Grete Stern Sueño No. 27: No destiñe con el agua 1951

Winning bigly. Triumphant talk of the town in Davos. Jamie Dimon, Lloyd Blankfein are on board. “They’re going to invest a lot of money in this country.” How long will it last?

• Trump to Tell Davos That ‘America First’ Is Good for Globalism (BBG)

President Donald Trump has a familiar message for the global elites populating the World Economic Forum in Davos, Switzerland: You were wrong. A year ago, some Davos participants predicted Trump’s protectionist rhetoric would lead to sluggish economic growth and lackluster stock market gains. It didn’t. And the president isn’t about to let that go unnoticed. Trump will arrive at the conference Thursday, joining a large delegation of U.S. officials already there, where he’s expected to boast about U.S. economic performance during his first year in office – unemployment down, the stock market up, robust growth. He’ll also seek to persuade the Davos audience in a major speech on Friday that his populist, “America First” policies can co-exist with globalism.

The president said on Twitter that he plans “to tell the world how great America is” and that “our economy is now booming and with all I am doing, will only get better.” “He wants to shatter the myth that he is only an ‘America First’ president,” said Anthony Scaramucci, the financier who was briefly Trump’s communications director and still informally advises the president. “That’s not the case. He is a globalist. He has a duality to his personality. He’s here to disrupt things, which he does a reasonably good to great job of.” The Swiss mountainside gathering of bankers, corporate chiefs and academics isn’t exactly Trump’s scene, and his administration deliberately spurned the conference prior to his inauguration last year. But now, chief executives are warming up to the president after a year in which his administration began a major deregulation effort and won passage of a law that slashes the U.S. corporate tax rate.

“What I’m bulled up about is that policy makers are making good policy decisions in the U.S. about taxes, about proper regulatory reform,” JP Morgan Chase CEO Jamie Dimon said in Davos. “I like a lot more stuff than I don’t like,” Goldman Sachs CEO Lloyd Blankfein said in an interview with CNBC. [..] Trump will host European executives on Thursday night to argue that the U.S. is a better place for businesses as a result of the tax overhaul and deregulation, his National Economic Council director, Gary Cohn, said Tuesday at a briefing. [..] Trump told reporters late Wednesday that he decided to go to Davos “to get them to bring back a lot of money. They’re going to invest a lot of money in this country.”

When does Beijing start to talk about currency manipulation.

• A Weaker Dollar Is Good For The US, Treasury Secretary Mnuchin Says (CNBC)

Treasury Secretary Steven Mnuchin said the U.S. is open for business and welcomed a weaker dollar, saying that it would benefit the country. Speaking at a press conference at the World Economic Forum in Davos Wednesday, he made a bid for investment into the U.S., saying the government was committed to growth of 3% or higher. “Obviously a weaker dollar is good for us as it relates to trade and opportunities,” Mnuchin told reporters in Davos, according to Bloomberg, adding that the currency’s short term value is “not a concern of ours at all.” “Longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the fact that it is and will continue to be the primary currency in terms of the reserve currency,” he said.

On the eve President Donald Trump’s arrival at the event, he said that the U.S. delegation to Davos was its largest ever. “(The) size of the delegation to Davos this year is testament to the scale of Trump’s work over the past year,” Mnuchin said. “What’s happening in the U.S. (is a) reflection of programs being put in place. As we look at U.S. growth, it continues to look quite good and is a very attractive place to invest,” he added. The dollar dipped slightly after his comments and hit a session low, with the dollar index slipping 0.47% for the day. The British pound climbed to a post-Brexit vote high shortly after 8:30 a.m. London time. Mnuchin iterated that his country is “absolutely” committed to free and fair trade, according to the Associated Press. He added that strong U.S. growth was good for the economy and that there was no inconsistency with Trump’s “America First” agenda, according to the news agency.

Calculation: others lose more than the US does short term.

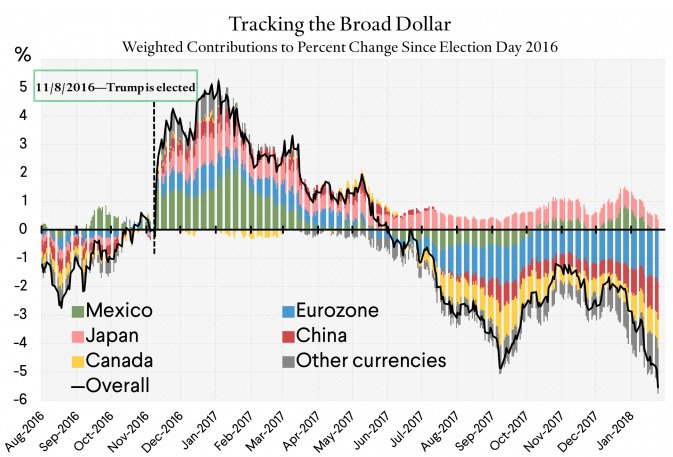

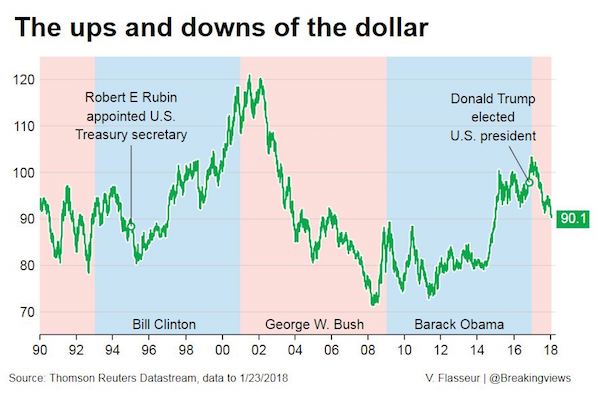

• Careless Whisper: Mnuchin Opens Door To New Era Of Currency Wars (BV)

Speaking one’s mind can be dangerous, especially for the U.S. Treasury secretary. Steven Mnuchin said on Wednesday that a weaker dollar was good for his country. Textbook theory certainly supports his view that a depreciating currency is good for exporters. But the remarks are a break with what his predecessors have publicly asserted since 1995. If the greenback became a trade weapon it would be to the detriment of foreign holders of U.S. debt. Treasury secretaries since Robert Rubin have repeated the mantra that a strong dollar is in U.S. interests. That meant something when Rubin articulated it in 1995 with the aim of shoring up a weak dollar. But it has been used ad nauseam since then, both when the U.S. authorities were intervening in the currency markets to buy their currency and when they were selling it.

What qualified as strong is up for grabs. Since 1995, an index of the dollar’s value against a basket of other major currencies has risen as high as 121 and then fallen more than 40% without the wording being questioned or amended. The maxim has served its purpose, though, by reassuring investors and other countries that the United States would not try to talk its currency down to win a trade advantage. Little wonder then that the dollar index, which has been on a losing streak since the year started, hit a three-year low after Mnuchin’s comments. He probably had no intention of weakening the dollar and there is no evidence that President Donald Trump’s administration is about to embark on such a policy. The remarks do, however, reveal how focused U.S. policymakers are on domestic interests. From there, actually egging on such moves is only a small step.

There’s no way to keep the reserve currency down, and there’s no alternative either, but they’ll take what they can get today.

• Trump Team Unleashes Verbal Assault On The Dollar (Pol.)

U.S. presidents and Treasury secretaries have a long tradition of declaring their allegiance to a strong dollar policy in public remarks, even if privately many welcomed a softer dollar to boost U.S. exports and reduce trade deficits. If the U.S. is publicly supporting a weak dollar while also imposing tariffs on foreign imports — as the Trump administration did this week — it could invite retaliation from other countries, potentially sparking both currency and trade wars, economists say. “It’s remarkable, really, this kind of bomb-throwing from Mnuchin on the dollar the same week they slap on tariffs,” said Ian Shepherdson of Pantheon Macroeconomics, referring to action this week by the Trump White House to impose tariffs on some imported solar panels and washing machines. “The problem with this is it just invites retaliation. This is not a friendly action.”

A weaker U.S. dollar, while potentially a boost for exports, makes many foreign consumer goods more expensive for Americans to buy. That could hit lower-income consumers the hardest, including less well-off voters in Trump’s political base. Retaliatory tariffs on U.S. exports could also hurt domestic manufacturers. The concept of a public strong-dollar policy dates back at least three administrations to when Lloyd Bentsen and Robert Rubin served as Treasury secretaries under President Bill Clinton. The general approach reflects the belief that a stronger dollar improves the value of U.S. Treasury bonds, equities and other dollar-denominated assets and gives Americans more purchasing power. It also generally reflects an improving U.S. economy.

“I have been consistent in saying, as my predecessors have said, that a strong dollar is good for the United States. If you look at the U.S. economy right now, the truth is our economy is performing quite well,” then-Treasury Secretary Jack Lew said in January 2015, echoing the regular public refrain of U.S. officials. Mnuchin did nod to this tradition in his Davos comments after remarking on the benefits of a weaker dollar. “Longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the fact that it is and will continue to be the primary currency in terms of the reserve currency,” he said.

She must appear impartial. But this of course is utter crap: “The dollar is of all currencies a floating currency and one where value is determined by markets..”. There are no markets. There’s only central banks.

• IMF’s Lagarde Urges Mnuchin to Clarify Remarks on Weak Dollar (BBG)

IMF Managing Director Christine Lagarde suggested that U.S. Treasury Secretary Steve Mnuchin may wish to explain his comments in which he appeared to back a weak dollar, adding that U.S. tax cuts will probably cause the world’s reserve currency to rally. “I really hope that Secretary Mnuchin has a chance to clarify exactly what he said,” Lagarde said in Bloomberg TV interview with Francine Lacqua and Tom Keene in Davos, Switzerland. “The dollar is of all currencies a floating currency and one where value is determined by markets and geared by the fundamentals of U.S. policy.” The dollar slid to the lowest since December 2014 on Thursday, a day after Mnuchin’s endorsement of a weaker greenback at the WEF. The euro also climbed to its strongest against the dollar since 2014. “Obviously a weaker dollar is good for us as it relates to trade and opportunities,” Mnuchin told reporters in Davos.

The currency’s short term value is “not a concern of ours at all.” Losses for the greenback have mounted since U.S. President Donald Trump’s inauguration a year ago, with the currency weakening against every Group-of-10 peer. Lagarde reiterated the IMF’s view, presented in its World Economic Outlook this week, that the U.S. tax reform is likely to lead to dollar’s strengthening in the medium term. For many market analysts, Mnuchin’s comments represent a stark break from previous U.S. administrations and could provoke pushback from other regions before too long. “This is a further break away from the ‘strong USD’ mantra launched in the mid-1990s by Clinton’s Treasury Secretary Rubin and adhered to by subsequent Treasury leaders,” wrote Credit Agricole CIB strategists led by Valentin Marinov in a note to clients. “Inevitably, the Administration’s vocal preference for a weak dollar is likely to raise the risk of global currency wars.”

A carrot for the Democrats. They’ll take it.

• Trump Supports Immigration Plan With Pathway To Citizenship For Dreamers (G.)

Donald Trump on Wednesday said he would support a plan that offered a pathway to citizenship for so-called Dreamers, young undocumented immigrants who were brought to the US as children, as part of a broader immigration package that the White House is expected to unveil next week. Trump made the comments to a group of reporters assembled for a briefing on the president’s immigration plan before he departs to Davos, Switzerland, for the World Economic Forum. According to the Associated Press, Trump said he would be open to allowing certain immigrants to become citizens after “10 or 12 years”. Trump told reporters he would allow the Dreamers to “morph into” citizens over a period of time.

“Whatever they’re doing, if they do a great job, I think it’s a nice thing to have the incentive, of after a period of years, being able to become a citizen.” Lindsey Graham, one of the Republican Senators deeply involved in the negotiations over immigration, called Trump’s statement “a major breakthrough”. “I truly appreciate President Trump making it clear that he supports a path to citizenship for Daca recipients,” he said. “This will greatly help the Senate efforts to craft a proposal which President Trump can sign into law.” Trump had previously rejected the idea of citizenship for the young immigrants as “amnesty”. According to the AP, a senior White House official immediately clarified the remarks, telling reporters that a pathway to citizenship for Dreamers was only a “discussion point” in the plan that the White House would preview to Congress on Monday.

He’s not bluffing.

• Trump ‘Looking Forward’ To Speaking Under Oath In Russia Inquiry (G.)

Donald Trump said late Wednesday that he would be willing to speak to the special counsel office’s under oath, adding that he was “looking forward” to talking with Robert Mueller, who is investigating Russian interference in the 2016 election, including alleged contacts with the Trump campaign. Speaking with reporters at the White House before he set out for the World Economic Forum in Davos, Switzerland, Trump was asked about a potential interview with Mueller. “I’m looking forward to it,” he answered. “I would love to do it.” He added that the interview could occur in “two or three weeks”. Trump’s statement would seem to end months of speculation about whether the special counsel would interview the president, though he also said he would testify under oath last year. The president’s attorneys have met with their counterparts in the special counsel’s office.

Mueller’s team is tasked with investigating Russian meddling in the election, including hacks of Democratic party emails and contacts between members of Trump’s campaign and Russians. The special counsel’s office has charged Trump’s former campaign manager Paul Manafort with money laundering and conspiracy, and his former national security adviser Michael Flynn and one of his former foreign policy advisers, George Papadopoulos, have each pleaded guilty to lying to the FBI about their contacts with Russians. The special counsel’s office is also investigating potential obstruction of justice, and has questioned the attorney general, Jeff Sessions, in part to discuss the president’s decision to fire James Comey as FBI director. Also on Wednesday, Trump rejected criticism of his attacks on the Russia inquiry. “You fight back, oh, it’s obstruction,” Trump said. He added: “We’re going to find out” if he gets a fair shake from Robert Mueller. “There’s been no collusion whatsoever,” Trump said. “There’s no obstruction whatsoever.”

For what it’s worth.

• Ratings Firm Issues First Grades On Cryptocurrencies (CNBC)

Weiss Ratings, which claims to offer the first “ratings” on cryptocurrencies, has judged ethereum to be better than bitcoin. The securities ratings agency announced Wednesday that it gave ethereum a B rating because it “benefits from more readily upgradable technology and better speed, despite some bottlenecks.” Bitcoin received a “fair” C+ rating because the digital currency is “encountering major network bottlenecks, causing delays and high transactions costs,” according to a release. “Despite intense ongoing efforts that are achieving some initial success, Bitcoin has no immediate mechanism for promptly upgrading its software code.” None of the 74 cryptocurrencies the agency covers received an “excellent” A rating. B-rated ethereum and digital currency EOS have the highest ratings.

That tough take is apparently a trademark of the 47-year-old independent financial ratings agency. Reports from Barron’s and The New York Times from 2002 and 1992, respectively, note Weiss’ lack of A ratings in coverage of insurance stocks, mutual funds and other securities. The Florida-based company usually flies under the radar in comparison to better-known agencies such as Standard & Poor’s and Moody’s. Weiss says it does not accept compensation from the companies it rates for issuing the rating. Foreign cryptocurrency investors were apparently very worried that Weiss would issue negative ratings on digital currencies. The agency said in a release Wednesday that “staff was up all night last night fending off denial of service attacks from Korea” and cited Korean social media posts calling others to bring down the ratings agency’s website. The hackers then broke into the website, took information from it and are distorting it on social media, the company said.

No, Beppe is not ‘gaffe-prone’. He built a formidable force, and he’s the first to recognize he’s too old to take the next step. M5S was always going to be movement by and for the young. Because they’re not yet corrupt.

• Beppe Grillo Steps Aside From Italy’s Five Star Movement (G.)

Beppe Grillo, the bombastic comedian who co-founded Italy’s anti-establishment Five Star Movement, has stepped aside in what some speculate could be a move to bolster the party’s chances before the general election on 4 March. Grillo, who has been instrumental in turning the movement into Italy’s most popular party, roared on to the political scene in 2009 after joining forces with the late web strategist Gianroberto Casaleggio to launch a blog that railed against political corruption. The blog struck a chord among an electorate weighed down by the economic crisis and fed up with the traditional political class, and became the driving force behind the movement’s phenomenal success in the 2013 elections, when it snatched the second-largest share of the votes.

But the blog has now removed most references to the party. The 69-year-old has started a new blog, which he said will focus on technology and visions for the future as part of an “extraordinary liberating adventure”. He added that while he “likes to have points of view” he is “fed up with opinions”. Quite what that means has left commentators guessing, but Grillo has been distancing himself from the party for some time. In 2015, just a year after the party made gains in the European elections, he announced that he was leaving politics and returning to comedy. As he toured comedy clubs, the gaffe-prone Grillo was thrust back into the spotlight a year later after taking a swipe at Sadiq Khan, saying the Muslim mayor of London would “blow himself up in front of Westminster”.

After that Grillo took more of a back seat, gradually grooming 31-year-old Luigi di Maio for the party’s leadership. Di Maio, who was elected leader in September and is the party’s candidate for prime minister, said on Tuesday night that the split did not mean “patricide” or “reneging on the past”. “The party is now moving forward on its own legs and getting stronger,” he said. The Five Star Movement is leading in opinion polls, ahead of the centre-left Democratic party, Silvio Berlusconi’s Forza Italia and the far-right Northern League. Roberto d’Alimonte, a political science professor at Rome’s Luiss University, said: “Maybe [Grillo] wants to guarantee its survival and see how it will fly in his absence.”

“..we won’t see it until after it’s signed, in Chile on March 8. Really. That’s the way things normally work.”

• How About Showing Us The TPP Deal We’re About To Sign? (SMH)

What’s in the revised Trans-Pacific Partnership deal for Australia? There’s no way to tell until we’ve seen the text, and we won’t see it until after it’s signed, in Chile on March 8. Really. That’s the way things normally work. After that, there’s still time to back out if we don’t want to ratify it, and there’s a precedent. All 12 would-be members signed up to the original Trans-Pacific Partnership in February 2016. Barack Obama found himself unable to get it through Congress and Donald Trump didn’t try. As best as we can tell, the new deal, TPP-11, is the old one with fewer bad bits. Twenty of the most contentious provisions included at the insistence of the US have been “suspended” until the US decides to join. They include enforced protections for the owners of pharmaceutical patents and extensions to copyright law.

There’s no guarantee they would come back if the US did decide to join. Each of the 11 other members would have to agree. Still in the agreement, although somewhat weakened, are the investor-state dispute settlement provisions insisted on by the US and Korea. They will allow private companies to sue national governments in extraterritorial tribunals, as Philip Morris did over Australia’s tobacco plain-packaging laws using the terms of an obscure Hong Kong investment agreement. John Howard successfully resisted having them in the US-Australia agreement and the Abbott government managed to avoid them in the Australia-Japan agreement, but we have apparently agreed to them now, for Japan, Korea and eight other nations. The upside is that our companies will also be able to sue governments.

It’s time for Putin to tell Erdogan to back off.

• Trump Warns Erdogan To Avoid Clash Between U.S., Turkish Forces (R.)

U.S. President Donald Trump urged Turkey on Wednesday to curtail its military operation in Syria and warned it not to bring U.S. and Turkish forces into conflict, but a Turkish source said a White House readout did not accurately reflect the conversation. Turkey’s air and ground operation in Syria’s Afrin region, now in its fifth day, targets U.S.-backed Kurdish YPG fighters, which Ankara sees as allies of Kurdish insurgents who have fought in southeastern Turkey for decades. Turkish President Tayyip Erdogan said he would extend the operation to Manbij, a separate Kurdish-held enclave some 100 km (60 miles) east of Afrin, possibly putting U.S. forces there at risk and threatening U.S. plans to stabilize a swath of Syria.

Speaking with Erdogan by telephone, Trump became the latest U.S. official to try to rein in the offensive and to pointedly flag the risk of the two allies’ forces coming into conflict. “He urged Turkey to deescalate, limit its military actions, and avoid civilian casualties,” a White House statement said. “He urged Turkey to exercise caution and to avoid any actions that might risk conflict between Turkish and American forces.” The United States has around 2,000 troops in Syria. However, a Turkish source said the White House statement did not accurately reflect the content of their phone call. “President Trump did not share any ‘concerns about escalating violence’ with regard to the ongoing military operation in Afrin,” the source said, referring to one comment in the White House summary of their conversation.

Get him out of there, to a safe place. Get him treatment. A society that persecutes its smartest and bravest cannot succeed.

• We Examined Julian Assange, And He Badly Needs Care – But He Can’t Get It (G.)

Julian Assange, the founder of WikiLeaks, has not stepped outside the heavily surveilled confines of the Ecuadorian embassy in London since he entered the building almost six years ago. Naturally, much of the media attention has focused on his international legal drama and threats to his safety, including arrest and possible extradition to the US. In contrast, ongoing violations of his human rights, including his fundamental right to healthcare in the context of his unusual confinement, have received less coverage. As clinicians with a combined experience of four decades caring for and about refugees and other traumatised populations, we recently spent 20 hours, over three days, performing a comprehensive physical and psychological evaluation of Mr Assange.

While the results of the evaluation are protected by doctor-patient confidentiality, it is our professional opinion that his continued confinement is dangerous physically and mentally to him, and a clear infringement of his human right to healthcare. Packing a stethoscope and blood pressure cuff, and after being conspicuously photographed entering the embassy, we performed our examinations in a poorly ventilated conference room. The reason for examining Mr Assange in these conditions is that he has no access to proper medical facilities. Although it is possible for clinicians to visit him in the embassy, most doctors are reluctant to do so. Even for those who will see him, their capacity to provide care is limited. At the embassy, there are none of the diagnostic tests, treatments and procedures that we have concluded he needs urgently.

As clinicians, it is our ethical duty to advocate for the health and human rights of all people as promised under international law, and to call on our colleagues to hold our professional societies, institutions and governments accountable. In 2012, Ecuador, in accordance with its right as a sovereign state, formally determined that Mr Assange meets the requirements enshrined by the 1951 convention and 1967 protocol relating to the status of refugees. Regardless of the allegations against Mr Assange, he remains a citizen of Australia and a refugee, and, as the Guardian reported last week, he is now also a citizen of Ecuador.

Trump should support Assange vs their common enemy.

• Washington Post, Legacy Press Betray Assange (DisM)

At this juncture, it bears reminding that Jeff Bezos, the current owner of the Washington Post, has a $600 million contract with the CIA in relation to his monolithic company Amazon. The Nation wrote in 2013: “Amazon, under the Post’s new owner, Jeff Bezos, recently secured a $600 million contract from the CIA. That’s at least twice what Bezos paid for the Post this year. Bezos recently disclosed that the company’s Web-services business is building a “private cloud” for the CIA to use for its data needs. Critics charge that, at a minimum, the Post needs to disclose its CIA link whenever it reports on the agency. Over 15,000 have signed the petition this week hosted by RootsAction.” The Nation’s coverage of the CIA’s contract with Amazon has since been removed from their web page for unknown reasons, but is available through archive services.

When discussing The Washington Post’s exercise in gaslighting, it is important to keep the outlet’s well-documented financial connection with the CIA through Bezos in mind. In so doing, it is also pertinent to note that the CIA has made its hatred for Assange very clear, especially over the course of the last year. CIA Director Mike Pompeo put the agency’s hatred for Wikileaks were on full display as recently as yesterday, when the CIA Director lambasted the journalistic organization as a threat on par with Al Qaeda. Pompeo said of Al Qaeda and Wikileaks: “They don’t have a flag at the UN, but they represent real threats to the United States of America.” That a group who publishes information that is inconvenient for the CIA would be likened to a terrorist network speaks to the threat which Wikileaks represents not to the safety of the American public, but to the plutocratic class and the American deep state.

Pompeo is well known for his previous reference to Wikileaks as a “non-state hostile intelligence service.” The Hill wrote of the incident: “In his first major public appearance since taking the top intelligence post in the Trump administration, Pompeo took aim at WikiLeaks founder Julian Assange and former National Security Agency (NSA) contractor Edward Snowden…” The Hill also cited Pompeo’s characterization of Assange as a: “fraud, a coward hiding behind a screen.” Pompeo’s vitriolic characterization of Wikileaks is helpful, because it demonstrates that the CIA’s response to Wikileaks is on par with the force with which terrorist organizations like Al Qaeda are pursued. In that light, the magnitude of the threat faced by Assange and Wikileaks associates cannot be over-estimated. Pompeo’s words are not only absurd in light of Wikileaks being an extremely accurate journalistic organization, but also depict the real impetus behind Assange having been trapped in the Ecuadorian embassy for years.

The CIA Director’s statements, even taken at face value, completely undercut the manipulative coverage of Wikileaks and Assange by outlets like the Washington Post. That providing evidence of corruption is considered an existential threat by the establishment is indicative of the value of Wikileaks to the public. The publisher is only a threat to those whose lies are exposed by their publications. The same plutocracy that has aggressively targeted Assange and Wikileaks has progressively strangled free press and freedom of thought in the United States and the world for decades.

The zenith of EU cruelty: starve a gutted economy of investment. It’s how you guarantee it can’t ever recover.

• Greece Pays A Heavy Price For Its Primary Surplus (K.)

Greece ended 2017 with a revenue shortfall of 719 million euros that was covered by the failure to implement budgeted investments of 1.57 billion euros, leading to a primary surplus of 1.94 billion euros. At the same time Greek taxpayers piled up more arrears to the state, with December witnessing an increase in the creation of new debts. The definitive data of the budget’s execution last year, issued on Wednesday by the Finance Ministry, showed that the primary surplus was far above the target, exceeding it by some 877 million euros. Public Investments Program spending was 800 million euros below target, depriving the economy of much-needed cash just as it is trying to recover.

The shortfall was particularly evident on the program’s EU co-funded side, which missed the target by 1.127 billion euros, while the national part of the program showed a 327-million-euro increase in investment. It is therefore no surprise that the economy is now seen to have grown by an even smaller rate than the revised estimate included in the 2018 budget. The 1.941-billion-euro primary surplus, if confirmed by Eurostat in April, will be added to the so-called cash buffer to be created ahead of the conclusion of the bailout program. The non-execution of public investments co-funded by the EU also had an impact on budget revenues, as inflows from Brussels were 1.213 billion euros short of the target.

Those that have jobs, that is.

• Greeks Work Longest Hours in Europe (GR)

Greeks work the longest hours in Europe, while Germans clock the least hours, new data by the OECD reveal. The OECD includes 35 developed countries and some developing nations. The data were presented during the World Economic Forum in Davos, Switzerland. Mexicans are shown to be the hardest workers in the world, as the average Mexican spends 2,255 hours working per year, the equivalent of around 43 hours per week. In Europe, Greeks work the longest hours, averaging 2,035 hours per year. Germans, on the other hand, work the least in Europe and the world, averaging only 1,363 hours per year. The differences between countries has to do with differences in work cultures, the OECD says.

For instance, Mexicans work the most hours because they have a fear of unemployment, while lax labor rules allow employers to break a 48-hour-week law. However, although South Koreans come third in hours worked per year, employees there aim to boost economic growth. The Japanese, who are stereotyped as working very long hours, in fact put in only 1,713 hours per year, below the OECD average. An important factor regarding hours of work is the level of productivity. According to the study, Germans work the least hours but manage to maintain high productivity levels. The average German worker is reported to be 27% more productive than their British counterparts who work 1,676 hours per year. The Dutch, French and Danes also work fewer than 1,500 hours per year on average, while Americans average 1,783 work hours per year.

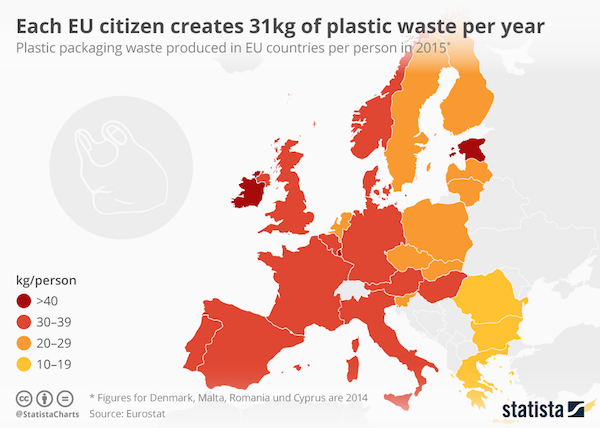

The easiest problem to solve, isn’t. So what hope is there then? If you must have plastic, and you rarely do really, make it compostable, edible. By next year, not 20-30 years from now.

• Each EU Citizen Creates 31kg Of Plastic-Waste Per Year (Stat.)

Plastic packaging waste is a huge problem around the world. Despite efforts in some European countries such as plastic bottle deposit schemes or having to pay for plastic bags in the supermarket, Statista’s Martin Armstrong notes that the average EU citizen creates 31kg of plastic waste per year. Eurostat figures show that the UK lies above this average, with its citizens responsible for 35kg of waste. The worst country by a long way though is Ireland. 61kg of packaging is thrown away by the average Irish person, 9kg more than the second most prolific country, Luxembourg. The least is created in Bulgaria where a more acceptable 14kg is disposed of over the year.