Salvador Dali Invisible Sleeping Woman, Horse, Lion 1930

Brought to you by the world’s richest country.

• 56% Of Americans Are Lying Awake At Night Worrying About Money (MW)

How are you sleeping lately? Some Americans are feeling uneasy. Consumer confidence fell to a two-year low in June, the Conference Board announced this week. It fell to 121.5 this month from a 131.3 in May. That’s the lowest level since September 2017. “The escalation in trade and tariff tensions earlier this month appears to have shaken consumers’ confidence,” Lynn Franco, senior director at the Conference Board, said in a statement. Continued uncertainty could “diminish” people’s confidence in the economic expansion, she added. Many people are living with wildly fluctuating income, a recent report from the Board of Governors of the Federal Reserve System said.

“Volatile income and low savings can turn common experiences — such as waiting a few days for a bank deposit to be available — into a problem.” Despite unemployment hitting a 49-year low, plus low interest rates and inflation, people are feeling skittish. “A major trade war between the U.S. and China represents our greatest economic risk,” according to Lynn Reaser, chief economist of the Controller’s Council of Economic Advisors. All of these worries are taking their toll. 78% of adults are losing sleep over work, relationships, retirement and other worries, according to a study released Thursday by personal-finance site Bankrate.com. Over half (56%) of Americans are lying awake at night worrying about money.

Can’t make anything anymore. And now there are plans to make Europe use US nukes…..

• America’s Monopoly Crisis Hits the Military (AC)

Early this year, U.S. authorities filed criminal charges—including bank fraud, obstruction of justice, and theft of technology—against the largest maker of telecommunications equipment in the world, a Chinese giant named Huawei. Chinese dominance in telecom equipment has created a crisis among Western espionage agencies, who, fearful of Chinese spying, are attempting to prevent the spread of Huawei equipment worldwide, especially in the critical 5G next-generation mobile networking space. In response to the campaign to block the purchase of Huawei equipment, the company has engaged in a public relations offensive.

The company’s CEO, Ren Zhengfei, portrayed Western fears as an advertisement for its products, which are, he said, “so good that the U.S. government is scared.” There’s little question the Chinese government is interested in using equipment to spy. What is surprising is Zhengfei is right about the products. Huawei, a relatively new company in the telecom equipment space, has amassed top market share because its equipment—espionage vulnerabilities aside—is the best value on the market. In historical terms, this is a shocking turnaround. Americans invented the telephone business and until recently dominated production and research. But in the last 20 years, every single American producer of key telecommunication equipment sectors is gone.

Today, only two European makers—Ericsson and Nokia—are left to compete with Huawei and another Chinese competitor, ZTE. This story of lost American leadership and production is not unique. In fact, the destruction of America’s once vibrant military and commercial industrial capacity in many sectors has become the single biggest unacknowledged threat to our national security. Because of public policies focused on finance instead of production, the United States increasingly cannot produce or maintain vital systems upon which our economy, our military, and our allies rely. Huawei is just a particularly prominent example.

Well, they can still make cars…

• US Car Industry Is Killing Itself (WS)

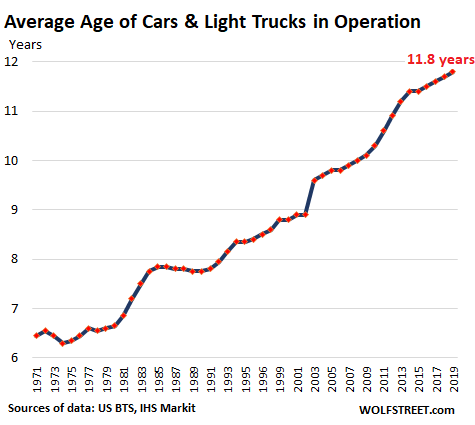

The average age of passenger cars and trucks on the road in the US ticked up again in 2019, to another record of 11.8 years, IHS Markit reported today. When I entered the car business in 1985, the average age had just ticked up to 7.8 years, and the industry was fretting over it and thought the trend would have to reverse, and customers would soon come out of hiding and massively replace those old clunkers with new vehicles, and everyone would sell more and make more. But those industry hopes for a sustained reversal of the trend of the rising average age have been bitterly disappointed:

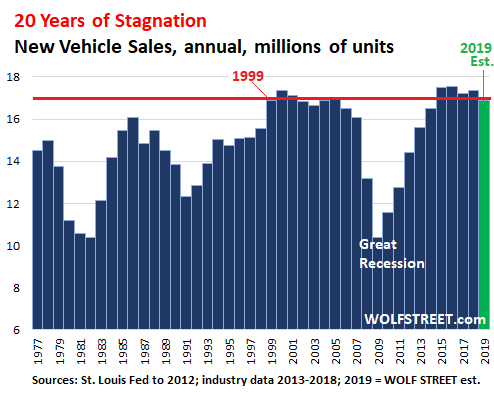

This rising average age is largely driven by vehicles lasting longer – an unintended consequence of relentless improvements in overall quality, forced upon automakers by finicky customers in an ultra-competitive market where automakers struggle to stay alive. To make it in the US, they have to constantly improve their products, and stragglers that can’t compete are left unceremoniously by the wayside. US consumers are brutal. This unintended consequence of rising overall quality contributes to the dreadful industry problem: The US, despite constant population growth, is a horribly mature auto market. In 1999, so 20 years ago, new vehicle sales reached a record of 16.9 million units.

This record was broken in 2000, with 17.3 million units. Then sales tapered off. By 2007, they’d dropped to 16.1 million units. Then the Financial Crisis hit, GM and Chrysler went bankrupt, Ford almost did, and peak-to-trough, sales plunged 40% to 10.4 million units by 2009. The recovery has been steep, and in 2015, finally the old record of the year 2000 was broken, but barely with 17.48 million units, and in 2016, the industry eked out another record of 17.55 million units. And that was it. Sales have fizzled since then. So far in 2019, the data indicates that sales are likely to fall below 17 million units, according to my own estimates, bringing the industry right back where it had been 20 years ago in 1999:

Nothing a little QE won’t fix?!

• Baoshang Bank Collapse Threatens China’s Economy (ABC.au)

Up until a few weeks ago the Baoshang Bank’s prospects seemed bright enough. According to Baoshing’s most recent regulatory filing, the smallish lender based in Inner-Mongolia, made a $600 million profit in 2017. It had assets of around $90 billion, non-performing loans were modest — under 2 per cent — and its capital buffers would fit comfortably with the global demands of a Tier1 bank. Then it collapsed. That set off a series of events rarely, if ever, seen in Chinese banking. Regulators seized Baoshang, the first action of its type since 1998. That may have shaken the foundations of Chinese banking, but of far greater significance was the collapse caused by China’s first recorded interbank default.

It is yet to be a “Lehman moment” — where the credit market freezes, banks stop lending to each other and the economy teeters above the abyss —but it has, as Societe Generale’s Wei Yao noted, “triggered severe liquidity tensions in the interbank market”. “The Baoshang incidence has challenged one fundamental belief of China’s financial system; interbank defaults are not possible thanks to 100 per cent implicit guarantees,” Ms Yao said. “Now that credit risks and counter-party risks have finally descended on this very core market in China’s financial system, all the key players in the system have to figure out how to price risks in the new paradigm, and quickly.”

Ms Yao said the understandable consequence was “a big and unpleasant wave of risk repricing”, with major banks shying away from doing business with smaller lenders. And that’s a worry, as small-to-medium sized banks combined have balance sheets as big as the big banks combined, but are far more dependent on interbank funding. The central bank (PBoC) immediately pumped around 600 billion yuan ($125 billion) into the system and halted a run on the banks by guaranteeing 100 per cent of all retail deposits.

Not the Onion.

• Deutsche Bank Passes Fed Stress Test In Boost For Its US Operations (R.)

Deutsche Bank’s shares rose as much as 4.8% on Friday after Germany’s biggest bank passed an annual health check by the U.S. Federal Reserve, in a boost to its Wall Street operations. But the Federal Reserve placed conditions on the U.S. operations of Credit Suisse, knocking its shares 1% lower after identifying weaknesses in its capital planning. The tests assess whether it is safe for banks to implement their capital plans, including using extra capital for stock buybacks, dividends and other purposes beyond providing a cushion against losses. They are designed to avoid a repeat of the taxpayer bailouts of the 2007-2009 financial crisis.

Deutsche Bank, whose U.S. business has been plagued by litigation, underperformance and regulatory investigations, topped the German bluechip index .GDAX in Frankfurt after its U.S. shares were up as much as 6% in after-the-bell trading on Thursday following the Fed’s news. The German bank maintained a large presence on Wall Street after the 2007-2009 financial crisis, while Credit Suisse made big cuts. But Deutsche’s efforts to compete with U.S. rivals have been hampered by litigation and regulatory investigations. Deutsche Bank Chief Executive Christian Sewing, who is battling to turn the bank around, said the Fed’s decision was “excellent news” in a memo to staff on its website. “Achieving success here was one of the key goals we set a year ago. It is a huge step forward for our business in the U.S. and globally. A strong operating platform in the Americas is essential to our clients,” he said.

Lowballing.

• Paul Singer Warns A 40% Market Crash Is Coming (ZH)

Speaking at the Aspen Ideas Festival, billionaire investor and Elliott Management founder, Paul Singer, warned that the global economy is heading toward a “significant market downturn” cautioning that “the global financial system is very much toward the risky end of the spectrum.” While Paul Singer’s traditionally downcast outlook is hardly surprising, as it permeates every investor letter published by the successful investor who has been particularly clear in the past decade that the Fed’s monetary experiment will end terribly, he sees two particular reasons why the economy is approaching a tipping point: “global debt is at an all-time high.

Derivatives are at an all-time high and it took all of this monetary easing to get to where we are today and I don’t think central bankers, or policymakers or academics are in any better shape to predict the next downturn and I think we are the high end of the risk spectrum.” He then ominously added that “I’m expecting the possibility of a significant market downturn.” How bad would the crash be? According to the Elliott Management CEO, there will be a market “correction” of 30% to 40% when the downturn hits, although unlike Goldman – which gave a timeline of 12 months in which the next major market will materialize, Singer said he couldn’t predict the timing.

In the panel discussion, Singer also said the market meltdown late last year after interest rates spiked in the 4th quarter was the first hint of a pending slump, as it indicated that the Federal Reserve and other central banks were now victims of their policies, something he has been warning about for years. “December supported the notion that they’re trapped,” he said. “What they should have done, and what they should do now, is try to restore the soundness of money. They should not be cutting rates right now. They should be calling on the congresses and parliaments around the developed world to take steps to deal with the economic slowdown in growth.”

Europe likes Iran just the way it is.

• US Gets No Commitment From NATO Allies For Help On Iran Threat (AP)

NATO allies gave the U.S. no firm commitments that they will participate in a global effort to secure international waterways against threats from Iran, acting Defense Secretary Mark Esper said Thursday, wrapping up his first alliance meeting. Esper said the U.S. will come back next month and provide reluctant allies more details on exactly how the Iranian threat has escalated in recent months, and how nations can work together to deter further aggression. “At the end of the day what our ask is here, near term, is to publicly condemn Iran’s bad behavior,” Esper said as he prepared to leave Brussels. “And in the meantime, in order to avoid a military escalation, help us maintain the freedom of navigation in the Strait of Hormuz, in the Persian Gulf and wherever.”

Esper, who didn’t have high expectations for firm commitments coming in, got little of either, though he said that some allies privately expressed interest in hearing more. Esper’s visit to NATO, just days after he took over at the Pentagon, came amid sharply increased tensions between the U.S. and the Islamic Republic. The Trump administration has blamed Iran for recent attacks on oil tankers in the Gulf of Oman, as well as bombings in Iraq. Iranian forces also shot down an American drone that it said had flown into its airspace, which the U.S. disputes. Earlier this week, as he headed to NATO, Esper said his goal was to persuade allies that the confrontation with Iran is a global challenge requiring an international response, and that it is “not Iran versus the United States.”

“There are many families here who will not want to participate in mediation until they know what Boeing knew, when they knew it, what they did about it, and what they’re going to do about it..”

• Boeing Hopes To Complete 737 MAX Software Fix In September (AP)

Boeing says it expects to finish work on updated flight-control software for the 737 Max in September, a sign that the troubled jet likely won’t be flying until late this year. The latest delay in fixing the Max came a day after the disclosure that government test pilots found a new technology flaw in the plane during a test on a flight simulator. The plane has been grounded since mid-March after two crashes that killed 346 people. Preliminary accident reports pointed to software that erroneously pointed the planes’ noses down and overpowered pilots’ efforts to regain control. A Boeing official said Thursday that the company expects to submit the software update to the Federal Aviation Administration for approval “in the September timeframe.”

Once Boeing submits its changes, the FAA is expected to take several weeks to analyze them, and airlines would need additional time to take their grounded Max jets out of storage and prepare them to fly again. Airlines were already lowering expectations for a quick return of the plane, which has been grounded since mid-March. Southwest Airlines, the biggest operator of Max jets, announced Thursday that it has taken the plane out of its schedule for another month, through Oct. 1. Earlier this week, United Airlines pulled the plane from its schedule through early September.

While Boeing engineers continue working on the plane’s software, company lawyers pushed Thursday to settle lawsuits brought by the families of dozens of passengers killed in the October crash of a Lion Air Max off the coast of Indonesia and the March crash of an Ethiopian Airlines Max near Addis Ababa. Boeing and the families of Lion Air Flight 610 victims agreed to mediation that could lead to early settlements. However, the families of some Ethiopian Airlines Flight 302 passengers are resisting mediation. “There are many families here who will not want to participate in mediation until they know what Boeing knew, when they knew it, what they did about it, and what they’re going to do about it to prevent this kind of disaster from occurring again,” said Robert Clifford, a Chicago lawyer who filed lawsuits on behalf of nearly two dozen victims of the Ethiopian crash.

Concentrate.

• Large US Companies Are Getting Bigger While The Small Wither Away (MW)

FTSE Russell will rebalance its suite of indexes at the close of trade Friday, and the changes will reflect several broad trends in equity markets over the past year, including the resilience of large-capitalization companies, the dismal performance of smaller U.S. firms, and the emergence of new, highly valued technology companies that promise to, or already have, revolutionized their respective industries. “We reconstitute the Russell indexes annually to accurately reflect equity markets,” said Catherine Yoshimoto, director of product management at FTSE Russell, in an interview. “All the companies are ranked by total market capitalization and the break point between the [large cap] Russell 1000 and [small cap] Russell 2000 are reset.”

The dividing line between the large cap index and the small fell this year, from a capitalization of $3.7 billion to $3.6 billion, as a result of the poor performance of small cap companies, which shrunk in average market capitalization from $2.5 trillion to $2.4 trillion, as the small cap index fell 6.3% over the past 12 months, versus a 7.5% rise in price for larger companies. Steven DeSanctis, equity strategist at Jefferies told MarketWatch that today’s environment — with rising labor costs, material costs and new trade barriers — is especially difficult for small companies to navigate. He estimates that earnings for Russell 2000 companies fell 14.5% in the first quarter of this year on 3.4% of sales growth, while the second quarter will likely show small-cap earnings falling 11.5%, on 3.6% of revenue growth. “Small cap companies are getting squeezed at the margin,” he said. “A lot of companies have revenue growth but falling profits.”

The story gets uglier by the day.

• CIA Finances Another Group of Fraudsters: the Venezuelan ‘Opposition’ (SCF)

Once again, the Central Intelligence Agency has been caught financing a group of grifters and fraudsters at the expense of the American taxpayers. In the latest case, just another in the agency’s 72-year history, the Trump administration-appointed ad hoc board of CITGO, the US subsidiary of the state-owned Venezuelan oil company, PDVSA, stands accused of steering $70 million of escrowed funds, earmarked for PDVSA’s fiscal year 2020 bond, to the pockets of CIA-supported officials of the Venezuelan opposition “Popular Will” party headed by the so-called “interim president” of Venezuela, Juan Guaidó.

In addition to Guaidó, who is accused by the legitimate Venezuelan government of money laundering, treason, and corruption, other Popular Will leaders under investigation by both the Venezuelan Attorney General and the US Justice Department include Carlos Vecchio, Guaidó’s envoy in Washington; Rossana Barrera and Kevin Rojas, Guaidó’s emissaries in Cucuta, a Colombian-Venezuelan border town; Sergio Vargara, Barrera’s brother-in-law and a Member of the Venezuelan Congress; Guaidó’s “ambassador” to Colombia, Humberto Calderon Berti, opposition businessman Miguel Sabal; and Guaidó’s chief of staff, Roberto Marrero. Over two dozen other Popular Will leaders are also under investigation for fraud involving money earmarked by the Trump administration, particularly Iran-Contra scandal felon and current Trump special envoy for regime change in Venezuela, Elliot Abrams.

Barrera and Rojas are accused of spending money given to the Popular Will by the US Agency for International Development (USAID), a longtime CIA financial pass-through, for “humanitarian relief” for alleged massive numbers of Venezuelan refugees in Colombia. The Popular Will grifters reportedly used the aid money, including that which was raised by Virgin Group’s billionaire founder and obvious CIA dupe Richard Branson, for expensive hotels, fancy restaurants, nightclubs, prostitutes, and clothing.

Varoufakis is way ahead of his time. Elections July 7, but he’ll be lucky to get any seats at all.

• Varoufakis: My Proposals Don’t Need Negotiation With Greece’s Creditors (A.)

– Reduction of the public debt with an embedded growth clause: the higher the national income, the more creditors will receive, and the reverse. Varoufakis said that this will force lenders to become partners in the recovery of Greece.

– Ending austerity by a drastic reduction of surpluses. Varoufakis said that Syriza and ND have pledged to return to the lenders the equivalent of at least 7,000 euros per capita each year from the so-called primary state surpluses. MeRA25 will unilaterally reduce these surpluses by 60-100 pct, depending on the recovery rate, he added.

– Abolition of obligatory prepayment of 100% of taxes, and capping the VAT rate at 18% for cash purchases, 15% for using a credit card. Reduction of corporate tax: e.g. from current 29 pct, to 26 pct for large businesses, 20 pct for medium-sized ones and 15 pct for small businesses; capping profits on SMEs at 50 pct tax (currently at 75 pct).

– Public extra-bank reliant payment system allowing free digital transactions among citizens, businesses and the state, benefitting all: e.g. by mutual debt cancellation, tax deductions, funding of anti-poverty programs, reducting the hold of private banks and the European Central Bank on citizens and state alike.

– Establishment of a public management company of private debt, so that non-performing loans (NPLs) are transferred from banks to this organisation, in exchange for government guarantees not counted towards public debt. In addition, a ban on loan sales, foreclosure auctions, especially of primary residences and small businesses.

– Inclusion under the Foundation of Social Insurance (IKA) of all freelancers who work more than 8 hours a week for the same employer. Incentives towards start-up entrepreneurs with a 5-year exemption from taxes and insurance contributions.

– Conversion of the Hellenic Republic Asset Development Fund to a Development Bank, abolition of all privatizations, and use of public property as collateral to create investment flows in the public sector; the new bank’s shares will be owned by insurance funds, boosting their capitalization.

Yanis Varoufakis insisted that these measures would be implemented without negotiation with Greece’s lenders and financial institutions, and underlined that the creditors might react by bringing back GRexit scenarios. In this case, which he ruled out, “it will cost them 1 trillion euros.” “If we continue to apply Syriza’s fourth memorandum there will be no young people left in our country,” concluded Varoufakis, who also reiterated that his party will not give a vote of confidence to either Syriza or New Democracy, but will nevertheless support any bill it considers fair.

Mass suicide.

• The First Genetically Modified Animals Approved For US Consumption (AP)

Inside an Indiana aquafarming complex, thousands of salmon eggs genetically modified to grow faster than normal are hatching into tiny fish. After growing to roughly 10 pounds (4.5 kilograms) in indoor tanks, they could be served in restaurants by late next year. The salmon produced by AquaBounty are the first genetically modified animals approved for human consumption in the U.S. They represent one way companies are pushing to transform the plants and animals we eat, even as consumer advocacy groups call for greater caution. AquaBounty hasn’t sold any fish in the U.S. yet, but it says its salmon may first turn up in places like restaurants or university cafeterias, which would decide whether to tell diners that the fish are genetically modified.

“It’s their customer, not ours,” said Sylvia Wulf, AquaBounty’s CEO. To produce its fish, Aquabounty injected Atlantic salmon with DNA from other fish species that make them grow to full size in about 18 months, which could be about twice as fast as regular salmon. The company says that’s more efficient since less feed is required. The eggs were shipped to the U.S. from the company’s Canadian location last month after clearing final regulatory hurdles.

As AquaBounty worked through years of government approvals, several grocers including Kroger and Whole Foods responded to a campaign by consumer groups with a vow to not sell the fish. Already, most corn and soy in the U.S. is genetically modified to be more resistant to pests and herbicides. But as genetically modified salmon make their way to dinner plates, the pace of change to the food supply could accelerate. This month, President Donald Trump signed an executive order directing federal agencies to simplify regulations for genetically engineered plants and animals. The move comes as companies are turning to a newer gene-editing technology that makes it easier to tinker with plant and animal DNA.

Home › Forums › Debt Rattle June 28 2019