Salvador Dali Paranoiac Woman-Horse (Invisible Sleeping Woman, Lion, Horse) 1930

And nobody cares that none of it is real… Or that 3/4 of Americans live paycheck to paycheck.

• Wall Street Wraps Up Its Best June In Generations (R.)

Wall Street advanced in heavy trading on Friday, with the S&P 500 and the Dow closing the book on their best June in generations, ahead of much-anticipated trade talks between U.S. President Donald Trump and Chinese counterpart Xi Jinping at the G20 summit now underway in Japan. All three major U.S. stock indexes gained ground at the close of the week, month, quarter and first half of the year, during which time the U.S. stock market has had a remarkable run. The S&P 500 had its best June since 1955. The Dow posted its biggest June percentage gain since 1938, the waning days of the Great Depression.

From the start of 2019, after investors fled equities amid fears of a global economic slowdown, which sent stock markets tumbling in December, the benchmark S&P 500 jumped 17.3%, its largest first-half increase since 1997. “The market came to the realization that the world is not going to end,” said John Ham, financial adviser at New England Investment and Retirement Group in North Andover, Massachusetts. “Also, (Federal Reserve chair) Powell did a 180 since (the Fed’s) last (interest) rate hike, which has put wind in our sails in the first half of the year.”

Mostly it all just sounds stupid to me.

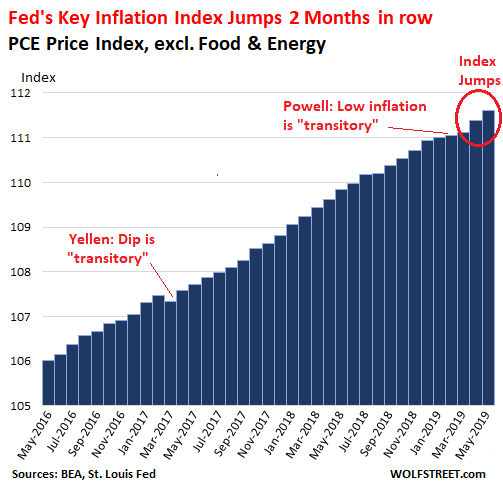

The inflation index that the Fed has anointed to be the yardstick for its inflation target – the PCE price index without the volatile food and energy components – rose 0.19% in May from April, according to the Bureau of Economic Analysis this morning. This increase in “core PCE” was near the top of the range since 2010. It followed the 0.25% jump in April, which had been the third largest increase since 2010. Fed Chair Jerome Powell, at the press conference following the no-rate-hike FOMC meeting last week, gave a clear and succinct summary of the US economy. It was mostly in good shape, he said, in particular where it mattered the most: “All of the underlying fundamentals for the consumer-spending part of the economy, which is 70% of the economy, are quite solid,” he said.

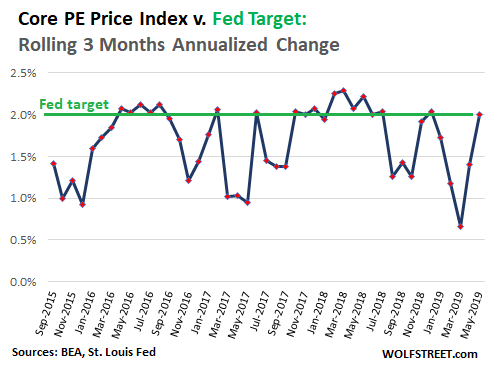

[..] The Fed’s “symmetric” target is a 2% annual increase in the core PCE index, meaning the increase can fluctuate some above or below the target without causing the Fed to act. Core PCE inflation was in the 2%-range for much of last year. But early this year, the increases softened. So in his opening remarks at the press conference, Powell said that “committee participants expressed concerns about the pace of inflation’s return to 2 percent.” [..] a trigger for a rate cut would be a “sustained” period significantly below the 2% target. Inflation data is volatile and jumps up and down. Earlier this year, when core PCE inflation fell significantly below 2%, Powell said that the factors behind this low inflation were “transitory.”

Janet Yellen, when she was still Fed Chair, also used “transitory” to describe the factors that in early and mid-2017 were causing an actual dip in core PCE – which hasn’t happened this year. And a few months later, she was proven right. After today’s data on the increase in the core PCE index, following the jump in April, the three-month increase – March, April, and May – has now hit 0.50%. Annualized, this amounts to 2.0% core PCE inflation over the past three months, in the bull’s eye of the Fed’s symmetrical target, with the last two months being substantially above the Fed’s target. But note the sharp decline in January, February, and March, and how it has now reversed:

The sooner the Fed is gone the better.

• You Are Nuts To Think A July Interest-Rate Cut Is A Slam Dunk (MW)

The markets have gotten so used to the Federal Reserve doing whatever it takes to keep the S&P 500 and bond prices rising that traders and investors are now expecting the Fed to go against its own judgment and aggressively cut interest rates next month. In putting a 100% probability on a cut in the federal funds target rate at the next Fed meeting on July 30 and 31, traders — and the economists who advise them — seem to have forgotten how language and math work. Not to mention economics. Comments by Fed Chairman Jerome Powell in the past 10 days have indicated that the Fed is open to cutting rates if necessary to keep the expansion going, but there’s no sign that policy makers have made up their minds about a July cut — or any cut at all, for that matter.

Powell said it would depend, “you know, on actual data and evolving risks.” The Fed might very well deliver the rate cut that the market is demanding, but only if something significant changes in the next four and a half weeks. The Fed won’t cut rates because it promised to do so at the last Fed meeting (it didn’t). And it won’t cut rates because the U.S. economy is teetering on the edge of recession (it isn’t), or because inflation is dropping (uh-uh), or because fragile financial markets could use a shot of confidence (nope). Before they cut rates, Fed officials would want to see some hard evidence that the outlook for the economy has materially worsened since they met on June 19. About the only thing that would qualify would be a disastrous meeting between Donald Trump and China’s Xi Jinping this weekend.

No more global player.

Wall Street may have the best June in generations, but not all of Wall Street.

• Deutsche Bank To Fire Up To 20,000: One In Six Full-Time Positions (ZH)

While Deutsche Bank finally delivered some good news for a change to its long-suffering investors, when it miraculously failed to fail the latest Fed stress test, on Friday the chronically sick bank reverted to its “cutting into muscle” baseline when the largest German lender with the €45 trillion notional derivatives was said to be preparing “to cut as much as half its global workforce in equities trading as part of a broad restructuring to boost profitability”, according to Bloomberg with the WSJ adding that the total number could be between 15,000 and 20,000 job cuts, or more than one in six full-time positions globally. The cuts being contemplated by senior executives reflect an acceleration of Deutsche Bank’s downsizing and another major pullback from its global ambitions.

If followed through, the reduction would represent 16% to 22% of Deutsche Bank’s workforce of 91,463 employees, as disclosed by the bank as of the end of March. According to the proposed plan the bank will eliminate hundreds of positions in equities trading and research, as well as derivatives trading, and is expected to start informing staff of cuts – including in the U.S. and Asia – as soon as next month. Rates trading is also affected. While the move begs the question just how effective half of the bank’s equity trading desk was, it will likely be welcomed by the market even if by slashing revenue producers the bank confirms that its trading margins have dropped to negative levels, a virtually unheard of event.

They should always talk.

• China and US Agree To Restart Trade Talks (R.)

The United States and China agreed on Saturday to restart trade talks and that Washington would hold off on imposing new tariffs on Chinese exports, signaling a pause in the trade hostilities between the world’s two largest economies. The truce offered relief from a nearly year-long dispute in which the countries have slapped tariffs on billions of dollars of each other’s imports, disrupting global supply lines, roiling markets and dragging on global economic growth. “We’re right back on track and we’ll see what happens,” U.S. President Donald Trump told reporters after an 80-minute meeting with Chinese President Xi Jinping on the sidelines of a summit of leaders of the Group of 20 (G20) major economies in Japan.

Trump said while he would not lift existing import tariffs, he would refrain from slapping new levies on an additional $300 billion worth of Chinese goods – which would have effectively extended tariffs to everything China exports to the America. “We’re holding back on tariffs and they’re going to buy farm products,” he said at a news conference. “If we make a deal, it will be a very historic event.” Trump said China would buy more farm products but did not provide specifics. In a lengthy statement on the talks, China’s foreign ministry said the United States would not add new tariffs on Chinese exports and that negotiators of both countries would discuss specific issues. Xi told Trump he hoped the United States could treat Chinese companies fairly, the statement added.

India and Iran.

• Russia-India-China Will Be The Big G20 Hit (Escobar)

It all started with the Vladimir Putin–Xi Jinping summit in Moscow on June 5. Far from a mere bilateral, this meeting upgraded the Eurasian integration process to another level. The Russian and Chinese presidents discussed everything from the progressive interconnection of the New Silk Roads with the Eurasia Economic Union, especially in and around Central Asia, to their concerted strategy for the Korean Peninsula. A particular theme stood out: They discussed how the connecting role of Persia in the Ancient Silk Road is about to be replicated by Iran in the New Silk Roads, or Belt and Road Initiative (BRI). And that is non-negotiable.

Especially after the Russia-China strategic partnership, less than a month before the Moscow summit, offered explicit support for Tehran signaling that regime change simply won’t be accepted, diplomatic sources say. Putin and Xi solidified the roadmap at the St Petersburg Economic Forum. And the Greater Eurasia interconnection continued to be woven immediately after at the Shanghai Cooperation Organization (SCO) summit in Bishkek, with two essential interlocutors: India, a fellow BRICS (Brazil, Russia, India, China, South Africa) and SCO member, and SCO observer Iran.

At the SCO summit we had Putin, Xi, Narendra Modi, Imran Khan and Iranian President Hassan Rouhani sitting at the same table. Hanging over the proceedings, like concentric Damocles swords, were the US-China trade war, sanctions on Russia, and the explosive situation in the Persian Gulf. Rouhani was forceful – and played his cards masterfully – as he described the mechanism and effects of the US economic blockade on Iran, which led Modi and leaders of the Central Asian “stans” to pay closer attention to Russia-China’s Eurasia roadmap. This occurred as Xi made clear that Chinese investments across Central Asia on myriad BRI projects will be significantly increased.

“While there, if Chairman Kim of North Korea sees this, I would meet him at the Border/DMZ just to shake his hand and say Hello(?)!”

• Trump Offers To Meet Kim Jong-Un At The DMZ (R.)

U.S. President Donald Trump said on Saturday he would like to see North Korean leader Kim Jong Un this weekend at the demilitarized zone (DMZ) between North and South Korea, and North Korea said a meeting would be “meaningful” if it happened. Trump, who is in Osaka, Japan, for a Group of 20 summit, is due to arrive in South Korea later on Saturday. He is scheduled to return to Washington on Sunday. If Trump and Kim were to meet, it would be for the third time in just over a year, and four months since their second summit, in Vietnam, broke down with no progress on U.S. efforts to press North Korea to give up its nuclear weapons.

Trump made the offer to meet Kim in a comment on Twitter about his trip to South Korea. “While there, if Chairman Kim of North Korea sees this, I would meet him at the Border/DMZ just to shake his hand and say Hello(?)!” he said. Trump later told reporters his offer to Kim was a spur-of-the-moment idea: “I just thought of it this morning.” “We’ll be there and I just put out a feeler because I don’t know where he is right now. He may not be in North Korea,” he said. “If he’s there, we’ll see each other for two minutes, that’s all we can, but that will be fine,” he added. Trump said he and Kim “get along very well”.

They still pretend it’s about software.

• Boeing 737 Max Likely Grounded Until The End Of The Year (CNBC)

Boeing’s 737 Max could stay on the ground until late this year after a new problem emerged with the plane’s in-flight control chip. This latest holdup in the plane’s troubled recertification process has to do with a chip failure that can cause uncommanded movement of a panel on the aircraft’s tail, pointing the plane’s nose downward, a Boeing official said. Subsequent emergency tests to fix the issue showed it took pilots longer than expected to solve the problem, according to The Wall Street Journal. This marks a new problem with the plane unrelated to the issues Boeing is already facing with the plane’s MCAS automated flight control system, an issue the company maintains can be remedied by a software fix.

Boeing hopes to submit all of its fixes to the Federal Aviation Administration this fall, the Boeing official said. “We’re expecting a September time frame for a full software package to fix both MCAS and this new issue,” the official said. “We believe additional items will be remedied by a software fix.” Once that software package is submitted, it will likely take at least another two months before the planes are flying again. The FAA will need time to recertify the planes. Boeing will need to reach agreement with airlines and pilots unions on how much extra training pilots will need. And the airlines will need some time to complete necessary maintenance checks.

There we go…

• Boeing 787 Dreamliner Caught In Deepening 737 MAX Probe (RT)

Federal prosecutors are expanding their Boeing probe, investigating charges the 787 Dreamliner’s manufacture was plagued with the same incompetence that dogged the doomed 737 MAX and resulted in hundreds of deaths. The US Department of Justice has requested records related to 787 Dreamliner production at Boeing’s South Carolina plant, where two sources who spoke to the Seattle Times said there have been allegations of “shoddy work.” A third source confirmed individual employees at the Charleston plant had received subpoenas earlier this month from the “same group” of prosecutors conducting the ongoing probe into the 737 MAX.

Boeing is in the hot seat over alleged poor quality workmanship and cutting corners at the South Carolina plant. Prosecutors are likely concerned with whether “broad cultural problems” pervade the entire company, including pressure to OK shoddy work in order to deliver planes on time, one source told the Seattle Times. The South Carolina plant manufactured 45 percent of Boeing’s 787s last year, but its supersize -10 model is built exclusively there. Prosecutors are on the hunt for “hallmarks of classic fraud,” the source said, such as lying or misrepresentation to customers and regulators. Whistleblowers in the Charleston factory who pointed to debris and even tools left in the engine, near wiring, and in other sensitive locations likely to cause operating issues told the New York Times they were punished by management, and managers reported they had been pushed to churn planes out faster and cover up delays.

[..] A critical fire-fighting system on the Dreamliner was discovered to be dysfunctional earlier this month, leading Boeing to issue a warning that the switch designed to extinguish engine fires had failed in “some cases.” While the FAA warned that “the potential exists for an airline fire to be uncontrollable,” they opted not to ground the 787s, instead ordering airlines to check that the switch was functional every 30 days.

Tidings from the Empire.

• EU Leaders Decide Against Weber For Commission Presidency (R.)

European Union leaders have agreed that conservative German candidate Manfred Weber will not become president of the bloc’s executive Commission, Germany’s Die Welt daily reported on Friday, citing sources familiar with the decision. The decision was reached during talks on the sidelines of the G20 summit in Osaka, Japan, Die Welt said. If confirmed, the compromise would be a blow to Chancellor Angela Merkel, who had backed Weber’s bid to replace Jean-Claude Juncker. French President Emmanuel Macron had opposed Weber’s candidacy, partly because of his lack of experience in high office.

EU leaders failed at a summit earlier this month to agree on who should hold the bloc’s top jobs after European Parliament elections last month, including on the Commission, which has broad powers on matters from trade to competition and climate policy. Weber is the leader of the European People’s Party (EPP), the conservative bloc that won most seats in the election and which includes Merkel’s Christian Democrats (CDU). A senior European diplomat told Reuters that socialist Dutchman Frans Timmermans, a deputy head at the Commission, was the front-runner to succeed Juncker. “Timmermans is the best placed,” the diplomat said.

The EU’s 28 national leaders will meet on June 30 to decide who fills the five prominent positions that would help the bloc navigate through internal and external challenges. The jobs include the presidency of the European Central Bank, which has helped the bloc’s economy return to growth after the financial crisis thanks to an extraordinary monetary stimulus programme.

“..a wayward jellyfish blown hither and yon by Progressive winds..”

Apart from the colorful homage to all things Mexican, the signal event of the night was Elizabeth Warren’s stealth political suicide when the popular question of Medicare-for-all came up and NBC’s Lester Holt asked the candidates for a show of hands as to who would abolish private health insurance altogether. Up shot Liz’s hand. Only New York’s mayor, the feckless Bill DeBlasio joined her. If the contest was a game of “Survivor” both would have thereby voted themselves off the island — except Big Bill was never really on the island, just circling around it like a wayward jellyfish blown hither and yon by Progressive winds.

The only “B” Team figure onstage who appeared to be a serious candidate was Hawaiian congressperson Tulsi Gabbard, a major in the US Army Reserve with tours-of-duty in Iraq and Kuwait — especially impressive when smacking down cretinous Ohio congressman Tim Ryan, who mistakenly asserted that the Taliban were behind 9/11. Uh, no, Tulsi informed him, it was al Qaeda (sponsored by our “friend” Saudi Arabia). I predict Tulsi will make the cut to the “A” team, despite the news media’s desperate efforts to shove her off the playing field.

Home › Forums › Debt Rattle June 29 2019