Paul Gauguin Portrait of Ingeborg Thaulow 1877

She made that up.

• Pelosi Says Public Opinion Shifting In Support Of Impeachment Inquiry (R.)

U.S. House Speaker Nancy Pelosi said on Saturday that public opinion is now on the side of an impeachment inquiry against President Donald Trump following the release of new information about his conversations with Ukrainian President Volodymyr Zelenskiy. Pelosi this week announced her support for an investigation after the surfacing of a whistleblower complaint that said Trump appeared to solicit a political favor from Ukraine’s president aimed at helping him be re-elected next year. Pelosi for months took a cautious approach in weighing the calls of other Democratic House members to launch impeachment proceedings against Trump, which grew louder after former Special Counsel Robert Mueller testified on July 24 about his probe of Trump and Russian interference in the 2016 election.

“In the public, the tide has completely changed; it could change now – who knows – but right now after seeing the complaint and the IG (Inspector General) report and the cavalier attitude the administration had towards it, the American people are coming to a different decision,” Pelosi said at a journalism event hosted by the Texas Tribune news website. She added that her resistance to holding an impeachment inquiry quickly evolved from urging that fellow Democrats remain cautious of the political fallout ahead of next year’s elections to full steam ahead as details emerged of Trump’s dealings with Ukraine’s leader. “A president of the United States would withhold military assistance paid for by taxpayers to shake down the leader of another country unless he did him a political favor – that is so, so clear,” Pelosi said.

[..] Several Democratic presidential candidates attended the three-day event in Austin, including Mayor Pete Buttigieg, former Representative Beto O’Rourke, Senator Amy Klobuchar and former Housing Secretary Julian Castro, all of whom agreed with Pelosi that the campaign to push Trump from office must focus on policies and not impeachment. While some polls have shown Americans are split on supporting impeachment, Castro, who served under former President Barack Obama, said he thinks the public will increasingly back the inquiry. “Like in Watergate, after more evidence gets out there … you’ll see more people of different political stripes start to support it,” Castro said at the event, referring to moves in 1974 to impeach former President Richard Nixon.

Pelosi called for impeachment without having seen the transcript or the complaint. That will forever be weird.

• Pelosi’s House Rule Changes are Key Part of “Articles of Impeachment” (CTH)

Back in December 2018 CTH noted the significant House rule changes constructed by Nancy Pelosi for the 116th congress seemed specifically geared toward impeachment. {Go Deep} With the House going into a scheduled calendar recess, those rules are now being used to subvert historic processes and construct the articles of impeachment. A formal vote to initiate an “impeachment inquiry” is not technically required; however, there has always been a full house vote until now. The reason not to have a House vote is simple: if the formal process was followed the minority (republicans) would have enforceable rights within it. Without a vote to initiate, the articles of impeachment can be drawn up without any participation by the minority; and without any input from the executive. This was always the plan that was visible in Pelosi’s changed House rules.

Keep in mind Speaker Pelosi selected former insider DOJ official Douglas Letter to be the Chief Legal Counsel for the House. That becomes important when we get to the part about the official full house impeachment vote. The Lawfare group and DNC far-left activists were ecstatic at the selection. Doug Letter was a deep political operative within the institution of the DOJ who worked diligently to promote the weaponized political values of former democrat administrations. Speaker Pelosi has authorized the House committees to work together under the umbrella of an “official impeachment inquiry.” The House Intelligence (Schiff) and Judiciary Committees (Nadler) are currently working together leading this process.

From recent events we can see the framework of Schiff compiling Trump-Ukraine articles and Nadler compiling Trump-Russia articles. Trump-Ukraine via Schiff will likely focus on a corruption angle; Trump-Russia via Nadler will likely focus on an obstruction angle. How many articles of impeachment are finally assembled is unknown, but it is possible to see the background construct as described above. Unlike historic examples of committee impeachment assembly, and in combination with the lack of an initiation vote, Pelosi’s earlier House Rule changes now appear intentionally designed to block republicans during the article assembly process. The minority will have no voice. This is quite a design.

Not really, but his arguments are interesting, and shared by many: how to put the CIA offside.

• Scott Adams Makes the Case for ‘President for Life’ Trump (Ricochet)

No, Scott Adams is not suggesting that Trump be president for life. But Scott is making the case for Trump being the last legitimate president. Hence (my conclusion), if we want our president to be legitimate then we should want Trump to be president for life. And given his age that would not be an oppressively long time. So what is Scott talking about?! He referenced the other day a tweet from the person Scott thinks is the “smartest man he has ever met” — Naval Ravikant: Does it bother anyone else that our elected officials live in a panopticon run by our intelligence agencies? A panopticon is like a one-way mirror where a person can see everything without being seen.

In other words, if you assume that our intelligence service has technological access to conversations, emails, texts by accessing both public networks and “things” owned by elected officials that are connected to the internet, then our intelligence apparatus is in an enormously powerful position vis a vis elected officials. That is, bureaucrats have something on officials that can be used as leverage to override the desires and preferences of constituencies. This delegitimizes the elected politician as acting in the constituents’ interest rather than that of the intelligence community. Earlier Senator Schumer said much the same thing: “Let me tell you: You take on the intelligence community — they have six ways from Sunday at getting back at you.”

Now, according to Scott, Trump is the only elected politician who can resist the threats of the intelligence agencies because his flaws are well-known and flagrant, thus he has the least risk of losing political power from anything the intelligence officials could leak and would be believed. (At this point most voters don’t think or will ever be made to think that Trump is a traitor, intentionally working against the interests of the United States. Nor do they think that he is engaged in any “abuse of power” that is over the line for a president.) This makes him more legitimate as a political leader — from a constituency standpoint — than anyone who could be elected. So why wouldn’t you want Trump to be president for life?

Chris Hedges has the same reasoning as Scott Adams.

• The Problem With Impeachment (Chris Hedges)

Impeaching Donald Trump would do nothing to halt the deep decay that has beset the American republic. It would not magically restore democratic institutions. It would not return us to the rule of law. It would not curb the predatory appetites of the big banks, the war industry and corporations. It would not get corporate money out of politics or end our system of legalized bribery. It would not halt the wholesale surveillance and monitoring of the public by the security services. It would not end the reigns of terror practiced by paramilitary police in impoverished neighborhoods or the mass incarceration of 2.3 million citizens. It would not impede ICE from hunting down the undocumented and ripping children from their arms to pen them in cages. It would not halt the extraction of fossil fuels and the looming ecocide. It would not give us a press freed from the corporate mandate to turn news into burlesque for profit. It would not end our endless and futile wars. It would not ameliorate the hatred between the nation’s warring tribes—indeed would only exacerbate these hatreds.

Impeachment is about cosmetics. It is about replacing the public face of empire with a political mandarin such as Joe Biden, himself steeped in corruption and obsequious service to the rich and corporate power, who will carry out the same suicidal policies with appropriate regal decorum. The ruling elites have had enough of Trump’s vulgarity, stupidity and staggering ineptitude. They turned on him not over an egregious impeachable offense—there have been numerous impeachable offenses including the use of the presidency for personal enrichment, inciting violence and racism, passing on classified intelligence to foreign officials, obstruction of justice and a pathological inability to tell the truth—but because he made the fatal mistake of trying to take down a fellow member of the ruling elite.

Decent overview of what’s going on.

• On The Motives Behind Whistleblower-gate (MoA)

The whistleblower statute says that the matter in question must be an “urgent concern” that is defined as: “… a serious or flagrant problem, abuse, violation of law or Executive order, or deficiency relating to the funding, administration, or operations of an intelligence activity involving classified information, but does not include differences of opinions concerning public policy matters”. At the core of the complaint in question is a claim that Trump used a phone call with President Volodymyr Zelensky of the Ukraine to press Zelensky to investigate two issues. The call memorandum was declassified and published. During the phone call Zelensky had two requests. He wanted U.S. anti-tank weapons and he wanted an invitation to the White House. (He got both.)

Trump also had a request. He asked that Ukrainian authorities investigate two issues of U.S. public interest. The first is the reported interferences by Ukrainian government officials in favor of Hillary Clinton during the 2016 election campaign. This also involved the notorious security company CrowdStrike which made some false claims about Russian hacking in the Ukraine. The second one is the also well-know intervention by then Vice-President Joe Biden against a Ukrainian Attorney General who had an open investigation against a company that was sponsoring his son Hunter Biden. The U.S. and the Ukraine have a treaty that requires them to cooperate on law enforcement matters. That Trump wanted the Ukrainian authorities to investigated these issues was well known.

His personal lawyer Rudi Giuliani had said for several months that he was looking into these questions. The issues pointed out in the complaint are clearly beyond the scope of the whistleblower statute. Trump’s actions with regard to the Ukraine, especially the phone call, were neither outside of any law nor do they involve any intelligence activity. What Trump did during the call was not nefarious. The issue is clearly a question of “differences in opinion concerning public policy matters”. A whistleblower complaint must be send to the relevant agency’s inspector general. If he finds it credible it goes to the head of the agency who decides if it is within the statute and, if it is, sends the complaint to Congress.

The agency’s inspector general Michael Atkinson found the complaint ‘credible’ but, after seeking legal advice, the acting director of national intelligence Joseph Maguire did not forward it to Congress. It was the right thing to do as the content of the complaint is neither ‘whistleblowing’ nor within the relevant statute. What happened next is curious: “The agency’s inspector general, Michael Atkinson, notified Congress that the complaint existed but says he and Maguire have reached an “impasse” over whether to turn it over.” I have found no legal analysis if this was a required move or outside of the usual process. After that step was taken details of the complaint leaked to the press as they were supposed to do.

I increasingly suspect Hillary will emerge.

• The Latest Plot To Topple Trump: Politics According To -Groucho- Marx (SCF)

Right after being falsely accused of conspiring with Russia for the past two and a half years, Trump is suddenly accused of the opposite – of conspiring with Ukraine instead! This Reversal of Fortune – and of accusations – demands that the American public be as stupid and brainwashed as the oppressed population of Oceania in George Orwell’s dark and prophetic classic dystopia “1984.” “We are at War with Eurasia! We have always been at War with Eurasia!” “No! We LOVE Eurasia! We are at War with EASTAsia! We have always been at war with Eastasia!” Clearly, the readers and viewers of the New York Times, the Washington Post, MSNBC, CNN and all the rest of America’s media “Powers That Be” have already been well trained in Orwellian Doublethink and witless stupidity.

Suddenly, President Vladimir Putin of Russia is no longer the Evil Bad Guy plotting with Trump. Now it is new President of Ukraine Volodymyr Zelenskyy, himself a former professional comic actor on television. The Marx Brothers would have loved to co-star with him. Perhaps after being forced out of the presidency Trump, himself a former hit TV star across America, could hire Zelenskyy as his sidekick in a revival of his famous reality television show “The Apprentice.” As the late great British satirist Michael Wharton, who wrote under the nom de plume Peter Simple liked to say – the wilder the fantasy, the more rapidly it was bound to ‘collapse” into the realm which we naively and inaccurately describe as “reality.”

And what is the latest terrible crime that the President of the United States is now –suddenly and without warning – accused of? He dared to investigate whether Hunter Biden, the son of another eminent politician, former vice president Joe Biden was guilty of corruption. Just think of the consequences if Trump and his officials were allowed to continue their investigation unhindered: They might – shockingly! – put some other corrupt former US politicians out of business. Obviously, that would be the most terrible threat imaginable to the Home of the Brave and the Land of the Free.

No wonder the US Deep State hates Donald Trump! But there is another goal for this concocted scandal. It’s a twofer – a two for one scandal – intended to topple Trump and remove Biden from serious consideration at the same time, clearing the way for the Deep State’s True Candidate – Senator Elizabeth Warren. The shamelessness of this latest concocted scandal would leave Josef Goebbels green with envy and laughing uncontrollably. Unfortunately, it isn’t a joke.

Hilarious: “It is such an obscene abuse of power and time involving so many people for so many years,” they said. “This has just sucked up people’s lives for years and years.”

I could have sworn they were talking about the Mueller investigation.

• State Dept. Ramps Up Probe Into Clinton Email Server (Hill)

The State Department reportedly intensified a probe into former Secretary of State Hillary Clinton’s private email server, contacting dozens of former aides involved in email exchanges that passed through Clinton’s server. The Washington Post reported Saturday that as many as 130 former Clinton aides have been contacted by State Department investigators in recent weeks, with many being informed that they have been found “culpable” for transmitting information that should have been classified at a higher level than it was originally sent. Former Obama administration officials describe the probe to the Post as an extraordinary investigation fueled by political animosity.

But current officials speaking on the condition of anonymity told the newspaper that the probe was structured to avoid the appearance of political bias. The probe, which reportedly reached the stage where former officials began being contacted shortly after Trump’s inauguration, was described by one senior agency official to the Post as having nothing to do with President Trump’s vows to investigate Clinton if elected during the 2016 election. “This has nothing to do with who is in the White House,” the official said. “This is about the time it took to go through millions of emails, which is about three and a half years.” “The process is set up in a manner to completely avoid any appearance of political bias,” another official told the Post.

Former officials involved in the probe described it as a political vendetta, with one telling the Post it was an “abuse of power” by the Trump administration. “It is such an obscene abuse of power and time involving so many people for so many years,” they said. “This has just sucked up people’s lives for years and years.”

No.

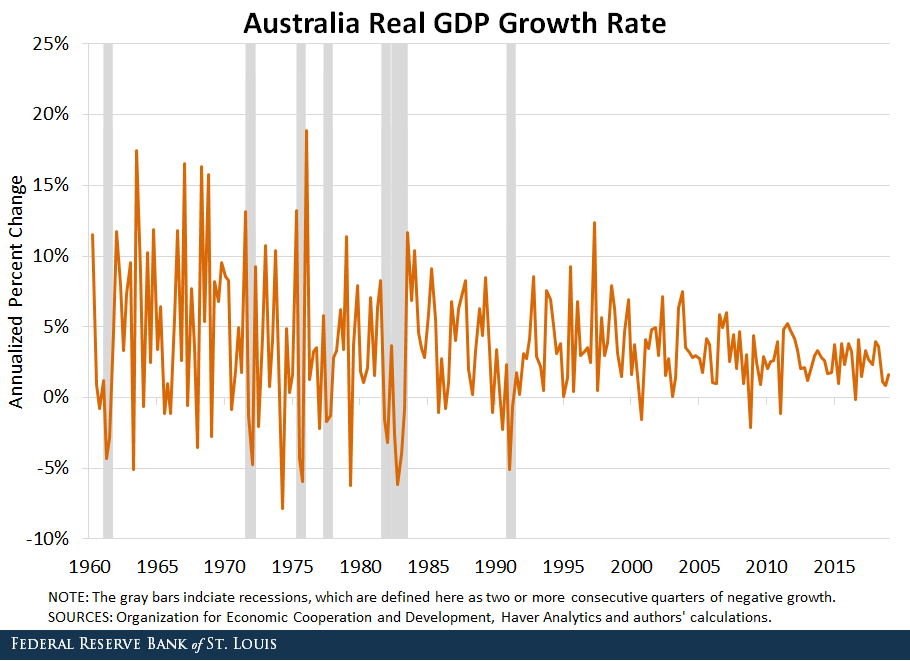

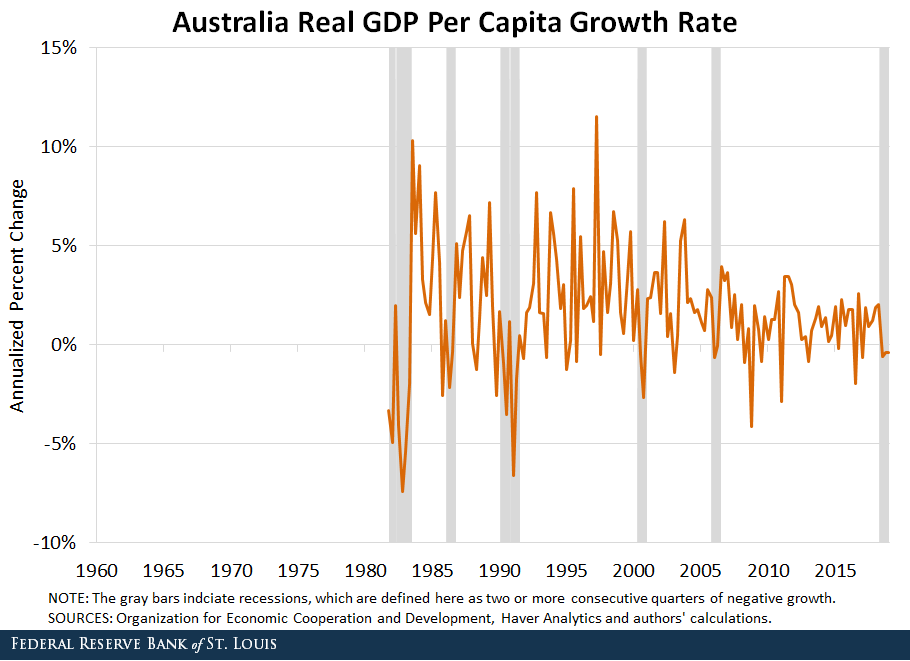

• Has Australia Really Had a 28-Year Expansion? (St.Louis Fed)

In July, the U.S. officially entered its longest expansion on record. Naturally, many are wondering if the expansion is sustainable. When asking this question, many turn to the Australian case, as it has been argued that Australia hasn’t had a recession in 28 years. But is this really the case? The figure below shows the growth rate of Australia’s GDP, with recessions shaded gray. (Recessions are defined here as two or more consecutive quarters of negative GDP growth.)

According to this, Australia has not had a recession since 1991 and has been growing since. However, when we look at real per capita GDP growth, the story changes. The figure below shows Australia’s per capita GDP growth rate. Again, recessions are shaded gray and defined as two or more consecutive quarters of negative growth.

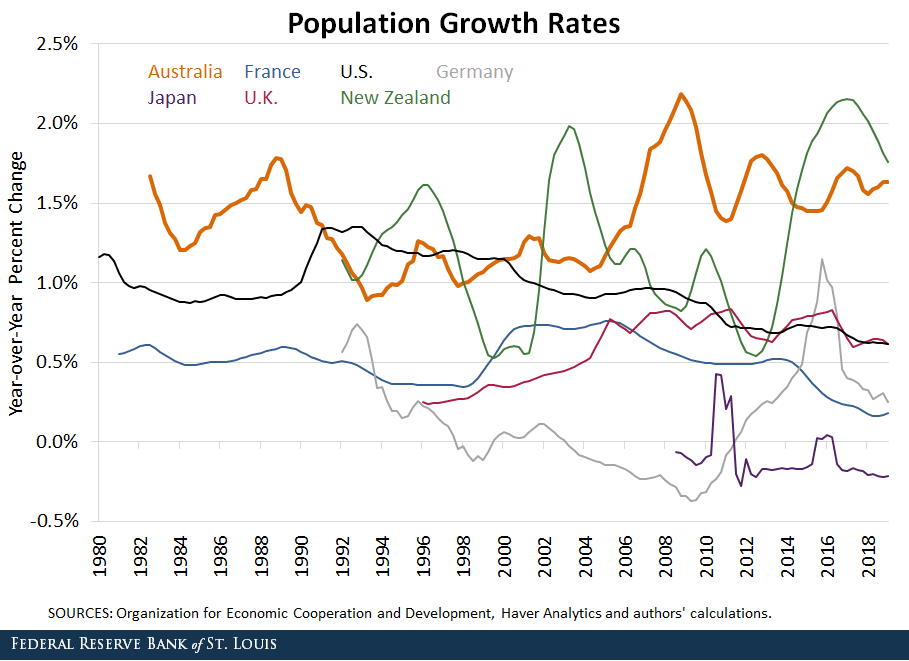

As shown in the figure, Australia has had three recessions since 1991 when looking at GDP per capita, the most recent one being from the second quarter of 2018 to the first quarter of 2019. This discrepancy between the growth rate of per capita GDP and the growth rate of GDP implies that population growth has been a key factor for Australia’s economic expansion. A rising population increases the size of the economy, and therefore total output increases, which is reflected in the level of GDP. However, the fact that we do see economic downturns in per capita terms means that population is growing faster than GDP. For nearly 40 years, Australia has had a higher population growth rate than other industrialized economies, as seen in the figure below.

In particular, it had a surge in population around 2008—during the height of the global financial crisis—due to migration. This population growth translated to overall positive GDP growth, but its effect on GDP growth hasn’t been enough to prevent recessions in per capita terms. Per capita recessions are not unique to Australia. In the table below, we compare the number of observed recessions when using GDP growth versus per capita GDP growth for several OECD countries. Again, a recession is defined as two or more consecutive quarters of negative growth.

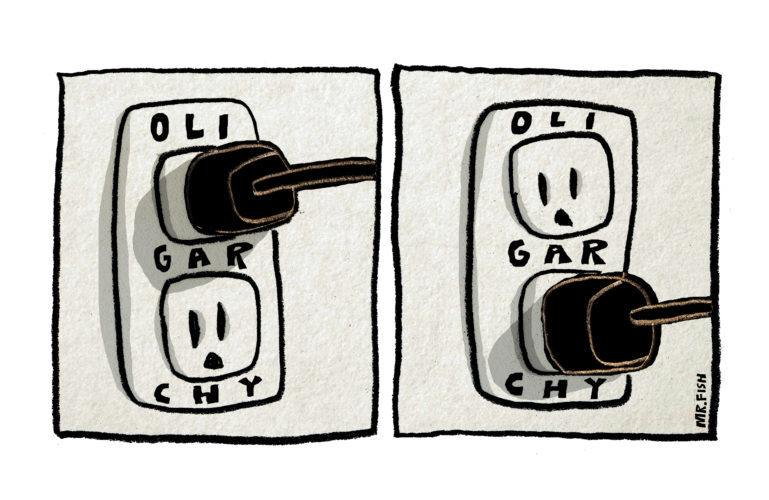

On a societal level (in)equality is strongly linked to prosperity.

• U.S. Income Inequality Worsens, Widening To A New Gap (NPR)

The gap between the richest and the poorest U.S. households is now the largest it’s been in the past 50 years — despite the median U.S. income hitting a new record in 2018, according to new data from the U.S. Census Bureau. U.S. income inequality was “significantly higher” in 2018 than in 2017, the federal agency says in its latest American Community Survey report. The last time a change in the metric was deemed statistically significant was when it grew from 2012-2013. While many states didn’t see a change in income inequality last year, the income gap grew wider in nine states: Alabama, Arkansas, California, Kansas, Nebraska, New Hampshire, New Mexico, Texas and Virginia.

The disparity grew despite a surging national economy that has seen low unemployment and more than 10 years of consecutive GDP growth. The most troubling thing about the new report, says William M. Rodgers III, a professor of public policy and chief economist at the Heldrich Center at Rutgers University, is that it “clearly illustrates the inability of the current economic expansion, the longest on record, to lessen inequality.” When asked why the rising economic tide has raised some boats more than others, Rodgers lists several factors, including the decline of organized labor and competition for jobs from abroad. He also cites tax policies that favor businesses and higher-income families.

Income inequality is measured through the Gini index, which measures how far apart incomes are from each other. To do that, the index assigns a hypothetical score of 0.0 to a population in which incomes are distributed perfectly evenly and a score of 1.0 to a population where only one household gets all of the income. In the U.S., the Gini index figure had been holding steady for the past several years. But it moved from 0.482 in 2017 to 0.485 in 2018. While that change may seem small, it’s statistically significant, the Census Bureau says. The agency notes that back in 2006, the figure stood at 0.464.

I haven’t read the book, but this is a little alarming.

• Edward Snowden’s Julian Assange is an Unfamiliar Julian Assange (MPN)

NSA whistleblower Edward Snowden and WikiLeaks’ former editor Julian Assange have a complicated relationship. On the one hand, they share important similarities: both are perceived as dangerous enemies by the United States government, and both have been documentary subjects of filmmaker Laura Poitras. On the other hand, they clearly disagree when it comes to the means of achieving government transparency and accountability. After all, if Snowden had agreed with Assange about publishing practices, it is likely that he would have followed Chelsea Manning’s example and sent the NSA documents he collected and disclosed in 2013 to WikiLeaks.

The recent publication of Permanent Record, Snowden’s 336-page memoir, takes the Snowden-Assange dynamic to new—and problematic—heights. When Assange was forcibly dragged out of the Ecuadorian embassy in early 2019, Snowden was among the leading voices condemning the arrest of the WikiLeaks founder, calling it a dangerous assault on journalism. But in his memoir, Snowden uses rhetorical tricks to present Assange and WikiLeaks as his deceitful and irresponsible foils in a blatant and seemingly self-serving effort to highlight his own trustworthiness and accountability. Indeed, reviewers at the Washington Post and New Yorker have already seized upon Snowden’s anti-Assange rhetoric to serve their own anti-Assange agendas.

Proponents of press freedom have become accustomed to Pentagon and national security state attacks on Assange, but Snowden’s puzzling claims about the white-haired Australian and his transparency organization are exceptionally dangerous because they come from an otherwise highly respectable and trustworthy source, and at a time when there is otherwise a virtual media blackout on WikiLeaks. To be sure, Snowden deserves recognition as a courageous whistleblower and as a global champion of privacy rights, but in Permanent Record, Snowden appears willing to use a political prisoner for personal gain, deliberately distorting the truth and perpetuating the imperialistic propaganda that threatens not only Assange’s health but also his very life—just like the corporate media and national security state he exposed in 2013.

Trans I Re by Fredrik Raddum