Pablo Picasso Garcon à la Pipe 1905

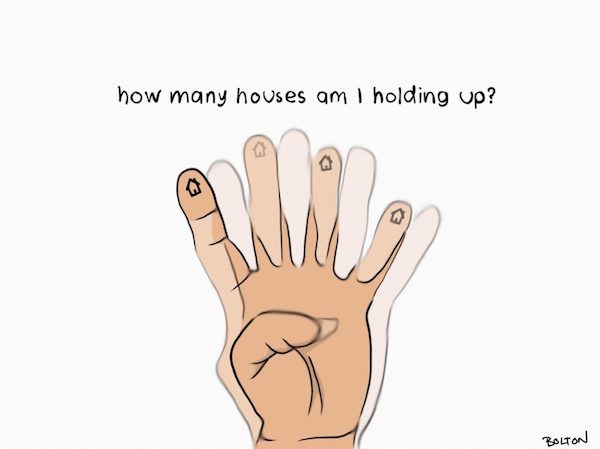

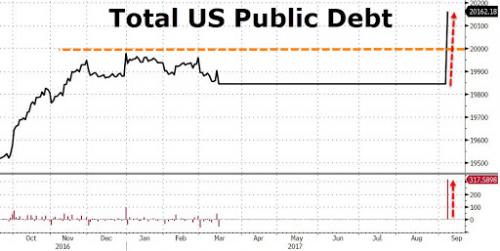

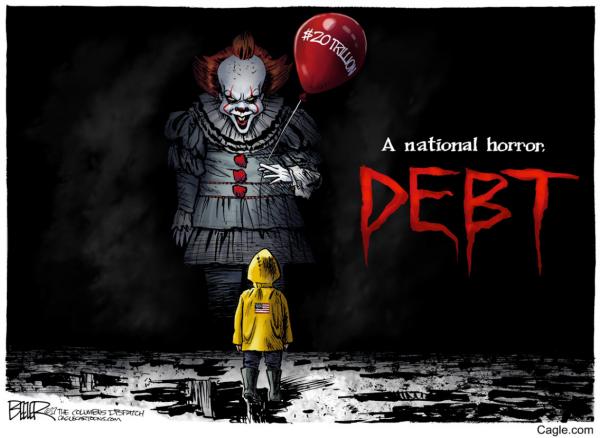

$34,880 of new debt per second..

• To Hell In A Bucket: America Is Going Broke At Mach 30 (Gordon)

“You know as well I do how this crazy debt based fiat money system works. The debt must perpetually increase or the whole financial system breaks down. The best we can hope for is that the ongoing currency debasement merely leads to a subtle erosion of living standards. That’s the best-case scenario. “But, again, no one except maybe a handful of your readers’ gives a rip about the federal debt. Plus, if you’re gonna keep writing about it you need to use better terminology. “The federal debt has grown at such a rapid rate that standard dollar units no longer capture what’s going on. The debt numbers are so large it is difficult to distinguish between hundreds of billions and tens of trillions of dollars. “For better perspective, you need to describe the debt growth in astronomical terms.

You see, astronomers use light years to adjust for large distances. A light year, as its name suggests, is the distance light travels in one year. One light year converts to light traveling about 5.87 trillion miles per year, excluding leap year of course. “You noted that since President Obama took office in early 2009, at about the time the American Recovery and Reinvestment Act was passed, the U.S. federal debt has increased from $10.6 trillion to nearly $20 trillion. Well, you were wrong. “In the several days since you wrote that article, did you see the federal debt jumped to over $20.1 trillion? “Apparently, after Congress suspended the debt limit last Friday, the Treasury went ahead and reported the $300 billion of off balance spending they’d run up over the last six months since hitting the debt ceiling in March.

This is what Treasury Secretary Mnuchin meant by resorting to ‘extraordinary measures’ to keep the government humming. Sounds like Enron accounting to us. “Anywho, over the last 104 months the federal debt has increased by $9.5 trillion – or at an annual rate of about $1.1 trillion. This equals a rate of increase that’s nearly 20% the speed of light. This also pencil’s out to $34,880 of new debt per second. Are you starting to grasp the enormity? “Still, if the speed of light example doesn’t do it for you, how about the speed of sound? When Chuck Yeager first outran sound he reached what was called Mach 1. That equals 767 miles per hour – or 1,125 feet per second. “So, at $34,880 of new debt per second, the federal government is running up the debt at a speed that’s over Mach 30. Yes, things have really gotten out of control!

I’m sure it’s entirely legal.

• Down $20 Billion, Boeing Stuffs Pension Fund With Its Own Shares (BBG)

Like so many companies in America, Boeing has largely neglected the gaping deficit in its employee pension as it doled out lavish rewards to shareholders. What’s raising eyebrows is how it plans to shore up the retirement plan. Last month, Boeing made its largest pension contribution in over a decade. But rather than put up cash and lock in the funding, the planemaker transferred $3.5 billion of its own shares, including those it bought back in years past. (The administrator says it expects to sell them over the coming year.) It’s a bold move, and one cheered by many on Wall Street. Yet to pension experts, it isn’t worth the risk. After a record-setting, 58% rally this year, Boeing is betting it can keep producing the kind of earnings that push shares higher. If all goes well, not only will the pension benefit, but Boeing says it will be able to forgo contributions for the next four years.

But if anything goes awry, the $57 billion pension – which covers a majority of its workers and retirees – could easily end up worse off than before. “It’s an irresponsible thing to do certainly from the perspective of the plan participants,” said Daniel Bergstresser, a finance professor at the Brandeis International Business School. “Ideally, you would like to put assets in the pension plan that won’t fall in value at exactly the same time that the company is suffering.” Under CEO Dennis Muilenburg, Boeing’s pension shortfall has widened as the Chicago-based company stepped up share buybacks. The $20 billion gap is now wider than any S&P 500 company except General Electric. And relative to earnings, Boeing shares are already trading close to the highest levels in a decade, a sign there might be more downside than upside.

[..] At the end of 2016, its pension had $57 billion in assets and $77 billion in obligations – a funding ratio of 74%, data compiled by Bloomberg show. Boeing froze pensions for Seattle-area Machinist union members last year under a hard-fought contract amendment. It also switched non-union workers to a defined contribution plan. And the stock transfer last month, combined with a planned $500 million cash payment this year, would be equal to all the company’s contributions during the previous five years. Nevertheless, it still leaves Boeing with roughly $15 billion in unfunded pension liabilities, although the shortfall should gradually shrink over the next four years, according to Sanford C. Bernstein. To be clear, Boeing has the money. In the past three years, the company generated enough excess cash to buy back $30 billion of its own shares.

But using equity instead of cash does have its advantages. It allows Boeing to conserve its free cash flow – a key metric for investors – by transferring Treasury shares that were repurchased at far lower values than today’s prices. In addition, Boeing will get a $700 million tax benefit, which will offset the cost of its $500 million cash contribution.

“The company has been saddled with debt since buyout firms KKR and Bain Capital, together with real estate investment trust Vornado Realty took Toys “R” Us private for $6.6 billion in 2005.”

• Toys ‘R’ Us Mulls Chapter 11 Bankruptcy Filing (R.)

Toys ‘R’ Us Inc could file for bankruptcy in the coming weeks as pressure from skittish suppliers intensifies, the Wall Street Journal reported on Friday, citing people familiar with the matter. The company and its restructuring advisers are considering filing for Chapter 11 protection in the U.S. Bankruptcy Court in Richmond, Virginia, according to the WSJ report. The privately-held toy retailer had previously said it was working with investment bank Lazard to help address its approximately $5 billion in debt, of which roughly $400 million comes due next year. The potential Chapter 11 filing could be a result of the company’s suppliers tightening trade terms, including holding back on shipments unless the toy retailer is able to make cash payments on delivery, the newspaper reported.

The move by Toys “R” Us to potentially file for bankruptcy comes at a time when more and more consumers increasingly make purchases from online retailers like Amazon.com and avoid visiting brick-and-mortar shops. There have been more than a dozen significant retail bankruptcies this year, but none for retailers as big as Toys “R” Us, which has more than 1,600 stores worldwide. Toys tapped restructuring attorneys from Kirkland & Ellis LLP, CNBC reported this month. The company has been saddled with debt since buyout firms KKR and Bain Capital, together with real estate investment trust Vornado Realty took Toys “R” Us private for $6.6 billion in 2005.

Interesting take.

• Bitcoin Needs To Be Worth $1,000,000 To Be A Legitimate Currency (MW)

Think bitcoin is in bubble territory? You ain’t seen nothing yet, says one cryptocurrency expert, who believes its value needs to surge by about 300 times over the next several years to be considered a legitimate currency or risk retreating into obscurity and obsolescence. Bitcoin, the No. 1 cryptocurrency, has drawn outsize attention over its parabolic rise—and the recent, brutal plunge it has been enduring in recent trade. Some market participants, however, make the case that despite its roughly 260% year-to-date rise it has to clear a far more stratospheric value hurdle to evolve into a practical form of money alongside fiat units like the U.S. dollar, Europe’s euro or British pound. A single bitcoin was worth about $3,568 in recent trade, off lows of the past few days, according to data site Coindesk.com, amid regulatory headwinds in China and critical comments from Wall Street pros like J.P. Morgan CEO Jamie Dimon.

Still, a bitcoin would need to be worth a stunning $1,000,000 to be a bona fide monetary unit, says Iqbal Gandham, U.K managing director at eToro, a trading platform. In other words, the digital currency would need to see a 300 fold run-up from its current level. To be sure, Gandham isn’t making a prediction; though he believes the currency has the ability to scale such lofty levels, Gandham thinks that bitcoin needs to climb to such a level to be truly viable as a monetary unit. To understand why is to understand the tiniest component of bitcoin—the Satoshi. Named after the purported creator of bitcoin, Satoshi Nakamoto. A Satoshi is equal to 0.00000001 bitcoin. Put another way, one bitcoin contains 100 million Satoshis. Satoshi’s value in dollars equated to $0.0000356819 at last check. Gandham argues that a Satoshi needs to be equivalent to a single penny, which it would when one bitcoin is worth $1,000,000.

“It is the Satoshi with which people will buy a cup of coffee,” Gandham told MarketWatch. He said using bitcoin now to purchase goods and services, as one would with dollars, isn’t feasible because bitcoin hasn’t reached the necessary economies of scale. “People don’t use a bar of gold to buy things, they use subdivisions of gold,” he said, saying that using bitcoin now to purchase items is like using a bar of gold to purchase a beverage or a meal. Gandham also said bitcoin really needs to get to that million-dollar mark in the next few years. Some are already wagering that it will get close: John McAfee, founder of his namesake antivirus software company says bitcoin is headed to the $500,000 level within three years. “It needs to get there in the next few years if it is really going to work,” Gandham said. “People will only spend the subdivision of bitcoin—and you can only spend the subdivision—if they are of reasonable value,” he said.

An actual Satoshi note that is redeemable for real money

“After 25 years of writing about her, my very last words on Hillary Clinton. Please shoot me if I violate this pledge..” Me too, this is it.

• Hillary Happened (Jeffrey St. Clair)

Unlike Bill, Hillary is a prolific, but graceless and transparent liar. She is also probably the nastiest political figure in America since Nixon. Yet she lacked Nixon’s Machiavellian genius for political manipulation. Hillary wears her menace on her face. She could never hide her aspiration for power; her desire to become a war criminal in the ranks of her mentor Henry Kissinger (symbolized by the laurels of a Nobel Peace Prize, naturally). Americans don’t mind politicians with a lust to spill blood, but they prefer them not to advertise it. Thus, Clinton was miscast from the beginning as a political candidate for elected office. Her skills and temperament were more suited to the role of political enforcer in the mode of Thomas Cromwell or John Erhlichman. But her ambition wouldn’t let her settle for the role of a backstage player.

“One thing I’ve learned over the years is how easy it is for some people to say horrible things about me when I’m not around,” she fumes with Nixonian fury, “but how hard it is for them to look me in the eye and say it to my face.” Hillary has tried to reinvent herself many times and does so yet again in this meretricious coda to her failed campaign. She made herself more domesticated for the southern electorate in Arkansas. She shifted the blame to her advisors after the disaster of her health care bill. She washed off the blood-spatter from the Ken Starr investigations by portraying herself as the target of a witch hunt. She exploited an addled Daniel Patrick Moynihan to justify running as an interloper for Senator in New York. She rationalized her votes for the Iraq War by saying she was duped by Colin Powell and Dick Cheney.

She manufactured a timely tear for the cameras after her loss to Obama. She assumed the mantle of unrepentant war-monger during her belligerent tenure as Secretary of State and transubstantiated into a white dove during her debates with Bernie Sanders. She has weeded and blurred inconvenient episodes from her resumé. She has gone on talking tours. She has appeared in town halls. She has reintroduced herself, again and again. She’s changed her name, hairstyles and fashion designers. She exchanged dresses for pantsuits. She shifted from drinking pinot noir to craft beers. She’s backed wars both before she opposed them and after she condemned them. But she remains the same Hillary Rodham Clinton Americans have known since 1992. Everybody sees this except her. Americans know Hillary better than she does herself.

All of her manufactured mirages are translucent to the very the people she wants to deceive. When Hillary looks in the mirror, she must see what might have been (should have been in her mind) and not what is. And that schism enrages her. “Why am I seen as such a divisive figure and, say, Joe Biden and John Kerry aren’t?” she mopes. “They’ve cast votes of all kinds, including some they regret, just like me? What makes me such a lightning rod for fury? I’m really asking. I’m at a loss.” This self-pitying book should prove a challenge for library cataloguers. Shall they shelve it as non-fiction or fiction?

“..only Trump could cut a bipartisan deal protecting immigrant Dreamers, and maybe Trump is the only president who could cut a bipartisan deal on Medicare for All..”

• Trump And The Democrats: What’s Next: A Deal With Bernie? (Salon)

Meanwhile, it seems as though Trump has determined that he can cut deals with the congressional Democrats without any blowback — it’s the old “I could stand in the middle of Fifth Avenue and shoot somebody” canard. He believes he’s invincible when it comes to the loyalty of his googly-eyed rally crowds. And he might be right. The same goes for Trump’s seemingly unwavering support among the congressional GOP, given how various Republicans have distanced themselves from him publicly only to vote for him last November or to vote with him on the Hill. If Trump is right and his base is stronger than we think, perhaps there’s a chance for the president to pull another Nixon-to-China maneuver.

Rewinding 45 years, Richard Nixon, with his notorious record of anti-communism, was perhaps the only living politician who could’ve reached out to Chinese leader Mao Zedong in 1972 without serious political repercussions. A Democrat or liberal Republican reaching out to China would’ve been pegged as soft on communism, but Nixon was pretty well immune from such an attack. Likewise, only Trump could cut a bipartisan deal protecting immigrant Dreamers, and maybe Trump is the only president who could cut a bipartisan deal on Medicare for All, especially now that fellow populist Bernie Sanders has introduced it in the Senate with the support of 15 other Democrats, including Al Franken and Elizabeth Warren.

Back in 2008, President Obama internally toyed with the idea, but moderate Democrats as well as Republicans would’ve balked, so Obama instead went with the framework for the Affordable Care Act, given its support among moderates on the Hill. If Trump were to back Sanders’ legislation, it’d be difficult for Republicans and moderates to walk away, knowing the loudness of Trump’s base. As with many legislative initiatives and issues, Republican voters tend to run away from anything that’s proposed by liberals and Democrats simply because liberals and Democrats, in their worldview, are weak and can’t be trusted. With a Republican president backing Medicare for All, GOP voters might be more inclined to support it. Politics aside, they’d absolutely benefit from such a program and its considerable savings over private health insurance.

OODA loop (observe, orient, decide, act).

• The OODA Loop Of Trump’s Insurgency Has Been Smashed (GG)

Trump is in the White House today because an open source insurgency put him there. I first wrote about Trump’s open source insurgency a year and a half ago (February 2016). At that point, it was already apparent Trump was very likely to win not just the primary, but the election. However, as prescient as my article was, I did get the plausible promise – the simple goal the effort that unites all of the disparate interests, the goal that animates an insurgency – wrong. At the time, I thought it was about representing forgotten interests (an error many writers are still making). Instead, the real uniting goal of Trump’s insurgency was “opposition to a failed establishment” That goal held the insurgency that put him in office together, despite gaffes, scandals, leaks, etc that would have ended the political career of any other candidate.

It was also a goal that allowed the insurgency to continue after winning the election. In most cases, once the goal has been accomplished (i.e. remove Mubarak), the insurgency evaporates. The reason it didn’t: the media. The media is the voice of establishment interests (social, economic, and national security). It locks establishment interests in place. It also explained away failure after failure (nutty Chinese trade policy, lie that led to Iraq war, unpunished financial crisis, etc.) of the US establishment, as if it never occurred. The media kept the insurgency alive through its overwhelming opposition to the Trump Presidency and Trump helped keep it alive by provoking the media at every turn. The alignment of this very public struggle with the plausible promise of the insurgency kept Trump’s support at about ~40% (and more than 50% in more than half of all Congressional districts nationally).

That insurgency is now over. Its OODA loop is smashed. Worried that Trump would end existing US spending/policies (largely, still geared to cold war priorities), the senior military staff running the Trump administration launched a counter-insurgency against the insurgency. They have been successful (if only they were half as good fighting against real world insurgencies). Here’s how: Former generals took control of key staff positions. They purged staff members that were part of the insurgency and tightly limited access to Trump. Finally, and most importantly, they took control of Trump’s information flow. That final step changed everything. General Kelly, Trump’s Chief of Staff, has put Trump on a establishment-only media diet. Further, staff members are now prevented from sneaking him stories from unapproved sources during the day (stories that might get him riled up and off the establishment message).

Making things ‘personal’ works for a narrative. In practice, though, not so much.

• A Flaw In US Foreign Policy That No One Wants To Talk About (TAM)

In an interview with RT in 2015, Syrian President Bashar al-Assad uttered perhaps one of his most intriguing statements since the Syrian conflict erupted in 2011. Assad stated: “Western propaganda has, from the very beginning, been about the cause of the problem being the president. Why? Because they want to portray the whole problem in Syria lies in one individual; and consequently the natural reaction for many people is that, if the problem lies in one individual, that individual should not be more important than the entire homeland. So let that individual go and things will be alright. That’s how they oversimplify things in the West.” He continued: “Notice what happened in the Western media since the coup in Ukraine. What happened? President Putin was transformed from a friend of the West to a foe and, yet again, he was characterized as a tsar…

This is Western propaganda. They say that if the president went things will get better.” Putting aside Assad’s vast and extensive list of war crimes and crimes against humanity, Assad highlighted one of the major flaws in Western thinking regarding America’s hostile policies toward a number of independent states. Just look at the current to-and-fro-ing between North Korea and the United States to gather an accurate picture of what is being referred to here. The problem of North Korea is consistently portrayed in the media as caused by one person (current leader Kim Jong-un), a narrative that ultimately ignores the role America and its allies have played in this current crisis.[..] What the media is really advancing here – particularly when one talks about a military option as a response to dealing with North Korea’s rogue actions – is the notion that if the U.S. could only take out Kim Jong-un, the problem of North Korea would disappear.

[..] The fact that the U.S. evidently doesn’t want to solve any problems at all – that it merely seeks to overthrow leaders that don’t succumb to its wishes – is a topic for a separate article but is certainly worth mentioning here as well. The same can ultimately be said of Donald Trump. Since his election victory, many celebrities, media pundits, and members of the intelligence community have sought to unseat and discredit him. Yet Donald Trump is merely a horrifying symptom of America’s problems; to think he alone caused them and that by removing him from office the U.S. would suddenly become a safe-haven of freedom and liberty is nothing short of idiotic.

If you agree with the latter sentiment, you must also concede that the problems facing North Korea, Syria, Venezuela, and elsewhere could never be solved by the U.S. forcibly removing their leaders. If Assad was removed from Syria, would extremism disappear or would it thrive in the political vacuum as it did in Iraq? Could Syria’s internal issues — which are much more extensive than the corporate media would have us believe — be solved by something as simple as removing its current leader? Can anyone name a country where this has been tried and tested as a true model for solving a sovereign nation’s internal crises? Anyone who truly believes a country’s problems can be solved in this facile way needs to do a bit more reading.

Congress has left a lot of things alone that are their responsibility

• This Isn’t Your Great-Grandad’s America (Jim Kunstler)

Hurricanes Harvey and Irma are so out of the news now that people not listening to the mold grow in their sweltering bedrooms probably think these events had something to do with the Confederate defeat. Both The New York Times and the WashPo are much more concerned this morning with doings on the planet Saturn, and the career moves of fashion icon Chelsea Manning, which is perhaps how things should be in Attention Deficit Nation. Standing by on developments there…. In the meantime, personally, I think it would be cruel to deport fully acculturated and Americanized young adults to Mexico and Central America. But there should be no question that it’s up to congress to figure out what to do about the DACA kids, and put it into coherent law. The Golden Golem of Greatness was correct to serve the ball into congress’s court.

The suave and charming Mr. Obama only punted the action on that problem, and rather cynically too, I suspect, since he knew the next president would be stuck with it. It’s hard to overcome the sentimental demagoguery this quandary fetches up. The so-called Dreamers are lately portrayed in the media as a monoculture of spectacularly earnest high-achievers, all potential Harvard grads, and future Silicon Valley millionaires working tirelessly to add value to the US economy. This, again personally, I doubt , and there’s also room to doubt that they are uniformly acculturated and Americanized as claimed by the journalists cherry-picking their stories to support the narrative that national borders and immigration laws are themselves cruel anachronisms that need to be opposed.

[..] It’s right and proper that congress should resolve the fate of the DACA kids by legislation, and that they should actively address reform of the 1965 immigration act, too. Things have changed. This isn’t your great-grandad’s America of burgeoning factories beckoning to the downtrodden abroad. This is a sunset industrial economy not really knowing where its headed, but indulging in grandiose fantasies of perpetual robotic leisure where actual work is obsolete but somehow everybody gets rich. Trump was also correct to set a six month deadline on for congress to act. It is clearly their responsibility to do so, and the deadline is exactly the sort of boundary in thought-and-act that this lazy-ass nation needs to begin accomplishing anything on its long and neglected to-do list of pressing issues.

Where are the defenders of democracy? Where’s the EU?

• Police In Catalonia Hunt For Hidden Ballot Boxes In Bid To Foil Referendum (R.)

Armed police in Spain have raided several print works and newspaper offices in Catalonia in recent days in a hunt for voting papers, ballot boxes and leaflets to be used in an Oct. 1 independence referendum which Madrid vehemently opposes. The searches, which have so far yielded nothing, are part of a concerted effort by the government to prevent the ballot from going ahead, amid fears that a vote to break away could trigger a political crisis even if Spain does not recognize the outcome. On Friday, the government passed measures to tighten control over the region’s spending to stop it using state cash to pay for the ballot, and earlier this week Madrid summoned over 700 Catalan mayors for questioning over their support for the vote. “They’ve lost the plot,” said Albert Batet, mayor of the town of Valls and one of those summoned for questioning.

“They are persecuting mayors, the press, printers. They are stretching the limits of democracy.” Catalonia’s president Carles Puigdemont, who faces criminal charges for organizing the referendum, says he has over 6,000 ballot boxes ready to deploy next month, but their whereabouts are a secret. Toni Castejon, spokesman for the Catalan police force union, said it was like finding a needle in a haystack. “Right now, we have no idea where they are,” he said. [..] For some supporters of the independence movement, the search for the ballot boxes and voting papers has become a symbol of what they see as state repression. Images of the Catalan police force – the Mossos d‘Esquadra – seizing what for many are symbols of democracy would be highly inflammatory, police say.

The Mossos report to the Catalan regional government and are highly regarded by Catalans, particularly after their handling of the Islamist militant attacks in the region in August that killed 16. But Spanish state prosecutors have ordered all police – including the Catalan force – to act. “What no one wants is the image of the Mossos taking away the ballot boxes,” said Castejon of the police union. “That would lead to a lot of anger and even civil unrest.”

Then again, this fits in quite well with how Brussels treats democracy, votes, referendums.

• Spanish State Poised To Seize Catalan Finances (BBC)

The Spanish government has given the regional government in Catalonia 48 hours to abandon “illegal” referendum plans or lose budgetary powers. Finance Minister Cristóbal Montoro said a mechanism had been approved for the state to take control of the autonomous region’s finances. Madrid is seeking to stop the Catalan government spending public money on its planned independence referendum. The Catalans are defying a court order to suspend the 1 October vote. Catalan President Carles Puigdemont launched his campaign for a “Yes” vote on Thursday night in the town of Tarragona, telling a rally at a former bullring: “Vote, and in so doing bring light to darkness that has lasted for too many years.” The crowd shouted back, “Independence”, “We will vote” and “We’re not afraid”, AFP news agency reports.

Spanish Prime Minister Mariano Rajoy was taking the unionist cause directly to Barcelona on Friday, addressing a meeting of his Popular Party in the Catalan capital. If the deadline is not met, the central government will take over the funding of most essential public services in the region, Mr Montoro said. “These measures are to guarantee that not one euro will go toward financing illegal acts,” he was quoted as saying by Reuters news agency after a cabinet meeting in Madrid. The takeover would last as long as the “situation”, he explained. Public finances are a particularly sore point for Catalans who for years have contributed more to the state budget than they get back in spending on public services.

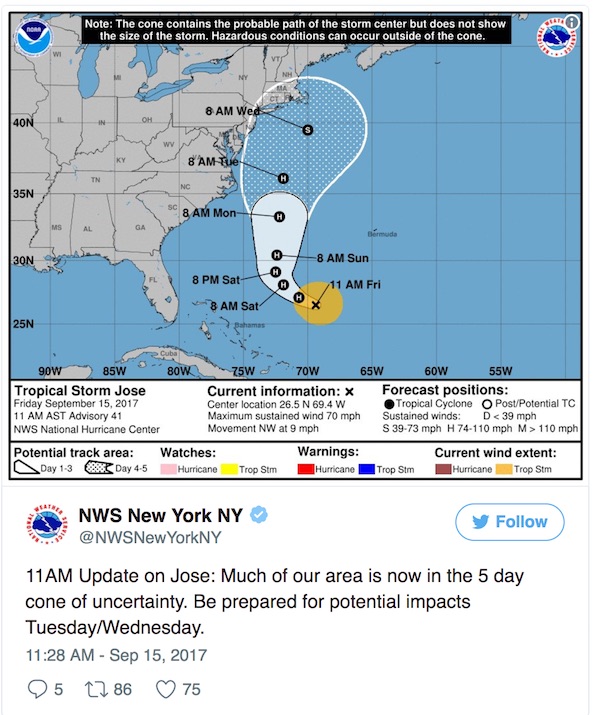

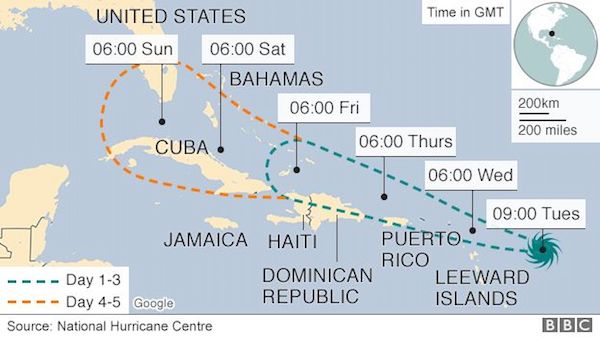

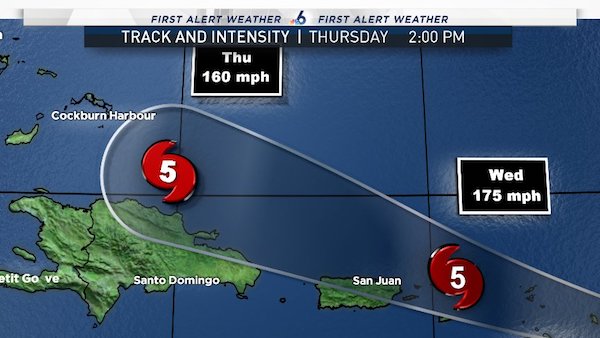

Someone posted a similar cone for José on Twitter about ten days ago. The idea is not new.

• New York City Is Within Hurricane Jose’s 5-Day “Cone Of Uncertainty” (ZH)

In what were perhaps the two biggest news stories of the past month, Hurricanes Irma and Harvey devastated the American south, disrupting local industry, destroying homes and critical infrastructure and dumping millions of gallons of raw sewage onto city streets – leading to the most destructive beginning to hurricane season in years. Meanwhile, cosmopolitan Yankees looked on in horror (with perhaps a touch of smugness) as they watched their southern neighbors being paddled out of flooded Texas homes by national guardsmen, or marooned in the seemingly endless lines of traffic snaking out of southern Florida, northeasterners now have their own storm to worry about.

And now, according to the National Weather Service, those same onlookers might be forced to endure similar hardships thanks to Hurricane Jose, already on its way to becoming a category one storm. Meteorologists at the National Hurricane Center say a wide stretch of the eastern and northeastern US, from Maryland up through Cape Cod, is within Jose’s five-day “cone of uncertainty” – meaning that a fully fledged hurricane could make landfall in or around New York City, potentially dealing another crushing blow to the city’s infrastructure after the city’s subway system has not yet finished repairing the damage from Superstorm Sandy, which took place five years ago.