Pablo Picasso Sleeper with shutters 1936

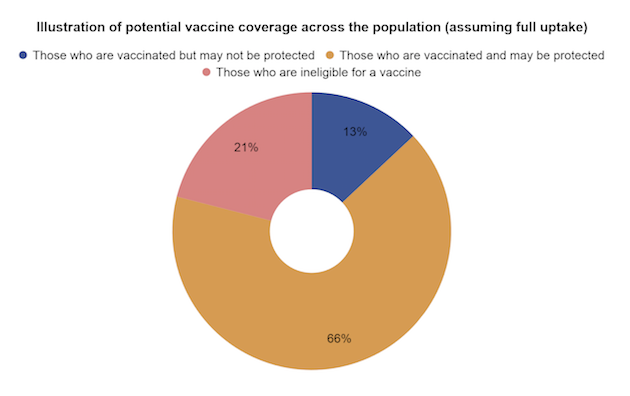

Geert: Don’t vaccinate your children with covid-vaccines! Ever!

Some eagles have too much time

https://twitter.com/i/status/1543921427606212608

“In that America, a man could easily support a family, we never gave a thought to our oil supply, and the doctor would see you now.”

• A Great Endeavor (Jim Kunstler)

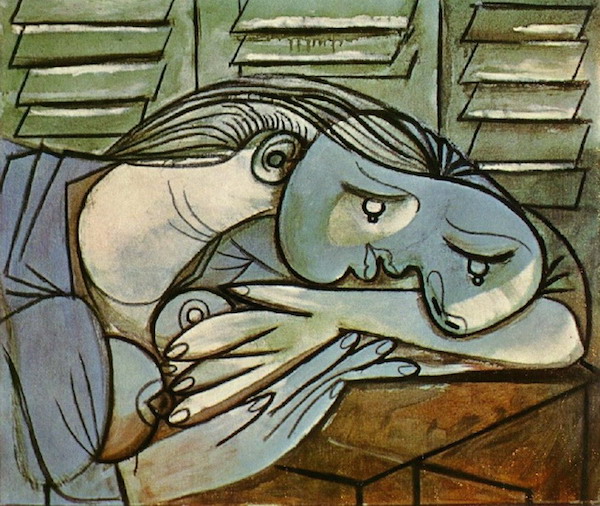

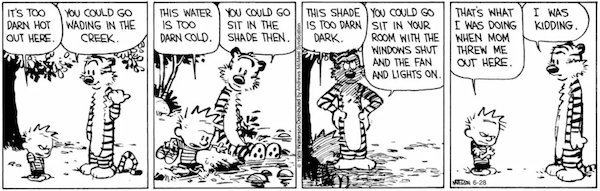

I wish I had a time machine. I would teleport a small delegation of Ben Franklin, Tom Jefferson, and Button Gwinnett from their sweltering labors at Independence Hall — then known as the Pennsylvania state house — to a Drag Queen Story Hour hosted by Lil Miss Hot Mess (“The People’s Drag Queen”) reading from her best-selling book, The Hips on the Drag Queen Go Swish, Swish, Swish, to a roomful of six-year-old offspring birthed by America’s current Progressive ruling elite. Here, I would explain, is what it has come to. Have today’s elites in our country, marinated in social justice and frantically signaling their goodness-and-virtue, gone perhaps a tad too far in their quest to liberate the populace from boundaries previously established for human behavior?

It’s one thing, you know, to throw off the onerous yoke of a British King and his agents, with their vexing taxes, despotic harassments, abuses and usurpations. It’s perhaps another thing “empowering” children to bethink themselves monomaniacs of sexual confusion, years before they’re mentally equipped to devine the conundrums of sex. What, after all, is a “hot mess?” Well, Google’s top search answer, from the Oxford Languages website, defines “hot mess” thusly: a person or thing that is spectacularly unsuccessful or disordered, especially one that is a source of peculiar fascination. Okay, I see: this metaphor signifies what the ruling elites would like our nation to become! And, more generally, western civ — that agglomeration of fusty creeds, shopworn traditions, oppressive laws, dubious virtues, and racist arts. Mission accomplished, then!

On July 4, 2022, America is a hot mess, but exactly! Are we not now spectacularly unsuccessful and disordered — in body, mind, polity, culture, mores, convictions, and aspirations? What is functioning in America these days? Absolutely nuthin’, ugh, say it again, to quote a song lyric of my bygone youth, when our project in Vietnam had gone off the rails. Of course, that was then and this is now. Back then, say 1970, we were the exuberant avatar of Modernity and the rest of the world was still a little groggy from World War Two. In that America, a man could easily support a family, we never gave a thought to our oil supply, and the doctor would see you now.

“..since Russia is such a major commodity country that can continue to trade with major nations, they will over time suffer less than the sanctioning countries.”

• This Implosion Will Be Fast – Hold Onto Your Seats (von Greyerz)

Russia is the second biggest gold producer in the world after China. Just like with oil, gas and many other commodities, the effect will be higher gold prices over time. The gold trade is international and the major buyers of gold are China and India. So Russia can continue to sell gold to the Far East, the middle East and South America. Also, when the EU sanctions started, the LBMA (London Bullion Market Association) decided not to accept gold that had been refined in Russia. So the effect of the G7 ban will be minimal since gold deliveries from Russian refiners to the bullion banks already stopped in early March. Biden also signed an executive order on 15 March this year, prohibiting US persons to be involved with gold trading with Russian parties.

Still, more sanctions by the US and Europe will over time create shortages in gold just as it has in other commodities. So Russia will be able to sell its commodities including gold to other markets at higher prices. But since Russia by far has the greatest commodity reserves in the world at $75 trillion, the value of these reserves are going to appreciate for years as we are now at the beginning of a major bull market in commodities. The US and EU sanctions of Russia affect around 15% of the world population so there are still plenty of markets where Russia can trade. The Roman Empire controlled parts of Europe, North Africa and the Middle East. The Empire prospered primarily due to free trade within the whole area with no sanctions. Sanctions hurt all parties involved. And since Russia is such a major commodity country that can continue to trade with major nations, they will over time suffer less than the sanctioning countries.

The consequences of these sanctions especially for Europe where many countries are dependent on Russian oil and gas will be totally devastating. So the US and Europe have really shot themselves in the foot. Coming back to gold, the US and G7 move is more likely to have a beneficial effect on gold over time with demand increasing and supply being restricted. Gold started an uptrend in year 2001 that lasted for 10 years to 2011 when gold reached $1,920. After a major correction for 3 years until 2016, to $1,060, gold has resumed its exponential uptrend. Although gold has not yet made sustained new highs in dollars, we have seen much higher highs in gold against most currencies. The temporarily strong dollar is making gold look weak measured in the US currency but that is unlikely to last for long.

Incoming!

• Gas Shortage Emergency Would Push Hamburg To Ration Hot Water – Senator (EN)

The north German city of Hamburg will ration hot water and limit heating temperatures in the event of a gas emergency, its environment senator has said. The major port, home to nearly two million people, will ration hot water in homes and limit maximum heating temperatures if there are gas shortages, announced Hamburg Senator for the Environment Jens Kerstan. “In an acute gas shortage, warm water could only be made available at certain times of the day in an emergency,” Kersten told the Welt am Sonntag newspaper, adding that the city was considering a general reduction of maximum room temperatures. Germany’s government is asking citizens and companies to cut back on energy use and help them fill up gas storage facilities before winter, over concerns surrounding Russian gas imports.

In June, Germany moved to stage two of its three-tier emergency gas plan after Russia reduced deliveries via the Nord Stream 1 pipeline. Stage two, called the Alarm Phase, is where there is a “significant deterioration” of gas supplies in Germany. According to Hamburg’s federal emergency plan, homes and critical institutions, such as hospitals, will be prioritised over industry in the third, emergency stage, which is where the government steps in to ration fuel. Yet, this might not be possible in Hamburg as “technical reasons” make it difficult to distinguish between commercial and private customers, according to Kerstan. He added that a possible temporary liquefied natural gas (LNG) terminal in the port of Hamburg could not be operational until next May at the earliest. “In the course of July we will know whether and at which location a temporary LNG terminal in Hamburg is feasible,” said Kerstan.

Sounds like you should negotiate for peace.

• Top German Trade Union Head Warns Entire Industries May Collapse (ZH)

Last month, Russia reduced Nordstream natural gas flows by 60% because of an alleged disruption. German industries, heavily reliant on cheap Russian NatGas, face skyrocketing energy costs that have put many in danger of collapse. “Because of the NatGas bottlenecks, entire industries are in danger of permanently collapsing: aluminum, glass, the chemical industry,” Yasmin Fahimi, the head of the German Federation of Trade Unions, told the newspaper Bild am Sonntag. Fahimi warned: “Such a collapse would have massive consequences for the entire economy and jobs in Germany.” Economics Minister Robert Habeck was quoted by Bloomberg on Saturday saying the government is working to address surging energy costs for utilities and power costs for businesses and households. He warned weeks ago Germany should prepare for further cuts NatGas.

Germany recently triggered the “alarm stage” of its NatGas-emergency plan to address shortages as the energy crisis in Europe’s largest economy is far from over. Habeck had also likened the squeeze on Russian NatGas supplies and its damaging effects on industries to a catalyst that could spark a Lehman Brothers-like crisis. Deutsche Bank’s chief FX strategist George Saravelos told clients days ago he was becoming increasingly concerned about the unfolding energy crisis in Germany. Saravelos pointed out that dwindling NatGas supplies to Germany and the resulting surge in electricity prices have created massive problems for industries and utilities.

The biggest blowup last week was German gas and power utility Uniper. Shares in the company crashed because it only received 40% of NatGas from Russia, and the rest had to be purchased in the open market (outside of long-term contracts), where prices have soared. This has created an immense strain on the utility, losing upwards of $30 million per day, or if annualized, could be an $11 billion loss. Risks are mounting of a full NatGas disruption: “Europe should be ready in case Russian gas is completely cut off,” IEA head Fatih Birol recently told FT.

“.. in 2020, Russia would supply more than half of Germany’s natural gas and about a third of all the oil that Germans burned to heat homes, power factories and fuel vehicles. Roughly half of Germany’s coal imports, which are essential to its steel manufacturing, came from Russia.”

• ‘We Were All Wrong’: How Germany Got Hooked On Russian Energy (G.)

On Sunday 1 February 1970, senior politicians and gas executives from Germany and the Soviet Union gathered at the upmarket Hotel Kaiserhof in Essen. They were there to celebrate the signing of a contract for the first major Russia-Germany gas pipeline, which was to run from Siberia to the West German border at Marktredwitz in Bavaria. The contract was the result of nine months of intense bargaining over the price of the gas, the cost of 1.2m tonnes of German pipes to be sold to Russia, and the credit terms offered to Moscow by a consortium of 17 German banks. Aware of the risk of Russia defaulting, the German banks’ chief financial negotiator, Friedrich Wilhelm Christians, took the precaution of asking for a loan from the federal government, explaining: “I don’t do any somersaults without a net, especially not on a trapeze.”

The relationship would benefit both sides: Germany would supply the machines and high-quality industrial goods; Russia would provide the raw material to fuel German industry. High-pressure pipelines and their supporting infrastructure hold the potential to bind countries together, since they require trust, cooperation and mutual dependence. But this was not just a commercial deal, as the presence at the hotel of the German economic minister Karl Schiller showed. For the advocates of Ostpolitik – the new “eastern policy” of rapprochement towards the Soviet Union and its allies including East Germany, launched the previous year under chancellor Willy Brandt – this was a moment of supreme political consequence. Schiller, an economist by training, was to describe it as part of an effort at “political and human normalisation with our Eastern neighbours”.

The sentiment was laudable, but for some observers it was a potentially dangerous move. Before the signing, Nato had discreetly written to the German economics ministry to inquire about the security implications. Norbert Plesser, head of the gas department at the ministry, had assured Nato that there was no cause for alarm: Germany would never rely on Russia for even 10% of its gas supplies. Half a century later, in 2020, Russia would supply more than half of Germany’s natural gas and about a third of all the oil that Germans burned to heat homes, power factories and fuel vehicles. Roughly half of Germany’s coal imports, which are essential to its steel manufacturing, came from Russia.

The era of cheap oil…

• Iran Slashes Cost of Its Oil to Compete With Russia in China (BBG)

Iran is being forced to discount its already cheap crude even more as a top ally gains a bigger foothold in the key Chinese market. China has become an important destination for Russian oil as Moscow seeks to maintain flows following the fallout from its invasion of Ukraine. That’s led to increased competition with Iran in one of the few remaining markets for its crude shipments, which have been significantly curtailed by US sanctions. Russian exports to China surged to a record in May, with the OPEC+ producer overtaking its cartel ally Saudi Arabia as the top supplier to the world’s biggest importer. While Iran has cut its oil prices to remain competitive in the Chinese market, it’s still maintaining robust flows, likely in part due to rising demand as China eases strict virus restrictions that had crushed consumption.

“The only competition between Iranian and Russian barrels may end up being in China, which would work entirely to Beijing’s advantage,” said Vandana Hari, founder of Vanda Insights in Singapore. “This is also likely to make the Gulf producers uneasy, seeing their prized markets taken over by heavily discounted crude.” China’s official data only lists three months of imports from Iran since the end of 2020, including in January and May this year, but third-party figures indicate a steady flow of crude. After a slight decline in April, imports have been over 700,000 barrels a day in May and June, according to Kpler. Industry consultant FGE says Russian Urals have displaced some Iranian barrels, however.

Iranian oil has been priced at nearly $10 a barrel below Brent futures to put it on par with Urals cargoes that are scheduled to arrive in China during August, according to traders. That compares with a discount of about $4 to $5 prior to the invasion. Iran’s Light and Heavy grades are most comparable to Urals. China’s independent refiners are major buyers of Russian and Iranian crudes, and cheap supplies are important because they’re constrained by rules around exporting fuels, unlike state-run processors. Known as teapots, they are not given quotas to ship fuels to overseas markets, where prices have surged on a supply crunch. Instead, they supply the domestic market and have incurred losses on refining in recent months as virus lockdowns sapped demand.

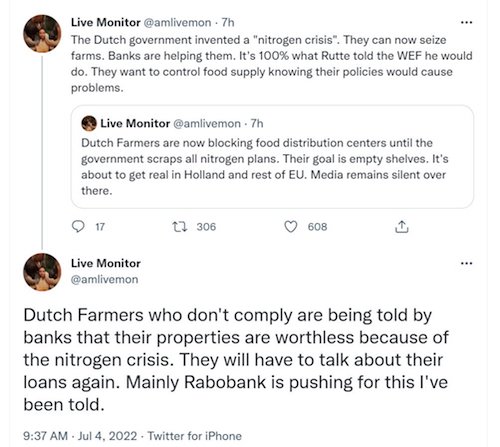

“..a social and economic war between the farmers and Build Back Better government ideology chasing climate change goals.”

• Dutch Farmers Intensify Protests (CTH)

The politicians in Dutch government recently passed sweeping new climate regulations that will result in more than a third of farmers losing their business. The government announced a €25 billion plan to radically reduce the number of livestock in the country in order to curtail emissions. As the Guardian reports, “A deal to buy out farmers to try to reduce levels of nitrogen pollution in the country had been mooted for some time,and was finally confirmed after the agreement of a new coalition government in the Netherlands earlier this week.” The plan is to reduce farming in the Netherlands, by a “one-third reduction in the numbers of pigs, cows and chickens in the country.” However, the farmers are fighting back.

The unorganized grass-roots groups have been randomly blocking roads and transportation hubs for the past three days. They have also been dropping truckloads of manure at the entrances of government businesses. In a show of solidarity, the fishing industry is now blocking ports. Additionally, the farmers are starting to block the distribution centers of supermarkets and key roads forming a cauldron where transit is at a standstill. As grocery store shelves go empty, the government is now asking the military to intervene and stop the farmer blockades. However, the Dutch people overwhelmingly support the farmers. Things have evolved into a social and economic war between the farmers and Build Back Better government ideology chasing climate change goals.

(Reuters) – “Dutch farmers angered by government plans that may require them to use less fertilizer and reduce livestock began a day of protests in the Netherlands on Monday by blocking supermarket distribution hubs in several cities. Amsterdam’s Schiphol airport and KLM, the Dutch arm of Air France, have advised travellers to use public transport, rather than cars, to reach the airport, as farmers’ activist groups said on social media they planned to use tractors to block roads. Several traffic jams were reported on highways in the east of the country and on ferry routes in the north, but none near Schiphol during the morning commute. Dutch and European courts have ordered the Dutch government to address the problem. Farmers say they have been unfairly singled out and have criticised the government’s approach. Monday’s protest is widely supported by farmers’ groups but not centrally organised.”

Laptops and Blackberries.

• Death On The Senate Steps (George Webb)

I wrote about six Senate laptops stolen from the US Senate Sergeant of Arms office after the events I witnessed on January 6th. Now a key witness to the fact, Michael Stegner, the Senate Sergeant of Arms, appears to have been murdered on his way to January 6th testimony. I had the good fortune of having a long-time Biden adviser drop one of the US State Department Blackberrys configured for the US Senate in my lap in May of 2017. In a potential scheme to implicate the Bidens only in dark weapons dealing in Ukraine, the actual perpetrators may have given away key incriminating evidence about themselves. These Blackberrys connected to the Senate Sergeant of Arms laptops I was told. Kickbacks for energy deals in Ukraine seemed to be the motivation for the US Senators like Joe Biden.

One thing is for sure – the “specially configured” US State Department Blackberrys keep leading us to a Ukrainian Billionaire named Igor Kolomoisky. We seemed to be finding one Kolomoisky skeleton in the closet after another looking at the US Senate Ukraine energy deals These “special” US State Department Blackberrys traced all the way back to Beau Biden in Kosovo and Serbian NATO conflicts, and I just made a trek through all these countries tracing the Blackberrys’ early history with the Bidens. Now I had hard evidence these encrypted Blackberrys connected to the US Congress deciding on covert action in Libya, Syria, and Ukraine through an encrypted Blackberry network.

From the very beginning in September 2016, I was on a hunt for US State Department Blackberrys used by Hillary Clinton and her executives John Podesta and Huma Abedin at the Clinton Foundation for Libya topple gains being used to fund Hillary Clinton’s 2016 Presidential Campaign. All suspicions on the very start, beginning with the seemingly fraudulent DNC ‘hack”, focused on one Dmitri Alperovich. I knew Dmitri as the CEO of a hacking team we bought at Network Associates in 2000 to write viruses and port the PGP encryption software to various platforms. From the outset, I knew proving the case against the Clinton Foundation for money laundering would require finding the US State Department Blackberrys that Dmitri configured. I wrote a book later about my chase to find the Dmitri Alperovich US State Department Blackberry trove called “Blackberries Matter” which again was an Amazon bestseller and then also quickly banned.

“We saw [the US] American human rights right here in the corners of prison cells and in torture chambers..”

• Human Rights: the United States and Western Style (Tajik)

The United States of America and its European posse regularly make allegations of human rights abuses against any nation that opposes their policies in the world, resists their aggressive rules, and creates obstacles to their hegemony. In atrocities committed against humans and their rights in real and tangible ways, however, said horde is not only an avant-garde of convoluted methods but also a seasoned practitioner of their own crafts. A real challenge for the US/West, nevertheless, arises when there is indisputable evidence of a clear disconnect between beautiful speeches they deliver on the subject of human rights and atrocious deeds they exact upon humans and their rights anywhere on the planet where they are allowed to do so.

With every use, this tool gets dull rendering it ineffective though. The jig was up for a lot of people decades ago. As Ayatullah Khamenei, the Leader of the Islamic Republic of Iran and the Islamic Revolution reminds us time and again, these shameful entities are nothing but savages and vicious wolves dressed like gentlemen with iron fists wrapped in velvet gloves. As part of an address to a group of Revolutionary Guard Commanders a while back, he described how human rights, as defined and implemented by the US and the West, had touched the lives of so many in the world, including himself and many other Iranians. He said,

“The attractive world the Westerners illustrate – in which human rights and freedom of choice exist – we have experienced that in our own lives during Pahlavi period. We understood the meaning of democracy and human rights in those days. [The US] Americans themselves collaborated with Pahlavi Regime in establishing horrific torture chambers that used torture devices and methods to capture our young people and crush our nation! This is that liberal democracy they are promising the world and their radios advertise to the people of the Third World inviting them to rush to it! They say these things to us, too. We have experimented and experienced this in our own lives. It is not something unfamiliar to us! We have personally touched the dark dictatorial rule of Pahlavi from whose claws blood dripped, from whose entire fabric corruption oozed; all these under the protective umbrella of [the US of] America, with the help of [the US of] America, with reliance on [the US of] America, it repeated these crimes and we literally touched them! These sorts of events are not unfamiliar to us. We saw [the US] American human rights right here in the corners of prison cells and in torture chambers and we felt them with our own meat and skin. Would our people forget these things?!”

Ayatullah Khamenei experienced, firsthand and for years, the torture chambers of then SAVAK (the information and security apparatus of Shah), the entity that had been established by the CIA. SAVAK enjoyed immensely the patronage of the US/West in all its torture endeavors. These first-hand experiences occurred decades before Abu Ghraib photos were released. At that time, the true nature of the US/West’s illiberal inhumanity had not been yet transparently exposed to many in the world.

Deep state.

• Supreme Court Targets the Real Enemy (Tucker)

The flurry of rulings from the Supreme Court has everyone’s head spinning. The most significant among them, even if it doesn’t capture all the headlines, is West Virginia v. EPA. The majority opinion is impressive, but the part I found truly wonderful is the concurring opinion by Justice Neil Gorsuch. This is where we see things headed, toward a major and much-welcome curbing of the power of the administrative state. Just to review what this thing is, it’s an unelected bureaucracy that rules the country without oversight from voters or legislatures. For well over 100 years, most courts have given it a pass, just assuming that the “experts” in the bureaucracies are handling things just fine, faithfully interpreting legislation, and merely creating rules for easy compliance.

Generations have gone by as this fourth branch of government has grown in size, scope, and strength. For the most part, its baneful impositions have been felt by one business or one industry at a time. You have heard the stories. The car dealer complains about how the Department of Labor is making him crazy. The machine-parts manufacturer is going bonkers about letters from the Occupational Safety and Health Administration. The energy company can never satisfy the Environmental Protection Agency (EPA). They are stories and we find them unfortunate, but we’ve generally avoided thinking of these as systematic, all-pervasive, and truly dangerous to the idea of freedom itself. However, there are some 432 of these agencies.

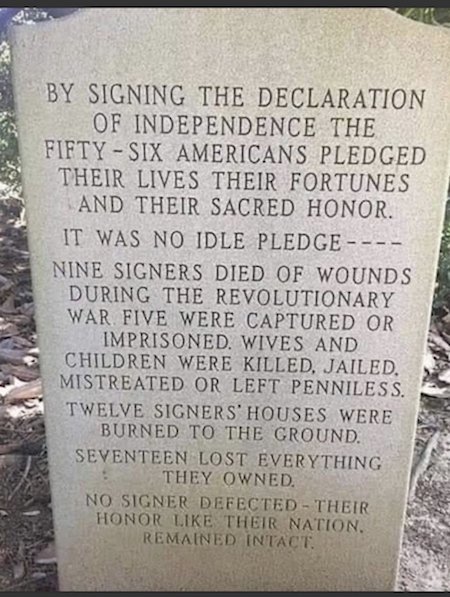

The authors of the Declaration of Independence noted their existence back in the day when they accused the English king of having “erected a Multitude of new Offices, and sent hither Swarms of Officers to harass our People, and eat out their Substance.” They fought a revolution to end the tyranny but now we have a home-grown form, starting in 1883 with the Pendleton Act and continuing throughout the 20th century as each new administration creates its own bureaucracy. The thing has taken on a power of its own. Strangely, the topic hardly comes up at all during elections, and that’s for a reason. Politicians running for office like to advertise their power to make change. They might even believe it. In reality, though, elected officials have very little influence over the conduct of public life relative to the administrative state. As Trump found, not even the president is a match for the deep state.

negative 27 per cent.

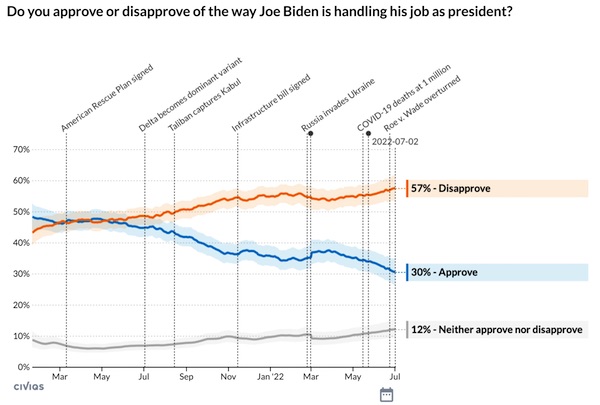

• Biden Job Approval Hits New Low (SN)

As Americans celebrate July the 4th, a new poll shows that President Biden’s job approval has sunk to its lowest level ever.A CIVIQS rolling job-approval average shows that 18 months into his term, Biden’s job approval stands at just 30 per cent, while 57 per cent disapprove of the job he is doing. With 12 per cent of participants refusing to be drawn on whether they approve or disapprove of Biden, his overall net job approval now stands at negative 27 per cent. The figure marks Biden’s worst job approval since becoming president, and he is now underwater in 48 states, with only voters in Hawaii and Vermont showing more approval than disapproval. Having stood at 34 per cent in May, Biden’s job approval has sunk by a further four percentage points, with only 19 per cent of Independents approving of him, and 67 per cent showing disapproval.

Biden’s popularity hasn’t been helped by his endless verbal slip-ups, which have left many Americans concerned about his mental faculties. However, the most damaging aspect of his presidency has undoubtedly been his failure to deal with a cost of living crisis which has seen inflation soar and gas prices hit new records.Biden loyalists have become increasingly absurd in trying to explain away gas price hikes and inflation, with former Treasury Secretary Larry Summers blaming people who downplay what happened on January 6.“The banana Republicans who are saying that what happened on January 6th was nothing or OK are undermining the basic credibility of our country’s institutions and that in turn feeds through, uh, for inflation,” said Summers.

“I can’t imagine what will happen when babies start dying. It’s going to be horrendous.” -Ed Dowd

“I can’t imagine what will happen when babies start dying. It’s going to be horrendous.” -Ed Dowd #2xMRNA #tippingpoint pic.twitter.com/eMqg25mPlT

— Jennifer Arcuri (@Jennifer_Arcuri) July 4, 2022

Scott Ritter: ‘Two-Front War: Biden’s Mouth is Writing Checks the US Military Can’t Cash’

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.