Ervin Marto Paris 1950

Number 4 in the UK charts, but the BBC refuses to play it. It’s just so well done, and so timely, that none of that matters. It’s 40 years ago that the same happened with the SexPistols’ “God save the Queen”. The BBC ban pushed the song up the charts.

• Liar Liar: The Protest Song Is Back (CaptainSKA)

NHS crisis, education crisis, u turns … you can’t trust Theresa May. Let’s get this into the top 40. Download now and force the BBC to play it on our airwaves. All proceeds from downloads of the track between 26th May and 8th June 2017 will be split between food banks around the UK and The People’s Assembly Against Austerity. Download from the following links: (Please note we previously released a version of Liar Liar in 2010 so don’t download the wrong one! Correct track is called ‘Liar Liar GE2017’)

It’s high time to at least have this discussion, and no longer let a bunch of economists deny it flat-out and end it there.

• The Magic Money Tree Exists (MMM)

The quality of debate in the 2017 UK General election has been generally terrible. The Tories have been trying to push the “There’s no such thing as a Magic Money Tree” line, and falling straight into the “Don’t think of a pink elephant” problem. This line is known in economic and political circles as The Noble Lie. The Magic Money Tree does exist. They all know it does. When there is a bank to bail out, does anybody ask where the money is coming from? When there is a nuclear missile system that needs building? How about when a foreign nation needs bombing? Like the elephant in the room The Tree cannot be mentioned, because then the electorate might start asking awkward questions about public services – perhaps we should have some? – and taxation – are we overtaxed for the size of government we have, given that we still have people without work?

Once you know about The Tree you might have your politicians delay a casino build and build a hospital instead. You might let the rich people keep their coins, but stop them using them to reserve scare doctors and teachers for their own purposes ahead of the general population. The Tories want to privatise everything, and Labour want to hit rich people hard with taxation sticks. There are no doubt reasons for these fetishes that psychologists would find fascinating. But they are damaging to our nation. They get in the way of doing the job. The debate we should be having is about the size of government we want. And then we instruct our government to provide that. Taxation then is just a thermostat on the wall. You count the bodies in the unemployment queue. If there are too many there is too much taxation and you turn the dial down. If there aren’t any and prices are hotting up, you may have too little taxation so you turn the dial up a little.

Alex Douglas explains in Getting Money out of Politics that the debate is one about resource allocation: “you don’t need to worry about ‘where the money will come from’ to pay for this or that programme or public service. Think about this instead: Are there enough resources to provide the proposed service? Is there enough wood, bricks, glass, PVC, to build new council houses? Is there enough land to build them on? Are there enough builders to build them? If not, are there enough apprenticeships to train them? Are there enough staff in the schools and hospitals? If not, are there enough colleges to train them? If not, are there enough resources to create more of these?” So let’s drop the pretence and get onto the real debate. We know that the last 40 years has been about the magic of the market and that government must constrain itself. It must do as it is told by a small number of unelected technocrats sitting in a central bank ivory tower.

Watch these 6 minutes. And then watch it again and again until you understand it. The world will never look the same. Share it wherever you can. Make people literate.

• The Basics of Modern Money (MMB)

A nation’s currency is a wonderful, powerful thing. Learn how countries like the U.S.—which issue their own sovereign currency—can afford to use that currency to serve their citizens. Get inspired about our untapped potential, and learn to be less worried about the so-called “national debt”!

Nice find, Michael.

• In The Last 10 Years US Economy Grew At Same Rate As In The 1930s (Snyder)

Earlier today I came across an article about President Trump’s new budget from Fox News, and in this article the author makes a startling claim… “The hard fact is that the past decade’s $10 trillion in deficit spending has produced the worst economic growth as measured by Gross Domestic Product in our nation’s history. You read that right, in the past decade our nation’s economy grew slower than even during the Great Depression. This stagnant, new normal, low-growth economy is leaving millions of working age people behind who have given up even trying to participate, and has led to a malaise where many doubt that the American dream is attainable.

When I first read that, I thought that this claim could not possibly be true. But I was curious, and so I looked up the numbers for myself. What I found was absolutely astounding. The following are U.S. GDP growth rates for every year during the 1930s…

1930: -8.5%

1931: -6.4%

1932: -12.9%

1933: -1.3%

1934: 10.8%

1935: 8.9%

1936: 12.9%

1937: 5.1%

1938: -3.3%

1939: 8.0%When you average all of those years together, you get an average rate of economic growth of 1.33%. That is really bad, but it is the kind of number that one would expect from “the Great Depression”. So then I looked up the numbers for the last ten years…

2007: 1.8%

2008: -0.3%

2009: -2.8%

2010: 2.5%

2011: 1.6%

2012: 2.2%

2013: 1.7%

2014: 2.4%

2015: 2.6%

2016: 1.6%When you average these years together, you get an average rate of economic growth of 1.33%. I thought that was a really strange coincidence, and so I pulled up my calculator and ran all of the numbers again and I got the exact same results. The 1930s certainly had more big ups and downs, but the average rate of economic growth during that decade was exactly the same as we have seen over the past 10 years. And of course the early 1940s turned out to be a boom time for the U.S. economy, while it appears that our rate of economic growth is actually slowing down. As I noted yesterday, U.S. GDP growth during the first quarter of 2017 was just 0.7%.

So could the US of course. The problem in Europe is it’s too late now. Getting it right would be seen as too negative in Germany, and it’s Germany, and Germany alone, that ultimately takes ll the main decisions in the EU.

• The UK Could Teach The Eurozone About Successful Monetary Unions (CityAM)

The Office for National Statistics (ONS) published last week some figures which show how a successful monetary union works in practice. It is not obvious at first sight, from the dry heading: “regional public sector finances”. The ONS collects information on the amounts of public spending and money raised in taxes across the regions of the UK. The difference is the so-called fiscal balance of the region. Only three regions generate a surplus. In London, the South East and the East of England, total tax receipts exceed public spending. The capital has a healthy positive balance of £3,070 per head, followed by the South East at £1,667 per head. Essentially, these two regions subsidise the rest of the UK. Public spending in the North East, for example, is £3,827 per person above the level of taxes raised in that region.

In Wales, it is even higher at £4,545. No wonder that one of the first things Carwyn Jones, leader of the Welsh Assembly, said after the Brexit vote was: “Wales must not lose a penny of subsidy”. The region which benefits most is Northern Ireland, which gets £5,437 per head more than it generates in tax. Scotland, to complete the picture, receives around half of that, at £2,824 per person. There is a lot of debate around Brexit and the border between the North and the Republic of Ireland. There is even talk of reunification, but on these numbers the Republic would be mad to want it. Essentially, the regions receive these subsidies because they are running deficits on their trade balance of payments. The exports of goods and services from the North East, for example, to the rest of the UK are much less than it imports.

In balance of payments jargon, the subsidy it receives is a monetary transfer from the rest of the country, principally from London and the South East. The ONS does not actually produce regional balance of payments statistics. But the fact that most regions receive these large transfers implies that they are just not productive enough to sustain their living standards by their own efforts. All the regions are in the sterling monetary union. Those running trade deficits cannot devalue to try to improve their position. They must instead rely on subsidy. Exactly the same principles apply in the Eurozone. The massive difference of course is that there is no central Eurozone government to make sure the weaker performing regions receive the necessary funding.

This is why President Macron and Chancellor Merkel announced they will examine changes to treaties to allow for further Eurozone integration. Even the hardline German finance minister, Wolfgang Schauble, said: “a community cannot exist without the strong vouching for the weaker ones”. To be sustainable, a monetary union needs large transfers between its regions. London and the South East already put their hands deep into their pockets for the rest of the UK. Gordon Brown did get one thing spectacularly right. He kept us out of the Euro.

Not even enough to stand still. Trump recovery? Nah.

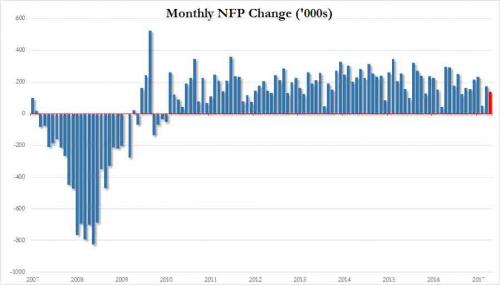

• Huge Miss: Only 138K US Jobs Added In May; April Revised Much Lower (ZH)

As previewed last night, the jobs “whisper” risk was to the downside, and in what was a very disappointing print released moments ago by the BLS, the whisper was spot on with only 138K jobs added in May, far below the 185K estimate, and below the lowest estimate of 140K. This was the second lowest print going back all the way to last October. Additionally, April’s big beat of 211K was revised substantially lower to only 174K, suggesting that any expectation the Fed may have had of “evidence” the recent economic slowdown was transitory was just crushed.

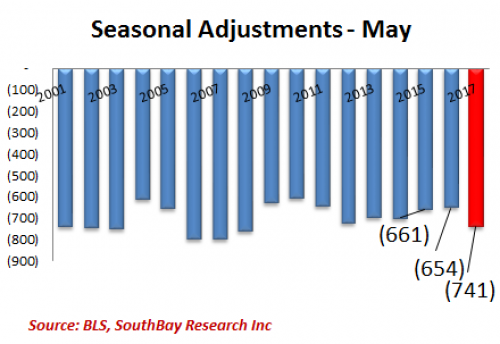

The change in total payrolls for March was revised down from +79,000 to +50,000, and the change for April was revised down from +211,000 to +174,000. With these revisions, employment gains in March and April combined were 66,000 less than previously reported. This means that over the past 3 months, job gains have averaged 121,000 per month, a far cry from the 181,000 average jobs added over the past 12 months. To be sure, as SouthBay Research points out, a big reason for the unexpected miss was the sharp seasonal adjustment favtor, which was the biggest going back to the financial crisis days:

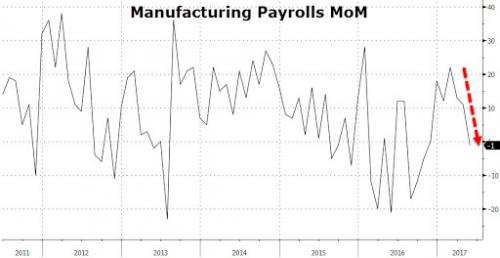

Not helping the Trump agenda, manufacturing jobs declined sharply, posting the weakest growth of 2017.

The quality of jobs just keeps deteriorating, even if numbers do not.

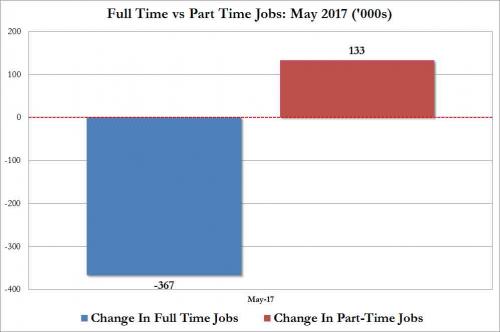

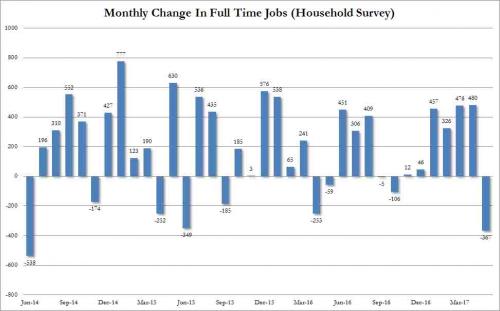

• US Full-Time Jobs Tumble By 367,000, Biggest Drop In Three Years (ZH)

While on the surface, the payrolls report, the wage growth and the unemployment rate (which dropped for all the wrong reasons) were disappointing, a quick look inside the underlying data reveals even more troubling trends, such as that in addition to the number of employed workers dropping by 233K according to the household survey, the composition of these jobs raised even more red flags because in May the US lost 367,000 full time jobs offset by the gain of 133,000 part time jobs.

Putting this number in context, it was the biggest drop in full-time jobs going back to June 2014. And in this context, we are happy to announce that while manufacturing jobs once again declined by 1,000, the waiter and bartender recovery continues to hum along, with 30,000 workers added in “food services and drinking places.”

EUrope gets $2 for every $1 increase in growth? I don’t believe that for a second.

• The Chinese Economic “Death Spiral” (Rickards)

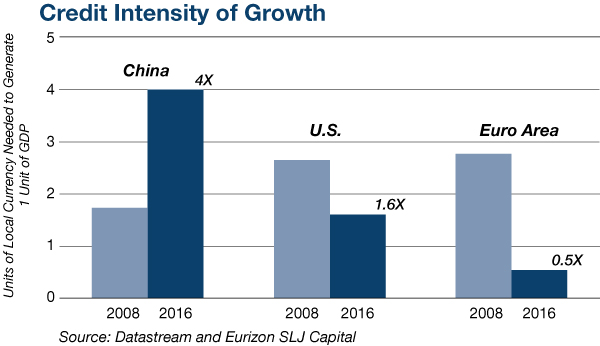

China has reported annual growth rates since the panic of 2008 of between 6.7% and 12.2%, with a steady downward trend since early 2010. If China’s growth engine is running out of steam, as I’ve described, how has China managed to maintain such relatively high growth rates? The answer is contained in three key words: debt, deflation and waste. Waste is a blunt word referring to non-productive investment. The investment component of China’s GDP is about 45% of the total. Most major economies show about 25% to 35% for investment. But at least half the Chinese investment is wasted. It goes to projects that will never produce an adequate return, either on an absolute basis or relative to alternative uses of the funds. If this wasted investment is subtracted from GDP, similar to a one-time write off under general accounting principles, then 8% growth would be 6.2%, and 6% growth would be 4.7%.

[..] Any economy can produce short-term growth by incurring debt and using the proceeds as government spending, tax cuts, investment, or grants. This is nothing more than the classic Keynesian fiscal stimulus with its mystical “multiplier” effect that produces more than $1.00 in aggregate demand for every $1.00 borrowed and spent. In fact, there’s ample evidence that the Keynesian multiplier only exists when an economy is in recession or the very early stages of an expansion, and when its debt levels are relatively low and sustainable. Highly indebted economies in the late stages of an expansion do not conform to Keynes’ theory of a multiplier. Unfortunately for China, it is both highly indebted and has not suffered a recession for eight years. China should therefore expect the GDP multiplier on new debt used for spending or infrastructure to be less than 1.

That is exactly what the data shows. The chart below measures credit intensity defined as the number of units of local currency needed to produce one unit of growth. The local currency metric is a measured by central bank money printing to monetize debt, and is therefore a proxy for the debt itself. The chart shows that in China today, it takes $4.00 of money printing to produce $1.00 of growth. This is up significantly from 2008 when it took $1.70 of money printing to produce $1.00 of growth. This shows that the Keynesian multiplier is less than 1, in fact it’s 0.25 in China today. (Only Europe shows a true multiplier where less than one unit of new money can produce a unit of growth).

Russia has used the crisis, and the sanctions, to make its economy more resilient. That’s power.

• Russia Can ‘Live Forever’ With $40 Oil in Warning to Hedge Funds (BBG)

A race to the bottom in oil prices may not have many winners, but Russia is certain it can survive. It’s less sure about hedge funds. “We’re actually ready to live forever with the oil price at $40 or below,” Russian Economy Minister Maxim Oreshkin said in a Bloomberg Television interview at the St. Petersburg International Economic Forum on Thursday. “All macroeconomic policy is now based on the assumption of the oil price of $40.” While the world’s biggest energy exporter has made clear it’s hunkering down for years of depressed oil prices, “forever” might be a slight exaggeration, according to the head of Russia’s second-largest bank. Still, “I fully agree with the minister that the oil price is no threat to the economy,” VTB Group CEO Andrey Kostin said during a panel on Friday. As Russia’s future economic plans increasingly converge around crude at that level, Oreshkin says he’s baffled by a more bullish turn taken by hedge funds.

Bets on rising WTI prices jumped the most this year just as Saudi Arabia and Russia were mustering support for the deal they struck in Vienna last month, U.S. Commodity Futures Trading Commission data show. “The oil price within one or two years might be much lower, and those funds which are on the other side of the deals on hedging for one, for two years – they are taking huge risks,” Oreshkin said. Hedge funds’ WTI net-long position – the difference between bets on a price rise and wagers on a drop – rose 20% in the week ended May 23, according to the CFTC. The number had plunged 50% in the previous four weeks. Net-long positions in benchmark Brent – which trades at a small premium to Russia’s Urals export blend – rose 17%, data from ICE Futures Europe showed. Oreshkin questioned “the strategy of those hedge funds” that are striking deals with shale producers for one to two years. “Because the risks are there,” he said.

Stephen keeps writing despite being gravely ill. Click the link to help.

• New York Times Reinvents Putin’s Comments on America’s Election (Lendman)

Instead of reporting precisely what he said, and certainly meant, about fabricated allegations of Russian US election hacking, The Times deliberately misrepresented his recent comments. Interviewed in France by Le Figaro, he repeated what he said many times before. No Russian interference occurred, no evidence suggesting it. “Who is making these allegations,” he asked? “Based on what? If these are just allegations, then these hackers could be from anywhere else and not necessarily from Russia.” Putin knows no hacking occurred. Information was leaked from one or more DNC insiders, no foreign governments involved. He stressed “(i)t makes no sense for (Russia) to do such things. What for?” Speaking to heads of international news agencies on the sidelines of the St. Petersburg Economic Forum, he said “no hackers can influence a foreign election campaign in a significant way.”

“No information leaked this way would resonate with the voters and affect the outcome. We don’t do this at a state level, have no intention of doing it, and on the contrary, we are fighting against it.” He also stressed Moscow’s involvement in creating multi-world polarity. Some countries (meaning US-led Western ones) want Russia contained to further their national interests. “They do this through all kinds of actions that are outside the framework of international law, including economic restrictions,” Putin explained. “Now, they see that this is not working and has produced no results. This irritates them and rouses them into using other methods to pursue their aims and tempts them to up the stakes.” “But we do not go along with these attempts, do not offer pretexts for action. They therefore need to invent pretexts out of nowhere.” Russia, China and Iran are the leading forces against Washington’s hegemonic ambitions – why they’re surrounded by US bases and targeted for regime change.

Addressing the issues of hackers, he said they “can be anywhere…in any country in the world…At the governmental level, we never engage in this. This is what is most important.” He explained attacks can occur from outside Russia made to look like they occurred from its territory. “Modern technology allows that. It is very easy.” It’s a CIA and NSA hacking method to blame Russia, China, Iran or other targeted countries for actions they didn’t commit. “(M)ost important is I am deeply convinced that no hackers can have a real impact on an election campaign in another country,” Putin stressed. “You see, nothing, no information can be imprinted in voters’ minds, in the minds of a nation, and influence the final outcome and the final result.” Those were his recent comments, clearly indicating no Russian direct or indirect involvement in US election hacking or against any other countries.

Instead of reporting what Putin said as I did above, The NYT headlined “Putin Hints at US Election Meddling by ‘Patriotically Minded Russian,” inferring possible state involvement he clearly explained didn’t happen time and again. The Times claimed he “(s)hift(ed) from his previous blanket denials…” False! He did no such thing! The Times: “(H)is comments…were a departure from the Kremlin’s previous position: that Russia had played no role whatsoever in” US election hacking. Fact: His comments repeated what he said many times before, no departure from his position or from any other Russian officials. The Times lied. The Times: “The boundary between state and private action…is often blurry, particularly in matters relating to the projection of Russian influence abroad.”

Again The Times inferred what didn’t happen. If Russian election hacking occurred, incriminating evidence would have been revealed long ago. There’s none, proving accusations are groundless. Instead of truth-telling on this and numerous other vital issues, especially geopolitical ones, notably on Russia, The Times consistently publishes rubbish. Everything it’s reported on alleged Russian US election hacking is disinformation, deception and fake news. Believe none of it.

$1 US – $1.40 NZD

• A Lifetime Of Debt: NZ’s Biggest Mortgages Are On Auckland North Shore (Stuff)

Owning your own home may be the Kiwi dream but some North Shore homeowners are “drowning in debt” without hope of being mortgage-free. New data from credit information website CreditSimple.co.nz showed North Shore homeowners under 55 had an average debt of $542,600: the highest debt in the country. The information also showed Shore homeowners over 55 still owed an average $381,500. This was the second-highest debt in the country, just behind central Auckland’s older homeowners with an average mortgage of $393,200. Brian Pethybridge, the manager of North Shore Budget Service, was not surprised by the figures. “It’s a phenomenon that’s going to rear it’s head basically because mortgages were $500,000 and now they’re looking at $1 million,” he said. “The options that you had before are limited. It’s a sign of the times.”

According to QV’s latest residential house values, the average house on the Shore was valued at $1.195m, up 8.5% on last year. Pethybridge said many North Shore homeowners were unlikely to pay off their mortgage by the time they retired. Many people’s retirement plans involved selling the house and moving to a cheaper area or a retirement village, he said. But Pethybridge warned there was no guarantee house prices would keep on going up. Another risk was that interest rates could go up and homeowners would not be able to service their mortgage repayments, he said. Banks were already warning people to be prepared to pay 7% interest, and Pethybridge remembered a time when interest rates went “up and up”. Some people were already paying interest-only on their mortgage, meaning the debt was not going down, he said.

“How can one man, even if he is the president, single-handedly alter our international obligations?”

• Obama Joined The Paris Agreement Unilaterally. Trump Can Quit The Same Way (BBG)

To critics of President Donald Trump’s decision to withdraw the U.S. from the Paris climate accord, it may seem like presidential fiat is a very dysfunctional way to do foreign policy. How, exactly, is such overwhelming power consistent with checks and balances? How can one man, even if he is the president, single-handedly alter our international obligations? The short answer is the Constitution, not so much in its origins as in its evolution. It’s an important reminder that the tremendous power of the imperial presidency isn’t an unmitigated good – at least when you don’t like the policies of the person holding office. It’s important to note that President Barack Obama put the U.S. into the Paris climate deal exactly the same way Trump took the U.S. out, namely by unilateral executive action.

Obama couldn’t have gotten two-thirds of the Senate to approve a climate protection treaty. That’s the constitutional requirement for a treaty, as designed by the framers, who for the most part didn’t contemplate that the president would be able to commit the U.S. internationally without the participation of Congress. Understanding that he couldn’t turn the Paris deal into a treaty, Obama turned to a tool used by modern presidents to streamline international deal-making: the executive agreement. An executive agreement doesn’t bring all the domestic legal effects of a treaty. Under the Constitution’s supremacy clause, treaties become the law of the land, which is not the case for executive deals. But that isn’t a huge difference today.

Executive agreements are internationally binding like treaties, because international law isn’t focused on domestic processes like ratification but on the promise to join the compact. The Supreme Court has weakened treaties by requiring explicit language for them to have direct domestic legal effect. And the court has also held that executive agreements can affect some domestic legal rights, a reflection of expanded presidential authority. Indeed, the Paris accord was designed to accommodate the reality that Obama needed to be entering into an executive agreement, not a treaty. It doesn’t call itself a treaty or a protocol but an agreement. And it is in practical terms largely nonbinding, calling for countries to set targets without setting sanctions for noncompliance.

Some conservatives have argued that the Paris accord really is a treaty and should have been submitted to the Senate. But whether they’re right or wrong is a matter courts ordinarily wouldn’t address. Given that Obama entered the Paris accord unilaterally, there isn’t much doubt that Trump can withdraw unilaterally. And liberals who would like to think otherwise would do well to recall that without the executive agreement option, the U.S. wouldn’t have joined the deal in the first place. What’s more remarkable still is that, even if the Senate had approved the Paris accord as a treaty, Trump could have withdrawn without getting the Senate’s consent.

Kabuki gone berserk.

• Liberal Circus in Washington Ignores Trump’s True Scandals (AHT)

After suffering a devastating election loss to the weakest candidate the GOP has ever had to offer, establishment liberals have stopped at nothing to rationalize their miserable defeat to reality television star Donald J. Trump, even concocting outlandish McCarthyite theories of foreign interference, in what seems to be intentional, purely for the obfuscation of the Democratic Party’s own deficiencies. Bereft of any evidence whatsoever, political elites accused our old Cold War nemesis, Russia, of interfering in the American presidential election to favor the GOP’s Donald Trump over Democratic Party darling Hillary Clinton. Mass liberal outrage and the Democratic Party’s newfound super-patriotism prompted investigation into foreign hacking claims and the Office of the Director of National Intelligence released its intelligence report on Russian interference in early January.

Despite its grandiose promises of revealing irrefutable evidence of the Kremlin’s direct involvement, the ODNI failed to deliver. Although lauded by both establishments as “damning,” the ODNI’s highly publicized intelligence report provided not a shred of evidence linking Russia to the hacking of the DNC; thus, concluding absolutely nothing. Political analysts, journalists, and those bearing at least some critical thinking ability dismissed the report altogether, as the first half contained nothing but baseless assertions, inconsistencies, and contradictions, while the second half was devoted entirely to irrelevant Russia Today bashing.

One would think that the increased potential of nuclear armageddon would dissuade political elites from accusing a nuclear power of such crimes without solid proof, but liberals never cease to amaze. Unfazed by popular skepticism and/or the general lack of evidence of Russia’s involvement, the liberal bourgeoisie, conjuring recycled Cold War sentiments, advanced their partisan crusade against Trump, painting him as some sort of Russian puppet installed to do the unconditional bidding of President Vladimir Putin. Eleven months have passed since the birth of these Russian hacking conspiracies, but the Trump-Russia non-scandal has persisted to dominate American political discourse ever since — with skepticism in the minority, surviving as fringe thought, at best. Trump’s actual conflicts of interest and legitimate criticism of his policies have drowned into irrelevance as his every tweet receives 24×7 coverage and the liberal mainstream media entertains any and every conspiracy theory of Russian collusion known to man.

“Did incoming officials in earlier election transitions never meet with Russian diplomats on the way to assuming their duties? And if they did meet, what do you suppose they talked about? The Baltimore Orioles pitching prospects?”

The extraordinary thought disorders of this moment in history are equally distributed across the political spectrum. They’re an inevitable product of what Sigmund Freud identified as the discontents of civilization, but they grow especially acute as that civilization enters an economic crack-up zone. The craziness is equally distributed while the nation’s wealth is not. The old middle, or center, is imploding both economically and psychologically, concentrating distortions of reality at each end, Left and Right. The disordered thought in Trumpism is as self-evident as (a) covfefe, though it came into being out of the authentic pain of those classes that bear the brunt of accelerating collapse. The thought disorders among Trump’s adversaries interest me more, because they emanate from the far more educated ranks of society, the place where rational leadership is supposed to spawn.

If you can’t depend on those people to think straight in difficult times, then it raises the question of what exactly is the value of an advanced education? For instance: the incredible new idea put out by CNN that it is verboten for officials in the government — the president especially — to meet with the Russian ambassador to the United States. I’ve asked this question before, but obviously it needs to be repeated in the face of this persistent nonsense: why do you think nations send diplomats to other lands if not to meet with and communicate with government officials? Since when — and why — are we shocked that a US president would meet in the White House with the Russian ambassador and foreign minister? Did previous presidents not meet with Russian diplomats? Did incoming officials in earlier election transitions never meet with Russian diplomats on the way to assuming their duties?

And if they did meet, what do you suppose they talked about? The Baltimore Orioles pitching prospects? The newest fusion cuisine? Or serious matters of mutual geopolitical interest? Do American diplomats in Moscow avoid meeting with Russian leaders? Why do we even bother to send them there? Whether it is a misunderstanding of reality by the educated people who work on Cable TV news, or a malicious twisting of the public’s credulity, it is producing a grievous breakdown in collective coherence with the potential of causing enormous political mischief in American life. The Dem/Prog “resistance” may think that it is taking a bold stand against a rogue government, but it is only making itself look dangerously unreliable as a supposed alternative to Trumpism.

Bailin, bailout. Up, down. Flip, flop. The EU is fast eroding any trust it still has.

• EU Sees Taxpayers Funding Bank Bad-Loan Fix Within Current Rules (BBG)

EU member states can use public funds to help struggling banks dispose of soured loans, but only within the limits of laws put in place since the financial crisis, according to an EU report. While EU law normally stipulates that the need for “extraordinary public financial support” means a bank is failing and should be wound down, an exception is made for temporary state aid, known as a precautionary recapitalization, to address a capital shortfall identified in a stress test. “It seems conceivable” for governments to use such aid to finance an impaired-asset measure, the May 31 report states. The document says the conditions in EU law for giving state aid to a solvent bank must be observed.

“Dealing with the issue of high NPLs should not imply any deviation from the rules of the banking union,” it states, referring to the package of laws intended to bolster financial stability and deepen integration in the bloc. Andrea Enria, head of the European Banking Authority, has been one of the most vocal proponents of allowing state aid for banks that incur losses in the course of selling bad loans. He told EU lawmakers in April that state aid could be used to “deal promptly and decisively with the significant legacy of asset-quality problems in the European banking sector, which remains a drag on the EU economy.” Freeing up public money to offset banks’ losses could help to chip away at the €1 trillion bad-debt mountain and could smooth the way for bailouts in the EU’s hardest-hit countries, including Cyprus, Portugal and Italy.

The EU forces one of its sovereign member states to sell its assets to China. That should flash some very bright red lights.

• Greece Approves $8 Billion Chinese-Backed Resort Project Outside Athens (G.)

Construction work on a $7.9bn project to develop a sprawling coastal Olympics complex and Athens’s former airport will begin in six months, the Greek government has said. State minister Alekos Flabouraris said on Friday that the leftist administration’s privatisation agency had given the go-ahead to a consortium of Abu Dhabi and Chinese investors backed by the Chinese conglomerate Fosun, which owns 12% of the British holiday company Thomas Cook, to turn the site into a major resort. It had been earmarked as a metropolitan park but was largely abandoned for the past decade. Now the consortium plans to build a 200-hectare (494-acre) park along with apartments, hotels and shopping malls at the site, which also includes some venues from the 2004 Olympics.

Greece committed to sell off state assets under the terms of the international bailout keeping its economy afloat since 2010. Its main private property developer, Lamda, signed a deal in 2014 to build on the Hellenikon coastal area, in one of Europe’s biggest real estate development projects. The announcement came as Greece’s statistics service, Elstat, said the economy expanded in the first three months of 2017, upwardly revising a previous flash estimate in May that showed a 0.1% quarterly contraction. Data showed the economy grew by 0.4% in January to March compared with the final quarter of 2016 when GDP contracted by 1.1%. [..] Under a deal with its EU/IMF lenders, Athens needs to speed up the Hellenikon investment and address any forestry and archaeological issues.

Home › Forums › Debt Rattle June 3 2017