Salvador Dali Hallucination. Six Images of Lenin on a Grand Piano 1931

Trump WEF

NOW – Trump Sticks it to WEF Globalists, Touts His America-First Agenda to the World Economic Forum in Davos |

America is back.

President Trump just stood before an entire conference of globalists at the World Economic Forum's annual meeting in Davos, Switzerland, and made it… pic.twitter.com/aLiw1W8pmi

— Overton (@overton_news) January 23, 2025

TRUMP: We're Asking Saudi Arabia And OPEC To Lower Oil Prices To Help End Ukraine War

"Saudi Arabia will be investing at least $600 billion in America. But I'll be asking the Crown Prince, who's a fantastic guy, to round it out to $1 trillion."

"I'm also going to ask Saudi… pic.twitter.com/S3bWB7JMT9

— KanekoaTheGreat (@KanekoaTheGreat) January 23, 2025

J6

https://twitter.com/i/status/1882144316145226065

Listen to this father speak out about what was done to his son who was a J6 prisoner. pic.twitter.com/2vAxVaoRX9

— Insurrection Barbie (@DefiyantlyFree) January 23, 2025

Chamath

Chamath Palihapitiya: While Silicon Valley created AirPods and Instagram Reels, Elon created reusable rockets and electric cars.

“I think it's fair to say that we have had a lost decade in Silicon Valley.

And when you look underneath why, what are the two most or three most or… pic.twitter.com/K4AwxWYbCX

— ELON CLIPS (@ElonClipsX) January 24, 2025

The best

A Message to the Unvaccinated .. pic.twitter.com/mwNGVtXMnC

— “Sudden And Unexpected” (@toobaffled) January 22, 2025

OMG

‘THE DEEP STATE IS REAL:’ White House Advisor Reveals How Bureaucracy Protects “Its Own Interests,” Predicts Bureaucracy Will ‘Crush’ RFK Jr. as HHS Secretary; "If I Was Given an Order… I Would Either Try to Block It or Resign”

“RFK Jr. is a very bad pick for HHS… it’s… pic.twitter.com/eYt7s935EJ

— O’Keefe Media Group (@OKeefeMedia) January 23, 2025

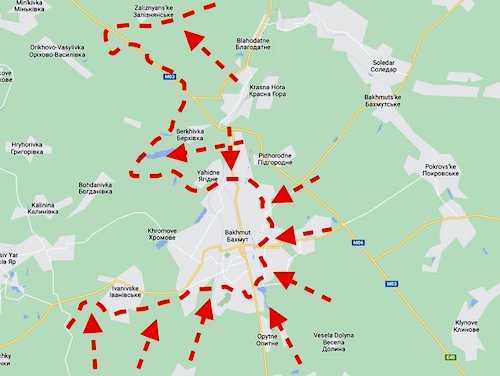

Putin says Zelensky is not a legitimate representative of Ukraine. No deals can be made with him. Has anyone told Trump?

• I Would Meet With Putin Immediately – Trump (RT)

US President Donald Trump has said he is ready to meet with Russian President Vladimir Putin as quickly as possible to negotiate an end to the Ukraine conflict. Trump, who took office on Monday, has repeatedly pledged to quickly negotiate a settlement between Russia and Ukraine. “From what I hear, Putin would like to see me, and we’ll leave as soon as we can. I’d meet immediately,” Trump told reporters at the White House on Thursday. “Every day we don’t meet, soldiers are being killed on the battlefield.” The Kremlin previously said it was open to such talks. Speaking to reporters earlier this week, Putin’s spokesman, Dmitry Peskov, denied that a Putin-Trump phone call was in the works. Trump has reportedly given his Ukraine envoy, Keith Kellogg, 100 days to hammer out a settlement between Moscow and Kiev.

On Wednesday, the US president threatened to impose new sanctions on Russia if Putin refuses to accept an unspecified “deal” to end the conflict. “Such dialogue between the two presidents had occurred during Trump’s first term,” Peskov said, adding that the Kremlin “has not received [such] signals so far.” Russia has insisted that Ukraine must abandon its plan to join the US-led NATO alliance in favor of becoming a neutral country. Putin has also demanded that Kiev renounce its claims to Crimea and four other regions that have voted to leave Ukraine and become part of Russia. Speaking to Bloomberg on Wednesday, Ukrainian leader Vladimir Zelensky argued that communication with Kiev should be “a priority” for the Trump administration. He added that he was open to negotiations if Trump could provide tangible “security guarantees” to Ukraine.

“..at least he is willing to give peace a chance with Russia over Ukraine. That alone makes Trump a welcome change from the vile warmongering of Biden and his would-be successor Kamala Harris.”

• Trump Knows Ukraine Conflict Means Nuclear WWIII, Gives Peace A Chance (SCF)

The chances of a peace deal in Ukraine are suddenly a lot higher under President Donald Trump only because he has a realistic sense of a nuclear Third World War happening between the United States and Russia if that conflict is not ended promptly. Peter Kuznick, an esteemed American professor of history, says that the Biden administration brought the world closer to a nuclear conflagration than at any time since the Cuban Missile Crisis in 1962. Biden did this by relentlessly arming Ukraine with weapons to strike deeper and deeper into Russia instead of trying to find a peaceful resolution to the conflict. Indeed, there was no diplomatic effort from Washington under Biden. It was ideologically and propaganda-driven for confrontation, as was the Democratic presidential candidate, Kamala Harris.

Kuznick points out that Trump is no John F Kennedy in terms of the latter’s depth of historical and philosophical knowledge. But in comparison with Joe Biden, Trump has shown more humanity and common sense by not insulting Putin and in reaching out for a peaceful end to the slaughter in Ukraine. Biden called Putin a thug and said he would back Ukraine as long as it takes to defeat Russia. The last Democrat administration spent $175 billion of U.S. taxpayers’ money propping up a NeoNazi regime in Kiev that has lost over one million military casualties since the war erupted in February 2022. By contrast, newly inaugurated President Trump says that he wants to meet Russian leader Vladimir Putin as a priority to find a peaceful way out of the conflict and to avoid a catastrophic escalation between nuclear powers.

Putin has welcomed a meeting with the new president and said he appreciates the urgent concern to avoid a nuclear disaster. Kuznick is author of The Untold History of the United States, which was coauthored with acclaimed film director Oliver Stone. The book was turned into an award-winning television series aired on Showtime, Netflix and other channels. Kuznick deplores the way the U.S. and NATO partners undermined international security by expanding on Russia’s borders despite earlier promises to the Soviet leaders that would not happen. If peace is to be found in Ukraine, it must be based on a bigger picture of lasting global security that considers all nations’ concerns. That means the United States must treat Russia’s national security concerns over NATO’s expansion seriously and respectfully.

Can the Trump administration deliver? It is packed with hawkish figures like Secretary of State Marco Rubio. Donald Trump is better placed than the Biden adminstration to cut a deal with Russia for peace in Ukraine and thereby avoid nuclear disaster, says Kuznick. Trump’s cabinet is filled with billionaires and his mercurial, superficial understanding of the world can be deprecated. Maybe his peaceful aspirations are muddled and not feasible given that Trump is surrounded by hawkish figures. But at least he is willing to give peace a chance with Russia over Ukraine. That alone makes Trump a welcome change from the vile warmongering of Biden and his would-be successor Kamala Harris.

“According to Putin, the move violated the Ukrainian constitution, leaving parliament as the sole legitimate authority in the country.”

• Zelensky Says He Could Speak With Putin (RT)

Ukrainian leader Vladimir Zelensky has said he could engage in direct peace talks with Russian President Vladimir Putin if US President Donald Trump provides Kiev with enough security guarantees, Bloomberg reported on Thursday. Zelensky signed a decree banning himself from any negotiations with Putin in the fall of 2022 after the Donetsk and Lugansk People’s Republics, along with the Kherson and Zaporozhye Regions, officially became part of Russia as a result of referendums. Ukrainian Foreign Minister Andrey Sibiga said earlier this month that the legislation remains in force. However, in an interview with Bloomberg on Wednesday in Davos, Zelensky appeared to have changed his stance on the issue. According to the agency, the Ukrainian leader now says he wants to secure a commitment from Trump to support and secure Ukraine before engaging with Putin.

“The only question is what security guarantees and honestly I want to have understanding before the talks. If he can guarantee this strong and irreversible security for Ukraine, we will move along this diplomatic path,” he said. Last year, Putin said he would only be able to negotiate with Zelensky if he were to hold an election and win it, to restore his legitimacy. Zelensky remains in power in Ukraine despite his term having officially expired in May last year. The Ukrainian leader canceled the presidential vote, citing martial law that he imposed due to the conflict with Russia. According to Putin, the move violated the Ukrainian constitution, leaving parliament as the sole legitimate authority in the country.

On Tuesday, US President Trump said he is ready to meet with Putin “anytime” to discuss a diplomatic settlement to the conflict between Moscow and Kiev. “We are talking to Zelensky. We are going to be talking with President Putin very soon and we will see how it all happens,” he said. Earlier this week, the Russian leader commended Trump’s intention to resume contacts between Moscow and Washington, which had been halted by the Biden administration. However, he stressed that dialogue can only happen on an “equal and mutually respectful basis.” Putin said Moscow noted the US president’s apparent willingness to restore communication and “do everything to prevent World War Three.”

“Putin shouldn’t have done it,” Trump, who took office on Monday, told Hannity. “He shouldn’t have done it and it has to stop.”

• Zelensky Is ‘No Angel’ – Trump (RT)

Ukrainian leader Vladimir Zelensky bears some responsibility for the armed conflict with Russia, US President Donald Trump has said. He argued that Zelensky, who has been granted a glowing reception in many Western capitals, should have done whatever necessary to avoid hostilities. During an interview with Fox News’ Sean Hannity that aired on Wednesday and Thursday, Trump reiterated the need to find a diplomatic solution to the conflict, set to enter its fourth year next month. “Zelensky – I got to say this – he wants to settle now. He’s had enough. He shouldn’t have allowed this to happen either,” Trump said. “You know, he’s no angel. He shouldn’t have allowed this war to happen,” he added. “First of all, he’s fighting a much bigger entity,” Trump stressed. He previously questioned the unconditional military and financial aid provided to Kiev by his predecessor, former President Joe Biden.

Trump also described Zelensky in the past as “the greatest salesman on Earth.” In the same interview, Trump criticized Russian President Vladimir Putin and threatened to impose more sanctions on Moscow “if they don’t make a settlement fast.” “Putin shouldn’t have done it,” Trump, who took office on Monday, told Hannity. “He shouldn’t have done it and it has to stop.” The president has repeatedly claimed that he would quickly negotiate a fair deal between Russia and Ukraine, but provided no specifics about possible terms. Both Moscow and Kiev have previously said that freezing the conflict along the current front line would be unacceptable. Putin has insisted that Kiev must abandon plans to join the US-led NATO military alliance, and renounce claims on Crimea and four other former Ukrainian regions that voted to join Russia in 2022.

Earlier this month, Trump’s Ukraine envoy, Keith Kellogg, said he hopes to resolve the conflict within 100 days. Trump has criticized Biden for neglecting diplomacy and said on several occasions that he was open to having a conversation with Putin. So far no date for negotiations has been announced. Kremlin spokesman Dmitry Peskov denied earlier this week that a phone call between the leaders was being arranged.

“We can get our country back,” he said. “But if we didn’t win this race, I really believe our country would have been lost forever.”

• Trump Gives First Oval Office Interview (JTN)

President Donald Trump gave his first Oval Office interview on Wednesday addressing a wide range of problems facing the United States, but assuring the nation that they are “all solvable.” “They’re all solvable problems … with time, effort, money — unfortunately — but they’re all solvable,” President Trump said in the interview with Fox News host Sean Hannity. He also reiterated his belief that this election was the most consequential in history. “We can get our country back,” he said. “But if we didn’t win this race, I really believe our country would have been lost forever.” Since taking office on Monday, President Trump signed a mountain of executive orders addressing the core issues from his campaign, including immigration, reversing Biden green energy policy, and delaying a ban on the popular social media app TikTok.

https://twitter.com/i/status/1882297253622386926

In the interview, Trump specifically dismissed criticism of his policy towards the popular social media app TikTok, which he promised to save from legislation passed by Congress which required the app to separate from its Chinese owner or be banned from the United States. Shortly after his inauguration, Trump issued an executive order to extend the deadline for the app’s parent company ByteDance to divest of the platform or face a ban. Security and privacy concerns about the app have simmered in Washington for years, spurred by the China-based parent company ByteDance’s close relationship with the Chinese Communist Party. “But you can say that about everything made in China. Look, we have our telephones made in China, for the most part. We have so many things made in China. So why don’t they mention that?” Trump asked.

“You know, the interesting thing with TikTok, is you’re dealing with a lot of young people, so they love–Is it that important for China to be spying on young people, on young kids watching crazy videos?” Trump also told Hannity that he truly believes he was saved by God from the would-be assassin’s bullet on the campaign trail last year, echoing his inaugural speech where he said he was “saved by God to make America great again.” “I turned…if I didn’t turn you know when the turn was like split second, perfect timing. So something happened, and I don’t think you can call it just luck,” Trump said, confirming that the incident increased his faith in God. Trump also said he is currently reviewing the John F. Kennedy assassination files and plans to release them.

“We are in there for $200 billion more than the EU. I mean, what are we, stupid? I guess the answer is ‘yes.’ They must think so..”

• Trump To Pull 20,000 US Troops From Europe – Sources (RT)

US President Donald Trump is considering reducing his country’s military contingent in Europe by 20% as he reviews Washington’s commitment to the continent, Italian news agency ANSA has reported, citing EU diplomatic sources. If the pullout occurs, the number of US service personnel in Europe will decrease from around 100,000 to 80,000, the agency reported on Wednesday. In recent conversations with European leaders Trump has “consistently” expressed a desire to downsize the US military presence on the continent, the sources said. “Furthermore, for those [US troops] who remain, he would like financial contributions from European countries, because these soldiers are a deterrent, and the costs cannot be borne solely by American taxpayers,” one of ANSA’s sources claimed.

Earlier this month, Trump said NATO member states in the EU should be spending 5% of their GDP on defense, way beyond the current goal of 2%. “They can afford it,” he claimed. On Tuesday, the US president called on Brussels to “equalize” with Washington when it comes to the support it provides to Ukraine. “We are in there for $200 billion more than the EU. I mean, what are we, stupid? I guess the answer is ‘yes.’ They must think so,” he said. Trump also pledged to impose tariffs on the bloc due to its trade surplus with the US. “The EU is very bad for us,” he claimed. During a joint press conference with German Chancellor Olaf Scholz on Wednesday, French President Emmanuel Macron noted: “now that the new administration has taken office in the US, it is more important than ever for Europeans… to play their full part in consolidating a united, strong, and sovereign Europe.”

https://twitter.com/i/status/1881478190130147743

This time, let’s see it all.

• Trump Orders Plan for Release of JFK, RFK, MLK Assassination Records (ET)

President Donald Trump on Thursday ordered plans to be drafted for the release of records related to the assassinations of President John F. Kennedy (JFK), Attorney General Robert F. Kennedy (RFK), and the Rev. Martin Luther King Jr. The president signed an executive order on Jan. 23 directing the director of national intelligence and the attorney general to prepare a plan in 15 days for the “full and complete release” of the JFK assassination files. The deadline for the plans for the RFK and King files is 45 days “That’s a big one,” Trump said while signing the order in the Oval Office. “A lot of people have been waiting for this for years, for decades. And everything will be revealed.” Trump promised at his pre-inauguration rally in Washington on Jan. 19 that he would release the remaining records on the assassinations of JFK, RFK, and King in the coming days.

The FBI accused Lee Harvey Oswald, a former U.S. Marine who had defected to the Soviet Union for a period after embracing Marxism, of assassinating JFK in 1963. Nightclub owner Jack Ruby shot and killed Oswald as authorities were moving him from the Dallas police headquarters to the county jail just two days after the assassination, stirring decades of speculation and conspiracy theories. JFK’s assassination coincided with a period of increasing mistrust in the federal government, and many Americans still believe that Oswald was part of a larger plot to kill the president. Gallup’s most recent poll on the subject, conducted in October 2023, found that 65 percent of U.S. adults reject the theory that a lone gunman killed JFK. Trump and former President Joe Biden previously released thousands of documents related to JFK’s killing. Roughly 99 percent of the assassination files had been released as of 2023, according to the National Archives.

However, Biden had agreed to delay the disclosure of additional records because of the necessity of protecting “against identifiable harms to the military defense, intelligence operations, law enforcement, and the conduct of foreign relations that are of such gravity that they outweigh the public interest in disclosure.” JFK’s nephew, Robert F. Kennedy Jr. (RFK Jr.), whom Trump has nominated to lead the U.S. Department of Health and Human Services, launched a petition in 2023 on the 60th anniversary of the assassination demanding that the Biden administration release all remaining government records on his uncle’s murder. RFK Jr. was just 9 years old when his uncle was assassinated in 1963, and he was 14 when his father was assassinated during the 1968 Democratic presidential primaries.

“The 1992 Kennedy Records Assassination Act mandated the release of all records related to the JFK assassination by 2017. Trump refused to do it. Biden refused to do it. What is so embarrassing that they’re afraid to show the American public 60 years later?” RFK Jr. wrote in a statement on his website in 2023. “Trust in government is at an all-time low. Releasing the full, unredacted historical records will help to restore that trust.” Biden had moved to redact some of the last remaining JFK assassination files, but Trump’s order states that this action is “not consistent with the public interest and the release of these records is long overdue.” “Their families and the American people deserve transparency and truth. It is in the national interest to finally release all records related to these assassinations without delay,” the order reads.

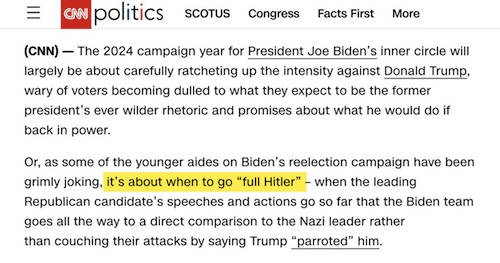

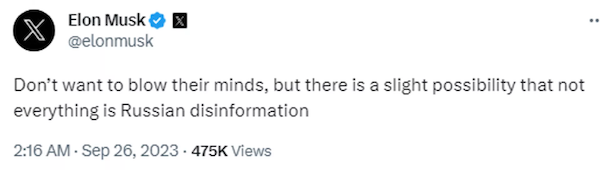

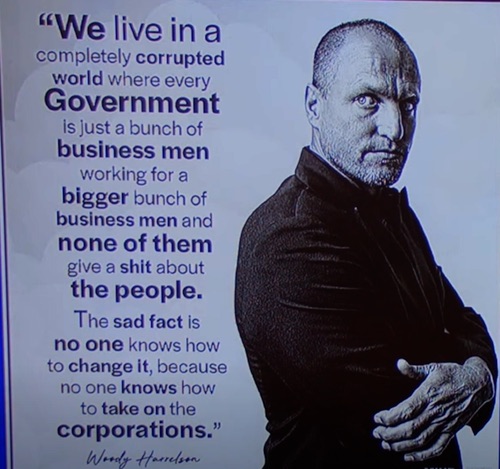

“So Trump is a Nazi. Musk is a Nazi. Half the country are Nazis. The problem is that, if you say everyone is a Nazi, then no one is a Nazi..”

“AOC is a certified Nazi hunter, a license that seems only to be available to figures on the left.”

• Nazispolozza: The Left’s Third Reich Mania Collapses into Comedy (Turley)

One of the least successful efforts of the left and many in the media this election was to paint Republican voters as “Nazis” hellbent on destroying democracy. While once verboten as a political comparison, liberal politicians and pundits have developed something of a Nazi fetish, where every statement and gesture is declared a return of the Third Reich. It seems like each news event presents a Rorschach test where every inkblot looks like a Nazi. That mania reached absurd, even comedic, levels with the attack on Elon Musk over an awkward gesture during the inauguration celebration. An exuberant Musk told the crowd, “My heart goes out to you. It is thanks to you that the future of civilization is assured.” As he gave those words, he placed his right hand on his chest and stretched his arm outward, his palm facing the floor. He then repeated the gesture before putting his hand on his chest again.

It was all done in a matter of seconds, but it was enough for the usual mob to erupt in faux outrage. Pundits insisted that Musk had chosen the moment to come out as a Nazi on national television. The Washington Post breathlessly reported this week how the “Nazi-style salute” had “invigorated fans on the far right.” The usual liberal professors were rolled out to offer a patina of authority to the ridiculous claim. Ruth Ben-Ghiat, a professor of history at New York University, declared, “Historian of fascism here. It was a Nazi salute and a very belligerent one too.” Mike Stuchbery went on X (the company owned by the man he now suggests is a Nazi reenactor) to declare, “I studied the Nazis at university, taught the history of Nazi Germany on two continents and wrote for major newspapers about Nazi Germany. I am internet famous for fact-checking chuds [gross people] on the history, ideology and policy of Nazi Germany. That was a Nazi salute.”

Well, that settles it. As the outrage continued, any doubt or dissent was denounced as evidence that you are obviously a Nazi as well. That became a bit embarrassing when the leading Jewish organization, the Anti-Defamation League, stated the obvious: This was not a Nazi salute but rather an “awkward gesture.” The core principle of liberal mob tactics is that there can be no divergence, even by a group like the ADL. The way to deal with opposing ideas or writings is by making someone persona non grata. If you do not cancel others, you will be canceled. So the ADL was effectively declared soft on Nazis by Rep. Alexandria Ocasio-Cortez (D-NY): “Just to be clear, you are defending a Heil Hitler salute that was performed and repeated for emphasis and clarity. People can officially stop listening to you as any sort of reputable source of information now. You work for them. Thank you for making that crystal clear to all.”

We’ve reached a level of absurdity where Jewish advocates are treated like they are virtual Nazi sympathizers. This is not the first time the Democrats have labeled Trump and his supporters “Nazis.” It started years ago as Democrats repeated analogies of Trump to Hitler and his followers to brownshirted neo-Nazis. Defeating Trump has been compared to stopping Hitler in 1933, and media personalities like Rachel Maddow went on the air with a hysterical claim that “death squads” were authorized by the Supreme Court. When Trump held a massive rally in New York’s Madison Square Garden before the election, the media were apoplectic and immediately declared it … you guessed it … akin to a Nazi rally. From the Washington Post to the New York Times, the media formed an affinity group meeting to fret over “echoes of 1939.” In case anyone missed the message, Democratic vice presidential candidate Tim Walz emphasized “a direct parallel” with the Nazis.

Over at the Nation, David Zirin treated Madison Square Garden (known for everything from cage fights to dog shows) as an almost Vatican-like space: “With his fascist New York City rally, Donald Trump has befouled what many believe to be a sacred space: Madison Square Garden.” So Trump is a Nazi. Musk is a Nazi. Half the country are Nazis. The problem is that, if you say everyone is a Nazi, then no one is a Nazi. It loses its meaning. That includes Ocasio-Cortez, who appears to have joined the ranks of the Reich after critics posted her making a Musk-like gesture during a speech. There was no torrent of media fretting about how the gesture reflected the extremism of AOC’s questioning need for a Supreme Court, seeking to bar Trump and dozens of Republicans from ballots, or supporting censorship. AOC is a certified Nazi hunter, a license that seems only to be available to figures on the left.

Of course, labeling political opponents as diabolically evil fanatics and seeking to bar candidates from ballots sounds a lot like … well … it sounds familiar. There is an alternative. We can put the rage rhetoric aside and have honest debates over differences on politics and laws. In other words, we can fight over policy … and leave the Nazis out of it.

“..his critics, who should find better ways to attack their opponents than calling “everyone Hitler.”

• US News Channel Fires Presenter After She Calls Musk A Nazi (RT)

A Milwaukee-based CBS affiliate has dismissed one of its weather presenters after she reportedly called Elon Musk a Nazi on social media, over a gesture the tech billionaire made during an inauguration rally for US President Donald Trump. Musk has been forced to deny making a Nazi salute, dismissing the allegation as a “dirty trick” by his critics, who should find better ways to attack their opponents than calling “everyone Hitler.” WDJT-TV (Channel 58), where meteorologist Sam Kuffel had worked since 2019, has confirmed her departure but provided no official explanation in an internal memo to or public comments, according to the Milwaukee Journal Sentinel. While the station described the matter as a “personal issue,” Kuffel was reportedly dismissed one day after commenting on Musk’s gesture on her Instagram account.

The TV channel has removed Kuffel’s bio from its website and no longer mentions her in its weather section, but retains articles written by her. Her Instagram account has been set to private, but screenshots purportedly capturing her posts are available online. She has not commented publicly on the incident. Before her tenure at WDJT-TV, the journalist worked at WAOW-TV (Channel 9) in Wausau, after graduating from the University of Wisconsin-Milwaukee with a degree in atmospheric science. The Anti-Defamation League, a US-based pro-Israeli group which monitors anti-Semitism and hate speech, has described Musk’s gesture as “awkward” but did not say it was a Nazi salute. Similarly, Israeli Prime Minister Benjamin Netanyahu, who is the subject of an International Criminal Court warrant on charges related to genocide, has tweeted in support of the X owner, declaring him to be “a friend of Israel.”

The Dems play a silly game of delaying all confirmations.

“We’re going to wear down the Democrats. Either you’re going to play ball with us, or you’re going to go without sleep..”

Ratcliffe was confirmed yesterday. We get one per day?

• GOP To Push Trump Nominees Through Democratic Walls (JTN)

Four days into President Donald Trump’s second administration, Secretary of State Marco Rubio is the sole Senate-confirmed member of the Cabinet, putting the 47th president well behind his recent predecessors in positioning his key advisors, a situation some Republicans have attributed to Democratic intransigence. The perceived obstruction efforts of the opposition party have Republican leadership gearing up for a tense battle to push Trump’s nominees over the finish line, be it “the easy way or the hard way.” While Rubio earned unanimous approval for the post on day one, Senate Democrats blocked the advancement of Trump’s CIA Director-designate, John Ratcliffe, and several key nominees have yet to even receive hearings.

“Democrats blocked John Ratcliffe’s confirmation vote because they don’t care about qualifications, integrity, or national security,” the Senate GOP account insisted. “But they do care about denying President Trump his cabinet, even if it hurts the country.” The upper chamber had expected to confirm Ratcliffe on Tuesday, though the Democrats managed to delay the final vote through a procedural measure. A former Director of National Intelligence and D.C. insider, Ratcliffe’s confirmation has not ranked among the more contentious of Trump’s nominees. Republicans, however, appear to have doubled down and are planning to work through the weekend to push through Trump’s nominees “the easy way or the hard way.”

Ratcliffe is far from the only Trump nominee to face scrutiny, however. FBI director-designate Kash Patel, DNI-designate Tulsi Gabbard, and Health and Human Services Secretary-designate Robert F. Kennedy Jr. all have yet to appear before their relevant Senate committees at all. Republicans’ assertions that Democrats have held up Trump’s Cabinet appointments appear to hold some water relative to the confirmation pace of some recent Democratic administrations and even Trump’s first term. His confirmation pace, thus far, appears just shy of Biden’s. In his first term, Trump saw two key officials receive Senate confirmation on Jan. 20, 2017. James Mattis and John Kelly received confirmation as Secretary of Defense and Department of Homeland Security secretary, respectively. Elaine Chao followed suit as Transportation secretary on Jan. 31, 2017.

Now-former President Joe Biden, secured the confirmations of DNI Avril Haines and Defense Secretary Lloyd Austin by this point in his presidency. Treasury Secretary Janet Yellen and Secretary of State Antony Blinken were confirmed on Jan. 25 and 26, 2021, respectively. President Barack Obama, however, saw seven members of his Cabinet confirmed via voice vote on Jan. 20, 2009. Several more were confirmed by either voice vote or roll call by Jan. 23. To be sure, several contentious nominees, including Pete Hegseth have cleared key procedural hurdles on the way to a floor vote, even earning some Democratic support despite personal scandals and a bevy of negative headlines. Republicans appear bullish on confirming Trump’s top nominees, especially Hegseth, but are also increasingly open to less conventional measures to steamroll through Democratic procedural hurdles.

“We’re going to wear down the Democrats. Either you’re going to play ball with us, or you’re going to go without sleep,” Sen. Markwayne Mullin, R-Okla., said on Fox News. Senate Majority Leader John Thune, for instance, has already vowed that the Senate will work through the weekend on confirming Cabinet nominees and has further declared that Republicans were willing to work “Nights. Weekends. Recesses.”

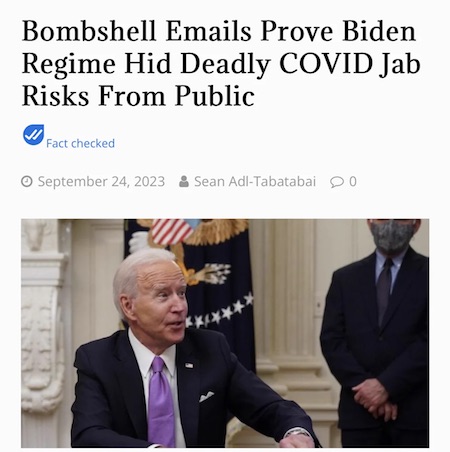

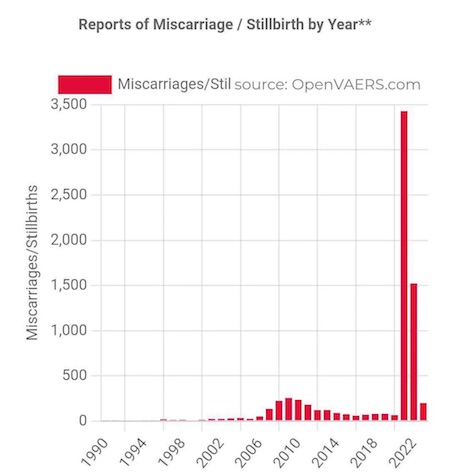

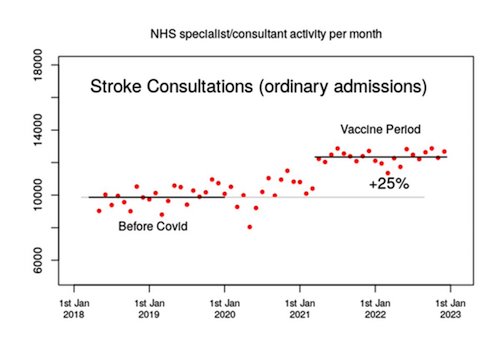

The whole issue should have been solved by now. All of it. Including all vaccine damage.

• SCOTUS Denies RFK Jr. Request To Block California’s Doctor Investigations (ZH)

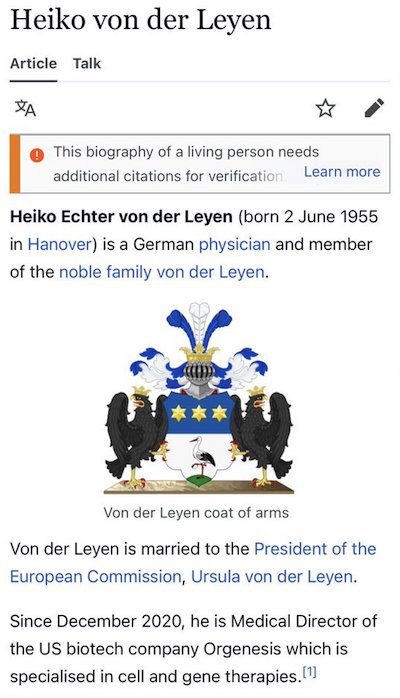

Justice Elena Kagan, who handles urgent appeals from California, rejected the emergency application in Kory v. Bonta late on Jan. 21. She did not explain why. The decision came 13 days after the case was docketed by the court on Jan. 8. Kagan did not ask California to respond to the application. Robert F. Kennedy Jr. was listed as one of two attorneys representing the physicians in the case. President Donald Trump has nominated Kennedy, an activist on environment and health-related issues, to be secretary of the U.S. Department of Health and Human Services (HHS). The other co-counsel on the application is Richard Jaffe of Sacramento, California. The Medical Board of California considers the expression of the doctors’ dissenting views on the disease as potentially dangerous misinformation that needs to be suppressed.

The board argues that it has legal authority to discipline the doctors for speech it deems to be medical misconduct. The physicians counter that they didn’t surrender their free speech rights when they obtained medical licenses. The application was initiated by Dr. Pierre Kory and Dr. Brian Tyson, both medical doctors; Dr. Le Trinh Hoag, an osteopathic physician; Physicians for Informed Consent; and Children’s Health Defense, a nonprofit organization founded by Kennedy. Kennedy has resigned from the nonprofit because of his pending HHS nomination, Jaffe told The Epoch Times. The application stated that California’s executive and legislative branches are “threatening California physicians with professional discipline for their viewpoint speech contrary to the mainstream COVID narrative.”

After the Federation of State Medical Boards in July 2021 asked its member medical boards in the United States to punish physicians for advancing perceived “COVID misinformation” and “disinformation” among patients and the public, Medical Board of California President Kristina Lawson announced in February 2022 that the board planned to sanction physicians for what it called “COVID misinformation.” The California Legislature passed AB 2098, which took effect in January 2023, making the dissemination of “misinformation” about the disease an offense for which doctors could be disciplined, the application stated. After a federal district judge halted the law in January 2023, the Legislature repealed the misinformation provision effective January 2024. The application said the board continued to probe physicians for violating its COVID-19 policy following the repeal.

The applicants were challenging “the practice and policy of threatening and targeting physicians with discipline for providing information and recommendations contrary to the mainstream COVID narrative,” according to the application. On April 23, 2024, the U.S. District Court for the Eastern District of California rejected a request to preliminarily block the state’s enforcement program, holding that the applicants lacked legal standing. Standing refers to the right of someone to sue in court. The parties must show a strong enough connection to the claim to justify their participation in a lawsuit. The ruling was upheld by the U.S. Court of Appeals for the Ninth Circuit on Nov. 27, 2024. The California Business and Professions Code, under which the California Medical Board claims its disciplinary authority, “regulates conduct, not speech,” the appeals court stated. “It provides for enforcement of the standard of care, which is the standard for physicians’ treatment of patients,” the court added.

To demonstrate standing, the applicants had to demonstrate that there was “a credible threat that the [board] will prosecute them under the statute,” but they did not do so, the appeals court stated. The Ninth Circuit said the court record showed that the only disciplinary action taken against a doctor “involved a physician encouraging her patient to use veterinary ivermectin and resulted in the stipulated surrender of her license.” The applicants were asking the Supreme Court for an injunction stopping the state from “continuing their enforcement program targeting the information, opinions, and recommendations on COVID-19 which California licensed physicians may provide to patients.” A related challenge that Kennedy and Jaffe filed with the Supreme Court was rejected by the full court on Jan. 13.

Kory

Dr. Pierre Kory Unveils the Immunological Catastrophe: The Misattribution of Post-Vaccination Syndromes to Long COVID in a Flagrant Display of Scientific Negligence

"I tell you another deception. The entire country medical system calls the chronic problems after COVID, they call… pic.twitter.com/Ex6bWVpj3L— Camus (@newstart_2024) January 23, 2025

“Stop the press! The Inspector General concludes that senior DOJ officials engaged in a, wait for it, leak? How did the Republic survive?”

• COVID Death Coverup: Trump-Hating Lawyers at DOJ Strike Again (PJM)

The last time a tornado hit Washington, D.C., like this was August 1814. That’s when British troops were fleeing a frightening twister. The storm extinguished fires the British set and killed more redcoats than the American army did. In the last 72 hours, Donald Trump has whirled through the Washington bureaucracy with similar fury. Things that seemed impossible last week, Trump made possible, like revoking LBJ’s sixty-year-old Executive Order 11246 that mandated the use of race in government contracting. Yet there is a mountain of problems. Meet two DOJ lawyers who used their positions to target the first Trump administration: Deborah Zerwitz and Jennifer Ramella. Unlike Jack Smith, Zerwitz and Ramella are still employed at DOJ. Zerwitz and Ramella are two progressive DOJ lawyers who work for the Inspector General. They authored the recent hit job on the first Trump term.

More on who they are in a moment, lots more. Here’s the hit. Just before the inauguration, the pair authored a little-noticed hit piece on actions taken in the first Trump term. Specifically, they worked on a report by the DOJ Inspector General. The DOJ IG published a report about nursing home COVID deaths that occurred in New York and elsewhere. In 2020, state officials in New York and elsewhere were shoving COVID patients into assisted living facilities, where their virus promptly spread to existing residents and killed them by the thousands. The Trump Justice Department opened a civil rights investigation into the despicable behavior under laws prohibiting discrimination against institutionalized persons, particularly the Civil Rights of Institutionalized Persons Act of 1980 (42 U.S.C. 1997).

The law is often referred to in shorthand as “CRIPA.” People in nursing homes have a federal civil right to not have Governor Andrew Cuomo shove sick patients with a deadly disease into their otherwise healthy nursing homes. The Inspector General report makes the shocking conclusion about the Trump DOJ: “The OIG investigation found that three then Senior DOJ Officials violated DOJ’s Confidentiality and Media Contacts Policy by leaking to select reporters, days before an election, non-public DOJ investigative information regarding ongoing DOJ investigative matters, resulting in the publication of two news articles that included the non-public DOJ investigative information.” Stop the press! The Inspector General concludes that senior DOJ officials engaged in a, wait for it, leak? How did the Republic survive?

In other words, the Inspector General investigated political appointees for talking to reporters about the behavior of targets of investigations. The offending conduct was something that took place all during the Robert Mueller investigation, the Jack Smith investigation, and every single investigation of Donald Trump during the Biden administration. In other words, the new DOJ inspector general report is abject horse manure. It stinks so bad the attorneys involved in the Inspector General report aren’t fit to hold their positions anymore at the Department of Justice. Too many bureaucrats on the GS scale have used their petty powers to smear and malign Donald Trump and his presidency, as Zerwitz and Ramella did here. Their behavior is particularly despicable because it provides political cover to state officials who were acting in a way that cost lives, the very thing federal law is designed to prevent.

Their report obscures the fact that Governor Cuomo and other state officials shoved COVID-infected people into nursing homes during the height of the pandemic and caused thousands of unnecessary deaths. The facts are straightforward. In April 2020, the DOJ received complaints about the COVID-related deaths of large numbers of elderly military veterans who lived in a Massachusetts nursing home. Allegations included claims that local officials concealed the deaths and stacked the dead bodies in a trailer. The Trump Justice Department launched an investigation in 2020 and issued a press release about its investigation. DOJ subsequently learned that several state agencies in Massachusetts were also investigating, so DOJ paused its investigation to give the state a chance to investigate the case first.

Information then surfaced that COVID-related nursing home deaths occurred at astonishing rates in New York and elsewhere because Governor Cuomo and other state officials required nursing homes to accept COVID-positive individuals. Thousands died because of this decision. Families sought answers, rightfully so.

DOJ officials opened an investigation, and the available information suggested that death rates in four states – New York, New Jersey, Pennsylvania, and Michigan – were much higher than in other states. DOJ asked each of the four states to produce data about their nursing home COVID-related deaths under CRIPA enforcement powers. The Trump DOJ transparently issued press releases about these requests, too: “Protecting the rights of some of society’s most vulnerable members, including elderly nursing home residents, is one of our country’s most important obligations,” said then-Assistant Attorney General for Civil Rights Division Eric Dreiband. “We must ensure they are adequately cared for with dignity and respect and not unnecessarily put at risk.”

“If you’re frightened of the debasement of your currency, or you’re frightened of the economic or political stability of your country, you can have an internationally based instrument called Bitcoin that will overcome those local fears..”

• Larry Fink Predicts $700,000 Bitcoin (RT)

Bitcoin could reach an astonishing $700,000 if institutional investors allocate between 2% and 5% of their portfolios to the cryptocurrency, Larry Fink, the head of BlackRock, the world’s largest asset management firm, has predicted. The digital coin has seen a surge in its value in recent months. In 2024, its price jumped 121%, reaching the peak of $108,135 in December. On Monday, following the inauguration of US President Donald Trump, Bitcoin hit a record $109,225. Trump had previously announced plans to make the US the world’s “crypto capital” and to set up a national Bitcoin reserve. Fink told an audience at a panel in Davos on Wednesday that he is “a big believer” in the world’s largest cryptocurrency as an instrument, highlighting its potential as a financial hedge.

“If you’re frightened of the debasement of your currency, or you’re frightened of the economic or political stability of your country, you can have an internationally based instrument called Bitcoin that will overcome those local fears,” Fink said. The investor cited a momentum towards institutional adoption of the cryptocurrency. “I was with a sovereign-wealth fund during this week, and there was a conversation, should we have a 2% allocation? Should we have a 5% allocation? If everybody adopted that conversation, it would be $500,000, $600,000, $700,000 for bitcoin,” argued Fink. The investor noted that he wasn’t promoting the token. Last year, BlackRock launched Bitcoin Trust and Ethereum Trust, exchange-traded funds investing directly into the two crypto tokens. Fink used to be skeptical of digital assets. In 2018, he told Bloomberg that BlackRock’s clients had zero interest in crypto.

Created in 2009, Bitcoin allows people to send and receive money over the internet without relying on traditional banks or governments. The decentralized nature of the token has also facilitated its misuse by organized crime gangs and for other illicit purposes such as money laundering and terrorist financing. The price is primarily affected by supply, market demand, availability, competing cryptocurrencies, and investor sentiment. Despite wide use for buying goods and services, there are no uniform international laws that regulate Bitcoin. The token was adopted as official currency in El Salvador in 2021. Governments around the world have been wary of the cryptocurrencies’ growing influence, warning about the dangers of investing into a volatile asset. According to an opinion piece by financial analyst Susie Violet Ward published by Forbes on Monday, Bitcoin’s institutionalization would compromise its original ethos as “freedom money,” with regulatory and economic control eroding the token’s decentralization.

See also Ryan McMaken’s excellent overview in yesterday’s Debt Rattle. The key line:

“..all persons born or naturalized in the United States and subject to the jurisdiction thereof..”

Those are two separate things!

• Judge Blocks Trump’s Birthright Citizenship Order (ET)

A U.S. judge on Jan. 23 blocked President Donald Trump’s order limiting birthright citizenship. U.S. District Judge John Coughenour after a hearing in Seattle issued a temporary restraining order that prohibits the Trump administration for 14 days from enforcing Trump’s order, which the president signed hours after taking office on Monday. “This is blatantly unconstitutional order,” Coughenour told a lawyer with the U.S. Justice Department during the hearing. The ruling was made in a case brought by the attorneys general of Arizona, Illinois, Oregon, and Washington state. It was one of several lawsuits lodged against the executive order. Trump’s order was set to take effect on Feb. 19. It says that the federal government does not automatically recognize birthright citizenship for children who are born to illegal immigrants in the United States.

Historically, babies born on U.S. soil receive U.S. citizenship. That’s based on court rulings interpreting the U.S. Constitution, which says in part that “all persons born or naturalized in the United States and subject to the jurisdiction thereof, are citizens of the United States.” Congress also passed a law containing similar language. Trump’s order says that the Constitution’s citizenship clause “has never been interpreted to extend citizenship universally to everyone born within the United States” and “has always excluded from birthright citizenship persons who were born in the United States but not ‘subject to the jurisdiction thereof.’” It clarifies that the federal government does not automatically grant citizenship to babies whose mothers are in the United States and whose fathers are neither U.S. citizens nor lawful permanent residents.

In their motion for a temporary restraining order, state officials said that Trump went beyond his powers with the order, describing it as “flatly contrary to the Fourteenth Amendment’s text and history, century-old Supreme Court precedent, longstanding Executive Branch interpretation, and the Immigration and Nationality Act.” Without court intervention, the order would leave more than 150,000 babies born this year without citizenship because their parents are illegally in the country, according to the attorneys general. Government officials said in response that the court should not issue a restraining order because the states have not suffered any injuries and because the plaintiffs are not likely to succeed.

“Ample historical evidence shows that the children of non-resident aliens are subject to foreign powers—and, thus, are not subject to the jurisdiction of the United States and are not constitutionally entitled to birthright citizenship,” government lawyers said.That included a Supreme Court justice writing in legal commentaries that birthright citizenship should not apply to babies whose parents were in the country “for temporary purposes.” Coughenour sided with the states, telling the courtroom before Department of Justice attorney Brett Shumate had even finished talking that he had signed the restraining order sought by the states.The two-week order is in place while Coughenour weighs issuing a preliminary injunction, which would likely remain in place as the case proceeds in the courts. Schumate during Thursday’s hearing argued the executive order was constitutional and that any order blocking it would be “wildly inappropriate.”

“The United States is losing its dominant global position, which may prompt Western elites to fuel new armed conflicts between nations..”

• West Could Orchestrate More International Conflicts – Russian Spy Chief (RT)

The United States is losing its dominant global position, which may prompt Western elites to fuel new armed conflicts between nations, according to Sergey Naryshkin, the head of Russia’s Foreign Intelligence Service (SVR). In an interview with RIA Novosti previewed on Friday, Naryshkin said the US is “gradually degrading and losing control.” He cautioned that some influential figures may attempt to spark international conflicts to serve their interests. The global situation in 2025 will remain unstable, the SVR chief predicted, highlighting the need for prudence among regional and global players. Naryshkin stressed that much depends on the rationality and restraint exercised by these actors.

The Russian official added that while the shift to a new, fairer multipolar world order is “complex and fraught with risks,” the emergence of new centers of power has significant potential for economic development and the ability to ensure global security and stability. Naryshkin expects the US and EU to be major participants in the future global architecture, with a level of influence on par with that of other great powers, including China, India and Russia. A new pan-Eurasian security arrangement will make the world as a whole more stable, he added. Moscow and Beijing have accused the West of refusing to accept that the economic rise of non-Western nations gives them a greater role in international affairs. Instead, Washington is seeking to replace international law with a “rules-based order” that gives the US undeserved benefits and suppresses competition, officials from Russia and China have argued.

“Prime Minister Keir Starmer and Chancellor Rachel Reeves have described their fiscal rules as “ironclad” and “non-negotiable.”

• UK Faces ‘Debt Death Spiral’ – Ray Dalio (RT)

The UK faces significant fiscal risks due to its rising borrowing costs and increasing debt levels, the boss of the world’s largest hedge fund, Ray Dalio, has warned. Britain’s annual interest payments have surpassed £100 billion (roughly $125 billion), Dalio, the founder of investment management firm Bridgewater Associates, said in an interview with the Financial Times. The recent sell-off in fixed-interest loan securities issued by the UK government, known as gilts, coupled with the weakening of the British pound, indicate that the market is struggling to absorb the government’s higher borrowing requirements, he explained. “When you get to the point that you have to borrow money to service the debt and interest rates are rising, so that debt-service payments rise, so you need to borrow more money to pay them, you’re in what the markets call a death spiral,” the investor told the FT in Tuesday’s report.

The UK’s ten-year borrowing costs rose from 3.75% in mid-September to a 16-year high earlier this month at 4.93%, the outlet noted. ”As those risks increase, everybody looks at that need to borrow more money at higher interest, which creates [a] self-reinforcing debt deterioration cycle,” Dalio also pointed out. The UK government in October adopted a budget for the financial year 2025/2026, pledging more funding for essential services and social support, and increased debt-servicing costs. Although the government announced tax increases, analysts have pointed out that these may not fully cover the additional spending, particularly amid slower economic growth.

The British pound has been declining since September, having lost about 8.2% of its value against the US dollar. The drop has been attributed to rising borrowing costs, market apprehension about the country’s debt levels, and reduced investor confidence. The trends have prompted another warning, this one from Berlin-based credit rating agency Scope Ratings. Recent moves in UK debt markets and the falling pound suggest that cracks may be appearing in Britain’s reserve currency status, Reuters reported on Wednesday, citing Denis Shen, a top analyst at the agency. The UK’s vulnerability to emerging market-style sell-offs could jeopardize its AA credit rating, Shen warns. In response to the challenges, the UK government said it remained “absolutely committed” to strict fiscal discipline. Prime Minister Keir Starmer and Chancellor Rachel Reeves have described their fiscal rules as “ironclad” and “non-negotiable.”

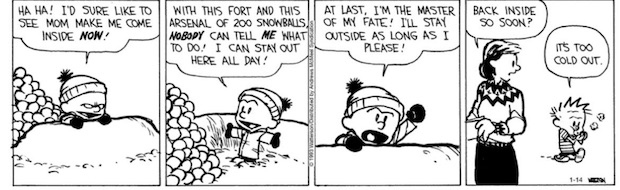

Cold day

https://twitter.com/i/status/1882097894423142503

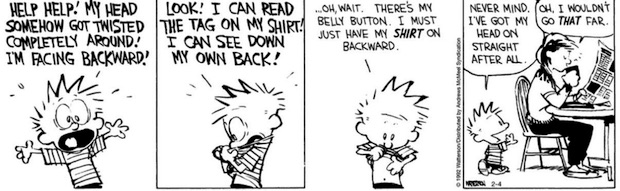

Denial

https://twitter.com/i/status/1882470128580796628

Cuttlefish

7. An amazing cuttlefish camouflage

— Dr King Winter (@I_Am_Winter) January 23, 2025

Phonics

https://twitter.com/i/status/1882264331016163414

Titanic

— Doglover (@puppiesDoglover) January 23, 2025

Airplane

A teacher showing his paper aeroplane pic.twitter.com/Jw0B1U765M

— non aesthetic things (@PicturesFoIder) January 23, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.