Esther Bubley Soldiers with their girls at the Indianapolis bus station 1943

And this is Yellen’s favorite index?! Makes you wonder.

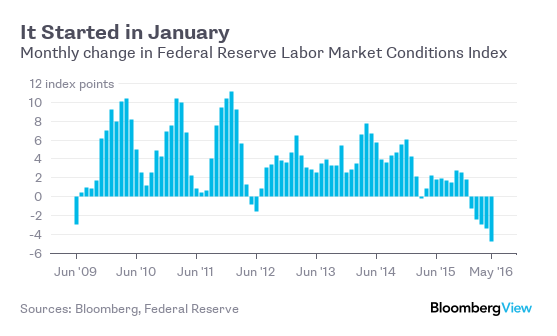

• This Job Market Slump Started In January

The sharp May hiring slowdown revealed in Friday’s employment report took a lot of people – including me – by surprise. It shouldn’t have. Things have actually been on the downswing for the U.S. labor market for months, according to the Federal Reserve’s Labor Market Conditions Index. The LMCI is a new measure cooked up by Federal Reserve Board economists in 2014 that consolidates 19 different labor market indicators to reflect changes in the job market. They calculated it going all the way back to 1976; the chart above shows its movements since the end of the last recession in June 2009. The May index, released Monday morning, showed a 4.8-point decline from April. As you can see from the chart, the index has now declined for five straight months — its worst performance since the recession.

The index does get revised a lot. When the January number was first reported on Feb. 8, for example, it was still modestly positive. Still, since the February number was released on March 7 the news from the LMCI has been unremittingly negative. Which probably should have told us something. Not many people were paying attention, though. Fed Chair Janet Yellen is apparently a fan of the LMCI, but I have to admit that I first learned of its existence Monday when Erica Groshen, the Commissioner of the BLS, mentioned it at a conference for BLS data users in New York. It was a good reminder, as were a lot of the other presentations at the conference, that the headline jobs numbers that get the lion’s share of attention – the monthly change in payroll employment and the unemployment rate – aren’t always the best places to look for information on the state of the jobs market.

They should really start having her do these speeches in a cave filled with smoke and vapors.

• Yellen Sees Rates Rising Gradually But .. (BBG)

Federal Reserve Chair Janet Yellen said the U.S. economy was making progress but was silent on the timing of another interest-rate increase, an omission viewed as a signal that a June move was off the table. “I continue to think that the federal funds rate will probably need to rise gradually over time to ensure price stability and maximum sustainable employment in the longer run,” Yellen said Monday during a speech in Philadelphia. Her comments were less specific than in her previous remarks in describing when she thought the Fed should raise rates again.

On May 27 at Harvard University, she said an increase would likely be appropriate in “coming months,” a phrase she didn’t repeat on Monday. Since then, the Labor Department reported U.S. employers in May added the fewest number of new jobs in almost six years, causing expectations for a rate increase to plunge. “She did not address the timing of the Fed’s next gradual move, which suggests to us that she is in no hurry,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd, arguing that her comments on the payroll report “largely rules out a move in rates next week. July is not a strong bet either.”

Beijing has not just allowed shadow banks to grow much too big, it has used this growth to hide its actions behind. Local governments got most of their credit to build highways to nowhere from shadow banks. It’s really weird that the western press only catches on now.

• The Shadow Looming Over China (Balding)

Of all the topics sure to be come up in Sino-U.S. economic talks this week – from the problem of excess capacity to currency controls – the health of China’s financial sector will no doubt feature high on the list. Especially worrying are the multiplying links between the country’s commercial and “shadow” banks – the name given to a broad range of non-bank financial institutions from peer-to-peer lending platforms to trusts and wealth management companies. All told, the latter now hold assets that exceed 80 percent of China’s gross domestic product, according to Moody’s – much of them linked to the commercial banking sector in one way or another. That poses a systemic threat, and needs to be treated as such. There’s nothing inherently wrong with shadow banks, of course.

Largely owned by the government, China’s commercial banks focus primarily on directing capital from savers to state-owned enterprises, leaving Chinese households and smaller private enterprises starved for funds. Shadow banks have grown to meet the demand. At their best, they allocate capital more efficiently than state-owned lenders and keep afloat businesses that create jobs and growth. The line between good shadow banks and dodgy ones is increasingly fuzzy, however, as is the divide between shadow and commercial banking. Traditional banks often assign their sales teams to sell shadow products. This gives an unwarranted sheen of legitimacy to schemes that are inherently risky. Buyers trust that the established bank will make them whole if their investment goes south.

Shadow banks are also selling more and more products directly to commercial banks. Wealth management products held as receivables now account for approximately 3 trillion yuan of interbank holdings, or around $500 billion — a number that’s grown sixfold in three years. According to Autonomous Research, as much as 85 percent of those products may have been resold to other shadow banks, creating a web of cross-ownership with disturbing parallels to the U.S. mortgage securities market just before the 2008 crash. In total, the big four state-owned banks hold more than $2 trillion in what’s classified as “financial investment,” much of it in trusts and wealth-management products.

A nation of lost souls.

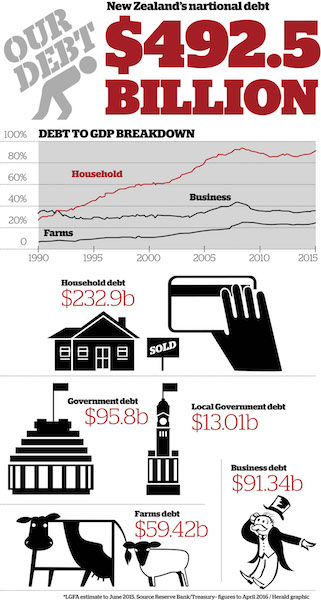

• Nation of Debt: New Zealand Sitting on Half-Trillion-Dollar Debt Bomb (NZH)

New Zealand is sitting on a half-a-trillion-dollar debt bomb and Kiwis are increasingly treating their houses like cash machines, piling on the debt as they watch the value of their properties soar. Reserve Bank figures show household debt, excluding investment property, has risen 23% in the past five years to $163.4 billion. Incomes have risen only 11.5%. Households are now carrying a debt level that is equivalent to 162% of their annual disposable income – higher than the level reached before the global financial crisis. Including property investment the total debt households owed as of April was $232.9 billion, according to the Reserve Bank. Satish Ranchhod, a senior economist at Westpac Bank, says the main driver has been low interest rates.

“Continued low interest rates have sparked a sharp increase in household borrowing at a time when income growth has been very modest.” And it’s housing loans where the growth has mainly come from. Housing loan debt has risen 23.4% to $132.83 billion. Student loans were up 22.9% to $14.84 billion and consumer loans are up 16.6% to $15.7 billion. Ranchhod said much of the rising debt on housing was down to investors, as more people jumped into the property market on the back of rising house prices. He also believed many people were using their home loans to make consumer purchases. “We think a lot of the increase in lending on housing loans will also be an increase in spending … people feel wealthy when the value of their home goes up.”

Hannah McQueen, an Auckland financial coach and managing director of EnableMe, said she had seen three clients in the past week alone who had paid for a new car by using the equity in their home to increase their mortgage debt. “It’s definitely on the increase … People think, ‘I’m worth so much more now …'”

Volatility just getting started.

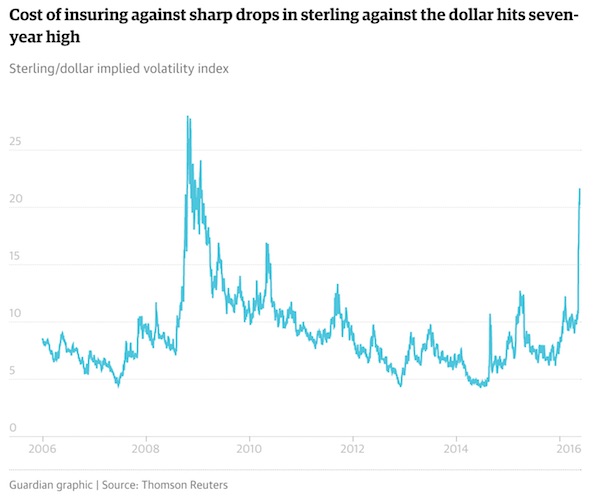

• Sterling Swings Wildly As Polls Suggest UK Heading For EU Exit (G.)

The pound swung wildly on currency markets on Monday, reaching extremes of volatility not seen since the financial crisis, as City traders reacted to polls suggesting voters were increasingly likely to send Britain out of the EU this month. The poll boost to the Vote Leave campaign sent the pound tumbling by up to 1.5 cents to below $1.44, adding to a decline of 2 cents last week and indicating the degree of pressure on the UK currency since the remain camp’s lead in the polls began to evaporate. A dovish speech by the US central bank chief, Janet Yellen, hinting that poor jobs data meant the Federal Reserve was unlikely to raise rates this month, steadied the pound – despite her comments that a vote to leave the EU could hurt the US economy.

“One development that could shift investor sentiment is the upcoming referendum in the United Kingdom. A UK vote to exit the European Union could have significant economic repercussions,” she said. Sterling’s value has become increasingly volatile as fears of a Brexit have increased among investors. The index charting the daily swings in the pound’s value has risen to its highest level of volatility since the first quarter of 2009. It is double the level seen in April when the remain camp was ahead in the polls. Elsa Lignos, a foreign exchange expert at City firm RBC, one of many to warn that the pound would come under further pressure should the lead established by Vote Leave be consolidated, said: “Brexit is almost all that matters for the pound at the moment.”

Hmm.. “..speculative-grade borrowers..”, “..highly indebted Canadian consumers ..”

• S&P Downgrades Royal Bank of Canada Outlook (WSJ)

Standard & Poor’s is downgrading the outlook for Royal Bank of Canada, a change it says reflects the lender’s increased risk appetite and credit-risk exposure relative to other domestic banks. The credit-ratings firm said Monday it was revising its outlook on RBC, Canada’s largest bank by assets, to “negative” from “stable,” but would leave its credit ratings untouched. The move comes less than two weeks after the Toronto-based lender reported a stronger-than-expected fiscal second-quarter profit but set aside bigger provisions to cover soured loans. “The outlook revision reflects concerns over what we see as RBC’s higher risk appetite, relative to peers,” said S&P credit analyst Lidia Parfeniuk in a release.

“We see one example of this in its aggressive growth in loans and commitments in the capital markets wholesale loan book, particularly in the U.S., with an emphasis on speculative-grade borrowers, including exposure to leveraged loans,” she added. S&P also pointed to RBC’s “higher-than-peer average exposure” to highly indebted Canadian consumers and to the country’s oil- and gas-producing regions, which have been hard hit by the collapse in crude-oil prices. S&P, however, affirmed RBC’s ratings including its “AA-/A-1+” long- and short-term issuer credit ratings. “RBC is one of the strongest and highest rated banks in Canada, reflecting our strong financial profile and the success of our diversified business model,” said RBC in an emailed statement. “This outlook change will have no direct impact to RBC clients,” it later added.

“..Goldman wired the $3 billion in proceeds to a Singapore branch of a small Swiss private bank instead of to a large global bank, as would be typical for a transfer of that size..”

• Goldman Probed Over Malaysia Fund 1MDB (WSJ)

U.S. investigators are trying to determine whether Goldman Sachs broke the law when it didn’t sound an alarm about a suspicious transaction in Malaysia, people familiar with the investigation said. At issue is $3 billion Goldman raised via a bond issue for Malaysian state investment fund 1Malaysia Development Bhd., or 1MDB. Days after Goldman sent the proceeds into a Swiss bank account controlled by the fund, half of the money disappeared offshore, with some later ending up in the prime minister’s bank account, according to people familiar with the matter and bank-transfer information viewed by The Wall Street Journal. The cash was supposed to fund a major real-estate project in the nation’s capital that was intended to boost the country’s economy.

U.S. law-enforcement officials have sought to schedule interviews with Goldman executives, people familiar with the matter said. Goldman hasn’t been accused of wrongdoing. The bank says it had no way of knowing how 1MDB would use the money it raised. Investigators are focusing on whether the bank failed to comply with the U.S. Bank Secrecy Act, which requires financial institutions to report suspicious transactions to regulators. The law has been used against banks for failing to report money laundering in Mexico and ignoring red flags about the operations of Ponzi scheme operator Bernard Madoff. The investigators believe the bank may have had reason to suspect the money it raised wasn’t being used for its intended purpose, according to people familiar with the probe.

One red flag, they believe, is that Goldman wired the $3 billion in proceeds to a Singapore branch of a small Swiss private bank instead of to a large global bank, as would be typical for a transfer of that size, the people said. Another is the timing of the bond sale and why it was rushed. The deal took place in March 2013, two months after Malaysia’s prime minister, Najib Razak, approached Goldman Sachs bankers during the annual meeting of the World Economic Forum in Davos, Switzerland. And it occurred two months before voting in a tough election campaign for Mr. Najib, who used some of the cash from his personal bank account on election spending, the Journal has reported, citing bank-transfer information and people familiar with the matter.

This being from the mouthpiece WaPo, g-d only knows what’s behind it.

• This Fannie-Freddie Resurrection Needs To Die (WaPo ed.)

It’s been said that Washington is where good ideas go to die. We don’t know about that, but some bad ideas are certainly hard to get rid of. Consider the persistent non-solution to the zombie-like status of Fannie Mae and Freddie Mac known as “recap and release.” The plan is to return the two mortgage-finance giants to their pre-financial-crisis status as privately owned but “government-sponsored” enterprises. That is to say, to recreate the private-gain, public-risk conflict that helped sink them in the first place. Their income would recapitalize the entities, rather than be funneled to the treasury, as is currently the case. Then they could exit the regulatory control known as “conservatorship” that has constrained them since 2008 — and resume bundling home loans and selling them, as if it had never been necessary to bail them out to the tune of $187 billion in the first place.

Congress last year effectively barred recap and release, at least for the next two years. Coupled with the Obama administration’s firm opposition, you’d think that would put a stake through its heart. But “no” is not an acceptable answer for the handful of Wall Street hedge funds that scooped up Fannie and Freddie’s beaten-down common stock for pennies a share after the bailout — and would realize a massive windfall if the government suddenly decided to let shareholders have access to company profits again. With megabillions on the line, the hedge funds have been arguing high-mindedly that their true concerns are property rights and the rule of law; they have also made common cause with certain low-income-housing advocates who see a resurrected Fan-Fred as a potential source of funds for their programs.

Left unexplained, because it’s inexplicable, is how the hedge funds’ arguments square with the fact that there wouldn’t even be a pair of corporate carcasses to fight over but for the massive infusion of taxpayer dollars and the public risk that represented. The latest iteration of recap and release is a hedge-fund-backed bill sponsored by Rep. Mick Mulvaney (R-SC), which would set Fannie and Freddie, unreformed, loose on the marketplace again and do so under terms wildly favorable to the hedge funds. Specifically, shareholders would be charged nothing for the government backing the entities would retain, supposedly to save scarce resources for the capital cushion. But as the WSJ recently noted, capital could be “risk-weighted” so forgivingly that the actual cushion required might be considerably less than headline numbers suggest.

Desperate move.

• State Department Blocks Release Of Hillary Clinton’s TPP Emails (IBT)

Trade is a hot issue in the 2016 U.S. presidential campaign. But correspondence from Hillary Clinton and her top State Department aides about a controversial 12-nation trade deal will not be available for public review — at least not until after the election. The Obama administration abruptly blocked the release of Clinton’s State Department correspondence about the so-called Trans-Pacific Partnership (TPP), after first saying it expected to produce the emails this spring. The decision came in response to International Business Times’ open records request for correspondence between Clinton’s State Department office and the United States Trade Representative. The request, which was submitted in July 2015, specifically asked for all such correspondence that made reference to the TPP.

The State Department originally said it estimated the request would be completed by April 2016. Last week the agency said it had completed the search process for the correspondence but also said it was delaying the completion of the request until late November 2016 — weeks after the presidential election. The delay was issued in the same week the Obama administration filed a court motion to try to kill a lawsuit aimed at forcing the federal government to more quickly comply with open records requests for Clinton-era State Department documents.

Clinton’s shifting positions on the TPP have been a source of controversy during the campaign: She repeatedly promoted the deal as secretary of state but then in 2015 said, “I did not work on TPP,” even though some leaked State Department cables show that her agency was involved in diplomatic discussions about the pact. Under pressure from her Democratic primary opponent, Bernie Sanders, Clinton announced in October that she now opposes the deal — and has disputed that she ever fully backed it in the first place.

John Oliver buys $15 million of unpaid debt for $60,000. And then forgives it. Now there’s an idea. Unless I’m very mistaken, that means $1 million could forgive $250 million in debt. $10 million, you free $2.5 billion in debt. Well, quite a bit more, actually, because now we’d be talking wholesale. People raise a millon bucks for all sorts of purposes all the time. Know what I mean?

Someone get this properly organized in a fund, and why wouldn’t they (?!), means: You donate $1 and $250 in debt goes away. Donate $100 and $25,000 goes up in air. 100 people donate $100 each, $2,500,000 in debt is gone. I’m not the person to do it, but certainly somebody can?! (Do call me on my math if I missed a digit..). It’s crazy people like Bill Gates or Mark Zuckerberg are not doing this. Or even Janet Yellen. Not all that smart after all, I guess. $1 billion can buy off $250 billion in debt. Want to fight deflation?

How to make sure an economy and society cannot recover.

• Taxes And Recession Slash Income Of Greek Households (Kath.)

The avalanche of new taxes that began this month will deal a devastating blow to household incomes, consumption and the prospects of the Greek economy in general. As the dozens of new measures are implemented, the market will also be forced to deal with the higher charges that will strengthen the lure of tax evasion. All this is expected to extend the recession and deter investment, while leading to more business shutdowns. Crucially, the disposable income of households will shrink anew due to the increase in taxation and the hikes in almost all indirect taxes and social security contributions.

Hundreds of thousands of families are cutting down on their basic expenses while many have run into debt over various obligations: For example, unpaid Public Power Corporation bills now total €2.7 billion. All that has resulted in major drop in retail spending. A consumer confidence survey carried out by Nielsen for the first quarter of the year shows that eight out of 10 Greeks are constantly attempting to reduce their household expenditure. Their main targets for cuts are going out for entertainment and food delivery, while they are buying cheaper and fewer groceries.

JHK: “As you may know, Kunstler.com is currently under an aggressive Denial of Service (DoS) attack. My web and server technicians are working to get the website and blog back up and live soon (though it’s going to cost a pretty penny). In the meantime, here is today’s blog. Please share this with any of your friends so they don’t miss out.”

• Nausea Rising (Jim Kunstler)

The people of the United States have real grievances with the way this country is being run. Last Friday’s job’s report was a humdinger: only 38,000 new jobs created in a country of over 300 million, with a whole new crop of job-seeking college grads just churned out of the diploma mills. I guess the national shortage of waiters and bartenders has finally come to an end. What’s required, of course, is a pretty stout restructuring of the US economy. And that should be understood to be a matter of national survival. We need to step way back on every kind of giantism currently afflicting us: giant agri-biz, giant commerce (Wal Mart etc.), giant banking, giant war-making, and giant government — this last item being so larded with incompetence on top of institutional entropy that it is literally a menace to American society.

The trend on future resources and capital availability is manifestly downward, and the obvious conclusion is the need to make this economy smaller and finer. The finer part of the deal means many more distributed tasks among the population, especially in farming and commerce operations that must be done at a local level. This means more Americans working on smaller farms and more Americans working in reconstructed Main Street business, both wholesale and retail. This would also necessarily lead to a shift out of the suburban clusterfuck and the rebuilding of ten thousand forsaken American towns and smaller cities.

For the moment, many demoralized Americans may feel more comfortable playing video games, eating on SNAP cards, and watching Trump fulminate on TV, but the horizon on that is limited too. Sooner or later they will have to become un-demoralized and do something else with their lives. The main reason I am so against the Hillary and Trump, and so ambivalent on Bernie is their inability to comprehend the scope of action actually required to avoid sheer cultural collapse.

Completely crazy. Is Trump really the only person who can stop this? For the first time since the Nazi invasion of Soviet-occupied Poland began on 22 June 1941, German tanks will cross the country from west to east.

• NATO Countries Begin Largest War Game In Eastern Europe Since Cold War (G.)

The largest war game in eastern Europe since the end of the cold war has started in Poland, as Nato and partner countries seek to mount a display of strength as a response to concerns about Russia’s assertiveness and actions. The 10-day military exercise, involving 31,000 troops and thousands of vehicles from 24 countries, has been welcomed among Nato’s allies in the region, though defence experts warn that any mishap could prompt an offensive reaction from Moscow. A defence attache at a European embassy in Warsaw said the “nightmare scenario” of the exercise, named Anaconda-2016, would be “a mishap, a miscalculation which the Russians construe, or choose to construe, as an offensive action”. Russian jets routinely breach Nordic countries’ airspace and in April they spectacularly “buzzed” the USS Donald Cook in the Baltic Sea.

The exercise, which US and Polish officials formally launched near Warsaw, is billed as a test of cooperation between allied commands and troops in responding to military, chemical and cyber threats. It represents the biggest movement of foreign allied troops in Poland in peace time. For the first time since the Nazi invasion of Soviet-occupied Poland began on 22 June 1941, German tanks will cross the country from west to east. Managed by Poland’s Lt Gen Marek Tomaszycki, the exercise includes 14,000 US troops, 12,000 Polish troops, 800 from Britain and others from non-Nato countries. Anaconda-2016 is a prelude to Nato’s summit in Warsaw on 8-9 July, which is expected to agree to position significant numbers of troops and equipment in Poland and the Baltic states.

It comes within weeks of the US switching on a powerful ballistic missile shield at Deveselu in Romania, as part of a “defence umbrella” that Washington says will stretch from Greenland to the Azores. Last month, building work began on a similar missile interception base at Redzikowo, a village in northern Poland. The exercise comes at a sensitive time for Poland’s military, following the sacking or forced retirement of a quarter of the country’s generals since the nationalist Law and Justice government came to power in October last year. So harsh have the cuts to the top brass been that the Polish armed forces recently found themselves unable to provide a general for Nato’s multinational command centre at Szczecin.

Tell me, do I feel safe now? 100,000 years is a long time. No fault lines? Volcanic activity?

• Finns To Bury Nuclear Waste In World’s Costliest Tomb (AFP)

Deep underground on a lush green island, Finland is preparing to bury its highly-radioactive nuclear waste for 100,000 years — sealing it up and maybe even throwing away the key. Tiny Olkiluoto, off Finland’s west coast, will become home to the world’s costliest and longest-lasting burial ground, a network of tunnels called Onkalo – Finnish for “The Hollow”. Countries have been wrestling with what to do with nuclear power’s dangerous by-products since the first plants were built in the 1950s. Most nations keep the waste above ground in temporary storage facilities but Onkalo is the first attempt to bury it for good. Starting in 2020, Finland plans to stow around 5,500 tons of nuclear waste in the tunnels, more than 420 metres (1,380 feet) below the Earth’s surface.

Already home to one of Finland’s two nuclear power plants, Olkiluoto is now the site of a tunnelling project set to cost up to €3.5 billion until the 2120s, when the vaults will be sealed for good. “This has required all sorts of new know-how,” said Ismo Aaltonen, chief geologist at nuclear waste manager Posiva, which got the green light to develop the site last year. The project began in 2004 with the establishment of a research facility to study the suitability of the bedrock. At the end of last year, the government issued a construction license for the encapsulation plant, effectively giving its final approval for the burial project to go ahead. At present, Onkalo consists of a twisting five-kilometre (three-mile) tunnel with three shafts for staff and ventilation. Eventually the nuclear warren will stretch 42 kilometres (26 miles).

[..] The waste is expected to have lost most of its radioactivity after a few hundred years, but engineers are planning for 100,000, just to be on the safe side. Spent nuclear rods will be placed in iron casts, then sealed into thick copper canisters and lowered into the tunnels. Each capsule will be surrounded with a buffer made of bentonite, a type of clay that will protect them from any shuddering in the surrounding rock and help stop water from seeping in. Clay blocks and more bentonite will fill the tunnels before they are sealed up.

Long piece on bleaching by the Guardian. Depressing.

• Great Barrier Reef: The Stench Of Death (G.)

It was the smell that really got to diver Richard Vevers. The smell of death on the reef. “I can’t even tell you how bad I smelt after the dive – the smell of millions of rotting animals.” Vevers is a former advertising executive and is now the chief executive of the Ocean Agency, a not-for-profit company he founded to raise awareness of environmental problems. After diving for 30 years in his spare time, he was compelled to combine his work and hobby when he was struck by the calamities faced by oceans around the world. Chief among them was coral bleaching, caused by climate change. His job these days is rather morbid. He travels the world documenting dead and dying coral reefs, sometimes gathering photographs just ahead of their death, too.

With the world now in the midst of the longest and probably worst global coral bleaching event in history, it’s boom time for Vevers. Even with all that experience, he’d never seen anything like the devastation he saw last month around Lizard Island in the northern third of Australia’s spectacular Great Barrier Reef. As part of a project documenting the global bleaching event, he had surveyed Lizard Island, which sits about 90km north of Cooktown in far north Queensland, when it was in full glorious health; then just as it started bleaching this year; then finally a few weeks after the bleaching began. “It was one of the most disgusting sights I’ve ever seen,” he says. “The hard corals were dead and covered in algae, looking like they’ve been dead for years. The soft corals were still dying and the flesh of the animals was decomposing and dripping off the reef structure.”

[..] When the coral dies, the entire ecosystem around it transforms. Fish that feed on the coral, use it as shelter, or nibble on the algae that grows among it die or move away. The bigger fish that feed on those fish disappear too. But the cascading effects don’t stop there. Birds that eat fish lose their energy source, and island plants that thrive on bird droppings can be depleted. And, of course, people who rely on reefs for food, income or shelter from waves – some half a billion people worldwide – lose their vital resource.

[..] What’s at stake here is the largest living structure in the world, and by far the largest coral reef system. The oft-repeated cliche is that it can be seen from space, which is not surprising given it stretches more than 2,300km in length and, between its almost 3,000 individual reefs, covers an area about the size of Germany. It is an underwater world of unimaginable scale. But it is up close that the Great Barrier Reef truly astounds. Among its waters live a dizzying array of colourful plants and animals. With 1,600 species of fish, 130 types of sharks and rays, and more than 30 species of whales and dolphins, it is one of the most complex ecosystems on the planet.

Coral off Lizard Island, bleached in March, and then dead and covered in seaweed in May. Photo: the Ocean Agency

Home › Forums › Debt Rattle June 7 2016