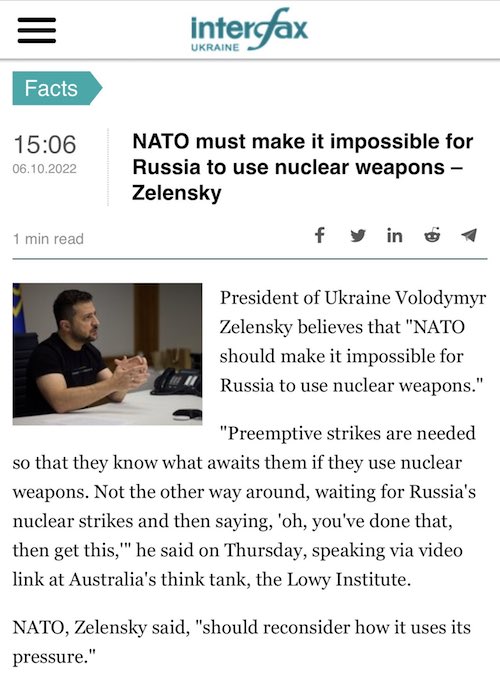

Alessandro Allori Portrait of a Lady c1560

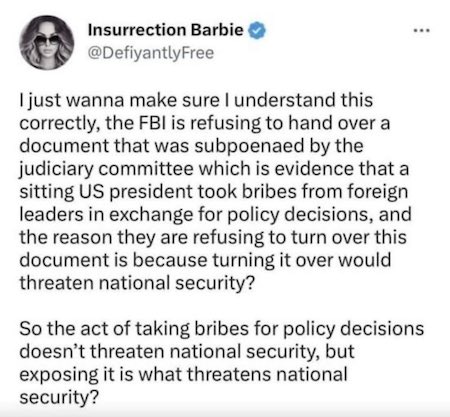

Whistleblowers

Really chilling clip.

James Comer, Chair of House Oversight, says 9 of the 10 whistleblowers that they’ve identified are missing! They’re either currently in court, they’re currently already jail, or they’re missing. He also says he knows who is intimidating them. pic.twitter.com/Uow0XEnPaa

— Charlie Kirk (@charliekirk11) May 14, 2023

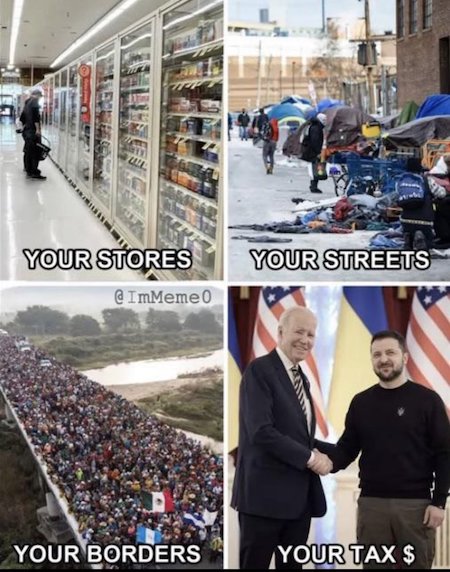

Soros Ukr

Just so you know who set up the war in Ukraine and our billions in taxpayer dollars are paying for it pic.twitter.com/d2gG9A6zU5

— • ᗰISᑕᕼIᗴᖴ ™ • (@4Mischief) May 15, 2023

Macgregor

US colonel Douglas McGregor-

The Ukrainian army loses 500 people daily. pic.twitter.com/VPlPXZwtwg— Spriter (@Spriter99880) May 10, 2023

Prygozhin talks to Kiev. But does he offer to give up military secrets? That’s a stretch.

• Wagner Chief Offered To Give Russian Troop Locations To Ukraine (WaPo)

In late January, with his mercenary forces dying by the thousands in a fight for the ruined city of Bakhmut, Wagner Group owner Yevgeniy Prigozhin made Ukraine an extraordinary offer. Prigozhin said that if Ukraine’s commanders withdrew their soldiers from the area around Bakhmut, he would give Kyiv information on Russian troop positions, which Ukraine could use to attack them. Prigozhin conveyed the proposal to his contacts in Ukraine’s military intelligence directorate, with whom he has maintained secret communications during the course of the war, according to previously unreported U.S. intelligence documents leaked on the group-chat platform Discord. Prigozhin has publicly feuded with Russian military commanders, who he furiously claims have failed to equip and resupply his forces, which have provided vital support to Moscow’s war effort. But he is also an ally of Russian President Vladimir Putin, who might well regard Prigozhin’s offer to trade the lives of Wagner fighters for Russian soldiers as a treasonous betrayal.

The leaked document does not make clear which Russian troop positions Prigozhin offered to disclose. Two Ukrainian officials confirmed that Prigozhin has spoken several times to the Ukrainian intelligence directorate, known as HUR. One official said that Prigozhin extended the offer regarding Bakhmut more than once, but that Kyiv rejected it because officials don’t trust Prigozhin and thought his proposals could have been disingenuous. A U.S. official also cautioned that there are similar doubts in Washington about Prigozhin’s intentions. The Ukrainian and U.S. officials spoke on the condition of anonymity to discuss sensitive information. In an interview with The Washington Post this month, Ukrainian President Volodymyr Zelensky would not confirm the contacts with Prigozhin. “This is a matter of [military] intelligence,” he said. The Ukrainian leader also objected to airing classified information publicly and said he believed that the leaks had benefited Russia.

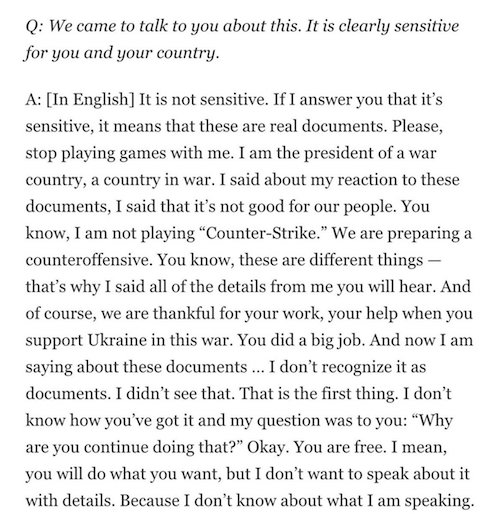

Zelensky doesn’t appear to get it. This is the Discord leaks.

• WaPo Deletes Part of Zelensky Interview Accusing It Of Aiding Russia (Antiwar)

The Washington Post deleted a portion of an interview with Ukrainian President Volodymyr Zelensky, where he accused the paper of helping Russia by posing a question about information contained in leaked classified documents. The interview was conducted on May 1 and published on Saturday. An archived version of the interview shows a testy exchange between Zelensky and the Post, which was later deleted. The Post asked Zelensky about documents they obtained that they said showed members of Ukraine’s Main Directorate of Intelligence, known as HUR, had “back-channel contact” with Yevgeny Prigozhin, the head of the Russian mercenary force Wagner Group. Zelensky appeared to think the Post received the information from a Ukrainian and demanded the paper reveal its source.

“I would also like to ask you a question: With which sources from Ukraine do you have contact? Who is talking about the activities of our intelligence? Because this is the most severe felony in our country. Which Ukrainians are you talking to?” he said. The Post said the information “did not come from Ukraine” and that it was part of the Discord leaks, which revealed information that was obtained by the US spying on Zelensky. The Post said the documents showed Kyrylo Budanov, the head of Ukraine’s Main Directorate of Intelligence, informed Zelensky about a “Russian plan to destabilize Moldova with two former Wagner associates.” The Post added: “Budanov informed you that he viewed the Russian scheme as a way to incriminate Prigozhin because ‘we have dealings’ with him.

You instructed Budanov to inform Moldovan President Maia Sandu, and Budanov told you that the GUR [HUR] had informed Prigozhin that he would be labeled a traitor who has been working with Ukraine. The document also says that Budanov expected the Russians to use details of Prigozhin’s secret talks with the GUR [HUR] and meetings with GUR [HUR] officers in Africa.” Zelensky responded by asking if the paper wanted the help Russia. “You are releasing some sort of information that does not help our state to attack and does not help us to defend our state. So, I don’t quite understand what you are talking about. I don’t quite understand your goal. Is your goal to help Russia?” he said. When the Post responded by saying it didn’t want to help Russia, Zelensky replied, “Well, it looks different.”

It’s not clear why the Post deleted the portion of the interview, but it could have been done at the behest of the Ukrainian government, which had previously pressured CBS News to remove a documentary on military aid to Ukraine. On Sunday night, the Post published a report on the HUR’s alleged contacts with Prighozhin. The report said Prighozhin, who is known to speak out against Russian military leadership, offered to give Ukraine information on Russian troop positions if Ukrainian forces withdrew from Bakhmut. But the report said US and Ukrainian officials thought the proposal was disingenuous. Prigozhin on Sunday made light of the allegations about his contacts with the HUR. According to the Post, he met with Ukrainian intelligence officials in an unnamed country in Africa. “Yes of course I can confirm this information, we have nothing to hide from the foreign special services. Budanov and I are still in Africa,” Prighozhin wrote on Telegram.

There’s more at the URL.

• Here Are The Zelensky ‘Treason’ Quotes The Washington Post Deleted (RT)

The Washington Post has deleted a large tract of an interview with Ukrainian President Vladimir Zelensky in which he lashed out at alleged “traitors” in his ranks. RT is publishing the entire section that the US newspaper would rather keep hidden. The following section appeared in an interview with the Ukrainian president published on Saturday. By Sunday it had been removed with no explanation. After discussing a trove of recently leaked Pentagon documents, which revealed – among other things – that the US monitors Zelensky’s communications, the newspaper presented him with a fresh allegation that has not yet been reported in the US media. Note that Evgeny Prigozhin is the founder and head of the Wagner Group, a Russian private military company currently fighting in the Donetsk People’s Republic.

WaPo: The documents indicate that GUR, your intelligence directorate, has back-channel contact with Evgeny Prigozhin that you were aware of, including meeting with Evgeny Prigozhin and GUR officers. Is that true?

Zelensky: This is a matter of [military] intelligence. Do you want me to be convicted of state treason? And so, it’s very interesting, if someone is saying that you have documents, or if someone from our government is speaking about the activities of our intelligence, I would also like to ask you a question: With which sources from Ukraine do you have contact? Who is talking about the activities of our intelligence? Because this is the most severe felony in our country. Which Ukrainians are you talking to?

WaPo: I talked to officials in government, but these documents are not from Ukraine, they are from…

Zelensky: It doesn’t matter where the documents are from. The question is with which Ukrainian official did you talk? Because if they say something about our intelligence, that’s treason. If they say something about a specific offensive plan of one general or another, this is also treason. That’s why I asked you, which Ukrainians are you talking to?

WaPo: About these specific documents? You are the first person I am talking to about them.

Zelensky: Okay.

WaPo: And I can read you what information exactly there is about Prigozhin and the GUR. On February 13, Kirill Budanov, chief of Ukraine’s Main Directorate of Intelligence, informed you about a Russian plan to destabilize Moldova with two former Wagner associates. Budanov informed you that he viewed the Russian scheme as a way to incriminate Prigozhin because “we have dealings” with him. You instructed Budanov to inform Moldovan President Maia Sandu, and Budanov told you that the GUR had informed Prigozhin that he would be labeled a traitor who has been working with Ukraine. The document also says that Budanov expected the Russians to use details of Prigozhin’s secret talks with the GUR and meetings with GUR officers in Africa…

Zelensky: Listen, to be honest, well, you just read something, you say something. I just don’t understand where you get it, whom you talk to and so on. You talk about how I met with Budanov. This suggests that you – how do you put it? It looks like you have people who have some records or you have some evidence or you have something, because that’s what it looks like. You are again doing, I apologize, what you were doing before. You are releasing some sort of information that does not help our state to attack and does not help us to defend our state. So, I don’t quite understand what you are talking about. I don’t quite understand your goal. Is your goal to help Russia? I mean, that means we have different goals. If I’m not sitting at the same table with them, I don’t quite understand what we’re talking about. Each of these inquiries simply demotivates Ukraine, demotivates certain partners to help Ukraine. Well, one way or another, I just don’t understand your goal.

WaPo: Our goal is not to help Russia.

Zelensky: Well, it looks different.

WaPo: No one gave us this information personally. These were in the leaked documents, which do indicate, as I said earlier, that the United States is listening in on you.

“..This narrative is promoted by those who “don’t want to see Ukraine win..”

• Western Pressure Can ‘Screw Up’ Ukrainian Counteroffensive: Ex-US General (RT)

The West could sabotage Ukraine’s much-hyped anticipated counteroffensive against Russia by piling up too much pressure on Kiev, a retired US general has warned. In an interview to Business Insider released on Thursday, Ben Hodges, former commander of US Army Europe, cautioned that portraying Ukraine’s push to reclaim lost territories as a make-or-break offensive could set a dangerous precedent and derail it even before its starts. “The only thing I think that can screw this up is if the West exerts so much pressure on Ukraine and it causes them to stop short of a total victory,” he told the outlet. Echoing remarks by some top Ukrainian officials, Hodges went on to say that he would “reject the talk that Ukraine’s only got one shot” at the offensive, and if it fails to “achieve a knockout blow,” then its Western backers would stop supporting Kiev.

This narrative is promoted by those who “don’t want to see Ukraine win,” he added. Hodges also noted that many top White House officials “are not committed to Ukraine absolutely winning,” rebuking the administration of US President Joe Biden for failing to clearly define its strategic objectives in the conflict. With speculation rampant in recent months about an imminent spring push, in late March Ukrainian Foreign Minister Dmitry Kuleba attempted to downplay its significance, saying that “we should counter by all means the perception of the counteroffensive as the decisive battle of the war.”

Earlier this week, Ukrainian President Vladimir Zelensky claimed that Kiev was ready for the offensive, but still needed a bit more time for the conditions to become optimal and for the groundwork to be laid so as to avoid “unacceptable” losses. However, in late March General Mark Milley, chairman of the US Joint Chiefs of Staff, voiced skepticism about the planned offensive, warning that Ukraine would have a hard time “kicking every Russian out” of the territories it claims as its own. In April, commenting on the potential move by Kiev, Kremlin Press Secretary Dmitry Peskov said that the Russian military “thoroughly tracks all the relevant information.”

This implicates us who support them.

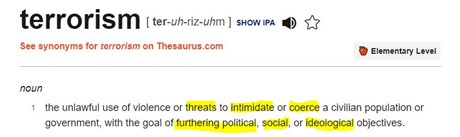

• Ukraine Now De-Facto ‘State-Sponsor Of Terrorism’ – Kremlin (RT)

Ukraine has de-facto turned into a “state-sponsor of terrorism,” Kremlin spokesman Dmitry Peskov has said. The official made the remarks in an interview with journalist Pavel Zarubin that aired on Sunday. The spokesman was asked for comments about a recent pledge by Ukraine’s military intelligence chief Kirill Budanov, who vowed to “keep killing Russians anywhere” across the globe. Despite their explosive nature, the remarks did not face any criticism from Kiev’s Western sponsors, Peskov noted. “The statement is unprecedented in its essence. And of course, it will be strange not to hear any words of condemnation from European capitals and from Washington. Logic says it’s impossible to do without condemnation,” he said. Budanov’s admission was yet further proof that Kiev has been directly orchestrating terrorist attacks against Russians, Peskov added.

The spokesman said that Russia’s “special services know what to do after such statements,” but did not elaborate on the potential countermeasures against such activities. “It’s evident that the Kiev regime is behind the killings, not only sponsoring them, but organizes, incites and carries them out. De-facto, we’re talking about a state-sponsor of terrorism.” The controversial remarks were made last week by the boss of the Ukrainian Defense Ministry’s Main Directorate of Intelligence (GUR) in an interview with Yahoo News. Budanov boasted that “we’ve been killing Russians” and will “keep killing Russians anywhere on the face of this world until the complete victory of Ukraine.” The statement came in response to a question whether the GUR had anything to do with last year’s murder of Darya Dugina, a journalist and daughter of prominent Russian philosopher Aleksandr Dugin. Budanov dismissed accusations of engaging in terrorism, stating that what Russia calls “terrorism, we call liberation.”

The terrorist activities that Moscow has attributed to Kiev have picked up in recent months. In April, for instance, Russian military blogger Vladlen Tatarsky was killed in St Petersburg with an improvised explosive device that had been concealed in a statuette handed to him during an event. The blast killed the blogger on the spot and injured over a dozen others. Russia’s Security Service (FSB) has blamed the blast on “Ukrainian special services and their agents, including fugitive members of the Russian opposition.” Last week, Russian author and political activist Zakhar Prilepin was targeted in a car bombing near the city of Nizhny Novgorod. The blast left Prilepin critically injured, and killed his close associate, who was inside the vehicle at the moment of the attack.

Plenty old videos with Joe as supremacist.

• White Supremacy Is ‘Most Dangerous Threat’ To US – Biden (RT)

In a speech to black college graduates on Saturday, US President Joe Biden labeled ‘white supremacy’ the most dangerous terrorist threat to the US. The statement – which is contradicted by crime statistics – was condemned by conservative pundits. “White supremacy… is the single most dangerous terrorist threat in our homeland,” Biden told graduates from Howard University, a historically black university (HBCU) in Washington DC. “I’m not just saying this because I’m at a black HBCU. I say this wherever I go,” Biden continued. “Fearless progress toward justice often means ferocious pushback from the oldest and most sinister of forces. That’s because hate never goes away… it only hides under the rocks.”

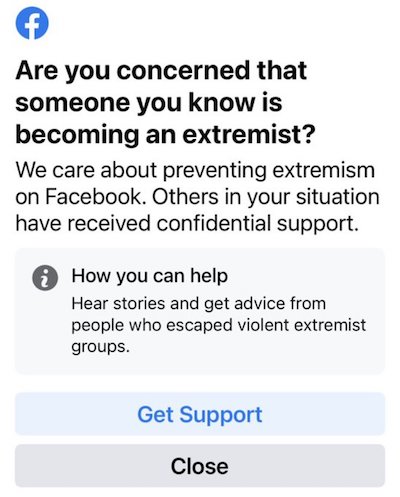

Throughout his time in office, Biden has often talked up the threat of white supremacy, claiming that belief in the superiority of the white race motivated former President Donald Trump’s supporters to riot at the US Capitol in January 2021, and declaring last year that black people live in fear of being “gunned down by weapons of war deployed in a racist cause.” In mid-2021, the Biden administration published the US government’s first ever National Strategy for Countering Domestic Terrorism, which named “racially motivated violent extremists” and anti-government extremists as “the two most lethal elements of today’s domestic terrorism threat.”

According to FBI crime statistics, the average Howard University graduate is 11 times more likely to be murdered by a member of their own race than a white perpetrator. While African-Americans commit the majority of all violent crime in the US, most crime – whether committed by white or black Americans – is intraracial. Biden’s statement was condemned by conservative pundits, who accused the president of using divisive rhetoric to solicit votes. “The Democratic Party spent most of the 19th Century and much of the 20th using overt racism to win elections,” libertarian activist Jon Miltimore tweeted, adding that “They are doing it again in the 21st century. The racism just looks a lot different than the 19th century version.” Journalist Julie Kelly called Biden a “pathological liar” and accused him of fueling “dangerous racial division.”

“exceptional work performed in the service of European unity.”

• The Charlemagne Prize for Hypocrisy and Mass Murder (Vogel)

On Sunday, 14 May 2023, Ukrainian President Volodimir Zelensky will receive the Charlemagne Prize for “exceptional work performed in the service of European unity.” The Prize will be given to Zelensky himself and to the Ukrainian people. The official citation is full of praise, lofty terms and high ideals, but somehow there is a ring of insincerity about it. Obviously, the Prize is given because eight years after starting a war against what it claims to be its own citizens, the Ukraine is now engaged in a real battle with its Russian neighbor. After shelling cities of the Donetsk and Lugansk regions, killing at least some 15,000 civilians and wounding countless others, Ukrainian soldiers and their NATO mentors now have to face a real enemy.

With European nations, as members of NATO and US vassal states, participating in brutal killing sprees in Yugoslavia, Iraq, Libya, Syria, Afghanistan, and given the violent past of nations like England, France, the Netherlands, Belgium, Germany, Spain, Portugal, Italy, Sweden and Denmark, what right do they have of lecturing Russia? The citation speaks of “an unspeakably brutal Russian war of aggression that contravenes international law, directed against the European Social Order, Security Order and Peace Order, with the objective of destabilising the European community of peoples…” As for upholding the principle of sovereignty that the EU supposedly holds so high and for which Zelensky is being praised to the skies, like everything else in the citation, it is a cynical sham. If the Ukraine is entitled to sovereignty and independence, what about Catalonia?

The last time the Catalans, who since the 17th century have desperately wanted to be sovereign and independent, tried to achieve this peacefully, they were brutally repressed by the government in Madrid and the unelected apparatchiks in the European Commission in Brussels. The European values defended by the guy with the hoarse voice and the olive green t-shirt are actually the same as those of the years 1941-45 when all of Europe was in the East trying to defeat the Red Army. Nevertheless, the Charlemagne Prize citation says about Zelensky and the Ukraine: “His country is defending Western values, unassailable principles of coexistence, peace and freedom, and therefore precisely what the European Union stands for politically.” All of it pure baloney.

Since 1950, the German city of Aachen has been giving the annual prize for helping to promote “European unity.” In 1955, it was given to Sir Winston Churchill who, only eleven years before, had in fact been responsible for flattening the ancient city with all its priceless monuments and killing almost two thousand of its citizens. Apparently, the Prize Committee believed that killing men, women and children with aerial bombardments was “exceptional work performed in the service of European unity.” The Committee still held that view half a century later when it gave the Charlemagne Prize to Tony Blair (1999), Bill Clinton (2000) and Javier Solana (2007). In their respective functions as British Prime Minister, US President and NATO Secretary General, this trio was responsible for destroying the European nation of Yugoslavia and bombing the European nation of Serbia, killing thousands of Serbian men, women and children. Many of those who escaped NATO bombs were contaminated by radioactive material from the depleted uranium munitions dropped on Serbia. Indeed, “exceptional work performed in the service of European unity.”

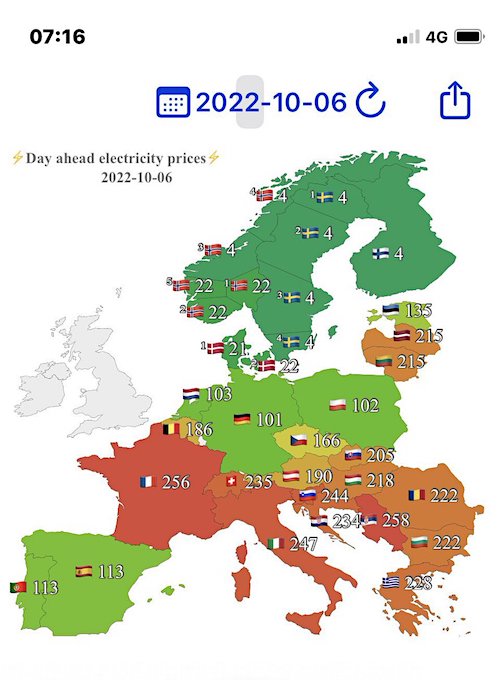

Wait till it gets colder.

• G7 and EU To Ban Restart Of Russian Gas Pipelines (RT)

The G7 and EU will ban Russian gas imports on routes where Moscow has cut supplies, according to officials involved in the negotiations, the first time pipeline gas trade has been blocked by Western powers since the invasion of Ukraine, Report informs via the Financial Times. The decision, which is to be finalized by G7 leaders at a summit in Hiroshima next week, will prevent the resumption of Russian pipeline gas exports on routes to countries such as Poland and Germany, where Moscow cut off supplies last year and triggered an energy crisis across Europe. Western powers want to ensure that Russia does not receive a boost to its energy revenues as they attempt to raise economic pressure 15 months after Moscow’s full-scale invasion of Ukraine.

One of the officials, all of whom spoke on condition of anonymity, said the move was “to make sure that partners don’t change their mind in a hypothetical future”. A draft G7 statement seen by the Financial Times said that the group of leading economies would further reduce their use of Russian energy sources “including preventing the reopening of avenues previously shut down by Russia’s weaponization of energy” at least until “there is a resolution of the conflict”. While the measures are unlikely to affect any immediate gas flows, it underscores a deep determination in Brussels to make permanent the rapid and painful pivot away from decades of reliance on Russian energy. The ban is highly symbolic because, at the start of the war, the EU had avoided targeting pipeline flows given their huge dependence on Moscow’s gas. Russia went ahead and cut supplies anyway, sparking a surge in gas prices to more than 10 times their normal level.

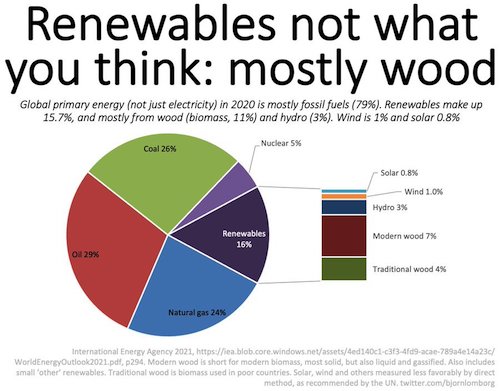

But in recent months prices have fallen substantially as Europe successfully cut demand over winter, accelerated the roll out of renewable energy and sourced alternative supplies such as seaborne cargoes of LNG. Moscow’s share of the European gas imports has fallen from more than 40 percent to less than 10 percent, and a mild winter has boosted gas storage in the EU. Officials are confident that gas storage, which is already some 60 percent full compared with roughly 30 percent at the same time in 2022, will reach capacity long before the next winter arrives. Oil pipelines where Russia has cut supplies, including the northern leg of the Druzhba line that supplies refineries in Germany and Poland, could also be blocked under EU measures to prevent a resumption in flows.

The embargo is being discussed by diplomats as part of the EU’s 11th sanctions package. The commission said it would not comment on sanctions discussions or leaks. One EU diplomat said that the proposal needed more clarification from Brussels to show how the “status quo” would change, particularly as some oil from Kazakhstan flows through Druzhba. “It has to be clear exactly how it would work,” they said. Berlin and Warsaw, despite having an exemption from sanctions on Russian oil, said that they would voluntarily end deliveries of crude through Druzhba last year although Poland continued to receive supplies until Russia cut off flows in February. German refineries stopped ordering Russian crude from the beginning of this year.

Aaron Maté territory.

• Play it Again Uncle Sam… Debunked Syrian Chemical Weapons Card in Ukraine (SCF)

The CW card is a complete dud. That Western media are playing it shows that their role is as sinister as mass drug-dealing. Western media are now accusing Russian forces of preparing to use chemical weapons (CW) of mass destruction in Ukraine, thereby making the case for greater NATO military intervention. The CW card is a complete dud. That Western media are playing it shows they are also complete duds, and that their role is as sinister as mass drug-dealing. Deliberate provocation by Western powers is the watchword. Britain this week supplying long-range missiles, as well as depleted uranium artillery shells, and drone attacks on the Kremlin are part of a sequence to solicit never-ending escalation. Accusing Russia of planning to use chemical weapons of mass destruction, as with earlier claims of Russia willing to use nuclear weapons, is all part of the orchestrated provocation.

The degradation of Western media standards has become so bad that they can get away with retailing such nonsense to consumers of this “information”. First of all, Russia does not have any chemical weapons. As a signatory to the international treaty known as the Chemical Weapons Convention (1997), the Russian Federation verifiably destroyed all of its arsenals as per its signatory obligations. The complete decommissioning of these weapons by Russia in 2017 was verified by the Organization for the Prohibition on Chemical Weapons (OPCW). The United States is the only major power that has not fully implemented the CW convention by retaining stockpiles of these weapons. Not only is speculation about Russian forces possibly using CW in Ukraine baseless, but the Western media are also deploying the shoddy lie used earlier against Syria. Incredibly, for anyone cognizant of the facts, such calumny is still peddled to blame the wrong people when the real perpetrator in Syria was Western-backed militants and their CIA and MI6-sponsored media accomplices, the so-called White Helmets.

Western media continue to claim that the Syrian government forces of Bashar al Assad used CW against civilians during the decade-old civil war in the Arab country. Russia supported the Syrian army to defeat NATO-backed radical extremists. Now the Western media are moralizing that the United States and other Western powers took no punitive action against Syria over CW which, it is contended, is acting as a precedent for Russia to use these weapons in the Ukraine conflict. Euronews quotes Hamish de Bretton-Gordon, a former British military intelligence officer, as saying: “The international community needs to reaffirm that any use of chemical or biological weapons would not be acceptable in any shape or form… I’m sure NATO and the West would act if they [Russia] used chemical weapons in Ukraine. But having said that they stood by when Assad used such weapons in Syria and that might embolden Putin.”

This is an outrageous lie being propagated by the Western media. It has been documented by independent investigations that the CW attacks in Syria were actually carried out by NATO-backed mercenaries in false-flag operations to provoke Western military intervention. One of those false flags in the city of Douma in April 2018 succeeded in its nefarious aims. Following the incident – dutifully amplified at the time by Western media for gaslighting the Western public – U.S. President Donald Trump bombed Syria “in revenge” along with British and French allies. However, it turned out later that Syria, Russia and Iran were vindicated in their initial claims that the CW incidents in Syria were false-flag stunts. Indeed, it was shown that personnel in the UN watchdog, the OPCW, engaged in a cover-up to implicate the Assad government when the real perpetrator was the jihadists backed by the West, as reported by Aaron Maté and other independent journalists.

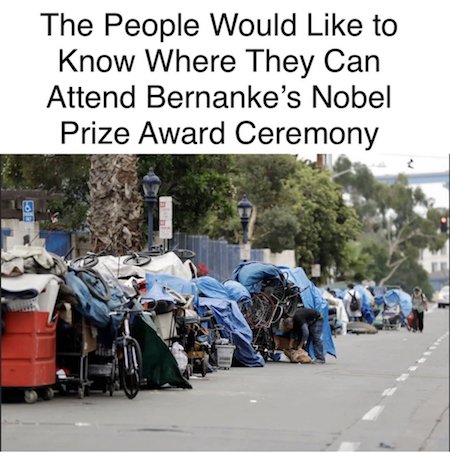

The defence fund for former Marine Daniel Penny is at $1.6 million.

• Deliver Us from Reality (Kimball)

“Because he can.” That’s the answer one has to give to those who ask how Alvin Bragg, a local district attorney in office by the slimmest of margins—and then only because of a huge subsidy from the anti-American billionaire George Soros—can get away with antics like indicting Donald Trump, a former (and, possibly, future) president of the United States, and, now, with charging former Marine Daniel Penny with manslaughter because he (along with at least two others) intervened to stop Jordan Neely from attacking fellow passengers on a New York subway. Because he can. As a friend remarked when digesting the spectacle of Penny being led away in handcuffs, totalitarian movements often start slowly, almost timidly, but as they gain power, they become more brazen. After a certain point, they do outrageous things just to intimidate the public and demonstrate their power.

We now know that the FBI, the CIA, and other elements of America’s security apparatus intervened directly in the decision making of Twitter and other social media companies to influence the course of the 2020 election. One part of that intervention had to do with organizing 51 senior former intelligence figures to sign a letter declaring that Hunter Biden’s laptop was “Russian disinformation.” That was a lie. They knew it was a lie. It didn’t matter. They did it because they knew they could get away with it. The United States is on the verge of being inundated with thousands upon thousands of illegal aliens. Many are from South or Central America. Hundreds are from China, even though they are crossing that notional line we used to be able to call, without irony, our southern border. Why did the Biden Administration decide to enact a real-life Camp of the Saints invasion of the United States? Because it could. There was no immediate price to pay.

In her classic study, The Origins of Totalitarianism, Hannah Arendt makes several observations that bear on our current situation. “There is no doubt,” she observes, “that the elite was pleased whenever the underworld frightened respectable society into accepting it on an equal footing. The members of the elite did not object at all to paying a price, the destruction of civilization, for the fun of seeing how those who had been excluded unjustly in the past forced their way into it. They were not particularly outraged at the monstrous forgeries in historiography of which all totalitarian regimes are guilty and which announce themselves clearly enough and totalitarian propaganda.”

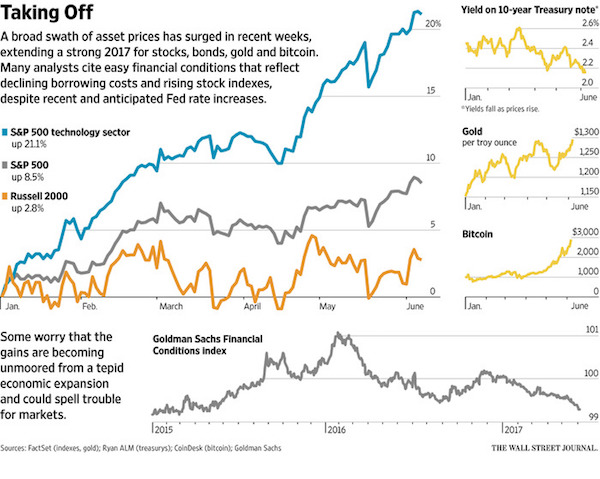

“..currency as a medium of exchange which allows us to turn our production into our consumption..”

• The Dynamics Driving The Dollar Down (Macleod)

John Maynard Keynes did the world a disservice with his offhand dismissal of Say’s law. Consequently, economists have lost the true relationship between production and consumption. And we have lost our understanding of the true role of currencies as a medium of exchange. Nearly all our economic errors have flowed from this dismissal. In order to understand the seriousness of it with respect to the dollar today, the denial of Say’s law is no less than a denial of the division of labour. Yet, plainly, the division of labour is the basis of all human economic activity. Without having something to sell, we cannot buy the things we need which we are unable to provide for ourselves efficiently or easily. Where we differ from other animals is that we develop our personal skills to maximise the value of our specialised production so that we can increase our wider consumption for the greatest relief of our needs and desires.

Our individual skills are the key that provides our wealth. And it is the role of currency as a medium of exchange which allows us to turn our production into our consumption. Several things follow from this truism. One is that if we reduce our total production, we reduce our total consumption, because the former leads to the latter. No, say the Keynesians, who put it the other way round. They say that if we reduce our consumption there will be a general glut of goods on the market and then prices will fall, leading to unemployment. The error is to not understand that first we must produce in order to consume, so that there cannot be a general glut, only changes in the level of productive output which are broadly matched by changes in overall consumption.

Surely, this can be easily understood even by non-experts. But this deliberate error — for that is what it can only have been — has led to a misunderstanding of the role of the medium of exchange. It provides the means to exchange goods of unequal value: for example, a cobbler makes shoes and boots, whose unit value will be greater than the individual food items he requires daily to feed his family. It also provides producers with the credit required to finance production, paying costs incurred before a final product is sold and creditors repaid. This is the essence of trade. And so long as transacting individuals only produce to consume, the expansion and contraction of the sum total of money and credit purely in connection with that trade cannot alter their value in terms of goods and services generally. Not so, say Keynes’s macroeconomists, now joined in chorus by the monetarists. They claim that expansion of money and credit alters the general price relation. Both believe in manipulating credit to this end.

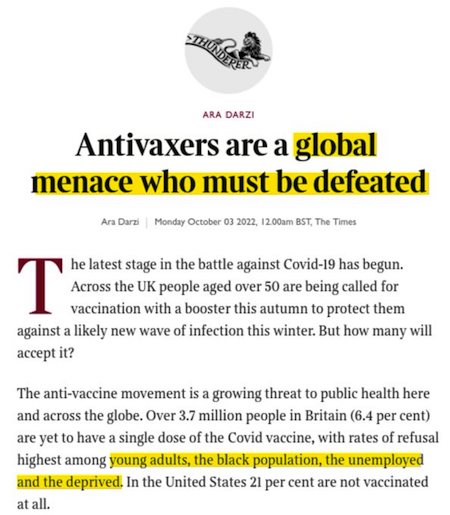

“..the most aggressive global propaganda attack in modern history..”

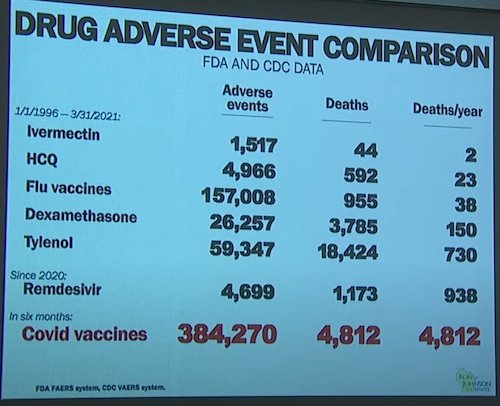

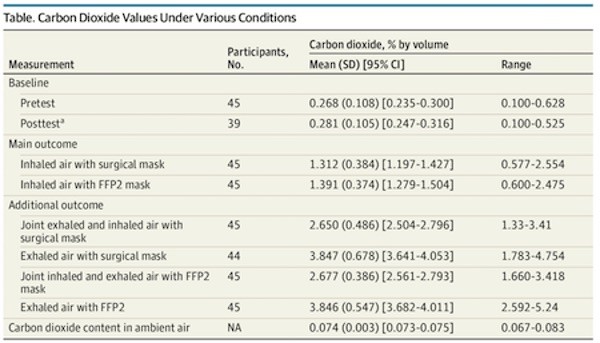

• Never Forget: A Retrospective On The Media Lies Surrounding COVID (ZH)

Lest we get too comfortable once again and forget that only a couple years ago the western world was on the verge of perpetual medical tyranny, it is important to look back at the massive media disinformation campaign concerning the effectiveness (or lack of effectiveness) of the pandemic mandates and the mRNA vaccines. Only two years ago, the public was bombarded by possibly the most aggressive global propaganda attack in modern history. And, this campaign was a conjoined effort between national governments, global institutions and corporations.

Keep in mind, all the hysteria was generated over a virus with a median official Infection Fatality Rate of only 0.23%. That’s right, all the fear mongering featured in the video below was in reaction to a “pandemic” that 99.8% of the population would easily survive, and this death rate was known only months after the spread started. Also keep in mind that essentially every single claim made by the media concerning covid featured below ended up being false. In many cases, the media knew that scientific evidence ran contrary to their narrative, but they promoted that narrative anyway. Enjoy this flashback of corporate media covid fear mongering, and never forget…

Covid Retrospective Series, Vol. 1

Media: The Unvaccinated Are Scum pic.twitter.com/hPvLfEtW3O

— Tom Elliott (@tomselliott) May 12, 2023

No play no pay?

• Assange Allies Turn to Squire Patton Boggs to Help Lobby DOJ (BBL)

A WikiLeaks fundraising organization has hired Squire Patton Boggs to lobby the Justice Department on behalf of the site’s publisher, Julian Assange, amid his espionage charges, according to public records and three sources familiar with the matter. German foundation Wau Holland has paid Squire at least $1.2 million since last October to push DOJ on journalists’ rights to publish classified information, federal disclosures show. The sources said the global law and public policy firm has been seeking a meeting with the department to discuss how the espionage case against Assange holds up in light of Attorney General Merrick Garland’s recent policy to protect journalists from enforcement actions.

The hiring of one of Washington’s most storied and influential firms marks an escalation of a years-long public advocacy campaign. Advocates haven’t yet succeeded in persuading the Biden administration to abandon the Trump-era prosecution of Assange for publishing classified war documents. There’s no sign the two Squire attorneys listed on the lobbying disclosures—both former government lawyers—have made headway in convening with DOJ officials to understand how Assange’s charges mesh with Garland’s press-friendly approach. But their campaign on behalf of someone condemned by members of both political parties, which hasn’t been previously reported, represents the Big Law firm’s most lucrative federally-disclosed work over the past six months.

Assange is a polarizing figure due to his high-profile national security breaches and publication of hacked Democratic National Committee emails in 2016. He was arrested in 2019 in London on a US warrant and remains detained as he fights his extradition. Squire’s efforts align with press freedom and civil liberties groups, major news outlets, and the House’s progressive wing, who have warned that extraditing Assange from the UK and putting him on trial in US court would threaten First Amendment rights. [..] Squire received $600,000 from the Wau Holland Foundation in each of the prior two quarters starting in October 2022, according to lobbying filings disclosed in mid-April. The foundation, a longtime Assange and WikiLeaks financer, enlisted the firm to lobby DOJ on “First Amendment issues related to the publication by journalists of classified information,” Squire said in the filings.

Khan

BREAKING: Imran Khan Says 'THEY' Will Try to Kill Him

During an interview with Sky, Imran Khan expressed his concern that 'they' would make attempts to either imprison or assassinate him.

He believes that 'they' are afraid of a free and fair election, given his party currently… pic.twitter.com/T5UmQMJv51

— Sulaiman Ahmed (@ShaykhSulaiman) May 14, 2023

Leopard

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 15, 2023

Deepest fish

Scientists at University of Western Australia set new record for deepest fish ever filmed at a depth of 8,336 meters.

During an expedition that took place in August 2022, the research vessel DSSV Pressure Drop embarked on a two-month journey to investigate trenches in the… pic.twitter.com/lITNAsqWBV

— Historic Vids (@historyinmemes) May 14, 2023

Big cats

Big cats.. pic.twitter.com/jbNSSvF9Wt

— Buitengebieden (@buitengebieden) May 14, 2023

Orca

— Shibetoshi Nakamoto (@BillyM2k) May 13, 2023

Boobies

Blue footed boobies.. 😊

🎥 IG: azeekeith11 pic.twitter.com/aHAtIQd4BT

— Buitengebieden (@buitengebieden) May 14, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.