Olivier Drot Morning in Downtown Athens June 7 2017

The inevitable result of no price discovery for years on end. Do note that no price discovery also means there are no investors.

• Spring Rally in Stocks, Bonds, Gold and Bitcoin Unnerves Investors (WSJ)

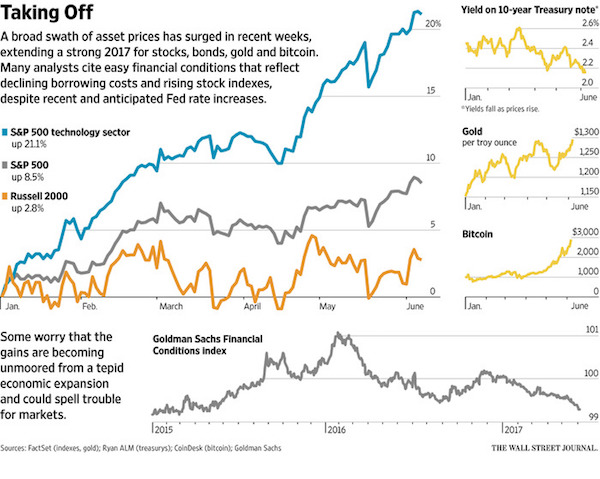

Stocks, bonds, gold and bitcoin—assets that rarely move in unison—have all been surging this spring, an everything rally that leaves investors confounded about how to play the plodding U.S. expansion and vulnerable to sharp reversals in fortune. Major U.S. stock indexes have soared to records this month, reflecting some investors’ confidence in the continued U.S. economic recovery along with expectations that large technology firms will accrue further market-share gains. At the same time prices of bonds, which often decline when stocks are rising, have risen lately, as U.S. inflation readings cooled off alongside a slowdown in some key industries. Gold has gained following terror attacks in the U.K., and turmoil in U.S. politics centering on the administration’s legislative prospects and a key congressional hearing this week featuring former FBI director James Comey.

The simultaneous gains have begun to concern some investors. Many point to a wave of money that is driving up asset prices, tied in part to lower bond yields and a lower dollar—a confluence of events they say feels good while it lasts but can’t go on forever. “We do think there are distortions” in the markets, said Iman Brivanlou, who oversees high-income equities at asset manager TCW. The Dow Industrials this month have posted two record closes, their first since March, and the 30-stock index remains just 0.33% below its all-time high despite a decline Tuesday of 47.81 points to 21136.23. The Nasdaq Composite Index has hit more than three dozen new highs this year, reflecting the surge of red-hot tech stocks such as Alphabet and Amazon.com , both of which this month have surpassed $1,000 a share. Bitcoin has tripled this year, hitting a record high Tuesday.

At the same time, U.S. bond yields on Tuesday sank to their 2017 low at 2.147% and the price of gold, long viewed as a barometer of market concern about potential risks ahead, settled at $1,294.40, its highest in seven months. A Goldman Sachs Group index of financial conditions that takes into account credit spreads, equity prices and other market gauges, this month suggested the easiest conditions since early 2015, before the Federal Reserve began lifting rates. Another measure of stress in U.S. money markets fell to near its lowest in seven years, while measures of expected stock-market swings have been at the lowest in a decade.

A global issue.

• Trump’s America Is Facing a $13 Trillion Consumer Debt Hangover (BBG)

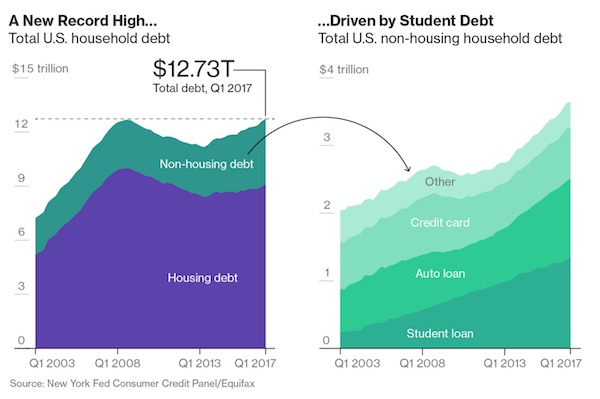

After bingeing on credit for a half decade, U.S. consumers may finally be feeling the hangover. Americans faced with lackluster income growth have been financing more of their spending with debt instead. There are early signs that loan burdens are growing unsustainably large for borrowers with lower incomes. Household borrowings have surged to a record $12.73 trillion, and the%age of debt that is overdue has risen for two consecutive quarters. And with economic optimism having lifted borrowing rates since the election and the Federal Reserve expected to hike further, it’s getting more expensive for borrowers to refinance. Some companies are growing worried about their customers. Public Storage said in April that more of its self-storage customers now seem to be under stress.

Credit card lenders including Synchrony Financial and Capital One Financial are setting aside more money to cover bad loans. Consumer product makers including Nestle posted slower sales growth last quarter, particularly in the U.S. Companies may have reason to be concerned. Consumer spending notched its weakest gain in the first quarter since the end of 2009, a problem in an economy where consumers account for 70% of spending, though analysts expect the dip to be transitory. And debt delinquencies are rising even as the job market shows signs of strength. “There are pockets of consumers that are going to be sorely tested,” said Christopher Low, chief economist at FTN Financial. “We’ve conditioned American consumers to use debt to close the gap between their wages and their spending. When the Fed hikes, riskier borrowers are going to get pinched first.”

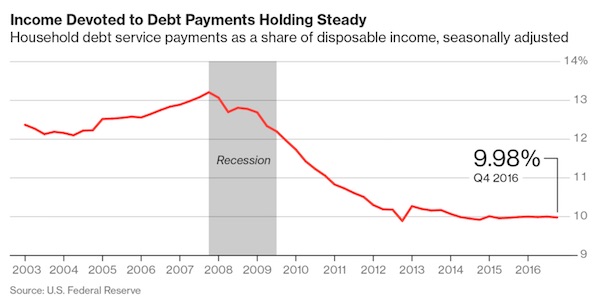

Since the 2008 financial crisis, the Fed has kept rates low to encourage companies and consumers to borrow more and spur economic growth. Much of the gains in household debt since 2012 have come from student loans, auto debt and credit cards. Over that time, wage growth has averaged around 2.2% a year, and the pace has been slowing for much of this year. Even if economists forecast that income growth will accelerate, those pickups have remained elusive. Donald Trump won the U.S. presidential election in part by convincing voters that he understood their economic pain. Keeping up with household debt payments is still broadly manageable for consumers. As of the end of last year, the ratio of principal and interest payments to disposable income for Americans was just shy of 10%, less than the average going back to 1980 of 11.33%.

And it’s too soon to say whether growing signs of pain among borrowers are just a return to more normal levels of delinquencies or evidence of a more serious credit downturn. Loan delinquencies are creeping higher after plunging from 2010 until the middle of 2016, but are still below historical averages.

This can only disappoint. The echo chamber is overcrowded.

• Bars Open Early Tomorrow So People Can Drink While Watching Comey Testify (BI)

If you want to have a drink while watching former FBI director James Comey testify before the Senate Intelligence Committee on Thursday, you’re in luck. Bars in Washington, DC, San Francisco, and Houston, Texas, are opening early on Thursday to screen Comey’s testimony, which is scheduled to begin at 10 a.m. EST. “Come on… you know you want to watch the drama unfold this Thursday,” Shaw’s Tavern, which will be serving $5 Stoli vodka and “FBI” sandwiches, wrote on Facebook. “Grab your friends, grab a drink and let’s COVFEFE!”

Oh boy, you can’t win, can you?

• Other Times Unemployment Has Been This Low, It Didn’t End Well (WSJ)

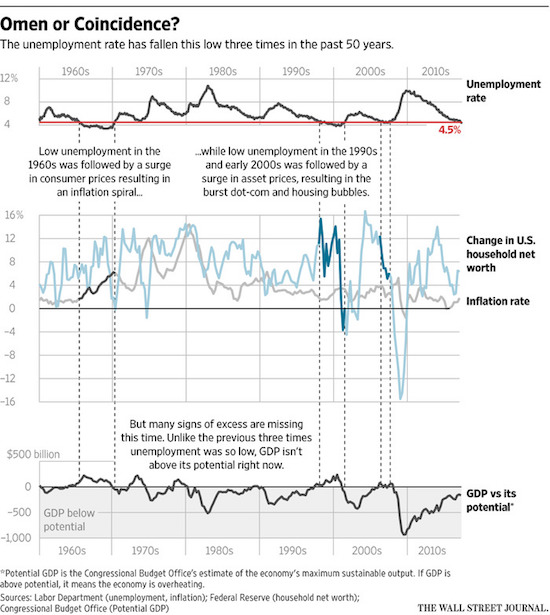

There have been only three fleeting periods in the past half-century when the U.S. unemployment rate was as low as it is today. This would be cause for celebration but for one disturbing fact: in hindsight, each period was associated with boiling excesses that led to serious economic trouble. Low unemployment of the late 1960s preceded an inflation spiral in the 1970s. The late 1990s bred the Dot-com bubble and bust. The mid-2000s saw the buildup and collapse of U.S. housing. While there is reason to believe today’s economy isn’t boiling over as in the past, those episodes call for caution. “It’s not a matter of superstition, it’s a matter of being mindful of the history of what such a low unemployment rate usually is followed by,” said Michael Feroli, chief U.S. economist of J.P. Morgan Chase.

While initially a welcome development, low unemployment in the 1960s laid the groundwork for a buildup of wage and price pressures, spurred on by low interest rates and aggressive government spending programs. The unemployment rate dropped to 4.3% in September 1965 and then below 4%. Today’s unemployment rate, also at 4.3%, could drop below 4% in the next year if it maintains its present trajectory. Unemployment returned again to 4.3% in January 1999. This time the inflation rate remained below 2% and it seemed that, unlike the late 1960s, the economy wasn’t overheating. But asset prices—the stock market in particular—soared after what had already been a long climb. The DJIA shot above 10000 for the first time in March 1998. Highflying tech companies commanded billion-dollar valuations with no profits to report. In hindsight, an internet bubble grew out of control.

Hoping to get the nazi vote?

• UK’s May Says She’d Rip Up Human Rights Law to Beat Terrorists (BBG)

Prime Minister Theresa May said she’d be willing to tear up human rights legislation in the battle against terrorists, as security continued to dominate the final days of the U.K. election campaign. Speaking to supporters at a campaign event in Slough, west of London, the premier said she wanted to make it easier for the authorities to deport foreign terror suspects and to limit the freedoms of individuals who pose a threat but who can’t be prosecuted in court. “If our human rights laws stop us from doing it, we will change the laws so we can do it,” May said. “If I am elected as prime minister on Thursday, that work begins on Friday.” May is facing criticism over her record overseeing U.K. homeland security in the wake of two terrorist attacks in two weeks ahead of Thursday’s national vote.

Those arms sales will be under heavy pressure no matter who wins.

• Corbyn: UK Foreign Policy Increases Terrorism Risk. Most Britons Agree (Ind.)

An overwhelming majority of people agree with Jeremy Corbyn that British involvement in foreign wars has put the public at greater risk of terrorism, according to a new poll. The exclusive ORB survey for The Independent found 75% of people believe interventions in Iraq, Afghanistan and Libya have made atrocities on UK soil more likely. The poll – conducted before Saturday night’s devastating attack – comes after Mr Corbyn was lambasted for suggesting foreign policy decisions were linked to terrorism in the UK and that the “war on terror” had failed. The deadly strike at London Bridge and Borough Market, the third attack in Britain in as many months, has seen security dominate the final days of the election campaign, with cabinet ministers squabbling over whether it could have been stopped.

Theresa May’s record as Home Secretary has been questioned and she has faced a call to resign over the matter from Mr Corbyn, not to mention a former aide to ex-Prime Minister David Cameron. In the wake of the Manchester attack, which killed 22 people last month, the Labour leader highlighted the potential role foreign military interventions play in increasing the likelihood of atrocities in the UK. Despite experts like Baroness Eliza Manningham-Bullerformer, a former MI5 chief, and Baroness Pauline Neville-Jones, ex-chair of the Joint Intelligence Committee, expressing similar views, he was accused by Conservatives of making excuses for terrorism.

But the ORB survey for The Independent found three-quarters of people – taking in all age groups, political persuasions and social classes – agreed Britain’s military involvement in Iraq, Afghanistan and Libya had increased the risk of terrorist acts. Within that, some 68% of Tory voters agreed foreign wars have enhanced the risks of terrorism at home. So did 80% of Labour supporters and 79% of people that voted for the Liberal Democrats in 2015.

This is hilarious in combination with the next article.

• Australia’s Economy Marks Record 26 Years Without Recession (AFP)

Australia marked a world-record 26 years without a recession Wednesday, as the economy grew 0.3% in the first-quarter, official data showed. The Australian Bureau of Statistics put the annual rate of growth at 1.7%, down from 2.4% in the previous three months. The soft quarterly reading was widely expected by analysts amid the impact of category four Cyclone Debbie on eastern Australia in late March, weaker trade figures and tepid wages growth. “The results today demonstrate the continued resilience of the Australian economy,” Treasurer Scott Morrison told reporters. The Australian dollar rallied by a quarter of a US cent to 75.27 cents just after the data was released, as some analysts had predicted a negative first-quarter reading.

Australia last recorded two negative quarters of economic growth in March and June 1991, before enjoying 103 quarters without a recession to equal the record set by the Netherlands. Economists said the resources-rich nation’s long stretch of expansion was supported by economic reforms in the 1980s and 1990s, such as the floating of the local currency, a flexible labour market, financial sector and capital markets deregulation and lower tariffs. Australia has also benefited from China’s economic growth and hunger for natural resources, which led to an unprecedented mining investment boom and record commodity prices. But economists have warned that economic growth in the next few years may not be as rosy. “In the context of the past few years, it is still a fairly weak outcome,” JP Morgan economist Tom Kennedy told AFP of the latest figures.

A record run without a recession entirly paid for with leveraged private debt: “They are all on a budget. Everyone’s got all their money in houses, that’s how it is.”

• Australians Curb Spending As Household Debt Balloons (R.)

Australia’s economy may have achieved a remarkable winning streak, avoiding a recession for 25 years, but there are now clear signs that the consumers who have driven much of the growth are running out of puff. With cash interest rates at a record low and house prices near record highs, the nation’s household debt-to-income ratio has climbed to an all-time peak of 189%, according to the Reserve Bank of Australia (RBA). That means there are an increasing number of people who have little cash for discretionary spending – on everything from cars to electrical appliances and new clothes – as their pay packets get consumed by large mortgages and high rental payments in the country’s red-hot property market.

And it’s not as if a sudden plunge in home prices would help – it might well expose and exacerbate the problem, at least in the short run, squeezing many who have bought into the frothy market with high mortgage repayments and little equity in their homes. “We are seeing a considerable spike in stress even in more affluent households. Large mortgages, big commitments but no income growth,” said Digital Finance Analytics (DFA) Principal Martin North. “Stressed households are less likely to spend at the shops, which acts as a drag anchor on future growth.” North estimates a record 52,000 households risk default in the next 12 months and that 23.4% of Australian families are under mortgage stress, meaning their income does not cover ongoing costs. That compares with about 19% a year ago.

“People are up to their ears in mortgages,” said Brad Smith, a car sales consultant at MotorPoint Sydney which has seen a stark slowdown in sales in the past six months. “They are all on a budget. Everyone’s got all their money in houses, that’s how it is.” Australians are also facing a cash crunch because price inflation in essential items such as food, electricity and insurance is accelerating at a 3.4% annual rate at a time when Australian wages are rising at their slowest pace on record, just 1.9% in the year to March. Meanwhile, growth in retail sales, personal loans and luxury car sales are all at multi-year lows, suggesting the household sector – nearly 60% of Australia’s A$1.7 trillion ($1.3 trillion) economy – is under severe strain.

Steve Keen’s efforts are having an effect.

• Is There A Magic Money Tree? Yes Children, But That’s The Wrong Question (G.)

Does anyone who has witnessed the pomp and circumstance of the Queen’s Jubilee, the funnelling of public money into Syrian airstrikes, or the systematic cutting of taxes for the rich really think we’re not paying nurses properly because we simply don’t have the money? Absolutely not: we don’t pay nurses properly because the government makes a choice not to. This fact calls to mind the words of the Texan minister Robert Fulghum: “It will be a great day when our schools have all the money they need, and our air force has to have a bake-sale to buy a bomber”. But the magic money tree is not a just daft expression in terms of how governments spend public money, it’s also misleading in terms of how the economy works as a whole.

Since 2008, we’ve been encouraged to see the economy like a household budget: if households spend too much money, they need to cut down on living costs so they don’t get into too much debt. To that end, the magic money tree says that if we spend too much money, we can’t just simply grow more. But actually, a country’s whole economy can grow more money if it needs to. Since 2009 the Bank of England has created £453bn of new electronic money to buy debt from the private sector using a mechanism called quantitative easing. Yes, you read that right: the Bank of England has created £453,000,000,000 of new money in the last eight years. Turns out the magic money tree is pretty big. Growing money is possible because an economy is nothing like a household budget. In a household, money comes in via people’s wages and goes out via living costs.

But in an economy, we all pay each other’s wages. Money doesn’t just travel in one direction in the economy, it circulates around. It’s the difference between one car driving in one end of a tunnel and out of the other, and lots of cars zigzagging around Spaghetti Junction. The issue isn’t whether we can grow money or not (we can – that’s just a fact), it’s where the money goes once it’s been grown. And the problem is that it doesn’t go to nurses, teachers or the public services they work for. It goes to institutions such as banks. The nurse in the BBC debate was highlighting a problem that exists across the whole economy: real wages haven’t increased for more than a decade, and this has meant more people have been relying on credit cards, with personal debt now higher than it was before the 2008 crash.

In other words, the fact that the nurse hasn’t had a pay rise is not just bad for her, it’s bad for all of us – because if that nurse is not earning enough, she won’t be spending money. And if she does spend money, she’ll do it by getting into unsustainable debt – which is itself outrageous considering the important, skilled work nurses do.

Raise €7 billion to buy a bank for €1.

• Santander Buys Struggling Spanish Banco Popular For €1 (BBG)

Banco Popular Espanol has been taken over by Santander after European regulators deemed that the bank was likely to fail. Popular will continue to operate under “normal business conditions” after all the bank’s shares and capital instruments were transferred to Santander, said the EU’s Single Resolution Board. The purchase price was €1, according to a statement. Santander plans to raise about €7bn (£6.1bn) of capital as part of the transaction. Popular had been looking for a buyer or a possible share sale after its balance sheet was battered by soured real estate loans that eroded its capital.

Its shares have dropped 53pc since the beginning of last week. In a statement, the ECB, which oversees the largest banks in the eurozone, said: “The significant deterioration of the liquidity situation of the bank in recent days led to a determination that the entity would have, in the near future, been unable to pay its debts or other liabilities as they fell due. “Consequently, the ECB determined that the bank was failing or likely to fail and duly informed the Single Resolution Board (SRB), which adopted a resolution scheme entailing the sale of Banco Popular Espanol to Banco Santander.”

That Paris accord is a hoax.

• Don’t Count on China as Next Climate Crusader (WSJ)

For years, a wide spectrum of groups in the U.S. lectured, cajoled and entreated China to go green. Multinationals and nonprofits teamed up with Chinese environmental groups to promote eco-friendly causes; Coca-Cola restored forests in the upper Yangtze. U.S. labs offered scientific support. Academics collaborated on research. The former Treasury secretary, Hank Paulson, championed China’s disappearing wetlands, a haven for migratory birds. The well-funded effort amplified voices within China demanding the government take action. It was, says Orville Schell, a longtime China watcher and environmentalist, “the most effective missionary work in the past couple hundred years.” So it’s an irony of historic proportions how the roles have reversed: China, the world’s worst polluter by far, is now a convert on climate change while the White House under Donald Trump has turned apostate.

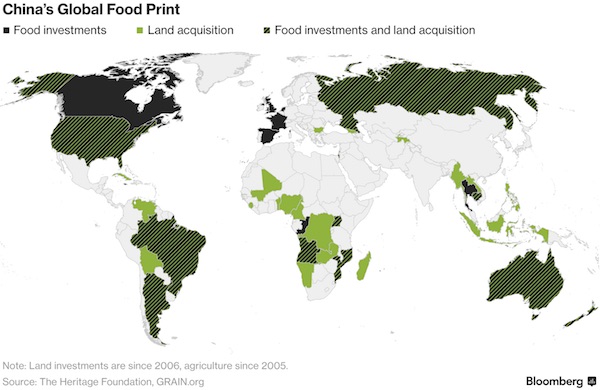

In pulling out of the 2015 Paris climate-change agreement, Mr. Trump has repudiated a signal accomplishment of the Obama presidency: persuading Beijing to become a partner in the effort to prevent the planet from heating up to the point of no return. Without China’s support, the Paris deal might have fallen apart. Mr. Paulson issued a statement saying he was dismayed and disappointed. “We have left a void for others to fill,” he said. When it comes to the environment, China is still torn by conflicting priorities. It has installed more solar and wind capacity than any other nation—and plans to invest another $360 billion in renewable energy between now and 2020. The economy is rebalancing away from heavy industry and manufacturing toward much cleaner services and consumption.

Coal consumption has declined for three straight years. On current trends, many scientists expect that China will reach peak carbon emissions well before its target date of 2030 under the Paris accord. Yet Beijing remains committed to rapid growth. And coal is still king. Just ask the residents of Beijing. Whenever economic policy makers set out to boost growth, spending flows to new real-estate and infrastructure projects, the steel mills around the capital fire up their coal furnaces—and commuters reach for their face masks. This winter was particularly hard on the lungs. A spending splurge meant that Beijing’s average pollution levels last year were double the national standard set by the State Council.

“How could they fail to come up with a video of the Donald and Vladimir swatting each other playfully with birch switches in a Moscow banya?”

• Gimme Shelter (Jim Kunstler)

“Have you all lost your mind?” Vladimir Putin replied to one of Megyn Kelly’s thrusts about alleged Russian perfidy toward the US in the gala interview that debuted her new Sunday Night star-chamber on NBC. Old Vlad put his finger on something there. His view of the late goings-on in America is like that of the proverbial detached Martian observer of strange Earthly doings, rattling his antennae and clicking his mouth-parts in mirth. To which retort, by the way, one would have to answer, ”Yes, absolutely.” The toils of slow economic collapse, accompanied by the ceaseless effort by various arms of the Deep State to spin “the narrative” around the voting public’s collective head, has driven the polity insane. And this, of course, is on view in the bedlam that US politics has become, Trump and all.

I’m waiting for The New York Times to run the three-column headline that says Russia Racist, Misogynist, and Islamophobic to finally bring together the programmed paranoia of NeoCon / DemProg alliance with the esprit de corp of the new collegiate Red Guard. Mr. Putin does not have to lift a finger to detonate the groaning garbage barge of US domestic affairs. It’s already ignited and is faring toward a very peculiar species of civil war. You can be sure that the NeoCon/DemProg axis is determined to get rid of Trump at all costs. Impeachment requires some sort of high crime or misdeamenor. So far, going on a year, they haven’t come up with any evidence that the Golden Golem of Greatness acted as a Russian agent in some fashion, and that itself has got to be a little suspicious, considering the thousands of clerks in the spinning mills of those legendary seventeen Intel outfits the government runs.

How could they fail to come up with a video of the Donald and Vladimir swatting each other playfully with birch switches in a Moscow banya? Five TV sitcom writers could surely come up with an angle — as long as it was a plausible entertainment. In the meantime, Trump prevails, the mad bull elephant of the Republican herd, majestically swinging his trunk against everything breakable in the political china shop while trumpeting “Covfefe! Covfefe!” Last week it was the Paris Climate Accords. The op-ed writers in the usual places bounced off the walls of their virtual rubber room in response. Paul Krugman had to be dragged down to hydrotherapy at the NYT after he set his hair on fire. And Rachel Maddow practically popped a carotid artery in her muscular neck from all that shrieking.

I’m a bit more sanguine about the US withdrawal. To me, the Paris Accords were just another feel-good PR stunt enabling politicians to pretend that they could control forces that are already way out-of-hand, an international vanity project of ass-covering. The coming economic collapse will depress global industrial activity whether anybody likes it or not, and despite anyone’s pretense of good intentions — and then we will have a range of much more practical problems of everyday life to contend with.

It’s getting time to rise up.

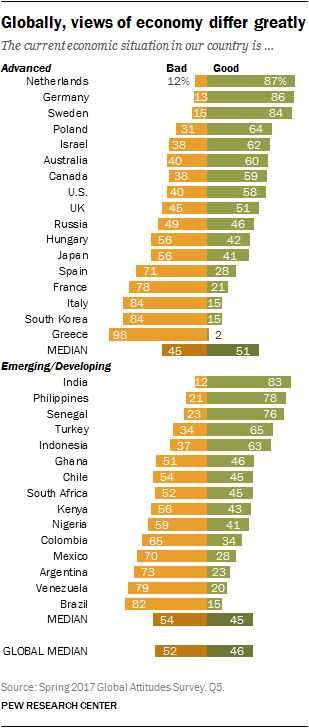

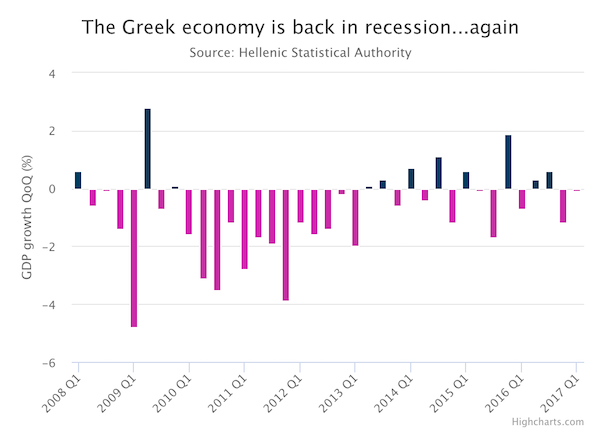

• 98% Of Greeks Downbeat About Their Current Economic Situation (K.)

Greeks are among the most pessimistic people in the world, according to the findings of a survey by the Pew Research Center which found that many Europeans as well as Japanese and Americans feel better about their national economies now than before the global financial crisis nearly a decade ago. Questioned about their national economy, only 2% of Greeks were upbeat, the lowest rate among the 32 countries polled. The Dutch, Germans, Swedes and Indians see their national economies in the most positive light, with more than 80% expressing optimism. The Pew survey also detected widespread concern about the future. A median of just 41% said they believed that a child in their country today would grow up to be better off financially than their parents. The most pessimistic about prospects for the next generation are the French (9%), the Japanese (19%) and the Greeks (21%).