Pablo Picasso Harlequin and woman with necklace 1917

More dollars borrowed globally than the Fed ever issued. And now it issues fewer.

• The Global Dollar Shortage is Here – And It’s Becoming A Big Problem (Palisade)

The credit market – in my opinion – is indicating an inevitable ‘crunch’ coming up. And even worse – we’re seeing the global dollar shortage deepening. [..] Personally – I think this may be the trigger that kicks off a brutal, worldwide, financial crisis. . . For instance – just look at what’s happened with Emerging Markets because of a tightening Federal Reserve, a stronger dollar, and drying liquidity. Don’t forget – a dollar shortage is synonymous with disappearing liquidity. Which means we can expect more violent and sudden market crashes to occur – just like we saw over the last two weeks.

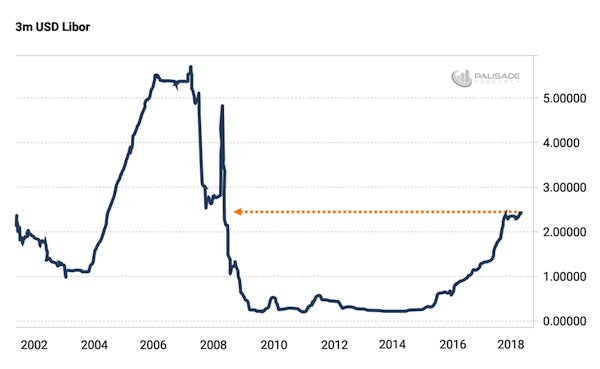

Stock markets (and bond markets) around the world took big losses. The only thing that really outperformed was gold. The fear of rising ‘real’ U.S. interest rates and slowing economic growth (especially from China) is making investors rethink their positions. Not to mention the cost of borrowing short-term dollars via LIBOR (aka London Interbank Offered Rate) is indicating aggressive financial tightening. Take a look at the 3-month U.S. dollar LIBOR rate – it just had its biggest one day jump since late May. And even more startling – it’s now at its highest level since 2008.

So what does this mean? Well – it’s indicating that the short-term borrowing of dollar denominated debt’s getting very expensive. And investors – especially overseas – are finding it harder and costlier to get their hands-on U.S. dollars. This isn’t a big surprise – but what’s making me worried is just how costly and scarce these dollars are becoming. . . Corporations worldwide borrowing dollars for business operations. And even ordinary citizens with mortgages and credit cards (which are mostly driven by LIBOR) will face higher interest payments.

Ahead of the tariffs kicking in, imports and exports rose. There’s a time lag here.

• The Party’s Far From Over For The US Economy, As GDP Will Show (MW)

The official scorecard for the economy, known as gross domestic product, will be released Friday. While economists polled by MarketWatch predict a 3% increase in third-quarter GDP, some estimates such as the Atlanta Federal Reserve’s “Nowcast” are closer to 4%. A few big wild cards are in play. The U.S. trade deficit shrank in the second quarter, for instance, but it looks set to expand in the third quarter. How come? Many American companies in the spring hastened to export soybeans and other goods to China and elsewhere before U.S. and retaliatory foreign tariffs kicked in. Exports have since declined.

At the same time, imports have risen to a record high. Americans are better off than they’ve been in years and they can afford to buy more imported goods. The strong dollar also makes foreign products cheaper. Businesses, for their part, ramped up production in the summer and restocked warehouse shelves. An increase in inventories boosts GDP, but it’s a herky-jerky statistic that’s always hard to predict. “Trade will be a significant drag [on GDP], but inventories will add to growth,” said Richard Moody, chief economist at Regions Financial.

More importantly, though, Americans kept spending. They almost certainly didn’t spend as much as they did in the spring, but they still spent a lot. Consumer spending accounts for some 70% of U.S. economic activity. If GDP generates the biggest headlines, the real story of where the economy is headed can be seen through the monthly tally on new orders for long-lasting products. These “durable” goods include new cars, appliances, computers, furniture and such. In any case, the economy cannot grow rapidly in the long run and generate a higher standard of living absent strong investment.

Trump takes a viewpoint. Then takes a step back, and then another one. Negotiating. It all looks completely different when you’re trying to figure out what’s going on than when your opinion is already made up.

Now people are saying Trump’s in Saudi pockets. The same people who said he’s in Putin’s pockets. So which is it? Both? And does everyone involved know this?

Trump’s been hammered on entirely false topics -Russiagate- for far too long for the hammerers to pull back now and move to the real ones. Dangerous.

• Trump, Europeans Call Saudi Account Of Khashoggi Death Inadequate (R.)

U.S. President Donald Trump joined European leaders on Saturday in pushing Saudi Arabia for more answers about Jamal Khashoggi after Riyadh changed its story and acknowledged that the journalist died more than two weeks ago at its consulate in Istanbul. Saudi Arabia said early on Saturday that Khashoggi, a critic of the country’s de facto ruler Crown Prince Mohammed bin Salman, had died in a fight inside the building. Germany called that explanation “inadequate” and questioned whether countries should sell arms to Saudi Arabia, while France and the European Union urged an in-depth investigation to find out what happened to the Washington Post columnist after he entered the consulate on Oct. 2 for documents for his marriage.

Turkish officials suspect Khashoggi, a Saudi national and U.S. resident, was killed inside the consulate by a team of Saudi agents and his body cut up. The Khashoggi case has caused international outrage and frayed political and business ties between Western powers and U.S. ally Saudi Arabia, the world’s No.1 oil exporter. Asked during a trip to Nevada if he was satisfied that Saudi officials had been fired over Khashoggi’s death, Trump said: “No, I am not satisfied until we find the answer. But it was a big first step, it was a good first step. But I want to get to the answer.” In an interview with the Washington Post, Trump said that “obviously there’s been deception, and there’s been lies.”

Trump’s comments about the Khashoggi incident in recent days have ranged from threatening Saudi Arabia with “very severe” consequences and warning of economic sanctions, to more conciliatory remarks in which he has played up the country’s role as a U.S. ally against Iran and Islamist militants, as well as a major purchaser of U.S. arms.

Bolton. Time for Trump and Putin to meet again.

• Trump Says US Will Pull Out Of Nuclear Arms Deal With Russia (AFP)

President Donald Trump confirmed Saturday that the United States plans to leave a Cold War-era nuclear weapons treaty with Russia, which criticized the move as Washington’s latest effort to be the sole global superpower. Trump claims Russia has long violated the three-decade-old Intermediate-Range Nuclear Forces Treaty, known as the INF, was signed in 1987 by president Ronald Reagan and Mikhail Gorbachev. But a foreign ministry source told the RIA Novosti state news agency that Washington’s “main motive is a dream of a unipolar world,” one that won’t be realized.

“We’re the ones who have stayed in the agreement and we’ve honored the agreement, but Russia has not unfortunately honored the agreement, so we’re going to terminate the agreement and we’re going to pull out,” Trump told reporters in Elko, Nevada. “Russia has violated the agreement. They’ve been violating it for many years. I don’t know why president (Barack) Obama didn’t negotiate or pull out. And we’re not going to let them violate a nuclear agreement and go out and do weapons (while) we’re not allowed to.”

Trump spoke as his National Security Advisor John Bolton was set to meet next week with Russia’s Foreign Minister Sergei Lavrov, ahead of what is expected to be a second summit between Trump and Russian leader Vladimir Putin this year. Bolton was also set to meet with Security Council Secretary Nikolai Patrushev and Putin aide Yuri Ushakov. Kremlin spokesman Dmitry Peskov said a “possible meeting” was being prepared between Putin and Bolton. The Trump administration has complained of Moscow’s deployment of 9M729 missiles, which Washington says can travel more than 310 miles (500 kilometers), and thus violate the INF treaty.

So there. But in 15 years it’ll be broke.

• Social Security Does Not Add To The Federal Deficit (F.)

This is not a political column, it’s a push back on the political distortion of legal and math facts about Social Security. Recently political leaders, such as the Senate leader Mitch McConnell, as Michael Hiltzik writes in the LA Times, are gunning to cut Social Security benefits to reduce the federal deficit. But Social Security can’t, by law, add to the federal deficit. Medicare and Medicaid can, but not Social Security. Social Security is self-funded. It is correct to say that Congress added to the deficit, not Social Security . The deficit rose substantially because of the 2017 tax cut, which reduced total revenue by 5% and revenue from corporate taxes by 35%.

And because it must balance its books Social Security is prudently funded. It collects revenue and saves for expected costs. Currently, Social Security has a $2.8 trillion trust fund built up by the boomer generation paying more in taxes than needed to pay current benefits. The trust fund is a vital way workers save for retirement. With tax revenues and earnings and principal from the trust fund Social Security is estimated to be solvent until 2034. After that, if it doesn’t get more revenue Social Security will only pay 77% of promised benefits. Social Security can’t add to the deficit because it pays for itself. If revenue falls short, benefits are cut.

Why am I thinking someone will say not a chance?! Or is it ‘give the dog a bone’?

• PM Tsipras Says EU Approved Greek Budget Without Pension Cuts (R.)

The European Union’s executive has approved Greece’s first post-bailout budget without requiring the implementation of legislated pension cuts, the country’s prime minister said on Saturday. “The European Commission approved the Greek budget without pension cuts after eight years of austerity,” Alexis Tsipras said, calling the development a “success”. The country’s third international bailout program ended in Augusts. The government aims to outperform on primary surplus targets for a fifth straight year to be in a position to avoid implementing painful austerity measures agreed with creditors.

You’ll need more people, and do it every week, and then every day.

• 700,000 March To Demand A Final Say On Brexit (Ind.)

The crowds stretched so far back that plenty of people never even made it to the rally. Masses overflowed through the streets of London for more than a mile, from Hyde Park Corner to Parliament Square, as an estimated 670,000 protesters took their demand for a fresh Brexit referendum right to Theresa May’s doorstep. They came from every corner of the UK, in what is believed to be the largest demonstration since the Iraq War march in 2003, when more than a million people turned out in the capital to oppose the conflict.

Amid the swathes of EU flags and banners, there was also a growing sense that campaigners, MPs and activists were realising, perhaps for the first time, that this was a battle that could be won. “We were the few, and now we are the many,” Tory MP Anna Soubry told the crowds crammed into Parliament Square. “We are winning the argument and we are winning the argument most importantly against those who voted Leave.” She said: “We will not walk away. We will take responsibility and sort out this mess with a people’s vote.”

After two days?! Promising!

• Series Of Small Earthquakes Detected Near UK Fracking Site (G.)

A series of small earthquakes have been detected in Lancashire close to the site where fracking operations began this week. The British Geological Survey (BGS), which provides impartial advice on environmental processes, recorded four tremors in the vicinity of the energy firm Cuadrilla’s site on Preston New Road near Blackpool on Friday. Fracking was stopped in 2011 after two earthquakes, one reaching 2.3 on the Richter scale, were triggered in close proximity to the site of shale gas test drilling. A subsequent report found that it was highly probable that the fracking operation caused the tremors. On Monday Cuadrilla began drilling again after campaigners lost a high court legal challenge.

The BGS said: “Since hydraulic fracturing operations started at Preston New Road, near Blackpool, we have detected some small earthquakes close to the area of operations. “This is not unexpected since hydraulic fracturing is generally accompanied by micro-seismicity. The Oil and Gas Authority (OGA) has strict controls in place to ensure that operators manage the risk of induced seismicity. “All of the earthquakes detected at Preston New Road so far are below the threshold required to cease hydraulic fracturing.” One of Friday’s tremors measured 0.3, the level beyond which the BSG says hydraulic fracking should proceed with caution. Tremors above 0.5 would force operations to cease.

Facebook has much bigger issues than who gets to play chairman.s

• Facebook Shareholders Call For Zuckerberg To Be Kicked Out As Chairman (Ind.)

Mark Zuckerberg’s strong control over Facebook has come under question after several high-profile investors called for him to step down as chairman of the company. The shareholder proposal follows a series of controversies and scandals at the technology firm, including large-scale data breaches and accusations that the social network has become a platform for misinformation campaigns and political propaganda. State and city treasurers from Illinois, Rhode Island and Pennsylvania joined the New York City Pension Funds and Trillium Asset Management in requesting the Facebook board of directors to make the role of chairman an independent position. “Doing so is best governance practice that will be in the interest of shareholders, employees, users, and our democracy,” the filing states.

The proposal cites Facebook’s “mishandling” of “severe controversies,” including how the social network was used to manipulate the 2016 US presidential elections through Russian troll farms, and the sharing of data with Chinese device manufacturers like Huawei. According to the shareholders, Facebook’s governance structure puts investors at risk and should fall in line with other major tech firms like Google, Microsoft and Apple in having separate CEO and chairperson roles. “Facebook plays an outsized role in our society and our economy. They have a social and financial responsibility to be transparent – that’s why we’re demanding independence and accountability in the company’s boardroom,” said New York City Comnptroller Scott Stringer.

A fresh take on something Varoufakis first mentioned a few years ago in the first -Greek- version of his book Talking to my Daughter About the Economy: make Big Tech partly public companies.

• What Has Google Ever Done for Us? (Varoufakis)

When James Watt built one of his famed steam engines, it was his creation, his product. A buyer who put the engine to work in, say, a textile factory could think of his profit stream as a just reward for having taken the risk of purchasing the machine and for the innovation of coupling it to a spinning jenny or a mechanical loom. By contrast, Google cannot credibly argue that the capital generating its profit stream was produced entirely privately. Every time you use Google’s search engine to look up a phrase, concept, or product, or visit a place via Google Maps, you enrich Google’s capital. While the servers and software design, for example, have been produced capitalistically, a large part of Google’s capital is produced by almost everyone.

Every user, in principle, has a legitimate claim to being a de facto shareholder. Of course, while a substantial part of Big Tech’s capital is produced by the public, there is no sensible way to compute personal contributions, which makes it impossible to calculate what our individual shares ought to be. But this impossibility can be turned into a virtue, by creating a public trust fund to which companies like Google transfer a percentage – say, 10% – of their shares. Suddenly, every child has a trust fund, with the accumulating dividends providing a universal basic income (UBI) that grows in proportion to automation and in a manner that limits inequality and stabilizes the macro-economy.

Home › Forums › Debt Rattle October 21 2018