Caravaggio Burial of St. Lucy 1608

Can’t make it up (fast enough): I used 6 anti-Trump Guardian articles from December 23 in my article yesterday, Dumping on the Donald. But guess what: I still missed one from that day. The contents are completely empty, but they really wanted to get the headline in.

• US Prepares To Hit The Wall As Reckless Trump Undoes Years Of Hard Work (G.)

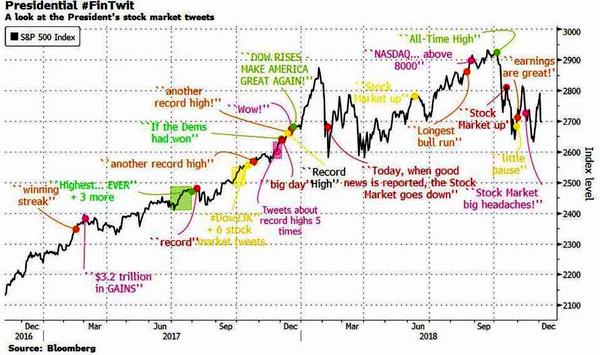

The accomplishments of a US president’s first year in office can be credited to his predecessor, at least where the economy is concerned. And Donald Trump was handed the best performing economy on the planet. All the tough decisions – to refinance the banks, rescue the car companies and deflate the real-estate bubble – had been made. The stock market was tearing along, setting records almost every week. Trump gave this rising balloon extra air with $1tn of tax cuts. It was borrowed money, but no matter. The economy sailed along for another year and the stock market carried on rising. His plan was to win the midterm congressional elections and then persuade the Republican party to give him another $1tn, or as near to it as possible.

In other words, he would use another pile of borrowed cash to pump up the economy again, hoping against hope that it would not blow up before his re-election. Without control of the House of Representatives, his plans are in ruins. And that was obvious to stock and bond traders, who followed the vote in November by putting a sell sign over their maps of America. December has proved to be the worst month for shares in many decades. Oil prices have slumped and the market is expecting worse to come in the new year. The reasons for pessimism are piling up. From the Atlantic to the Pacific, US home sales are struggling, with agents reporting that there are not enough buyers and asking prices are not being met.

[..] And in recent days Trump has given markets something else to worry about – building the wall. His threat to shut down the government if Congress refuses to provide him with the money for a pan-American border fence with Mexico has spooked traders. This reckless threat was preceded by the surprise decision to pull US troops out of Syria. If Trump could make such a move without consulting important allies, then perhaps he was capable of the “long shutdown” he has promised in his tweets. With ever fewer calming voices in the White House to rein in the president’s wilder excesses, it’s understandable that the finance industry is jittery about the prospects for 2019.

Trump likes Mnuchin. Who’s been around from the get-go. And of course both know there are hard times ahead.

• Trump Urges Americans To Buy The Dip; Voices Confidence In Mnuchin, Powell (ZH)

“We have companies, the greatest in the world, and they’re doing really well,” Trump told reporters at the White House on Christmas Day. “They have record kinds of numbers. So I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” Trump’s invocation to BTFD came one day after the most violent Christmas Eve selloff on record, and the day when the S&P fell not only to its lowest level in 20 months, but also slumped into a bear market. For Trump, the stock market has served as a barometer on his administration, and while he was pointing out virtually every major uptick for the past two years, the recent plunge has infuriated him, leaving him mute on any market-related topic.

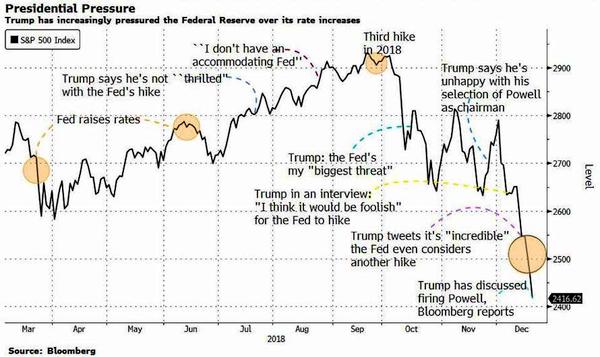

But a more important catalyst for a potential Wednesday rally came when Trump appeared to back off on his demands that the Fed stop hiking, which culminated with Trump reportedly seeking to fire Fed Chair Powell and speculation that if the market does not stop falling, Treasury Secretary Mnuchin may also be on the chopping block. Alongside urging Americans to BTFD, Trump expressed confidence in the Treasury secretary and the Federal Reserve, in an attempt to calm financial markets further roiled after a recent Bloomberg report that the president had discussed firing the central bank’s chairman over raising interest rates.

Asked about Fed Chairman Jerome Powell, Trump said the central bank is “raising interest rates too fast” but he has “confidence” that the Fed will “get it pretty soon.” Trump was also asked if he has confidence in Treasury Secretary Steven Mnuchin who sparked a market panic on Monday with his late Sunday statement in which he said he had called the CEOs of the top 6 banks to make sure bank liquidity levels are fine (prompting a frenzy of question what he knows that the rest of the market does not) and followed it up with a call with the Plunge Protection Team on Monday, which however failed to prevent one of the worst one-day routs in history . Trump’s response: “yes I do, very talented guy, very smart person.”

While answering questions from reporters at the White House after addressing U.S. armed forces members on a Christmas Day video conference call, Trump also said the Fed is hiking borrowing costs because the “economy is doing so well” – which is accurate, however it is the market that is spooked by the aggressive tightening – adding that U.S. companies are having “record kinds of numbers” and it’s a “tremendous opportunity to buy.” The remarks represented Trump’s first expression of public support for Mnuchin and Powell since Bloomberg reported last week that the president has discussed dismissing Powell who was recommended by Mnuchin. Overnight, Bloomberg also reported that the president also weighed dismissing Mnuchin, while another said that Mnuchin’s tenure may depend in part on how much markets continue to drop.

But CNN has found an anonymous source who claims Mnuchin is on his way out. Bloomberg claimed something similar.

Is it getting through to people that nothing CNN has to say about Trump has any news value?

• Trump’s Frustration With Mnuchin Rising – Source (CNN)

President Donald Trump’s frustration with Treasury Secretary Steven Mnuchin is ratcheting up further after markets suffered their worst Christmas Eve drop ever despite Mnuchin’s attempts to calm Wall Street, according to a source close to the White House. The source told CNN that Mnuchin could be in “serious jeopardy” with Trump, who regularly rages at Cabinet members he feels have made mistakes, before he cools off. Trump nevertheless vouched for Mnuchin publicly, shifting blame for the market volatility to the Federal Reserve instead. “Yes, I do,” Trump said Tuesday when asked whether he had confidence in Mnuchin. “Very talented, very smart person.”

But the source painted a different picture of Mnuchin’s standing behind the scenes. “Mnuchin is under the gun,” the source said. The Treasury secretary left Washington for a Christmas holiday in Mexico’s Cabo San Lucas as the federal government shut down over the weekend, while Trump canceled his own planned trip to his Mar-a-Lago resort in Florida and remained cooped up in the White House over the holiday, absorbing a flood of negative news about the markets. Mnuchin aides have been scrambling to find economic data to help their boss calm Trump down, but Trump was said to be unhappy with what Mnuchin was telling him, this source said. An administration source dismissed the latest round of rumors that the secretary’s continued tenure was on the line. “This is nonsense,” they said.

Abenomics bleeds to death very slowly and even more expensively.

• BOJ’s Kuroda Further Waters Down Pledge To Hit Inflation Target Quickly (R.)

Conceding it was taking longer than expected to achieve 2 percent inflation, Kuroda said global risks have “come to warrant further attention” as China’s growth slows and trade frictions hurt business sentiment. He also said the BOJ must be mindful of the rising costs of prolonged monetary easing, such as the chance years of near-zero rates could hurt financial institutions’ profits and discourage them from boosting lending. “The BOJ will proceed step by step toward achieving its price target, while taking into account in a balance manner not only the benefits of monetary easing but also its costs,” Kuroda told an annual meeting of business lobby Keidanren on Wednesday. Up till now, Kuroda has repeatedly said the BOJ will seek to achieve 2 percent inflation “at the earliest date possible.”

[..] The BOJ is caught in a bind. With inflation distant from its target, it is forced to maintain a massive stimulus despite the negative spillovers. Its dwindling policy ammunition limits the ability to ramp up stimulus to prevent another recession. The dilemma has created a rift within the BOJ with its board members disagreeing on ways to address the dangers of prolonged easing, minutes of the October rate review showed. Kuroda said the situation has changed from when the BOJ deployed a massive asset-buying program in 2013, when such a drastic action was critical to pull Japan out of stagnation. Now, the economy is in good shape but inflation remains weak and closer attention is needed to overseas risks, he said. “In complex times like now, what’s required is to persistently continue with the current powerful easing while weighing the benefits and costs of our policy in a balanced manner,” Kuroda said.

Nobody wants whale hunts. They’re arcane and stupid. So stop buying Japanese cars and electronics. Get organized. Either boycott them completely or hold your tongue.

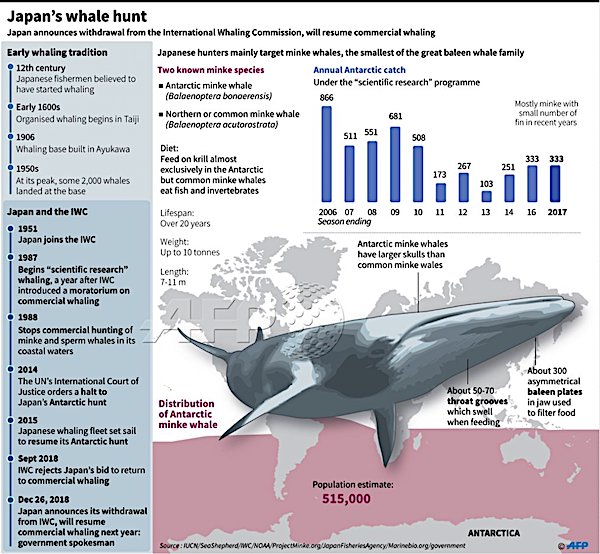

• Japan To Resume Commercial Whaling (AFP)

Japan said Wednesday it is withdrawing from the International Whaling Commission and will resume commercial whaling next year, sparking criticism from activists and anti-whaling countries including Australia. The announcement comes after Japan failed earlier this year to convince the IWC to allow it to resume commercial whaling. Top government spokesman Yoshihide Suga said the commercial hunts would be limited to Japan’s territorial waters. “We will not hunt in the Antarctic waters or in the southern hemisphere,” he added. Tokyo has repeatedly threatened to pull out of the IWC, and has been regularly criticised for catching hundreds of whales a year for “scientific research” despite being a signatory to a moratorium on hunting the animals.

Suga said Japan would officially inform the IWC of its decision by the end of the year, which will mean the withdrawal comes into effect by June 30. Leaving the IWC means Japanese whalers will be able to resume hunting in Japanese coastal waters of minke and other whales currently protected by the IWC. But Japan will not be able to continue the so-called scientific research hunts in the Antarctic and elsewhere that it has been exceptionally allowed as an IWC member. Japan joins Iceland and Norway in openly defying the IWC’s ban on commercial whale hunting, and its decision sparked international criticism.

I think they slip because their economies are in trouble.

• Asian Stocks Slip On US Shutdown Worries, Trump’s Fresh Criticism Of Fed (MW)

Asian markets were mostly lower on Wednesday after President Donald Trump said that there was “nothing new” in efforts to end the partial government shutdown over a U.S.-Mexico border wall. Traders had no fresh leads from Wall Street, which was closed on Christmas. U.S. stocks are headed for their worst December since the Great Depression in 1931. South Korea’s Kospi, 1.3% to 2,028.01 and the Shanghai Composite Index shed 0.3% to 2,498.29. Japan’s Nikkei, which plunged 5% on Tuesday, picked up 0.9 percent to 19,327.06. Shares fell Taiwan and throughout Southeast Asia. Markets in Hong Kong and Australia were closed.

The partial shutdown of the U.S. government that started Saturday shows no signs of abating. “Nothing new. Nothing new on the shutdown. Nothing new. Except we need border security,” Trump told reporters. The White House said Trump will reject any deal that does not include any funding for a wall or a fence. The Democrats have opposed this and are offering $1.3 billion for security. The routines of 800,000 federal employees are expected to be disrupted by the shutdown, but essential services will keep running. Trump’s criticism of the U.S. central bank triggered a drop in Asian equities on Tuesday. “The only problem our economy has is the Fed,” the president said on Twitter.

“They don’t have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders.” Trump has since said since that interest rate hikes were a “form of safety” for an economy that was doing well, while stressing that the Fed was raising rates too quickly. “The outsized moves are not reflective of the current U.S. economic landscape, but that seems to matter little so far as fear mongering continues to permeate every pocket of global capital markets,” Stephen Innes of OANDA said in a market commentary.

Trump brings down Asian stocks. Didn’t win your Christmas lottery? You know who to blame.

• Asian Stocks Retreat As US Political Tumult Adds To Growth Worry (R.)

Asian stock markets retreated again on Wednesday, extending a rout that began last week as U.S. political uncertainty exacerbated worries over slowing global economic growth. Investors were unnerved by the U.S. federal government partial shutdown and President Donald Trump’s hostile stance toward the Federal Reserve chairman. U.S. Treasury Secretary Steven Mnuchin had also raised market concerns by convening a crisis group amid the pullback in stocks. S&P 500 emini futures were last down 0.6 percent, pointing toward a lower start for Wall Street when the U.S. market reopens after Christmas Day, when many of the world’s financial markets were shut.

Markets in Britain, Germany and France will remain closed on Wednesday. MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.5 percent, brushing a two-month low. The Shanghai Composite Index lost 0.4 percent while South Korea’s KOSPI shed 1.6 percent. Japan’s Nikkei, which slumped 5 percent the previous day, had a volatile session. It swerved in and out of the red, falling more than 1 percent to a 20-month-low at one stage, before ending the day with a gain of 0.9 percent. “In addition to concerns toward the U.S. economy, the markets are now having to grapple with growing turmoil in the White House which has raised political risk ahead of the year-end,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

The CIA and MI6 are watching.

• ‘We’re Not Far From Zuckerberg Getting Subpoenaed’ (Ind.)

David Carroll, an associate professor at Parsons School of Design in New York, said this week may finally have dealt Facebook its “knockout” blow. As an outspoken critic of the way Facebook uses people’s data, Prof Carroll is currently suing Cambridge Analytica under the Data Protection Act following the UK firm’s role in mining data from 87 million Facebook users for the purpose of political profiling during the 2016 US presidential elections. But the latest revelations that other tech firms were given access to people’s private messages was beyond even what he thought Facebook was capable of. “Even as someone who is deeply sceptical of Facebook, I was surprised by the latest revelations,” he told The Independent.

“I didn’t know it could be that bad in terms of scope and scale. But it all seems to fit with Zuckerberg’s master plan for global domination.” The first lawsuit against Facebook regarding the Cambridge Analytica scandal, which affected more than 87 million users, comes courtesy of the attorney general of the District of Columbia. It is unlikely to be the last, given Facebook is also currently facing probes by the US Securities and Exchange Commission, the Federal Trade Commission and the Department of Justice – and that’s just in the US. A relatively insignificant fine of £500,000 that was handed to Facebook in the UK may be dwarfed following investigations by the Irish data protection regulator, which are being seen as the first serious test of Europe’s new General Data Protection Regulation.

But with more than 2 billion users worldwide and an annual revenue of more than $40 billion in 2017, it will take more than a fine to have any significant impact on Facebook. Prof Carroll has called for Facebook CEO Mark Zuckerberg and other senior executives to be subpoenaed and thinks it might not be long before that becomes a reality. “We need to get them under oath and ask them questions they cannot dodge. It will depend on the Mueller investigation. It’s imaginable additional facts come to our knowledge to justify Zuckerberg’s subpoena and we find out how much he knew and when. We need more to justify it but we’re not that far from getting there.”

Elect your decision makers at random. That way they can’t be bought by special interests. And that’s just one of many advantages.

James Bridle is the author of New Dark Age: Technology and the End of the Future.

• How Can We Break The Brexit Deadlock? Ask Ancient Athens (Bridle)

In the central marketplace of ancient Athens, around 350BC, there stood a machine called the kleroterion. This was a six-foot-high slab of stone that had a series of slots on the front, and a long tube bored down from the top to the base. Those up for selection for the various offices of state would insert metal ID tags, called pinakia, into the slots, and a functionary would pour a bucket of coloured balls, suitably shaken, into the top of the tube. The order in which the balls emerged would determine who took which role, some for the day, some for a year.

Today the kleroterion survives, in fragments, in Athens’ Museum of the Ancient Agora, alongside other pieces of democratic technology such as the clepsydra, a water clock used to time orators’ speeches and the fragments of pottery, called ostraka, on which they scratched the names of the too-powerful politicans they wished to see banished from the city, and from which we derive the modern word “ostracism”. The method of governance embodied in the kleroterion, which dates back to the very establishment of democracy, is called sortition, meaning selection by lot, as opposed to election by vote. The Athenians believed that the principle of sortition was critical to democracy. Aristotle declared that: “It is accepted as democratic when public offices are allocated by lot; and as oligarchic when they are filled by election.”

But along the way, sortition – and the even more exciting possibility of actual banishment – has fallen out of most democracies’ toolkits. Sortition in ancient Athens had a number of important qualities. First, those eligible for selection included the entire suffrage (which, it must be noted, was at the time limited to adult male citizens). Second, it applied to much more than jury selection, which is the only form in which sortition survives in most places today, and included magistrates, legislators and the main governing councils of the city – all the important posts, in fact, bar the military. And third, and perhaps most significantly, it both embodied and enabled transparent and participatory governance: that is, anybody could come down to the agora and not merely see but understand how the machine worked – and anyone could be selected by it.

No, your reputation’s pretty much shot.

• Brexit Made The UK A Global Joke. Can We Rebuild Our Reputation? (Kampfner)

Britain is now the butt of global mirth and cringe-making sympathy. I spent most of this autumn on trips trying to link our creative industries with those of other countries. From Mexico City to Montreal, Amsterdam to Tallinn, the welcome starts with the avuncular hand on the shoulder, a sigh and a reference to “our British friends”, followed by “I hope you’re all right”. Consternation over the original referendum decision long ago gave way to bafflement over the chaos. “What on earth is Mrs May doing playing pantomime host in the House of Commons at a time like this?” someone asked me last week. “We used to think that you were serious, reliable people.” Americans and Europeans used to tune in to our parliamentary antics to wonder at the jousting.

Now they are baffled that we continue to play games at a time like this. I am constantly asked why we hark on about the second world war, as if we are stuck in time and are not proud of our achievements since. The gulf between those trying to sell the UK’s skills and modernity and the poor calibre of our political culture is hitting hard. Business groups, which had been surprisingly cowed, are now waking up to the dangers of the brain drain. It is not just young, ambitious Europeans who are moving home, apparently to our prime minister’s delight. The movement of talented Britons to other countries is steady and will grow, as the reality of Brexit sinks in. Why work in a country that regards economic self-harm as just one of those things you have to get through? Why work in a country that permits people to come rather than welcomes them?

Putin moves silently.

• Arab League Set To Readmit Syria Eight Years After Expulsion (G.)

Gulf nations are moving to readmit Syria into the Arab League, eight years after Damascus was expelled from the regional bloc over its brutal repression of peaceful protests against President Bashar al-Assad. At some point in the next year it is likely Assad will be welcomed on to a stage to once again take his place among the Arab world’s leaders, sources say. Shoulder to shoulder with the Saudi crown prince, Mohammed bin Salman, and Egypt’s latest autocrat, General Abdel Fatah al-Sisi, the moment will mark the definitive death of the Arab spring, the hopes of the region’s popular revolutions crushed by the newest generation of Middle Eastern strongmen.

Syria was thrown out of the Arab League in 2011 over its violent response to opposition dissent, a move that failed to stem the bloodshed that spiralled into civil war. Now though, a regional thaw is already under way. This week, the Sudanese president, Omar al-Bashir, became the first Arab League leader to visit Syria in eight years, a visit widely interpreted as a gesture of friendship on behalf of Saudi Arabia, which has shored up ties with Khartoum in recent years. Pro-government media outlets posted pictures of the two leaders shaking hands and grasping each other’s arms on a red carpet leading from the Russian jet that ferried Bashir to Damascus along with the hashtag “More are yet to come”.

50 plant species? Who’s that going to impress?

• More Than 50 Australian Plant Species Face Extinction Within Decade (G.)

More than 50 Australian plant species are under threat of extinction within the next decade, according to a major study of the country’s threatened flora. Just 12 of the most at-risk species were found to be listed as critically endangered under national environment laws – the Environment Protection and Biodiversity Conservation Act – and 13 had no national threatened listing at all. The scientists behind the research, published in the Australian Journal of Botany this month, say the results point to a need for re-evaluation of Australia’s national lists for threatened plants. It is the first major assessment of the status of Australia’s threatened flora in more than two decades. Plants account for about 70% of Australia’s national threatened species list, with 1,318 varieties listed as either critically endangered, endangered or vulnerable.

The research team assessed species that met criteria for either a critical or endangered listing at national or state levels to track their rate of decline. They did this by reviewing all available literature on the plants – including recovery plans, conservation advice and peer-reviewed research – and conducting interviews with 125 botanists, ecologists and land managers with expertise on particular geographic regions or species. The study examined 1,135 species, including 81 that were unearthed through the interview process as being eligible for a critically endangered or endangered listing but did not have one. It found 418 plants had continued declines in their population and a further 265 species had insufficient monitoring information available to determine their status.

The scientists concluded that 55 species were at high risk of extinction within the next 10 years, with fewer than 250 individual plants or only a single population remaining. They found just 12 of the most imperilled species were listed under the EPBC Act as critically endangered and 13 had no listing at all. They said there were also 56 species of plants currently on the critically endangered list that they assessed as having no documented declines or that were stable or even increasing.

Home › Forums › Debt Rattle December 26 2018