Edward Hopper Chop Suey 1929

They dine together, close a deal, and then can’t wait to tell entirely different stories to the press. But Trump has forced them into action.

• Top Democrats Announce Deal With Trump To Protect ‘Dreamers’ (MW)

Top Democratic leaders said Wednesday night that they had reached a compromise agreement with President Donald Trump to enact protections for the children of undocumented immigrants in exchange for increased border security measures that do not include funding for a wall — which the White House then disputed. “We had a very productive meeting at the White House with the president,” read a joint statement from Senate Minority Leader Chuck Schumer and House Minority Leader Nancy Pelosi. “The discussions focused on DACA. We agreed to enshrine the protections of DACA into law quickly, and to work out a package of border security, excluding the wall, that’s acceptable to both sides.” But shortly after that statement, White House press secretary Sarah Huckabee Sanders disputed that border-wall funding was off the table. “Excluding the wall was certainly not agreed to,” she said.

Schumer, of New York, and Pelosi, of California, had dinner with Trump at the White House on Wednesday night. It was apparently the second bipartisan agreement between Democrats and Trump in the past week, after last week’s surprise deal that provided funding for Hurricane Harvey relief and extended the debt ceiling for three months, much to Republicans’ chagrin. Extending protections for the Deferred Action for Childhood Arrivals program, which were rescinded by the Trump administration last week, is a top priority for Democrats and many Republican lawmakers. Without new legislation, the 690,000 children of undocumented immigrants — so-called “Dreamers” — enrolled in the program could face deportation as their status expires over the next two years. Trump had said he may “revisit” the issue of Dreamers in six months if Congress didn’t act.

It’s like driving into a dark and wet dead end alley.

• Fed Balance Sheet Reduction Will Reduce Funds Sent To Treasury (BI)

The Federal Reserve is not expected to raise interest rates again until at least December, and even that increase is now in doubt given low inflation and high political uncertainty in the United States. That doesn’t mean the central bank has no plans to tighten monetary policy, however. Officials are widely expected to announce the start of a gradual reduction of the Fed’s $4.4 trillion balance sheet, which more than quintupled in response to the Great Recession and financial crisis of 2007-2009. Policymakers are hoping the shrinkage, which they intend to accomplish by ceasing reinvestments of maturing bonds back into the central bank’s portfolio, will have minimal market impact. But a previous episode in 2013 known as the “taper tantrum,” when bond yields spiked sharply higher at the mere mention of a possible end to the Fed’s bond-buying program, offers a cautionary tale.

Regardless of immediate market impact, there will be a longer term effect on the government budget, currently the subject of heated debate, that most investors and politicians are ignoring. That’s because the Fed’s bond-buying program, in addition to lowering the government’s borrowing costs at a time when weak economic activity called for bigger budget deficits, created a stream of yearly returns of nearly $100 billion for the Federal Reserve which it then siphoned back to the Treasury. Sometimes these are referred to as the Fed’s “profits,” but that is a deceptive way of describing what is in effect an intra-government transaction. “As assets under management drop, so too will revenue on that portfolio. This will be a lost revenue source for the Treasury that will raise deficits and add to the Treasury’s financing” costs, writes Societe Generale Economist Stephen Gallagher in a research note to clients.

Downward volatility.

• “You Should Take the Fed at Their Word” (WS)

The markets have been brushing off the Fed and have done the opposite of what the Fed has set out to accomplish. The Fed wants to tighten financial conditions. It’s worried about asset prices. It’s worried that these inflated assets which are used as collateral by the banks, pose a danger to financial stability. It has mentioned several inflated asset classes by name, including commercial real estate, which backs $4 trillion in loans heavily concentrated at regional banks. And yet, markets have loosened financial conditions since the Fed started its tightening cycle in earnest last December. Markets are hiding behind “low” inflation, when the Fed is focused on asset prices. So longer-term yields have been falling even as short-term yields have moved up in line with the Fed’s target rate, and thus the yield curve has flattened.

The dollar has been falling. Equities have been soaring to new highs. And companies, if they’re big enough, are able to get funding for the riskiest projects at stunningly low rates. “I think there is maybe too much confidence that the Fed is not really going to do too much more on interest rates, that we’ll have one or two more rate hikes and that’s it,” Brian Coulton, chief economist for Fitch Ratings, told Reuters on Tuesday. Market participants are expecting “just one or two interest rate increases a year” despite the Fed’s stated expectation of seeing long-run interest rates at around 3.0%. “When the Fed says they’re going to engage in a gradual rate of interest rate increases, they mean three or four rate hikes every year and we think that’s what they’re going to do,” Coulton said. “We think that you should take them at their word and it may even be a little faster than that.”

This disconnect between market expectations and the Fed’s stated intentions could create volatility in fixed-income markets when markets finally catch up, he said. Volatility, when it’s used in this sense, always means downward volatility: a sudden downward adjustment in prices and spiking yields – a painful experience for the coddled bond market with big consequences for the stock market. “We think they’re going to be … getting more worried about some of the negative consequences of QE, the fact that it encourages risk taking and may create some issues for the banks,” he said. And he expects – this is “more of a personal view,” he said – that the Fed will continue with the rate hikes, or even accelerate them, even if consumer price inflation remains low.

“There’s low volatility until they’re highly volatile.” Sounds like Minsky.

• “Markets Have Always Been Wrong” – Jamie Dimon (ZH)

Oh, listen, markets are markets. There’s low volatility until they’re highly volatile. The stock market is high until it goes low. Markets therefore have always been wrong. And I think people are making mistakes. I can give you reasons why it might be low. We’ve had this fairly consistent, coherent, consistent growth. But forget the geopolitical noise and stuff like that. We’re chugging along, 2%. Europe is doing 2%. Russia – I mean, Japan is doing 1.5%, China’s doing their 6%. You know, earnings are doing okay. We’ve had a fairly benign economic environment. That’s a reason. I can give you another reason is that the Central Banks of the world that bought $12 trillion of securities. 12 trillion. Since they started doing QE. And that’s only just the U.S. That’s an awful lot of security purchases that might – in all things be equal, and remember things are never all equal – can reduce volatility.

And there may be other sides that are known. And once other sides happen, watch out. Then volatility goes way up. They’ll say they’re a genius, they figured out when it’s going to happened. I don’t guess on which kind of volatility. Like I said, we do a business. And we have to manage the volatility.” [..] The hurricanes are irrelevant. I wouldn’t have any policy matter as a function of hurricanes. Going to reduce GDP in the short run, they’ll probably increase it after that. I’ll let the economists figure it out. But almost a $20 trillion economy, that isn’t a reason to change monetary policy. It will create a lot of noise in the numbers, but I wouldn’t overreact to that. Advice, it’s very sympathetic. We’re doing – just so you know, we’re going to do a lot for affordable housing, get these people in these states 20,000 people in Florida, 6,000 in Houston. Most of the banks are waiving fees, delaying loan payments, offering special services for your employees and stuff like that.”

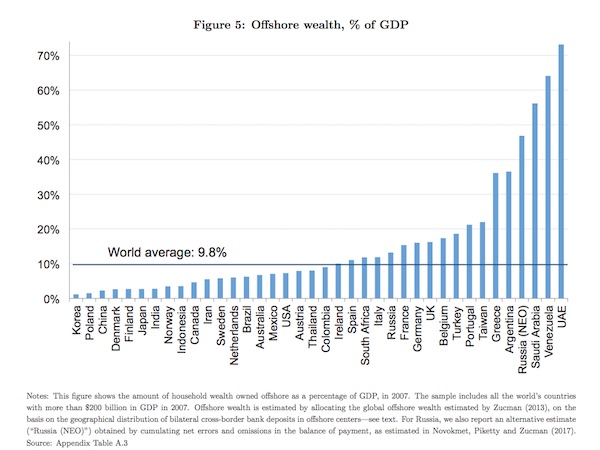

Saw the graph before. Greece is the big one here.

• 10% of Global GDP Is Stashed In Tax Havens (BI)

The Panama Papers and other major leaks from offshore tax havens have helped shed light on just how much money the world’s wealthiest people are parking in untaxed obscurity, away from the authorities and, importantly, economic researchers. This new evidence has helped economists gain greater insight into just how steep disparities between the rich and the poor have become, because having actual data on offshore holdings tends to widen wealth gaps considerably. Three of these researchers have teamed up on two important papers that offer a more in-depth look at what the world’s worst tax-evading and -avoiding nations are, and they find that the existence of tax havens makes inequality much worse than it appears with standard, publicly available economic data.

“The equivalent of 10% of world GDP is held in tax havens globally, but this average masks a great deal of heterogeneity—from a few % of GDP in Scandinavia, to about 15% in Continental Europe, and 60% in Gulf countries and some Latin American economies,” Annette Alstadsæter at the Norwegian University of Life Sciences, Niels Johannesen of the University of Copenhagen, and Gabriel Zucman of the University of California at Berkeley write in the first of the two articles. Global gross domestic product is about $75.6 trillion, according to World Bank figures. They then apply these estimates to build revised series of top wealth shares in 10 countries accounting for nearly half of world GDP. “Because offshore wealth is very concentrated at the top, accounting for it increases the top 0.01% wealth share substantially in Europe, even in countries that do not use tax havens extensively,” the authors write. “It has considerable effects in Russia, where the vast majority of wealth at the top is held offshore.”

About 60% of the wealth of Russia’s richest households is held offshore, the economists estimate. “More broadly, offshore wealth is likely to have major implications for the concentration of wealth in many of the world’s developing countries, hence for the world distribution of income and wealth.” “These results highlight the importance of looking beyond tax and survey data to study wealth accumulation among the very rich in a globalized world,” they continue. They say that despite lip service to transparency, “very little has been achieved” in recent years. “With the exception of Switzerland, no major financial center publishes 18 comprehensive statistics on the amount of foreign wealth managed by its banks.”

GDP is a lousy measure.

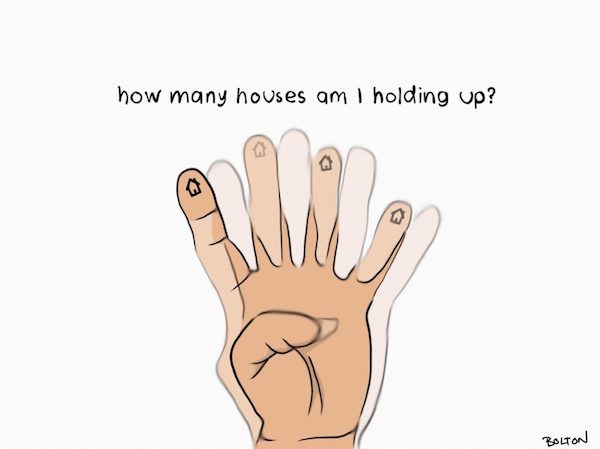

• Did You Know Housing Gets Counted Twice In GDP? (Murray)

Your car gets counted once in GDP when it is built, not when it is driven. Your clothes, your bicycle, your furniture, all get counted once when they are manufactured, and not again when they are worn, ridden, or sat on. But homes are counted twice: Once when they are constructed, and again when they are occupied. The argument to include both housing construction (as a new capital investment good) and housing occupancy (as a consumption good) arises from a conceptual trick at the heart of national accounting. That trick is to separate out two types of ‘final’ goods when adding up the ‘value-added’ in the economy, which is what GDP does. One good is a consumption good. These are goods (and services) that households consume, like clothes, food, entertainment, and so forth. All the value added at intermediate stages in the production chain of these goods can be captured by looking only at the final retail value of the goods.

That value represents the total value-added across the economy to produce that good. The other type of good is an investment good. This is a good that lasts a long time and contributes to future production. A new rail line, for example, is classified a new investment good, and the value of its production is counted in GDP, even though households don’t get any value from it until it is used to run trains. Once the rail line is being used to run trains, the value of those travel services is also counted in GDP as a consumption good, which will include within it the value contribution of the rail line itself. Thus there is a type of double-counting when it comes to investment goods — you count them when they are made, and you count them again when they are used to make consumption goods.

This is intentional. The production of investment goods is a large share of GDP — between 20 and 40% in most countries. By ignoring this production, which is also the more volatile part of production over the business cycle, GDP loses much of its value as a measure of how economically active a country is. The construction of new homes is, therefore, an investment good, which gets counted in GDP. But then the occupancy of these same homes gets counted gain as a consumption ‘home rental’ good each period after. This applies to the 70% of households (in Australia at least) who own their own home, not just the renters. Although they don’t pay themselves rent to occupy their home, GDP is calculated as if they do by ‘imputing’ the rent that homeowners would have to pay themselves if they instead rented their home.

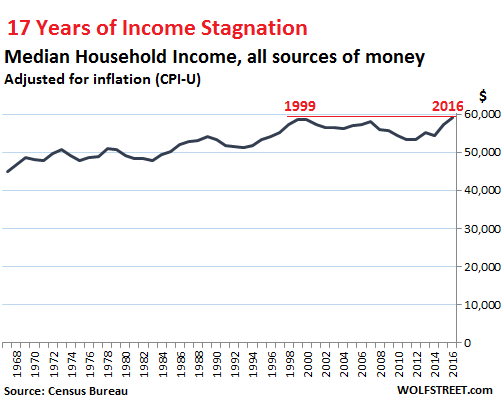

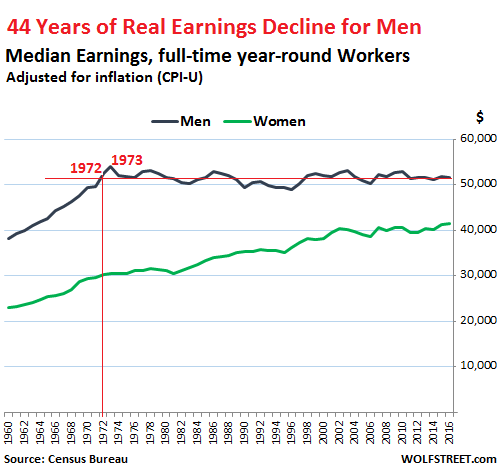

” On this inflation-adjusted basis, men had earned more than that in 1972″

..

• The Real Earnings of Men (WS)

For women who were working full-time year-round, median earnings (income obtained only from working) rose 0.7% on an inflation-adjusted basis from a year ago to $48,328, continuing well-deserved increases over the data series going back to 1960. The female-to-male earnings ratio hit a new record of 80.5%, after steady increases, up from the 60%-range, where it had been between 1960 and 1982. And while that may still be inadequate, and while more progress needs to be made for women in the workforce, it was nevertheless the good news.

Men in the workforce haven’t been so lucky. They have experienced the brunt of the wage repression over the past four decades, obtained in part via inflation, where wages inch up, but not quite enough to keep up with the Fed-engineered loss of purchasing power of the dollar. Median earnings for men who worked full-time year-round fell 0.4% in 2016, adjusted for inflation, to $51,640. On this inflation-adjusted basis, men had earned more than that in 1972 ($52,361). And it’s down 4.4% from the earnings peak in 1973 ($54,030). This translates into 44 years of real earnings decline:

Just in time for the Party Congress. What a lucky coincidence!

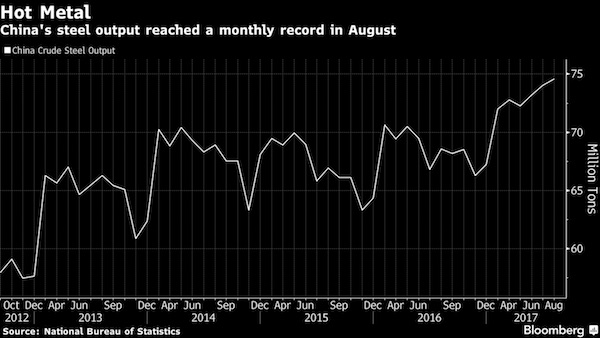

• China’s Steel Mills Run at Full Tilt as Output Hits New Peak (BBG)

Steel production in China chalked up a fresh monthly record as mills in the world’s top supplier increase output to profit from a rally in prices to six-year highs before government-ordered pollution curbs are implemented. Crude steel output climbed to 74.59 million metric tons last month, surpassing the previous peak of 74.02 million in July, and up from 68.57 million in August 2016, according to the statistics bureau Thursday. While that’s an all-time high for the month, daily output was less than the record in June. Production surged 5.6% to 566.4 million tons in the first eight months, also a record. Steel prices have been supercharged this year in the country that accounts for half of global output. A crackdown on illegal mills shuttered some supply, boosting the remaining producers, while demand has been underpinned by significant state-backed stimulus.

Investors are also eyeing signals that the government will press ahead with anti-pollution curbs over winter. “Steel mills have boosted output as profit margins are good,” said Helen Lau at Argonaut Securities in Hong Kong. “Production cuts won’t set in until September or October, so steelmakers are churning out as much as they can in the meantime.” Spot reinforcement bar in China, a benchmark product used in construction, hit 4,396 yuan a ton early this month, the highest level since October 2011. Prices have gained 30% this year. Steel output may drop in coming months as Asia’s top economy presses ahead with supply-side reforms. Hebei province, the center of China’s mammoth steel industry, has plans that’ll allow for winter output cuts of as much as 50% to reduce pollution. Citigroup Inc. has estimated daily production could shrink 8% because of the environmental crackdown.

But wait! Same source, same day, opposite views.

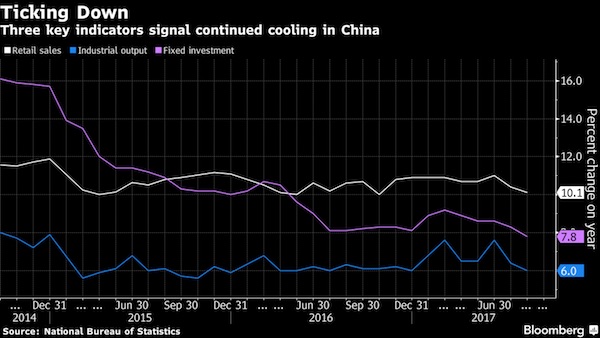

• China’s Economy Cools Again (BBG)

The pace of China’s economic expansion unexpectedly cooled further last month after a lackluster July, as factory output, investment and retail sales all slowed. • Industrial output rose 6.0% from a year earlier in August, versus a median projection of 6.6% and July’s 6.4%. That’s the slowest pace this year • Retail sales expanded 10.1% from a year earlier, versus a projection of 10.5% and 10.4% in July, also the slowest reading in 2017 • Fixed-asset investment in urban areas rose 7.8% in the first eight months of the year over the same period in 2016, compared with a forecast 8.2% rise. That’s the slowest since 1999.

The continued cooling of the world’s second-largest economy suggests that efforts to rein in credit expansion and reduce excess capacity are hitting home ahead of the key 19th Party Congress in October. Still, producer-price inflation and a manufacturing sentiment gauge both exceeded estimates earlier this month, signaling some resilience. The Shanghai Composite Index reversed earlier gains to fall 0.4%. “Today’s data shows that the economy clearly already peaked in the first half of this year,” said Larry Hu at Macquarie in Hong Kong. “Recently both property and exports are slowing down and that’s why the whole economy is slowing.” “Regulatory tightening in the financial sector is putting a squeeze on highly indebted firms reliant on shadow bank financing,” said Frederic Neumann at HSBC in Hong Kong.

“And officials are unlikely to take their foot off the regulatory brakes any time soon. Growth therefore looks set to weaken further into year end, as regulators step up their campaign to rein in shadow banking.” “That’s still on track to a gradual moderation,” Chang Jian, chief China economist at Barclays in Hong Kong, said in a Bloomberg Television interview. “The government has been closing capacity, especially those that don’t meet environmental standards, and enforcement this year has been much stricter in the run-up to the 19th Party Congress.”

An empire built on war.

• US Senate Rejects Bid To Repeal War Authorizations (R.)

The U.S. Senate rejected an amendment on Wednesday that would have forced the repeal of war resolutions used as the legal basis for U.S. military actions in Iraq, Afghanistan and against extremists in Syria and other countries. The Senate voted 61 to 36 to kill the measure, which six months after it became law would have put an end to authorizations for the use of military force (AUMF) passed in 2001 and 2002. The legislation was offered by Republican Senator Rand Paul as an amendment to a must-pass annual defense policy bill, which lawmakers are using as a vehicle to gain a greater say in national security policy. Paul’s measure was aimed at asserting the constitutional right of Congress to approve military action, rather than the president.

Some of the other amendments address issues such as sanctions on North Korea and President Donald Trump’s ban on transgender troops in the military. Many members of Congress are concerned the 2001 AUMF, passed days after the Sept. 11 attacks to authorize the fight against al Qaeda and affiliates, has been used too broadly as the legal basis for a wide range of military action in too many countries. The majority of support for the amendment came from Democrats, who joined Paul in arguing that it is long past time for Congress to debate a new authorization for the use of force. “We should oppose unauthorized, undeclared, unconstitutional war. At this particular time, there are no limits on war,” Paul said.

Not really. They’re just chasing illusions.

• Has the NYT Gone Collectively Mad? (Robert Parry)

For those of us who have taught journalism or worked as editors, a sign that an article is the product of sloppy or dishonest journalism is that a key point will be declared as flat fact when it is unproven or a point in serious dispute – and it then becomes the foundation for other claims, building a story like a high-rise constructed on sand. This use of speculation as fact is something to guard against particularly in the work of inexperienced or opinionated reporters. But what happens when this sort of unprofessional work tops page one of The New York Times one day as a major “investigative” article and reemerges the next day in even more strident form as a major Times editorial? Are we dealing then with an inept journalist who got carried away with his thesis or are we facing institutional corruption or even a collective madness driven by ideological fervor?

What is stunning about the lede story in last Friday’s print edition of The New York Times is that it offers no real evidence to support its provocative claim that – as the headline states – “To Sway Vote, Russia Used Army of Fake Americans” or its subhead: “Flooding Twitter and Facebook, Impostors Helped Fuel Anger in Polarized U.S.” In the old days, this wildly speculative article, which spills over three pages, would have earned an F in a J-school class or gotten a rookie reporter a stern rebuke from a senior editor. But now such unprofessionalism is highlighted by The New York Times, which boasts that it is the standard-setter of American journalism, the nation’s “newspaper of record.” In this case, it allows reporter Scott Shane to introduce his thesis by citing some Internet accounts that apparently used fake identities, but he ties none of them to the Russian government.

Acting like he has minimal familiarity with the Internet – yes, a lot of people do use fake identities – Shane builds his case on the assumption that accounts that cited references to purloined Democratic emails must be somehow from an agent or a bot connected to the Kremlin. For instance, Shane cites the fake identity of “Melvin Redick,” who suggested on June 8, 2016, that people visit DCLeaks which, a few days earlier, had posted some emails from prominent Americans, which Shane states as fact – not allegation – were “stolen … by Russian hackers.” Shane then adds, also as flat fact, that “The site’s phony promoters were in the vanguard of a cyberarmy of counterfeit Facebook and Twitter accounts, a legion of Russian-controlled impostors whose operations are still being unraveled.”

See my article yesterday.

• Crisis Brings Sea Change To Greek Housing Market (K.)

“What we are experiencing is the end of the era of home ownership in Greece as households can no longer save to buy property,” says Nikos Hatzitsolis, chief executive at real estate firm CB Richard Ellis-Axies, underscoring the fundamental changes that the crisis has triggered in the Greek property market. This change, the experts explain, is not just evident in the case of those just flying the nest who wouldn’t be in any position to own their home anyway unless it was given to them by their family, but also existing homeowners who are opting to leave their property and rent it out or sell it. “Around 70% of homeowners are becoming renters because they choose to sell their property to pay off debts such as mortgages, late taxes or credit card debt,” says Lefteris Potamianos, vice president of the Athens-Attica Estate Agents Association.

“If any money is left over from the transaction, it is not reinvested in another property, as was the case in the past, but used to rent another home. Basically, the dream of ownership that drove past generations has come to an end.” A significant%age of homeowners choosing to rent out their home and lease a different property for themselves also consists of young people who see their accommodation requirements increasing, due to the birth of a child for example, or want to live in an area with better schools or security. “We are seeing more and more such cases in the property market,” says Potamianos. “Given that sales prices are very low and it is hard to find a buyer, many owners prefer to rent out their property and then rent another for themselves, as getting bank funding for a purchase is incredibly difficult. Some even move around to see which area suits them best. Renting has this flexibility, allowing you to relocate if you’re not happy.”

For the overwhelming majority, however, renting is the only option, as buying is seen as bringing no advantages whatsoever anymore. “Even from a purely economic perspective, it’s not worth owning a home today. In contrast, people who rent avoid all the additional tax costs and are not exposed to the instability of the tax framework for real estate assets, which has become a tool of politics and results in no taxpayer knowing what tomorrow will bring,” explains Hatzitsolis. “Previous generations believed that buying houses was a form of investment. This is no longer the case, as we’re seeing a completely different mentality in younger people.”

The expert also draws attention to the cases of people who are stuck with their properties. “I know an owner who inherited a house in [the upscale Athenian suburb of] Ekali and has to pay 80,000 euros a year in property tax,” he recounts. “At best, the house could fetch 50,000 euros a year in rent, which means that this man has to cover losses of 30,000 euros every year, something that is a complete dead end.” This owner has little choice but to sell, says Hatzitsolis, adding that such cases also explain why an increasing number of people are refusing their inheritances.

Europe won’t rest until they have created their very own Somalia.

• More Austerity May Be Ahead (K.)

Greek authorities will honor their commitments as laid out in the latest loan deal with international creditors, even if this results in the need for additional austerity measures next year, a top government official indicated Wednesday. In an unusual show of honesty and realism, the same official suggested that there might not be a “clean exit” for Greece after its third bailout expires next summer but something more restrictive. There are a range of possible scenarios between that of a clean exit, which Prime Minister Alexis Tsipras has heralded, and the prospect of a credit line for Greece, the official said. On the prospect of more austerity next year, the official said he believed that there would not be a big divergence in fiscal targets next year. “If there is, we’ll see what happens, but were are committed to a target of 3.5% of GDP,” the official said, referring to the primary surplus goal set by creditors.

The official also noted that, once a primary surplus target is reached, residual revenue will go toward boosting the Social Solidarity Income program for 2017 for Greeks who have been hardest hit by austerity but also toward paying off state debts to the private sector and to growth programs. Decisions on these matters are expected to be taken following talks with the mission chiefs representing Greece’s foreign lenders, who are expected to travel to Athens next month and to assess the progress of authorities in boosting tax collection and curbing spending. Although Greek officials have underlined the importance of completing the next bailout review by the end of the year, sources suggest that the process might drag into January.

The most important thing, the official noted, is “that we are not part of the problem” when important discussions about the future of the Greek program get under way in the first quarter of next year, touching on the participation (or not) of the IMF in Greece’s third bailout and relief for the country’s debt burden. Greek authorities are concerned about the IMF’s stance opposite Athens. Apart from the Fund’s traditionally tough position on fiscal matters, there are concerns too about its demands for a further recapitalization of Greek banks. The official, however, assumed the stance of the ECB on this issue, noting that there is no need for Greek banks to receive further capital. The official said that Greece planned to tap international bond markets in the next 6-9 months following a successful return in July.

Home › Forums › Debt Rattle September 14 2017