Fred Stein Nadinola 1944

The system closes ranks.

• Trump Signals Provide Comfort to Central Bankers, Finance Ministers (WSJ)

The Trump administration appears unlikely to upend seven decades of global financial cooperation by scorning the IMF and World Bank, a source of comfort to central bankers and finance ministers gathering this week in Washington. In recent days, the new administration has shown signs the U.S. is taking a more traditional approach to economic diplomacy and the use of “soft power” than early administration rhetoric suggested. President Donald Trump, after meeting with NATO’s chief earlier this month, praised the alliance and reaffirmed Washington’s commitment to it. Nikki Haley, U.S. ambassador to the United Nations, has been leveraging the institution to advance Mr. Trump’s foreign-policy agenda. Other signals of the shift that are being seen by some officials at the meetings included the administration’s relatively modest proposed changes to NAFTA and its about-face last week on censuring China for its currency policy.

Meantime, Treasury Secretary Steven Mnuchin has reaffirmed the role of the IMF in promoting global economic growth and stability, saying at a gathering of global-finance chiefs last month that multilateral institutions can be “very important” to projecting U.S. interests abroad. Indeed, the U.S. signed off on an official communiqué by the Group of 20 largest economies that reaffirmed commitment to an international financial system “with a strong…and adequately resourced IMF at its center.” “There’re a number of things that global institutions can do to help strengthen global growth for all,” a senior Treasury official said ahead of the semiannual meetings in Washington this week of the World Bank and IMF’s member countries.

[..] The IMF has been criticized in the past for being too lax on China, especially when its exchange rate was estimated to have been up to 40% undervalued and its trade surplus topping 10% of GDP. The IMF has since stepped up its public censure of some Beijing policies, such as a bank lending boom that could endanger financial stability in the world’s second largest economy. The IMF is also planning to ramp up its warnings toward another Washington target—Germany—which maintains the world’s largest trade surplus. In particular. “Germany, with its aging population, should have, and can legitimately aim to have, a degree of surplus,” Ms. Lagarde said this week in a briefing with European press. “But not to the extent we see at the moment: 4% would perhaps be justified, but 8% is not.”

France, Italy and Greece: Europe’s risk spots. US Treasuries and the dollar look inviting.

• Protectionism Is More Than a Political Statement (Grant)

Yet again, Greece is another crisis in progress, as the nation has a $7 billion debt payment to make in July and nowhere near the cash on hand to pay it. The official debt-to-GDP figure is 183%, according to EU data, but it is a nonsensical number. The ECB lends money to the Greek banks and the banks lend money to the country. This is the epicenter of the rigged scheme. If you take the total public debt and add in the debt of Greek banks, then the total debt to GDP ratio is 302%, based on my calculations. One more time bomb ticking as the International Monetary Fund will not lend any new money to Greece, in my opinion, with the U.S. representatives on the IMF now reporting to the Trump administration.

It is not the size of the country that matters but the size of the debt, and a $560 billion public and bank debt load is no small figure. Since it is virtually impossible in many European countries to forgive the debt, given their political constraints, the “breakpoint” may finally be arriving. This means Greece will be leaving the EU, one way or another, and defaulting on its debts. Now, you can hold whatever view you like on these situations. You can ascribe to the “muddle through” theory or the “kick the can” theory. But what you cannot do is pretend that there are not significant risks facing the EU. We have these three “risk situations” in progress, and then we have Brexit under way, and it is my opinion that the EU is coming apart at the seams.

Many large financial institutions are looking aghast at the U.S. Treasury market. Virtually every leading bank has been predicting a return to a 3.00% yield for the benchmark 10-year note, and they have all been wrong – again. In fact, this is probably the biggest “pain trade” so far this year. Many people blame a “short squeeze” for the recent drop in yields on Treasuries. That is only part of the reason. The other has been the flow of capital, which is headed out of Europe and into the United States. “Protectionism” is more than a political statement. Asian money managers are exiting Europe, and the European money managers are exiting Europe, and the relative safety of the U.S. bond markets is providing a haven from European risk. This is a sound strategy, in my opinion. “Buy American, Sell American and Trade American” is where I want to be at the present time.

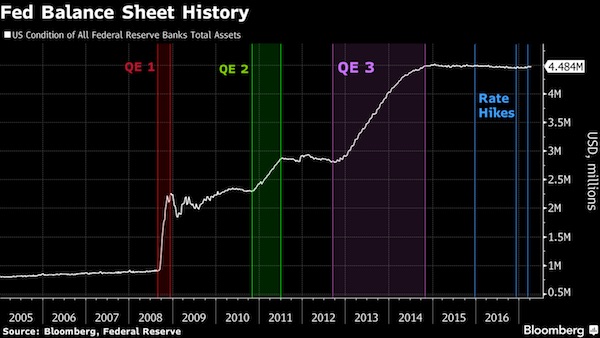

The same market players who live off, and are propped up by, Fed largesse. Insane.

• Fed Intensifies Balance-Sheet Discussions With Market Players (BBG)

Federal Reserve staff, widening their outreach to investors in anticipation of a critical turning point in monetary policy, are seeking bond fund manager feedback on how the central bank should tailor and communicate its exit from record holdings of Treasuries and mortgage-backed securities. Fed officials are intent on shrinking their crisis-era $4.48 trillion balance sheet in a way that isn’t disruptive and doesn’t usurp the federal funds rate as the main policy tool. To do that, they need to find the right communication and assess market expectations on the size of shrinkage, which is why conversations with fund managers have picked up recently. “All indications suggest that conversations around the balance sheet have accelerated,” said Carl Tannenbaum at Northern Trust Company. “The consideration of everything from design of the program to communication seems to have intensified.”

Most U.S. central bankers agreed that they would begin phasing out their reinvestment of maturing Treasury and MBS securities in their portfolio “later this year,” according to minutes of the March meeting. They also agreed the strategy should be “gradual and predictable,” according to the minutes.Fed staff routinely seek feedback from investors and bond dealers to get a fix on sentiment and expectations. The New York Fed confirmed the discussions and said it is part of regular market monitoring. The Fed is getting closer to disclosing its plan, and conversations have become more intense. “They are gauging what’s the extent of weak hands in the market that will dump these assets,” said Ed Al-Hussainy, a senior analyst on the Columbia Threadneedle Investment’s global rates and currency team. “They are calling all the asset managers. It is not part of the regular survey.”

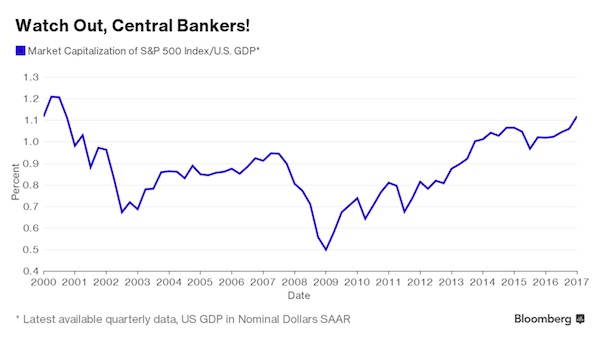

“..years of low interest rates have bloated stock valuations to a level not seen since 2000..”

• Paul Tudor Jones Says U.S. Stocks Should ‘Terrify’ Janet Yellen (BBG)

Billionaire investor Paul Tudor Jones has a message for Janet Yellen and investors: Be very afraid. The legendary macro trader says that years of low interest rates have bloated stock valuations to a level not seen since 2000, right before the Nasdaq tumbled 75% over two-plus years. That measure – the value of the stock market relative to the size of the economy – should be “terrifying” to a central banker, Jones said earlier this month at a closed-door Goldman Sachs Asset Management conference, according to people who heard him. Jones is voicing what many hedge fund and other money managers are privately warning investors: Stocks are trading at unsustainable levels. A few traders are more explicit, predicting a sizable market tumble by the end of the year.

Last week, Guggenheim Partner’s Scott Minerd said he expected a “significant correction” this summer or early fall. Philip Yang, a macro manager who has run Willowbridge Associates since 1988, sees a stock plunge of between 20 and 40%, according to people familiar with his thinking. Even Larry Fink, whose BlackRock oversees $5.4 trillion mostly betting on rising markets, acknowledged this week that stocks could fall between 5 and 10% if corporate earnings disappoint. Their views aren’t widespread. They’ve seen the carnage suffered by a few money managers who have been waving caution flags for awhile now, as the eight-year equity rally marched on.

But the nervousness feels a bit more urgent now. U.S. stocks sit about 2% below the all-time high set on March 1. The S&P 500 index is trading at about 22 times earnings, the highest multiple in almost a decade, goosed by a post-election surge. Managers expecting the worst each have a pet harbinger of doom. Seth Klarman, who runs the $30 billion Baupost Group, told investors in a letter last week that corporate insiders have been heavy sellers of their company shares. To him, that’s “a sign that those who know their companies the best believe valuations have become full or excessive.”

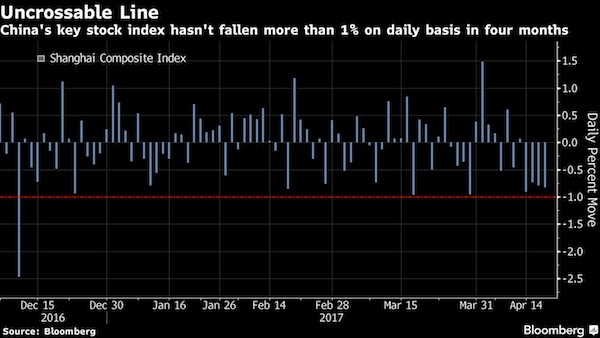

Market vs government.

• China’s Stocks Refuse to Drop More Than 1% (BBG)

In a Chinese stock market where superstition and government intervention often count for more than economic fundamentals, unusual trading patterns are par for the course. But even by China’s standards, the latest market anomaly to grab the attention of local investors stands out. The Shanghai Composite Index, notorious for its wild swings over the past two years, has gone 85 trading days without a loss of more than 1% on a closing basis, the longest stretch since the market’s infancy in 1992. On 13 days during the streak, the index recovered from intraday declines exceeding 1% to close above that threshold. The phenomenon has been especially stark recently, with the gauge erasing about half of its 1.6% drop in the final 90 minutes of trading on Wednesday.

For some investors, it’s a sign that state-directed funds are putting a floor under daily market swings – a development that presents short-term buying opportunities when the Shanghai Composite dips more than 1% during intraday trading. The theory may have merit: China’s securities regulator has this year sought to stabilize the stock market by limiting the extent of declines in the Shanghai Composite, according to people familiar with the strategy, who asked not to be identified discussing a matter that hasn’t been disclosed publicly. “There is room for arbitrage in the short term,” said Zhang Haidong, a money manager at Jinkuang Investment Management in Shanghai. The Shanghai Composite rose less than 0.1% on Thursday, rebounding from an intraday loss of as much as 0.7%.

And no imagination either. Just copying others.

• Toronto To Impose 15% Tax On Foreign Home Buyers (G.)

Foreigners who buy homes in Toronto and its surrounding area now face an additional 15% tax – echoing a recent measure adopted in Vancouver – as part of a slew of measures aimed at tempering a heated housing market that ranks as one of Canada’s most expensive. The tax – part of proposed legislation unveiled on Thursday by the Ontario provincial government – will be levied on houses purchased in the Golden Horseshoe, an area that stretches from the Niagara region and the Greater Toronto Area to Peterborough. It will apply to all residential purchases made by those who are not citizens or permanent residents of Canada, as well as foreign corporations. Once the legislation passes, the tax would be applied retroactively to purchases made as of 21 April. “When young people can’t afford their own apartment or can’t imagine ever owning their own home, we know we have a problem,” said Kathleen Wynne, the Ontario premier.

“And when the rising cost of housing is making more and more people insecure about their future, and about their quality of life in Ontario, we know we have to act.” Amid two years of double-digit gains and mounting fears of a housing bubble, her government has consistently fended off calls to intervene. The pressure ramped up earlier this month, after figures showed the average price of homes in the Greater Toronto Area soared 33% in the past year, pushing the cost of a detached home to an average of C$1.21m. “There is a need for interventions right now in order to calm what’s going on,” said Wynne. The tax would be revenue neutral, she added, aimed squarely at tempering demand. “In some ways, we have to realise this is a good problem to have … [It] is the unwanted consequences of a strong economy with a promising future.”

“..many U.S. pols grovel before the Israeli government seeking a sign of favor from Prime Minister Netanyahu, almost like Medieval kings courting the blessings of the Pope at the Vatican.”

• Why Not a Probe of ‘Israel-gate’? (Robert Parry)

The other day, I asked a longtime Democratic Party insider who is working on the Russia-gate investigation which country interfered more in U.S. politics, Russia or Israel. Without a moment’s hesitation, he replied, “Israel, of course.” Which underscores my concern about the hysteria raging across Official Washington about “Russian meddling” in the 2016 presidential campaign: There is no proportionality applied to the question of foreign interference in U.S. politics. If there were, we would have a far more substantive investigation of Israel-gate. The problem is that if anyone mentions the truth about Israel’s clout, the person is immediately smeared as “anti-Semitic” and targeted by Israel’s extraordinarily sophisticated lobby and its many media/political allies for vilification and marginalization.

So, the open secret of Israeli influence is studiously ignored, even as presidential candidates prostrate themselves before the annual conference of the American Israel Public Affairs Committee. Hillary Clinton and Donald Trump both appeared before AIPAC in 2016, with Clinton promising to take the U.S.-Israeli relationship “to the next level” – whatever that meant – and Trump vowing not to “pander” and then pandering like crazy. Congress is no different. It has given Israel’s controversial Prime Minister Benjamin Netanyahu a record-tying three invitations to address joint sessions of Congress (matching the number of times British Prime Minister Winston Churchill appeared). We then witnessed the Republicans and Democrats competing to see how often their members could bounce up and down and who could cheer Netanyahu the loudest, even when the Israeli prime minister was instructing the Congress to follow his position on Iran rather than President Obama’s.

Israeli officials and AIPAC also coordinate their strategies to maximize political influence, which is derived in large part by who gets the lobby’s largesse and who doesn’t. On the rare occasion when members of Congress step out of line – and take a stand that offends Israeli leaders – they can expect a well-funded opponent in their next race, a tactic that dates back decades. [..] .. there have been fewer and fewer members of Congress or other American politicians who have dared to speak out, judging that – when it comes to the Israeli lobby – discretion is the better part of valor. Today, many U.S. pols grovel before the Israeli government seeking a sign of favor from Prime Minister Netanyahu, almost like Medieval kings courting the blessings of the Pope at the Vatican.

This comes two days after the Intercept published an interview with Assange, who among other things said:“In fact, the reason Pompeo is launching this attack is because he understands we are exposing in this series all sorts of illegal actions by the CIA, so he’s trying to get ahead of the publicity curve and create a pre-emptive defense..”

• Arresting Julian Assange Is A Priority, Says US Attorney General (G.)

The arrest of WikiLeaks founder Julian Assange is now a “priority” for the US, attorney general Jeff Sessions has said. Hours later it was reported by CNN that authorities have prepared charges against Assange, who is currently holed up at the Ecuadorian embassy in London. Donald Trump lavished praise on the anti-secrecy website during the presidential election campaign – “I love WikiLeaks,” he once told a rally – but his administration has struck a different tone. Asked whether it was a priority for the justice department to arrest Assange “once and for all”, Sessions told a press conference in El Paso, Texas on Thursday: “We are going to step up our effort and already are stepping up our efforts on all leaks. This is a matter that’s gone beyond anything I’m aware of. We have professionals that have been in the security business of the United States for many years that are shocked by the number of leaks and some of them are quite serious.”

He added: “So yes, it is a priority. We’ve already begun to step up our efforts and whenever a case can be made, we will seek to put some people in jail.” Citing unnamed officials, CNN reported that prosecutors have struggled with whether the Australian is protected from prosecution from the first amendment, but now believe they have found a path forward. A spokesman for the justice department declined to comment. Barry Pollack, Assange’s lawyer, denied any knowledge of imminent prosecution. “We’ve had no communication with the Department of Justice and they have not indicated to me that they have brought any charges against Mr Assange,” he told CNN. “They’ve been unwilling to have any discussion at all, despite our repeated requests, that they let us know what Mr Assange’s status is in any pending investigations. There’s no reason why Wikileaks should be treated differently from any other publisher.”

US authorities has been investigating Assange and WikiLeaks since at least 2010 when it released, in cooperation with publications including the Guardian, more than a quarter of a million classified cables from US embassies leaked by US army whistleblower Chelsea Manning.

And no protest from Berlin?

• German Chancellery Investigated In Probe Into WikiLeaks Sources (R.)

Berlin’s chief public prosecutor has extended an investigation into the release of a trove of documents by WikiLeaks to include the chancellery as well as the Bundestag lower house of parliament, broadcaster NDR said on Thursday. Last December, WikiLeaks released the confidential documents, which German security agencies had submitted to a parliamentary committee investigating the extent to which German spies helped the U.S. National Security Agency (NSA) to spy in Europe. The extension of the investigation to include the chancellery did not necessarily mean the Berlin public prosecutor had firm suspicions that individuals at Chancellor Angela Merkel’s office were involved in the leak, NDR said.

Government sources told Reuters that the chancellery had agreed several weeks ago to the investigation “against unknown” persons, to allow the inquiry to proceed. There were no firm suspicions against chancellery officials, the sources added. Surveillance is a sensitive issue in Germany where East Germany’s Stasi secret police and the Nazi era Gestapo kept a close watch on the population. Merkel told the parliamentary committee in February that she did not know how closely Germany’s spies cooperated with their U.S. counterparts until 2015, well after an uproar over reports of U.S. bugging of her cellphone.

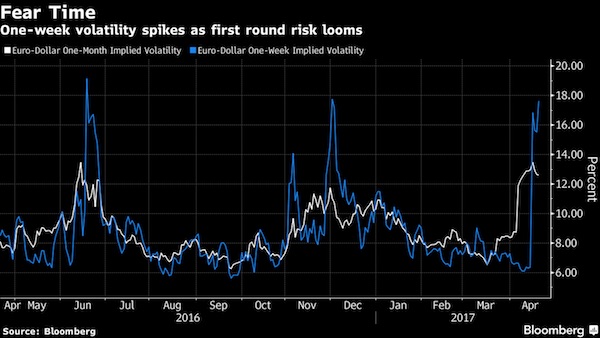

Plenty nerves on Monday morning. And that’s just for round 1.

• Coffee and Thin Liquidity on Traders’ Menus for French Vote (BBG)

It may not be cafe au lait, but traders are likely to need plenty of coffee to sustain them through the first round of the French election. Ten thousand miles away in Melbourne, IG’s trading crew are due at their desks before dawn on Monday to deal with any fallout, while back in Europe, Societe Generale will be staffed overnight, according to a person familiar with their plans who asked not to be named because they aren’t authorized to speak publicly. Staff at HSBC will work extended hours, a spokeswoman said, Tradition is asking more voice brokers to come in on Sunday, while London-based Caxton FX is providing its night owls with pizzas. Other analysts and investors will be nervously watching from home, ready to dash to the office should French voters spring a surprise.

With the first predictions from France due at 8 p.m. Sunday in Paris, currency markets – which open one hour later – will give traders an early chance to react. At IG in Australia a “fully-manned” team will be on deck as the results roll in, according to Chris Weston, the firm’s chief market strategist. “Political events have a significant ability to alter volatility, more than any other event,” he said. Shifts in opinion polls have bolstered the focus on Sunday’s first round, which decides which of the top candidates progress to the run-off vote. The campaign has turned into a four-way race, with anti-euro candidate Marine Le Pen and independent Emmanuel Macron running just ahead of Republican Francois Fillon and the Communist-backed Jean-Luc Melenchon.

While polls show that either Macron or Fillon – considered the more market-friendly candidates – would be favored against the less-centrist opponents in a run-off, it’s the outside prospect of a Le Pen-Melenchon one-two that will keep traders sweating on Sunday. That’s reflected in the options market, which reflects the first round of French elections as posing the greater risk.

UK democracy couldn’t take a Brexit overturn.

• EU leader: UK Would Be Welcomed Back If Voters Overturn Brexit (G.)

The president of the European parliament has said Britain would be welcomed back with open arms if voters changed their minds about Brexit on 8 June, challenging Theresa May’s claim that “there is no turning back” after article 50. Speaking after a meeting with the prime minister in Downing Street, Antonio Tajani insisted that her triggering of the departure process last month could be reversed easily by the remaining EU members if there was a change of UK government after the general election, and that it would not even require a court case. “If the UK, after the election, wants to withdraw [article 50], then the procedure is very clear,” he said in an interview. “If the UK wanted to stay, everybody would be in favour. I would be very happy.”

He also threatened to veto any Brexit deal if it did not guarantee in full the existing rights of EU citizens in Britain and said this protection would forever be subject to the jurisdiction of the European court of justice (ECJ). Both are potential sticking points for May, who has promised to end free movement of EU citizens and rid Britain forever of interference by the ECJ, but the European parliament must ratify any Brexit deal agreed by negotiators before it can be completed. Lawyers are divided on whether the UK can unilaterally change its mind about leaving and are bringing a test case to establish the legal reversibility of article 50, but the parliament president spelled out a process by which a simple political decision by other member states would be sufficient. “If tomorrow, the new UK government decides to change its position, it is possible to do,” said Tajani. “The final decision is for the 27 member states, but everybody will be in favour if the UK [decides to reverse article 50].”

Says who?

• Britain Must Pay EU Divorce Bill In Euros (AFP)

Britain may be leaving the EU but it will still have to settle the divorce bill in euros, not pounds, according to an EU document on the upcoming negotiations Thursday. “An orderly withdrawal of the United Kingdom from the Union requires settling the financial obligations undertaken before the withdrawal date,” said the European Commission document seen by AFP. “The agreement should define the precise way in which these obligations will be calculated … the obligations should be defined in euro,” it added. The document did not say how much the Brexit settlement might cost but EU officials have previously said it could be as much as €60 billion, sparking howls of outrage in London which puts the figure nearer €20 billion.

Titled “Non Paper on key elements likely to feature in the draft negotiating directives,” the document was drawn up for the European Commission which will conduct the Brexit negotiations with Britain. It covers in more detail the same ground outlined last month by EU president Donald Tusk in response to Prime Minister Theresa May’s official March 29 notification that Britain was leaving the bloc.

A sea route. And a landlocked country. Nuff said.

• Austria Calls For Closure Of Mediterranean Migrant Route (Pol.)

Austrian Interior Minister Wolfgang Sobotka has called for the immediate closure of the Mediterranean route used by refugees seeking asylum in Western European countries, local media reported Wednesday. Closing the route “is the only way to end the tragic and senseless dying in the Mediterranean,” Sobotka said. Asked about the potential of a barrier being erected at the Brenner Pass on the border between Italy and Austria, Sobotka said: “In the event of a sudden influx, we are equipped and able to ramp up border management within hours.” According to U.N. aid agencies, nearly 9,000 migrants were rescued in the Mediterranean over the Easter weekend.

As weather conditions improve, more migrants are expected to make their way to Europe. “A rescue in the open sea cannot be a ticket to Europe, because it gives organized crime every argument to persuade people to escape for economic reasons,” Sobotka said. Last summer, Austria advocated for the closure of the Western Balkan route used by migrants coming from the Middle East seeking their way to Western European countries. Austrian Defense Minister Hans Peter Doskozil last February said Vienna planned to increase cooperation with 15 countries along the Balkan route to keep migrants from reaching northern Europe, claiming the EU is not adequately protecting its external borders.

Home › Forums › Debt Rattle April 21 2017