Pablo Picasso Studio with plaster head 1925

We see the world through the eyes of Hollywood. There’s good and there’s bad, and WE are always on the good side. But the world is not like that. We know this because the best literature never is either. But who reads literature anymore?

Scott Ritter: We trained Nazis

"We Trained Nazis" – Former US Marine Corp Intelligence Officer, Scott Ritter

"The first troops to be trained by US and British soldiers were the neo-Nazi Azov Battalion" pic.twitter.com/QKlGXwCAhk

— Ignorance, the root and stem of all evil (@ivan_8848) March 12, 2022

“..you are all better off letting Vladimir Putin take out the garbage for you.”

• Perfectly Lawful and Legal and Unfortunate (Anna Von Reitz)

When the old Russian Federation broke up, and Russia released the Ukraine as an independent country it came with the proviso that if there was evidence of criminality, genocide, international threats to Russia on Ukrainian soil, etc. Russia could come back in and secure the situation. This is part of Russia’s obligation to the rest of the world as well as a matter of Russian security. So, Ukraine was free to be its own country, with the understanding that they were going to be good little international citizens. And if they got out of hand, Russia would come back in and clean things up. Following Ukrainian independence in 1991, the Usual Suspects piled on. It was like a gold rush. Drug smuggling. Human trafficking. Arms sales. Counterfeiting. Organ harvesting. Oil privateering.

Every sordid nasty dirty business in the world was imported to Ukraine, by all the Agencies, the “US Corp”, the DOD, the Mobs of various nations, and associated corporations like Blackwater and Halliburton and on and on and on. All the Dirty Deal Guys showed up like gangbangers. And everyone including Russia just shook their heads. It was business as usual for the Ollie Norths of the world.[..] So, Russia invoked its treaty proviso and came in to clean the situation up and as Vladimir Putin said, “take the garbage out” — not because they wanted to spend all that money and risk their lives and take all the abuse that the propaganda machine can throw — but because otherwise, they’d have all those stockpiles of chemical and biological weapon on their back door step, along with all the other nastiness that was already going on.

[..] Tough as it is, say, aye, Vladimir Putin. Thank you, Russia. And to the people of Ukraine, we know you are, for the most part, innocent victims of the oligarchs and their western Sugar Daddies. Make it easy on yourselves. Stay home and step back. Let Russia clean out the Vermin for you. You’ll be glad you did. If the US/Ukrainian oligarchy had been allowed to continue, the vicious animals would have come in and used a pretext to engage in war on your beautiful land. They would have done what they did in Iraq and polluted it will dirty bombs and dirty artillery shells and ruined your land for farming for generations.

Then they would have gone home and jerked up the price of food for everyone ten times over, because your produce, your wheat, and everything else wouldn’t be there to compete against them. These mean and diabolical criminals always have ten axes to grind. They always figure to win, if not one way, then by another. Take it from the Americans. We’ve been dealing with them for 160 years. We know what they do. We know how they think. And you are all better off letting Vladimir Putin take out the garbage for you. Believe it or not.

Putin evil plan

@edthetechie pic.twitter.com/LVFHVRWUmK

— 4lch3m1st (@4lch3m1st) March 12, 2022

Key: “Russians view the hostilities as a repeat of the Great Patriotic War of 1941-1945.”

• Much Wants More And Loses All (GEFIRA)

The collective post-West has been running amok for the last two weeks. The powers that be make believe that they did not expect that events would unfold the way they are unfolding now (though they did their best to make things happen as they are happening) and they make a show imposing sanctions on the aggressor and assuring the populace that the aggressor sooner or later will cave in. There is yet a third aspect to the phenomenon: the same powers that be want the people to forget that merely twenty years back they themselves assaulted Yugoslavia/Serbia, used missiles with depleted uranium, bombed cities and shot at civilians. Of course, that earlier event was a humanitarian action while the current one is a brutal act of aggression, but we digress.

Now there is a big misconception on the part of the post-West about Russia. If the Western media claim the Russian people are against the war or that the Russian people are about to rebel and overthrow President Putin, then they are either delusional or lying through their teeth. Reality is something that refuses to obey our wishes. The Russian people have rallied around their president and and their authorities; the Russian people – unlike citizens of the post-Western countries – are patriotic and ready to sacrifice themselves in defence of their fatherland. Western sanctions? The post-West may withdraw businesses and impose sanctions on Russian oligarchs, which is music to the ears of the Russian people. They resented Western dominance anyway and they will be more than happy to see the oligarchs mopped up from their society.

Russians view the hostilities as a repeat of the Great Patriotic War of 1941-1945. Contrary to what has been done to the Western collective mentality, the Russian authorities under Vladimir Putin took great efforts to raise Russia’s citizens in patriotic values. Russians are going to win because they do not care about money so much as the West does. That’s one big misconception that Western people have about their opponents from the East. It is the West that cannot imagine a life without money and the resultant luxuries. Sanctions or no sanctions, Western companies will sooner or later (I bet: sooner) resume business with Russia because – as everybody in the West knows – “money makes the world go round”. No less a person than Comrade Lenin famously said: capitalists will sell us the rope with which we will make a noose to hang them. And so they will, make no bones about it.

“The current soaring fuel prices at service stations world-wide are not an outcome of the Russian action in Ukraine. They are the outcome of the sanctions.”

The current Western sanctions on nations that refuse to follow the directives of the West do not carry any weight at all; or anything that comes close. Non-Western countries can survive without Tesla, Porsche and Ferrari cars. Earth will continue to spin without French perfumes and champaign. With those facts known though unspoken, the USA continues to impose sanctions on other nations by utilizing the power of the Greenback, ie US Dollar of USD for short. But this approach is foolish to say the least, and it is bound to backfire. America is determined to keep the stature of the USD as the single reserve world currency. But to maintain this stature, America must make sure that the rest of the world needs to use the USD and that it has no other alternative.

But when successive American administrations impose sanctions on other nations that prevent them from using the USD, they are effectively shooting their last and only remaining asset in the foot. This is not a complex issue that requires a PhD in macro-economics to understand. It is very simple in fact. You cannot coerce people to do something by way of banning them from doing it. This is a simple logical contradiction that even children can understand. This oxymoronic comedy of errors appears more ludicrous when we see that the USD is the only asset left that the USA can use to impose sanctions with. Do successive American administrations really believe that sanctioned and potentially sanctionable nations, are going to sit idle and starve themselves to death without taking pre-emptive measures to avert this?

If anything, sanctions over the years have taught even small and developing countries like Cuba, Syria and Iran to be self-reliant and innovative. Those countries have produced whole ‘armies’ of technicians who are able to manufacture spare parts even for old American cars. When you see photos of 1950’s Chevvies in Cuba, rest assured that there are hardly any original made-in-America parts left in them. If an American owns such an antique model and cannot find parts for it in the US, he/she may be able to find them in Cuba. [..] The current soaring fuel prices at service stations world-wide are not an outcome of the Russian action in Ukraine. They are the outcome of the sanctions.

These sanctions can only turn back and hurt the hand that created them. They are not arrows aimed at targets. They are boomerangs, but even boomerangs are meant to return to the hand that launched them when they miss the target. But Western sanctions are sharply-pointed boomerangs that can only hit back, and hit with vengeance, and the soaring fuel prices may just be only the beginning.

“The shooting war may or may not be over soon, but the financial war has just started and will continue after the shooting stops.”

• Putin’s Options (Jim Rickards)

There’s no doubt that the financial sanctions put on Russia by the U.S., the U.K., EU members and others are the most severe ever imposed. The U.S. Treasury has announced 15 separate sanctions programs in recent days and no doubt more are on the way. The targets of these sanctions include Russian banks, Russian stocks and bonds and various payment channels. Most significantly, the U.S. froze the accounts of the Central Bank of Russia. That’s the first time a major central bank’s assets have been frozen since the Cold War, and possibly ever. Yet the financial attacks on Russia go far beyond official sanctions. Numerous private companies including Microsoft, Exxon Mobil, Shell and some major airlines have ceased their business activities in Russia.

Visa and Mastercard have stopped accepting credit card charges from Russia. Google and Apple have turned off the mobile payment apps on phones held by Russian citizens. Shipping giant Maersk has stopped its vessels from unloading or taking cargo from Russian ports. Stock index funds are pushing Russian companies out of their indexes and the Norwegian sovereign wealth fund is divesting Russian stocks. The list of public and private embargoes and boycotts goes on. The financial impact on Russia will be extreme. The Russian economy may be expected to collapse by 20% or more in the first half of 2022, an amount comparable to the economic collapses in the second quarter of 2020 during the first lockdown stage of the pandemic. But Russia has not stood still.

The Central Bank of Russia imposed capital controls so that Russian companies cannot pay interest or principal on international debts. That means those loans and bonds may soon go into default. Many such securities may be stuffed into 401(k) plans of Americans under the umbrella of “emerging markets” funds or ETFs. Even more important is the possibility that interbank lending may start to dry up as Russian banks are frozen and Western banks reduce leverage and shrink balance sheets in order to reduce risk. This will lead to defaults in the West and could even mark the beginning of a global liquidity crisis that can only be contained by Federal Reserve currency swap lines, like we saw in the early stages of the pandemic when markets were collapsing.

But even that technique may not work since there are no swap arrangements in place between the Fed and the Central Bank of Russia. The shooting war may or may not be over soon, but the financial war has just started and will continue after the shooting stops. For that matter, a global financial panic may emerge even before the shooting stops. We all see what’s happening on the surface. Here’s what you don’t see: Someone is on the wrong side of every one of those trades. Hedge funds and banks are losing billions and are sinking. It takes about a week for bodies to float to the surface.

“US sanctions once imposed are extraordinary difficult to lift.”

• Russia’s Long-term Economic Prospects (Milanovic)

When we look at Russia’s long-term economic prospects, it is also useful to begin with some assumptions and to look at historical examples. We can make two assumptions. First, that the current Russian regime, in one form or another, might continue for some ten to twenty years. Second, we can assume that American and Western sanctions will continue throughout the entire period of say, 50 years that we consider here. The arguments for this are as follows. US sanctions once imposed are extraordinary difficult to lift. As of today, there are already 6,000 various Western sanctions imposed against Russia which is more than the sum of sanctions in existence against Iran, Syria and North Korea put together. History shows that US sanctions can last almost without any time limit: sanctions on Cuba are more than 60 years old, on Iran, more than 40 years old, and even the sanctions on the USSR (e.g. the Jackson-Vanik amendment) that were imposed for one reason continued on the books during twenty years after the end of the USSR even after the original reason that led to the sanctions (Jewish migration) had entirely disappeared.

When the post-Putin government tries to have sanctions lifted, it will be faced by a such a list of concessions that would be politically impossible to satisfy. Thus, sanctions, perhaps not in the exactly the same form, may be expected to last for the entire duration of what we call the long-term here (50 years). It seems obvious then that Russian long-term economic policy will have to follow two objectives: import substitution, and the shift of the economic activity away from Europe towards Asia. While these objectives are, I think, clear the realization will be extremely difficult. As before, consider the historical precedents. Soviet industrialization can be seen as an attempt to substitute imports by creating a strong domestic industrial base. That process however was based on two elements that would be missing in Russia’s future.

First, Soviet access to Western technology that was at the origin of most large Soviet complexes like the Krivoy Rog and the largest factory of tractors in the world in Tsaritsyn (later Stalingrad). The surplus extracted through collectivization, and hunger and death of millions, and even the gold taken from Orthodox churches, were used to purchase Western technology. There was never any doubt among the Bolsheviks, from Lenin to Trotsky to Stalin to Bukharin, that for the USSR to develop, it had to industrialize and to do so it needs to import technology from the more developed countries. (That conscience of relative underdevelopment of Russia was extremely strong among all Russian Marxists who were all modernizers.) The ability to import similarly advanced Western technology that could provide the basis for downstream import substitution, will not exist under the regime of sanctions. Therefore such technology would have to be invented locally.

There is, however, is a huge temporal break. Had anyone proposed import substitution approach in the 1990s, it would have been difficult to implement but not impossible: the USSR (and Russia) had at that time a broad industrial base (production of airplanes, cars, white goods; largest producer of steel etc.). The sector was not internationally competitive but, it could have been improved, and with right investments made competitive. But most of these industrial complexes have in the meantime been privatized and liquidated, and whatever was not, is technologically obsolete. In thirty years after the beginning of the “transition”, Russia has not been able to develop any technologically advanced industry except in the military area.

“Putin just shot “King Dollar” in the head. We can see it in the financial markets, as the price of everything commodity related is going up relentlessly in dollar terms. ”

• Fiat Currencies Are Going To “Fail Spectacularly” (Lawrence Lepard)

What just happened in the last two weeks is enormously important and misunderstood by many investors. The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves are nothing short of a monetary earthquake. The last comparable event was Nixon’s abandonment of the gold standard in 1971. Russia, with the backing and support of China, just told the world that it is no longer going to sell its oil, gas and wheat for Western currencies which are programmed to debase. The West in its response just said to all countries around the world: “If you have foreign exchange reserves, held in our system, they are no longer safe if we disagree with your politics.” It is similar to what the Canadians did when they moved to seize the bank accounts of Canadians who had demonstrated support for the truckers without due process of law.

Both of these political moves are blatant advertisements for what I call “non state controlled money without counterparty risk”, like gold and bitcoin. If governments can weaponize their money when they do not like what you are doing, what is the natural defense? The US Dollar has been the reserve currency of the world since WW II and the Bretton Woods agreement. This has given the US an enormous advantage and subsidy from the rest of the world because everyone else needs to produce goods and services to obtain dollars and the US can simply produce dollars at no cost by printing them. Putin is now cast in the role of Charles de Gaulle who complained about the “exorbitant privilege” of the US with its dollar hegemony. As we all know, de Gaulle demanded gold in exchange for France’s US dollar FX surpluses and this outflow forced Nixon to close the gold window.

Recall that post this event, gold went from $35 per ounce to $800 per ounce (23x). Russia’s move will lead to a similar move in favor of gold. Putin could see that the US fiscal and monetary situation was becoming untenable and he decided to use this to create an existential threat to the US and the world financial system. He undoubtedly knows that the West has artificially suppressed the price of gold and that is why he has been building his gold reserves steadily for the past 20 years. Putin just shot “King Dollar” in the head. We can see it in the financial markets, as the price of everything commodity related is going up relentlessly in dollar terms.

Russia is long commodities, long gold and doesn’t need fiat currency. His debt to GDP ratio is low and taxes are low. If the world financial markets collapse on a relative basis, the position of Russia will be improved significantly. This is what I believe he is playing for. If investors do not recognize this they will be caught wrong footed as I believe many are today.

Seeing the world through US eyes alone may not be sufficient anymore.

• ‘We Are in a New Cold War’ With China: Ex-US Assistant Secretary of State (ET)

The Chinese Communist Party (CCP) and United States are engaged in a cold war, according to a former senior state department official. As such, the Chinese regime’s burgeoning alliance with Russia has broad implications for the future of the Indo-Pacific region. “People don’t really want to have to ponder things like global devastation, but it’s here and it’s with us,” David Stilwell, former Assistant Secretary of State for East Asia and Pacific Affairs and retired Air Force Brigadier General, told EpochTV’s “China Insider” program on March 10. “The PRC [People’s Republic of China] has nukes and are building out their nuclear arsenal considerably right now,” he said. “We are in a new Cold War.”

Stilwell said that China’s effective alliance with Russia, wherein the CCP has tacitly supported a war of aggression against Ukraine, had already drawn nations throughout the Indo-Pacific closer to the United States hardened their resolve against the CCP. The worsening ties between states like Japan and South Korea with China were unavoidable, Stilwell said, because of CCP leadership’s choice to give cover to Russia’s war in spite of the fact that China previously pledged to defend Ukraine from nuclear threats. “It’s unavoidable,” Stilwell said. “The PRC named themselves … in the negotiations with Russia going into the war. They declared themselves to be basically on board with the invasion of Ukraine and all those things.” “They can’t walk that back. That’s out there. It’s commitment. But, I have to think that China’s rethinking it given how poorly this has gone for the Russians.”

Stilwell said that this strategic rethink was important for CCP leader Xi Jinping’s plans to forcibly unite Taiwan with mainland China, and that Russian failures in Ukraine would likely render Chinese military strategists more cautious in their ambitions regarding Taiwan. The CCP’s initial goal for forcing the unification of Taiwan with the mainland was to be achieved by 2049, Stilwell said. Xi, however, appeared to advance that goal to 2035. U.S. military officials, meanwhile, have warned that it could happen as soon as 2027. Stilwell agreed with that assessment. He said that, should Xi obtain a third term as leader of the CCP later this year, Xi would likely try to solidify his personal legacy by taking Taiwan before that term ends in 2027.

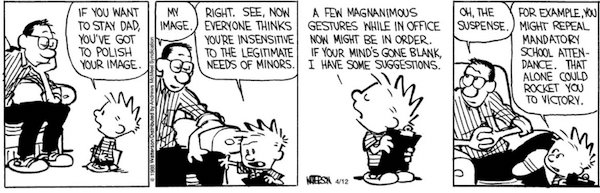

Sounds just like the west:

“..parents who were reluctant to vaccinate their children have faced pressure to comply. Some said they lost work bonuses or were given a talk by their supervisors. In other cases, their children faced punishment varying from losing honors or even getting barred from attending school..”

• Children in China Diagnosed With Leukemia After Taking Chinese Vaccines (ET)

After receiving her first dose of the COVID-19 vaccine, Li Jun’s 4-year-old developed a fever and coughs, which quickly subsided after intravenous therapy at the hospital. But after the second shot, the father could tell something was wrong. Swelling appeared around his daughter’s eyes and did not go away. For weeks, the girl complained about pains on her legs, where bruises started to emerge seemingly out of nowhere. In January, a few weeks after the second dose, the 4-year-old was diagnosed with acute lymphoblastic leukemia. “My baby was perfectly healthy before the vaccine dose,” Li (an alias), from China’s north-central Gansu Province, told The Epoch Times. “I took her for a health check. Everything was normal.”

He is among hundreds of Chinese that belong to a social media group claiming to be suffering from or have a household member suffering from leukemia, developed after taking Chinese vaccines. Eight of them confirmed the situation when reached by The Epoch Times. Names of the interviewees have been withheld to protect their safety. The leukemia cases span across different age groups from all parts of China. But Li and others particularly pointed to a rise in patients from the younger age group in the last few months, coinciding with the regime’s push to inoculate children between 3 and 11 years old beginning last October.

Li’s daughter had her first injection in mid-November under the request of her kindergarten. She is now undergoing chemotherapy at the Lanzhou No. 2 People’s Hospital where at least 20 children are being treated for similar symptoms, most of them between the age of 3 and 8, according to Li. “Our doctor from the hospital told us that since November, the children coming to their hematology division to treat leukemia have doubled the previous years’ number and they are having a shortage of beds,” he said. Li claimed that at least eight children from Suzhou district, where he lives, have died recently from leukemia.

There had been some resistance from Chinese parents when the campaign to vaccinate children first rolled out. They expressed concern about the lack of data about the effects of Chinese vaccines on young people. The vaccines are supplied by two Chinese drugmakers, Sinopharm and Sinovac, which carry an efficacy rate of 79 percent and 50.4 percent, respectively, based on available data from trials conducted on adults. [..] But parents who were reluctant to vaccinate their children have faced pressure to comply. Some said they lost work bonuses or were given a talk by their supervisors. In other cases, their children faced punishment varying from losing honors or even getting barred from attending school, as in the case of Wang Long’s 10-year-old son.

“It is a very hard statistic to massage since people are either dead or they’re not.”

• Hospitals No Longer Required to Report COVID Deaths (Mercola)

With the end of the HHS COVID death reporting system, the only means of tracking COVID deaths will now rely on the collection of data from death certificates at the state level. However, as the unnamed official told the WSWS reporter: “… deaths are reported by the counties/states but the process is very slow and many coroners are actually not wanting to cite COVID as the reason, while hospitals rely on diagnoses.” This last part of the sentence may refer to the hospital incentives for a COVID diagnosis, which increases the potential it would be listed in the ICD codes that were communicated to the HHS. Although the CDC and HHS would like the data to remain hidden, a cost-benefit analysis by Stephanie Seneff, Ph.D., and independent researcher Kathy Dopp revealed the jab is deadlier than the infection in anyone under the age of 80.

The analysis looked at publicly available official data from the U.S. and U.K. for all age groups and compared all-cause mortality to the risk of dying from COVID-19. Seneff and Dopp wrote: “As of 6 February 2022, based on publicly available official UK and US data, all age groups under 50 years old are at greater risk of fatality after receiving a COVID-19 inoculation than an unvaccinated person is at risk of a COVID-19 death. “All age groups under 80 years old have virtually no benefit from receiving a COVID-19 inoculation, and the younger ages incur significant risk. This analysis is conservative because it ignores the fact that inoculation-induced adverse events such as thrombosis, myocarditis, Bell’s palsy, and other vaccine-induced injuries can lead to shortened life span.”

Their analysis is upheld by OneAmerica’s announcement that the death rate in working-age Americans from 18 to 64 years in the third quarter of 2021 was 40% higher than prepandemic levels. This finding is stunning since one of the most reliable data points we have is all-cause mortality. It is a very hard statistic to massage since people are either dead or they’re not. Their inclusion in the national death index database is based on one primary criterion — they’ve died — regardless of the cause. As noted in a (not peer-reviewed) study led by scientist Denis Rancourt, who looked at U.S. mortality between March 2020 and October 2021: “All-cause mortality by time is the most reliable data for detecting true catastrophic events causing death, and for gauging the population-level impact of any surge in deaths from any cause.”

South Australia

Zero medical evidence for mandates (vaccines).

So the only question is this… ‘why were they so determined to put this shit into peoples bodies including children?’

Credit Pete Evens pic.twitter.com/36GbxwSSAx

— Justin Borg -UAP candidate Melbourne (@JustinBorg_UAP) March 7, 2022

“..a 9,751 percent raise from his proposed severance of $9.4 million in 2019..”

• Moderna Approved a $926 Million Golden Parachute For Its CEO (DM)

The amount of money that Moderna’s CEO would get if the company is sold and he’s replaced is now a jaw-dropping $926 million, a 9,751 percent raise from his proposed severance of $9.4 million in 2019. Stephane Bancel’s ‘change-in-control’ package was approved at the end of last year by the Massachusetts-based company’s board of directors, CNBC reported. Most of the golden parachute – $922.5 million, to be exact – is in the form of stock, which has yo-yoed during the COVID-19 pandemic. The rest includes a cash payment of $1.5 million and a bonus of $2.5 million. Bancel, 49, who is already worth a reported $4.3 billion, would only get the money if the company is sold or merged and he loses his job in the process. Last year, he earned a combined $18.2 million, a 41 percent increase from 2020.

The French-born executive’s last known address is a three-bedroom, 1,537-square-foot apartment in Boston worth an estimated $1.2 million, according to Zillow. Things have changed a lot for Moderna since the start of the pandemic in early 2020. It went from losing $747 million that year to making $12.2 billion in 2021, largely from sales of its two-dose vaccine, its only commercially available product. The biotech company is also developing shots for the flu and other infectious disease. Much of Bancel’s sky-high parachute is tied to Moderna’s stocks, but share prices have gone up and down during the pandemic, making it hard to determine how much they’ll be worth if and when Bancel cashes them out. Moderna shares reached a record high of $497.49 each on August 10, 2021, before tumbling to $253.98 by December 31. On Thursday, one share was worth $139.52.

meme war 3

Meme war 3 pic.twitter.com/QOIJTZH4bc

— All the News (@FELASTORY) March 13, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.