Shirley Temple Chrismas 1939

What a surprise.

• Americans Are Now In More Debt Than They Were Before The Financial Crisis (MW)

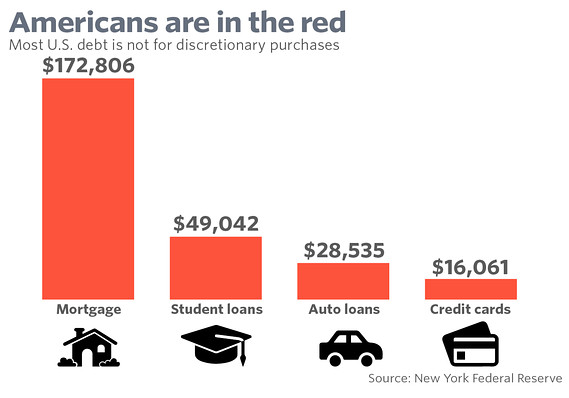

Americans may soon exceed the amount of credit-card debt they racked up during the Great Recession. The average household with credit card debt owes $16,061, up 10% from $14,546 10 years ago and $15,762 last year, according to a new analysis of Federal Reserve Bank of New York and U.S. Census Bureau data by the personal finance company NerdWallet. The amount of household credit card debt is still down from a recent high of $16,912 in 2008 at the height of the recession. The U.S. won’t hit pre-recession credit card debt levels until the end of 2019, NerdWallet’s analysis projects. Total debt (including mortgages, auto loans and student loans) is expected to surpass the amounts owed at the beginning of the Great Recession by the end of 2016, NerdWallet found, mostly due to mortgages and student loans.

Mortgage debt jumped from $159,020 per household in 2010 to $172,806 in 2016, and debt from auto loans grew from $20,032 in 2010 to $28,535 in 2016. Nationwide, total household debt (including mortgages, auto loans and student loans) now equals almost $12.4 trillion, up from about $11.7 trillion in 2010. Why the growth in debt, given that many consumers should be skittish about living beyond their needs after the credit bubble of the Great Recession? The reason concerns a problem that has long dogged Americans. Median household income has grown 28% over the last 13 years, said Sean McQuay, a personal finance expert at NerdWallet, but expenses have outpaced it significantly. Case in point: Medical costs increased by 57% and food and beverage prices by 36% in that period.

Many Americans find it difficult to stick to savings goals. And that’s even worse if you have a family. The amount that a two-parent, two-child family needs just to pay the bills (but not have money left over for savings) ranges from about $50,000 to more than $100,000 depending on where a family lives, according to data from the nonprofit and nonpartisan think tank the Economic Policy Institute. Rent has risen 3.9% in the last year alone, according to the Bureau of Labor Statistics. “The economy is doing better, but we’re really not seeing that trickle down to individual households the way we’d hope,” McQuay said. Rising living costs mean, if anything, consumers should pay extra attention to their budgets in the next year, he said. “We’re allergic to the idea of budgeting,” he said. “It sounds just as awful as dieting.”

No contradiction whatsoever with the article above.

• Americans Want To ‘Live Big(ly)’ In The Trump Era (CNBC)

In the Trump era, excess is in and modesty is out. After years of stealth wealth, humility and downsizing, the president-elect is ushering in a new era of living large, Nobel Prize-winning economist Robert Shiller said Wednesday. “We used to be more into modest living,” the Yale professor told CNBC, speaking about the years after the financial crisis. “Now people are thinking, ‘[that] doesn’t work.’ You know? You have to live big-league and you’re on your way. While there’s no empirical evidence pointing to this shift, Shiller said the excitement is visible at Trump rallies and in the stock market. Despite a slight dip on Wednesday, the Dow Jones industrial average remained near 20,000.

Shiller’s comments add to budding sentiment that America’s new billionaire-in-chief — with his gold-plated penthouse, private jumbo jet and multiple mansions — could shift American attitudes away from inequality and toward the 1980s-style aspiration and worship of wealth. That quest for the good life could also stimulate spending — particularly in housing, Shiller said. “Trump is a real estate man, right? He talks about living big, living large. I can imagine that this will boost housing demand as well, among at least those who are excited by Trump,” he said. Still, Shiller cautioned that investors shouldn’t get too comfortable, as the Trump rally could end up like Calvin Coolidge’s run nearly a century ago. Coolidge was president during the Roaring ’20s, before the decade-long Great Depression started in 1929. “It could be like … Coolidge prosperity. It went for a while and it ended badly,” he said.

“There’s a difference, though, between Calvin Coolidge and Donald Trump, if you haven’t noticed. Trump is way more controversial,” Shiller added.

But bigly.

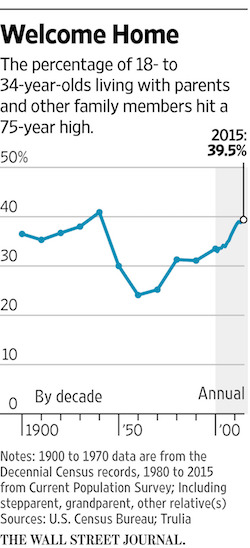

• Percentage of Young Americans Living With Parents Rises to 75-Year High (WSJ)

Almost 40% of young Americans were living with their parents, siblings or other relatives in 2015, the largest percentage since 1940, according to an analysis of census data by real estate tracker Trulia. Despite a rebounding economy and recent job growth, the share of those between the ages of 18 and 34 doubling up with parents or other family members has been rising since 2005.

Back then, before the start of the last recession, roughly one out of three were living with family. The trend runs counter to that of previous economic cycles, when after a recession-related spike, the number of younger Americans living with relatives declined as the economy improved. [..] The share of young Americans living with parents hit a high of 40.9% in 1940, just a year after the official end of the Great Depression, and fell to a low of 24.1% in 1960. It hovered between about 31% and 33% from 1980 to the mid-2000s, when the rate started climbing steadily.

The result is that there is far less demand for housing than would be expected for the millennial generation, now the largest in U.S. history. The number of adults under age 30 has increased by 5 million over the last decade, but the number of households for that age group grew by just 200,000 over the same period, according to the Harvard Joint Center for Housing Studies. Analysts point to rising rents in many cities and tough mortgage-lending standards as the culprit, making it difficult for younger Americans to strike out on their own.

It’s been a while. Anything to do with QE?

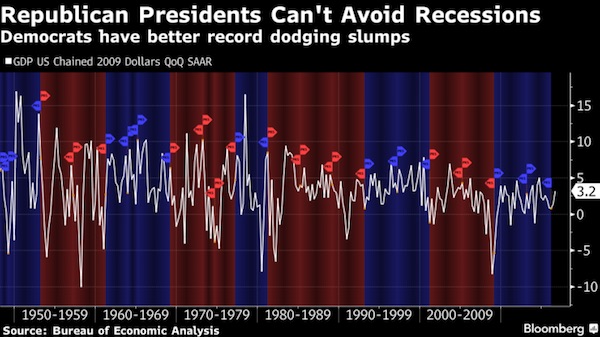

• Republican Presidents Can’t Seem To Avoid Recessions (BBG)

Here’s a frightening factoid for Donald Trump as he prepares to take office next month: Every Republican president since World War II has been in power during at least one recession. Of course, as the saying goes, past performance is not necessarily indicative of future results and the billionaire developer may well avoid a downturn on his watch. But with the economic expansion soon to become the third-longest on record, the risk of a contraction occurring during his time in office can’t be cavalierly dismissed. “Republican presidents seemingly can’t do without” recessions, Joachim Fels, global economic adviser for PIMCO, wrote in a blog post dated Dec. 12. The same can’t be said of Democrats. Outgoing President Barack Obama did preside over an economic downturn in his first six months in office – one he inherited from his predecessor, Republican George W. Bush.

John F. Kennedy took office just before a recession ended. And the U.S. entered and exited slumps when Jimmy Carter and Harry Truman were in charge. But it was recession-free during the tenures of Democrats Lyndon Johnson in the 1960s and Bill Clinton in the 1990s. “The U.S. economy has performed better when the president of the United States is a Democrat rather than a Republican,” Princeton University professors Alan Blinder and Mark Watson wrote in a paper published in the American Economic Review this year. The difference isn’t due to more expansionary fiscal and monetary policies under Democrats, according to Blinder, who served in the Clinton White House, and Watson. Instead it appears to stem from less costly oil shocks, a more favorable international environment, productivity-boosting technological advances and perhaps more optimistic consumers, they wrote. Some of those disparities may be down to better policies, but luck also played a role.

It’ll happen.

• Plan To Tax US Imports Has Better Odds Of Becoming Law Than Many Think (CNBC)

A controversial proposal to tax all goods and services coming into the United States has a better chance of becoming law than many on Wall Street suspect. The so-called “border-adjusted” tax is part of the House tax overhaul plan that also would reduce the corporate rate from 35% to 20%. The idea is to tax goods as they come into the country from overseas, but to avoid taxing U.S. exports at all. For instance, a car imported into the U.S. from Mexico would be taxed, but the American-made steel sent to Mexico would not.

Proponents say the proposed “destination tax” would encourage more U.S. production of goods and create U.S. jobs. But opponents say it will send prices higher, unfairly cut profits for some sectors, particularly the retail industry, and could prompt retaliation. The idea is similar but not quite like a VAT, or value added tax, common in other countries. The stock market has been celebrating promises of lower corporate taxes that could boost business spending, but it has been ignoring proposals that could sting some companies’ bottom lines. Retailers, automakers and refiners are among the industries that could be hit if imports are taxed.

What you get from blowing bubbles. You destroy societies.

• Home Ownership Among 25-Year-Olds In England, Wales Halved In 20 Years (G.)

The proportion of 25-year-olds who own a home has more than halved over the past 20 years, according to a report that points to the generational impact of the housing crisis. Home ownership has dropped from 46% of all 25-year-olds two decades ago to 20% now, the Local Government Association said. The LGA, which represents more than 370 councils in England and Wales, said more homes for affordable or social rent are needed to allow people to save up for a deposit and get on the housing ladder. The LGA’s housing spokesman, Cllr Martin Tett, said: “Our figures show just how wide the generational home ownership gap is in this country. A shortage of houses is a top concern for people as homes are too often unavailable, unaffordable and not appropriate for the different needs in our communities.

“The housing crisis is complex and is forcing difficult choices on families, distorting places, and hampering growth. But there is a huge opportunity, as investment in building the right homes in the right places has massive wider benefits for people and places.” Analysis for the LGA by the estate agent Savills found that the construction of social rented homes – owned and managed by local authorities and housing associations – plunged by 88% between 1995-96 and 2015-16. The association warned that the sharp fall, combined with rents rising at a faster pace than incomes, meant that home ownership was becoming more difficult for an increasing number of people. Home ownership across all age groups has fallen by 4.4% since 2008, while private renters increased by 5.1%, the LGA said.

Beppe Grillo wants full nationalization. The political class just blunders on.

• Monte Paschi Headed for Nationalization After Sale Failure (BBG)

Banca Monte dei Paschi di Siena SpA will probably fail to lure sufficient demand for a €5 billion capital increase, leading to what would be the country’s biggest bank nationalization in decades, said people with knowledge of the matter. No anchor investor has shown interest in the stocks sale, the Siena-based company said in a statement late Wednesday. Two debt-for-equity swap offers will raise about €2 billion, with investors converting bonds for about €2.5 billion, the lender said. The interest is probably insufficient to pull the deal off, said the people, who asked not to be identified before a final assessment. Qatar’s sovereign-wealth fund, which had considered an investment, hasn’t committed to buying shares, people with knowledge of the matter have said.

Other institutions that were considering buying shares have indicated that they would put funds in the troubled bank only if it’s able to raise €1 billion from cornerstone investors, according to the people. Monte Paschi Chief Executive Officer Marco Morelli had crisscrossed the globe looking for investors to back the bank’s reorganization plan, which included a share sale, a debt-for-equity swap and the sale of €28 billion worth of soured loans. A nationalization of Monte Paschi, the biggest in Italy since the 1930s, could be followed by rescues for lenders including Veneto Banca and Banca Popolare di Vicenza as part of a €20 billion government package. State intervention and a hit to bondholders is the most likely scenario for Monte Paschi, Manuela Meroni, an analyst at Intesa Sanpaolo SpA wrote in a note to clients Thursday. “The solution to the Monte Paschi issue could reduce the systemic risk for the sector,” Meroni wrote.

Monte Paschi shares failed to open in Milan on Thursday after being indicated lower. The shares have dropped 87% this year, trimming the bank’s value to €478 million. If government funds are used in the bank’s recapitalization, bondholders will probably have to take losses under European burden-sharing rules. The cabinet is considering a so-called precautionary recapitalization that may reduce the potential losses. A cabinet meeting may be held as early as Thursday evening to rescue Monte Paschi, newspaper La Stampa reported, without saying where it got the information.

Especially in the rear-view mirror.

• China’s Currency Outflows Are Much Larger Than They Appear (MW)

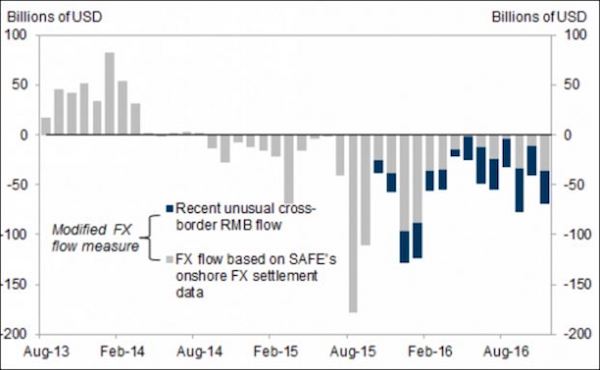

Investors have been drastically underestimating the pace at which money is leaving China. Since June, the People’s Bank of China has liquidated $1.1 trillion in foreign-currency reserves, according to a calculation by a team of analysts at Goldman Sachs. That’s nearly double the $540 billion reported by the PBOC, when adjusted for shifts in the yuan’s valuation, between August 2015 and November 2016. Goldman arrived at its figure by incorporating data provided by the State Authority on Foreign Exchange, the arm of the PBOC responsible for currency flows. That data details flows that are considered approved Chinese corporate demand, as well as money flowing through the offshore yuan market. If one factors in these outflows, the total amount of capital that has left China in that time period balloons from the reported $540 billion to $1.1 trillion, Goldman said. Goldman illustrates these flows in a chart, below:

“Since June, this data has continued to suggest significantly larger [foreign exchange] sales by the PBOC than is implied by FX reserve data [the gap is about $25 billion a month on average in the last several months],” said the team, led by MK Tang, executive director of global investment research Asia, in a research note released to the media on Monday. The PBOC has been selling its foreign currency reserves, which have declined for 14 straight months through November, to help support its rapidly weakened currency, the yuan. After selling off earlier in the year, the dollar has strengthened rapidly against most major currencies including the yuan. In fact, dollar gains accelerated following President-elect Donald Trump’s Nov. 8 electoral victory. Presently, the yuan, USDCNY, +0.0706% also known as the renminbi, is trading near its weakest level against the dollar since late 2008.

Greenwald is very clear. But help me out: does the interviewer try to imply that there is circumstantial evidence regardless of there not being any? That because a lot of so-and-so’s have said there is, that somehow means there must be?

• Glenn Greenwald Weighs In On Election Hacks (MSNBC)

Co-founding editor of The Intercept, Glenn Greenwald, talks to Ari Melber about the investigation into Russian hacks involving the 2016 election.

Never let a good crisis go to waste. Zero credibility.

• EU To Boost Border Checks On Cash, Gold To Tackle ‘Terrorism Financing’ (R.)

The European Commission proposed tightening controls on cash and precious metals transfers from outside the EU on Wednesday, in a bid to shut down one route for funding of militant attacks on the continent. The move follows Monday’s attack on a Christmas market in Berlin, where 12 people were killed as a truck plowed into a crowd. It is part of an EU “action plan against terrorist financing” unveiled after the bombings and shootings in Paris in November 2015. Under the new proposals, customs officials in EU states will be able to step up checks on cash and prepaid payment cards transferred via the post or through freight shipments.

Authorities will also be given the power to seize cash or precious metals carried by suspect individuals entering the EU. People carrying more than 10,000 euros ($10,391.00) in cash are already required to declare this at customs upon entering the EU. The new rules would allow authorities to seize money even below that threshold “where there are suspicions of criminal activity,” the EU executive commission said in a note. “With today’s proposals, we strengthen our legal means to disrupt and cut off the financial sources of terrorists and criminals,” the commission vice-president Frans Timmermans said.

Not every European is a complete fool yet.

• EU Court Says Mass Data Retention Illegal (R.)

The mass retention of data is illegal, the European Union’s highest court said on Wednesday, dealing a blow to Britain’s newly passed surveillance law and signaling that security concerns do not justify excessive privacy infringements. The Court of Justice of the European Union (ECJ) said its ruling was based on the view that holding traffic and location data en masse allowed “very precise conclusions to be drawn concerning the private lives of the persons whose data has been retained”. Such interference with people’s privacy could only be justified by the objective of fighting serious crime and access to data should be subject to prior review by a court or independent body except in urgent cases, it said.

The ruling is likely to upset governments seeking to deal with the threat of attacks such as those in Paris and Brussels and, on Monday, in Berlin. Those attacks have reinforced calls from governments for security agencies to be given greater powers to protect citizens, while privacy advocates – who welcomed the ruling – say mass retention of data is ineffective in the fight against such crimes. The perpetual debate over privacy versus security took on an extra dimension after Edward Snowden leaked details of mass spying by U.S. and British agents in 2013. The ECJ said governments could demand targeted data retention subject to strict safeguards such as limiting it to a particular geographic location but the data must be stored within the EU given the risk of unlawful access.

The court was responding to challenges against data retention laws in Britain and Sweden on the grounds that they were no longer valid after the ECJ struck down an EU-wide data retention law in 2014. A spokesman for Britain’s interior ministry said it was disappointed with the judgment and would be considering its potential implications in the case launched before Britain voted in June to quit the European Union. “Given the importance of communications data to preventing and detecting crime, we will ensure plans are in place so that the police and other public authorities can continue to acquire such data in a way that is consistent with EU law and our obligation to protect the public,” he said.

Pretty cold for Athens too.

• Greek Low-Pensioners Stand Long Queues For The Christmas Bonus (KTG)

Greece’s low-pensioners have been waiting for the extra Christmas bonus announced by Prime Minister Alexis Tsipras for days. The magic, sparkling moment was set as December 22nd. The money started to flow into bank accounts already since Wednesday afternoon. Defying the icy-cold weather and Schaeuble’s objections, dozens of elderly rushed to ATMs to withdraw the unexpected Christmas present together with the pension for January. Those unable to use cards rushed to the banks as early as possible in the morning and stood line for many hours before the doors opened. 1.6 million low-pensioners receive the Christmas bonus which is the difference of the pension and lump sum to the amount of €850.

If a pensioner receives €600, the Christmas bonus will be €250. Due to capital controls, the amount that can be withdrawn within two weeks is €840. At the same time, 240,000 low pensioners will see the poverty allowance (EKAS) cut by 50%. It means they will lose €1,380 per year. I asked a neighbor how will he spend the Christmas bonus. “I will have my bones warmed,” the 87-year-old answered with a bright smile. He has been living without heating for the last three years. He went broke and spent all his savings after austerity cuts in 2010 deprived him of the 13th and 14th pension. He lost €1,200 per year.

My article from yesterday. Please help us help.

• The Automatic Earth in Greece: Big Dreams for 2017 (Automatic Earth)

Both Konstantinos and myself -and all the other volunteers at O Allos Anthropos- want to thank you so much for all the help you’ve given over the past year -and in 2015-. We’re around $30,000 for 2016 alone, another $5000 since my last article 4 weeks ago. I swear, for as long as I live, this will never cease to amaze me. And then of course what happens is people start thinking and dreaming about what more they can do for those in peril. Wouldn’t you know…

A Merry Christmas to all of you, to all of us. Very Merry. God bless us, every one. Thank you for everything.

If I may make a last suggestion, please forward this ‘dream’ to anyone you know -and even those you don’t-, by mail, Twitter, Facebook, Instagram, word of mouth, any which way you can think of. Go to your local mayor or town council, suggest they can help and get -loudly- recognized for it. There may be a dream involved for 2017, but that was our notion a year ago as well, and look what we’ve achieved a year later: it is very real indeed. And anyone, everyone can become part of that reality for just a few bucks. If the institutions won’t do it, perhaps the people themselves should. That doesn’t even sound all that crazy or farfetched. There’s a lot of us.

Konstantinos Polychronopoulos, Athens December 2016

Home › Forums › Debt Rattle December 22 2016