt yet higher from 96.5pc of GDP to nearer 100pc, made worse by the effects of deflation on debt dynamics.

Mr Hollande said France will invoke article 42.7 of the Lisbon Treaty, the solidarity clause obliging other member states to come to his country’s help by “all means in their power”. It would be beyond parody for Brussels to continue insisting on budget rules in such a political context. The French economy is slowly recovering as the triple effects of a weak euro, cheap oil, and quantitative easing by the ECB combine to create a short-term blast of stimulus, but it still remains remarkably depressed a full six years into the post-Lehman cycle of global expansion. Growth crept up to 0.3pc in the third quarter after stalling earlier in the year. Unemployment is still stuck at 10.7pc and has actually risen over recent months. “Momentum may fade in 2017 as tailwinds peter out,” said the Commission.

France’s move opens whole new avenues for Finland, too, to finance debts.

• Finnish Parliament Will Debate Next Year Leaving Euro Zone (Reuters)

Finland’s parliament will debate next year whether to quit the euro, a senior parliamentary official said on Monday, in a move unlikely to end membership of the single currency but which highlights Finns’ dissatisfaction with their country’s economic performance. The decision follows a citizens’ petition which has raised the necessary 50,000 signatures under Finnish rules to force such a debate, probably the first such initiative in any country of the 19-member euro zone. “There will be signature checks early next year and a parliamentary debate will be held in the following months,” said Maija-Leena Paavola, who helps guide legislation through parliament. The petition – which will continue to gather signatures until mid-January – demands a referendum on euro membership, but this would only go ahead if parliament backed the idea.

Despite the initiative, a Eurobarometer poll this month showed 64% of Finns backed the common currency, though that is down from 69% a year ago. But the Nordic country has suffered three years of economic contraction and is currently performing worse than any other country in the euro zone. Some Finns say the country’s prospects would improve if it returned to the markka currency and regained the ability to set its own interest rates, pointing to the example of neighboring Sweden, which is outside the euro. The markka could then devalue against the euro, making Finnish exports less expensive. “Since 2008 the Swedish economy has grown by 8%, while ours has shrunk by 6%,” said Paavo Vayrynen, a Finnish member of the European Parliament who launched the initiative.

Nomi is a fan of the Automatic Earth and our Debt Rattles, which she calls: “the most comprehensive daily rundown of main stream and alternative press articles out there!” Makes her an even smarter cookie.

• An Entirely Rigged Political-Financial System (Nomi Prins)

Too big to fail is a seven-year phenomenon created by the most powerful central banks to bolster the largest, most politically connected US and European banks. More than that, it’s a global concern predicated on that handful of private banks controlling too much market share and elite central banks infusing them with boatloads of cheap capital and other aid. Synthetic bank and market subsidization disguised as ‘monetary policy’ has spawned artificial asset and debt bubbles – everywhere. The most rapacious speculative capital and associated risk flows from these power-players to the least protected, or least regulated, locales. There is no such thing as isolated ‘Big Bank’ problems. Rather, complex products, risky practices, leverage and co-dependent transactions have contagion ramifications, particularly in emerging markets whose histories are already lined with disproportionate shares of debt, interest rate and currency related travails.

The notion of free markets, mechanisms where buyers and sellers can meet to exchange securities or various kinds of goods, in which each participant has access to the same information, is a fallacy. Transparency in trading across global financial markets is a fallacy. Not only are markets rigged by, and for, the biggest players, so is the entire political-financial system. The connection between democracy and free markets is interesting though. Democracy is predicated on the idea that every vote counts equally, and in the utopian perspective, the government adopts policies that benefit or adhere to the majority of those votes. In fact, it’s the minority of elite families and private individuals that exercise the most control over America’s policies and actions.

The myth of a free market is that every trader or participant is equal, when in fact the biggest players with access to the most information and technology are the ones that have a disproportionate advantage over the smaller players. What we have is a plutocracy of government and markets. The privileged few don’t care, or need to care, about democracy any more than they would ever want to have truly “free” markets, though what they do want are markets liberated from as many regulations as possible. In practice, that leads to huge inherent risk. Michael Lewis’ latest book on high frequency trading seems to have struck some sort of a national chord. Yet what he writes about is the mere tip of the iceberg covered in my book. He’s talking about rigged markets – which have been a problem since small investors began investing with the big boys, believing they had an equal shot. I’m talking about an entirely rigged political-financial system.

Have they given in on foreclosures? Will tens of thousands more Greeks be thrown into the streets?

• Greece Reaches Deal With Lenders Unlocking Stalled Aid (Reuters)

Greece reached an agreement with its lenders on financial reforms early on Tuesday, its finance minister said, removing a major obstacle holding up fresh bailout loans for the cash-starved country. Athens signed up to a new aid program worth up to €86 billion earlier this year, but payment of part of an initial tranche had been held up over disagreement on regulations on home foreclosures and handling tax arrears to the state. “There was an agreement on all the milestones … whatever was required,” Finance Minister Euclid Tsakalotos told reporters after meeting representatives of European institutions and the IMF on aid disbursement.

Tsakalotos said the deal meant Parliament could now ratify the set of reforms to law, and that deputy eurozone finance ministers, known as the Euro Working Group, would on Friday endorse the deal. That would allow a €2 billion aid disbursement and about €10 billion in recapitalization aid to the country’s four main banks, he said. Greece has been keen to complete its first assessment under the new bailout package, its third since 2010, so it can start talks with lenders on debt relief.

The levels of nonsense in the expert comments is priceless. Would that have a negative effect on prices too?

• UK Inflation Stays Below Zero as Price Weakness Persists (Bloomberg)

U.K. consumer prices fell for a second month in October, extending the weakest bout of inflation in more than half a century. The Office for National Statistics said prices declined 0.1% from a year earlier, matching the median forecast of economists in a Bloomberg survey. That’s the third negative reading this year and largely reflects weaker global commodity costs. Core inflation, which excludes volatile food and energy prices, accelerated to 1.1% from 1%. The Bank of England expects inflation to remain low into 2016 before picking up toward its 2% target. BOE Governor Mark Carney has highlighted core inflation as an important measure for policy makers as they weigh when to begin interest rate increases after keeping them at a record low for more than six years.

Consumer-price inflation has been below 1% all this year and less than 2% since the end of 2013. Britain last saw a sustained period of price declines in 1960, according to a historic series constructed by the statistics office. In forecasts published this month, the BOE said inflation is likely to reach its goal in late 2017 and accelerate to 2.2% a year later. Services inflation, a proxy for domestic price growth, was at 2.2% in October. “In the absence of sharp movements in global commodity prices, inflation is likely to accelerate quickly beyond October as the direct impact of past falls in oil drops out,” said Dan Hanson, an economist at Bloomberg Intelligence in London. “Evidence that this is happening is likely to be enough for the BOE to begin monetary tightening in May.”

“The long emergency is showing signs of morphing into something like civil war.”

• There Are No Safe Spaces (Jim Kunstler)

One thing seems assured: hard-line governments are coming soon. Politically, the West had boundary problems that go way beyond the question of national borders to the core psychology of modern liberalism. When is enough of anything enough? And then, what are you really willing to do about it? The answer lately among the Western societies is to do little and do it slowly. The behavior of college administrators and faculties in the USA these days is emblematic of this cowardly dithering. Intellectual despotism reigns on campus and the university presidents roll over like possums. They don’t have the moral strength to defend free speech as the campus witch-hunts ramp up.

The result will be first the intellectual death of their institutions (brain death), and then the actual death of college per se as a plausible route to personal socioeconomic development. The financial racketeering that has infected higher education — the engineering of the gargantuan college loan scam in tandem with the multiplication of “diversity” deanships and tuition inflation — pretty much guarantees an implosion of that system. The cowardice in the college executive suites is mirrored in our national politics, where no persons of real standing will dare step forward to oppose the juggernaut of Hillary-the-Grifter, or take on the clowning Donald Trump on the grounds of his sheer mental unfittedness to lead a government. In case you haven’t noticed, the center not only isn’t holding, it gave way some time ago.

The long emergency is showing signs of morphing into something like civil war. The Maoists on campus apparently want to turn it into race war, too. So many forces are in motion now and they are all tending toward criticality. The European Union may not survive the reestablishment of boundaries, since it was largely based on the elimination of them. Spain and Portugal are back to breaking down politically again. The Paris bloodbath has discredited Angela Merkel’s plea for “tolerance” — of what is proving to be an intolerable alien invasion. The only political figure on the scene who doesn’t appear to be talking out of his ass is Vlad Putin, who correctly stated at the UN that undermining basic institutions around the world was not a good idea.

“In order to qualify as a victim of a tragedy, you have to be each of these three things: 1. a US-puppet, 2. rich and 3. dead.”

• A Most Convenient Massacre (Dmitry Orlov)

What a difference a single massacre can make! • Just a week ago the EU couldn’t possibly figure out anything to do to stop the influx of “refugees” from all those countries the US and NATO had bombed into oblivion. But now, because “Paris changed everything,” EU’s borders are being locked down and refugees are being turned back. • Just a week ago it seemed that the EU was going to be swamped by resurgent nationalism, with incumbent political parties poised to get voted out of power. But now, thanks to the Paris massacre, they have obtained a new lease on life, because they can now safely embrace the same policies that a week ago they branded as “fascist.”

• Just a week ago the EU and the US couldn’t possibly bring themselves admit that they are utterly incompetent when it comes to combating their own creation—ISIS, that is—and need Russian help. But now, at the après-Paris G-20 summit, everybody is ready to line up and let Putin take charge of the war against terrorism. Look—the Americans finally found those convoys of tanker trucks stretching beyond the horizon that ISIS has been using to smuggle out stolen Syrian crude oil—after Putin showed them the satellite photos! Am I being crass and insensitive? Not at all—I deplore all the deaths from terrorist attacks in Iraq, in Syria, in Lebanon, and in all the other countries whose populations did absolutely nothing to deserve such treatment. I only feel half as bad about the French, who stood by quietly as their military helped destroy Libya (which did nothing to deserve it).

Note that after the Russian jet crashed in the Sinai there weren’t all that many Facebook avatars with the Russian flag pasted over them, and hardly any candlelight vigils or piles of wreaths and flowers in various Western capitals. I even detected a whiff of smug satisfaction that the Russians got their comeuppance for stepping out of line in Syria. Why the difference in reaction? Simple: you were told to grieve for the French, so you did. You were not told to grieve for the Russians, and so you didn’t. Don’t feel bad; you are just following orders.

The reasoning behind these orders is transparent: the French, along with the rest of the EU, are Washington’s willing puppets; therefore, they are innocent, and when they get killed, it’s a tragedy. But the Russians are not Washington’s willing puppet, and are not innocent, and so when they get killed by terrorists, it’s punishment. And when Iraqis, or Syrians, or Nigerians get killed by terrorists, that’s not a tragedy either, for a different reason: they are too poor to matter. In order to qualify as a victim of a tragedy, you have to be each of these three things: 1. a US-puppet, 2. rich and 3. dead.

Can’t wait for Russia to publish the details.

• ISIS Financed by 40 Countries, Including G20 Member States – Putin (Sputnik)

Putin said at the G20 summit that Russia has presented examples of terrorism financing by individual businessmen from 40 countries, including from member states of the G20. “I provided examples related to our data on the financing of Islamic State units by natural persons in various countries. The financing comes from 40 countries, as we established, including some G20 members,” Putin told reporters following the summit. The fight against terrorism was a key topic at the summit, according to the Russian leader. “This topic (the war on the terror) was crucial. Especially after the Paris tragedy, we all understand that the means of financing terrorism should be severed,” the Russian president said. Russia has also presented satellite images and aerial photos showing the true scale of the Islamic State oil trade.

“I’ve demonstrated the pictures from space to our colleagues, which clearly show the true size of the illegal trade of oil and petroleum products market. Car convoys stretching for dozens of kilometers, going beyond the horizon when seen from a height of four-five thousand meters,” Putin told reporters after the G20 summit. The Russian president also said that Syrian opposition is ready to launch an anti-ISIL operation if Russia provides air support. “A part of the Syrian opposition considers it possible to begin military actions against ISIL with the assistance of the Russian air forces, and we are ready to provide that assistance,” the Russian president said. If this happens, the army of Syrian President Bashar Assad, on the one hand, and the opposition, on the other hand, will fight a common enemy, he outlined.

Russian President Vladimir Putin said Monday that the United States has shown a certain willingness to resume cooperation with Russia in several areas. “It seemed to me that, at least at an expert level, at the level of discussing problems, there was, indeed, a clear interest in resuming work in many areas, including the economy, politics, and the security sphere,” Putin told reporters. Vladimir Putin said that Russia needs support from the US, Saudi Arabia and Iran in the fight against terrorism. “It’s not the time to debate who is more effective in the fight against ISIL, what we need to do is consolidate our efforts,” president Putin added.

“Assuming there were higher powers behind the Russian plane bombing than just a bunch of cave-dwelling a la carte terrorists, those arrested may just be tempted enough by the $50 million award to reveal who the mastermind behind this particular terrorist attack was.”

• Putin Confirms Egypt Plane Crash Due To Bomb, Offers $50 Million Reward (ZH)

The world may have moved on from the tragic terrorist attack that took place just three weeks ago above Egypt’s Sinai peninsula, which killed all 224, but for some inexplicable reason Russia refused to admit what was obvious to most from the first minutes since ISIS released a video clip of the midair explosion: that the crash was the result of a bomb set to go off shortly after take off. But no longer. Moments ago the Kremlin confirmed for the first time on Tuesday that a bomb did bring down a Russian passenger plane that crashed over the Sinai Peninsula in Egypt on Oct. 31, killing all 224 people on board. “One can unequivocally say that it was a terrorist act,” Alexander Bortnikov, the head of Russia’s FSB security service, told a meeting chaired by President Vladimir Putin.

Bortnikov added that during the flight, a homemade device with the power of 1.5 kilograms of TNT was detonated. “As a result, the plane fell apart in the air, which can be explained by the huge scattering of the fuselage parts of the plane.” This not the first time that Russia has faced “barbarous terrorist crimes, more often without apparent causes, outside or domestic, as it was with the explosion at the railway station in Volgograd at the end of 2013.” Bortnikov added: “We haven’t forgotten anything or anyone. The murder of our nationals in Sinai is among the bloodiest crimes in [terms of] the number of casualties.” Putin also spoke, vowing to find and punish the culprits behind the Sinai plane attack. “Our military work in Syria must not only continue. It must be strengthened in such a way so that the terrorists will understand that retribution is inevitable.”

“The murder of our people in Sinai is among the bloodiest crimes in terms of the number of victims. We won’t wipe the tears out of our souls and hearts. This will remain with us forever. But it won’t stop us from finding and punishing the perpetrators.” According to RT, Russia will act in accordance with Article 51 of the UN Charter, which provides for countries’ right to self-defense, Putin said. “Those who attempt to assist criminals should be aware that the consequences of such attempts will be entirely their responsibility,” he added. Finally, just to make sure Russia gets its blood debt repaid, The Russian Federal Security Service director also announced a reward of $50 million for information on those behind the terror attack on the A321.

Obama can push this through, but would that be wise?

• More Than Half of US State Governors Say Syrian Refugees Not Welcome (CNN)

More than half the nation’s governors – 27 states – say they oppose letting Syrian refugees into their states, although the final say on this contentious immigration issue will fall to the federal government. States protesting the admission of refugees range from Alabama and Georgia, to Texas and Arizona, to Michigan and Illinois, to Maine and New Hampshire. Among these 27 states, all but one have Republican governors. The announcements came after authorities revealed that at least one of the suspects believed to be involved in the Paris terrorist attacks entered Europe among the current wave of Syrian refugees. He had falsely identified himself as a Syrian named Ahmad al Muhammad and was allowed to enter Greece in early October.

Some leaders say they either oppose taking in any Syrian refugees being relocated as part of a national program or asked that they be particularly scrutinized as potential security threats. Only 1,500 Syrian refugees have been accepted into the United States since 2011, but the Obama administration announced in September that 10,000 Syrians will be allowed entry next year. The Council on American-Islamic Relations said Monday, “Defeating ISIS involves projecting American ideals to the world. Governors who reject those fleeing war and persecution abandon our ideals and instead project our fears to the world.”

Authority over admitting refugees to the country, though, rests with the federal government – not with the states – though individual states can make the acceptance process much more difficult, experts said. American University law professor Stephen I. Vladeck put it this way: “Legally, states have no authority to do anything because the question of who should be allowed in this country is one that the Constitution commits to the federal government.” But Vladeck noted that without the state’s participation, the federal government would have a much more arduous task. “So a state can’t say it is legally objecting, but it can refuse to cooperate, which makes thing much more difficult.”

Right wing Canada sees an opportunity, too, for political gain over the backs of people fleeing the very terror they’re now supposedly suspected of.

• Paris Attacks Fuel Calls For Canada To Delay Taking In 25,000 Syrians (AFP)

Canada’s prime minister Justin Trudeau has faced calls to delay bringing in 25,000 Syrian refugees by the end of the year due to security concerns prompted by the Paris terror attacks. While an online petition against fast-tracking Syrian asylum seekers’ bids to relocate to Canada gained steam, the premier of Saskatchewan province, Brad Wall, urged the prime minister to “suspend” the move. “I understand that the overwhelming majority of refugees are fleeing violence and bloodshed and pose no threat to anyone,” Wall wrote in an open letter. “However, if even a small number of individuals who wish to do harm to our country are able to enter Canada as a result of a rushed refugee resettlement process, the results could be devastating,” he added.

The Islamic State group has claimed responsibility for the bomb and gun attacks that killed at least 129 people in Paris on Friday. In another part of Canada, Quebec Immigration Minister Kathleen Weil said it was still ramping up to welcome the refugees, adding she is confident security will not be compromised. “I did get assurances from [Immigration Minister John] McCallum and [Public Safety Minister] Ralph Goodale that all the measures are being taken to ensure that the newcomers have been properly vetted.” Dueling online petitions for and against a delay, meanwhile, had amassed more than 55,000 and 25,000 signatures, respectively by midday Monday. One cited “national security” concerns in asking for a postponement, while the other blasted the first for stoking “despicable and inhumane xenophobic” attitudes.

This won’t become a big story until and unless it hits a rich part of the world.

• El Niño: Food Shortages, Floods, Disease And Droughts (Guardian)

The UN has warned of months of extreme weather in many of the world’s most vulnerable countries with intense storms, droughts and floods triggered by one of the strongest El Niño weather events recorded in 50 years, which is expected to continue until spring 2016. El Niño is a natural climatic phenomenon that sees equatorial waters in the eastern Pacific ocean warm every few years. This disrupts regular weather patterns such as monsoons and trade winds, and increases the risk of food shortages, floods, disease and forest fires. This year, a strong El Niño has been building since March and its effects are already being seen in Ethiopia, Somalia, Kenya, Malawi, Indonesia and across Central America, according to the World Meteorological Organisation. The phenomenon is also being held responsible for uncontrolled fires in forests in Indonesia and in the Amazon rainforest.

The UN’s World Meteorological Organization warned in a report on Monday that the current strong El Niño is expected to strengthen further and peak around the end of the 2015. “Severe droughts and devastating flooding being experienced throughout the tropics and sub-tropical zones bear the hallmarks of this El Niño, which is the strongest in more than 15 years,” said WMO secretary-general Michel Jarraud. Jarraud said the impact of the naturally occurring El Niño event was being exacerbated by global warming, which had already led to record temperatures this year. “This event is playing out in uncharted territory. Our planet has altered dramatically because of climate change,” he said. “So this El Niño event and human-induced climate change may interact and modify each other in ways which we have never before experienced. El Niño is turning up the heat even further.”

In 1997, the phenomenon led to severe droughts in the Sahel and the Indian subcontinent, followed by devastating floods and storms, which killed thousands of people and caused billions of dollars of damage across Asia, Latin America and and Africa. The WMO said countries are expected to be much better prepared for a strong El Niño now than they were in 1997, but governments and charities are warning of serious food shortages and floods. “While difficult to predict, the El Niño this year looks set to be the strongest on record. This is a real threat to people’s lives, health and livelihoods across the world, which will see increased calls for humanitarian assistance as people struggle to grow crops, face water shortages and disease,” said a spokeswoman at Britain’s Department for International Development.

And the beat goes on.

• Greek Coast Guard Rescues 1,244 Refugees In Three Days (AP)

Greek authorities say 1,244 refugees and economic migrants have been rescued from frail craft in danger over the past three days in the Aegean Sea, as thousands continue to arrive on the Greek islands. A coast guard statement Monday said rescuers responded to a total 34 incidents since Friday morning, near the islands of Lesbos — where most migrants head — Chios, Samos, Kos, Kalolimnos and Megisti. The count does not include thousands more people who safely made the short but often deadly crossing from nearby Turkey’s western coast.

Four children, four women and one man. Can we mourn them the way we mourn the Paris victims?

• Refugee Boat Overturns Near Greek Island, At Least Eight Dead (AP)

Greece’s coast guard says a plastic boat carrying refugees or migrants has overturned near the coast of the eastern Aegean island of Kos, killing at least eight people. The coast guard said Tuesday it had rescued seven people and had located eight bodies, two of which were still trapped inside the overturned vessel. Crews were searching for between three and five more people listed as missing. It was not immediately clear how the boat overturned, or what the passengers’ nationality was.

Home › Forums › Debt Rattle November 17 2015