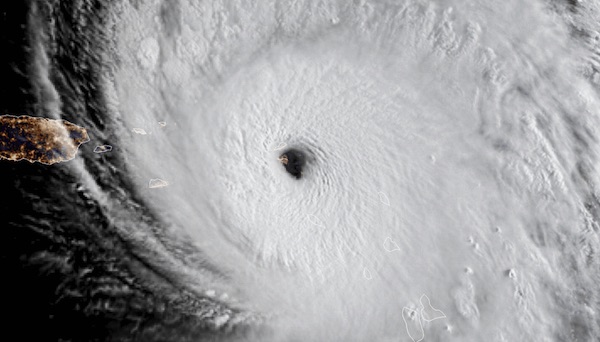

St. Maarten seen through the eye of Irma

Too early to say much of anything. Barbuda is gone. So is much of St. Martin. Close to uninhabitable.

If Irma hits Puerto Rico anywhere near full force, that would be exceedingly dramatic. Ditto for Haiti, Miami. This has just started.

NOAA Hurricane Hunters flight director Richard Henning on CNN: “Irma “is actually getting stronger. … You can’t overhype this storm”.

• Irma Devastates The Caribbean (AlJ)

Nearly every building on the island of Barbuda has been damaged and almost 900,000 people have been left without power in Puerto Rico as the Category 5 Hurricane Irma continues its journey towards mainland US. About 60 percent of Barbuda’s roughly 1,400 people were left homeless, Gaston Browne, Antigua and Barbuda prime minister, told the Associated Press news agency, when the eye of the storm passed almost directly overhead early on Wednesday. “Either they were totally demolished or they would have lost their roof,” Browne said after returning to Antigua from a plane trip to the neighbouring island. “It is just really a horrendous situation.” Browne said roads and telecommunications systems were destroyed and recovery will take months. A two-year-old was killed as a family tried to escape a damaged home during the storm, he said.

Puerto Rico was buffeted by powerful winds and heavy rain as authorities struggled to get aid to small Caribbean islands already devastated by the storm. The US National Weather Service said Puerto Rico had not seen a hurricane of Irma’s magnitude since Hurricane San Felipe in 1928, which killed a total of 2,748 people in Guadeloupe, Puerto Rico and Florida. But as the storm moved west, it devastated the small islands in its path. Significant effects were reported on St Martin, an island split between French and Dutch control. Photos and video circulating on social media showed major damage to the airport in Philipsburg and the coastal village of Marigot heavily flooded. The US National Hurricane Center said Irma’s winds would fluctuate, but the storm would probably remain at Category 4 or 5 for the next day or two as it moves past just to the north of the Dominican Republic and Haiti on Thursday, nears the Turks & Caicos and parts of the Bahamas by Thursday night and touches Cuba on Friday night.

“Less than an hour before the meeting, Republican House of Representatives Speaker Paul Ryan had called the Democratic proposal that Trump later embraced a “ridiculous and disgraceful” idea..”

• Trump Sides With Democrats On Debt Limit In Rare Bipartisan Deal (R.)

President Donald Trump forged a surprising deal with Democrats in Congress on Wednesday to extend the U.S. debt limit and provide government funding until Dec. 15, embracing his political adversaries and blindsiding fellow Republicans in a rare bipartisan accord. Trump, living up to his reputation for unpredictability, met at the White House with congressional leaders from both parties and overruled Republicans and U.S. Treasury Secretary Steven Mnuchin, who wanted a longer-term debt-limit extension rather than the three-month Democratic proposal the president embraced. “We could have done a one-year deal today,” Mnuchin told reporters aboard Air Force One later in the day en route back to Washington from an event in North Dakota where Trump spoke about taxes.

Mnuchin said Trump chose a short-term deal to keep his options open on possibly raising military funding later this year, suggesting a longer-term government funding deal might have blocked that. Trump is very focused on military spending, “particularly with what’s going on in North Korea and other parts of the world today,” Mnuchin said. “The president wasn’t willing to give up his need for additional military spending.” If passed by the Republican-led Congress, the three-month agreement would avert an unprecedented default on U.S. government debt, keep the government funded at the outset of the fiscal year beginning Oct. 1 and provide aid to victims of Hurricane Harvey. “It was a really good moment of some bipartisanship and getting things done,” top Senate Democrat Chuck Schumer said. Less than an hour before the meeting, Republican House of Representatives Speaker Paul Ryan had called the Democratic proposal that Trump later embraced a “ridiculous and disgraceful” idea that would “play politics with the debt ceiling.”

Curious timing. Note that Reuters has fully entered the anti-Trump echo chamber.

• Fed’s Fischer Resigns, Leaving Trump Earlier Chance To Shape Central Bank (R.)

U.S. Federal Reserve Vice Chair Stanley Fischer, a veteran central banker who helped set the course for modern monetary policy, said on Wednesday he will step down from his position in mid-October, potentially accelerating President Donald Trump’s opportunity to reshape the direction of the central bank. In a letter to Trump, Fischer, 73, said he was resigning for personal reasons effective on or around Oct. 13, eight months before his term as vice chair expires in June. In the letter, Fischer said jobs growth had returned to the United States and that “steps to make the financial system stronger and more resilient” had been taken – actions that may now be weakened by the Trump administration.

His departure leaves the seven-person board of governors with as few as three sitting members, depending on whether and when the Senate confirms Trump nominee Randal Quarles to the role of vice chair for supervision, a job distinct from Fischer’s vice chairmanship. The Senate Banking Committee is scheduled to vote on the nomination on Thursday. The White House said it had no immediate comment on Fischer’s departure or on the timing for filling his spot or other positions at the Fed. Though the Fed often operates with fewer than its full complement of seven governors, it has never dipped as low as three. Fischer’s earlier-than-expected departure intensifies the urgency for Trump to decide how deeply he wants to overhaul U.S. monetary policy. Fed Chair Janet Yellen’s term expires in February. While Trump has spoken approvingly of her performance he has also kept the door open to naming his top economic adviser Gary Cohn, or someone else, to the job.

He thinks he’s taken all he’s going to get.

• Deutsche Bank Boss Calls On ECB To Halt Cheap Money (R.)

Deutsche Bank chief executive John Cryan has called on the European Central Bank to change course on providing cheap money, warning he sees price bubbles in stocks, bonds and property. “The era of cheap money in Europe should come to an end – despite the strong euro,” Cryan told a room full of bankers in Frankfurt on Wednesday, a day before the ECB’s governors meet to discuss policy. Low interest rates, money printing and a penalty charge for hoarding cash have been at the heart of attempts by the central bank to reinvigorate the 19-country euro zone economy in the wake of the 2008-09 financial crisis. But the policy, which has seen the ECB print more than €2 trillion ($2.4 trillion) so far, has been politically divisive, prompting fierce criticism from famously thrifty Germans.

It has also imposed a heavy cost on still fragile banks, turning deposits into a hot potato that many would rather avoid so as not to pay charges to their central bank for storing them. The head of Germany’s largest commercial bank warned of the fallout from cheap money, cautioning against using the strong euro as a justification for printing more. “We are now seeing signs of bubbles in more and more parts of the capital market,” he said. Cryan also said Frankfurt was the most natural location as a financial hub as banks move from London after Britain’s decision to leave the European Union – ahead of Paris, Dublin and Amsterdam. “There is only one European city which can fulfil these requirements and that city is Frankfurt,” he said, pointing to Frankfurt’s supervisory authorities, law firms, consultancies and airport.

Multiple papers have been leaked in recent days. They won’t be the last.

• New Leak Of Brexit Papers Reveals Fissures Between Britain And EU (G.)

The EU will risk heightening tensions with the UK on Brexit by publishing five combative position papers in the coming days, including one that places the onus on Britain to solve the problem of the Irish border, according to documents leaked to the Guardian. The Irish document shows that Michel Barnier, the EU’s chief negotiator, will call on the UK to work out “solutions” that avoid the creation of a hard border and guarantee peace on the island. The leaks come a day after the Guardian obtained a draft memo showing the British government’s position on post-Brexit EU migration, which has been denounced as “completely confused”, “economically illiterate” and “a blueprint on how to strangle London’s economy”. The Ireland paper is one of five due to be published by the European commission in the coming days. Each is dated 6 September and was drawn up by Barnier’s article 50 taskforce in Brussels.

Together, the papers lay bare the complexity of disentangling Britain from the European Union. Each paper is focused on withdrawal day, 29 March 2019, delving into technical minefields not dealt with during the referendum campaign. EU proposals include:

• A demand – likely to inflame Brexiters – for the UK to legislate for the “continued protection” of special foods such as Parma ham and feta cheese, as well as French burgundy and Spanish cava. Brussels wants to ensure that more than 3,300 food and drink products are protected from British copycats after Brexit.

• Ensuring that any goods in transit on Brexit day would be subject to the jurisdiction of the European court of justice. In effect, British companies and the British government would be liable to fines from Brussels for breaking EU VAT and customs rules.

• A warning to the government that it must guarantee EU data protection standards on classified EU documents. If not, the EU wants these documents erased or destroyed.

• Asking Britain not to discriminate against EU companies which are carrying out state-funded infrastructure projects that began before Brexit day.

How to spell deflation.

• Consumption Exhaustion (Lebowitz)

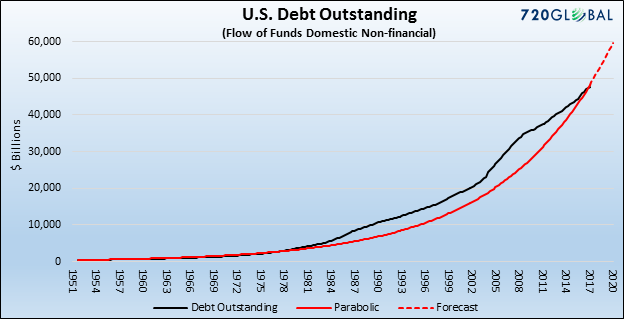

Debt serves as a regulator of economic growth and is the focus of ill-advised fiscal and monetary policy. It is no coincidence that no matter what economic topic we explore, debt is usually a central theme. Illustrated in the chart below is the actual trajectory of total U.S. debt outstanding (black) through March 2017 and a calculated parabolic curve (red). The parabolic curve uses 1951 as a starting point and a quarterly 1.82% compounding factor to create the best statistical fit to the actual debt curve. If we start with the $434 billion of debt outstanding on December 1951 and grow it by 1.82% each quarter thereafter, the result is the gray line. If debt outstanding continues to follow this parabolic curve, it will exceed $60 trillion by the first quarter of 2020, or nine quarters from now.

Many economists point to the stability of debt service costs as a reason to ignore the parabolic debt chart. Despite rising debt loads, falling interest rates have served as a ballast allowing more debt accumulation at little incremental cost. While that may have worked in the past, near zero interest rates makes it nearly impossible to continue enjoying the benefits of falling interest rates going forward. Importantly, social safety net obligations, demographics, and political dynamics argue that debt growth is likely to continue accelerating as implied by the chart above. Without interest rates falling in step with rising debt burdens, debt service costs will begin to rise appreciably.

The power of compounding, extolled by Albert Einstein as the eighth wonder of the universe, is as damning in its demands as it is merciful in its generosity. Barring negative interest rates, debt service costs will be an insurmountable burden by 2020. However, if the debt trajectory slows as it did in 2008 that too will bring about painful consequences. In other words, all roads lead to trouble.

“China maintains a quasi-pegged exchange rate, which requires balancing the inflow and outflow of capital. That means attracting foreign investment is a necessary precondition for investing abroad..”

• China Realizes It Needs Foreign Companies (Balding)

China is increasingly desperate for foreign investment. Yet foreign companies are less and less interested in what it has to offer. How this problem gets resolved may be one of the most important questions facing China’s economy. After China joined the World Trade Organization, in 2001, overseas investors couldn’t wait to jump in. Foreign direct investment grew at an annualized rate of 10.8% from 2000 to 2008. Enticed by China’s market size and development capacity, companies were willing tolerate almost any kind of restriction. They turned over intellectual property; entered into joint ventures as junior partners, essentially training their eventual competitors; and accepted restricted access to wide swathes of the economy. Since the financial crisis, however, things have changed.

Wages in China have risen by an average of 11% a year, making it less attractive for outsourcing. Despite years of complaints, intellectual property theft hasn’t abated (just ask Michael Jordan, who had to wage a four-year court battle to get ownership of his own name in China). Add in an increasingly hostile business environment, and it’s not surprising that overseas companies are losing enthusiasm. Since 2008, utilized foreign direct investment has increased by an average rate of only 4% a year. According to quarterly balance-of-payment data, FDI has amounted to only $55 billion this year through June. The last time China’s mid-year inflows were that low was in 2009, the year after the financial crisis. This could have serious economic consequences.

Due to shady invoicing – which many firms use to evade capital controls – the money flowing into China through its trade surplus has shrunk. From 2010 through 2014, banks reported net settlement inflows from goods trade of nearly $1.7 trillion. Since January 2015, net settlement by banks has amounted to only $278 billion, while the official trade surplus is $1.3 trillion. For a country that relies on capital accumulation to sustain growth, this is a significant problem. Making matters worse, China maintains a quasi-pegged exchange rate, which requires balancing the inflow and outflow of capital. That means attracting foreign investment is a necessary precondition for investing abroad, which is China’s main method of advancing its foreign-policy objectives.

All on red.

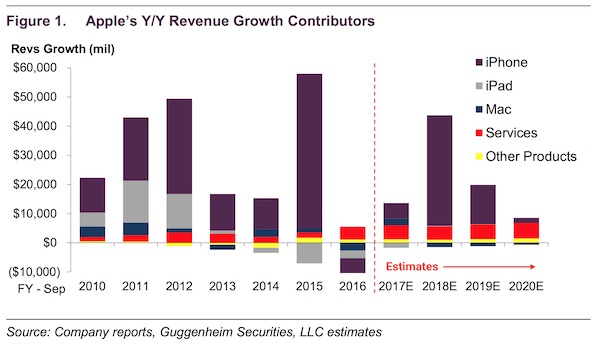

• Apple Needs iPhone 8 To Solve A Giant Financial Headache (BI)

Apple will launch its next-generation iPhone (expected to be called the iPhone 8 or the iPhone Edition) on September 12, and this chart from Guggenheim Securities analyst Robert Cihra gives you a good idea of the giant headache Apple needs that new phone to solve. The graph is interesting because it shows Apple’s business in a seldom-seen way: It charts only the revenue growth of the company, broken out by product. The chart does a good job of showing how Apple’s various product lines have increasingly stalled over the years. In each of the last four years, Apple had one or more major product lines with shrinking sales. In 2016, that came to a head, and Apple’s overall revenue went into decline for the first time ever.

Note that in 2016, Apple’s worst year, the only division growing revenues was Services — apps, content, and software in iTunes. The stakes for iPhone 8 and its kindred models — iPhone 7s and iPhone 7s Plus — couldn’t be higher. If they don’t grow revenues, then the company as a whole doesn’t grow. The task facing Apple is not trivial. As this chart from Deutsche Bank shows, the iPhone tends to grow more slowly than the smartphone market as a whole — and the smartphone market has flatlined.

Spain threatens criminal charges for people seeking self-determination.

• Catalonia Launches Its Independence Challenge Against Spain (AFP)

Catalonia’s regional parliament passed a law on Wednesday (Sep 6) paving the way for an independence referendum on Oct 1 which is fiercely opposed by Madrid, setting a course for Spain’s deepest political crisis in decades. The looming showdown comes three weeks after militant attacks in Barcelona, the capital of Catalonia, and a seaside resort which killed 16 people and wounded more than 120. The law was adopted with 72 votes in favour and 11 abstentions after 12 hours of often stormy debate in the regional assembly. Lawmakers who oppose independence for the wealthy northeastern region of Spain quit the chamber before the vote. After the law was passed, separatist lawmakers, who have a majority in the assembly, sang the Catalan anthem, “Els Segadors”, which recalls a 1640 revolt in the region against the Spanish monarchy.

Lawmakers approved the bill despite a February ruling by Spain’s Constitutional court declaring it would be unconstitutional. Shortly after the law was passed the president of Catalonia, Carles Puigdemont, and the rest of his cabinet signed a decree calling the referendum, presenting a show of unity in the face of threats of legal action by Madrid, which deems the plebiscite illegal. Deputy Prime Minister Soraya Saenz de Santamaria said before the law was passed that the government had asked the Constitutional Court to declare “void and without effect the agreements adopted” by the Catalan parliament. She also denounced the regional assembly’s agreement to quickly vote on the bill with little debate as an “act of force” characteristic of “dictatorial regimes”. At the same time, public prosecutors announced they would seek criminal charges for disobedience against the president of the Catalan parliament, Carme Forcadell, and other Catalan officials for allowing the vote on the referendum law.

Macron can only do what Merkel allows him.

• Emmanuel Macron To Outline Vision For Europe’s Future In Athens Speech (G.)

Emmanuel Macron will make Greece the launchpad for a major policy speech on the future of Europe as he starts his first official trip to the country on Thursday. From the dramatic setting of the ancient Pnyx in Athens, the French president is expected to outline his vision for the continent in what is being called his most important overseas address since taking office in May. Amid the rocky hills of the Pnyx beneath the Acropolis, the speech will focus on the virtues of democracy as the European Union – and Greece – finally show signs of economic revival. “It will be a message of confidence in Greece but also a European symbolic message, given that in many ways Greece has been a symbol of Europe’s crisis,” said an Élysée Palace source. “The restart of Greece is the restart of the eurozone.”

It is a measure of the significance the Greek government is attaching to the visit that Macron is making the address from such an august setting. From the earliest days of Athenian democracy, the Pnyx was a meeting place for popular assemblies. In more modern times its use has been limited to the rare photo op. The young president will be the first French leader to speak from it, in what Greeks are also calling a subliminal message of hope. Macron has been criticised at home for his carefully choreographed media appearances evoking the grandeur of eras past, and has seen his approval ratings drop dramatically. But officials say the rich symbolism of Macron’s Athens speech will underscore the argument that, despite its battle to stay in the eurozone and keep bankruptcy at bay, Greece remains at the heart of Europe’s tradition and history.

“We see it is as a very important visit,” said the deputy minister of economy and development, Stergios Pitsiorlas. “We are very much hoping it will not only deepen economic cooperation but also herald a change in the political dynamic in the EU which for so long has been dominated by a single state, Germany.” France has stood by Greece, often defending it in fraught negotiations, since international creditors, led by Berlin, were forced to come to the debt-stricken country’s rescue issuing the first of three bailouts in return for tough reforms in May 2010. Macron, a former economy minister, has long advocated debt relief for Athens – echoing the view of its leftist-led government that without it the Greek economy can never fully recover.

While politicians on all sides cheer the ‘recovery’.

• Crisis-Ridden Greek Households Cut Even On Milk And Bread (KTG)

The economic crisis continues to plague Greek households struggling too make ends meet – month in, month out. A survey conducted by Nielsen shows a decline in consumption and therefore the plight of thousands of families. Greeks cut on essential goods like milk and bread. The drop in the category of milk in the organized retail market reached 8.6% in the first half of 2017. Sales of essential consumer goods continue to drop, according to a Nielsen survey of the Greek market. Sales of milk, bread and alcoholic beverages are among the goods that suffer most. In the first half of 2017 the drop in the sale of milk reached 8.6%, while sales of packaged bread shrank by 5.3%. Sales of alcoholic beverages also recorded significant losses, as whiskey sales dropped by 6.8% over the same period.

Overall, retail trade lost 1.1% in value in the first half of the year compared to the same period last year. More pronounced downward trends were recorded in personal care products at 4.4%, and household goods at 3.5%. Sales of deodorants and diapers dropped by 7.3% and 7.2% respectively. In household goods, chlorine dropped by 8.9% and kitchen paper towel by 7.7%. The only positive trend in all sectors was in fresh / bulk products where sales increased by 2.0%. An earlier Nielsen survey has shown that food sales in Greece have dropped by 18 percent since 2009, when the current economic crisis begun. In 2009, food sales reached a record high, totalling 13.15 billion euros. However, as Greece entered the first bailout program in 2010, the demand for food items started to drop. The decrease was also attributed partly to the closing down of small grocery and convenience stores..

Home › Forums › Debt Rattle September 7 2017