Times Square at night 1954

Is there anything sadder in the world?

• Last Male Northern White Rhino Dies (Sky)

The last male northern white rhino has died in Kenya, keepers have confirmed. The 45-year-old animal died from “age-related complications”, leaving only two females of his subspecies alive. In a statement, the Ol Pejeta Conservancy in Kenya said the rhino, called Sudan, was put down after his condition “worsened significantly” and he was unable to stand. Scientists have gathered his genetic material and are working on developing in-vitro fertilisation (IVF) to save his subspecies. In a statement, the zoo wrote: “Sudan will be remembered for his unusually memorable life. “In the 1970s, he escaped extinction of his kind in the wild when he was moved to Prague Zoo. Throughout his existence, he significantly contributed to survival of his species as he sired two females.

“Additionally, his genetic material was collected yesterday and provides a hope for future attempts at reproduction of northern white rhinos through advanced cellular technologies. “During his final years, Sudan came back to Africa and stole the heart of many with his dignity and strength.” Richard Vigne, Ol Pejeta’s CEO, said: “We on Ol Pejeta are all saddened by Sudan’s death. “He was a great ambassador for his species and will be remembered for the work he did to raise awareness globally of the plight facing not only rhinos, but also the many thousands of other species facing extinction as a result of unsustainable human activity. “One day, his demise will hopefully be seen as a seminal moment for conservationists worldwide.”

The northern white rhino population in Uganda, Sudan, Chad and Central African Republic was largely wiped out by poachers in the 1970s and 1980s, fuelled by a demand for rhino horn in traditional Chinese medicine and dagger handles in Yemen. Four fertile northern white rhinos, two male and two female, were moved from a zoo in the Czech Republic to Ol Pejeta with high hopes they would breed in an environment similar to their native habitat. Although they were seen mating, there were no successful pregnancies.

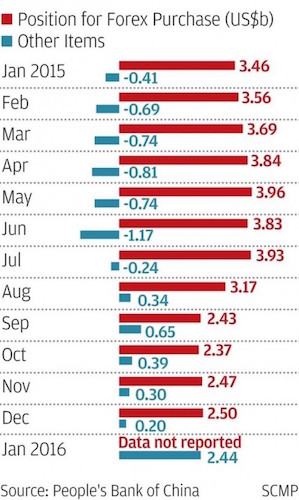

To be fair, we’re killing our own species too. Where is the US going to find the $47 trillion?

• Alzheimer Care For Americans Alive Today Projected To Cost $47 Trillion (BBG)

Alzheimer’s disease is among the most expensive illnesses in the U.S. There’s no cure, no effective treatment and no easy fix for the skyrocketing financial cost of caring for an aging population. Spending on care for people alive in the U.S. right now who will develop the affliction is projected to cost $47 trillion over the course of their lives, a report issued Tuesday by the Alzheimer’s Association found. The U.S. is projected to spend $277 billion on Alzheimer’s or other dementia care in 2018 alone, with an aging cohort of baby boomers pushing that number to $1.1 trillion by 2050. Research so far has been stymied by clinical failures. By one count, at least 190 human trials of Alzheimer’s drugs have ended in failure.

No company has successfully marketed a drug to treat it, though many big pharmaceutical companies, including Merck and Pfizer, have tried. Biogen, a company based in Cambridge, MA, saw its shares dive last month after it said it was expanding the number of participants in its trial for the drug aducanumab. However, significant cost savings can be achieved, according to the new report, by the simple act of early diagnosis. Currently, individuals are typically diagnosed in the dementia stage, rather than when they have developed only mild cognitive impairment [MCI]. Identifying the disease early can allow it to be better managed, in part with existing drugs that treat its symptoms. In doing so, the study postulates, America could save $7.9 trillion over the lifetimes of everyone alive right now.

The Alzheimer’s Association commissioned researchers at Precision Health Economics to study the potential savings of obtaining an earlier diagnosis. It used data from the Health and Retirement Study, a “nationally representative sample of adults age 50 and older,” run by the University of Michigan and supported by the National Institute on Aging and the Social Security Administration. The $7.9 trillion in savings was derived from a scenario in which all adults who develop Alzheimer’s receive an early diagnosis in the MCI stage. The cumulative cost in such a circumstance is projected at $39.2 trillion—far below the $47.1 trillion that would be spent under current diagnostic patterns.

[..] There are now an estimated 5.5 million Americans aged 65 or older with Alzheimer’s. In 2025, that number is projected to be 7.1 million. By 2050, it could reach 13.8 million. Along with the increasing costs, the report also found Alzheimer’s to be increasingly lethal. It’ss currently the sixth-leading cause of death in the U.S., and deaths attributed to it jumped by 123% between 2000 to 2015, the report found.

What stock market?

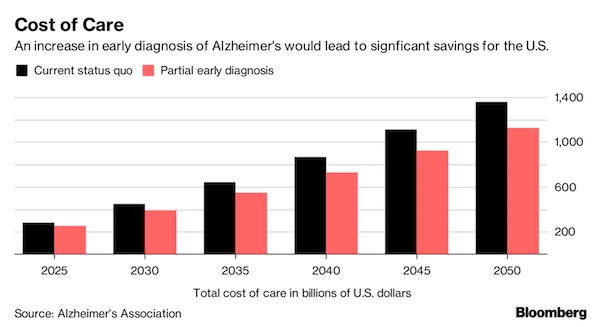

• The Stock Market Meltup Is Over: Morgan Stanley (MW)

The stock market meltup is over. At least, that’s the prognosis of one prominent Wall Street strategist who believes the torrid January rally that gave way to a correction may have been the market’s short-term apex. The S&P 500 jumped 7.5% between the end of 2017 and Jan. 26, when it notched the last in a string of record closes at 2,872.87. “We think January was the top for sentiment, if not prices, for the year. With volatility moving higher we think it will be difficult for institutional clients to gross up to or beyond the January peaks,” said Michael Wilson, chief U.S. equity strategist at Morgan Stanley Institutional Securities, in his weekly note on Monday. “Retail sentiment indicators also look to have peaked in January and we do not see anything on the horizon to get retail investors more bullish than they were following a tax cut.”

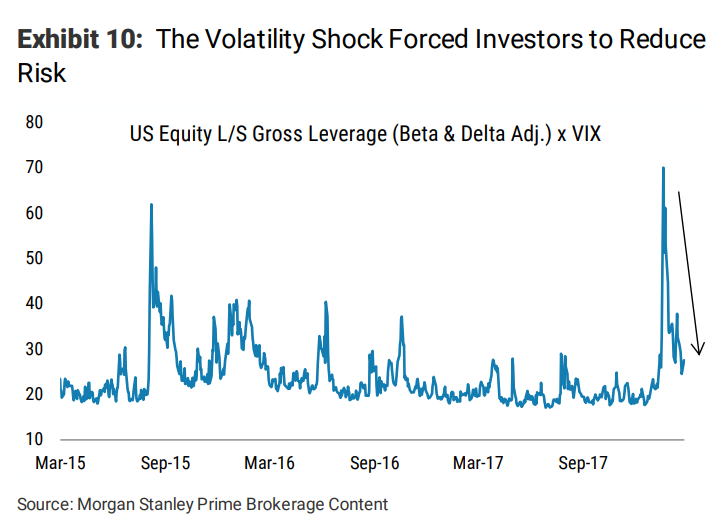

As a result, the much-anticipated meltup in stocks that numerous strategists had been forecasting since last year won’t likely happen in 2018, he said. A meltup is an unexpected rise in asset prices as investors surge into the market on fear of missing out. “When we look at our internal data combined with industry flows and sentiment, we think there is a strong case that January was the melt-up, or at least the culmination of it,” Wilson added. One key point in Wilson’s thesis is that gross leverage by Morgan Stanley’s hedge fund clients hit an all-time high in January. Gross leverage, according to the strategist, is a good measure of investor willingness to assume risk.

The record was also set right before the early February “volatility shock” forced investors to scale back their exposure to risk and Wilson does not expect gross leverage to return to January levels any time in the near future.

Going forward, Wilson expects U.S. stock returns to be mostly driven by increase in earnings estimates. “If we just roll forward the current bottom-up estimates, the forward earnings per share would be $166 and $170 by June 30 and September 30, respectively. That is approximately 3% and 5% higher than today’s $161. Not exciting, but not very bad either,” he said. “However, those numbers might need to come down if we start to see some evidence of lower margins since consensus forecasts assume no operating margin degradation. That is another reason why we think the S&P 500 makes its highs for the year this summer. It’s also a wild card that has big idiosyncratic risk at the stock level in our view.”

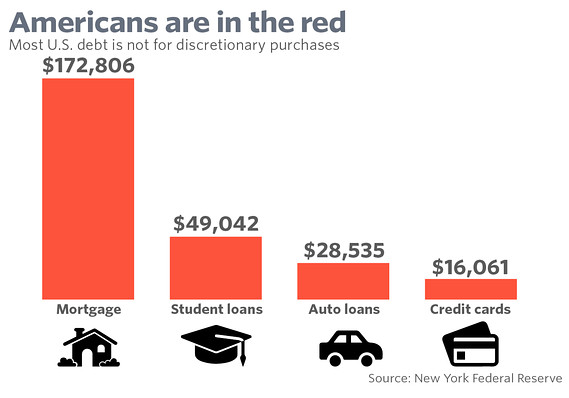

The many faces of debt.

• It’s Not Just Tech. Credit Markets Give Fuel to Equity Rout (BBG)

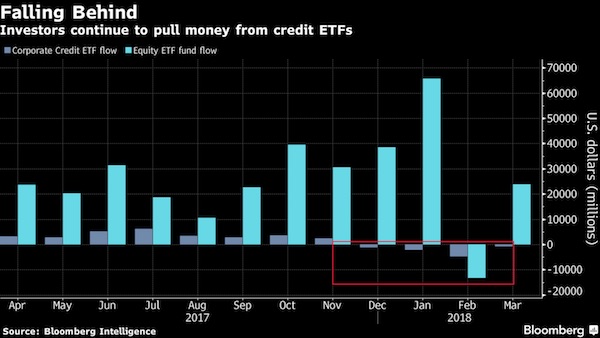

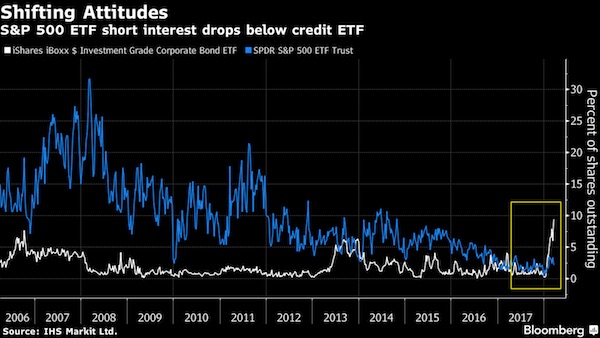

Equity investors grappling with a technology selloff, trade tensions and hawkish monetary chatter have a new foe to contend with: growing angst in credit markets. After resisting the full force of the gales that swept through markets earlier this year, corporate bonds are sending ominous messages. Traders are jumping out of the asset class as investment-grade spreads sit near their widest in six months and yields rise to the highest in more than six years – just as stock investors seek to recover from the first S&P 500 correction in two years. “If credit spreads widen, the equities with bad balance sheets will underperform,” said Louis de Fels at Raymond James Asset Management. “We’re quite cautious on the quality of the assets.”

Corporate bonds held by smart money have historically proven a leading indicator for the direction of stocks. That may spell disappointment for investors heeding Wall Street advice to shift towards equity, a late-cycle outperformer. “Credit leads equities and will underperform,” said Andrew Brenner at Natalliance Securities in New York, citing Federal Reserve hikes, signs of softer U.S. output and corporate sales of short-term U.S. debt. “We expect equities to catch up on the downside.” For now, stock investors appear sanguine. U.S. equity funds took in a record $34.5 billion in the week to March 14, compared to just $2.4 billion for bonds, according to Stanford C Bernstein. That brings the quarterly total for debt funds to $37.3 billion, the slimmest quarterly addition since the three months ending in December 2016, the data show.

But in the end it’s just another form of debt.

• How Economies Could Insure Themselves Against The Bad Times (Shiller)

The time has come for national governments around the world to start issuing their debt in a new form, linked to their countries’ resources. GDP-linked bonds, with coupons and principal that rise and fall in proportion to the issuing country’s GDP, promise to solve many fundamental problems that governments face when their countries’ economies falter. And, once GDP-linked bonds are issued by a variety of countries, investors will be attracted by the prospect of high returns when some of these countries do very well. This new debt instrument is especially exciting because of its monumental size. Although issues may start out small, they will be very important from the outset. The capitalised value of total global GDP is worth far more than the world’s stock markets and could be valued today in the quadrillions of US dollars.

[..] I have been advocating something like GDP-linked bonds for 25 years. In my 1993 book Macro Markets, I described the world’s GDPs as the “mother of all markets” and emphasised a form of debt called “perpetual claims”. But I did not work out a real plan of implementation and advocacy. [The book] ‘Sovereign GDP-Linked Bonds’ does just that. The basic idea is simple enough. Governments issue GDP-linked bonds to raise funds, just as corporations issue shares. By issuing such bonds, governments pledge to pay in proportion to the resources they have, measured by their countries’ GDP. The price-to-GDP ratio of GDP-linked bonds is essentially analogous to the price-to-earnings ratio of corporate shares. The difference is that GDP is an order of magnitude larger than corporate profits represented by the stock market.

Well, it won’t be boring.

• US Expected To Impose Up To $60 Billion In China Tariffs By Friday (R.)

The Trump administration is expected to unveil up to $60 billion in new tariffs on Chinese imports by Friday, targeting technology, telecommunications and intellectual property, two officials briefed on the matter said Monday. One business source, who has discussed the issue with the administration, said that the China tariffs may be subject to a public comment period, which would delay their effective date and allow industry groups and companies to lodge objections. This would be considerably different from the quick implementation of the steel and aluminum tariffs, which are set to go into effect on March 23, just 15 days after President Donald Trump signed the proclamations.

A delayed approach could allow time for negotiations with Beijing to try to resolve trade issues related to the administration’s “Section 301” probe into China’s intellectual property practices before tariffs take effect. The White House declined to comment Monday. China has vowed to take retaliatory measures in response. A source who had direct knowledge of the administration’s thinking told Reuters last week that the tariffs, authorized under the 1974 U.S. Trade Act, would be chiefly targeted at information technology, consumer electronics and telecoms and other products benefiting from U.S. intellectual property. But they could be much broader and hit consumer products such as clothing and footwear, with a list eventually running to 100 products, this person said.

But Zuckerberg sold just in time.

• Facebook Stock Value Down $35 Billion On Cambridge Analytica Controversy (Ind.)

Facebook stock dropped $35bn (£25bn) by close of trading on Wall Street, as the company deals with questions over its privacy rules in the wake of a scandal involving data firm Cambridge Analytica harvesting a vast repository of user information. The social media giant’s stock value declined by around 7%, paralleling losses throughout the technology industry and raising questions about the controversy inflicting lasting damage to Facebook’s bottom line. It amounted to the largest single-day%age decline for Facebook stock since 2014, with the drop outpacing broader declines across Wall Street.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite all shed more than a percentage point in value by market’s close. Prominent tech companies like Apple, Microsoft and Alphabet all saw declines as political pressure on Facebook intensified, building on months of deepening scrutiny of the tech sector by elected officials.

Six degrees of Facebook.

• Former Obama Campaign Director: Facebook Was “On Our Side” (ZH)

The recent controversy and escalating scandal over Facebook’s decision to ban Trump-linked political data firm Cambridge Analytica over the use of data harvested through a personality app under the guise of academic research has opened a veritable Pandora’s box of scandal for the Silicon Valley social media giant. Carol Davidsen, who served as Obama’s director of integration and media analytics during his 2012 campaign (in her LinkedIn profile she says she was responsible for “The Optimizer” & “Narwhal” big data analytics platforms), claims – with evidence, that Facebook found out about a massive data-mining operation they were conducting to “suck out the whole social graph” in order to target potential voters.

After Facebook found out, they knowingly allowed them to continue doing it because they were supportive of the campaign. “[M]ore than 1 million Obama backers who signed up for the [Facebook-based app] gave the campaign permission to look at their Facebook friend lists. In an instant, the campaign had a way to see the hidden young voters. Roughly 85% of those without a listed phone number could be found in the uploaded friend lists. What’s more, Facebook offered an ideal way to reach them,” reads an article Davidsen posted as a prelude to her postings.

I doubt that it can make it worse. We haven’t seen the beginning of it.

• How Facebook Made Its Data Crisis Worse (BBG)

Facebook tried to get ahead of its latest media firestorm. Instead, it helped create one. The company knew ahead of time that on Saturday, the New York Times and The Guardian’s Observer would issue bombshell reports that the data firm that helped Donald Trump win the presidency had accessed and retained information on 50 million Facebook users without their permission. Facebook did two things to protect itself: it sent letters to the media firms laying out its legal case for why this data leak didn’t constitute a “breach.” And then it scooped the reports using their information, with a Friday blog post on why it was suspending the ad firm, Cambridge Analytica, from its site. Both moves backfired.

On Friday, Facebook said it “received reports” that Cambridge Analytica hadn’t deleted the user data, and that it needed to suspend the firm. The statement gave the impression that Facebook had looked into the matter. In fact, the company’s decisions were stemming from information in the news reports set to publish the next day, and it had not independently verified those reports, according to a person with knowledge of the matter. By trying to look proactive, Facebook ended up adding weight to the news.

On Saturday, any good will the company earned by talking about the problem first was quickly undone when reporters revealed Facebook’s behind-the-scenes legal maneuvering. “Yesterday Facebook threatened to sue us. Today we publish this,” Carole Cadwalladr, the Observer reporter, wrote as she linked her story to Twitter, in a post shared almost 15,000 times. The Guardian said it had nothing to add to her statement. The Times confirmed that it too received a letter, but said it didn’t consider the correspondence a legal threat.

You ain’t seen nothing yet.

• Tech World Experiencing A Major ‘Trust Crisis’ – Futurist (CNBC)

Big brands have to reestablish trust with consumers on data safety, futurist Chris Riddell told CNBC at Credit Suisse’s annual Asian Investment Conference on Tuesday. Riddell, who describes his job title as “fundamentally seeing how technology is changing humanity,” said the world is currently experiencing a severe “trust crisis.” “People now are more willing to share data than ever before” but the of data breaches at major companies break “trust and confidence,” he stated.

Social media platform Facebook is currently under fire amid allegations that private data firm Cambridge Analytica lied about deleting user data it had improperly obtained from a Russian-American researcher in 2015. “We’re in an era of category killers, where one organization is dominating in an industry,” Riddell said, pointing to Facebook and Google as examples. The challenge for those businesses is to rebuild trust and use technology to create transparency, he continued.

RussiaRussiaRussia

• If You Come to a Fork in the Road, Take It (Jim Kunstler)

Various readers, fans, blog commenters, Facebook trolls, and auditors twanged on me all last week about my continuing interest in the RussiaRussiaRussia hysteria, though there is no particular consensus of complaint among them — except for a general “shut up, already” motif. For the record, I’m far more interested in the hysteria itself than the Russia-meddled-in the-election case, which I consider to be hardly any case at all beyond 13 Russian Facebook trolls.

The hysteria, on the other hand, ought to be a matter of grave concern, because it appears more and more to have been engineered by America’s own intel community, its handmaidens in the Dept of Justice, and the twilight’s last gleamings of the Obama White House, and now it has shoved this country in the direction of war at a time when civilian authority over the US military looks sketchy at best. This country faces manifold other problems that are certain to reduce the national standard of living and disrupt the operations of an excessively complex and dishonest economy, and the last thing America needs is a national war-dance over trumped-up grievances with Russia.

The RussiaRussiaRussia narrative has unspooled since Christmas and is blowing back badly through the FBI, now with the firing (for cause) of Deputy Director Andrew McCabe hours short of his official retirement (and inches from the golden ring of his pension). He was axed on the recommendation of his own colleagues in the FBI’s Office of Professional Responsibility, and they may have been influenced by the as-yet-unreleased report of the FBI Inspector General, Michael Horowitz, due out shortly.

The record of misbehavior and “collusion” between the highest ranks of the FBI, the Democratic Party, the Clinton campaign, several top political law firms, and a shady cast of international blackmail peddlars is a six-lane Beltway-scale evidence trail compared to the muddy mule track of Trump “collusion” with Russia. It will be amazing if a big wad of criminal cases are not dealt out of it, even as The New York Times sticks its fingers in its ears and goes, “La-la-la-la-la….” It now appears that Mr. McCabe’s statements post-firing tend to incriminate his former boss, FBI Director James Comey — who is about to embark, embarrassingly perhaps, on a tour for his self-exculpating book, A Higher Loyalty: Truth, Lies, and Leadership.

Going mainstream doesn’t seem to fit the deep state’s preferences.

• Over 70% of US Citizens Believe America Is Controlled By A ‘Deep State’ (RT)

Over 70% of US citizens in the Republican and Democratic parties believe America is controlled by a “deep state” of unelected government officials, according to a new poll. They also fear state surveillance, it reveals.

Although most Americans interviewed are not familiar with the term ‘deep state’, when they heard the definition as a cadre of unelected government and military officials who secretly influence government policies, a majority expressed belief in its ‘probable existence’ according to the Monmouth University poll released Monday.Additionally six in 10 of those polled think that these unelected government figures wield too much power when it comes to shaping federal policy. “We usually expect opinions on the operation of government to shift depending on which party is in charge. But there’s an ominous feeling by Democrats and Republicans alike that a ‘deep state’ of unelected operatives are pulling the levers of power,” said Patrick Murray, director of the independent Monmouth University Polling Institute.

Donald Trump has popularized the term ‘deep state’ over the course of his presidency. In January he blasted the ‘deep state’ Department of Justice for allegedly shielding a Hillary Clinton aide who used a non-secure private email account while conducting government business. The poll also highlights widespread fears of state surveillance, with 80% of Americans believing that the US government currently spies on the activities of its citizens. “This is a worrisome finding. The strength of our government relies on public faith in protecting our freedoms, which is not particularly robust. And it’s not a Democratic or Republican issue. These concerns span the political spectrum,” Murray added.

When incompetence shines through. They’re pitching anti-Corbyn attack ads on…Facebook.

• UK Tories Set To Slump To Record Low At Local Elections (G.)

Conservative party support in London looks set to slump to a record low at the local elections on 3 May as the young, ethnically diverse electorate turns to Labour in increasing numbers. Projections from the Tory peer and psephologist Robert Hayward indicate the Conservatives will lose about 100 council seats. If they lose more than 93 – less than three seats in each of London’s boroughs – the Tories would fall below their previous low of 511 councillors in the capital. That came in 1994, just after the pound had fallen out of the exchange rate mechanism and Labour had begun the recovery that led to its 1997 general election landslide. “I’d be surprised if the Tories did not have an all-time low number of councillors,” Hayward said.

“Labour were very successful in London in the general election last year and I’d expect that to continue in 2018.” The Tories could even lose their two flagship boroughs of Wandsworth, which has been in Conservative control since 1978, and Westminster, which has been Tory since the last local government reorganisation in 1964. More likely, Barnet in north London might go Labour and the Liberal Democrats could triumph in Kingston in south-west London where they are also targeting the neighbouring council, Richmond. The most spectacular reverse would be the loss of Kensington and Chelsea, the Conservative heartland won by Labour with the narrowest of margins at last year’s general election, where the Tory council has come under fire for its mishandling of the Grenfell Tower fire.

He took the money and then killed him.

• Former French President Sarkozy In Custody Over Libya Funding Probe (F24)

Former French president Nicolas Sarkozy has been called in for questioning by investigators looking into suspected Libyan financing of his 2007 election campaign, an official in the French judiciary said Tuesday. Libyan officials from the Gaddafi era have claimed they helped finance Sarkozy’s election campaign. An investigation into the case has been underway since 2013. It is the first time Sarkozy has been questioned in the inquiry. The hearing comes several weeks after a former associate, Alexandre Djouhri, was arrested in London as part of the investigation and later released on bail. Investigators are examining claims that Gaddafi’s regime secretly gave Sarkozy €50 million overall for the 2007 campaign. Such a sum would be more than double the legal campaign funding limit at the time of €21 million.

In November 2016, French-Lebanese businessman Ziad Takieddine said he delivered three suitcases from Libya, containing five million euros in cash, to Sarkozy and his former chief of staff and campaign director, Claude Guéant, between 2006 and 2007. Sarkozy, who was president from 2007 to 2012, has always denied the allegations. A lawyer for the former French president could not be reached immediately for comment on Tuesday. Sarkozy had a complex relationship with Gaddafi. Soon after his election to the presidency, Sarkozy invited the Libyan leader to France for a state visit and welcomed him with high honors. But Sarkozy then put France in the forefront of NATO-led airstrikes against Gaddafi’s troops that helped rebel fighters topple his regime in 2011.

In other news: war is peace.

• Greece Undermining EU-Turkey Migrant Deal, German Report Says (K.)

Data published by the German newspaper Die Welt suggest that Greece has been undermining the European Union-Turkey deal signed two years ago to stem the flow of refugees and migrants to the continent. Citing unnamed officials in Berlin, Brussels and the EU’s border agency Frontex, the report alleges that the Greek government has moved a large number of asylum seekers from the Aegean islands to the mainland, effectively preventing their return to Turkey. The message is that any asylum seeker who manages to land on one of the Greek islands, he can then move on to central Europe, officials told the newspaper.

According to EU figures cited by the newspaper, between March 2016 and January 2018, 62,190 asylum seekers landed on the Aegean islands, of whom 27,635, or 45%, were subsequently transferred to mainland Greece. German officials told the newspaper that only a very small number of people whose asylum request had been turned down by authorities had been returned to Turkey. Greece, the same officials said, is effectively creating an incentive for migrants hoping to enter the continent which could lead to a spike in arrivals.