Salvador Dali They were there 1931

AOC is a step too far for Kimberley Strassel- and many others. She tweets: “The Republican Party has a secret weapon for 2020. It’s especially effective because it’s stealthy: The Democrats seem oblivious to its power. And the GOP needn’t lift a finger for it to work. All Republicans have to do is sit back and watch 29-year-old Rep. Alexandria Ocasio-Cortez . . . exist.”

That reminds me a lot of what many people said about Trump a few years ago, and that is no coincidence. AOC shakes up things like the Donald did, things in desperate need of shaking up.

She unveiled her Green New Deal, and got tons of ridicule. But 9 senators and 64 congressmen already sponsor her resolution. Perhaps her biggest danger is that they, the old guard, line up with her, and she becomes one of them. Or no, her biggest risk is in criticizing Trump and falling into the old guard that way. While her biggest danger is calling herself a socialist, which is a death sentence in the US.

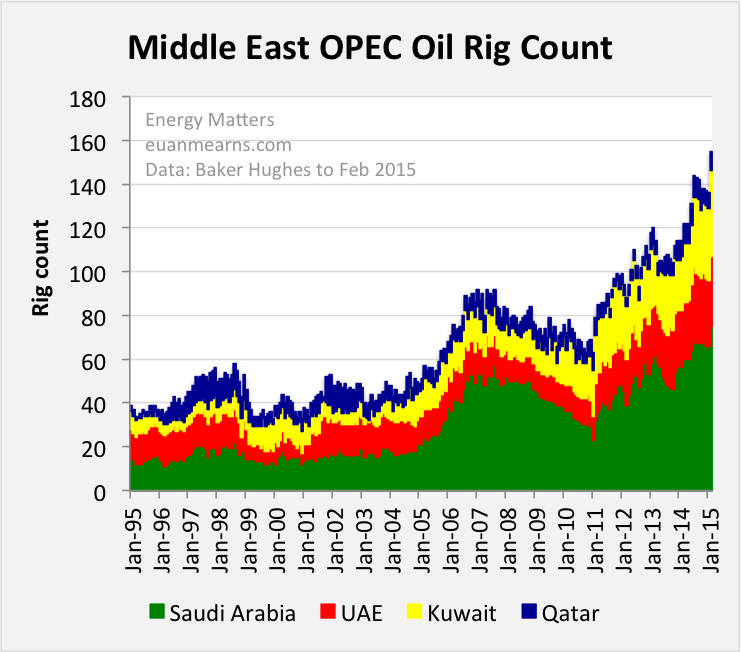

And there’s her limited knowledge of energy issues, which apparently leads her to think present systems can be replaced 1-on-1 by renewable ones, while the no. 1 energy plan should be to use much less.

But she got something to say, this piece is pretty solid, and it will appeal to many disgruntelds:

‘We have a system that is fundamentally broken.’ — Rep. @AOC is explaining just how f*cked campaign finance laws really are pic.twitter.com/7rRXf9pD6Z

— NowThis (@nowthisnews) February 7, 2019

• AOC, The Little Socialist That Could (Strassel)

AOC, as she’s better known, today exists largely in front of the cameras. In a few months she’s gone from an unknown New York bartender to the democratic socialist darling of the left and its media hordes. Her megaphone is so loud that she rivals Speaker Nancy Pelosi as the face of the Democratic Party. Republicans don’t know whether to applaud or laugh. Most do both. For them, what’s not to love? She’s set off a fratricidal war on the left, with her chief of staff, Saikat Chakrabarti, this week slamming the “radical conservatives” among the Democrats holding the party “hostage.” She’s made friends with Jeremy Corbyn, leader of Britain’s Labour Party, who has been accused of anti-Semitism.

She’s called the American system of wealth creation “immoral” and believes government has a duty to provide “economic security” to people who are “unwilling to work.” As a representative of New York, she’s making California look sensible. On Thursday Ms. Ocasio-Cortez unveiled her vaunted Green New Deal, complete with the details of how Democrats plan to reach climate nirvana in a mere 10 years. It came in the form of a resolution, sponsored in the Senate by Massachusetts’ Edward Markey, on which AOC is determined to force a full House vote. That means every Democrat in Washington will get to go on the record in favor of abolishing air travel, outlawing steaks, forcing all American homeowners to retrofit their houses, putting every miner, oil rigger, livestock rancher and gas-station attendant out of a job, and spending trillions and trillions more tax money.

Oh, also for government-run health care, which is somehow a prerequisite for a clean economy. It’s a GOP dream, especially because the media presented her plan with a straight face – as a legitimate proposal from a legitimate leader in the Democratic Party. Republicans are thrilled to treat it that way in the march to 2020, as their set-piece example of what Democrats would do to the economy and average Americans if given control. The Green New Deal encapsulates everything Americans fear from government, all in one bonkers resolution.

AOC already has 9 senators and 64 congressmen sponsoring her resolution. Look for them distancing themselves as soon as it hurts them in the polls.

• Green New Deal Takes Its First Congressional Baby Step (IC)

Over the last few months, support for the Green New Deal has become a litmus test for 2020 Democratic hopefuls, and the resolution serves dual purposes: to unite lawmakers around the idea of a Green New Deal, and to offer a basic definition of what that means. For 2020 contenders who have conceptually supported the Green New Deal, the resolution makes clear that the phrase isn’t just a talking point, but connected to a specific set of policy priorities. Confirmed and rumored presidential hopefuls Elizabeth Warren, Kamala Harris, Kirsten Gillibrand, Cory Booker, and Bernie Sanders will be among the nine senators co-sponsoring the resolution. Sixty-four House Democrats will also be co-sponsoring the legislation, including Reps. Ro Khanna, D-Calif., Pramila Jayapal, D-Wash., and Joe Neguse, D-Colo.

“We’re going to be pressuring all of the 2020 contenders to back this resolution,” said Stephen O’Hanlon, a spokesperson for the Sunrise Movement, which helped launched the Green New Deal into the national spotlight with its sit-in at Pelosi’s office last November. “That’ll make it clear who’s using the Green New Deal as a buzzword and who’s actually serious about what it entails. For our generation, the difference between the Green New Deal as a buzzword and substantive policy is life and death.” [..] On Tuesday, the Sunrise Movement hosted some 500 watch parties around the country for a livestream laying out its next steps to support the resolution. As of Wednesday, the group was in the process of organizing visits to 600 congressional offices nationwide, for constituents to demand that their representatives co-sponsor Ocasio-Cortez and Markey’s measure. Supported by Justice Democrats — the group that backed Ocasio-Cortez’s primary run — Sunrise will also be launching a 15-city campaign tour through early primary states.

A ‘Green New Deal’ touted by Alexandria Ocasio-Cortez has some of the most aggressive climate goals ever put forward by Democratic lawmakers https://t.co/c9ZcdbNzKV pic.twitter.com/4LFAZrgV3l

— Reuters Top News (@Reuters) February 8, 2019

2 weeks old but relevant.

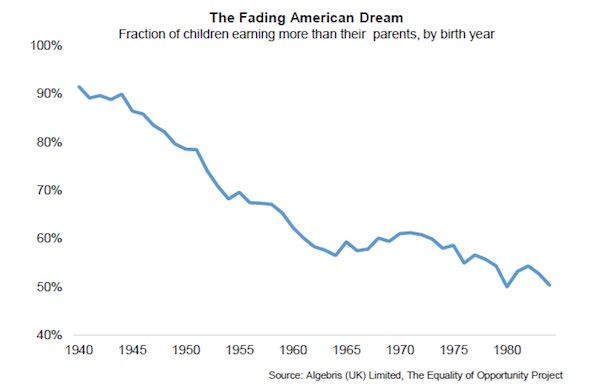

• Are Billionaires The American Dream? (NYMag)

In 1835, Alexis de Tocqueville produced one of the earliest accounts of the American dream. In his famous study of the Jacksonian U.S., the Frenchman wrote that Americans possessed “the charm of anticipated success” — a ubiquitous optimism that he attributed to our country’s democratic character, and to the “general equality of condition” that prevailed among its “people.” On Wednesday night, Sean Hannity took de Tocqueville to task. In the Fox News’ host’s telling, general economic equality is not a precondition for the American dream, but rather, an insurmountable obstacle to it — because the American dream is (apparently) to earn more than $10 million year without having to pay a top marginal tax rate higher than 37 percent.

Of course, Hannity did not actually frame his argument as a rebuke of de Tocqueville. His true target was Alexandria Ocasio-Cortez. After popularizing the idea of a 70 percent top marginal tax rate earlier this month, the freshman congresswoman recently suggested that the mere existence of billionaires was both immoral, and a threat to American democracy. “I do think that a system that allows billionaires to exist when there are parts of Alabama where people are still getting ringworm because they don’t have access to public health is wrong,” Ocasio-Cortez told the writer Ta-Nehisi Coates, during an interview on Martin Luther King Day.

One day later, the congresswoman approvingly quoted an op-ed by the economists Gabriel Zucman and Emmanuel Saez, which argued that the purpose of high taxes on the wealthy wasn’t merely to generate revenue, but rather, to safeguard “democracy against oligarchy.” Hannity’s not buying it. The Fox News host informed his audience Wednesday that Ocasio-Cortez had “called the American dream immoral,” and that she wants to “empower the government to confiscate” said dream. “Better hide your nice things,” Hannity advised his audience (whom he ostensibly believes to be composed primarily of billionaires), “because here come the excess police.”

[..] “Power and property may be seperated for a time, by force or fraud — but divorced never, ” Benjamin Leigh, a conservative legislator in Virginia’s House of Delegates, argued at that state’s Constitutional Convention in 1830. “For, so soon as the pang of separation is felt … property will purchase power, or power will take property.”

Good to see my longtime friend Jesse Colombo slowly moves to my position on markets, now spelling them “markets”. And we see China largely the same too.

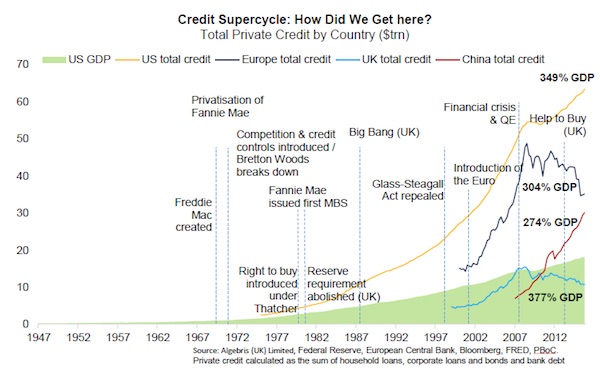

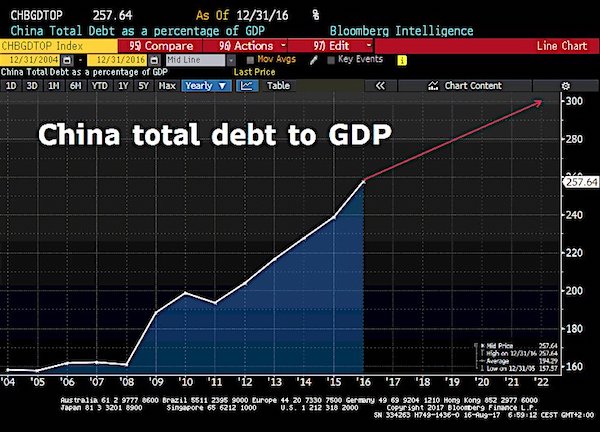

• China Is Unlikely To Become The World’s Largest Economy Anytime Soon (Colombo)

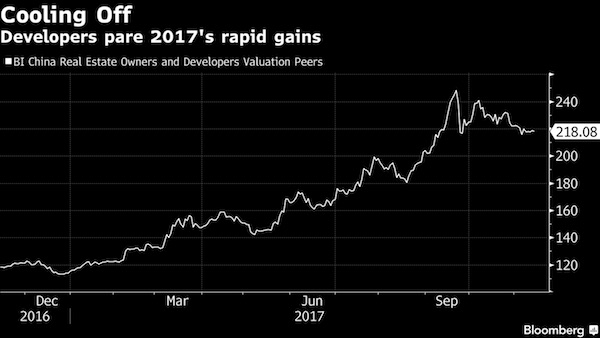

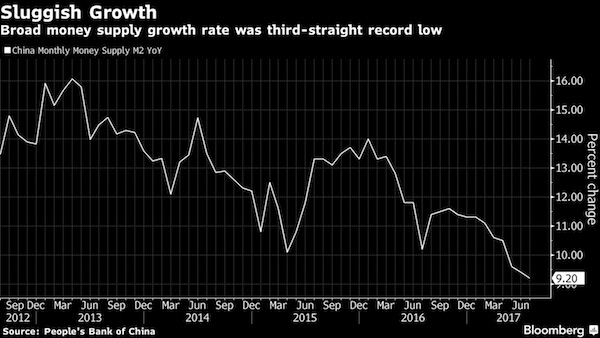

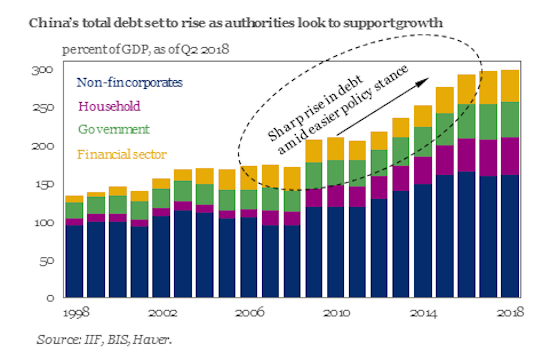

As I have been warning for several years, China is experiencing a credit and asset bubble like Japan was in the 1980s. China’s powerful credit expansion in the past decade (as the chart below shows) is one of the main reasons why the global economy recovered from the Great Recession. China’s credit bubble of the past decade will prove to be a one-shot deal – in the next global economic downturn, there won’t be another large economy like China to binge on debt and create a temporary growth party that bails everyone else out.

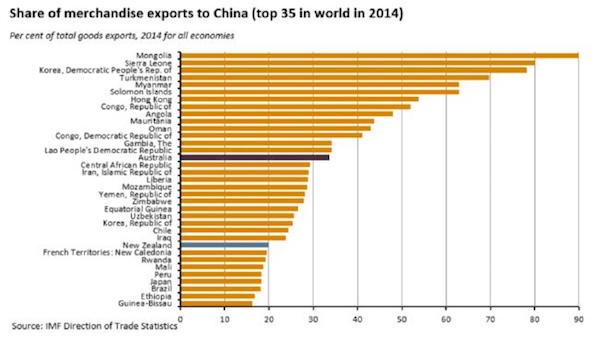

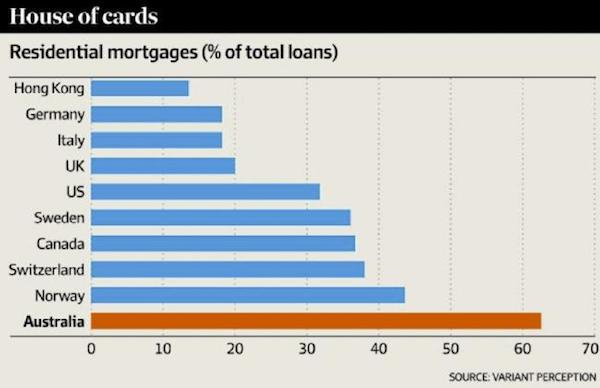

An economic stagnation or slowdown in China is the least of our worries, I’m afraid. I am worried about a full-blown popping of their credit and asset bubble (like Japan in the early-1990s), which would reverberate around the world. In that scenario, Western exports to China would plunge, commodity-exporting economies from Australia to emerging markets would suffer, and the global economy would experience another severe recession if not an outright depression. The world has played with fire over the past decade and it’s just a matter of time before we all pay the price.

Caught on Twitter: “Asked at a presser if he wakes up each morning regretting that he’s the @bankofengland governor in the age of Brexit, @markcarney1 replies: “I don’t wake up in the morning any more … I wake up in the middle of the night.”

• European Economy Raises Fresh Global Growth Fears (MW)

The Bank of England and the European Commission both offered downbeat outlooks on Thursday, reaffirming growing fears about the health of Europe’s economy. Although, the BOE left interest rates unchanged, as expected, it cut its forecast for 2019 GDP to 1.2% versus its previous estimate of 1.7%, with its current level representing the weakest growth since 2009 when a crisis sparked by complex mortgage bonds cast a pall over the global financial system. “Naturally, the uncertainty over Brexit means considerable uncertainty over the U.K. macro outlook, and therefore monetary policy,” said Bill Diviney, senior economist at ABN Amro.

Both the BOE and Diviney still see a soft Brexit — where Britain leaves the European Union with a trade agreement in place — as the most likely scenario, but the U.K. economy seems destined to slow, notwithstanding any expectations of a trade resolution. [..] And it doesn’t look rosy on either side of the English Channel. On Thursday, the European Commission cut its forecast for 2019 eurozone growth to 1.3% in 2019, compared with the 1.9% expected in November. Underlining its forecast was weaker-than-expected industrial and manufacturing data for the eurozone’s biggest economy Germany. “We think there are a number of important take-aways,” said Diviney. “First of all, despite the large downgrade in economic growth forecasts, they probably do not go far enough, and further revisions are likely.”

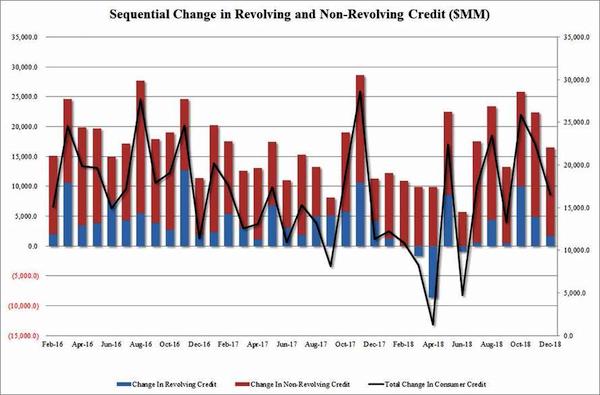

From revolving into non-revolving credit. Progess in America 2019.

• US Consumer Credit Hits $4 Trillion; Student, Auto Loans Hit All Time High (ZH)

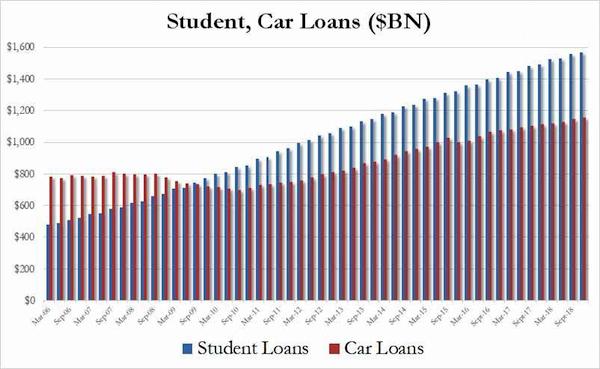

After a few months of wild swings, in December US consumer credit normalized rising by $16.6 billion, just below the $17 billion expected, after November’s whopping $22.5 billion. The surge in borrowing in November brought the total to just above $4 trillion for the first time ever on the back of a America’s ongoing love affair with auto and student loans. Revolving credit increased by $1.7 billion to $1.045 trillion, a modest slowdown since November’s $4.8 billion.

[..] while the slowdown in December credit card use may prompt fresh questions about the strength of the US consumer during the all-important holiday spending season, the recent dramatic upward revision to personal savings notwithstanding, one place where there were no surprises, was in the total amount of student and auto loans: here as expected, both numbers hit fresh all time highs, with a record $1.593 trillion in student loans outstanding, an impressive increase of $10.3 billion in the quarter, while auto debt also hit a new all time high of $1.155 trillion, an increase of $9.5 billion in the quarter. In short, whether they want to or not, Americans continue to drown even deeper in debt, and enjoying every minute of it.

Is it too late for Corbyn to take control of the conversation? is he even capable?

• Corbyn Sparks Labour Civil War Over Referendum (Ind.)

Jeremy Corbyn is battling to calm a growing Labour civil war over his refusal to support a fresh Brexit referendum, as some of his MPs threatened to quit the party in protest. The Labour leader was forced to justify his intentions after his new offer to help Theresa May deliver Brexit triggered accusations that he had torpedoed his party’s policy of keeping a public vote on the table. Amid growing tensions, Mr Corbyn wrote to party members to insist that party backing for a Final Say referendum remained an option – hours after furious Labour MPs accused their leader of helping enable Brexit.

The backlash was triggered when Mr Corbyn wrote to Ms May on Wednesday evening offering continued discussions in “constructive manner” with the aim of “securing a sensible agreement that can win the support of parliament and bring the country together”. Labour would support an exit deal if five conditions were met, he said, including a customs union with the EU and guarantees on workers’ rights. The move infuriated anti-Brexit MPs pushing for Labour to back giving the public the final say on Brexit, with two suggesting they were considering quitting the party over the issue. Owen Smith, who stood against Mr Corbyn for the party leadership in 2016, said Labour should be opposing the “disaster” that is Brexit.

Asked if Mr Corbyn’s letter paved the way for Labour MPs to support a Brexit deal put forward by Ms May, he told BBC 5Live: “I think that’s probably right. My fear is that this is the leadership rolling the pitch for accepting a version of Theresa May’s deal, and I think that will be at odds with our values and damaging to our country and damaging to the politics that we’ve traditionally believed it. “Brexit is a right-wing ideological project and we should be opposing it on those terms.”

And by then, why bother?

• Brexit Deal May Not Be Put To MPs Until Late March (G.)

The Brexit negotiations are being pushed to the brink by Theresa May and the EU, with any last-minute offer by Brussels on the Irish backstop expected to be put to MPs just days before the UK is due to leave. In strained talks on Thursday, during which Donald Tusk suggested that Jeremy Corbyn’s plan could help resolve the Brexit crisis, Theresa May and the European commission president, Jean-Claude Juncker, agreed to hold the next face-to-face talks by the end of February. That move cuts deep into the remaining time, piling pressure on the British parliament to then accept what emerges or face a no-deal scenario.

It is understood that EU officials are looking at offering May a detailed plan of what a potential technological solution to the Irish border might look like, which could be included in the legally non-binding political declaration on the future trade deal. The blueprint would pinpoint the problem areas and commit to breaching the technical gaps where possible to offer an alternative to the customs union envisaged in the withdrawal agreement’s Irish backstop. But officials believe it is increasingly likely that any renegotiated deal will only be put to the Commons at the end of March, necessitating even then an extension of the article 50 negotiating period to get legislation through parliament.

On Thursday the German finance commissioner, Günther Hermann Oettinger, suggested the chance of a no-deal Brexit was now as high as 60%. “If the British side asks for an extension of two or three months and there are reasons for that, I think there’s a good chance that the member states would accept that unanimously,” he said. “But in the eight or 12 weeks there needs to be the possibility of achieving progress and that there must be a withdrawal agreement at the end of that.”

Old paradigms are dying everywhere. Given the state we find ourselves in, how bad can that be?

• France Recalls Rome Envoy Over Worst Verbal Onslaught ‘Since The War’ (G.)

Paris has taken the extraordinary step of recalling its ambassador from Rome, in the worst crisis between the two neighbouring countries since the second world war. France blamed what it called baseless verbal attacks from Italy’s political leaders, which it said were “without precedent since world war two”. Italy’s two deputy prime ministers, the far-right Matteo Salvini and Luigi Di Maio of the populist, anti-establishment Five Star Movement, have in recent months criticised the French president, Emmanuel Macron, on a host of inflammatory issues, from immigration to the gilets jaunes (yellow vest) anti-government demonstrations.

Di Maio this week met leaders of the gilets jaunes seeking to run in May’s European parliament elections as he declared the “wind of change has crossed the Alps” and a “new Europe is being born of the yellow vests”. France said the comments were an unacceptable “provocation”. Announcing the immediate return to Paris of its ambassador for talks, the French foreign office said in a statement: “For several months, France has been the target of repeated, baseless attacks and outrageous statements. Having disagreements is one thing but manipulating the relationship for electoral aims is another. “All of these actions are creating a serious situation which is raising questions about the Italian government’s intentions towards France.”

Salvini responded by saying the Italian government did not want to fall out with France and suggested a meeting with Macron to fix the relationship. “I don’t want to row with anyone, I’m prepared to go to Paris, even by foot, to discuss the many issues we have,” he said. But, in a further dig at Macron, he said France must first address three issues: French police must stop pushing migrants back into Italy, end lengthy border checks blocking traffic and hand over around 15 Italian leftist militants who have taken refuge in France in recent decades.

Macron with his sub-30% approval rating is not a threat.

• Rome’s War Of Words With Macron May Prove Self-Defeating (G.)

Diplomatic etiquette would normally classify the recall of an ambassador for “consultations” as a middle-order symbol of displeasure. During the cold war, the summoning, or withdrawal, of an ambassador was mundane. More recently, Hungary pulled its ambassador from the Netherlands in 2017, in response to criticism by the outgoing Dutch ambassador in Hungary. But for France to withdraw its ambassador to Rome for the first time since the second world war represents a genuine diplomatic shock. For two European powers to fall out to this extent shows how far European populists are prepared to break the rules. Only a fortnight ago, faced by persistent insults from Rome, the Elysée chose to take the high road, saying it would not enter a stupidity contest.

President Emmanuel Macron had also promised not answer back, saying that is what the Italian populists wanted. But faced by Italian deputy prime minister Luigi Di Maio’s repeated courting of leaders of the gilet jaunes (yellow vests) protests that have repeatedly sparked violence in Paris, French patience snapped. It marks an extraordinary collapse in Franco-Italian relations since the recent high water mark of January 2018 when Macron signed a bilateral treaty of friendship alongside Italy’s previous prime minister, Paolo Gentiloni. That was only two months before the Italian elections in May. Macron had signed the treaty partly to reassure the Italians that Paris would not only face toward Berlin after Brexit.

But perhaps the seeds of the collapse were sown the day the treaty was signed. In Rome, Macron could not resist saying he hoped the Italians in their elections would make a pro-European choice – advice that Italians, fixated by migration from Libya, totally ignored by bringing a populist coalition government to power. [..] Italy, in recession and heading for only 0.2% growth this year, will need some allies in Europe and in Brussels. Its banking system remains undercapitalised. The Five Star Movement is determined to show it is on the side of the people, and not the bankers, but translating that emotion into practical budgetary policy is proving difficult. Insults by contrast come easier, and cheaper.

Oh, well, it’s just cars.

• Fiat Chrysler Shares Plummet 12% On Weak Outlook (CNBC)

Fiat Chrysler shares crashed by nearly 12 percent Thursday after the Italian-American automaker forecast a weak outlook for 2019. The automaker said it expects results in the first half of the year to be down over last year, in part because the company will not be selling two generations of the Jeep Wrangler side-by-side, as it did in 2018. It is also planning some Wrangler production downtime to retool factories for launch of the plug-in hybrid version of the iconic off-road machine in early 2020. The company also said continued actions to manage dealer inventories will hit its finances in the first half of the year. It is also facing higher-than-expected capital expenditures, shelling out roughly €500 million in connection with U.S. diesel emissions cases. It’s also paying an effective tax rate that’s about 25% higher than it was in 2018, mostly due to changes in the US.

Best English must be Jamaican. Shows that languages are alive.

• ‘Globish’: Why France Has A Love-Hate Relationship With Global English (G.)

French writers were up in arms this week after the Salon du Livre book fair in Paris announced a celebration of young adult books that would feature a “Bookroom”, a “Photobooth”, and even a “Bookquizz”, a prospect so exciting it needs two zs. Such anglicisms, critics wrote, were an “unconscionable act of cultural vandalism”, employing the “sub-English known as Globish”. It is a lamentable irony, then, that Globish has been so energetically popularised by a Frenchman. In 2004, the former IBM executive Jean-Paul Nerrière began selling his system of simplified English (only 1,500 words) to students around the world. (Globish is a portmanteau of “globe” and “English”.)

The earliest attested use of the term, however, described in 1997 a more natural linguistic hybridisation of various “non-western forms of English” that had become just as “creative and lively” as the standard tongue. “Globish” is therefore both a trademark for one man’s singular vision of international communication, and a way of describing the branching of English into multiple exotic planetary species. But the literary Parisians see it simply as yet more Anglo-Saxon cultural imperialism. Well, as the French do sometimes say, c’est la life.

A widespread idea, singling out Trump is not very useful.

• Trump’s Absurd Claim that Americans Are Free from Government Coercion (Bovard)

In his State of the Union address Tuesday night, President Trump received rapturous applause from Republicans for his declaration: “America was founded on liberty and independence — not government coercion, domination, and control. We are born free, and we will stay free.” But this uplifting sentiment cannot survive even a brief glance at the federal statute book or the heavy-handed enforcement tactics by federal, state, and local bureaucracies across the nation. In reality, the threat of government punishment permeates Americans’ daily lives more than ever before: The number of federal crimes has increased from 3 in 1789 to more than 4000 today.

Congress has criminalized “transporting alligator grass across a state line; unauthorized use of the slogan ‘Give a hoot, don’t pollute’; and pretending to be a 4-H club member with intent to defraud,” as the Buffalo Criminal Law Review noted. Law enforcement agencies arrested over 10 million people in 2017— roughly three percent of the population. Trump momentarily noticed the existence of government coercion last month when he complained about the FBI using “29 people” and “armored vehicles” for the arrest of Roger Stone. But SWAT teams conduct up to 80,000 raids a year, according to the ACLU, mostly for drug arrests or search warrants. Many innocent people have been killed in such raids.

Trump on Tuesday highlighted the case of Alice Johnson, unjustly sentenced to life in prison for a nonviolent drug offense. Trump’s commutation of her sentence is no consolation to the targets of 1.6 million drug arrests in 2017 – and it is not like those individuals showed up voluntarily at police stations asking to be “cuffed-and-stuffed.” More people are arrested for marijuana offenses than for all violent crimes combined, according to FBI statistics. No coercion? Tell that to the scores of thousands of victims of asset forfeiture laws, which entitle law enforcement to confiscate people’s cash, cars, and other property based on the flimsiest accusation.

Federal law-enforcement agencies seized more property via asset forfeiture provisions in 2014 year than all the burglars stole from homeowners and businesses nationwide. Since 1970, the number of people confined in American prisons has increased by over 500 percent. Almost 10 percent of all American males will end up in prison at some point in their lives, according to an a 1997 Justice Department report. More than 10 percent of black males aged 20 to 34 were behind bars as of 2006, according to the Journal of American History.

Jay Powell flew over the cuckoo’s nest.

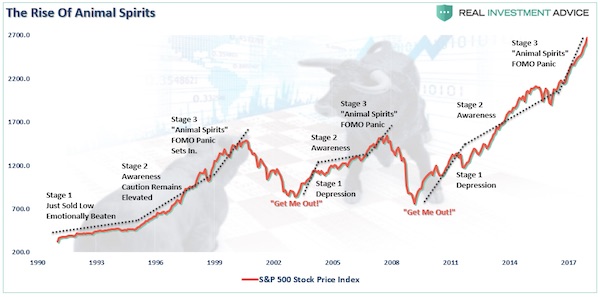

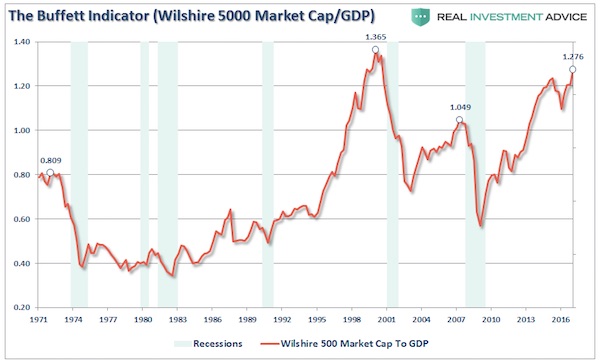

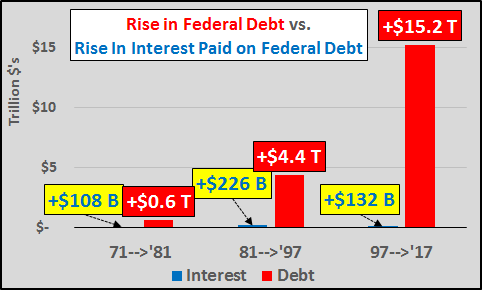

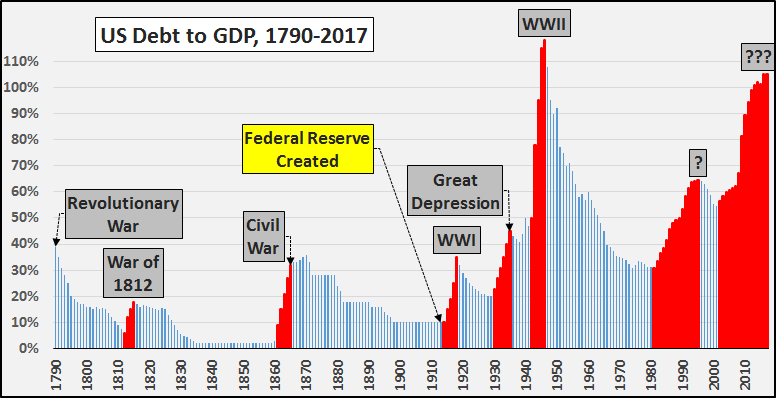

• Albert Edwards: Negative Rates, 15% Budget Deficits And Helicopter Money (ZH)

Earlier this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative “empirical evidence” that greenlights this unprecedented NIRPy step (in addition to QE of course). Today, in his latest note to clients after returning from a 2 week vacation in Jamaica, SocGen’s Albert Edwards picks up on this point and cranks it up to 11 writing that “as central banks thrash around for new tools, I have long thought the next recession would trigger the adoption of helicopter money and deeply negative Fed Funds. Clients have been sceptical of the latter because of the negative impact on bank margins, but now I am more convinced than ever that we will see negative Fed Funds.”

Predictably, Edwards takes aim at the SF Fed “analysis”, writing that “just because the San Fran Fed has published this paper doesn’t mean the Washington Fed will adopt the policy in the next recession, but with this economic cycle clearly now in its final act, one can sense that a number of trial balloons are being floated on what the Fed might do in the next recession. This is just one of them.” More to the point, Edwards also focuses on the recent resurgence of interest in Modern-Money Theory, i.e., MMT, or government-mandated helicopter money, which is predictably a “theory” espoused by socialists everywhere most notably Bernie Sanders and his economic advisors…

… and writes that “many of the more radical Democrats in the US seem to be adopting the idea and since I expect the US budget deficit to soar to 15% of GDP in the next recession, the ideas of MMT will surely become even more popular.” Edwards is convinced that “the Fed and other central banks will be desperate enough to adopt outright monetisation (aka helicopter money, that is to say the direct central bank financing of public sector deficits) in the next recession. And as that will coincide with public sector deficits in the mid teens, we will be conducting a live MMT experiment. Welcome to a brave new world!”

If there’s anything that typifies how today’s institutions view the world, it must be that they see themselves in the frontline fighting against the problems they first caused.

• Fed’s Powell On The Biggest Challenge Over The Next Decade (CNBC)

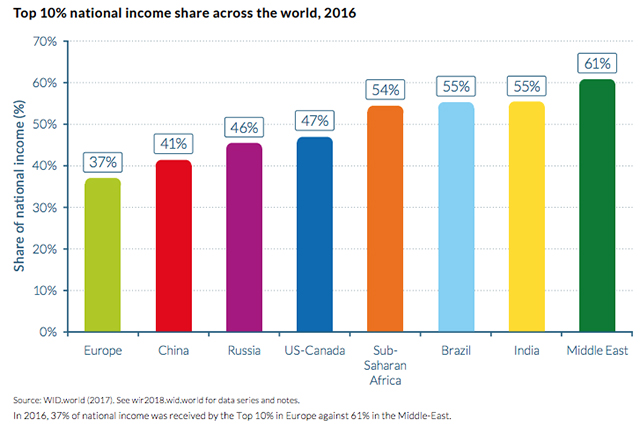

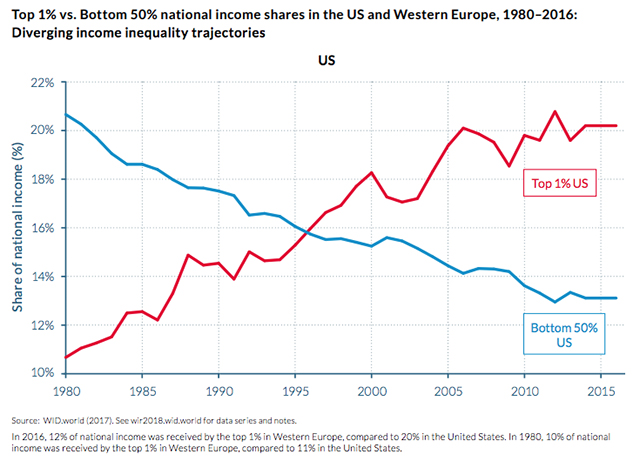

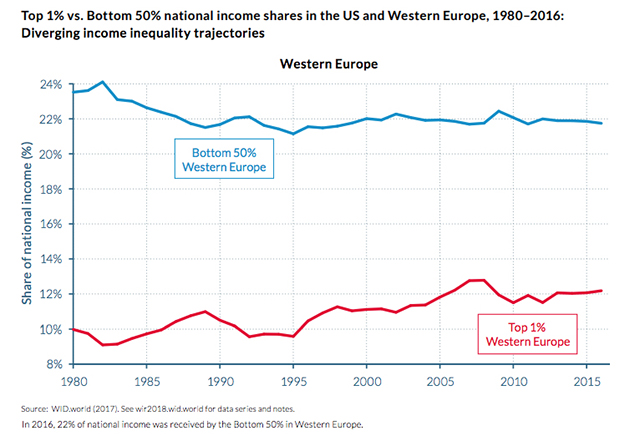

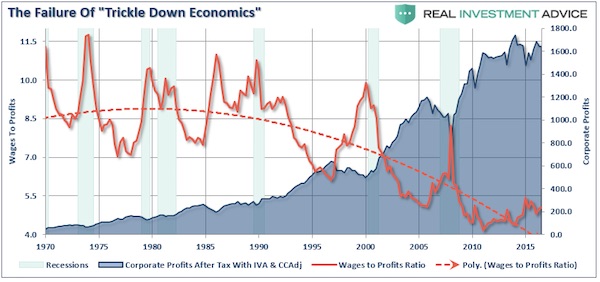

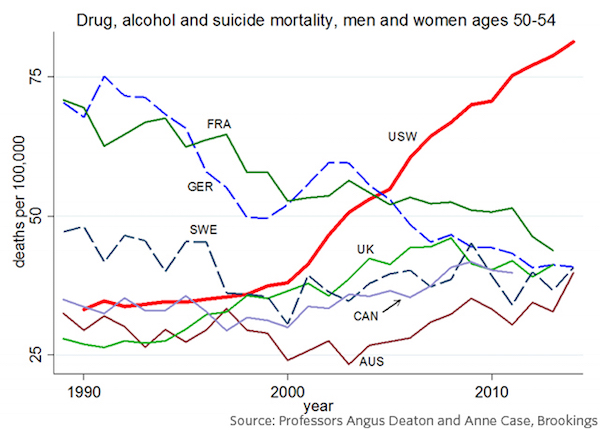

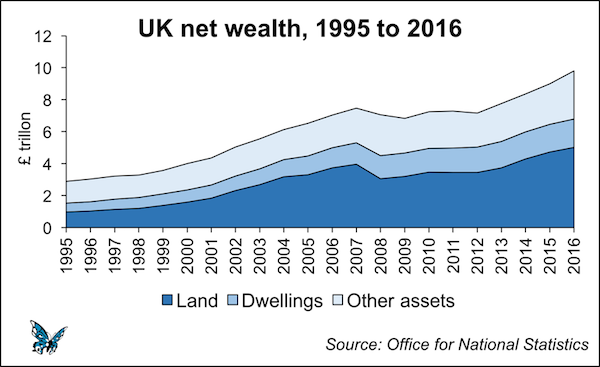

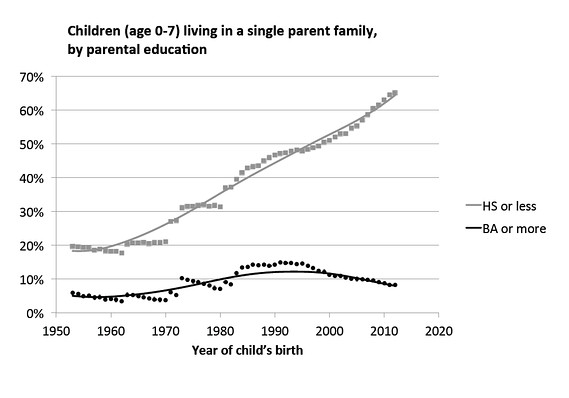

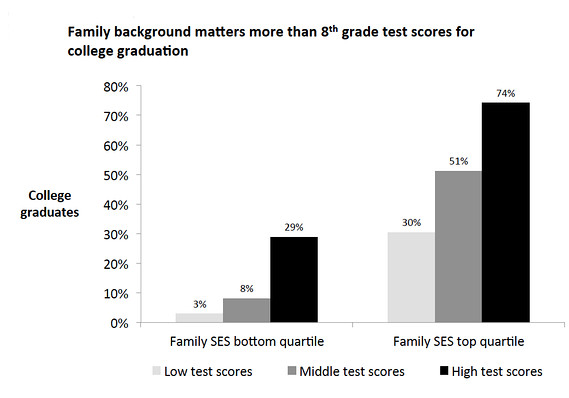

Sluggish productivity and widening wealth gap are the biggest challenges facing the U.S. over the next decade, Federal Reserve Chairman Jerome Powell said Wednesday. Speaking at a town hall in Washington D.C. to a group of educators, the central bank leader said his greatest economic fears lie outside the Fed’s purview. Specifically, he called for more aggressive policies to address income inequality. Wages at the middle and lower levels have “grown much more slowly” than those at the higher end, he said. “We want prosperity to be widely shared. We need policies to make that happen,” Powell added.

For the chairman, the forum was a chance to take some lighter questions — he revealed that to relax he plays guitar and rides his bicycle — but he also turned serious when addressing the issues of the future. Powell stressed the importance of increasing labor force participation and improving mobility between income classes, which is an area where he said the U.S. has lagged in recent years. “That’s not our self-image as a country, nor is it where we want to be,” he said. “There are policies that we need to do that everyone should be able to agree on that will change mobility, improve people’s chances and enable people to better take part in the workforce of the future,” Powell added.