Hokusai Views of Mount Fuji: Ejiri in Suruga Province 1831

I’ve seen a dozen versions of this. Few people seem to know how to properly translate Merkel’s comments, let alone interpret them. Well, let’s just say Merkel is in election mood, and stuff like this does well in Germany.

• Europe “Must Take Its Fate Into Its Own Hands” – Angela Merkel (AFP)

Europe “must take its fate into its own hands” faced with a western alliance divided by Brexit and Donald Trump’s presidency, German Chancellor Angela Merkel said Sunday. “The times in which we could completely depend on others are on the way out. I’ve experienced that in the last few days,” Merkel told a crowd at an election rally in Munich, southern Germany. “We Europeans truly have to take our fate into our own hands,” she added. While Germany and Europe would strive to remain on good terms with America and Britain, “we have to fight for our own destiny”, Merkel went on. Special emphasis was needed on warm relations between Berlin and newly-elected French President Emmanuel Macron, she said. The chancellor had just returned from a G7 summit which wound up Saturday without a deal between the US and the other six major advanced nations on upholding the 2015 Paris climate accords.

Merkel on Saturday labelled the result of the “six against one” discussion “very difficult, not to say very unsatisfactory”. Trump offered a more positive assessment on Twitter Sunday, writing: “Just returned from Europe. Trip was a great success for America. Hard work but big results!” The US president had earlier tweeted that he would reveal whether or not the US would stick to the global emissions deal – which he pledged to jettison on the campaign trail – only next week. On a previous leg of his first trip abroad as president, Trump had repeated past criticism of NATO allies for failing to meet the defensive alliance’s military spending commitment of 2% of GDP. Observers noted that he neglected to publicly endorse the pact’s Article Five, which guarantees that member countries will aid the others they are attacked.

When shorts defeat their own goals: “..the more investors prepare for this by putting large amounts of money aside to plow into a crashing market to pick up the pieces, the more likely they will be to stop the crash in its tracks. “

• Stocks Won’t Crash Spectacularly but May Zigzag Lower (WS)

The market is like a “coiled spring” after eight years of QE and interest rate repression, Singer said in the email announcing the $5-billion offering. His firm wants to have the liquidity to capitalize on a “possibly large opportunity set that could emerge when investor confidence is impaired, recent correlations and assumptions don’t work, and prices are changing rapidly.” He added: “The nature of modern markets is that rich opportunity sets seem to be ephemeral, providing surprising volatility, bargains and dislocations for only brief periods of time before governments, aware of the politically destructive effects of extreme volatility, rally to take stern actions to keep the balls up in the air.” So they’d have to act fast to front-run the Fed.

It will be an event that could produce extraordinary returns by picking up the pieces before central banks jump in and once again bail out stockholders and bondholders. That’s the theory. But here’s the thing: the more investors prepare for this by putting large amounts of money aside to plow into a crashing market to pick up the pieces, the more likely they will be to stop the crash in its tracks. As a sharp sell-off unfolds and after regular dip-buyers are crushed, the nervous crash buyers that don’t want to miss this opportunity will start buying. They’re nervous because the Fed could jump in and reverse the crash, and they want to pick up the pieces before that happens. So they’ll jump in early and the intense buying will stop the crash. This includes short-sellers who want to take profits and cover their positions during a crash.

They’re the most nervous bunch of them all. Under this buying pressure, asset prices would begin to bounce before the Fed steps in, and given the bouncing prices, it might not step in, though prices might not reach prior highs. Then, after a period of calm which the smart money will use to unload these positions and take profits, the sell-off would start all over again until crash-buyers pile in again to front-run the Fed. This can go on for many years – a brutal zigzagging lower that never quite offers the buying opportunities because too much money jumps in too soon to turn selloffs into rallies that then fail. Japanese stocks have gone through this since 1989 despite the Bank of Japan’s umpteen rounds of QE and endless interest rate repression. And they’re still going through it, with the Nikkei down nearly 50% from its peak almost three decades ago.

Given the smart money’s fervent intentions to capitalize on these crashes and given investors’ eagerness to put a lot of money behind this strategy in advance, I think a long drawn-out Japan-like downtrend in asset prices with dizzying ups and even bigger downs is a likely if terrible scenario that may well crush how investors feel about buying and holding these assets, as it did in Japan.

The foundations are crumbling.

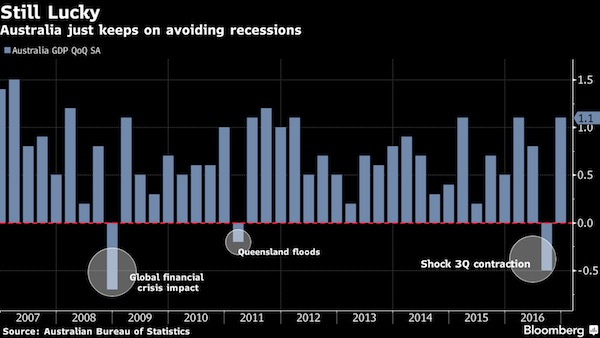

• The Great Aussie Recession-Free Run Is Looking Shaky – Again (BBG)

Weak signals from Australia are forcing economists to revisit their Q1 growth forecasts. Some are even suggesting a contraction. Home building, net exports and household consumption could be a drag on GDP for the first three months of 2017, according to some estimates. A negative print would raise the specter of recession, especially as a cyclone that ripped through Queensland’s key coal mining region is tipped to subtract from growth in the three months through June. Sluggish data “all points to growth being only marginally positive at this stage and there’s certainly the risk of a negative quarter,” said Shane Oliver, chief economist at AMP in Sydney, who now expects first-quarter GDP growth of around 0.2% rather than the 0.5-0.6% he previously penciled in.

Australia’s enviable track-record in avoiding two straight quarters of contraction since 1991 is on shaky ground. While the economy grew a solid 1.1% in the final three months of last year, it was rebounding from a shock 0.5% decline. Australia & New Zealand Bank last week said growth could be just 0.1% in the first quarter of this year. That would be an annual rate of 1.5%, the lowest since 2009. While the Reserve Bank of Australia has said holding its benchmark interest rate at a record low 1.5% since September is appropriate for “sustainable growth” and meeting its inflation target, a soft GDP number won’t go unnoticed.

Oliver says anemic growth in the first half means the risks are still to the downside for borrowing costs, even if the market sees about a 20% chance of a cut this year. A weak number would likely cast further doubt on the government’s growth forecasts, delivered in its annual budget this month, as Prime Minister Malcolm Turnbull’s ruling coalition struggles in the polls. The Treasury is forecasting GDP growth of 1.75% in the 12 months through June, accelerating to 3% by fiscal 2019. “We’ve long held the view that sub-trend growth is likely to persist. This idea of a return back to 3%-plus growth looks a little ambitious at this stage,” said Su-Lin Ong at Royal Bank of Canada.

There’s so much money locked up in the housing bubble, spending can only go down. Bubbles are never innocent.

• Australia Retail Sector Shudders (Aus.)

“It’s no secret it’s tough in retail at the moment and the share prices of traditional retail business models are reflecting that”, said Andrew Mitchell, portfolio manager at Ophir Asset Management. “The reality is the Australian consumer just isn’t spending right now.” “Household disposable income growth is at the lowest point since the GFC (global financial crisis). Higher utility prices and higher petrol prices continue to create an impact and the out-of-cycle rate rises from banks won’t help either. When you have wage growth sitting at the lowest levels in 30 years, it s going to affect the discretionary spend.” Economic statistics point to some of the toughest times in the sector as shoppers go on strike, not even being swayed by heavily discounted sales as stores make room for winter stock.

Retail spending has slumped, according to UBS economist Scott Haslem. He noted that three of the past four months had seen month-on-month falls in national retail spending for the first time in almost six years, sending the year-on-year pace of sales to just 2.1% in March, its slowest since mid-2013. Mr Haslem admitted the weakness had been surprising, especially given the general level of consumer confidence, which seems to have stabilised of late. “This has caught us somewhat by surprise. Not least because overall consumer confidence, while modestly lower, remains around average and this (month s) wage data also show more evidence quarterly wage growth is ‘basing’ “, he said.

Mr Haslem pointed to the cashflow of the average Australian home as the culprit. “While low interest rates and falling petrol costs have softened the blow from slowing wage growth in recent years, with still low wages growth, and renewed rises across utilities, debt interest and petrol costs, household cashflow is now under significant renewed downward pressure”, he said. “Overall, the recent sharp weakening in consumer cashflow sheds much insight into the recent weakening in early 2017 retail sales. While households have broadly maintained their real consumption growth into late 2016, this has been significantly achieved by drawing on their saving. But with cashflow growth continuing to slow, and savings intentions rising, it’s likely this drawdown in saving rate will end.”

The dumbest possible comment: this time is different.

• US Homeowners Are Again Pocketing Cash as They Refinance Properties (WSJ)

Americans refinancing their mortgages are taking cash out in the process at levels not seen since the financial crisis. Nearly half of borrowers who refinanced their homes in the first quarter chose the cash-out option, according to data released this week by Freddie Mac. That is the highest level since the fourth quarter of 2008. The cash-out level is still well below the almost 90% peak hit in the run-up to the housing meltdown. But it is up sharply from the post-crisis nadir of 12% in the second quarter of 2012. In a cash-out refi, a borrower refinances an existing mortgage with a new one, typically at a lower borrowing cost, that has a higher principal balance than the existing one. This allows the homeowner to pay off the old mortgage and still have cash left over for other uses.

The growing popularity of cash-out refis has helped buoy refinance activity. After booming for several years, demand for refinance mortgages had begun to slow as the Federal Reserve began increasing short-term interest rates and longer-term bond yields moved higher. Mortgage rates remain low by historical standards, though. The average rate for a fixed, 30-year mortgage was 3.95%, Freddie Mac reported this week. Meanwhile, rising home prices have helped increase the equity homeowners have in their houses. This allows more people to refinance to capture the benefit of lower mortgage rates. And borrowers whose homes are rising in value are often more likely to be interested in refinancing for cash. For example, in Denver and Dallas, where home prices have jumped, more than half of refinancers opted for cash last year, according to Freddie Mac.

To some housing-market observers, the fact that more homeowners are tapping their homes for cash represents a healthy confidence in the economy. It comes against a backdrop of continued gains in employment. At the same time, the increasing use of cash-out refis causes some concern since, in the run-up to the financial crisis, borrowers used their homes like veritable ATMs. Len Kiefer, Freddie Mac’s deputy chief economist, says this time has been different. Borrowers now are subject to stricter standards when they get a loan or refinance a mortgage. There is also less money at stake now than a decade ago.

Corbyn is making UK media nervous: A Telegraph headline today: “Jeremy Corbyn has long hated Britain”

• The Guardian Mourns Corbyn’s Polling Surge (Cook)

It is quite extraordinary to read today’s coverage in Britain’s supposedly left-liberal newspaper the Guardian. In the “man bites dog” stakes, the day’s biggest story is the astounding turn-around in the polls two weeks before the British general election. Labour leader Jeremy Corbyn has narrowed the Conservatives’ lead from an unassailable 22 points to 5, according to the latest YouGov survey. It looks possible for the first time, if the trend continues, that Corbyn could even win the popular poll. (Securing a majority of the British parliament’s seats is a different matter, given the UK’s inherently undemocratic electoral system.) Is the news that the “unelectable” Corbyn has dramatically closed the gap with the Tories front page news for the Guardian? Well, only very tangentially. It is buried in the paper’s lead story, which is far more interested in issues other than the new poll finding.

The story – headlined “May puts Manchester bombing at heart of election with attack on Corbyn” – largely adopts Conservative leader Theresa May’s line of attack against Corbyn for his suggestion that there might be a link between long-term western violence in the Middle East (now usually referred to as “intervention”) and terror attacks like the one in Manchester last week. Labour’s dramatic rise in the polls is briefly mentioned 12 – yes, 12! – paragraphs into the story. It is almost as though the Guardian does not want you to know that Corbyn and his policies are proving far more successful in the election campaign than the Guardian predicted or ever wanted. In fact, the Guardian’s only story on the poll – buried deep on the inside pages – could not be less enamoured with the polling turn-around. The story – headlined “Labour poll rise suggests Manchester attack has not boosted Tories” – is again framed as a story about Conservative failure rather than the draw of Corbyn and his policies.

Here is as excited as the Guardian can get about the Tories’ highly diminished 5-point lead: “It was always going to be the case that the polls would narrow during the course of the campaign, as Labour’s policies received greater media exposure, but the YouGov poll implies that public opinion is more volatile.” It sounds almost as though the Guardian, which has been denigrating Corbyn since his election as Labour leader nearly two years ago (along with the rest of the British media), does not want him to win. Let’s put that another way. It’s almost as though Britain’s only supposedly left-liberal newspaper would prefer that May and the Conservatives won. This, let us remind ourselves, is the same Conservative party that has made the once-surging, far-right UKIP party largely redundant by adopting many of its ugliest policies.

Seeking publicity dead ahead of an election with plans to protect children from X,Y,Z, is a dead give away spindoctors are involved. Bill Clinton ‘launched’ a V-chip plan ahead of the 1996 election. when he was under severe pressure, which supposedly allowed parents to control what their kids could watch on TV. Great success voting wise, but never heard from again.

• Tories Pledge New Law Over Domestic Violence Directed At Children (G.)

Theresa May has pledged to create a new aggravated offence when domestic violence is directed towards a child, in order to allow perpetrators to be punished for longer. She also confirmed that a Tory government would introduce a statutory definition for domestic violence and establish a special commissioner to stand up for victims. “We will launch a relentless drive to help survivors find justice and increase the number of successful prosecutions. This hidden scandal, that takes place every day in homes across Britain, must be tackled head on,” said May. “And we must respond to the devastating and lifelong impact that domestic abuse has on children, who carry the effects into adulthood.”

She argued that the Conservative party had delivered “real steps towards tackling domestic violence” over seven years, but wanted to go further. The Tory manifesto promised to support victims to leave abusive partners and to review the funding for refuges. However, the Labour party has analysed domestic violence rates since 2009, with an increase in violence against women perpetrated by their acquaintances. There has been a levelling off of violence against women by strangers and a fall in violence against men. Sarah Champion, the shadow women’s minister, has campaigned against the loss of 17% of specialist refuges for domestic violence victims in England since 2010.

“..tweeting would have saved a lot of money and an embarrassing French and German media portrayal of a “confused and isolated America.”

• US Should Focus On The Economy And Skip Irrelevant Talking Forums (CNBC)

Seeking to cut $610 billion from health care for the poor, and $192 billion from food assistance to 43 million Americans struggling to make ends meet, while spending millions of dollars on European jamborees will probably strike most people as an example of bad and insensitive public policy. Given the vacuity of last week’s European meetings, one may question why was it necessary for the U.S. president to spend four days and all that money to repeat for the nth time to people who took $165 billion net out of their U.S. trade in 2016 what he has been telling them over the last two years. No European leader has been in any doubt for quite some time that (a) trillions of dollars in U.S. trade deficits and a soaring net foreign debt of $8.1 trillion could not continue, (b) trade policies would be reviewed with particular attention to countries running systematic and large trade surpluses with the U.S., (c) the treaty on global warming would be closely scrutinized and (d) U.S. would insist on all member countries honoring their financial obligations to the NATO alliance.

All these issues have been explained in bilateral and multilateral forums and constantly amplified by the European media. The White House should have taken a cue from Italy’s former (and most probably future) Prime Minister Matteo Renzi. Outraged by do-nothing summits in Brussels, he scolded the spendthrift Eurocrats for squandering public money and precious time on matters where a simple SMS could have taken care of their trivial agenda. Yes, tweeting would have saved a lot of money and an embarrassing French and German media portrayal of a “confused and isolated America.” That would have also spared Washington the German G-7 lecture about the virtues of free trade. Lacking no chutzpah, the German chancellor Angela Merkel told President Trump last week that the U.S. should not complain about trade deficits with Germany.

Why? Simple, she said: Germany is a big investor in the U.S. creating thousands of jobs. There was no repartee from the U.S. side because our trade experts failed to slip a note to the president to tell him that these investments were financed with the money we gave them to buy German goods. Running large trade deficits with Germany enables German companies to recycle their dollar earnings in the U.S., killing whatever is left of jobs and incomes in our manufacturing – Detroit automakers being one of the prominent cases in point. Yes, we are giving them the rope … and the German chancellor apparently wanted more of it. Thanks in large part to these kinds of trade policies we now have the stock of human and physical capital that sets the limits to potential (and noninflationary) growth rate at a miserable 1.5%.

Undeterred, our free-traders insist that we should focus on services, leave the manufacturing sector to Germans and the Chinese, keep piling on foreign debt and still think that we can make the country safe and secure, maybe even run the world on the side. A wonderful picture, isn’t it? Hospitality industries, Silicon Valley and Hollywood will be our big money spinners. Maybe. But that’s not the public policy platform that won the presidency last year. So, let’s see what the vox populi says during the all-important mid-term Congressional elections in November 2018. These elections could seal the fate of this administration and of the legislative control by the Republican Party.

“I am appalled at the behavior of the media,” she declared. “It’s the collapse of journalism.”

• Camille Paglia: Democrats Are Colluding With The Media To Create Chaos (WE)

Camille Paglia is much more worried about the media than about the steady string of Trump-related scandals they claim to be uncovering. In a Tuesday interview with the Washington Examiner, Paglia excoriated the press for its coverage of Trump’s decision to fire FBI Director James Comey and his alleged sharing of classified information with Russian officials. Fresh off a spirited panel with Christina Hoff Sommers hosted by the Independent Women’s Forum, the iconic feminist dissident, who serves as a professor of media studies at the University of the Arts, accused journalists of colluding with the Democratic Party in an effort to damage the Trump administration. “Democrats are doing this in collusion with the media obviously, because they just want to create chaos,” she said when asked to comment on the aforementioned stories.

“They want to completely obliterate any sense that the Trump administration is making any progress on anything.” The popular author, whose latest book was released in March, pointed to early struggles experienced by previous presidential administrations to illustrate the media’s bias against Trump. “Obama’s administration for the first six months was chaos,” Paglia recalled. “Bill Clinton’s was chaos for six months. Nobody holds that against a new person.” “Those two guys had actually been politicians!” she continued, noting Trump’s relative inexperience with government operations. Paglia’s assessment of media bias in the Trump era leaves little room for optimism.

“I am appalled at the behavior of the media,” she declared. “It’s the collapse of journalism.” As the Examiner reported in April, Paglia, who cast her ballot for Jill Stein last November, is predicting Trump will win re-election in 2020. “I feel like the Democrats have overplayed their hand,” she said at the time. Though the news cycle has moved through plenty of additional scandals in the past month, it appears as though Paglia’s assessment of the president’s prospects has not changed. “I’m looking forward to voting Democrat again,” the acclaimed philosopher explained. “But the point is I feel that the media has so utterly lost its credibility that I think people are going to vote against the media again.”

This fun is far from over.

• How Team Obama Tried To Hack The Election (NYP)

New revelations have surfaced that the Obama administration abused intelligence during the election by launching a massive domestic-spy campaign that included snooping on Trump officials. The irony is mind-boggling: Targeting political opposition is long a technique of police states like Russia, which Team Obama has loudly condemned for allegedly using its own intelligence agencies to hack into our election. The revelations, as well as testimony this week from former Obama intel officials, show the extent to which the Obama administration politicized and weaponized intelligence against Americans. Thanks to Circa News, we now know the NSA under President Barack Obama routinely violated privacy protections while snooping through foreign intercepts involving US citizens — and failed to disclose the breaches, prompting the Foreign Intelligence Surveillance Court a month before the election to rebuke administration officials.

The story concerns what’s known as “upstream” data collection under Section 702 of the Foreign Intelligence Surveillance Act, under which the NSA looks at the content of electronic communication. Upstream refers to intel scooped up about third parties: Person A sends Person B an e-mail mentioning Person C. Though Person C isn’t a party to the e-mail, his information will be scooped up and potentially used by the NSA. Further, the number of NSA data searches about Americans mushroomed after Obama loosened rules for protecting such identities from government officials and thus the reporters they talk to. The FISA court called it a “very serious Fourth Amendment issue” that NSA analysts — in violation of a 2011 rule change prohibiting officials from searching Americans’ information without a warrant — “had been conducting such queries in violation of that prohibition, with much greater frequency than had been previously disclosed to the Court.”

A number of those searches were made from the White House, and included private citizens working for the Trump campaign, some of whose identities were leaked to the media. The revelations earned a stern rebuke from the ACLU and from civil-liberties champion Sen. Rand Paul. We also learned this week that Obama intelligence officials really had no good reason attaching a summary of a dossier on Trump to a highly classified Russia briefing they gave to Obama just weeks before Trump took office. Under congressional questioning Tuesday, Obama’s CIA chief John Brennan said the dossier did not “in any way” factor into the agency’s assessment that Russia interfered in the election. Why not? Because as Obama intel czar James Clapper earlier testified, “We could not corroborate the sourcing.”

But that didn’t stop Brennan in January from attaching its contents to the official report for the president. He also included the unverified allegations in the briefing he gave Hill Democrats. In so doing, Brennan virtually guaranteed that it would be leaked, which it promptly was. In short, Brennan politicized raw intelligence. In fact, he politicized the entire CIA.Langley vets say Brennan was the most politicized director in the agency’s history. Former CIA field-operations officer Gene Coyle said Brennan was “known as the greatest sycophant in the history of the CIA, and a supporter of Hillary Clinton before the election. I find it hard to put any real credence in anything that the man says.”

“..it is unrealistic and a complete waste of time to make an assessment of the American President’s foreign policy..”

• Syria’s Assad Explains How The US Really Works (ICH)

While Americans endlessly battle each other over seemingly important choices like Clinton and Trump or Democrats and Republicans, it is clear that the majority of the population has little understanding of how the U.S. government operates. Yet, for those who pay the price for the apathy and confusion of the general population of the West, it often becomes stunningly obvious that neither presidents nor political parties in America represent any discernible difference in the ongoing agenda of the Deep State and the rest of the oligarchical apparatus. Indeed, that agenda always marches forward regardless of who is president or which political party is in control.

Syria’s president Bashar al-Assad has thus had the unique position of not only being on the receiving end of American imperialism by virtue of not only being a citizen of a target country but also by being the head of the country, steeped in politics in his own right and thus understanding how certain factors come into play at the national level. With that in mind, it is worth pointing out a recent statement made by Assad during the course of an interview regarding the opinion of the Syrian government on Donald Trump. Assad stated,

“The American President has no policies. There are policies drawn by the American institutions which control the American regime which are the intelligence agencies, the Pentagon, the big arms and oil companies, and financial institutions, in addition to some other lobbies which influence American decision-making. The American President merely implements these policies, and the evidence is that when Trump tried to move on a different track, during and after his election campaign, he couldn’t. He came under a ferocious attack. As we have seen in the past few week, he changed his rhetoric completely and subjected himself to the terms of the deep American state, or the deep American regime. That’s why it is unrealistic and a complete waste of time to make an assessment of the American President’s foreign policy, for he might say something; but he ultimately does what these institutions dictate to him. This is not new. This has been ongoing American policy for decades.”

Assad also addressed the Western media’s portrayal of him as a “devil” who kills and oppresses his own people. He stated,

“Yes, from a Western perspective, you are now sitting with the devil. This is how they market it in the West. But this is always the case when a state, a government, or an individual do not subjugate themselves to their interests, and do not work for their interests against the interests of their people. These have been the Western colonial demands throughout history. They say that this evil person is killing the good people. Okay, if he is killing the good people, who have been supporting him for the past six years? Neither Russia, nor Iran, nor any friendly state can support an individual at the expense of the people. This is impossible. If he is killing the people, how come the people support him? This is the contradictory Western narrative; and that’s why we shouldn’t waste our time on Western narratives because they have been full of lies throughout history, and not something new.”

Russiagate in France. Macron better not walk his talk.

• Macron Promises Tough Talk At First Putin Meeting (R.)

New French President Emmanuel Macron is promising tough talk at his first meeting with Vladimir Putin on Monday, following an election campaign when his team accused Russian media of trying to interfere in the democratic process. Macron, who took office two weeks ago, has said that dialogue with Russia is vital in tackling a number of international disputes. Nevertheless, relations have been beset by mistrust, with Paris and Moscow backing opposing sides in the Syrian civil war and at odds over the Ukraine conflict. Fresh from talks with his Western counterparts at a NATO meeting in Brussels and a G7 summit in Sicily, Macron will host the Russian president at the palace of Versailles outside Paris. Amid the baroque splendor, Macron will use an exhibition on Russian Tsar Peter the Great at the former royal palace to try to get Franco-Russian relations off to a new start.

“It’s indispensable to talk to Russia because there are a number of international subjects that will not be resolved without a tough dialogue with them,” Macron said. “I will be demanding in my exchanges with Russia,” the 39-year-old president told reporters at the end of the G7 summit on Saturday, where the Western leaders agreed to consider new measures against Moscow if the situation in Ukraine did not improve. Relations between Paris and Moscow were increasingly strained under former President Francois Hollande. Putin, 64, canceled his last planned visit in October after Hollande said he would see him only for talks on Syria. Then during the French election campaign the Macron camp alleged Russian hacking and disinformation efforts, at one point refusing accreditation to the Russian state-funded Sputnik and RT news outlets which it said were spreading Russian propaganda and fake news.

Shamelessly promoting Steve’s new book “Can we avoid another financial crisis?”, of which this is an excerpt.

• Economists Have to Embrace Complexity to Avoid Disaster (Steve Keen)

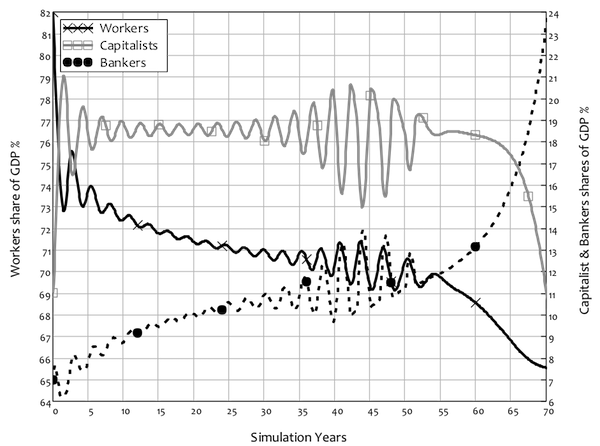

With a higher propensity to invest comes the debt-driven crisis that Minsky predicted, and which we experienced in 2008. However, something that Minsky did not predict, but which did happen in the real world, also occurs in this model: the crisis is preceded by a period of apparent economic tranquillity that superficially looks the same as the transition to equilibrium in the good outcome. Before the crisis begins, there is a period of diminishing volatility in unemployment: the cycles in employment (and wages share) diminish [..] But then the cycles start to rise again: apparent moderation gives way to increased volatility, and ultimately a complete collapse of the model, as the employment rate and wages share of output collapse to zero and the debt to GDP ratio rises to infinity.

This model, derived simply from the incontestable foundations of macroeconomic definitions, implies that the “Great Moderation”, far from being a sign of good economic management as mainstream economists interpreted it (Blanchard et al., 2010, p. 3), was actually a warning of an approaching crisis. The difference between the good and bad outcomes is the factor Minsky insisted was crucial to understanding capitalism, but which is absent from mainstream DSGE models: the level of private debt. It stabilizes at a low level in the good outcome, but reaches a high level and does not stabilize in the bad outcome. The model produces another prediction which has also become an empirical given: rising inequality. Workers’ share of GDP falls as the debt ratio rises, even though in this simple model, workers do no borrowing at all. If the debt ratio stabilises, then inequality stabilises too, as income shares reach positive equilibrium values.

But if the debt ratio continues rising—as it does with a higher propensity to invest—then inequality keeps rising as well. Rising inequality is therefore not merely a “bad thing” in this model: it is also a prelude to a crisis. The dynamics of rising inequality are more obvious in the next stage in the model’s development, which introduces prices and variable nominal interest rates. As debt rises over a number of cycles, a rising share going to bankers is offset by a smaller share going to workers, so that the capitalists share fluctuates but remains relatively constant over time. However, as wages and inflation are driven down, the compounding of debt ultimately overwhelms falling wages, and profit share collapses. Before this crisis ensues, the rising amount going to bankers in debt service is precisely offset by the declining share going to workers, so that profit share becomes effectively constant and the world appears utterly tranquil to capitalists—just before the system fails.

Figure 5: Rising inequality caused by rising debt

Mob or Salvation Army? Al Capone posed as both at the same time…

• Greek Archbishop: ‘I See a Europe of Exploitation, not Solidarity’ (GR)

Europe’s current face was not one of solidarity and support but more one of exploitation, Archbishop of Athens and All Greece Ieronymos suggested on Sunday, in an interview broadcast by the state television channel ERT1. “Today, I do not see a Europe of solidarity but I see every day, more often and more clearly, the Europe of exploitation,” he said. The foundations of this Europe had to “go back to the starting point, from where it began, with the same thoughts and the same purpose,” the head of the Orthodox Church of Greece added. The Archbishop also commented on the recent terrorist strike in Manchester, expressing his horror and condemnation and noting that “terrorism is one of the worst repercussions of war.”

It was necessary, he said, “to also look at the other side, to see who are those leading these people to become terrorists.” On Church-State relations, he said the role of the Church was to talk to everyone, including those responsible for the state, because the Church was not a political party and “cooperation is therefore necessary”. On the issue of Church property, he noted that the Church’s spiritual mission could not be carried out without economic support. “The Church must be free and financially independent,” he said. With regard to refugees, Ieronymos said the Church sees them as “people in need” and that their final destination “should be their own country.” In the future, he added, we must consider whether “refugees have also become a part of the exploitation of humanity.”

Home › Forums › Debt Rattle May 29 2017