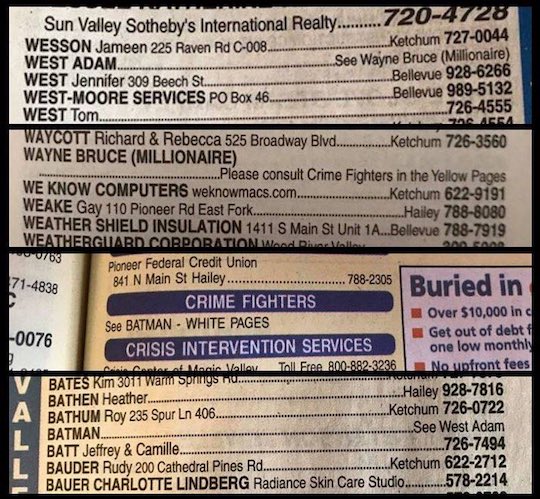

Adam West died last week. This was his phone book listing in Ketchum, ID where he lived.

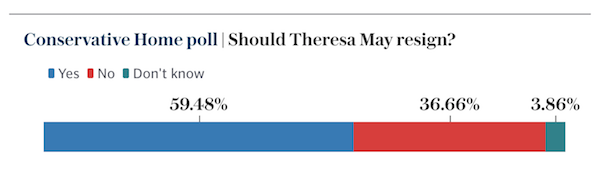

Even the -Tory- Telegraph has turned on the ‘winner’: Another one of their headlines: “Theresa May arrogantly abandoned Thatcherism – this is her reward”.

• New Economic Woes Put Theresa May Under Fresh Pressure (Tel.)

Theresa May has been hit by a series of economic blows, with consumers tightening their belts and businesses increasingly showing fears of a sharp slowdown as she attempts to cling on to power. The crucial services sector stands on the brink of a contraction, new data shows, and credit card spending has fallen for the first time in four years. High Street footfall has also gone sharply into reverse and manufacturing and construction companies in the English regions report a widespread slowdown in activity. Most of the gloomy figures published today were gathered prior to Mrs May’s disastrous snap election. It has further undermined confidence, according to the Institute of Directors (IoD). The hung parliament has triggered a massive swing towards negativity among the business leaders.

Before the election, IoD members’ net confidence, which offsets economic pessimism and optimism, was almost balanced at minus three. In the aftermath of the election it has plunged to minus 37. Businesses were increasingly ready to openly criticise Mrs May over the weekend after her interventionist manifesto failed to inspire strong public support. Stephen Martin, IoD director general, said last night: “It was disheartening that the only reference the Prime Minister made to prosperity in her Downing Street statement was to emphasise the need to share it, rather than create it in the first place.” Official figures later this week are expected to show a tightening squeeze on consumers. Economists estimate that wages grew by 2pc the year to April, down from 2.1pc a month earlier. Meanwhile inflation is expected to remain at 2.7pc, with rises to come.

Shoppers are curbing their spending in response, according to data from Visa. The credit card company said household expenditure in May was gown 0.8pc on last year, the first decline since 2013. Consumers cut back on clothing and household goods especially. Visa UK managing director Kevin Jenkins said the data “clearly shows that with rising prices and stalling wage growth, more of us are starting to feel the squeeze”.

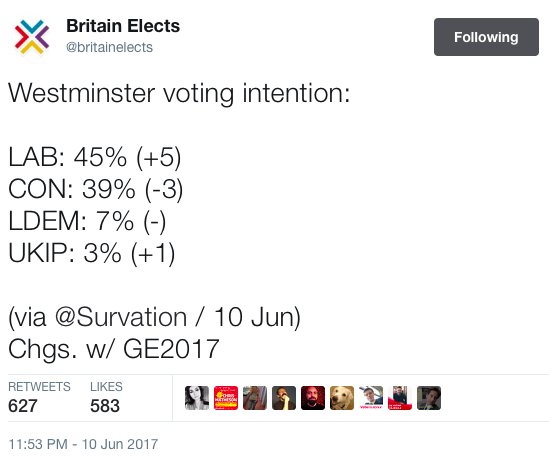

All Jeremy Corbyn has to do is tell Europe that he won’t feel bound by anything they negotiate with May.

• EU Threatens Year-Long Delay In Brexit Talks Over UK Negotiating Stance (G.)

Theresa May is to be told the EU will take a year to draft a new mandate for its chief negotiator, Michel Barnier, effectively killing the Brexit negotiations, if she insists on discussing a future trade relationship at the same time as the UK’s divorce bill. In a sign of growing impatience with the shambolic state of the British side of the talks, senior EU sources said that if London insisted on talking about a free trade deal before the issues of its divorce bill, citizens rights and the border in Ireland were sufficiently resolved, it would be met with a blunt response. “If they don’t accept the phased negotiations then we will take a year to draw up a new set of negotiating guidelines for Barnier,” one senior EU diplomat said, adding that the EU could not understand Britain’s continued claim that it would be able to discuss trade and the divorce terms in parallel.

The EU’s 27 leaders formally agreed to give Barnier a narrow set of tasks at a summit in April and they have no intention of rethinking the so-called phased approach when they meet May at a European summit on 22-23 June. Formal Brexit talks are due to begin on 19 June, the same day as the Queen’s speech, at which point it will be known whether May has secured the support of a majority of MPs for her policy agenda. The Department for Exiting the European Union (DExEU) sent a note to the European commission on Friday evening to signal that the government was operational and pre-negotiation talks about logistics should begin this week as planned. Olly Robbins, May’s EU adviser, told his European counterparts: “The prime minister has directed that the procedures for preparing the negotiations for the formal withdrawal from the European Union should start as soon as possible.” There is some scepticism in Brussels, however, about the ability of May’s minority administration to make effective decisions.

But they keep all their own clowns in Parliament? Government, even?

• Donald Trump’s State Visit To Britain Put On Hold (G.)

Donald Trump has told Theresa May in a phone call he does not want to go ahead with a state visit to Britain until the British public supports him coming. The US president said he did not want to come if there were large-scale protests and his remarks in effect put the visit on hold for some time. The call was made in recent weeks, according to a Downing Street adviser who was in the room. The statement surprised May, according to those present. The conversation in part explains why there has been little public discussion about a visit.

May invited Trump to Britain seven days after his inauguration when she became the first foreign leader to visit him in the White House. She told a joint press conference she had extended an invitation from the Queen to Trump and his wife Melania to make a state visit later in the year and was “delighted that the president has accepted that invitation”. Many senior diplomats, including Lord Ricketts, the former national security adviser, said the invitation was premature, but impossible to rescind once made.

“Stockman believes the S&P 500 could easily fall to 1,600, about a 34% drop from current levels.”

• It’s The Calm Before A Gigantic, Horrendous Storm: David Stockman (CNBC)

If David Stockman is right, Wall Street should hunker down. “This is one of the most dangerous market environments we’ve ever been in. It’s the calm before a gigantic, horrendous storm that I don’t think is too far down the road,” he recently said on “Futures Now.” Stockman, who was director of the Office of Management and Budget under President Ronald Reagan, made his latest prediction after lawmakers grilled former FBI Director James Comey over whether President Donald Trump tried to influence the Russia investigation. “This is a huge nothing-burger, but you don’t take comfort from that. You get worried about that because the system is determined to unseat Donald Trump,” said Stockman. Stockman argues the latest drama on Capitol Hill is a distraction from the real problems facing the economy.

“If the Senate can involve itself in something this groundless, it’s just more hysteria about Russia-gate for which there is no evidence. If they can bog themselves down in this, then we have a dysfunctional, ungovernable situation in Washington,” he said, noting there are just seven weeks until lawmakers go home for the August recess. Stockman contends it’s unlikely tax reform and an infrastructure package will become reality in this environment — two business-friendly policies seen as a huge benefit to Wall Street. In fact, he warns, the country could see a government shutdown in a matter of months. A scenario like that could wipe out all of the stock market gains since the election and more, according to Stockman.

“I don’t know what Wall Street is smoking. They ought to be getting out of the casino while it’s still safe. Yet there’s this idea that since he [Trump] wasn’t incriminated, that proves that we can move on,” he said. “I think it’s crazy.” Stockman believes the S&P 500 could easily fall to 1,600, about a 34% drop from current levels. He’s made similar calls like this in the past, but they haven’t materialized. “There is nothing rational about this market. It’s just a machine-trading-driven bubble that’s nearing some kind of all-time craziness, mania,” he said.

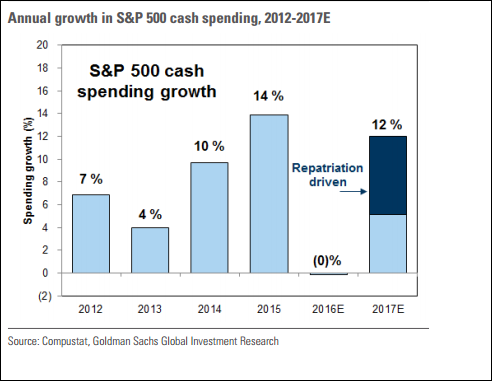

Buybacks again. And again.

• The Risk To The “Bull” Thesis (Roberts)

Following the election, the markets began pricing in a strongly recovering economic environment driven by a wave of legislative policies. While the market has indeed advanced, the economic and fundamental realities HAVE NOT changed since the election. As noted on Friday: “Economic data is not buying it either. Headline after headline, as of late, has continued to disappoint from new and existing home sales to autos, inventories, and employment. This also puts the Fed at risk of further rate hikes this year. ‘It appears traders are losing faith in the rest of the year as the odds of a hike occurring in December is now above that of September (as both drop to around 25%). As economic data has crashed since The Fed hiked rates in March, so the markets expectations has dropped to just 1.44 rate-hikes this year (one in June guaranteed), well below The Fed’s guidance of 2 more rate-hikes minimum.’”

Another huge risk going forward, as well, is the risk to further stock buybacks to support higher EPS as the lack of legislative reforms to boost the bottom line fade. As noted by Goldman just after the election: “We expect tax reform legislation under the Trump administration will encourage firms to repatriate $200 billion of overseas cash next year. “A significant portion of returning funds will be directed to buybacks based on the pattern of the tax holiday in 2004.” – Goldman Sachs. But it is not just the repatriation but lower tax rates that will miraculously boost bottom line earnings, but as noted from Deutsche Bank tax cuts are the key. “Every 5pt cut in the US corporate tax rate from 35% boosts S&P EPS by $5. Assuming that the US adopts a new corporate tax rate between 20-30%, we expect S&P EPS of $130-140 in 2017 and $140-150 in 2018. We raise our 2017E S&P EPS to $130.”

Maybe not so fast. Here is the problem. While you may boost bottom line earnings from tax cuts, the top line revenue cuts caused by higher interest rates, inflationary pressures, and a stronger dollar (as expected would be the result of tax reform) will exceed the benefits companies receive at the bottom line. I am not discounting the rush by companies to buy back shares at the greatest clip in the last 20-years to offset the impact to earnings by the reduction in revenues. However, none of the actions above go to solving the two things currently plaguing the economy – real jobs and real wages. Economic realities and wishful fantasies eventually reconnect and generally in the worst possible way.

Bubble? Hell, no.

• Big Tech Stocks Under Pressure After Apple Shares Downgraded (CNBC)

After a drop in big technology stocks Friday caused the Nasdaq composite to post its worst week of the year, the shares were likely to come under pressure again on Monday after Apple shares were downgraded. Mizuho Securities’ Abhey Lamba downgraded the iPhone maker to neutral from buy on Sunday, saying the best case scenario is priced into the shares. The analyst echoed a common concern of investors taking profits in big technology stocks last week. “The stock has meaningfully outperformed on a YTD basis and we believe enthusiasm around the upcoming product cycle is fully captured at current levels, with limited upside to estimates from here on out,” wrote Lamba, who cut his 12-month price target to $150, which is about one dollar above where Apple closed Friday.

A Friday selloff pushed the Nasdaq down more than 1.5% last week, but the selling was worse among the biggest stocks. Apple, Alphabet, Microsoft, Facebook and Amazon lost nearly $100 billion in market value on Friday on no specific headlines, but rather investors questioning whether valuations for the names were getting ahead of themselves. Nasdaq-100 futures were lower Sunday evening following the Apple downgrade. [..] Apple, Facebook and Amazon are still up more than 27% so far in 2017. Alphabet is up 20% and Microsoft shares are 11% higher for the year. By comparison, the S&P 500 is up more than 7% year-to-date.

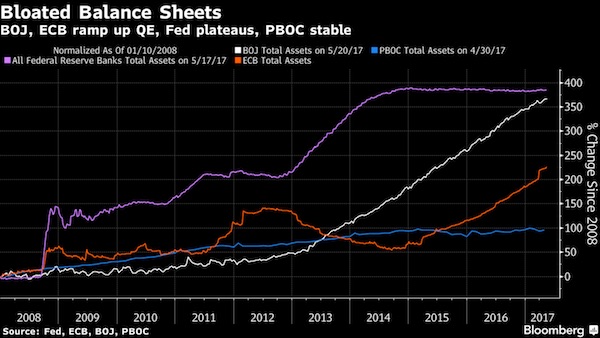

The graph indicates balance sheet change, not total numbers. Bit misleading when a $5 trillion asset pile, with the Fed at $4.5 trillion, is the topic.

• China’s $5 Trillion Asset Pile Could Still Expand (BBG)

Investors who fret about when and how global central banks will run down their crisis-era balance sheets can be relaxed about the biggest of them all – China’s. Whereas the Fed’s $4.5 trillion asset pile is set to be shrunk and the ECB’s should stop growing by the end of this year as the outlook brightens, China’s $5 trillion hoard is here to stay for the time being – and could even still expand, according to the majority of respondents in a Bloomberg survey. The PBOC balance sheet is a fundamentally different beast from its global peers – run up through years of capital inflows and trade surpluses rather than hoovering up government bonds – but it still matters for the global economy. Changes in the amount of base money in the world’s largest trading nation are having a bigger impact than ever, making the variable key for stability in a year when political transition in Beijing is in the cards.

“China is more than a couple of years away from balance-sheet contraction,” said Ding Shuang, chief China economist at Standard Chartered, pointing out that the growth in the broad money supply is still behind the government’s target. The balance sheet has broadly leveled off, and contracted in the first quarter of this year, though that was mostly through seasonal factors related to liquidity operations around the Lunar New Year, when the demand for cash surges. Now, with the Fed set to raise rates this year, the PBOC is still wary of accelerating cash outflows from China and may need to use reserves to support the currency even as trade surpluses keep piling up. Most economists said they predict that the balance sheet will be around the same size or bigger by the end of the year, in the survey of 21 institutions including Bank of China, Nomura and SocGen.

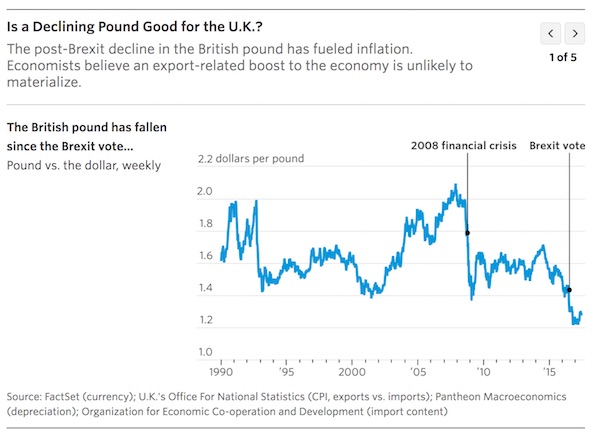

No, you don’t get inflation from a falling currency. But you just might get higher prices.

• When Currencies Fall, Export Growth Is Supposed to Follow (WSJ)

For decades, economics textbooks argued that suddenly weaker currencies are a boon to growth, because they make a country’s exports more competitive or profitable on the global stage, which in turn boosts domestic production and employment. What if that theory no longer holds? Economists and government officials are increasingly wondering if that effect is diminishing, especially among advanced Western economies with shrinking manufacturing capacity and supply chains increasingly interwoven with the rest of the world. The new idea is that much of the benefit from a falling currency is offset by the higher prices paid for components imported from overseas. The U.K. is emerging as a test case for whether globalization has diminished the effect.

Although its currency has been battered by the financial crisis, the Brexit vote to leave the European Union—which took place a year ago June 23—and the country’s fresh bout of political uncertainty, its exporting power hasn’t responded as textbooks might suggest. Chemicals made at Chemoxy’s factory in Middlesbrough are worth about 20% more in the export market after last June’s fall in sterling, given the beefed-up value of the currencies used to buy those goods overseas. Higher costs for imported materials, however, all but erased that advantage. “We have a huge interdependency on international markets,” says Chemoxy Chief Executive Ian Stark. The company exports more than 60% of its products and imports about 85% of its chemical raw materials. A weaker pound, he says, “isn’t revolutionary.”

British businesses ranging from car makers to food processors to lumber mills are discovering the same thing. Adam Posen, president of the Peterson Institute for International Economics, and a member of the Bank of England’s rate-setting monetary policy committee between 2009 and 2012, says the effects of currency moves on exports have faded over time. After the financial crisis in 2008, a big sterling depreciation didn’t result in the pickup in exports “we would have expected,” he says. “You just don’t get as much bang for your pound as you used to,” said Mr. Posen. Whether or how the relationship between a currency’s strength and economic growth still holds has ramifications for international politics.

In the U.S., manufacturers have long complained about the impact of a strong dollar. President Donald Trump has accused Japan and China of keeping their currencies artificially low, hampering U.S. exports. In 1992, the pound fell by around 11% between September and the end of that year after the U.K. crashed out of the European exchange rate mechanism—a precursor to the euro that required a stronger pound than the government could sustain. The U.K. economy then went on an export tear, which turned a trade deficit into a five-year surplus and jump-started a recovery.

“Aldi’s prices were also up to 50% lower than traditional grocery chains, a move that appeared to follow rival Lidl’s announcement on prices.”

• Aldi Fires $3.4 Billion Shot In US Supermarket Wars (R.)

German grocery chain Aldi said on Sunday it would invest $3.4 billion to expand its U.S. store base to 2,500 by 2022, raising the stakes for rivals caught in a price war. Aldi operates 1,600 U.S. stores and earlier this year said it would add another 400 by the end of 2018 and spend $1.6 billion to remodel 1,300 of them. The investment, which raises Aldi’s capital expenditure to at least $5 billion so far this year, comes at a time of intense competition and disruption in the industry. German rival Lidl will open the first of its 100 U.S. stores on June 15. In May, Lidl said it would price products up to 50% lower than rivals. Wal-Mart, the largest U.S. grocer, is testing lower prices in 11 U.S. states and pushing vendors to undercut rivals by 15%. Wal-Mart, the world’s biggest retailer, is expected to spend about $6 billion to regain its title as the low-price leader, analysts said.

The furious pace of expansion by Aldi and Lidl is likely to further disrupt the U.S. grocery market, which has seen 18 bankruptcies since 2014. The two chains are also upending established UK grocers like Tesco and Wal-Mart’s UK arm, ASDA. In May, Aldi CEO Jason Hart told Reuters the chain intended to have prices at least 21% lower than rivals and would focus on adding in-house brands to win over price-sensitive customers. “We’re growing at a time when other retailers are struggling,” Hart said in a statement. Hart added that Aldi’s prices were also up to 50% lower than traditional grocery chains, a move that appeared to follow rival Lidl’s announcement on prices. The latest store expansion will create 25,000 U.S. jobs and make Aldi the third-largest grocery chain operator in the country behind Wal-Mart and Kroger, the German chain said in a statement. Aldi’s 2,500 stores would equal about 53% of Wal-Mart’s U.S. outlets.

As I said yesterday, highly curious. When he won on May 7, just 5 weeks ago, there were no candidates, no apparatus, and no money: word was the candidates even had to pay for their own campaigns. And look now.

Note: France is still under a state of emergency.

• France’s Macron Set For Landslide Majority In Parliament (R.)

French President Emmanuel Macron’s party is set for a giant majority in parliament, opinion pollsters said on Sunday after a first round of voting. According to two pollsters, his Republic On the Move (LREM) party and its ally Modem were set to win well over 400 seats in the 577-seat National Assembly. The two organisations along with others forecast he had won well over 30% of first round votes as voting closed. A poll by Elabe put the number of seats at between 415 and 445, while a poll by Kantar Sofres put it at between 400 and 445. A second round of voting will determine the actual number of seats Macron wins. The first round for the most part eliminates eliminates candidates who have gathered less than 12.5% of registered voters.

Long interview for Naomi’s new book “No Is Not Enough”.

• Naomi Klein: ‘Trump Is An Idiot, But He’s Good At That’ (G.)

The fact that Naomi Klein predicted the forces that explain the rise to power of Donald Trump gives her no pleasure at all. It is 17 years since Klein, then aged 30, published her first book, No Logo – a seductive rage against the branding of public life by globalising corporations – and made herself, in the words of the New Yorker, “the most visible and influential figure on the American left” almost overnight. She ended the book with what sounded then like “this crazy idea that you could become your own personal global brand”. Speaking about that idea now, she can only laugh at her former innocence. No Logo was written before social media made personal branding second nature. Trump, she suggests in her new book, No Is Not Enough, exploited that phenomenon to become the first incarnation of president as a brand, doing to the US nation and to the planet what he had first practised on his big gold towers: plastering his name and everything it stands for all over them.

Klein has also charted the other force at work behind the victory of the 45th president. Her 2007 book, The Shock Doctrine, argued that neoliberal capitalism, the ideological love affair with free markets espoused by disciples of the late economist Milton Friedman, was so destructive of social bonds, and so beneficial to the 1% at the expense of the 99%, that a population would only countenance it when in a state of shock, following a crisis – a natural disaster, a terrorist attack, a war. Klein developed this theory first in 2004 when reporting from Baghdad and watching a brutally deregulated market state being imagined by agents of the Bush administration in the rubble of war and the fall of Saddam Hussein. She documented it too in the aftermath of the Boxing Day tsunami in Sri Lanka, when the inundated coastline of former fishing villages was parcelled up and sold off to global hotel chains in the name of regeneration.

And she saw it most of all in the fallout of Hurricane Katrina in New Orleans, when, she argued, disaster was first ignored and exacerbated by government and then exploited for the gain of consultants and developers. Friedmanites understood that in extreme circumstances bewildered populations longed above all for a sense of control. They would willingly grant exceptional powers to anyone who promised certainty. They understood too that the combination of social media and 24-hour cable news allowed them to manufacture such scenarios almost at will. The libertarian right of the Republican party, in Klein’s words, became “a movement that prays for crisis the way drought-struck farmers pray for rain”.

Here’s hoping Chelsea has some peace and perhaps even fun.

• Chelsea Manning Explains Why She Went to Prison for You (TAM)

Chelsea Manning has given her first interview since being released from prison last month in which she explains her motivations for making public thousands of military documents. Excerpts of her interview with ABC‘s “Nightline” co-anchor Juju Chang aired Friday on the network’s “Good Morning America.” Asked about why she leaked the trove of documents, she says, “I have a responsibility to the public … we all have a responsibility.” “We’re getting all this information from all these different sources and it’s just death, destruction, mayhem.” “We’re filtering it all through facts, statistics, reports, dates, times, locations, and eventually, you just stop,” she adds. “I stopped seeing just statistics and information, and I started seeing people.” Asked by Hing what she would tell President Obama, Manning, choking up, says, “I’ve been given a chance,” she says. “That’s all I asked for was a chance.”

Stop bombing. Start rebuilding. There is no other solution.

• Over 2,500 Migrants Rescued In Mediterranean In 2 Days, Over 50 Missing (RT)

More than 2,500 migrants were rescued off the Libyan coast in the past 48 hours while attempting to cross the Mediterranean in “flimsy dinghies,” the UN refugee agency has said. At least eight people have died and dozens are feared missing. “Eight corpses have been recovered so far and at least 52 people are feared missing from two incidents involving large numbers of people on flimsy dinghies off the coast of Libya on Saturday,” Director of Europe Bureau of the UN Refugee agency (UNHCR) Vincent Cochetel said in a statement, citing the Italian Coast Guard. In all, over a dozen search-and-rescue operations, coordinated by the Italian Coast Guard, were launched over the weekend. The rescued migrants are expected to be disembarked in Italy over the next few days, the agency added.

“UNHCR applauds the rescue efforts by European government authorities, the Italian Coast Guard and NGOs, but is deeply saddened that the death toll continues to rise,” the statement reads. Over 1,770 people are estimated to have perished or gone missing while trying to cross the Mediterranean so far this year, according to agency’s estimates, while more than 50,000 migrants reached Italian shores, most of them through Libya. The death toll among migrants trying to reach Europe is believed to be much higher, according to the UNHCR, though, as many of them presumably die in the Sahara desert without even making it to the Libyan coast. The migrant death toll is expected to spike in the next few months with the beginning of summer sailing season, the agency warns. While urging to strengthen international efforts to save people attempting to cross the Mediterranean, UNHCR stated that the “solutions cannot just be in Italy.” Italy has on numerous occasions said that it does not enough resources to deal with the migrant influx from Libya.

Home › Forums › Debt Rattle June 12 2017