Pablo Picasso Guitar 1925

“It’s about wealth and power, not political systems or ideology.”

• The China Battle Has Just Started (Vague)

Long-term, intense economic competition between China and the United States is inevitable. It’s simply a result of China’s new economic size. It’s about wealth and power, not political systems or ideology. Forget these two countries per se. Take any country that has been an uncontested economic leader for decades, add a rapidly rising country that is becoming an economic threat, and watch the battle for markets, trade, and intellectual property unfold. The current trade negotiations could get uglier and derail. But even if they don’t, both sides will likely feel they did not get what they needed, and future rounds could get worse. There’s almost never a situation where the two leaders in a market don’t get locked in a protracted, high-stakes struggle.

[..] It’s also worth noting the history of free trade. The United States was one of the most protectionist nations in history during most of the nineteenth and early twentieth centuries, the very period in which it rose to economic supremacy, with tariffs routinely as high as 50 percent. More politicians than not backed tariffs because they protected American industry. And supporters liked tariffs because they kept wages high. In addition, in the era before the income tax, tariffs were our chief source of revenue, and Washington relished the fact that they created a government surplus (and many a congressional debate of that era was about how to spend that surplus). The subject dominated the halls of Congress.

[..] Now that the United States has woken up, my best guess is that it is not going to sit idly and let China’s encroachment continue. Trump’s approach may be poorly conceived and ham-handed, but some kind of more assertive response was overdue. China’s raison d’être is its own wealth and preeminence, and it is not likely it will permanently stand down, even if it does so strategically from time to time. In fact, in discussing this trade negotiation, Xi is now invoking China’s almost mythic tale of heroic perseverance, the Long March. Absent a China implosion—a la Japan in the late 1990s—even occasional rapprochement won’t abate the ferocity of this competition. The only question is how polite or impolite, or even bellicose, it will be.

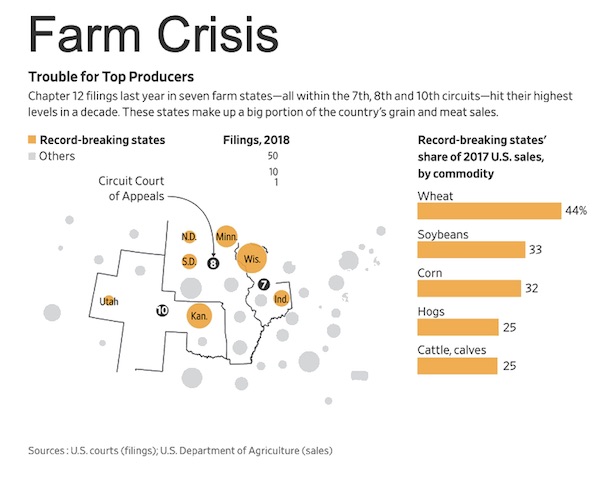

Let China grow its own food. Nothing wrong with that.

• Beijing Warns US Farmers May Lose China Market For Good (SCMP)

Farmers in the United States cannot afford to lose the Chinese market, but farmers in China will be able to withstand the impact of American tariffs, according to a top agriculture official in Beijing. Han Jun, vice-minister of agriculture and rural affairs, said China’s retaliatory tariffs on American products – the latest of which took effect on Saturday – now covered “virtually all US agricultural product exports to China”, warning that US farmers could lose the Chinese market for good. “If the US doesn’t lift all additional tariffs [levied on Chinese products], bilateral agricultural product trade between China and the US, including soybean trade, will never go back to normal,” Han told the official Xinhua news agency.

“If the US loses China’s market, it will be very difficult for the US to regain it.” Han, who is also a top policymaker as deputy head of the Office of the Central Leading Group for Rural Affairs, said the two rounds of aid offered by US President Donald Trump to American farmers would not be enough to cover their potential losses if they lost the Chinese market. But he said Chinese farmers would be able to weather the impact of American tariffs. In terms of the soybean trade, while China’s imports from the United States had plunged, it could find ways to diversify its sources, including encouraging Chinese farmers to grow more of the crop and buying more from other countries, Han said.

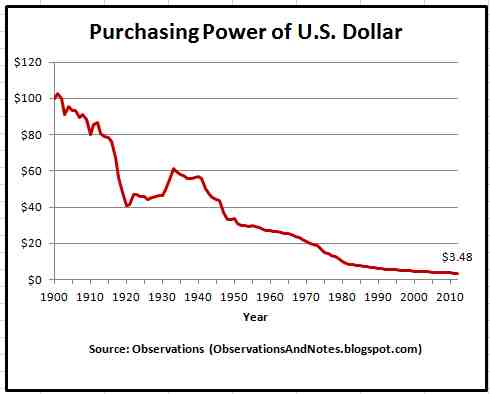

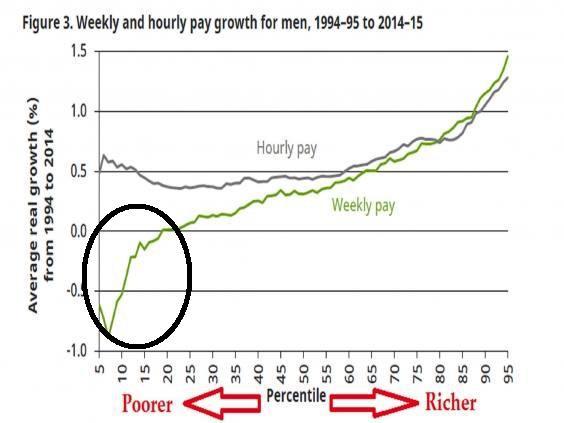

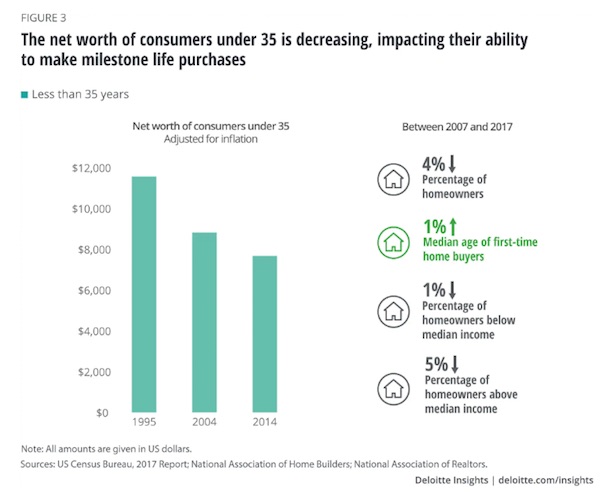

Everybody gets poorer while the Fed pours trillions into the economy.

• Millennial Net Wealth Collapses (ZH)

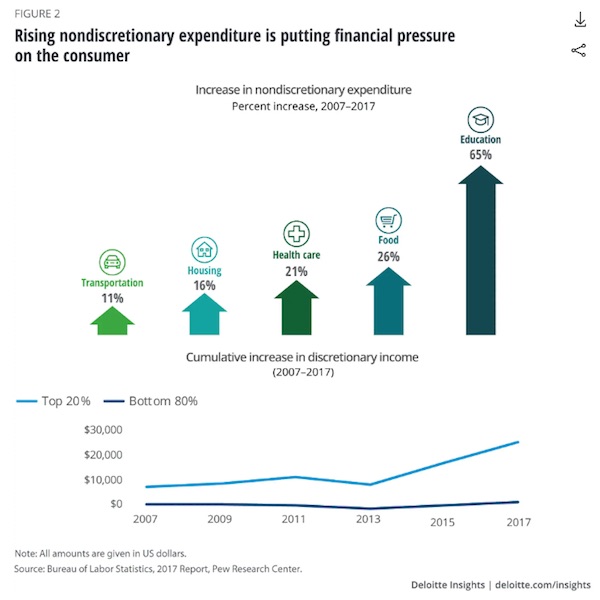

The net worth of millennials (18- to 35-year-old) has collapsed 34% since 1996, according to a new, shocking report from Deloitte. Millennials are financially worse off than any other generation before them. With student loans, auto and credit card debts, rising rents, and out of control, health-care costs have pushed their average net worth below $8,000. Deloitte told The Washington Post that their findings reveal that millennials are delaying home-buying and marriage because of massive debt loads and rising costs are making big ticketed items virtually unaffordable. “The narrative out there is that millennials are ruining everything, from breakfast cereal to weddings, but what matters to consumers today isn’t much different than it was 50 years ago,” chief retail officer Kasey Lobaugh told the Post.

“Generally speaking, there have not been dramatic changes in how consumers spend their money.” Lobaugh described the soaring wealth inequality gap as another reason why young adults have little or no net wealth. In a separate report, we highlighted in April that 60% of millennials don’t have $500 in savings. The Post said education expenses had climbed 65% in the past decade. Food prices have increased by 26%, health care costs are up 21%, housing jumped 16%, and transportation costs rose 11%. The study showed millennials had delayed the American dream of a house, family, and automobile because of their insurmountable debts. Since 2005, retail spending has increased by about 13%, to roughly $3 trillion per year, but Deloitte said much of that growth is due to population increase, not a robust consumer base.

In the past decade, the income growth of the top 10% of Americans jumped 1,305% more than the bottom 90% of Americans – which means millennials stuck in the gig-economy with multiple jobs and high debt loads will be trapped in a life of financial misery.

“..the Fed has failed to distinguish between credit driven bubbles and mania driven bubbles..”

• Aftermath: Interview with James Rickards (Whalen)

In the beginning of your book, you use the metaphor of The Odyssey to describe the choices facing the Federal Reserve Board going back to Alan Greenspan, who we knew as “Uncle Alan” in Washington years ago. You talk about how the Fed went from deflating bubbles before Greenspan, as with the “taking away the punch bowl” image, then to trying to maintain bubbles, and now overtly using monetary policy to stoke inflation and huge asset bubbles. Where does that leave us today?

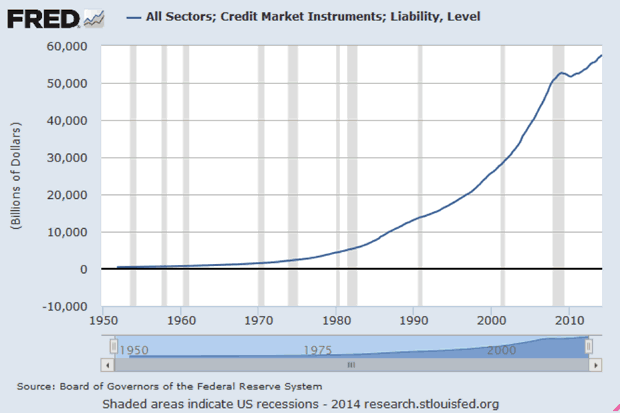

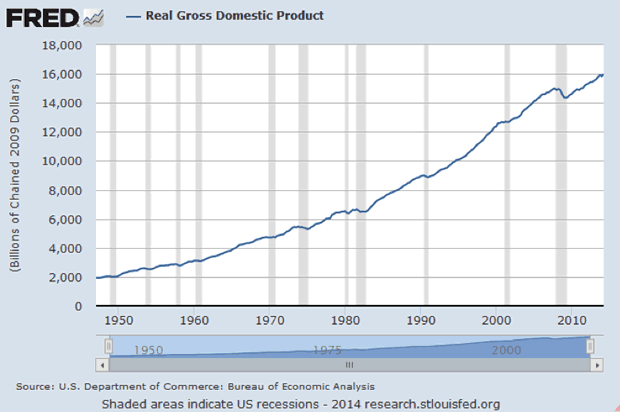

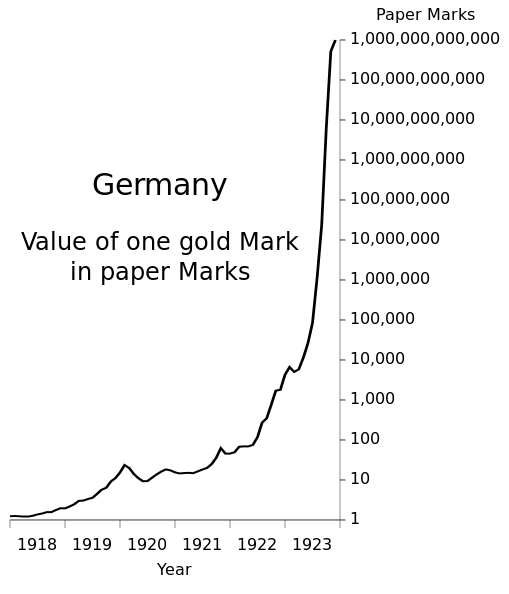

Rickards: In the book I talk about how Greenspan defeated deflation in 2005 before he left office, but, this was a Pyrrhic victory. Low rates gave rise to the housing bubble and subprime debt crisis. Since 2008, we’ve had more of the same but a more extreme version of Greenspan’s anti-deflation medicine. If Greenspan’s three-year experiment with sub 2% rates gave rise to the Global Financial Crisis, what was the world to make of the Bernanke-Yellen policy of 0% for seven years? Bernanke’s Federal Reserve also engaged in a completely unprecedented money printing binge called quantitative easing.

[..] the Fed has failed to distinguish between credit driven bubbles and mania driven bubbles. The former are dangerous because they are connected with the credit system, the latter less so because people loose money but the crisis is not systemic. The 2000 dot.com bubble was speculative, but not credit driven so it did not turn into a systemic crisis when it popped. Of course 2008 was credit driven and it did metastasize throughout the system right up to the top of the food chain with large banks and the housing GSEs failing. When you are kicking around the idea of should I or should I not pop the bubble, this is a key distinction and the threshold question for policy.

[..] It’s one thing when loose monetary policy results in private credit extremes. The Fed can reign that in. But, what happens when public credit from the Fed is the source of the problem? The Bernanke choice of stoking asset price inflation via zero rates and QE is not something that can be reversed without a great deal of pain. Once you make that trade-off between promoting inflation and future market instability, you have no way out. You’re much better off taking the pain and accepting a lower level of economic growth in the short-run rather than deferring the pain but creating far larger asset bubbles down the road. There is no way out of the Bernanke policy choice without bigger bubbles and much larger market crash that results.

Why they must be broken up.

• Google, Facebook Have Tight Grip On Growing US Online Ad Market (R.)

The U.S. internet advertising industry is projected to hit $160 billion by 2023 from $107 billion last year, led by fast-growing categories like mobile video with Alphabet Inc’s Google and Facebook Inc firmly controlling the market, consultancy PwC said on Wednesday. The two tech giants together commanded nearly 60% of the U.S. internet advertising market in 2018, according to the report, up 3% from the previous year. Google’s YouTube dominates online video, while Facebook has been expanding its video product called Watch and adding advertising options. Google and Facebook are both currently under watch by U.S. regulators for possible antitrust concerns, as well as tech giants Apple Inc and Amazon.com Inc.

U.S. wireless carrier AT&T Inc despite spending $85 billion for media company Time Warner to transform into a media and advertising firm, has only managed to eke out single digit market share, according to PwC. Gaining market share is difficult because platforms must have features that are new and specific as well as some degree of emerging technology, said C.J. Bangah, a principal at PwC. An advantage the telecommunications companies like AT&T have over Google and Facebook is they will benefit from 5G, the next generation wireless network that is expected to bring technology like autonomous cars to reality.

A discussion we will be having. Because what we have now has failed us.

MMT is not a regime that you ‘apply’ or ‘switch to’ or ‘introduce’. Rather, it is a lens which allows us to see how our fiat monetary systems already work. How you decide to use that understanding depends on the value system or ideology you apply to it. It thus makes little sense to talk of ‘MMT-type prescription’ or an ‘MMT solution’. Indeed, governments already operate according to the framework offered by MMT, regardless of what they may claim in public (and the accounting smokescreens they may employ). Citizens are constantly told that the government cannot afford to invest more in education, healthcare, infrastructure, welfare and other public services.

Yet, there is never a lack of money when it comes tax cuts for the rich, bank bailouts, military activities and other programmes that benefit our political and economic elites. As of March 2006, approximately £4.5 billion had been spent by the UK in Iraq, enough to pay for the building of around 44 new hospitals and to fund the recruitment and retention of over 10,300 new teachers for ten years. Yet, there was never any debate about how the UK would ‘fund’ the war. Unfortunately, the mainstream macroeconomic narrative continues to plague large swathes of the left, particularly in Europe. Meadway’s article is representative. It concentrates ‘on the practical and political implications [of MMT], why they are wrong–and why Labour’s own economic programme makes more sense’. In that sense, he is really talking about a conception of the application of MMT according to a certain value set, rather than MMT itself.

Pepe doesn’t convince me.

• The Great Bilderberg Secret Of 2019 (Escobar)

The great Bilderberg secret of 2019 had to do with why, suddenly, the Trump administration has decided that it wants to talk to Iran “with no preconditions”. It all has to do with the Strait of Hormuz. Blocking the Strait could cut off oil and gas from Iraq, Kuwait, Bahrain, Qatar and Iran – 20% of the world’s oil. There has been some debate on whether this could occur – whether the US Fifth Fleet, which is stationed nearby, could stop Tehran doing this and if Iran, which has anti-ship missiles on its territory along the northern border of the Persian Gulf, would go that far. An American source said a series of studies hit President Trump’s desk and caused panic in Washington.

These showed that in the case of the Strait of Hormuz being shut down, whatever the reason, Iran has the power to hammer the world financial system, by causing global trade in derivatives to be blown apart. The Bank for International Settlements said last year that the “notional amount outstanding for derivatives contracts” was $542 trillion, although the gross market value was put at just $12.7 trillion. Others suggest it is $1.2 quadrillion or more. Tehran has not voiced this “nuclear option” openly. And yet General Qasem Soleimani, head of the Iranian Revolutionary Guards Corps’ Quds Force and a Pentagon bête noire, evoked it in internal Iranian discussions. The information was duly circulated to France, Britain and Germany, the EU-3 members of the Iran nuclear deal (or Joint Comprehensive Plan of Action), also causing a panic.

Oil derivative specialists know well that if the flow of energy in the Gulf is blocked it could lead to the price of oil reaching $200 a barrel, or much higher over an extended period. Crashing the derivatives market would create an unprecedented global depression. Trump’s former Goldman Sachs Treasury Secretary Steve Mnuchin should know as much. And Trump himself seems to have given the game away. He’s now on the record essentially saying that Iran has no strategic value to the US. According to the American source: “He really wants a face-saving way to get out of the problem his advisers Bolton and Pompeo got him into. Washington now needs a face-saving way out. Iran is not asking for meetings. The US is.”

Quicksand. The entire country.

• Welsh Government Officially Switches To Campaign For Remain (TNE)

Brexit minister Jeremy Miles said that efforts towards an acceptable Brexit had reached “the end of the road”. He said any Brexit deal must now be subject to a public vote, with remaining in the EU on the ballot paper. The Labour-led government, along with Plaid Cymru, had previously followed a 2017 policy outlined in the White Paper ‘Securing Wales’ Future’, that aimed to find “the least damaging kind of Brexit”, as Miles put it. But the government in Westminster have made this impossible, he said. “We as a government must recognise these realities and change course,” said Miles. “Parliament should now show the courage to admit it is deadlocked.” Although Wales voted to leave by 52%, public opinion has shifted towards Remain, said Miles.

Strongarming?!

• Fitch Downgrades Mexico And Moody’s Lowers Outlook (R.)

In a double blow for Mexico, credit ratings agency Fitch downgraded the nation’s sovereign debt rating on Wednesday, citing risks posed by heavily indebted oil company Pemex and trade tensions, while Moody’s lowered its outlook to negative. The Mexican peso weakened as much as 1.3% on the news. Cutting Mexico’s rating to BBB, nearing junk status, Fitch said the financial woes of state oil company Pemex were taking a toll on the nation’s prospects. Fitch said mounting trade tensions influenced its view, according to a statement issued shortly after the end of a meeting in the White House in which Mexican officials tried to stave off tariffs U.S. President Donald Trump has vowed to impose next week.

Following a surge in mostly Central American migrants arriving at the U.S. border, Trump threatened blanket tariffs on Mexican imports if it did not do more to stem the flow. “Growth continues to underperform, and downside risks are magnified by threats by U.S. President Trump,” Fitch said. Mexican President Andres Manuel Lopez Obrador took office in December with ambitious plans to build a $8 billion refinery, a decision ratings agencies and investors warned would divert funds from its more profitable production and exploration business. Lopez Obrador has said the ratings agencies were punishing Mexico for the “neo-liberal” policies of previous administrations. A Reuters analysis of Pemex accounts from the past decade shows debt increased by 75% during the term of Lopez Obrador’s predecessor, Enrique Pena Nieto, amid a landmark energy reform.

The same governments that talk about going green own carmakers.

• Fiat Chrysler Withdraws Merger Offer For Renault, Blames French Politics (R.)

Fiat Chrysler said it has abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world’s third-biggest automaker. A source close to the French carmaker’s board said Fiat Chrysler made the move after France sought to delay a decision on the deal in order to win the support of Nissan Motor Co, Renault’s Japanese alliance partner. French government officials had pushed for Nissan to support the merger. Nissan had said it would abstain. The French government, which owns a 15% stake in Renault, had also pushed Fiat Chrysler for guarantees that France would not lose jobs, and for a dividend to be paid to Renault shareholders, including the government, people familiar with the talks said.

Fiat Chrysler’s original proposal offered no special dividend to Renault shareholders. “It has become clear that the political conditions in France do not currently exist for such a combination to proceed successfully,” Fiat Chrysler said in a statement issued early Thursday from London. Renault, in a separate statement, said its board was “unable to take a decision due to the request expressed by the representatives of the French state to postpone the vote to a later meeting.”

Russia lost an entire generation of young men.

• Lavrov Says D-Day Memorials Are Part Of A ‘False’ History Of WWII (BI)

Ahead of the 75th anniversary of the D-Day invasion of France, Russia’s foreign minister has written an article arguing that the commemorations of the event are part of a “false” history that belittles the contributions of the Soviet Union toward defeating Nazi Germany. Sergey Lavrov chastised Western powers in an article published in Russia’s International Affairs magazine on Tuesday, ahead of events in Europe to mark the D-Day landings on the Nazi-occupied Normandy coast. “False interpretations of history are being introduced into the Western education system with mystifications and pseudo-historical theories designed to belittle the feat of our ancestors,” Lavrov wrote.

“Young people are being told that the main credit in victory over Nazism and liberation of Europe goes not to the Soviet troops, but to the West due to the landing in Normandy, which took place less than a year before Nazism was defeated.” He added: “It was the peoples of the Soviet Union who broke the backbone of the Third Reich. That is a fact.” [..] Historians agree that the Soviets sustained the heaviest losses of all powers involved in World War II, placing the death toll for the Red Army at between 9 million and 11 million troops, part of an estimated 26 million Soviet citizens who died. Lavrov also wrote Russia had been falsely labeled as an aggressor in World War II. “Our detractors seek to diminish the role of the Soviet Union in World War II and portray it if not as the main culprit of the war, then at least as an aggressor, along with Nazi Germany,” he wrote.

Quite the claim: “There was a wish to wait for the maximum weakening of Germany’s military power from its enormous losses in the east, while reducing losses in the west..”

• Russia to West: D-Day Wasn’t Decisive In Ending World War Two (R.)

Russia told the West on Wednesday the Normandy landings on D-Day in 1944 did not play a decisive role in ending World War Two and that the Allied war effort should not be exaggerated. Moscow’s comments might irk war veterans in Britain where the 75th anniversary on Wednesday of the largest seaborne invasion in history was marked at a ceremony in Portsmouth attended by Queen Elizabeth and world leaders including Donald Trump and Angela Merkel. Speaking at a weekly news conference in Moscow, Foreign Ministry spokeswoman Maria Zakharova offered a tribute to those who died on the western front of World War Two and said Moscow appreciated the Allied war effort.

“It should of course not be exaggerated. And especially not at the same time as diminishing the Soviet Union’s titanic efforts, without which this victory simply would not have happened,” she said. The Soviet Union lost over 25 million lives in what it calls the Great Patriotic War, and Moscow under President Vladimir Putin has taken to marking victory in the war with a massive annual military parade on Red Square. “As historians note, the Normandy landing did not have a decisive impact on the outcome of World War Two and the Great Patriotic War. It had already been pre-determined as a result of the Red Army’s victories, mainly at Stalingrad (in late 1942) and Kursk (in mid-1943),” Zakharova told reporters.

More than 150,000 allied troops launched an air, sea and land attack on Normandy on June 6, 1944 that ultimately led to the liberation of western Europe from Nazi Germany. Moscow, which had been fighting German forces in the east for almost three years by the time of D-Day, and gradually pushing them back from early 1943, had been urging Britain’s Winston Churchill to open a second front as far back as August 1942. “There was a wish to wait for the maximum weakening of Germany’s military power from its enormous losses in the east, while reducing losses in the west,” she said.

And we just keep making the stuff. And keep proclaiming we love our children.

• People Eat At Least 50,000 Plastic Particles A Year (G.)

The average person eats at least 50,000 particles of microplastic a year and breathes in a similar quantity, according to the first study to estimate human ingestion of plastic pollution. The true number is likely to be many times higher, as only a small number of foods and drinks have been analysed for plastic contamination. The scientists reported that drinking a lot of bottled water drastically increased the particles consumed. The health impacts of ingesting microplastic are unknown, but they could release toxic substances. Some pieces are small enough to penetrate human tissues, where they could trigger immune reactions.

Microplastic pollution is mostly created by the disintegration of plastic litter and appears to be ubiquitous across the planet. Researchers find microplastics everywhere they look; in the air, soil, rivers and the deepest oceans around the world. [..] Most food and drink types have not been tested, however, meaning the study only assessed 15% of calorie intake. “We don’t know a huge amount. There are some major data gaps that need to get filled,” said Kieran Cox, at the University of Victoria in Canada, who led the research.

Other foods, such as bread, processed products, meat, dairy and vegetables, may well contain just as much plastic, he said. “It is really highly likely there is going to be large amounts of plastic particles in these. You could be heading into the hundreds of thousands.” Some of the best available data is on water, with bottled water containing 22 times more microplastic than tap water on average. A person who only drank bottled water would consume 130,000 particles per year from that source alone, the researchers said, compared with 4,000 from tap water.