Laurits Andersen Ring At Breakfast 1898

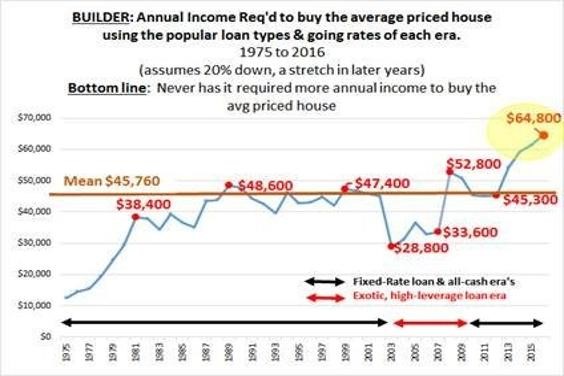

Income vs prices has never been more expensive. There’s much more in Hanson’s article.

• Most Expensive Housing Ever: A 1% Mortgage Rate Surge Changes Everything (MH)

BUILDER HOUSES: The average $361k builder house requires nearly $65k in income assuming a 4.5% rate, 20% down, and A-grade credit. Problem is, 20% + A-credit are hard to come by. For buyers with less down or worse credit, far more than $65k is needed. For the past 30-YEARS income required to buy the average priced house has remained relatively consistent, as mortgage rate credit manipulation made houses cheaper. Bottom line: Reversion to the mean can occur through house price declines, credit easing, a mortgage rate plunge to the high 2%’s, or a combination of all three. However, because rates are still historically low and mortgage guidelines historically easy, the path of least resistance is lower house prices.

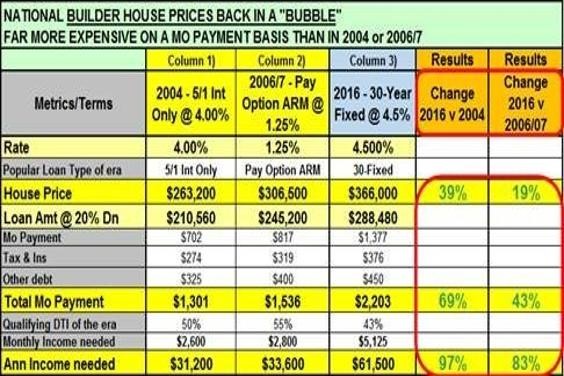

The following chart compares Bubble 1.0 (2004 and 2006) to Bubble 2.0 on an apples-to-apples basis using the popular loan programs of each era. Bottom line: Builder prices are up 19% from 2006 but the monthly payment is 43% greater and annual income needed to qualify for a mortgage 83% more.

‘T is the season to be plastic.

• This Christmas Americans Will Spend An Average Of $422 Per Child (EC)

For many Americans, the quality of Christmas is determined by the quality of the presents. This is especially true for our children, and some of them literally spend months anticipating their haul on Christmas morning. I know that when I was growing up Christmas was all about the presents. Yes, adults would give lip service to the other elements of Christmas, but all of the other holiday activities could have faded away and it still would have been Christmas as long as presents were under that tree on the morning of December 25th. Perhaps things are different in your family, but it is undeniable that for our society as a whole gifts are the central feature of the holiday season. And that is why so many parents feel such immense pressure to spend a tremendous amount of money on gifts for their children each year.

Of course this pressure that they feel is constantly being reinforced by television ads and big Hollywood movies that continuously hammer home what a “good Christmas” should look like. Once again in 2016, parents will spend far more money than they should because they want to make their children happy. According to a brand new survey from T. Rowe Price, parents in the United States will spend an average of 422 dollars per child this holiday season… “More than half of parents report they aim to get everything on their kids’ wish lists this year, spending an average of $422 per child, according to a new survey from T. Rowe Price.” To me, that seems like a ridiculous amount of money to spend on a single child, but this is apparently what people are doing.

But can most families really afford to be spending so wildly? Of course not. As I have detailed previously, 69% of all Americans have less than $1,000 in savings. That means that about two-thirds of the country is essentially living paycheck to paycheck. So all of this reckless spending brings with it a lot of additional financial pressure. But because we are a “buy now, pay later” society, we do it anyway. We are willing to mortgage a little bit of the future in order to have a nice Christmas now. Another new survey has found that close to half the country feels “pressure to spend more than they can afford during the holiday season”…

Possible only -beyond short term- with Fed money. Animal spirits sounds cute, but all investors have is money based on ultra cheap rates.

• Ray Dalio Says Animal Spirits Under Donald Trump Just Getting Started (F.)

During the dark days of the financial crisis Ray Dalio, head of the world’s largest hedge fund Bridgewater Associates, published papers and YouTube seminars to describe the forces that drive the economy and explain why severe cycles like the credit collapse occur. The effort was intended to guide productive responses to the implosion of Wall Street, which crippled Main Street, and avert policies that could diminish a recovery. With the Dow Jones Industrial Average nearing a record 20,000, unemployment below 5% and the U.S. economy in the seventh year of a recovery, Dalio’s tomes on ‘how the economic machine works’ aren’t as top of mind as they once were. But that’s not to say Dalio, one of Wall Street’s weightiest hedge fund investors, has lost interest in the subject.

On Tuesday morning, Dalio published a monthly update that indicates he believes the U.S. economy is poised for a sudden and dramatic shift under President-elect Donald Trump. If the economic machine is presently churning along in a steady but somewhat muted recovery from the Great Recession, Dalio believes it may kick into overdrive as Trump implements a pro-business agenda that could stimulate the animal spirits of investors and businesses across United States. “[T]he Trump administration could have a much bigger impact on the US economy than one would calculate on the basis of changes in tax and spending policies alone because it could ignite animal spirits and attract productive capital,” Dalio states in a post published to LinkedIn. He adds, “regarding igniting animal spirits, if this administration can spark a virtuous cycle in which people can make money, the move out of cash (that pays them virtually nothing) to risk-on investments could be huge.”

Dalio believes Trump has staffed his administration with business-people who will be inclined to take quick action on perceived drags on the economy, whether that involves taxation, regulation or labor laws. What’s also clear is Dalio believes there are presently major impediments to the economy that need to be lifted. “This new administration hates weak, unproductive, socialist people and policies, and it admires strong, can-do, profit makers,” says Dalio. The Trump administration “wants to, and probably will, shift the environment from one that makes profit makers villains with limited power to one that makes them heroes with significant power,” he adds [..] “A pro-business US with its rule of law, political stability, property rights protections, and (soon to be) favorable corporate taxes offers a uniquely attractive environment for those who make money and/or have money. These policies will also have shocking negative impacts on certain sectors,” Dalio says, without describing in more detail the winners and losers.

The ongoing confusions about what inflation is. One key rule: if spending doesn’t rise, and by a lot, there will be no inflation. There may be higher prices for some things, but that’s not the same. And where could higher spending come from when 2/3 of Americans don’t even have $1000 saved for an emergency?

• Someone Has to Tell The Fed Inflation Is Not Accelerating (CEPR)

The Federal Reserve Board raised interest rates last week and seem poised to do so again in the not distant future. The rationale is that the economy is now near or at full employment and that if job growth continues at its recent pace it will lead to a harmful acceleration in the inflation rate. We have numerous pieces raising serious questions about whether the labor market is really at full employment, noting for example the sharp drop in employment rates (for all groups) from pre-recession levels and the high rate of involuntary part-time employment. But the story of accelerating inflation is also not right. This is particularly important, since John Williams, the president of the San Francisco Fed, cited accelerating inflation as a reason to support last week’s rate hike, and possibly future rate hikes, in an interview in the New York Times.

Williams has been a moderate on inflation, so there are many members of the Fed’s Open Market Committee who are more anxious to raise rates than him. A close look at the data does not provide much evidence of accelerating inflation. The core PCE deflator, the Fed’s main measure of inflation, has risen 1.7% over the last year, which is still under the 2.0% target. This target is an average, which means that the Fed should be prepared to allow the inflation rate to rise somewhat above 2.0%, with the idea that inflation will drop in the next recession. Anyhow, the 1.7% rate is slightly higher than a low of 1.3% reached in the third quarter of 2015, but it is exactly the same as the rate we saw in the third quarter of 2014. In other words, there has been zero acceleration in the rate of inflation over the last two years.

Furthermore, even this modest acceleration has been entirely due to the more rapid increase in rent over the last two years. The inflation rate in the core consumer price index, stripped of its shelter component, actually has been falling slightly over the last year. It now stands at 1.1% over the last year. It is reasonable to pull shelter out of the CPI because rents do not follow the same dynamic as most goods and services. In fact, higher interest rates, by reducing construction, are likely to increase the pace of increase in rents rather than reduce them.

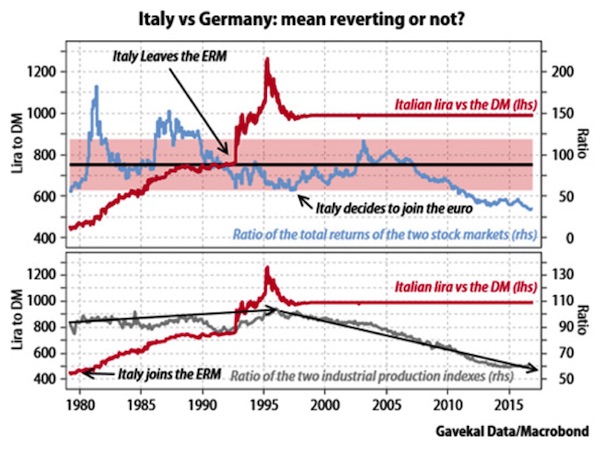

Italy’s banks are about to do the country in.

• Brace Yourself For Italy’s Bankruptcy (Gavekal)

Matteo Renzi has joined a long line of Italian prime ministers who failed to “reform” their country. This is another way of saying that he could not wave a magic wand and make Italy competitive with Germany. The grim reality is that no Italian leader stood a chance of changing their country once the fateful decision was made to peg its currency to Germany’s. At the time of the euro’s launch in 1999, I argued that the risk profile of Italy would change from being an economy where there was a high probability of many currency devaluations to the certain probability of eventual bankruptcy. Sadly, that moment is not so far away.

The chart below tells the story of Italy’s recent economic history in two parts, namely, (i) March 1979 to March 1999, and (ii) March 1999 to the present. Italy joined the Exchange Rate Mechanism in 1979 at 443 lira per deutschemark, yet by 1990 frequent devaluations meant that rate had slid to about 750 lira. By the early 1990s, the Bundesbank was overseeing a newly unified German monetary system and in order to fight inflation it had driven real interest rates to 7%. By September 1992 the stresses on the system caused the UK, Sweden and Italy to exit the ERM, which meant another huge currency devaluation, pushing the lira as low as 1250 against the deutschemark, but delivering a huge tourist boom to boot.

Still, from 1979 to 1998 Italian industrial production outpaced that of Germany by more than 10%, while Italian equities outperformed German equivalents by 16% (this indicates that Italian firms were earning a higher return on invested capital than those in Germany). Then came the euro. By 2003 it was clear that Italy was uncompetitive and subsequently, Italian equities have underperformed German equities by -65%, reversing the previous half century’s pattern when Italian equities outperformed on a total return basis. Similarly, since 2003 Italian factory output has lagged Germany’s by 40%.

The diagnosis is simply that Italy has become woefully uncompetitive, and as a result, is not solvent. This much is clear from the perilous state of its banking system, which is always the outcome when banks lend to firms that have been rendered uncompetitive by some reckless central banker. Short of imposing Greek-style slavery on Italy, there is not much hope of solving the problem, but I rather doubt that the Italian electorate will be as patient as its neighbours across the Ionian sea.

Let Beppe Grillo have a go at this. What does Italy have to lose?

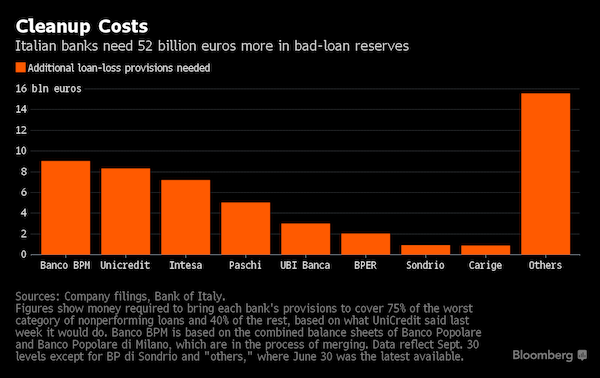

• Italy Bank Rescue Won’t Fill $54 Billion Hole in Balance Sheets (BBG)

Italian banks need at least €52 billion ($54 billion) to clean up their balance sheets, much more than the rescue package proposed Monday by the government. The shortfall is an estimate of how much lenders would have to increase loan-loss provisions to allow for the sale of bad debt. It includes the 8 billion euros of provisions UniCredit has said it will add before selling €18 billion of its worst loans and uses that ratio as a proxy for the gap at other banks. The total also includes the 5 billion euros Banca Monte dei Paschi di Siena has been struggling to raise in recent months. The Italian government asked parliament this week to increase the public borrowing limit by as much as €20 billion to potentially backstop Monte Paschi and other lenders.

The rescue package needs to be closer to €30 billion to solve Italy’s bad-debt crisis, according to Paola Sabbione at Deutsche Bank. That conclusion assumes UniCredit and some other lenders can raise about €20 billion through capital markets, asset sales and profit retention – leaving the government to fill the rest of the €52 billion hole. “Some of the publicly traded banks can probably raise some of the funds needed for a cleanup, including Monte Paschi,” said Sabbione, who has covered Italian banks for the past decade. “So the government would have to plug in the rest. But still, at this level, it won’t do the full job.” UniCredit, the nation’s largest lender, plans to increase loan-loss provisions to 75% for nonperforming loans with the lowest chances of recovery and 40% for two other categories considered less dire.

The increased writedowns will help the Milan-based lender sell about a third of its bad loans to asset manager Fortress Investment. UniCredit is planning to raise €13 billion of new equity funding to cover the increased provisions as well as other restructuring costs and to improve its capital ratio. The company’s shares have jumped 15% since the Dec. 13 announcement, giving analysts confidence the bank will have little trouble tapping investors for the funds. Italian banks had €356 billion of bad loans at the end of June and €165 billion of provisions against them, according to the latest Bank of Italy data. To get the worst category to 75% provisioning and the rest to 40%, as UniCredit is doing, would take €52 billion.

French banks in turn are heavily into Italian banks. Just like they were into Greek banks, but they dodged that one when their political clout made the EU shift their burden onto the Greek pople. Will Italy let them do the same?

• Top French Banks Sue ECB To Reduce Capital Demands (R.)

France’s top lenders are suing the ECB to get an exemption from holding capital against deposits parked with a state-owned fund, the most high-profile challenge to supervision from Frankfurt to date. As well as providing euro zone banks with funding, the ECB has been their main regulator for the past two years, tasked with ending cozy relationships between the industry and national authorities that contributed to the financial crisis. The Frankfurt-based institution has been sued repeatedly over its bond-buying programs and by smaller banks seeking to escape its supervision. But this is the first case brought by major banks in the euro zone and is a rare confrontation between France’s financial elite and the ECB’s supervisory board, led by the former head of France’s own banking regulator, Daniele Nouy.

The lawsuits have been brought by BNP Paribas, Societe Generale, Credit Agricole, Credit Mutuel, Groupe BPCE and La Banque Postale over the past few weeks, filings with the European Court of Justice show. Sources with direct knowledge of the cases told Reuters the banks are protesting the ECB’s demand that they set aside capital against special deposits they have with state investment institution Caisse des Dépôts et Consignations (CDC). The legal action comes amid heightened tension between banks and the ECB, which is inundating the financial sector with excess cash to try to stimulate growth while charging banks for depositing it with the central bank overnight. “You are seeing banks more and more go to court to challenge the supervisor,” a senior legal source said. “Years ago that was unthinkable.”

So, Italy, France and Spain too, all have severely troubled banks.

• Spanish Banks Lose EU Case on Mortgage Interest Repayments (BBG)

Competition watchdogs won a partial victory at the EU’s top court over their attempt to force Spanish banks to pay back millions of euros in tax breaks for the acquisition of stakes in foreign firms, Bloomberg News reports. Lenders, including Banco Popular Espanol SA and Banco Bilbao Vizcaya Argentaria SA, may have to give back billions of euros to mortgage customers after a ruling by the court.

Over 6 weeks later, “India’s Reserve Bank has issued around 1.7 billion new notes, with less than one-third the value of what was removed..”

• India’s Small Businesses Facing ‘Apocalypse’ (G.)

India’s vast informal economy has been reeling since 8 November, the morning after India’s prime minister, Narendra Modi, announced the sudden voiding of the country’s two most-used bank notes. It is the largest-scale financial experiment in Indian history: gutting 14 trillion rupees – 86% of the currency in circulation – from the most cash-dependent major economy in the world. More than a month on, India’s Reserve Bank has issued around 1.7 billion new notes, with less than one-third the value of what was removed. The sixth-largest economy in the world is running on 60% less currency than before. Lines outside banks continue to stretch, and India’s small business lobby says its members are facing an “apocalypse”. But Modi insists he isn’t done.

Initially intended to flush out the “black money” said to be hoarded by elites and criminals, the government now frames demonetisation as the first step in a “cashless” revolution to shift the billions of transactions undertaken each day in India online – and onto the radar of tax authorities. This week, labour minister Bandaru Dattatreya announced it would soon be mandatory for employers to pay their staff into bank accounts, a hugely ambitious step in a country where as many as 90% of workers are paid in cash. Already struggling, businessmen such as Sharma are dreading the prospect of more enforced digital migration. “How do you think I can pay the workers with a cheque if they don’t have a bank account?” he asks, in a tiny office thick with incense smoke. “And it takes three days to clear a cheque. What will they eat during those days?”

His reasons are not just altruistic. Apart from potentially raising his tax bill – in a country where just 1% pay income tax – paying salaries electronically would mean giving staff Delhi’s mandated minimum wage, currently 9,724 rupees (£114) per month for unskilled workers. “Right now no one pays the minimum wage that the government decides,” Sharma says. “It will only make things expensive: we will charge the customer.” Outside his workers’ earshot, he adds: “If someone is doing the work of Rs.2000, why should we pay them Rs.15,000?” But workers too are wary of the big push online. Tens of millions of Indians have been given zero-deposit bank accounts in the past two years under a government scheme to boost financial inclusion. But even after demonetisation prompted a rush of new deposits, 23% of the accounts still lie empty.

Stuck. A large depreciation would be too costly, but keeping it high would eat up foreign reserves.

• Let The Yuan Fall Or Not? Beijing’s Big Burning Currency Question (SCMP)

As the Chinese yuan keeps weakening against the dollar, a question is becoming acute for Beijing: should China let the market take its course and permit a deep currency fall or should it keep burning its foreign exchange reserves to support the currency’s value? The debate over what Beijing should do about its currency is heating up as regulators’ ambiguity over the question is becoming costly and unsustainable, particularly since the Federal Reserve raised interest rates. Against Beijing’s desire for a “controllable” depreciation, the government is losing control over capital flight, depleting foreign exchange reserve stockpile at an alarming speed, and failing to convince investors that there is “no fundamental basis for the continuous depreciation”.

Yu Yongding, a renowned Chinese economist who sat on the central bank’s monetary policy committee when the yuan was revalued in July 2005, said it was time for Beijing to reconsider the matter. “The fear of the yuan’s depreciation has become a burden for us,” Yu told a forum over the weekend. Yu, who for years has called for liberalizing the yuan’s exchange rate over years, said China should give up foreign exchange interventions and safeguard its foreign exchange reserves so that China will “have sufficient ammunition” for future rainy days. While Yu’s view is not in line with Beijing’s current policy, it is winning academic support. Xu Sitao, the China chief economist at Deloitte, an auditing firm, said “the best strategy is to let the yuan fall in full, and the worst strategy is slowly depleting foreign exchange reserves”.

“The currency is facing a triple whammy of accelerating capital outflows, faster U.S. interest-rate increases and concerns over domestic financial markets..”

• Yuan Bears Strike as Capital Outflows Override PBOC (BBG)

China’s renewed efforts to curb declines in its currency are doing little to dissuade yuan bears. Traders have turned increasingly negative amid tighter liquidity, sending bets for further losses soaring. The gap between forward contracts wagering on the offshore yuan a year from now versus its current level is heading for a record monthly jump, just as the extra cost for options to sell the currency against the dollar hit a six-month high relative to prices for contracts to buy. The currency is facing a triple whammy of accelerating capital outflows, faster U.S. interest-rate increases and concerns over domestic financial markets as liquidity tightens.

Strategists say its weakening, set to be the biggest this year in more than two decades, may accelerate as the government restores the annual quota for citizens to convert yuan holdings into foreign exchange. President-elect Donald Trump has also threatened to slap 45% tariffs on China’s imports to the U.S. “Bears are adding positions because expectations for the yuan to depreciate are getting stronger and stronger,” said Larry Hu, head of China economics at Macquarie Securities Ltd. in Hong Kong. “The pressures will likely continue and could get even worse, considering capital outflows and concerns on the reset of individuals’ conversion quota.”

..in China, state-run banks are by far the main source of funding. Shadow banks.

• To Problems With China’s Financial System, Add the Bond Market (NYT)

Chinese officials cheered on the country’s stock market when it reached heady new highs, offering hope that it could become a new source of money to fix China’s economic problems. Then, last year, the market crashed. Now another fast-growing part of China’s vast and increasingly complicated financial market is showing signs of distress: its $9 trillion bond market. Prices for government and corporate bonds have tumbled over the past week, a sell-off that continued on Tuesday. The situation has spooked investors, prompting the government to temporarily restrain some trading and to make emergency loans to struggling financial institutions. The price drops have resulted in higher borrowing costs at a time when more Chinese companies need the money to cope with slowing economic growth. Yields reached new highs again on Tuesday.

In part, China is reacting to financial shifts across the globe. With the Federal Reserve raising short-term interest rates and many expecting the presidency of Donald J. Trump to lead to heavier government spending, investors worldwide are selling bonds. But China is struggling with its own balancing act. The Chinese bond slump also stems from Beijing’s efforts to wring excess money from its financial system and to stop potential bubbles that may lurk in shadowy, hard-to-track corners of its economy. Should it continue with those efforts, bonds could fall further. “The adjustment has not yet finished,” said Miao Zuoxing, a partner at the FXM Brothers Fund. “It will continue and normalize until money is put where the government can see it.”

[..] China has particular reason to worry. As the world’s second-largest economy, after the United States, it relies on a rickety financial system that is mired in debt and susceptible to hidden stresses. Higher overseas interest rates could also prompt more Chinese investors to move their money out of the country, either to chase higher returns elsewhere or to avoid what some see as China’s growing problems. In the mature financial system of the United States, businesses have plenty of ways to get money. They can borrow from a bank, raise money selling stocks or bonds, or seek funds directly from any number of investors.

But in China, state-run banks are by far the main source of funding. That helped power the country’s economic rise, but it also led to loans going to politically connected borrowers rather than to where the economy needed it most. That is one reason the Chinese economy is now stuck with more steel, glass, cement and auto factories than it needs. Particularly in the past two years, China has taken steps to encourage the development of robust stock and bond markets as well as private lenders, needing a way to ensure the flow of money was being directed by profit-minded investors rather than politicians and their allies at state-owned banks.

Heavy fisted. It’s all history has taught.

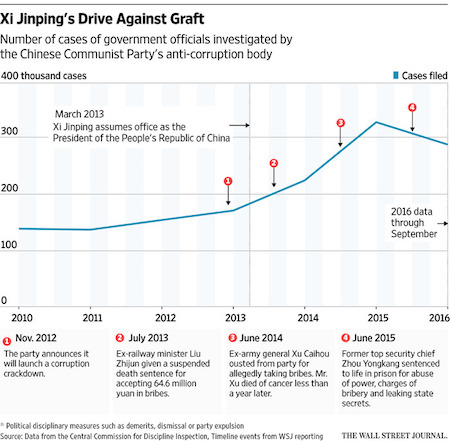

• China’s Anticorruption Drive Ensnares the Lowly and Rattles Families (WSJ)

When Liu Chongfu returned home to his pig farm in December 2014 after months in detention, he was haunted by what he had done. Under interrogation, he later told his family, he falsely admitted to bribing government officials. Back home, released without being charged, Mr. Liu had nightmares and splitting headaches. His conscience weighed on him, his family said. So he publicly recanted in March 2015. In a written statement sent to the court, he said interrogators had deprived him of sleep and threatened his family to extract a phony confession that helped send four other men to prison. In his statement, also posted online, he said he lied “because they forced me to where there was no other way than death. I didn’t want to die.”

President Xi Jinping has called his anticorruption campaign, one of the leader’s defining initiatives, a “life or death” matter. It is among the most popular elements of his administration, given how corruption has been endemic in China and how it threatens to undermine confidence in Communist Party control. Since the campaign began in 2013, its reach has allowed Mr. Xi to root out resistance to his rule and secure party control over a society that is more prosperous and demanding. Mr. Liu’s confession and retraction suggest a dark side to Mr. Xi’s efforts. Families around China say overzealous authorities have forced confessions, tortured suspects and made improper convictions.

The farmer tried to retract his confession before, while still in detention. “I cannot violate my conscience to do this,” he told his interrogators, according to his statement, a transcript of a video he made with his lawyer. He knew it would send innocent officials to jail, he said, and that “the real tragedy is still to follow.” The four were convicted anyway.

“I finally saw the blue sky. It was wonderful!”

• Smog Refugees Flee Chinese Cities As ‘Airpocalypse’ Blights Half A Billion (G.)

Tens of thousands of “smog refugees” have reportedly fled China’s pollution-stricken north after the country was hit by its latest “airpocalyse” forcing almost half a billion people to live under a blanket of toxic fumes. Huge swaths of north and central China have been living under a pollution “red alert” since last Friday when a dangerous cocktail of pollutants transformed the skies into a yellow and charcoal-tinted haze. Greenpeace claimed the calamity had affected a population equivalent to those of the United States, Canada and Mexico combined with some 460m people having to breathe either hazardous pollution or heavy levels of smog in recent days.

Lauri Myllyvirta, a Beijing-based Greenpeace activist who has been chronicling the red alert on Twitter, said that in an attempt to shield his lungs he was avoiding going outside and using two air purifiers and an industrial grade dust mask “that makes me look like Darth Vader”. “You just try to insulate yourself from the air as much as possible,” said Myllyvirta, a coal and air pollution expert. Others have simply opted to flee. According to reports in the Chinese media, flights to some pollution-free regions have been packed as a result of the smog. Ctrip, China’s leading online travel agent, said it expected 150,000 travellers to head abroad this month in a bid to outrun the smog. Top destinations include Australia, Indonesia, Japan and the Maldives.

Jiang Aoshuang, one of Beijing’s “smog refugees”, told the state-run Global Times she had skipped town with her husband and 10-year-old son in order to spare their lungs. Jiang’s family made for Chongli, a smog-free ski resort about three hours north-west of the capital, only to find it packed with other fugitives seeking sanctuary from the pollution. “It really felt like a refugee camp,” she was quoted as saying. Yang Xinglin, who also fled to Chongli, said she had requested time off from her job at a state-owned real estate firm so she did not have to inhale the smog. “You ask me why I left Beijing? It’s because I want to live,” Yang, 27, told the Guardian.

But why in the last few days of an 8-year term?

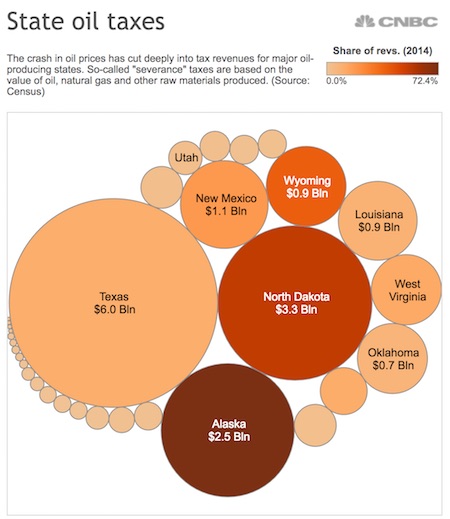

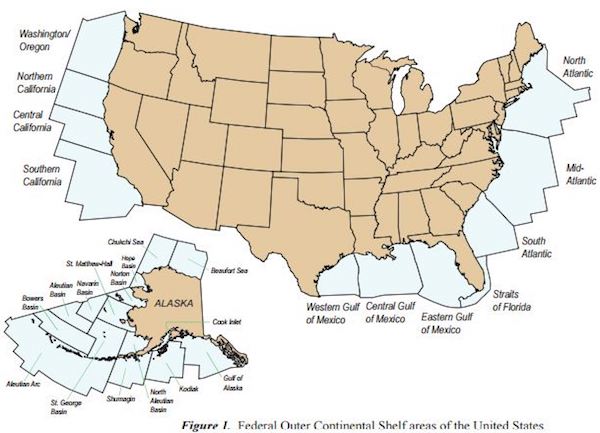

• Obama Invokes 1953 Law To Indefinitely Block Arctic, Atlantic Drilling (CNBC)

President Barack Obama on Tuesday moved to indefinitely block drilling in vast swaths of U.S. waters. The president had been expected to take the action by invoking a provision in a 1953 law that governs offshore leases, as CNBC previously reported. The law allows a president to withdraw any currently unleased lands in the Outer Continental Shelf from future lease sales. There is no provision in the law that allows the executive’s successor to repeal the decision, so President-elect Donald Trump would not be able to easily brush aside the action. Trump has vowed to open more federal land to oil and natural gas production in a bid to boost U.S. output. Obama on Tuesday said he would designate “the bulk of our Arctic water and certain areas in the Atlantic Ocean as indefinitely off limits to future oil and gas leasing, though the prospects for drilling in the affected areas in the near future were already questionable.

The lands covered include the bulk of the Beaufort and Chukchi seas in the Arctic and 31 underwater canyons in the Atlantic. The United States and Canada also announced they will identify sustainable shipping lanes through their connected Arctic waters. Canada on Tuesday also imposed a five-year ban on all oil and gas drilling licensing in the Canadian Arctic. The moratorium will be reviewed every five years. “These actions, and Canada’s parallel actions, protect a sensitive and unique ecosystem that is unlike any other region on earth,” Obama said in a statement. “They reflect the scientific assessment that, even with the high safety standards that both our countries have put in place, the risks of an oil spill in this region are significant and our ability to clean up from a spill in the region’s harsh conditions is limited.”

Home › Forums › Debt Rattle December 21 2016